What is Underwater Power and Cable Systems Market Size in 2026?

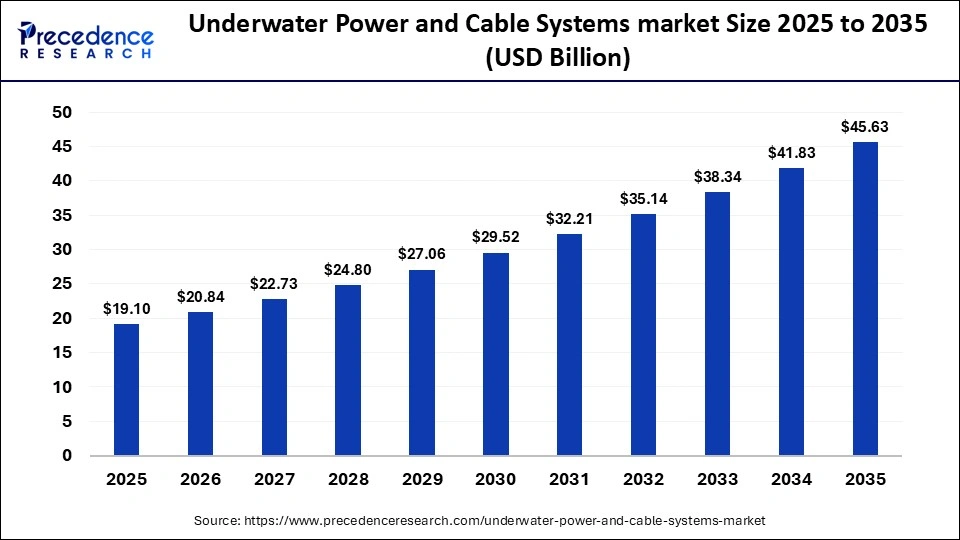

The global underwater power and cable systems market size was calculated at USD 19.10 billion in 2025 and is predicted to increase from USD 20.84 billion in 2026 to approximately USD 45.63 billion by 2035, expanding at a CAGR of 9.10% from 2026 to 2035. The market is driven by rising offshore energy projects and subsea infrastructure developments, enabling efficient transmission of electricity and data across marine environments.

Key Takeaways

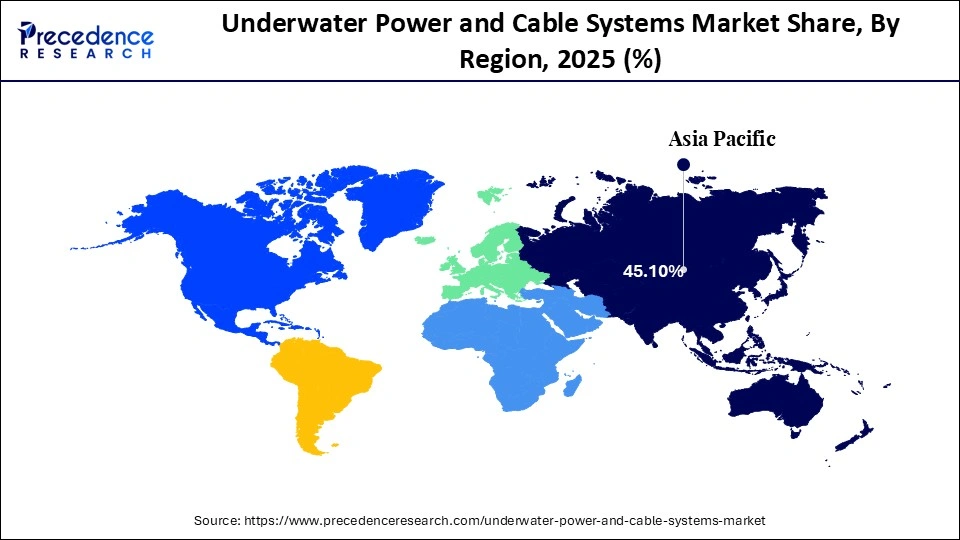

- Asia Pacific led the underwater power and cable systems market with the largest revenue share of 45.1% in 2025.

- North America is expected to grow at the fastest CAGR during the forecast period.

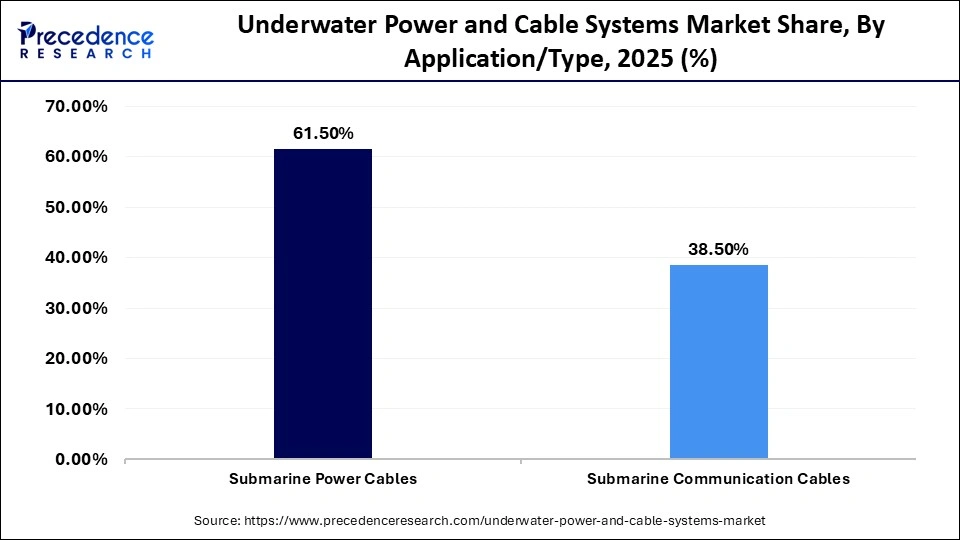

- By application / type, the submarine power cables segment held the largest market share of 61.5% in 2025.

- By application, the submarine communication cables segment is expected to grow at the fastest CAGR over the projection period.

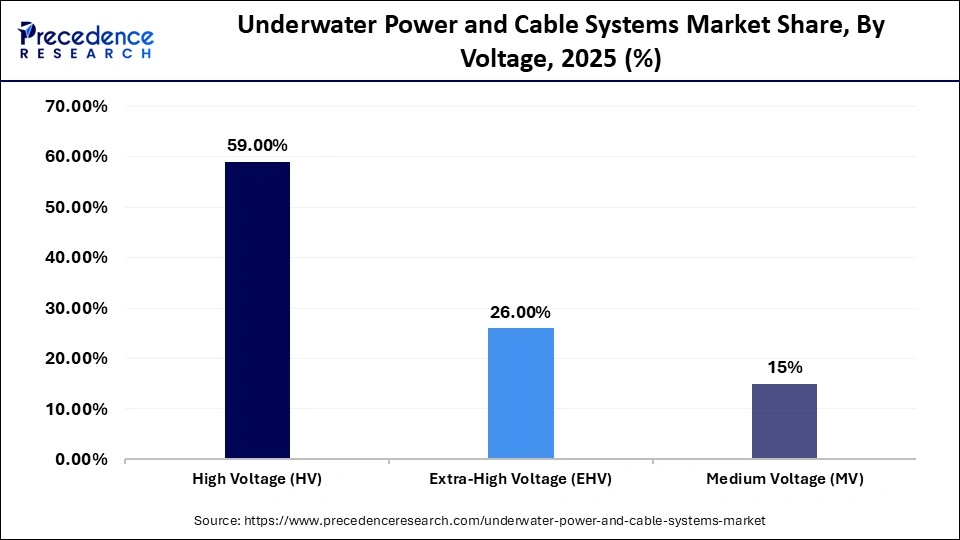

- By voltage, the high voltage (HV) segment dominated the market with a 59% share in 2025.

- By voltage, the medium voltage (MV) segment is expected to expand at the fastest CAGR of 11.5% during the forecast period

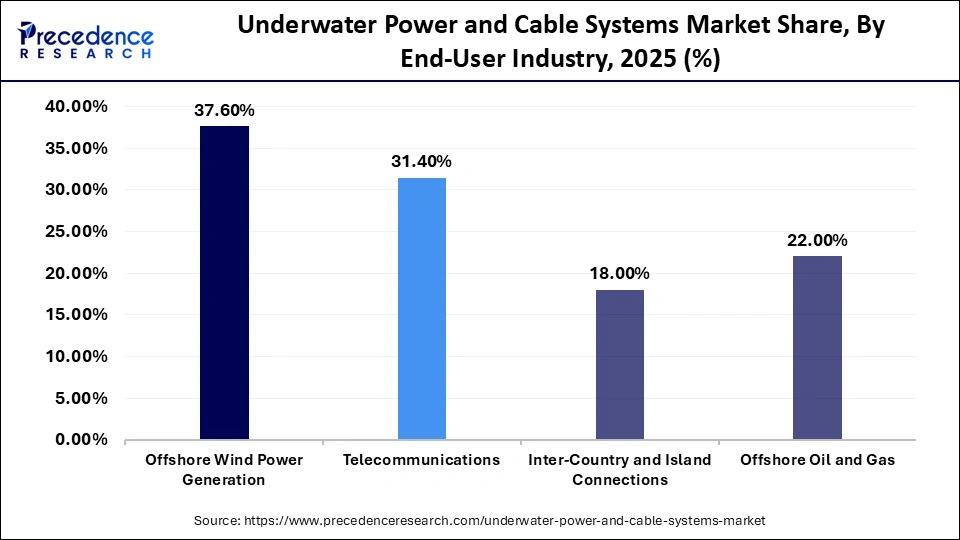

- By end-user industry, the offshore wind power generation segment held the largest market share of 37.6% in 2025.

- By end-user industry, the offshore oil and gas segment is expected to expand at a CAGR of 15.6% over the forecast period.

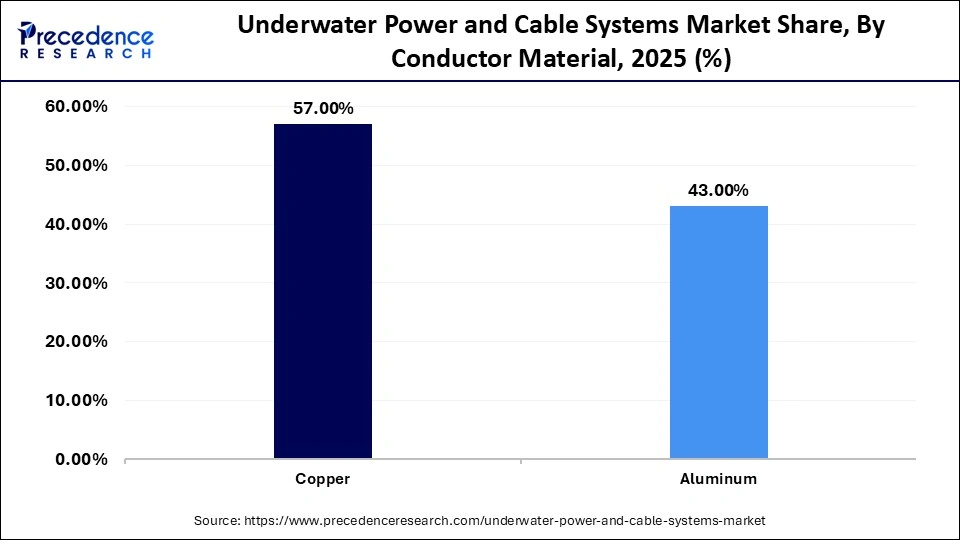

- By conductor material, the copper segment dominated the market with the largest share of 57% in 2025.

- By conductor material, the aluminum segment is projected to grow at the fastest CAGR of 9.4% over the projected period.

Market Overview

Underwater power and cable systems enable the transmission of electricity through specially engineered submarine cables installed beneath oceans, rivers, or lakes. These cables are designed with advanced installation, waterproof shielding, and protective armoring to safely transmit high-voltage power over long distances in underwater environments. The market represents a global industry focused on the development, manufacturing, installation, and deployment of underwater power transmission cables that enable efficient electricity transfer across water bodies. The market is growing due to the rapid expansion of offshore renewable energy projects like wind and tidal farms, increasing subsea oil and gas exploration, and the rising demand for reliable, high-capacity underwater power transmission networks.

Role of Emerging Technologies in the Growth of the Underwater Power and Cable Systems Market

The market for underwater power and cable systems is advancing through the shift toward high-voltage direct current (HVDC) transmission, advanced XLPE insulation, corrosion-resistant sheathing, and reinforced cables with lifespans exceeding 50 years, all of which reduce transmission losses. Integration of AI and automation in installation and maintenance is cutting operational costs by around 20% through predictive maintenance, real-time thermal monitoring, and intelligent fault detection. Major projects like North Sea Link and Viking Link highlight the use of fiber optic sensing and AI-driven grid optimization to improve efficiency and reliability in long-distance subsea power transmission.

Underwater Power and Cable Systems Market Trends

- Shift Toward High Voltage and Advanced Cable Configurations: Both single-core and multi-core underwater cables are seeing strong adoption, with single-core preferred for offshore wind and island grids, while multi-core cables are increasingly used in complex transmission networks.

- Strategic Consolidation and Technology Investments: The market is witnessing mergers, partnerships, and R&D expansion focused on advanced cable materials and smart monitoring, enabling integrated project execution and large-scale, reliable underwater power deployments.

- Rising Data Transmission Capacity and Cost Efficiency: Innovations like increased fibre pair density and spatial division multiplexing (SDM) enhance transmission without enlarging cable size, reducing per-terabit costs and enabling new subsea routes and direct data center interconnections.

- Expanding HVDC and HVAC Deployments: Adoption of high-voltage systems is accelerating offshore renewable integration and long-distance power evacuation, supported by advanced insulation and protective cable technologies.

- AI, Machine Learning, and Real-Time Monitoring Integration: Predictive maintenance, reliability improvements, and data-driven grid management are being achieved through AI-enabled monitoring, optimizing cable operations and supporting bandwidth requirements.

- Demand Driven by AI Workloads and Cloud Applications: High-capacity subsea systems are increasingly required for hyperscale data applications, with projects like Google Pacific Connect delivering multi-terabit transoceanic connectivity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.10 Billion |

| Market Size in 2026 | USD 20.84 Billion |

| Market Size by 2035 | USD 45.63 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application / Type,Voltage,End-User Industry,Conductor Material, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Application / Type Insights

Why Did the Submarine Power Cables Segment Lead the Market?

The submarine power cables segment led the underwater power and cable systems market in 2025, capturing the largest share of 61.5%. This is because submarine power cables serve as essential infrastructure for bulk electricity transmission across the sea. These cables have the capability to transmit large volumes of electricity over long distances underwater, making them vital for modern energy networks.

The submarine communication cables segment is expected to grow at the fastest CAGR over the forecast period. This is because these cables underpin global digital connectivity by enabling high-speed data transmission between continents and Island regions. Rising Internet usage, cloud computing expansion, and growing data center infrastructure are significantly boosting subsea communication investments. Continuous advancements in fiber optic technology and cable durability are enhancing performance and operational lifespan.

Voltage Insights

What Made High Voltage the Dominant Segment in the Market?

The high voltage (HV) segment dominated the underwater power and cable systems market, holding the largest share of 59% in 2025. HV cables generally operate above 100 KV and are engineered to transmit substantial volumes of electricity across long distances. These make them indispensable for linking offshore renewable energy projects, particularly wind farms, to mainland grids. Growing investment in offshore infrastructure and cross border connection are boosting the demand for reliable long-distance low-loss transmission solutions, creating the need for high voltage power cables and systems.

Meanwhile, the medium voltage (MV) segment is expected to grow at the fastest CAGR of 11.5% during the forecast period due to the increasing deployment of coastal electrification projects and distributed renewable energy installations. MV submarine cables are ideal for connecting offshore wind farms, island grids, and local energy networks, providing a balance of cost-efficiency, reliability, and ease of installation for short- to medium-distance power transmission. Rising demand for decarbonization and distributed energy integration is further accelerating the adoption of medium voltage systems in marine and coastal energy infrastructure.

End-User Industry Insights

How Does the Offshore Wind Power Generation Segment Dominate the Market?

The offshore wind power generation segment dominated the underwater power and cable systems market, accounting for 37.6% of the total share. This is mainly due to the rapid expansion of offshore wind farms across global coastlines, which significantly increased the demand for high-capacity and long-distance transmission infrastructure. Underwater power and cable systems from the backbone of these projects, enabling seamless transfer of electricity generated at sea to mainland grids. As offshore turbines are being installed farther from coastlines, the demand for technologically advanced, high-voltage cables with enhanced durability and reliable installation practices has intensified, further boosting market growth.

The offshore oil and gas segment is expected to grow at the highest CAGR of 15.6% over the forecast period. The growth of the segment is driven by the increasing offshore exploration activities and deepwater production projects, which drive demand for highly resilient underwater power and cable systems. Increasing offshore energy activities, including oil and gas field expansions, are driving demand for robust and integrated cable solutions that can withstand harsh marine environments. Additionally, operators are modernizing infrastructure with digital monitoring, automation, and remote control systems, which further necessitate advanced underwater power and cable networks to ensure operational efficiency, safety, and uninterrupted energy supply.

Conductor Material Insights

What Made Copper the Leading Segment in the Market?

The copper segment led the underwater power and cable systems market, accounting for nearly 57% share in 2025. This is due to its superior electrical conductivity, which ensures highly efficient power transmission over long distances with minimal energy loss. Its excellent durability and strong resistance to corrosion make it particularly suitable for harsh subsea environments, supporting large-scale offshore, interconnection, and renewable energy projects. Additionally, copper's proven reliability in high-performance applications has reinforced its preference among operators, despite its relatively higher cost and heavier weight compared to alternative conductor materials.

On the other hand, the aluminum segment is expected to grow at a CAGR of 9.4% during the forecast period. While aluminum has lower electrical conductivity than copper, advancements in conductor engineering, insulation materials, and cable design have significantly improved its performance. Its lighter weight and lower material cost make handling, transportation, and installation more economical, positioning aluminum as an increasingly attractive and competitive option for modern subsea power projects.

Regional Analysis

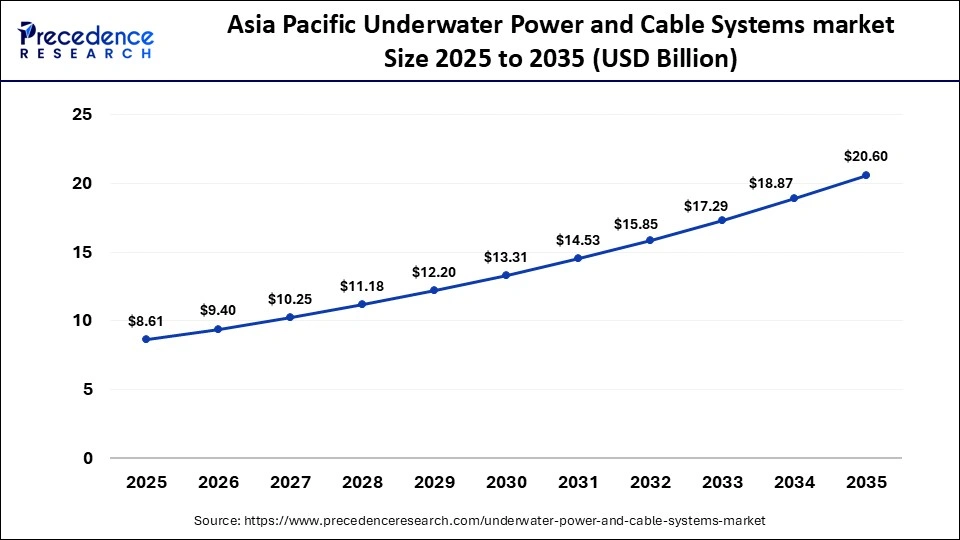

Asia Pacific Underwater Power and Cable Systems Market Size and Growth 2026 to 2035

The Asia Pacific underwater power and cable systems market size is expected to be worth USD 20.60 billion by 2035, increasing from USD 8.61 billion by 2025, growing at a CAGR of 9.12% from 2026 to 2035

What Made Asia Pacific the Dominant region in the Underwater Power and Cable Systems Market?

Asia Pacific dominated the underwater power and cable systems market by capturing a major share of 45.1% in 2025. This is mainly due to massive offshore wind targets in China and the rapid expansion of Intra-Asia data center networks. Strong demand is further supported by rapid urbanization and industrialization across key economies such as China, Japan, and India. Significant investments in offshore wind projects and cross-border interconnection initiatives, along with the growing adoption of HVDC cables for efficient long-distance and cross-border energy transmission, continue to strengthen regional leadership. Additionally, the rising integration of fiber optic systems for real-time monitoring is expected to ensure the long-term growth of the market.

India Market Trends

The underwater power and cable systems market in India is growing, driven by large-scale infrastructure upgrades and an accelerated transition toward renewable energy. The government is actively strengthening regional and cross-border power connectivity to enhance grid stability and transmission efficiency. The country's data and transmission capacity are expected to expand nearly fourfold, driven by the rapid rise of hyperscale data centers and digital infrastructure. For instance, initiatives such as new offshore wind development plans in Gujarat and Tamil Nadu, along with expanded interconnection projects with neighboring countries, have further increased demand for advanced submarine and higher-capacity cable systems.

What Makes North America the Fastest-Growing Region in the Market?

North America is expected to grow at the fastest CAGR in the market during the projection period, driven by regions' accelerating adoption of offshore renewable energy. The U.S. and Canada are expanding offshore wind installations along their coastlines, creating strong demand for subsea transmission infrastructure to connect projects to onshore grids. These projects deliver power from remote, renewable-rich zones to densely populated urban centers, highlighting the strategic role of underwater cable systems in North America's broader energy transition.

How is the Opportunistic Rise of Europe in the Underwater Power and Cable Systems Market?

Europe is experiencing significant growth in the market, supported by the continent's ambitions for a renewable energy transition. Growing offshore wind projects, particularly across the North Sea region, are generating substantial demand for power transmission infrastructure. In addition, increasing cross-border interconnection projects among European nations are strengthening electricity trade and enhancing grid reliability. A strong emphasis on environmental sustainability is also encouraging innovation in low impact ecofriendly cable technologies, further reinforcing Europe's strategic position in the global market.

What Drives the Market in the Middle East & Africa?

The market in the Middle East & Africa (MEA) is expected to be driven by its strategic role as a major corridor for global data traffic and cross-border electricity transmission. The interconnection projects and the electrification of offshore oil, gas, and renewable installations are significantly boosting demand for advanced cable infrastructure across the region. For instance, in recent years, several new subsea cable landings and the Red Sea connectivity project, with the expanded Gulf Cooperation Council (GCC) grid interconnection upgrades, have reinforced the region's position as a vital bridge between Europe, Asia, and Africa, further driving investments in high-capacity underwater cable systems

Underwater Power and Cable Systems Market Companies

- Prysmian Group (Italy)

- Nexans S.A. (France)

- NKT A/S (Denmark)

- Sumitomo Electric Industries (Japan)

- LS Cable & System (South Korea)

- Hengtong Group (China)

- ZTT (Zhongtian Technology) (China)

- SubCom LLC (USA)

- NEC Corporation (Japan)

- Alcatel Submarine Networks (Nokia) (France)

- JDR Cable Systems (TFKable) (UK)

- Hellenic Cables (Greece)

- Furukawa Electric (Japan)

- TE Connectivity (Switzerland)

- Orient Cable (NBO) (China)

Recent Developments

- In January 2026, Nixon achieved the world record with the deepest ever HVDC subsea cable installation. It is a 500 kV high voltage direct current subsea power cable installation at a depth of 2150m on Italy's Tyrrhenian Link in collaboration with Italian grid operator Terna, making the deepest offshore power cable deployment to date.

- In November 2025, V. Tal announced a new Synapse submarine cable between Brazil and the U.S. Neutral infrastructure company V. Tal unveiled its Synapse submarine cable project connecting Tuckerton (New Jersey, USA) and Sao Paulo (Brazil).

- In October 2025, LS cable system completes Asia's largest HVDC cable production facility. South Korean manufacturer LS Cable and System finished construction of what it calls Asia's largest HVDC submarine cable production plant in Gangwon-do. The facility includes advanced vertical continuous vulcanization lines for ultra-long cables for energy highways.

- In September 2025, Xlinks Germany GmbH plans to build a 4800km Undersea high voltage power cable (Sila Atlantik) to deliver solar and wind energy from Morocco to Germany.

- In March 2025,Singapore expands subsea cable Hub with big tech engagement. It is supported by major investments and active participation from tech giants like AWS, Google, Microsoft, and met in new cable systems connecting Singapore to Southeast Asia and Trans Pacific routes.

Segments Covered in the Report

By Application Type

- Submarine Power Cables

- Submarine Communication Cables

By Voltage

- High Voltage (EV)

- Extra High Voltage (EHV)

- Medium Voltage (MV)

By Conductor Material

- Copper

- Aluminium

By End-User Industry

- Offshore Wind Power Generation

- Inter-Country & Island Connection

- Offshore Oil & Gas

- Telecommunications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting