U.S. Environmental Remediation Market Size and Forecast 2025 to 2034

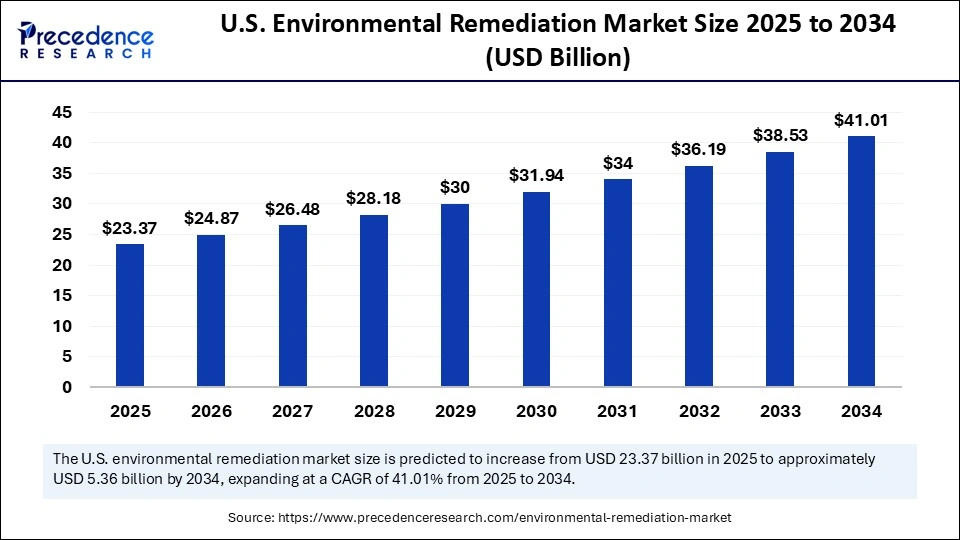

The U.S. environmental remediation market size was calculated at USD 21.95 billion in 2024 and is predicted to increase from USD 23.37 billion in 2025 to approximately USD 41.01 billion by 2034, expanding at a CAGR of 6.45% from 2025 to 2034. The U.S. environmental remediation market is growing due to stricter regulations from government bodies, such as the EPA, and increased public awareness of environmental sustainability.

U.S. Environmental Remediation Market Key Takeaways

- In terms of revenue, the U.S. environmental remediation market was valued at USD 21.95 billion in 2024.

- It is projected to reach USD 41.01 billion by 2034.

- The market is expected to grow at a CAGR of 6.45% from 2025 to 2034.

- By service type, the removal and disposal segment held the largest share of 41.20% in 2024.

- By service type, the emergency response abatement segment is expected to grow at the fastest CAGR of 7.60% during the forecast period.

- By end-use sector, the government & institutional buildings segment captured the biggest market share of 29.50% in 2024.

- By end-use sector, the healthcare facilities segment is expected to grow at the fastest CAGR of 8.10% during the forecast period.

- By project type, the renovation-related abatement segment contributed the highest market share of 38.70% in 2024.

- By project type, the emergency/unplanned remediation segment is expected to grow at the fastest CAGR of 8.40% during the forecast period.

Impact of AI on the U.S. Environmental Remediation Market

AI is integrated into the U.S. environmental remediation market to enhance efficiency, decrease costs, and allow more effective solutions for pollution and contamination challenges by using machine learning to forecast trends, improve cleanup processes, and develop intelligent remediation technologies. By offering real-time contaminant detection along with predictive modeling, AI supports better decision-making processes, allowing quicker responses to environmental hazards. AI's ability to learn to adapt is vital for complex environmental systems, permitting strategies to be adjusted in real time based on the latest environmental feedback.

Market overview

The significance of the U.S. environmental remediation market lies in its role in cleaning contaminated water, soil, and sediment, driven by stringent federal regulations such as CERCLA (Superfund) and public requirements for a healthy environment. A history of industrial activity, primarily in the chemical, oil & gas, and manufacturing sectors, has resulted in widespread contamination of soil and groundwater, creating an ongoing need for remediation services. Both the public and private sectors invest heavily in research and development to create more efficient and effective remediation technologies, placing the U.S. as a global leader in environmental protection.

U.S. Environmental Remediation Market Growth Factors

- The cleanup of decades-old industrial pollution in soil as well as groundwater remains a significant driver, demanding expensive and complex remediation efforts.

- Advances in areas like machine learning, Artificial Intelligence (AI), and robotics are improving the efficiency and precision of cleanup operations, which include real-time monitoring and predictive modeling.

- The rising concern over specific contaminants, like nitrates in groundwater from agricultural practices, drives the need for specialized remediation technologies such as bioremediation and phytoremediation.

- A growing trend is the acceptance of "green" remediation techniques that decrease carbon footprints, utilize renewable energy, along with promoting ecological restoration alongside contamination cleanup.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 41.01 Billion |

| Market Size in 2025 | USD 23.37 Billion |

| Market Size in 2024 | USD 21.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.45% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End-Use Sector, and Project Type |

Market Dynamics

Drivers

Why Is Increasing Public Awareness of Environmental Pollution the Driving Force for the U.S. Environmental Remediation Market?

Increasing public awareness drives the U.S. environmental remediation market because it creates remarkable political and social pressure on governments as well as industries to act, leading to stricter regulations together with increased need for cleanup services. Public concern over pollution contributes to increased media attention, as well as political action, resulting in stricter environmental regulations and policies that mandate cleanup activities.High-profile cases of pollution, often captured by the media, can quickly spark public outcry, compelling government agencies, along with industries, to take immediate action.

Restraint

Why Is the Limited Availability of Skilled Labor to Execute Specialized Remediation Tasks a Restraint for the U.S. Environmental Remediation Market?

The limited availability of skilled labor is a restraint on the U.S. environmental remediation market, as it contributes to higher project expenses, delays in project execution, and hindered innovation, all stemming from a lack of professionals with specialized expertise in areas such as environmental science, chemical engineering, and advanced treatment methods. The requirement for skilled labor consistently outpaces the supply, making it challenging for companies to scale operations as well as respond effectively to the rising environmental challenges that need complex solutions.

Opportunity

Why Is Addressing Soil and Water Contamination an Opportunity for the U.S. Environmental Remediation Market?

Addressing soil and water contamination presents a substantial opportunity for the U.S. environmental remediation market due to regulatory mandates, evolving public awareness, a history of industrial pollution, economic benefits from brownfield redevelopment, as well as the continued demand to mitigate ongoing sources of contamination, such as agricultural runoff and oil and gas activities. Stringent government regulations together with enforcement mandate the cleanup of contaminated sites to save public health and the environment, pushing significant investment in remediation.

Service Type Insights

Why Did the Removal and Disposal Segment Dominate the U.S. Environmental Remediation Market in 2024?

The removal and disposal segment dominates the U.S. environmental remediation market due to the sheer volume of legacy contamination from historical industrial activities, the ongoing demand to handle hazardous waste, stringent regulatory frameworks, as well as the direct and immediate nature of physical cleanup contrast to in-situ methods for heavily contaminated sites. Federal regulations and policies, like the Superfund program, mandate the cleanup of abandoned hazardous waste sites. These regulations drive the need for remediation services, which typically focus on physical removal and disposal to meet compliance standards and protect public health.

The emergency response abatement segment is experiencing the fastest growth due to increased industrial activity, stricter environmental regulations, growing environmental risks associated with spills, and the need for rapid response services. Growing concerns about the ecological and health impacts of hazardous spills push the need for immediate and effective containment.

End-Use Sector Insights

Why Did the Government & Institutional Buildings Segment Dominate the U.S. Environmental Remediation Market in 2024?

The U.S. government & institutional segment dominate environmental remediation due to federal and state mandates for cleaning up large-scale contamination from legacy industrial and military activities, such as Superfund sites, under numerous regulations, including CERCLA. A remarkable number of contaminated sites, which include Superfund sites and federal facilities, need extensive cleanup and restoration efforts, largely contributed to by government initiatives.

The healthcare facilities segment is witnessing the fastest growth due to increased knowledge of hygiene as well as HAIs, the modernization of facilities, the outsourcing of customized environmental services, and a rising demand for green cleaning practices. Healthcare facilities are increasingly modernizing with developed technologies as well, and are outsourcing environmental services to specialized vendors. These vendors offer the expertise needed for cleanliness management, primarily through the integration of IoT and advanced management systems.

Project Type Insights

Why Did the Renovation-Related Abatement Segment Dominate the U.S. Environmental Remediation Market in 2024?

The renovation-related abatement segment dominates the U.S. environmental remediation market because of the strict regulatory frameworks, mainly those from the EPA, such as CERCLA and Superfund, which mandate cleanups as well as create a continuous need for services targeting historical industrial contamination. Increased public concern across environmental health as well as corporate social responsibility initiatives is propelling greater acceptance of effective remediation practices. This heightened knowledge pressures stakeholders to tackle contamination.

The emergency/unplanned remediation segment is witnessing the fastest growth as raised industrial accidents from aging infrastructure, mainly in the oil and gas sector, and a growth in extreme weather events associated to climate change, both creating an urgent requirement for rapid cleanup. Industrialization and urbanization continue to raise the risk of accidents as well as spills that result in contamination and necessitating immediate cleanup efforts. Many industries, mainly oil and gas, depend on aging pipelines and storage tanks, raising the risk of accidental releases along with creating an immediate need for remediation.

U.S. Environmental Remediation Market Companies

- Clean Harbors

- AECOM

- Tetra Tech

- Jacobs Solutions Inc.

- WSP

Recent Development

- In June 2024, the partnership marks a strategic move towards tackling the pressing issue of 1,4-dioxane contamination in North America, with a focus on the United States and Canada. Under the terms of the agreement, it assists a beacon of hope in the fight against this pervasive pollutant, which is known to be a potential human carcinogen. (Source: https://www.synbiobeta.com)

Segments Covered in the Report

By Service Type

- Inspection and Risk Assessment

- Building surveys

- Bulk sampling and lab analysis

- Air monitoring

- Encapsulation

- Sprayed coatings

- Sealants

- Enclosure (Structural containment methods)

- Removal and Disposal

- Full-scale remediation

- Controlled demolition

- Disposal logistics (landfill, transport)

- Emergency Response Abatement (Post-fire, flood, or structural damage cases)

By End-Use Sector

- Industrial Facilities

- Manufacturing

- Chemical plants

- Refineries

- Others

- Commercial Buildings

- Offices

- Retail malls

- Hotels

- Residential Structures

- Single-Family Homes

- Multi-Family Apartments

- Public Housing Units

- Government & Institutional Buildings

- Schools and universities (AHERA-specific)

- Courthouses, military facilities, public housing

- Healthcare Facilities (Hospitals, long-term care homes, clinics)

- Transportation Infrastructure

- Airports

- Rail Stations & Subways

- Bridges & Tunnels

By Project Type

- Renovation-Related Abatement (Interior upgrades, HVAC replacement)

- Pre-Demolition Abatement (Compliance before structural teardown)

- Emergency/Unplanned Remediation (Building damage from fire, flooding, collapse)

- Planned Maintenance Abatement (Phased upgrades in occupied buildings)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting