What is the mRNA Synthesis Raw Materials Market Size?

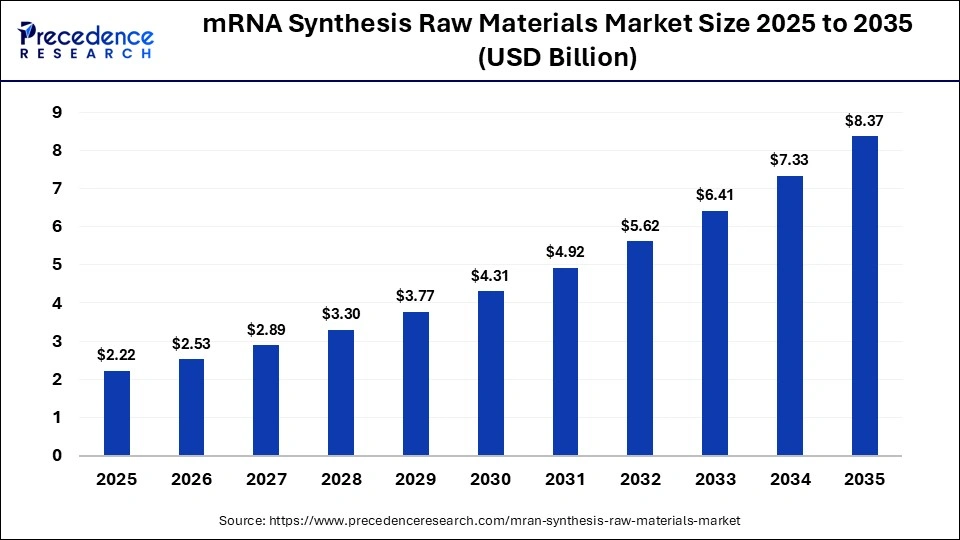

The global mRNA synthesis raw materials market size was calculated at USD 2.22 billion in 2025 and is predicted to increase from USD 2.53 billion in 2026 to approximately USD 8.37 billion by 2035, expanding at a CAGR of 14.21% from 2026 to 2035. The market is primarily driven by increasing investments in biotechnology, infectious disease preparedness, and personalized medicine development.

Market Highlights

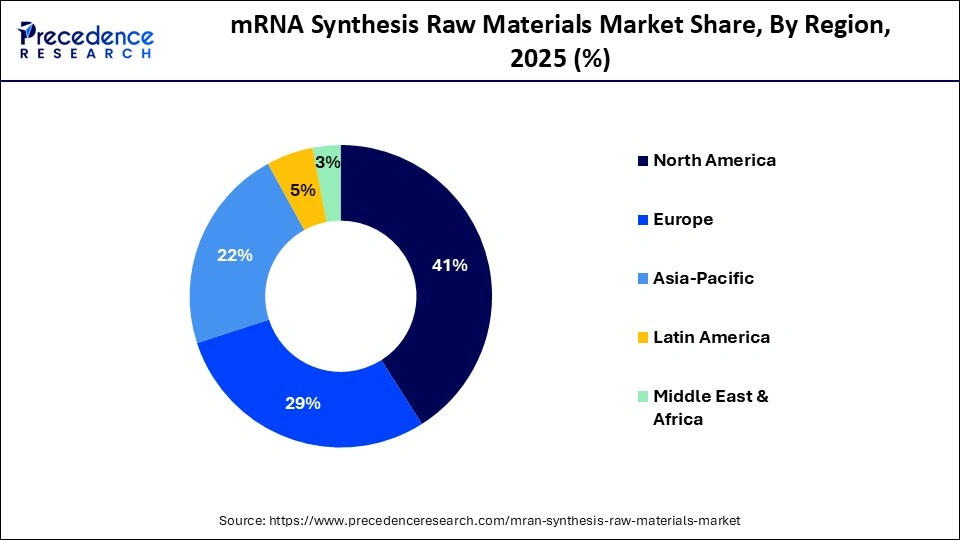

- North America dominated the global mRNA synthesis raw materials market with the largest market share of 41% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR 5.26% between 2026 and 2035.

- By type, the nucleotides segment dominated the market with the biggest share of 40% in 2025.

- By type, the capping agents segment is expected to grow at a CAGR of 4.6% between 2026 and 2035.

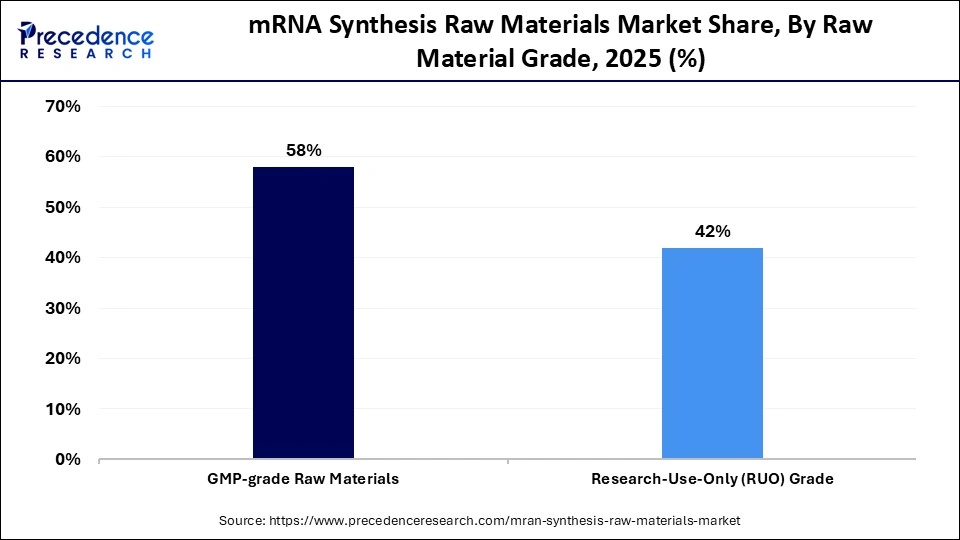

- By raw material grade, the GMP-grade raw materials segment contributed to the highest market share of 58% in 2025.

- By raw material grade, the research-use-only grade segment is expected to grow at a healthy CAGR between 2026 and 2035.

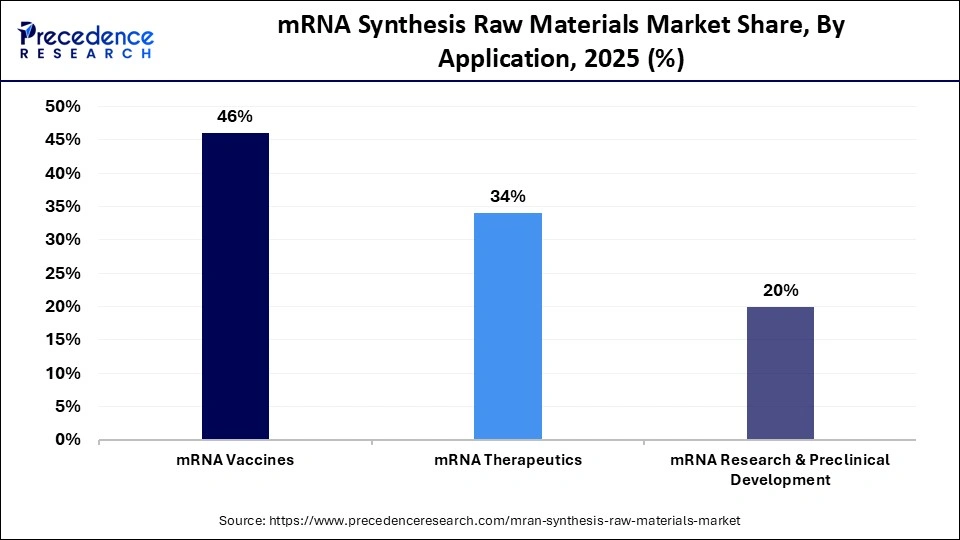

- By application, the mRNA vaccines segment held a major market share of 46% in 2025.

- By application, the mRNA therapeutics segment is expected to expand at a notable CAGR from 2026 to 2035.

- By end user, the biopharmaceutical & biotechnology companies segment captured the highest market share of 47% in 2025.

- By end user, the CDMOs segment is poised to grow at a healthy CAGR between 2026 and 2035.

Why is the mRNA Synthesis Raw Materials Market Gaining Momentum?

The mRNA synthesis raw materials market is witnessing a strong growth due to the growing use of mRNA technology in the treatment of cancer and rare diseases and the development of vaccines. The market comprises critical reagents, enzymes, nucleotides, capping agents, templates, and supporting consumables required for in-vitro transcription (IVT)–based production of messenger RNA used in vaccines, therapeutics, and research applications. The market supports clinical, commercial, and research-scale mRNA manufacturing for infectious diseases, oncology, rare diseases, and personalized medicine.

- Increased government funding for pandemic preparedness, growing clinical pipeline expansion, and rising R&D investments are driving market growth. Additionally, improvements in lipid nanoparticles, nucleotide enzymes, and capping reagents are improving the scalability and efficiency of mRNA production.

What are the Major Trends in the Market?

- Increasing use of modified nucleotide to improve mRNA stability and reduce immunogenicity.

- Rising demand for high-purity enzymes and reagents to support large-scale and GMP-compliant mRNA manufacturing.

- Growing adoption of lipid nanoparticles (LNPs) as the preferred delivery system for mRNA therapeutics and vaccines.

- Expansion of in-house manufacturing capabilities by biopharmaceutical companies to secure raw material supply and reduce dependency on external vendors.

- Unlocking New Frontiers: Opportunities Driving the mRNA Synthesis Raw Materials Market.

- Growing development of rRNA-based therapeutics beyond vaccines, including cancer immunotherapy and rare genetic disorder treatment, is creating the demand for specialized raw materials.

- Rising investments in GMP-grade raw material production offer opportunities for suppliers to support clinical and commercial scale manufacturing.

- Expansion of pandemic preparedness programs by governments is driving long-term procurement opportunities for mRNA synthesis components.

- Increasing focus on cost-effective and scalable mRNA production technologies is opening avenues for innovation in enzymes, nucleotides, and delivery-related materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.22Billion |

| Market Size in 2026 | USD 2.53 Billion |

| Market Size by 2035 | USD 8.37Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.21% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Raw Material Grade, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

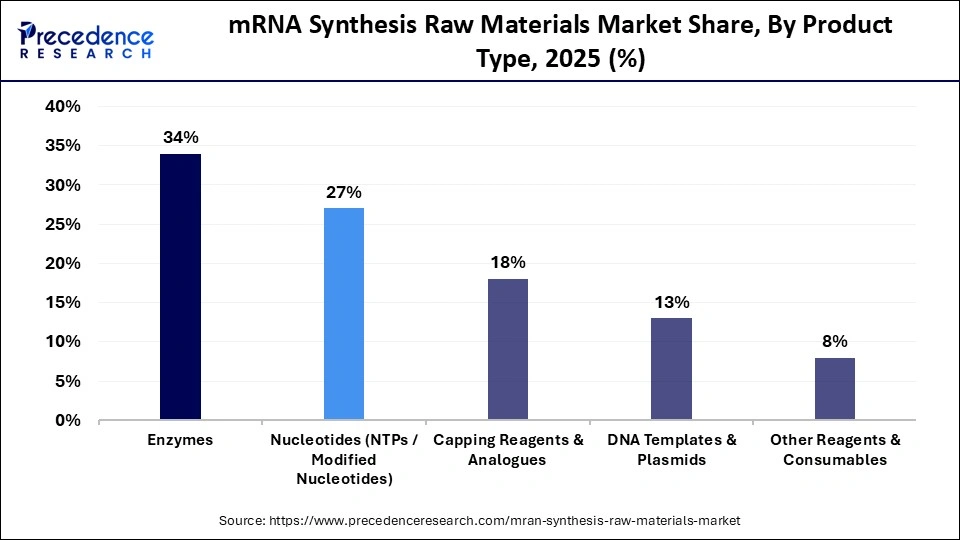

What Made Enzymes the Dominant Segment in the mRNA Synthesis Raw Materials Market?

The enzymes segment dominated the market for mRNA synthesis raw materials, accounting for approximately 34% share in 2025. This is mainly due to their vital function in in vitro transcription procedures. For effective mRNA synthesis, structural integrity, and translation efficiency, enzymes like RNA polymerases, nucleases, and capping enzymes are essential. The need for high-purity, high-performance enzymes has dramatically increased due to the expanding scale-up of mRNA production, especially for vaccines and therapeutic applications, contributing to the segment's dominance.

The capping reagents & analogues segment is expected to grow at the fastest CAGR during the projection period. The segment's growth is mainly driven by an increasing focus on enhancing translational efficiency and mRNA stability. Advanced cap analogues are essential for next-generation mRNA therapeutics because they increase mRNA half-life and decrease immune recognition. Adoption is accelerating due to growing investments in co-transcriptional capping technologies and novel cap chemistries. Strong growth is anticipated for this segment due to the growing therapeutic pipelines that extend beyond vaccines.

Raw Material Grade Insights

Why Did the GMP-Grade Materials Segment Dominate the mRNA Synthesis Raw Materials Market?

The GMP-grade raw materials segment dominated the market with a 58% market share in 2025 due to strict regulations controlling mRNA-based treatments and vaccines. GMP-compliant materials are mandated by regulatory bodies to guarantee product safety, uniformity, and traceability during the production process. GMP-grade nucleotides, enzymes, and reagents are always in high demand because the majority of commercial and late-stage clinical mRNA products target regulated markets.

The research-use-only grade segment is expected to grow at a rapid pace during the projection period, driven by growing government initiatives and the capacity of biopharmaceutical manufacturing. To improve healthcare self-reliance, nations in the region are investing in local mRNA production. Demand for research-use-only raw materials is rising due to increased clinical research activity and the expansion of CDMOs. Additionally, ongoing innovation in mRNA technology and the growing number of mRNA-based projects across oncology, infectious diseases, and personalized medicine continue to fuel the adoption of RUO-grade materials.

Application Insights

The mRNA vaccines segment dominated the market while holding a 46% share in 2025. This is because of their demonstrated effectiveness in widespread immunization campaigns. The demand for raw materials is still being driven by the strong manufacturing ecosystem that has been created by the widespread use of mRNA vaccines. Sustained dominance is supported by government funding of stockpiling programs and continuous vaccine development for infectious diseases.

The mRNA therapeutics segment is expected to grow at the fastest CAGR in the upcoming period, driven by expanding clinical pipelines targeting cancer, genetic disorders, and autoimmune diseases. Unlike vaccines, therapeutic applications often require customized mRNA, increasing demand for specialized raw materials. Rising success rates in clinical trials and growing pharmaceutical interest are accelerating adoption. This segment is expected to witness sustained growth as mRNA platforms mature beyond prophylactic use.

End-User Insights

What Made Biopharmaceutical & Biotechnology Companies the Dominant Segment in the mRNA Synthesis Raw Materials Market?

The biopharmaceutical & biotechnology companies segment dominated the market with the largest share of 47% in 2025, driven by their robust mRNA pipelines and strong R&D capabilities. These companies make significant investments in R&D and preclinical studies, requiring a steady supply of high-quality raw materials to ensure reproducibility, efficiency, and regulatory compliance. Additionally, their ability to scale production and adopt cutting-edge mRNA technologies positions them as the primary end-users, driving consistent demand in the market.

The CDMOs segment is expected to grow at the highest CAGR throughout the forecast period, as outsourcing trends accelerate across the biopharmaceutical industry. Smaller biotech firms increasingly rely on CDMOs for scalable and compliant mRNA production. CDMOs are expanding capacity and investing in advanced mRNA manufacturing technologies, boosting raw materials consumption. This shift is expected to continue as demand for flexible manufacturing rises.

Regional Insights

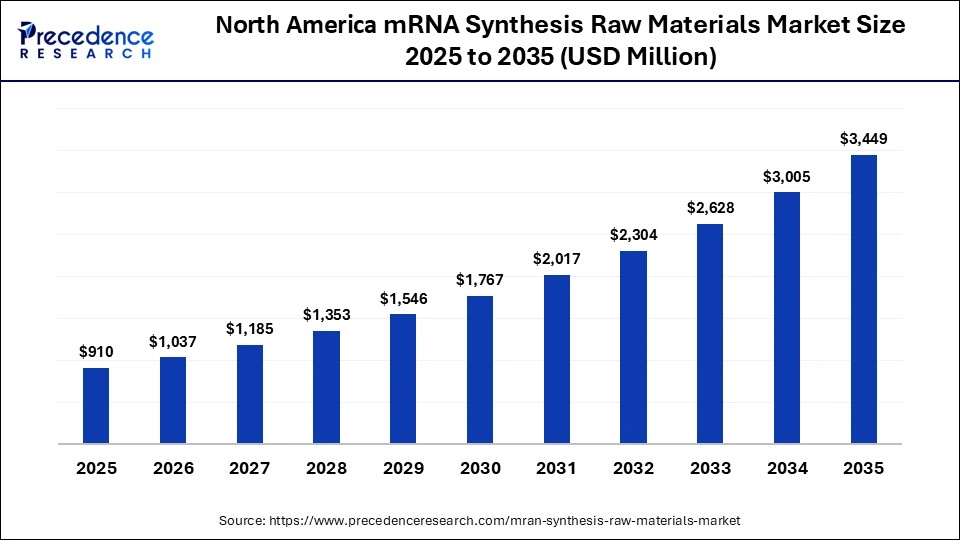

How Big is the North America mRNA Synthesis Raw Materials Market Size?

The North America mRNA synthesis raw materials market size is estimated at USD 910.00 million in 2025 and is projected to reach approximately USD 3,449.00 million by 2035, with a 14.25% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the mRNA Synthesis Raw Materials Market?

North America dominated the market with the largest share of 41% in 2025, propelled by early mRNA technology adoption and robust biopharmaceutical infrastructure. Market leadership is also supported by the existence of top mRNA developers, strong funding sources, and advantageous regulatory frameworks. The region's position is further strengthened by high investment in R&D and domestic manufacturing capabilities.

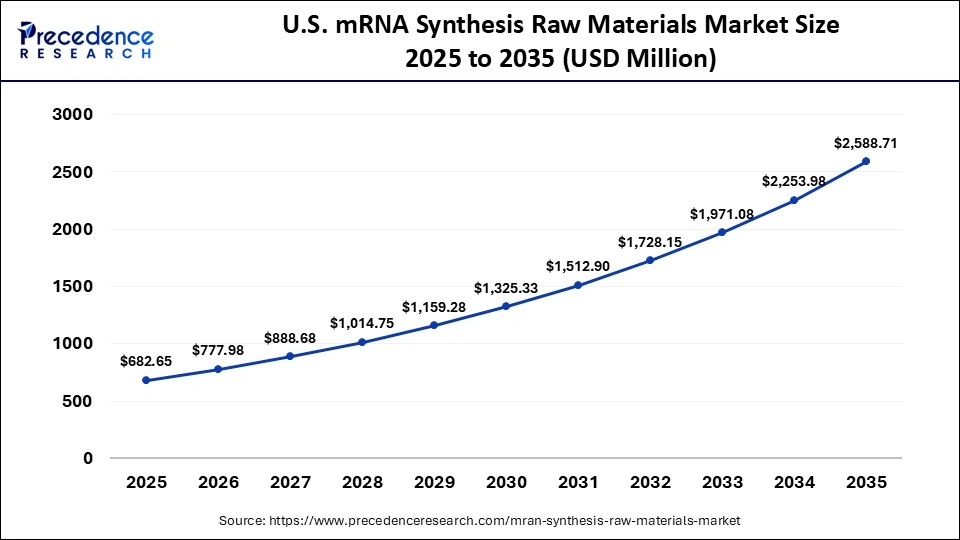

What is the Size of the U.S. mRNA Synthesis Raw Materials Market?

The U.S. mRNA synthesis raw materials market size is calculated at USD 682.25 million in 2025 and is expected to reach nearly USD 2,588.71 million in 2035, accelerating at a strong CAGR of 14.26% between 2026 and 2035.

U.S. Market Analysis

The mRNA synthesis raw materials market is growing rapidly in the U.S. due to the country's strong biopharmaceutical and biotechnology infrastructure and high investment in R&D. The success of mRNA-based COVID-19 vaccines has accelerated interest in mRNA therapeutics for infectious diseases, oncology, and personalized medicine. Supportive regulatory frameworks and advanced research facilities further enable the development and adoption of mRNA technologies, driving demand for high-quality raw materials.

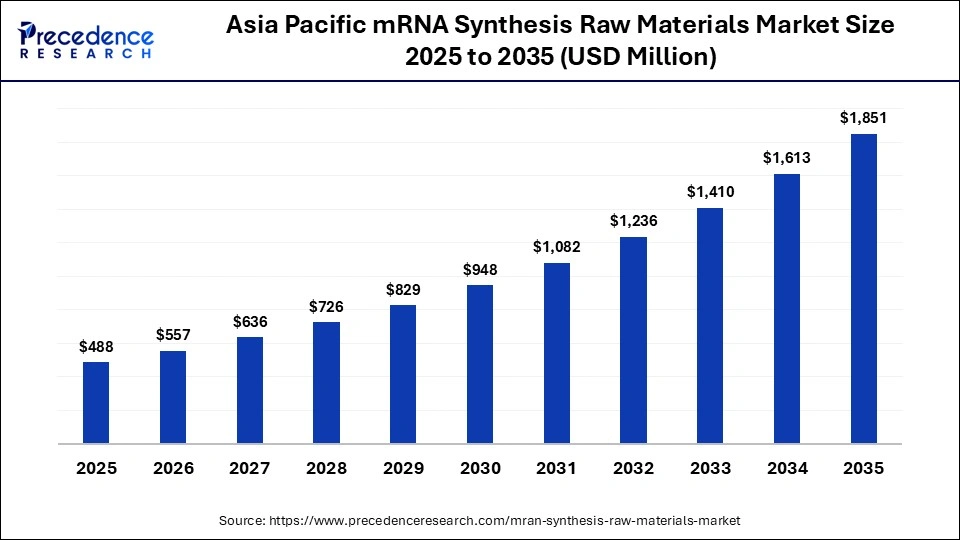

What is the Asia Pacific mRNA Synthesis Raw Materials Market Size?

The Asia Pacific mRNA synthesis raw materials market size is expected to be worth USD 1,851.00 million by 2035, increasing from USD 488.00 million by 2025, growing at a CAGR of 14.26% from 2026 to 2035.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate in the market throughout the forecast period. This is mainly due to increasing investments in biotechnology and pharmaceutical R&D, coupled with rising government initiatives supporting mRNA-based therapeutics. Expanding biopharmaceutical infrastructure, a growing number of CROs and research institutions, and a large talent pool of skilled scientists are accelerating mRNA research activities. Additionally, collaborations with global biotech companies and increasing adoption of advanced technologies are driving strong demand for high-quality mRNA synthesis raw materials in the region.

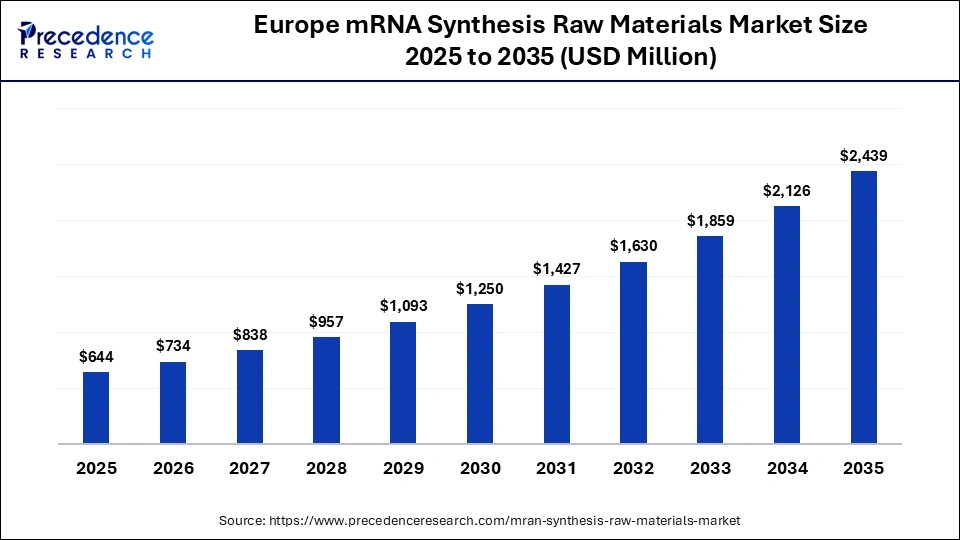

What is the Europe mRNA Synthesis Raw Materials Market Size and Growth Rate?

The Europe mRNA synthesis raw materials market size has grown strongly in recent years. It will grow from USD 644.00 million in 2025 to USD 2,439 million in 2035, expanding at a compound annual growth rate (CAGR) of 14.24% between 2026 and 2035.

Why is Europe Considered a Notably Growing Region in the mRNA Synthesis Raw Materials Market?

Europe is expected to grow at a notable rate in the market throughout the forecast period, driven by stricter clinical guidelines and a high prevalence of diabetes, mobility issues, and neurodegenerative disorders. Rising healthcare initiatives also contribute to regional market growth. The EU4Health provided funding to healthcare organizations, national authorities, and other entities through grants and public procurement to make a healthier Europe. The region's emphasis on advanced healthcare technologies, regulatory compliance, and adoption of innovative pressure-relief mattress solutions further drives market growth.

China Market Analysis

China is a major contributor to the Asia Pacific mRNA synthesis raw materials market due to its rapidly growing biotechnology and pharmaceutical sectors. Significant investments in mRNA research, vaccine development, and gene therapy, combined with expanding R&D infrastructure and a large pool of skilled scientists, drive strong demand for high-quality raw materials. Government initiatives supporting biotechnology and life sciences further accelerate the adoption of mRNA technologies in the country.

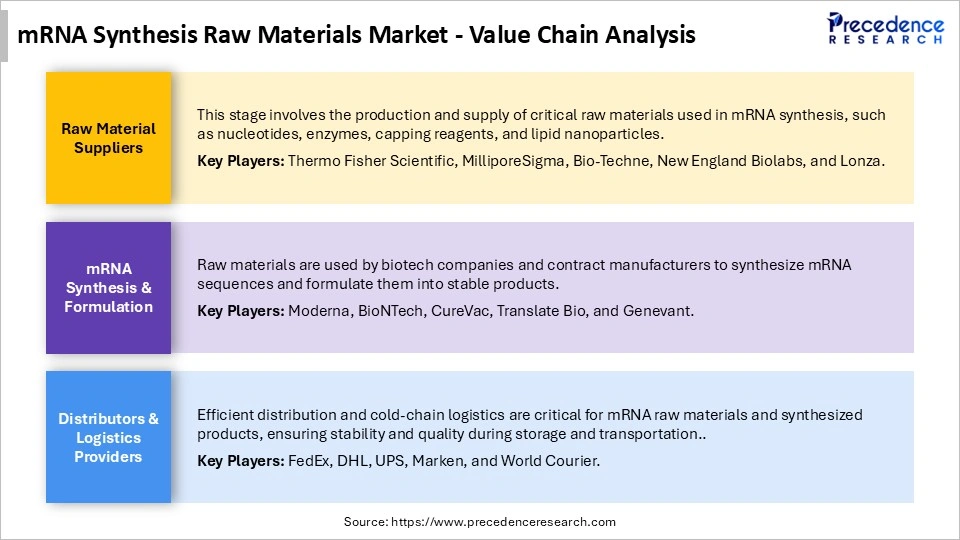

mRNA Synthesis Raw Materials Market Value Chain Analysis

Who are the Major Players in the Global mRNA Synthesis Raw Materials Market?

The major players in the mRNA synthesis raw materials market include Thermo Fisher Scientific Inc., Merck KGaA (including MilliporeSigma), Maravai LifeSciences (primarily through TriLink BioTechnologies), F. Hoffmann-La Roche Ltd., New England Biolabs (NEB), Jena Bioscience GmbH, Yeasen Biotechnology (Shanghai) Co., Ltd., BOC Sciences, Promega Corporation, HONGENE, Creative Biogene, GenScript Biotech Corporation, Sartorius AG, Takara Bio Inc., Lonza Group AG, ST Pharm, Creative Enzymes

Recent Developments

- In May 2025, TriLink BioTechnologies debuted its first mRNA synthesis kit with CleanCap capping technology, an all-in-one IVT solution offering higher yields and lower dsRNA for research and therapeutic development.(Source: https://www.businesswire.com)

- In September 2025, Elegen launched ENFINIA IVT Ready DNA, a high-accuracy, cell-free linear DNA template designed to eliminate the need for bacterial cloning. This product delivers templates with encoded poly(A) tails in as little as 10 business days to accelerate personalized cancer vaccine and gene therapy development.(Source: https://www.synbiobeta.com)

Segments Covered in the Report

By Product Type

- Enzymes

- RNA polymerases

- DNases

- RNases inhibitors

- Nucleotides (NTPs / modified nucleotides)

- Capping Reagents & Analogues

- DNA Templates & Plasmids

- Other Reagents & Consumables

By Raw Material Grade

- GMP-grade Raw Materials

- Research-use-only (RUO) Grade

By Application

- mRNA Vaccines

- mRNA Therapeutics

- mRNA Research & Preclinical Development

By End-User

- Biopharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting