U.S. mRNA Therapeutics Market Size and Forecast 2025 to 2034

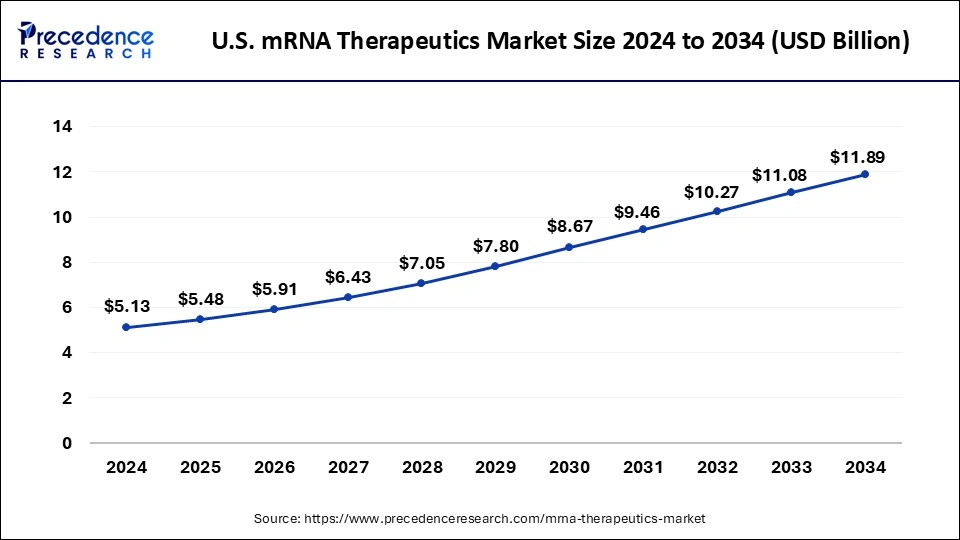

The U.S. mRNA therapeutics market size accounted for USD 5.13 billion in 2024 and is predicted to increase from USD 5.48 billion in 2025 to approximately USD 11.89 billion by 2034, expanding at a CAGR of 9.00% from 2025 to 2034.

U.S. mRNA Therapeutics Market Key Takeaways

- In terms of revenue, the global U.S. mRNA therapeutics market was valued at USD 5.13 billion in 2024.

- It is projected to reach USD 11.89 billion by 2034.

- The market is expected to grow at a CAGR of 9% from 2025 to 2034.

- By type, the prophylactic vaccines segment held the largest share of 52.60% in 2024.

- By application, the oncology segment led the market, with a revenue share of 57.42% in 2024. The segment is observed to sustain the growth rate during the forecast period.

- By end-use, the hospital and clinics segment held the largest share of the 60.15% market in 2024. The segment is expected to sustain its position throughout the forecast period.

Market Overview

The U.S. mRNA therapeutics market refers to the segment of the pharmaceutical industry involved in the development, production, and commercialization of mRNA-based therapeutics. mRNA therapeutics utilize messenger RNA (mRNA) molecules to deliver genetic instructions to cells, triggering the production of therapeutic proteins to treat or prevent diseases.

mRNA therapeutics refers to a class of medical treatments that utilize messenger RNA (mRNA) molecules to instruct cells in the body to produce specific proteins. mRNA is a type of genetic material that carries the instructions from DNA to the cellular machinery responsible for protein synthesis. In the context of therapeutics, synthetic or modified mRNA is designed to encode for a particular protein with therapeutic benefits.

The fundamental idea behind mRNA therapeutics is to introduce exogenous mRNA into cells, prompting them to produce specific proteins that can have therapeutic effects. This approach is distinct from traditional drug development, which often involves creating and administering proteins directly.

The number of Americans 65 and older grew around five times faster than the country as a whole during the 100 years between 1920 and 2020, according to the US Census Bureau. Senior citizens made up 55.8 million of the US population in 2020 or 16.8% of the overall population.

U.S. mRNA Therapeutics Market Growth Factors

- The success of mRNA vaccines, particularly in the context of the COVID-19 pandemic, has significantly boosted confidence in the mRNA platform. Vaccines such as those developed by Pfizer-BioNTech and Moderna have demonstrated the efficacy and safety of mRNA technology, paving the way for further exploration and investment in mRNA therapeutics, while promoting the growth of the U.S. mRNA therapeutics market.

- The mRNA platform allows for relatively rapid development of therapeutics compared to traditional methods. This speed is crucial in responding to emerging infectious diseases or rapidly evolving medical needs. The scalability of mRNA production is also advantageous for large-scale manufacturing, making it easier to meet global demand.

- Increased investment from both public and private sectors, as well as collaboration between pharmaceutical companies and biotechnology firms, has fueled advancements in mRNA therapeutics. Partnerships between established pharmaceutical companies and innovative biotech firms can accelerate research and development efforts.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.00% |

| Market Size by 2034 | USD 11.89 Billion |

| Market Size in 2025 | USD 5.48 Billion |

| Market Size by 2024 | USD 5.13 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

Market Dynamics

Driver

Developments in bioinformatics and synthetic biology

The creation and improvement of mRNA therapies have been made possible by the quick speed at which synthetic biology and bioinformatics are developing. The development of more efficient mRNA therapeutics has been facilitated by advances in genomics knowledge, gene editing skills, and the application of advanced computer models to forecast the structure and behavior of mRNA. These developments significantly increase the range of possible uses for mRNA technology, extending beyond infectious illnesses to encompass, among other things, genetic abnormalities, and cancers. Because of the expanding use and effectiveness of modern technologies, the U.S. mRNA therapeutics market is also fueled by ongoing advancements in the domains of synthetic biology and bioinformatics.

Restraint

Storage & stability and delivery challenges

mRNA molecules are not as stable as conventional small molecule medications by nature. Certain COVID-19 mRNA vaccines require storage at extremely low temperatures, which presents logistical hurdles for distribution, especially in areas with limited access to sophisticated cold storage equipment. Furthermore, one of the biggest challenges is delivering mRNA to target cells efficiently. Although delivery has improved with the introduction of lipid nanoparticles, research is still ongoing to address concerns with tissue-specific targeting, cellular absorption, and potential off-target consequences. Thus, this is expected to hamper the U.S. mRNA therapeutics market growth.

Opportunity

Increasing demand for personalized medicine

The goal of personalized medicine is to customize care to each patient's particular genetic profile and medical needs. This method of providing healthcare has gained popularity recently and is a considerable divergence from the one-size-fits-all paradigm. Because mRNA technologies may be tailored to target specific disease variants or specific genetic profiles, they have great potential in this area.

In the context of personalized medicine, mRNA vaccines and therapies are especially appealing because of their potential for customization, which also increases their therapeutic effectiveness and safety profile. The need for individualized medicine is growing as a result of this. The market for mRNA technologies is impacted by the growing demand for these technologies as more patients and healthcare professionals become aware of the advantages of customized medicine.

Type Insights

Based on the type, the prophylactic vaccines segment dominated the U.S. mRNA therapeutics market in 2024. The mRNA platform's ability to facilitate rapid vaccine development has been a key advantage, particularly in responding to emerging infectious diseases. The mRNA technology allows for a quicker response to evolving pathogens by designing and producing vaccines in a shorter timeframe compared to traditional vaccine development methods. The success of mRNA prophylactic vaccines has attracted significant investment in the mRNA therapeutics market. Pharmaceutical companies and biotech firms are increasingly focusing on the development of mRNA-based vaccines for various infectious diseases, driving market growth.

- For instance, in September 2023, the Coalition for Epidemic Preparedness Innovations (CEPI) and BioNTech SE formed a strategic alliance to progress mRNA-based vaccine candidates. BNT166 is being developed to prevent mpox, which is an infectious disease that can have serious and potentially fatal consequences. It is caused by a virus belonging to the Orthopoxvirus family.

A growing number of mpox cases that later turned into an international outbreak in May 2022 brought the disease to the attention of the world. Up to $90 million in financing will be made available by CEPI to aid in the development of vaccine candidates based on mRNA.

Application Insights

Based on the application, theoncology segment held the largest share of the U.S. mRNA therapeutics market in 2024. The adaptability of mRNA allows for the development of personalized cancer therapies. By tailoring mRNA sequences to a patient's specific tumor mutations or antigens, researchers aim to create targeted and individualized treatments for different types of cancers. Moreover, the growing prevalence of cancer in the country also propels the segment growth.

- For instance, the American Cancer Society estimated mortality rates and new cancer cases in 2022 (It is predicted that there will be 609,360 cancer-related deaths and 1.9 million new cancer cases diagnosed in the US in 2022.

End-use Insights

Based on the end-use, the hospital and clinics segment led the U.S. mRNA therapeutics market in 2024. The segment is observed to sustain its dominance throughout the forecast period. Hospitals and clinics play a central role in the administration of mRNA vaccines. The widespread distribution of COVID-19 mRNA vaccines, such as those developed by Pfizer-BioNTech and Moderna, has been facilitated through healthcare institutions. These vaccines have been administered globally to prevent the spread of the virus.

Hospitals and clinics provide patients with access to innovative therapies, including mRNA therapeutics. As these therapies advance through clinical trials and receive regulatory approval, healthcare providers may integrate them into treatment protocols for specific diseases. Thus, this is expected to propel the market growth.

US mRNA Therapeutics Market Companies

- GSK plc.

- BioNTech SE

- CureVac N.V.

- Sangamo Therapeutics, Inc.

- Translate Bio, Inc.

- Moderna, Inc.

- Argos Therapeutics Inc.

- Arcturus Therapeutics

- AstraZeneca plc.

- Pfizer Inc.

- CRISPR Therapeutics AG

Recent Developments

- In July 2023, MIT scientists are leading a three-year research study financed by the U.S. Food and Drug Administration (FDA) Center for Biologics Evaluation and Research that intends to build the first fully integrated, continuous mRNA production platform in history. The project is valued at $82 million. In addition to accelerating the development and production of mRNA technologies—which businesses are investing in at previously unheard-of levels in the hopes of creating novel vaccines and treatments for cancer, metabolic disorders, genetic diseases, and other conditions—the resulting pilot-scale system is meant to strengthen society's capacity to respond to pandemics in the future.

Segments Covered in the Report

By Type

- Therapeutic Vaccines

- Prophylactic Vaccines

By Application

- Oncology

- Rare Genetic Diseases

- Infectious Diseases

- Others

By End-use

- Research Organizations

- Hospitals & Clinics

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting