What is U.S. Healthcare Consumables Market Size?

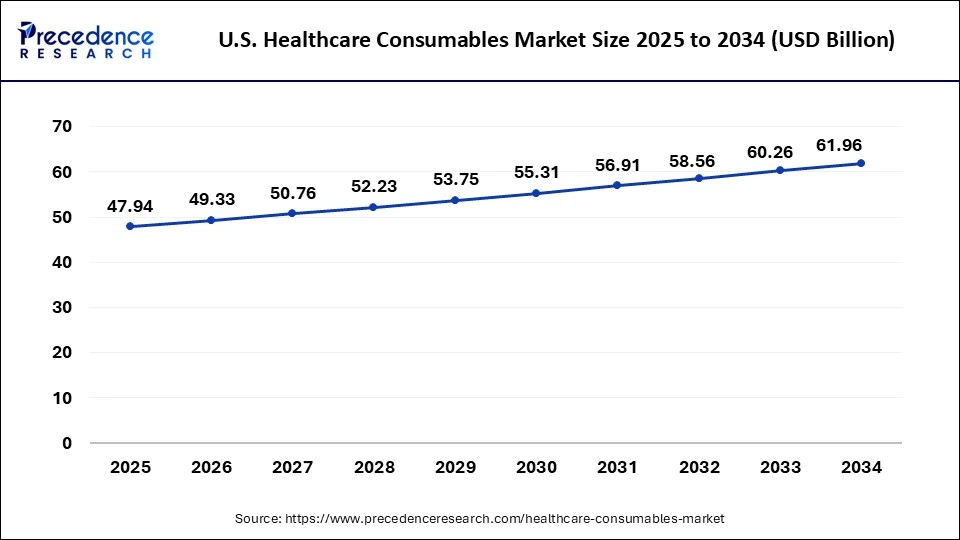

The U.S. healthcare consumables market size is estimated at USD 47.94 billion in 2025 and is projected to be worth around USD 61.69 billion by 2034, growing at a CAGR of 2.50% from 2025 to 2034

Market Highlights

- By product type, the sterilization consumables segment held the largest share of the market in 2024.

- By product type, the diagnostic consumables segment is expected to grow at the highest CAGR during the forecast period.

- By raw materials, the plastic resin segment held the largest share of the market in 2024.

- By end user, in 2023, the hospital segment dominated the US healthcare consumables market.

- by end user, the clinics/physician office segment is expected to grow at a rapid rate over the forecast period.

U.S. Healthcare Consumables Market Overview: Supplies That Save Lives

The U.S healthcare consumables market offers products with a variety of uses in general healthcare or medical procedures. These products usually consist of medical scales, surgical blades, bandages, gauze, syringes, tape, staples, stethoscopes, and many other items. Healthcare consumables are generally defined as goods that are utilized in a hospital, clinic, or other medical facility. Healthcare supplies have specific uses.

Any item utilized by a medical practitioner to enhance overall patient care is often referred to as a healthcare consumable. The majority of healthcare consumables are disposable, single-use items. Its goal is to protect hospital-acquired illnesses from affecting individuals who have been admitted to the hospital or another healthcare facility. Over the projection period, there is expected to be an even greater demand for healthcare consumables due to the increased prevalence of chronic illnesses that need medical treatment.

U.S. Healthcare Consumables Market Growth Factors

- The growing incidence of chronic diseases, such as diabetes, cardiovascular diseases, and respiratory disorders, drives the demand for UShealthcare consumables market. Products like test strips, insulin syringes, and respiratory care consumables become essential for managing these conditions.

- The rising number of surgical interventions and procedures in the USboosts the demand for disposable surgical consumables such as gloves, gowns, drapes, and single-use instruments. This trend is driven by factors like an ageing population requiring surgical interventions and advancements in surgical techniques.

- Public awareness campaigns and educational initiatives about the importance of hygiene and infection control contribute to increased demand for healthcare consumables. This is particularly evident in the country where awareness about preventive healthcare measures is on the rise.

U.S. Healthcare Consumables Market Outlook: Emerging Opportunities

- Industry Growth Overview: The growth in the aging population, chronic diseases, focus on infection control with single-use products, and technological advancements are driving the industry growth.

- Sustainability Trends: Sustainability trends of the U.S. healthcare consumables focus on adopting a circular economy model and increasingly prioritizing reusable products.

- Major Investors: Large healthcare-focused private equity firms, venture capital firms, and large corporate entities are the major investors in the market.

- Startup Ecosystem: The development of digital health solutions, personalized medical devices, and remote patient monitoring to solve specific healthcare problems is the focus of the startup ecosystem.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 47.94 Billion |

| Market Size in 2026 | USD 49.33Billion |

| Market Size by 2034 | USD 61.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.50% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Raw Material, End User |

Market Dynamics

Driver: Rising chronic diseases and growing elderly populations

A high volume of patients with chronic illnesses results in a higher number of hospital admissions. The biggest risk factor for neurological, urological, and cardiovascular conditions is aging. Surgical and diagnostic procedures are typically necessary for many disorders involving the use of consumables such as gloves, catheters, stethoscopes, guidewires, and thermometers. The group of the American population that is now rising at the quickest rate is the elderly (those over 65). Thereby, the rising rate of chronic diseases in geriatric population is observed to act as a driver for the UShealthcare consumables market.

- According to the Partnership to Fight Chronic Disease, 81% of hospital admissions in the United States are related to chronic illnesses. Therefore, it is anticipated that the UShealthcare consumables market will increase as a result of the regular rise in the frequency of chronic illnesses and the rising number of hospital admissions.

- As of June 2023, the population of Americans 65 and over grew around five times faster than the country's overall population between 1920 and 2020, according to the USCensus Bureau.

Restraint: High cost and environmental concerns

The cost of healthcare consumables, especially disposable items, can be a significant burden on healthcare budgets. In some cases, the perceived high cost of disposable products may lead healthcare facilities to explore cost-saving alternatives, impacting the UShealthcare consumables market for certain products. In addition, the increased use of disposable healthcare consumables contributes to environmental concerns related to plastic waste and pollution.

There is a growing emphasis on sustainability and environmentally friendly practices, leading to potential restraints on the use of certain single-use items. Thus, the high cost and environmental concerns might be a major challenge for the UShealthcare consumables market over the forecast period.

Opportunity: Growing partnership

The growing partnership is expected to offer a lucrative opportunity for the UShealthcare consumables market during the forecast period. Clients of the partnering companies can benefit from pooled resources. These include full medical equipment management at a healthcare institution, which includes regular maintenance, recall monitoring and response, distribution and disinfection, and more.

Through the standardization of equipment management procedures across healthcare systems and proactive data safety monitoring, the program may also assist to save costs and increasing productivity for its clients. Additional services offered by such collaboration further enhance the customer experience.

- In March 2023, a deal worth up to $760 million over ten years was announced to provide GE HealthCare's Healthcare Technology Management (HTM) services to Advantus Health Partners' clients. Advantus Health Partners is a provider of healthcare solutions, helping healthcare organizations implement more effective and efficient supply chain models.

Segment Insights

Product Type Insights

It was estimated that the sterilization consumables segment dominated the market in 2023. Sterilization pouches and bags are widely used in healthcare settings to package and sterilize medical instruments. These pouches provide a barrier against microorganisms, ensuring the sterility of instruments until they are ready for use.

Moreover, sterilization wraps and covers are disposable materials used to wrap or cover larger medical equipment before the sterilization process. They help maintain the sterility of equipment during storage and transportation within the healthcare facility.

Besides, the diagnostic consumables segment is expected to grow at the highest CAGR during the forecast period. Diagnostic test kits encompass a wide range of consumables used for detecting specific biomarkers or indicators of diseases. These kits include reagents, test strips, and other disposable components necessary for conducting tests such as pregnancy tests, glucose monitoring, and infectious disease testing. Thereby, driving the segment expansion.

Raw Materials Insights

The plastic resin segment held the largest share of theUShealthcare consumables market in 2023. Plastic resins, such as polyethylene, polypropylene, and polyvinyl chloride (PVC), are commonly used for the packaging of healthcare consumables. Plastic packaging provides a protective barrier, ensuring the sterility of products such as syringes, gloves, and bandages.

Additionally, they are used to manufacture components of diagnostic tests, including housing for test kits, microfluidic devices, and other disposable elements. These materials provide the necessary precision and versatility for diagnostic applications. Thus, the increasing application is expected to propel the segment's growth.

End User Insights

The hospital segment dominated the market in 2023. Hospitals heavily rely on PPE, including disposable gloves, masks, gowns, and face shields, to protect healthcare workers from infections and maintain a safe environment during patient care. Moreover, they use a wide range of surgical consumables, such as disposable drapes, gowns, surgical gloves, and single-use instruments. These items contribute to maintaining a sterile surgical environment and reducing the risk of surgical site infections.

Besides, the clinics/physician office segment is expected to grow at a rapid rate over the forecast period. Clinics and physician offices use PPE, including disposable masks, gloves, gowns, and face shields, to protect healthcare providers and patients during examinations and medical procedures. Additionally, these healthcare settings often utilize diagnostic consumables such as test kits, reagents, and laboratory supplies for various diagnostic tests and screenings, enabling rapid and accurate diagnoses. Thereby, driving the segment growth.

Regional Insights

U.S. Driven by Advanced Healthcare System

The U.S. healthcare consumables market is expected to grow significantly during the forecast period, due to the presence of an advanced healthcare system. At the same time, the growth in healthcare investments and expanding private sectors are increasing the utilization of consumables. Additionally, the growing geriatric population is also increasing the demand for healthcare consumables to support their surgeries and treatments. Moreover, the growing development of single-use devices and wound care solutions is also accelerating their early adoption, driving the demand for healthcare consumables, which is promoting the market growth.

Value Chain Analysis

- R&D: The R&D of the U.S. healthcare consumables focuses on improving infection control, integration of digital health solutions, and development of minimally invasive technologies.

Key players: Johnson & Johnson, Medtronic, 3M. - Clinical Trials and Regulatory Approvals: The safety and effectiveness are evaluated in the clinical trial and regulatory approval of the U.S. healthcare consumables through risk-based pathways.

Key players: Johnson & Johnson, Medtronic, 3M. - Formulation and Final Dosage Preparation: The formulation and final dosage preparation of the U.S. healthcare consumables involves the combination of the active ingredients with excipients to develop a stable, effective, and patient-friendly final dosage form.

Key players: BD, Johnson & Johnson, 3M - Packaging and Serialization: The packaging and serialization of U.S. healthcare consumables consists of the use of FDA unique device identification systems for traceability, sterile barrier systems for product integrity.

Key players: Johnson & Johnson, Medtronic, 3M. - Patient Support and Services: Patient support and services of U.S. healthcare consumables provide product information, technical assistance, direct-to-patient programs, and training resources.

Key players: Johnson & Johnson, Abbott Laboratories, Medtronic

Recent Developments

- In January 2023, A strategic collaboration agreement between Canon Medical Systems USA Inc. and ScImage, Inc. was established. Canon Medical Systems USA Inc. is a commercial subsidiary of Canon Medical Systems Corporation, a pioneer in revolutionary diagnostic imaging technologies worldwide. Sclmage delivers Cloud-native enterprise image management, PACS, and image exchange solutions for the healthcare industry, headquartered out of Los Altos, CA.

- In March 2022, Cardinal Health Inc. launched one of the first surgical incise drapes combined with chlorhexidine gluconate (CHG) to minimize the risk of onsite surgical contamination by gram-negative bacteria. The incise is sturdy, breathable, and provides a sterile surface to avoid any further contamination.

U.S. Healthcare Consumables Market Leaders: Key Players' Offering

- Boston Scientific Corporation: The company provides various guidewires, catheters, and stents.

- 3M: Medical tapes, wound care products, sterilization assurance products, etc., are provided by the company.

- Johnson & Johnson: The company provides surgical sutures, staplers, wound management solutions, etc.

- Medtronic: Infusion sets, surgical instruments, cannulae, etc., are provided by the company.

- BD: The company provides needles, syringes, IV catheters, diagnostic systems, and blood collection tubes.

Segments Covered in the Report

By Product Type

- Wound care Consumables

- Diagnostic Consumables

- Respiratory Supplies

- Drug Delivery Products

- Dialysis Consumables

- Sterilization Consumables

- Incontinence Products

- Disposable Gloves

- Disposable Masks

- Hands Sanitizer

- Others

By Raw Materials

- Rubber

- Non-woven Materials

- Glass

- Metals

- Plastic Resin

- Paper

- Others

By End User

- Hospitals

- Clinics/physician office

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content