U.S. Dental Anesthesia Market Size and Growth 2026 to 2035

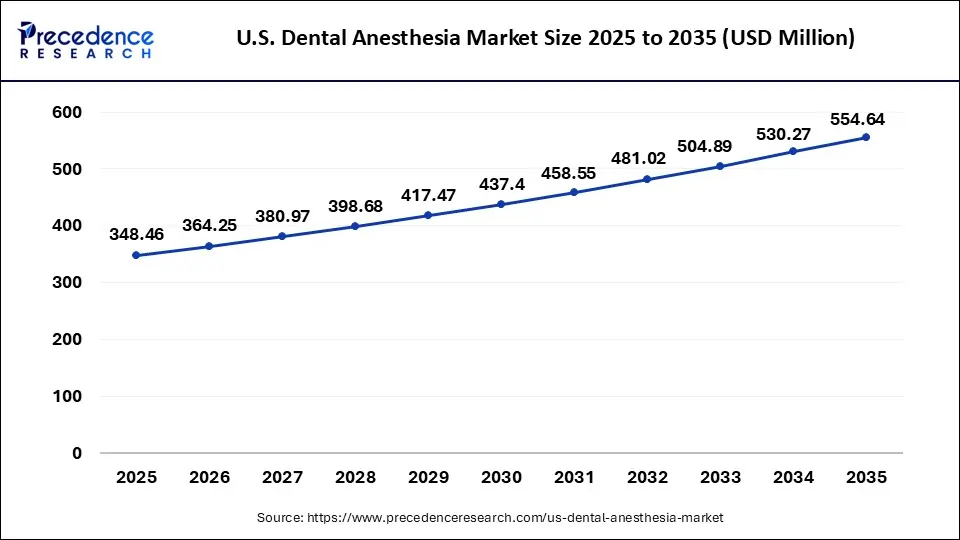

The U.S. dental anesthesia market size was USD 348.46 million in 2025, estimated at USD 364.25 million in 2026, and is anticipated to reach around USD 554.64 million by 2035, expanding at a CAGR of 4.76% from 2026 to 2035. The increasing prevalence of oral and dental care treatment that driving the growth of the market.

The U.S. dental anesthesia market is anticipated to capture a significant market share in 2025, owing to the increased demand for cosmetic and reconstructive dental services and an increase in the demand for general and local anesthesia. The U.S. is supplemented by an established healthcare infrastructure and a large distribution of advanced dental technologies, enabling the administration of anesthesia to be conducted safely and efficiently.

Moreover, the rise in the popularity of pain-free dentistry and the inclination of patients to avail of the method of sedation are adding to the growth of the market. Dental care is ensured by good insurance coverage and a good regulatory system that adds to the ease of its availability and cost. The availability of major dental equipment manufacturers, pharmaceuticals, and the advancement of digital dentistry in the U.S. make the country one of the leaders in the development of dental anesthesia.

U.S. Dental Anesthesia Market Key Takeaways

- The global dental anesthesia market was valued at USD 333.54 million in 2025.

- It is projected to reach USD 530.27 million by 2035.

- The market is expected to grow at a CAGR of 4.80% from 2026 to 2035.

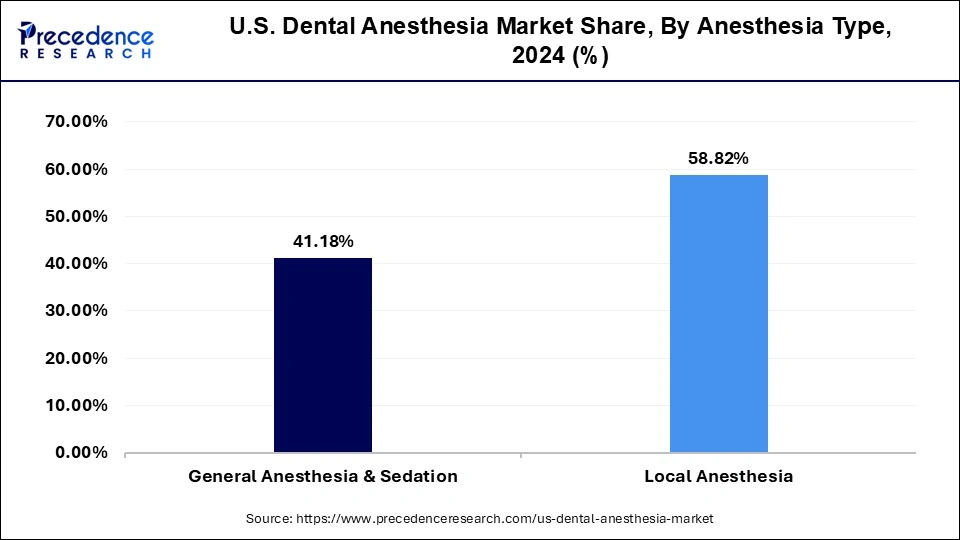

- By anesthesia type, the general anesthesia and sedation segment is anticipated to show considerable growth in the market over the forecast period.

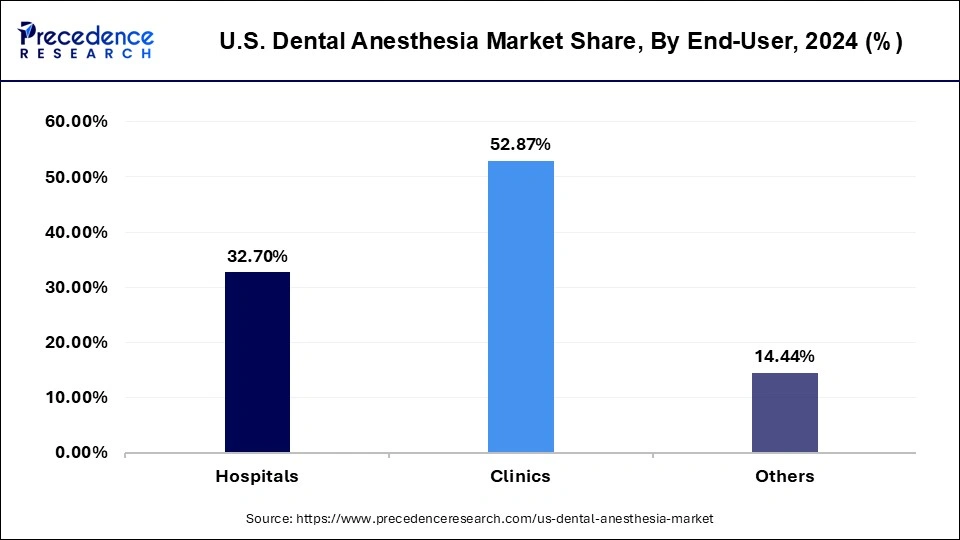

- By end user, the hospitals segment is anticipated to show considerable growth in the market over the forecast period.

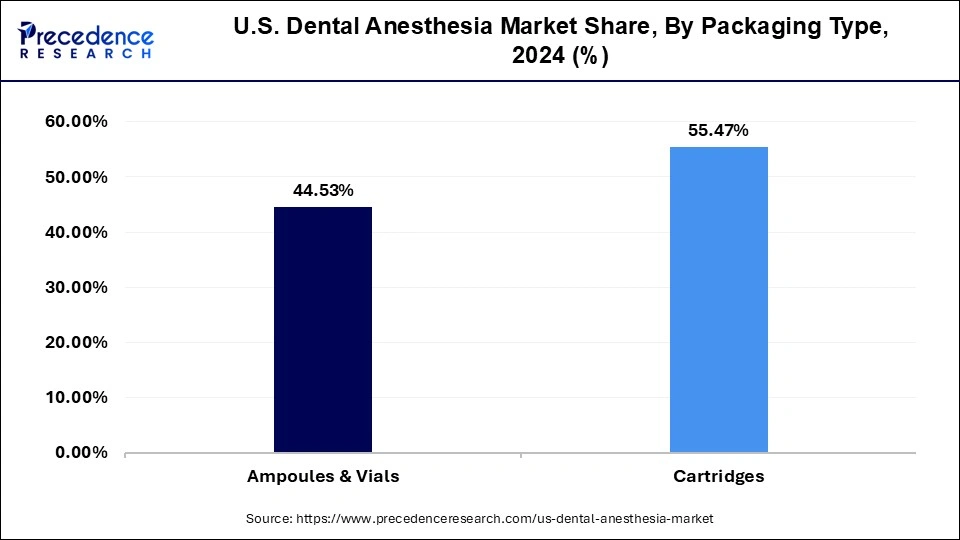

- By packaging type, the ampoules and vials segment is anticipated to show considerable growth in the market over the forecast period.

- By product type, the Articaine segment dominated the market with the highest share 34.75% in 2025.

- By product type, the Lidocaine segment is expected to be the fastest-growing during the forecast period.

- By anesthesia type, the local anesthesia segment contributed the biggest market share of 58.82% in 2025.

- By end user, the clinic segment captured the highest market share of 52.87% in 2025.

- By packaging type, the cartridges segment generated a major market share of 55.47% in 20245.

- By packaging type, the ampoules and vials segment is expected to witness a notable growth CAGR during the predicted period.

How is AI Integration Transforming the U.S. Dental Anesthesia Market?

The use of artifical intelligence is playing a significant role in transforming the U.S. dental anesthesia market with regard to the precision, safety, and efficiency of patient care. Artificial intelligence aids dentists in defining the doses of anesthesia according to individual patients in terms of age, weight, medical history, and anxiety. The use of robots to deliver anesthesia is being looked into to enhance accuracy and reduce errors. Furthermore, AI is enhancing patient scheduling, workflow management, and clinical documentation. AI technologies enhance the quality of care, minimize the risks of complications, and increase patient trust in dentistry services.

Market Overview

The U.S. dental anesthesia market revolves around the offering of drugs given to the patients in the form of injections, gels, or spray to numb the dental area in which the dental procedure will take place. It restricts the sensation in the specific area of the mouth where it injected without losing complete consciousness. Dental anesthesia is considered as the safe and secure procedure in dental treatment. Local anesthesia, general anesthesia, and sedation anesthesia are the three main types of anesthesia. The rising cases of the dental problems and oral hygiene issues in the population due to the aging factors and the shift in lifestyle that driving the expansion of the U.S. dental anesthesia market.

U.S. Dental Anesthesia Market Growth Factors

- The increasing prevalences of oral and dental problems due to dental caries and others are driving the demand for the oral and dental treatment procedures that are anticipated to drive the growth of the dental anesthesia market.

- The increasing shift in the lifestyle due to the rising disposable income in the population which drives the consumption of the junk food, and acceptance of the sedentary lifestyle that are causes the increasing dental and oral health issues which drives the growth of the market.

- The increase in aging population that are highly affected by some kind of dental problems due to the aging effects which causing the time-to-time treatment or dental procedures that are driving the expansion of the market.

- The increasing awareness about oral and dental care and the rising trends of dental aesthetic surgery for enhanced facial looks are further propelling the growth of the market.

- The rising investment by the U.S. government on the healthcare sector and the dental care industry in terms of consumer goods associated to the dental problem or dental care program that driving the growth of the U.S. dental anesthesia market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 348.46 Million |

| Market Size in 2026 | USD 364.25 Million |

| Market Size by 2035 | USD 554.64 Million |

| Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Anesthesia Type, End User, and Packaging Type |

Market Dynamics

Driver

Growing aging population

The growing geriatric population of the United States is one of the major driving factors in the growth of the market. The geriatric population is more likely to get affected by some kind of oral and dental healthcare problems due to the aging effects and lifestyle that need a time-to-time treatment procedure which are driving the demand for dental anesthesia. Dental anesthesia is used in dental surgeries that is used to numb the specific areas inside the mouth in which the surgery will take place, it is administered by the dentists. Dental anesthesia is given in the form of gels, sprays, and mostly by injections. The increasing prevalence of the dental surgeries in the United States are propelling the growth of the U.S. dental anesthesia market.

Restraint

High cost

The increased cost of the dental treatment and procedures like medicine, anesthesia, and others are observed to create a restraint for the U.S. dental anesthesia market. Moreover, the overall costly treatments for dental and oral issues in the United States creates another hindering factor for the market to grow. However, government initiatives and production of cost-effective solutions for the dental industry is observed to overcome the restraining factor.

Opportunity

Advancements in procedures

The technological advancements in the dental anesthesia like in enhancing the comfort by innovations in the anesthesia formulation and delivery methods that minimizes the discomfort of administration of the traditional dental anesthesia procedures are driving the opportunity in the market's growth. The rising investment in the research and development program in enhancing the safety and efficiency of the dental anesthesia and the customization of the dental anesthesia as per the requirement of the patients are boosting the growth market. Additionally, the rising major pharmaceuticals and healthcare facilities are further propelling the growth of the U.S. dental anesthesia market.

Product Type Insights

The Articaine segment dominated the U.S. dental anesthesia market with the largest share in 2025. Articaine is marketed as Septocaine in the United States. It is the local anesthesia was approved by the U.S. food and drug administration in 2000. It is the second most used and effective anesthesia which is used in dentistry in the U.S. Articaine contains the thiophene group and commonly used as the dental anesthesia in the United States. Articaine is used in the dental anesthesia for local filtration injections, also in the mandible, with the higher successful rate that other anesthesia in the dentistry. It is the safer and most secure type of anesthesia in dentistry that can be used in both adult and pediatric patients.

The Lidocaine segment is expected to be the fastest growing segment in the market during the forecast period. Lidocaine is the type of anesthesia which is used in the numbing of the body part temporarily before the surgical procedures. The increasing popularity of lidocaine in the dentistry due to its efficiency that drives the expansion of the segment.

Anesthesia Type Insights

The local anesthesia segment dominated the market in 20245, owing to the rising trends and innovations, such as computer-controlled delivery, buffered formulations, needle-free systems, and AI integration. There is a rapid shift towards greener local and analgesic options, such as methoxyflurane, and the growing focus on replacing high-impact greenhouse gases. Moreover, there is a rising demand for precise local anesthesia, specifically designed for medically compromised patients.

The benefits of general anesthesia are the guarantee of deep sedation and the inability of the patient to move, which helps a specialist to carry out dental care properly and stress-free. General anesthesia requires special anesthesiologists, high technologies, and strict requirements of behaviour to reduce the risks of harm, like respiratory issues or unwanted responses. Moreover, the increase in patient demand regarding pain and anxiety-free treatment experience will inevitably contribute to the growth in demand.

End-User Insights

The clinic segment dominated the market and expected to sustain its position in the market during the forecast period. The higher prevalence of the dental treatment in the clinic due to the increase availability of the skilled professionals and moderndental equipment that makes the procedure less invasive and higher efficient which drives the growth of the clinical segment.

The increasing preference by the patients to visit the clinics for the dental treatment of surgical procedure due to the availability of the technological advance equipment and timely availability of the medication which boosts the growth of the segment.

The hospitals segment is expected to grow substantially in the U.S. dental anesthesia market. The benefit of complete oral health as a part of general healthcare service is being realized they are expanding hospital dental departments and services. Such facilities are prepared to handle more advanced teeth work, including actual facial trauma surgery, cancerous growth removal, or restoring an entire mouth, which may involve general anesthesia or heavy sedation in most cases.

Hospitals also possess the infrastructure, such as elaborate monitoring equipment and trained teams of anesthesiology practitioners, that standalone dental clinics lack to offer dental anesthesia safely during high-risk or lengthy dental procedures. Moreover, the growing convergence between dental and medical practitioners in a hospital setting enhances more integrated care of patients.

Packaging Type Insights

The cartridges segment dominated the market with the largest share in 2025. The growth of the segment is attributed to the rising adoption of cartridges for allowing safer and pain free experience during the dental procedures. Dental anesthesia cartridge come into the three variants that are cylinder, plunger or stopper, and cap.

The cylinder cartridge is one of the main types of the dental cartridge, it the cylindrical shape glass tube that contains the anesthetic liquid or drug which is closed by the plunger of cap. Cartridge is considered as the safest and secure medium to store or transport the drugs which results in the higher adoption of the segment.

The ampoules and vials segment is expected to grow at a significant CAGR over the forecast period. The most suitable packaging type used in the delivery of injected anesthetic solutions includes ampoules and vials because they are durable, sterile, and maintain the chemical stability of the contents. The trend of dental clinics offering more complicated surgical procedures and types of sedation leads to the increasing demand for reliable and optimal packaging. The manufacturers also take investments in tamper-resistant designs and clear labelling to match the requirements and minimize instances of medication mistakes. The development of technologies of formulation and packaging makes ampoules and vials more convenient to use and efficient, which also makes their use more favorable.

Country-level Insights

U.S. Dental Anesthesia Market Analysis

The U.S. industry experiences a massive growth due to the increasing prevalence of dental diseases, technological innovations such as needle-free injectors, computer-controlled local anesthetic delivery (CCLAD) systems, and AI-enabled delivery. In July 2024, the American Society of Anesthesiologists and the Centers for Medicare & Medicaid Services (CMS) announced the Medicare Physician Fee Schedule (PFS) rule, including reduced physician payments in 2025 and the Quality Payment Program (QPP).

Value Chain Analysis

- R&D

This stage prioritizes precision and personalized dosing, next-generation delivery systems, AI and automated monitoring, and novel drug formulations.

Key Players: Dentsply Sirona, Septodont, Milestone Scientific, 3M Oral Care, Sunstar Americas, Septodont, Dentsply Sirona, Henry Schein, 3M Oral Care, Sunstar Americas, Septodont, Dentsply Sirona, 3M Oral Care, Patterson Companies, DentalHiFi, Pierrel Pharma.

- Distribution to Hospitals, Pharmacies

This stage includes direct selling to hospitals and large oral surgery centers to offer personalized service and technical training.

Key Players: Henry Schein, Inc., Patterson Companies, Benco Dental, Medline Industries, Cardinal Health, Septodont, Dentsply Sirona, Solventum, Pierrel Pharma, Milestone Scientific.

- Patient Support & Services

This stage involves the adoption of needle-free systems and computer-controlled local anesthetic delivery to reduce patient anxiety and injection pain.

Key Players: Septodont, Dentsply Sirona, Henry Schein, Patterson Companies, Milestone Scientific, and Solventum.

Top Companies in the U.S. Dental Anesthesia Market and their Offerings

- 3M: Ubistesin, xylestesin, mepivastesin, restorative materials, safety equipment like SecureFit safety glasses and Aura respirators.

- Dentsply Sirona: Injectable anesthetics, topical anesthetics, delivery systems and accessories, dental needles and syringes.

- Laboratories Inibsa: Artinibsa, xilonibsa, scandinibsa, inibsacain, dental devices.

- Zeyco: Injectable local anesthetics, topical anesthetics, and supportive dental supplies.

- Henry Schein, Inc.: Injectable anesthetics, topical anesthetics, delivery systems, anesthesia equipment, anesthetic reversal & buffering.

U.S. Dental Anesthesia Market Recent Developments

- In January 2025, Septodont Inc., the international industrial leader in the field of dental anesthetic products, and Premier Dental, the world-renowned manufacturer of innovative dental solutions that have gathered high popularity among dentists worldwide, are excited to announce the site launch of BufferPro@ 8.4% sodium bicarbonate buffering solution.

- In January 2025, Vertex Pharmaceuticals had Suzetrigine, a Nav1.8-selective analgesic, approved by the FDA as a one-time treatment of dental-related post-surgical pain.

- In July 2024, the FDA released draft guidance to device companies to manage composite resin devices and curing lights as a sign of extending the dental device regulation.

Segments Covered in the Report

By Product Type

- Articaine

- Lidocaine

- Mepivacaine

- Bupivacaine

- Prilocaine

- Others

By Anesthesia Type

- General Anesthesia and Sedation

- Local Anesthesia

By End User

- Hospitals

- Clinics

- Others

By Packaging Type

- Ampoules and Vials

- Catridges

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting