mRNA Therapeutics CDMO Market Size and Forecast 2025 to 2034

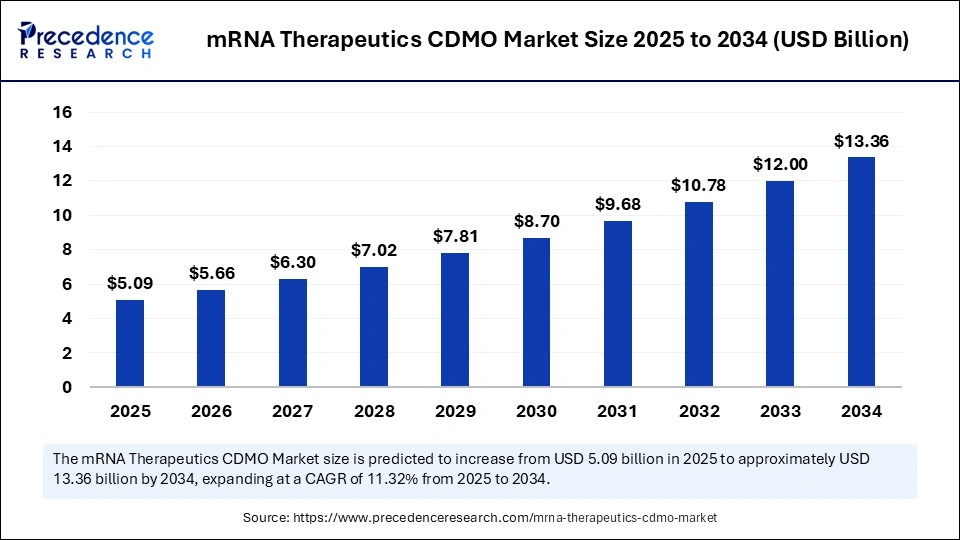

The global mRNA therapeutics CDMO market size accounted for USD 4.57 billion in 2024 and is predicted to increase from USD 5.09 billion in 2025 to approximately USD 13.36 billion by 2034, expanding at a CAGR of 11.32% from 2025 to 2034.The growth of the market is driven by rising demand for personalized medicine, rapid vaccine development, advancements in mRNA technology.

mRNA Therapeutics CDMO MarketKey Takeaways

- In terms of revenue, the mRNA therapeutics CDMO (Contract Development and Manufacturing Organization) market is valued at $ 5,090 million in 2025.

- It is projected to reach $13.36 billion by 2034.

- The market is expected to grow at a CAGR of 11.32% from 2025 to 2034.

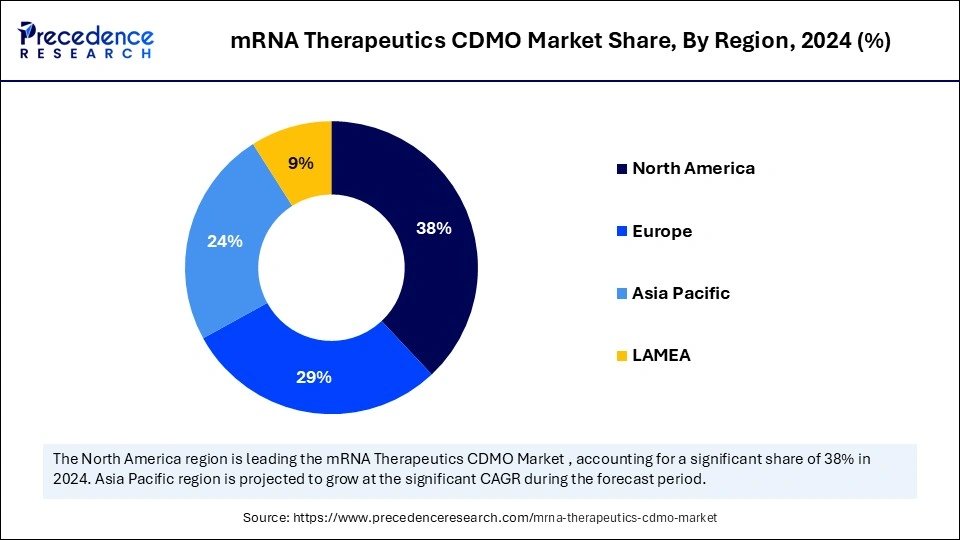

- North America accounted for the highest revenue share of 38% in 2024.

- Asia Pacific is projected to grow at a solid CAGR of 10.83% between 2025 and 2034.

- By application, the viral vaccines segment captured the biggest revenue share in 2024.

- By application, the cancer immunotherapies segment is expected to grow at a significant CAGR from 2025 to 2034.

- By indication, the infectious diseases segment dominated the market with the largest revenue share in 2024.

- By indication, the metabolic & genetic diseases segment is growing at a CAGR of 11.75% from 2025 to 2034.

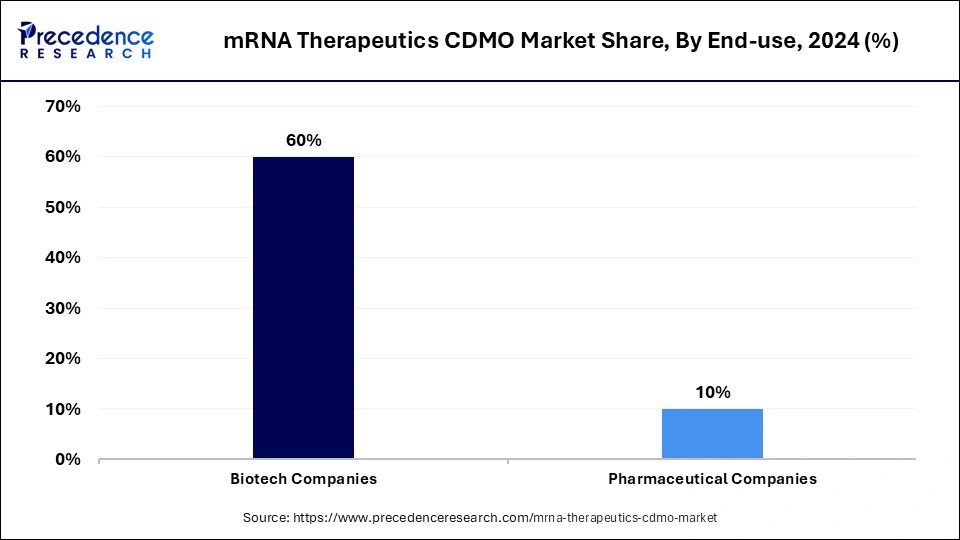

- By end-use, the biotech companies segment captured the major revenue share of 60% in 2024.

- By end-use, the government & academic research institutes segment is expected to expand at the highest CAGR of 11.63% from 2025 to 2034.

How AI Reshapes the Future of mRNA Therapeutics CDMOs?

Artificial intelligenceis revolutionizing the mRNA therapeutics CDMO market by enhancing the capabilities of CDMOs. AI is making complex processes easier and creating new ways to innovate, saving time and effort. mRNA therapies are now rolling out in oncology, autoimmune conditions, and rare genetic disorders beyond infectious disease treatment, thanks to AI. Across all stages of development, AI tools are optimizing mRNA sequence design and delivery systems as well as automating quality control and predictive maintenance for manufacturing processes. This is making more accurate commercialization, lowering risk, and increasing scalability. CDMOs that now rely on AI for their operations can nimbly pivot to new therapeutic requirements and changes while ensuring compliance and adherence to stringent regulatory processes.

As the healthcare industry shifts toward personalized medicine with tailored approaches for next-generation biologics, AI-enabled CDMOs will emerge as key partners throughout the drug development process. Their capability to tie large-scale, data-informed decision-making together with the abstract nature of bioprocessing provides an incredible advantage in leveraging the future of mRNA and therapy development.

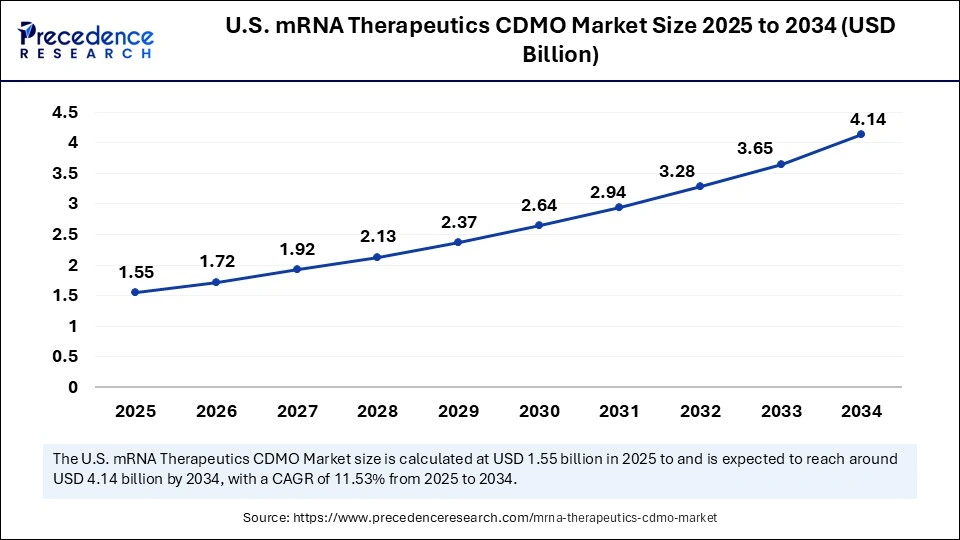

U.S. mRNA Therapeutics CDMO Market Size and Growth 2025 to 2034

The U.S. mRNA therapeutics CDMO market size was exhibited at USD 1.39 billion in 2024 and is projected to be worth around USD 4.14 billion by 2034, growing at a CAGR of 11.53% from 2025 to 2034.

Why did North America Dominate the mRNA Therapeutics CDMO Market?

North America dominated the mRNA therapeutics CDMO market with the largest revenue share of 38% in 2024. This is mainly due to its well-established biopharmaceutical sector, high R&D intensity, and increased collaboration between biotech companies and CDMOs. Adoption of mRNA-based technologies accelerated quickly due to the presence of existing and emerging CDMOs, and the increased production of COVID-19 vaccines in the past few years. Most notably, increased government funding for the development of personalized medicine, cancer immunotherapy, and treatment of rare diseases bolstered the growth of the market in the region. There is a significant trend of outsourcing manufacturing activities to third parties to accelerate the development of novel drugs and vaccines. Such outsourcing has spurred the demand for CDMO services in mRNA chemistry and manufacturing.

The U.S. is a leading country in North America, as it has a high volume of mRNA-based clinical trials being performed. Pharmaceutical companies and emerging biotech companies are collaborating with CDMOs to facilitate mRNA chemistry and manufacture mRNA-based drugs. More than 60% of global mRNA-related clinical studies occur in the U.S. As home to many CDMOs, the U.S. possesses some of the most comprehensive end-to-end mRNA capabilities. In addition, the rising prevalence of metabolic disorders is boosting the demand for personalized medicine, which further creates the need for mRNA.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to grow at the fastest CAGR of 10.83% in the upcoming period. The rapid expansion of biopharmaceutical and biotechnology sectors in the region is creating opportunities for CDMOs. Affordable manufacturing and increased investment in genomic and precision medicine are also attracting CDMOs from across the globe. Countries across the Asia Pacific are strengthening their capacity in nucleic acid-based therapies, bolstered by government-led policies and international collaboration. Rising healthcare expenditure, increasing number of clinical trials, and the high prevalence of infectious diseases are some of the major factors contributing to the growth of the market within the region. Regional CDMOs are increasingly offering more advanced services like mRNA encapsulation in lipid nanoparticles and high-volume sterile fill-finish to help local and global customers shorten their therapeutic timelines.

China is emerging as a major force in the mRNA therapeutics market within Asia Pacific due to its rapidly evolving biotechnology sector and strategic investments in developing mRNA technology. The country has also rolled out national initiatives to stimulate innovation in gene and cell therapies. Leading players in the country, such as WuXi Biologics, are expanding their services to include mRNA synthesis and purification, which further supports market expansion.

Market Overview

The mRNA therapeutics CDMO market encompasses companies that provide outsourced development and manufacturing services for mRNA-based drugs. These services include process development, formulation, analytical testing, and good manufacturing practices (GMP) compliant manufacturing services for clinical and commercial applications. The market has gained significant momentum since the approval of mRNA vaccines, which has led to increased interest in using mRNA for indications other than infectious diseases, including oncology, rare genetic diseases, and personalized medicine. CDMOs are primary partners for pharmaceutical and biotech organizations, as they can offer their technical expertise and complexity-appropriate infrastructure to reduce the production burden without requiring significant internal capex investment. The rising investment in R&D on mRNA therapeutics contributes to market growth.

What Major Factors Boost the Growths of the mRNA Therapeutics CDMO Market?

- Growing Application of mRNA Therapeutics: In addition to vaccines, there are emerging opportunities for mRNA applications in areas such as cancer immunotherapy, rare diseases like the genetic condition Duchenne muscular dystrophy (DMD), and protein replacement therapy, which is creating additional demand for specialized development and manufacturing services.

- Increased Outsourcing by Biotech and Pharmaceutical Companies: There is a significant increase in the number of companies wanting to outsource to CDMOs, based on the preference to avoid high capital expenditures necessary for mRNA manufacturing infrastructure, which drives the demand for flexible and scalable contract services.

- Technological Advancements in mRNA Manufacturing: Technological advancements led to the automation of mRNA synthesis and the development of innovative lipid nanoparticles (LNPs) and drug delivery systems, which are reducing time and improving product stability and scalability, making CDMO services increasingly desirable and dependable.

- Capital Investment and Funding into mRNA Platforms: Increasing investment by venture capital, government support, and pharmaceutical investments into mRNA technologies are accelerating the development of potential pipeline products, leading to greater demand for CDMO relationships.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.36 Billion |

| Market Size in 2025 | USD 5.09 Billion |

| Market Size in 2024 | USD 4.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Indication, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Clinical Trials

The mRNA therapeutics sector is experiencing a notable increase in clinical trials, especially in the area of oncology. As of 2024, there were over 60 mRNA-based cancer vaccines in clinical trials. The U.S. and China are leading the research with greater than 45 of the total trials. This rise in clinical trials is reflective of the increase in capacity requirements of specialized CDMO facilities that would support complex mRNA development and manufacturing workflow processes. For example, in October 2023, AGC Biologics added additional capacity for plasmid DNA and mRNA production to their Heidelberg facility. The facility has installed single use bioreactor technology and improved development processes and GMP cleanrooms so they can run multiple projects at the same time with shorter timelines. Such strategic expansions and collaborations are critically important for the biotech industry and research institutes to meet the growing demands of mRNA therapeutics and facilitate quick and efficient development.

Restraint

Regulatory Uncertainties and Policy Changes Impede Market Stability

The mRNA CDMO market faces several challenges due to regulatory complexities and policy decisions. CDMOs must deal with evolving regulations and stringent quality control measures. However, these regulations vary from country to country, making them challenging to maintain consistency in the operation. For instance, in 2025, the U.S. Department of Health and Human Services (HHS) under Secretary Robert F. Kennedy Jr. canceled a $590 million contract with Moderna to develop an mRNA-based vaccine against bird flu, citing safety risks and the need for greater public confidence in medical technology. Such a policy not only threatened the company's long-term financial viability but also hinted at potential volatility for CDMO's whose contracts with the government may also be subject to future uncertainty. Regulatory uncertainty can deter investment and complicate long-term planning efforts by CDMO, as demonstrated by the potential for investment diversification and strategic planning. Overall, regulatory uncertainties highlighted the need for CDMOs to implement a proactive approach to address potential risks.

Opportunity

Expansion in Emerging Markets and High Demand for Personalized Medicine

Emerging markets in Asia Pacific, like China, India, and Australia, offer immense opportunities for CDMOs to establish mRNA manufacturing facilities due to the rising R&D activities and the expansion of the biotechnology sector. For example, in December 2024, Australia proudly opened its first mRNA vaccine manufacturing site in Melbourne, the Moderna Technology Centre, the only facility in the Southern Hemisphere that manufactures mRNA vaccines from start to finish at the commercial scale. This facility produces as many as 100 million vaccine doses annually for COVID-19, influenza, and respiratory syncytial virus (RSV). The facility was opened as a part of a 2 billion dollar, 10-year agreement between Moderna and the Australian government, federal and state, to reduce reliance on international supply chains and regain pandemic preparedness autonomy. The rising demand for personalized medicine, specifically mRNA-based cancer vaccines, mandates agile manufacturing. CDMOs that can adapt and evolve with small-batch patient-specific approaches to manufacturing will take advantage of this demand for an individualized suite of offerings as the therapeutic landscape matures.

(Source: https://djsir.vic.gov.au)

Application Insights

How Viral Vaccines Segment Dominate the mRNA Therapeutics CDMO Market?

The viral vaccines segment dominated the market with the largest share in 2024 because mRNA is widely utilized in the development of vaccines for infectious diseases like COVID-19, influenza, and RSV. The existing momentum in mRNA technology has allowed for rapid design and production of vaccines, and now, with the exhilarating demand for scalable solutions, pharma and biotech companies are increasingly turning to CDMOs for development. These arrangements allow pharmaceutical and biotech companies to expedite their development while maintaining regulatory compliance and appropriate quality.

The cancer immunotherapies segment is expected to expand at a significant CAGR over the projected period. Cancer immunotherapies are attracting a great deal of investment in R&D, creating the need for mRNA encoding for tumor-specific antigens and designed for peptide epitopes for improved immune responses. The ability to design mRNA is exciting for oncology because similar to the potential in HIV, it allows for the configuration of one's disease state, which is resulting in large investments in clinical pipelines. CDMOs offer important services to support rapid preclinical testing and scalable manufacturing, and the ability to push forward personalized cancer therapies is dependent on it. With the increasing cancer burden worldwide, the demand for novel immunotherapies is rising, opening up new avenues for mRNA.

Indication Insights

Why did the Infectious Diseases Segment Dominate the Market?

The infectious diseases segment dominated the mRNA therapeutics CDMO market with the major revenue share in 2024 as this is the most mature, commercialized, and validated area for mRNA-based therapeutics. The global success of mRNA COVID-19 vaccines highlighted the safety and efficacy of mRNA, which thereby opens new avenues to develop effective mRNA solutions against more infectious diseases. CDMOs continue to partner in the production of large-volume vaccines for a variety of infectious diseases. The increased prevalence of infectious diseases across the globe created the need for mRNA-based vaccines.

The metabolic and genetic diseases segment is expected to grow at the fastest CAGR of 11.75% during the forecast period, as the application of mRNA for rare or previously un-treatable conditions is expanding. mRNA can effectively treat metabolic and genetic diseases due to its capability to create therapeutic mechanisms by either directly expressing proteins or correcting genetic anomalies. mRNA therapeutics temporarily restore the functions of disease genes by expressing corrective proteins. With considerable increases in R&D and orphan drug designation approvals, CDMOs are engaged in small-batch, high-precision manufacturing projects that meet the needs of new metabolic and genetic therapies.

End-Use Insights

What Made Biotech Companies the Dominant Segment in the Market?

The biotech companies segment dominated the mRNA therapeutics CDMO market with the largest revenue share of 60% in 2024. This is mainly due to their leadership position surrounding the development of mRNA technologies, along with their reliance on CDMO partners for manufacturing large batches of mRNA vaccines. Most biotech companies do not have enough manufacturing capacity nor a complete internal understanding of regulations. Thus, partnerships with the right CDMO are required for development, testing, and scale-up. The rising participation of biotech companies in R&D encourages them to collaborate with CDMOs. Collaborating with CDMOs allows biotech companies to focus on core competencies instead of focusing on manufacturing activities.

The government and academic research institutes segment is expanding at the highest CAGR of 11.63% in the upcoming period, as growth in public funding for research into mRNA was accelerated post-COVID. These institutions are increasing their partnerships with CDMOs to leverage their sources and facilitate research that they conduct to develop viable candidates for therapeutics. The focus on preparedness for pandemics and the development of breakthrough therapies are propelling the growth of the market.

mRNA Therapeutics CDMO Market Companies

- Danaher (Aldevron)

- Biomay AG

- Bio-Synthesis, Inc.

- eTheRNA

- Kaneka Eurogentec S.A.

- TriLink BioTechnologies

- ApexBio Technology

- BioNTech SE

- Biocina

- Lonza

- Recipharm AB

- Novo Holdings (Catalent, Inc.)

- Samsung Biologics

Recent Developments

- In May 2025, OSE Immunotherapeutics SA announced a strategic collaboration with Angoulême/Bordeaux- based Inside Therapeutics and Angers-based MiNT Laboratory to develop mRNA therapeutics and accelerate nanodrug development. The collaboration with OSE and MiNT provides with a fantastic opportunity to demonstrate the technology for the development of mRNA therapies from early development through to clinical trials and GMP production.

(Source: https://www.globenewswire.com) - In April 2025, Wacker Biotech, a leading contract development and manufacturing organization (CDMO) wholly owned by Wacker Chemie AG, announced a strategic collaboration with RNAV8 Bio, a Boston-based pioneer in mRNA engineering. The collaboration is aimed at progressing the development and production of mRNA-based advanced therapies for the biopharma industry. WACKER provides pDNA/mRNA manufacturing and lipid formulation; RNAV8 offers an mRNA engineering platform.

(Source: https://www.webwire.com) - In January 2024, Lonza, a global development and manufacturing partner to the pharmaceutical, biotech and nutraceutical markets, announced collaboration with Oxford Nanopore Technologies plc a company delivering a new generation of nanopore-based molecular sensing technology. The collaboration aims to cGMP validate and commercialize a first-of-its-kind novel test to accurately determine multiple critical quality attributes of mRNA products by directly sequencing both the DNA template and the messenger RNA (mRNA).

(Source: https://www.lonza.com) - In January 2025, Esphera SynBio, a pre-clinical stage synthetic biology company, has launched a new project aimed at enhancing the efficacy of mRNA vaccines. This project is supported by the CQDM Quantum Leap program, which facilitates collaborations between Canadian companies and global biopharmaceutical organizations.

(Source: https://www.contractpharma.com)

Segments Covered in the Report

By Application

- C Viral Vaccines

- Protein Replacement Therapies

- Cancer Immunotherapies

By Indication

- Infectious Diseases

- Metabolic & Genetic Diseases

- Cardiovascular & Cerebrovascular Diseases

By End-use

- Biotech Companies

- Pharmaceutical Companies

- Government & Academic Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting