What is U.S. mRNA Synthesis Raw Materials Market Size?

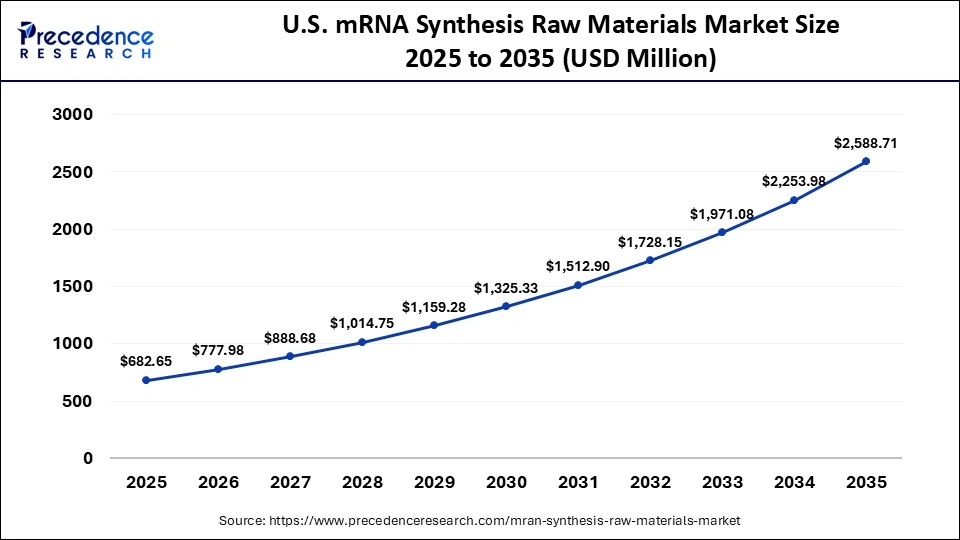

The U.S. mRNA synthesis raw materials market size is calculated at USD 682.25 million in 2025 and is predicted to increase from USD 777.98 million in 2026 to approximately USD 2,588.71 million by 2035, expanding at a CAGR of 14.26% from 2026 to 2035. The market is witnessing substantial growth due to headway in mRNA technology for vaccines and therapeutics, necessitating vast supplies of specialized raw materials for R&D and manufacturing.

Market Highlights

- By type, the nucleotides segment contributed the highest market share in 2025.

- By type, the capping agents segment is growing at a strong CAGR between 2026 and 2035.

- By application, the vaccine production segment captured the highest market share in 2025.

- By application, the therapeutics production segment is poised to grow at a healthy CAGR between 2026 and 2035.

- By end-use, the biotech and pharmaceutical companies segment generated the biggest market share in 2025.

- By end-use, the CROs & CMOs segment is expanding at the fastest CAGR between 2026 and 2035.

What is the U.S. mRNA Synthesis Raw Materials Market?

The U.S. mRNA synthesis raw materials market comprises key components such as nucleotides, enzymes, and capping agents, which are vital for producing mRNA used in vaccines and therapeutics. Growth is driven by expanding mRNA applications, including vaccines, oncology, and rare diseases, along with R&D investment and rising demand for GMP-grade materials, positioning the sector as foundational and competitive for suppliers like Thermo Fisher and Merck KGaA. The market is expanding strongly, moving beyond pandemic needs toward steady growth in personalized medicine, which requires high-purity, reliable supply chains.

Major Trends in the U.S. mRNA Synthesis Raw Materials Market

- Shift towards GMP-Grade and High-Purity Materials: Demand for raw materials that meet stringent Good Manufacturing Practice standards is significant and increasing, and is essential for ensuring product quality, consistency, and regulatory compliance.

- Rapid Expansion beyond Vaccines: Companies are heavily investing in R&D for mRNA-based treatments for oncology, like cancer immunotherapy, rare genetic disorders, protein replacement therapies, and autoimmune diseases.

- Supply Chain Integration and Resilience: To mitigate supply chain bottlenecks and ensure scalability, companies are increasingly investing in end-to-end mRNA manufacturing platforms and forming strategic collaborations with raw material suppliers to enhance self-sufficiency in critical materials.

- Technological Advancements in Capping and Delivery: There's a notable shift toward advanced technologies, particularly enzymatic capping methods over traditional chemical methods, due to their higher efficiency and yield, which improve mRNA stability and cellular uptake.

- Automation and Digital Integration: Manufacturers are leveraging automation and AI-driven tools in raw material production to optimize reagent use, predict yields, and improve overall efficiency and batch-to-batch consistency.

How will AI transform the U.S. mRNA Synthesis Raw Materials Market?

Artificial intelligence (AI) is transforming the U.S. mRNA raw materials market. This transformation stems largely from optimized synthesis enabled by digital twins, predictive analytics, and automation, which improve yield, quality, and supply chain efficiency. AI creates digital twins of production systems to simulate, optimize workflows, minimize waste, and predict maintenance needs, improving efficiency and consistency. AI algorithms help ensure the timely availability of crucial raw materials, supporting a stable supply for manufacturers. Additionally, AI analyzes vast biological datasets to identify potential mRNA targets, predict interactions, and accelerate regulatory submissions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 682.25 Million |

| Market Size in 2026 | USD 777.98 Million |

| Market Size by 2035 | USD 2,588.71 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.26% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, Application, End-Use, State Level |

Segment Insights

Type Insights

How did the Nucleotides Segment Dominate the U.S. mRNA Synthesis Raw Materials Market in 2025?

Nucleotides

The nucleotides segment dominated the market in 2025, driven by the essential building blocks, adenine, uracil, cytosine, and guanine, needed to create mRNA strands. Modified nucleotides play a crucial role in enhancing mRNA stability and minimizing unwanted immune responses. The large-scale in vitro transcription (IVT) process for mRNA vaccines and therapeutics requires significant quantities of these raw materials, leading to high demand. As mRNA technology advances into oncology and rare diseases, the need for specialized, high-quality nucleotides increases, ensuring supply chain resilience and driving market growth.

Caping Agents

The capping agents segment is expected to experience the fastest growth during the forecast period. This growth is primarily due to the rising demand for advanced capping technologies that enhance the stability, translation efficiency, and overall efficacy of mRNA-based therapeutics and vaccines. Capping is essential for protecting the mRNA molecule from degradation by enzymes and is critical for efficient protein production within cells. There is a notable shift in the industry from traditional, less efficient chemical capping methods to more effective enzymatic systems that offer better yields and batch consistency.

Application Insights

What made the Vaccine Production Segment Lead the U.S. mRNA Synthesis Raw Materials Market in 2025?

Vaccine Production

The vaccine production segment led the market in 2025, largely due to the proven success and rapid scalability of mRNA technology following the COVID-19 pandemic. This success has resulted in a surge in demand for materials needed for vaccines targeting influenza, RSV, and cancer, due to their high efficacy, quick development timelines, and scalability. A robust pipeline of mRNA vaccines for various pathogens necessitates a consistent and large-scale supply of raw materials, maintaining high demand. Additionally, mRNA technology allows for rapid updates to vaccine sequences in response to emerging variants, establishing it as a cornerstone of public health and further anchoring raw material demand.

Therapeutics Production

The therapeutics production segment is projected to grow the fastest over the forecast period, primarily driven by substantial research and development investments into new mRNA therapies for cancer, rare diseases, and infectious diseases. This creates a significant demand for high-purity raw materials to support this growing pipeline and clinical trials. Innovations in synthesis, particularly with modified nucleotides like pseudouridine and capping agents like CleanCap, enhance therapeutic performance and fuel demand for these specialized inputs, supporting the entire mRNA ecosystem from research to manufacturing.

End-Use Insights

Why did the Biotech and Pharmaceutical Companies Segment Dominate the U.S. mRNA Synthesis Raw Materials Market in 2025?

Biotech and Pharmaceutical Companies

The biotech and pharmaceutical companies segment dominated the market in 2025. This is due to major investments, expansion of in-house manufacturing capabilities, and strategic partnerships for critical materials like nucleotides and capping agents. This demand extends beyond vaccines to new therapeutics. Companies such as BioNTech and Moderna are building or acquiring raw material production capabilities to improve control, quality, and cost. Existing and expanding facilities for mRNA vaccines and therapeutics require substantial quantities of raw materials, including enzymes, lipids, and modified nucleotides.

CROs & CMOs

The CROs & CMOs segment is experiencing the fastest market growth. This is mainly because smaller biotechnology firms are increasingly outsourcing development tasks, necessitating specialized partners with expertise in mRNA production and infrastructure. Small to mid-sized biotech firms are turning to these organizations to avoid the high costs associated with building in-house production facilities, fostering a streamlined operational model. These partners are scaling up to support both early-stage research and larger clinical trial quantities, offering integrated services and creating a one-stop shop for drug sponsors.

State Level Insights

California Market Trends

California is a key player in the global market, particularly through regions like Silicon Valley and other tech corridors that serve as innovation hubs in software, green energy, and venture-backed startups, extending into the biotech sector. The state has historically taken a proactive approach to biosecurity regulation, implementing legislation that requires mandatory sequence screening for DNA synthesis companies. Numerous contract development and manufacturing organizations, along with specialized raw material manufacturers, operate within the state.

Massachusetts Market Trends

Massachusetts is also emerging as a significant player in the global market, serving as a primary biopharmaceutical center in the U.S. The region is home to industry leaders such as Moderna, which boasts substantial in-house manufacturing capabilities. Massachusetts benefits from a world-class research ecosystem, featuring top universities and advanced research institutes. This environment, combined with significant federal funding from agencies like the NIH and the BARDA, fosters robust public-private partnerships that accelerate the development and production of essential raw materials for both vaccines and emerging therapeutics.

Value Chain Analysis

- Research & Development (R&D): This focuses on the fundamental biology and design of mRNA therapeutics.

Key Players: Novartis, Pfizer, Sarepta Therapeutics, Charles River Laboratories, and IQVIA. - Clinical Trials and Regulatory Approval: In this, human trials are conducted in phases to prove safety, efficacy, and dosage. This involves extensive data collection and submission to regulatory bodies like the FDA for market approval.

- Key Players: Sarepta Therapeutics, Pfizer, Novartis, and Bluebird Bio.

- Manufacturing:This stage involves the highly complex and scalable production of the mRNA molecule and its formulation into the final drug product in sterile, GMP-compliant conditions.

Key Players: Catalent, Lonza, FUJIFILM Diosynth Biotechnologies, Biogen, Gilead Sciences, and Merck KGaA. - Logistics and Patient Delivery:This critical step involves specialized cold chain or cryogenic logistics to transport the often temperature-sensitive therapies from manufacturing sites to hospitals or treatment centers globally.

Key Players: DHL Group, FedEx Logistics, Marken, and UPS Healthcare. - Treatment and Commercialization:This involves administering the therapy to the patient within certified treatment centers.

Key Players: Novartis, Roche, Vertex, and St. Jude Children's Research Hospital.

Who are the Major Players in the U.S. mRNA Synthesis Raw Materials Market?

The major players in the U.S. mRNA synthesis raw materials market includes Thermo Fisher Scientific Inc., TriLink BioTechnologies, Aldevron, Merck KGaA, New England Biolabs, Moderna, Inc., Pfizer Inc., BOC Sciences, Creative Biogene, Evonik Industries AG, Integrated DNA Technologies , Promega Corporation, Arcturus Therapeutics Holdings Inc., Ginkgo Bioworks, Inc., and AGC Biologics

Recent Developments

- In May 2025, TriLink BioTechnologies (TriLink), a Maravai LifeSciences company, announced a major donation to academic labs in the U.S. and Europe to celebrate the launch of its first mRNA synthesis kit featuring CleanCap capping technology. Each of the seven selected institutions will receive ten kits capable of producing up to 250mg of capped mRNAs, enhancing research in mRNA medicine and significantly reducing dsRNA compared to competitors through efficient synthesis. (Source:https://www.trilinkbiotech.com)

- In September 2024, Elegen launched ENFINIA™ IVT Ready DNA, designed for immediate use in mRNA development. This high-fidelity, long linear DNA can accelerate workflows by up to 3X, eliminating the drawbacks of plasmid-derived templates, which require extra processing and quality checks. (Source:https://www.businesswire.com)

- In June 2025,Cytiva, a Danaher company, completed expansions in the U.S., Europe, and Asia as part of a $1.6 billion investment since 2019. These expansions will enhance in-region manufacturing to meet rising customer demand, ensuring faster delivery of products like chromatography resins and cell culture media. (Source:https://pharmaceuticalmanufacturer.media)

Segments Covered in the Report

By Type

- Nucleotides

- Capping Agents

- Enzymes

- Plasmid DNA

- Others

By Application

- Vaccine Production

- Therapeutics Production

- Others

By End-Use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting