U.S. Payment Integrity Market Size and Forecast 2025 to 2034

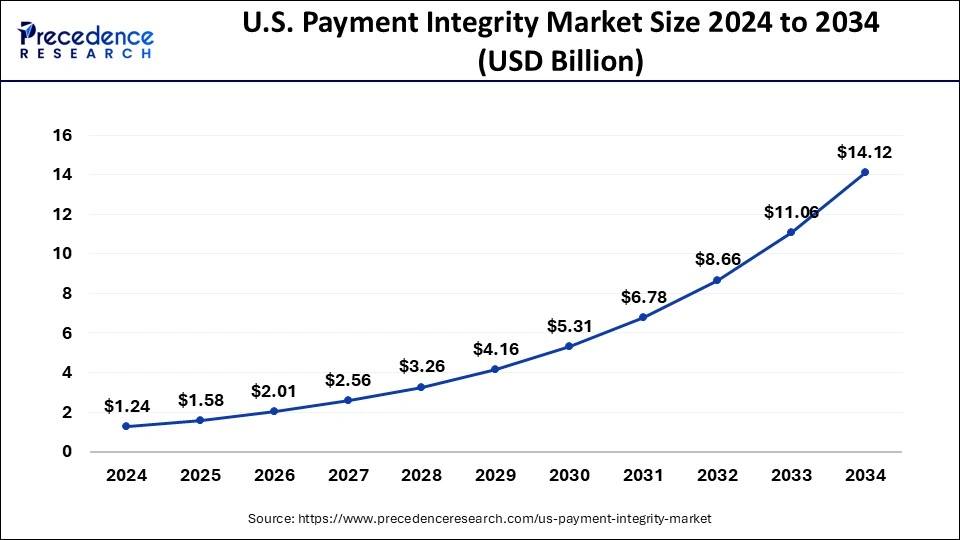

The U.S. payment integrity market size was calculated at USD 1.24 billion in 2024 and is predicted to increase from USD 1.58 billion in 2025 to approximately USD 14.12 billion by 2034, expanding at a CAGR of 27.50% from 2025 to 2034.

U.S. Payment Integrity Market Key Takeaways

- By component, the services segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By function, the Query and Reporting segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By mode of delivery, the cloud based solutions sib segment is projected to grow at a 15% CAGR during the forecast period.

- By application, the clinics sub segment is expected to grow at the fastest rate with a 13% CAGR.

- By end user, the public and government payers segment is projected to grow the fastest, as government programs and public sector payers increasingly adopt integrity solutions.

Market Overview

The payment integrity industry is focused on reducing fraud, waste, and abuse in healthcare payments within the United States. It involves various technologies, solutions, and services aimed at identifying and preventing improper payments, improving claims accuracy, and enhancing overall payment processes. Payment integrity initiatives are particularly crucial in the healthcare sector, where fraudulent or erroneous payments have significant financial implications for government programs, private insurers, and healthcare providers. These initiatives strive to ensure that payments are made only for legitimate services and that billing and coding practices are accurate and compliant with regulations. The market in the United States is driven by the need to control healthcare costs, reduce fraud, and enhance operational efficiency in the payment ecosystem. Government programs such as Medicare and Medicaid, private insurers, and self-insured employers are among the main stakeholders invested in payment integrity initiatives.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.24 Billion |

| Market Size by 2034 | USD 14.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 27.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Function, Application, Mode of Delivery, and End Use |

Market Dynamics

Drivers

Government initiatives to reduce improper payments

The U.S. government has implemented several initiatives to reduce improper payments, including the Payment Integrity Information Act (PIIA) and the Improper Payments Elimination and Recovery Improvement Act (IPERIA). These initiatives drive the adoption of payment integrity solutions in the government sector. Medicare's prior authorization program might profit from improved communication. This program compels recipients to obtain approval before obtaining specific items, such as motorized wheelchairs, and it has the potential to cut expenses and erroneous payments.

According to recent White House data, the erroneous payment percentage, including unexplained payments, decreased significantly in FY 2022—from 7.2% to 5.1%—even though several new programs, including pandemic assistance programs, were reported for the first time in years. This decrease is a significant step in the right direction and reflects ongoing efforts by OMB and Federal agencies to boost payment integrity, including the implementation of the Payment Integrity Information Act of 2019.

Increasing Electronic Medical Records (EMR) and Electronic Health Records (EHR) Applications for Payment integration

Convenience and safety are top priorities for both businesses and customers in the modern world. All healthcare providers accept payments, but when such systems are not integrated with patient EMRs or electronic health records, the process may seem complicated or out-of-date to the user. Payments are managed by healthcare professionals and patients in a simple, secure, and practical manner by integrating them into EMRs and EHRs.

Integrating payments into the EMR/EHR reduces difficulties and improves response rates because traditional billing is a burden to both the patient and the provider. An integrated platform allows for automatic billing, ensuring prompt invoice issuance and doing away with the laborious task of a collection specialist auditing patient accounts.

Restraints

One of the most significant in the payment integrity market is the challenge of managing sensitive healthcare and financial data while maintaining strict compliance with privacy regulations. Payment integrity solutions require access to vast amounts of claims information, patient records, and payer data to identify errors or fraud. However, this dependence on data introduces considerable risk, as any breach or mishandling can result in legal penalties, reputational damage, and a loss of trust among stake holders. With evolving regulations such as HIPPA and state level privacy laws, companies must constantly update their systems to ensure compliance, which adds operational costs and complexity.

These security concerns often make providers and payers hesitant to fully embrace newer solutions, slowing adoption and creating barriers for vendors aiming to scale their offerings.

Another key restraints lies in the difficulty of integration payment integrity tools with the diverse and fragmented systems already used across the healthcare ecosystem. Hospitals, clinics, insurers, and government payers often rely on legacy IT infrastructures or proprietary platforms that do not seamlessly communicate with one another. Implementing new payment integrity solutions in such environments requires extensive customization, technical expertise, and time consuming data migration. This lack of interoperability can delay deployment and increase implementation costs, discouraging smaller organizations in particular from adopting these systems. Moreover, inconsistent data formats and incomplete records reduce the effectiveness of integrity tools, as they struggle to provide accurate insights without unified data. This technological fragmentation remains a major roadblock for the market's broader expansion.

Opportunities

Increasing engagement of players

Various new and unexcepted opportunities for player participation have emerged in recent years. The people in charge of their care want to communicate more with them. They have accepted technology into healthcare more broadly than ever before, including home health and telehealth.

Consumer healthcare costs are a significant source of personal financial stress at the same time. Furthermore, the total will exceed USD 491 billion and is expected to continue growing at a 10% annual rate in the foreseeable future.

Players have realized that offering better member services is an advantage in a market that is consumer driven. Customers view maintaining their health plan as crucial to having good medical experiences. The adoption of digital health will keep increasing as health insurers expand their coverage.

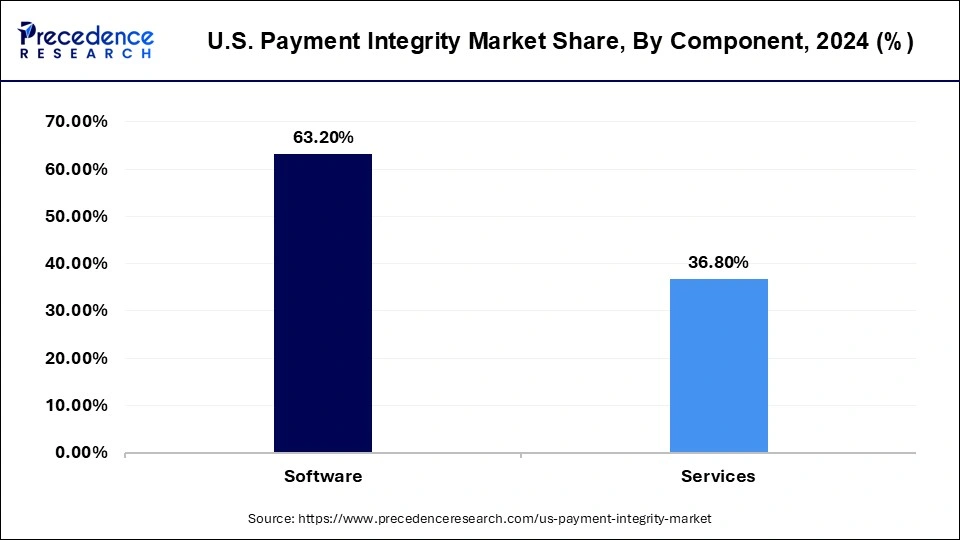

Component Insights

The Software sector is anticipated to grow at the highest CAGR from 2025 to 2034.Artificial Intelligence and machine learning capabilities are frequently incorporated throughout applications, offering users capabilities such as digitization and predictive capabilities. Moreover, artificial intelligence software in payment integrity helps detect and gather evidence against fraud schemes. It also helps in deriving actionable insights and processes large volumes. Furthermore, artificial intelligence allows easy sharing of information between teams in the identification of behavior-based patterns. Overall, with software, the market for payment integrity will flourish, attributing to the use of artificial intelligence.

The services sector is growing at the fastest rate during the forecast period. The services segment of payment integrity refers to multiple solutions from the top organizations, such as secure payment, payment recovery, credit balance services, overpayment identification, and identification of coding errors. Many top key players providing payment integrity solutions are continuously updating their payment integrity solutions for smooth working and fraud-free transactions. Additionally, these services increase the provider's satisfaction as this technology-driven claim uses advanced algorithms with great potential for payment error detection, and it leads to the recovery of higher dollars.

Within the payment integrity market, the services segment is emerging as the fastest growing component. This growth is largely driven by the increasing demand for specialized consulting, implementation, and support that organizations require to optimize integrity platforms. Healthcare payers and providers are realizing that technology alone is not sufficient to achieve comprehensive fraud prevention, claims accuracy, and compliance; they need expert guidance and continuous services to maximize value. As regulations evolve and new reimbursement models come into play, service providers are stepping in to deliver tailored solutions, training, and ongoing system integration. This makes the services segment a critical driver of adoption, positioning it as the key growth engine in the market.

U.S. Payment Integrity Market, By Component, 2022-2024 (USD Million)

| By Component | 2022 | 2023 | 2024 |

| Software | 486.52 | 618.38 | 786.59 |

| Services | 285.74 | 361.62 | 458.01 |

Function Insights

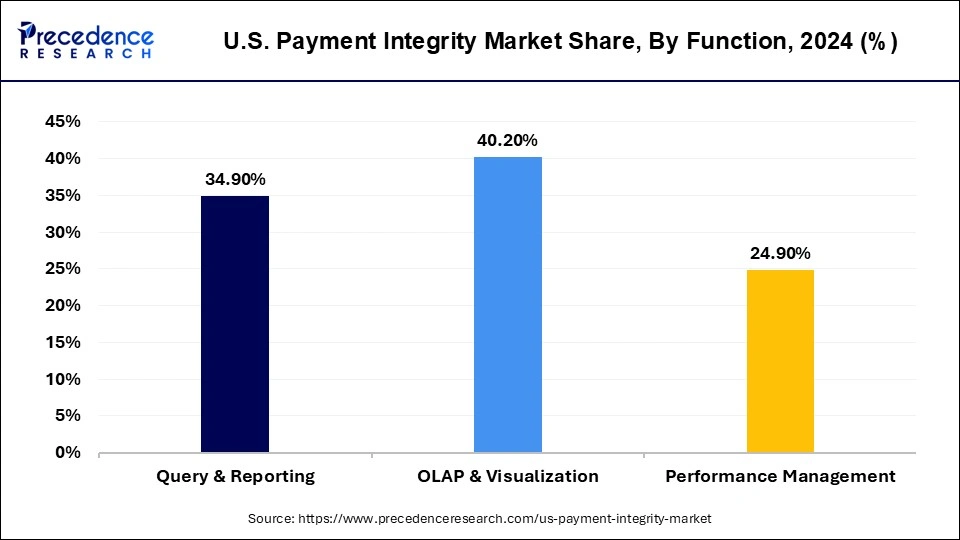

Based on the function, the Query & Reporting sector is growing at the highest CAGR from 2025 to 2034. Query and Reporting is a critical part involving multi-step processes as it holds necessary for the specific workflow. Many firms provide the solution for these functionalities, although the design of this tool and its internal features differ. For example, the query reporting by the Cotiviti firm is done by QR web, which helps in efficient operations. Additionally, this function enables the enhancement of medical record reviews containing 100 advanced filters. The above-mentioned factor is anticipated to propel the market.

On the other hand, the OLAP & Visualization segment is expanding at a remarkable rate. Generally, online analytical processing refers to a set of software tools to analyze data to make business decisions. It provides a platform to extract information from the database system. Additionally, the OLAP database enables the user to examine several multidimensional data, which is critically important in decision management. Furthermore, OLAP and visualization allow the users to run complicated queries to retrieve this multidimensional data as well as due to the processing of OLAP; the data integrity or payment integrity is not compromised.

In terms of function the query and reporting segment is anticipated to grow the fastest as organizations seek more actionable insights from their data. The ability to investigate anomalies, drill down into claims, and generate meaningful reports has become vital for preventing leakage and assuring payment accuracy. With healthcare data becoming increasingly complex, query and reporting functions are enabling stakeholders to move beyond surface level analytics and uncover hidden patterns that signal potential errors or fraud. Moreover, regulatory pressures for transparency are pushing organizations to adopt systems that can generate detailed, auditable reports on demand. This segment's role in empowering decision makers with clarity and accountability makes it central to the next phase of market expansion.

U.S. Payment Integrity Market, By Function, 2022-2024 (USD Million)

| By Function | 2022 | 2023 | 2024 |

| Query & Reporting | 270.29 | 342.51 | 434.27 |

| OLAP & Visualization | 308.9 | 392.98 | 500.33 |

| Performance Management | 193.07 | 244.51 | 309.91 |

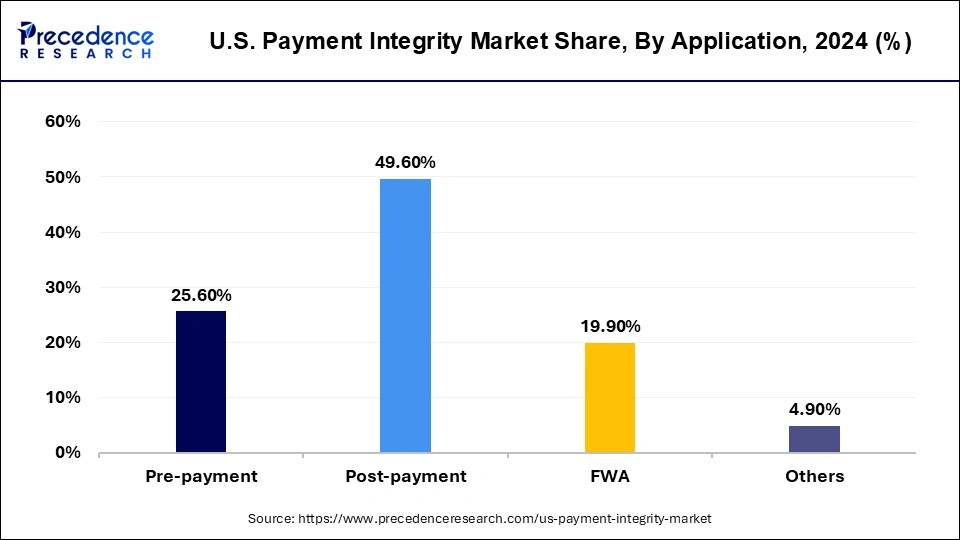

Application Insights

On the basis of application, the pre-payment sector is expected to grow at the fastest rate from 2025 to 2034. Claims editing pre-payment service is one of several cost-effective measures implemented during the healthcare reimbursement process to assure the accuracy of the medical bill. This method or service by a corporation protects the patient from overpaying for healthcare services and paying for items that should never have been paid for in the first place.

Among applications, clinics represent the fastest growing segment due to their increasing adoption of payment integrity solutions to manage rising claims volumes and administrative complexity. Unlike large hospitals, clinics often operate with tighter margins and smaller administrative teams, Which makes claims errors and fraud specially costly. Payments integrity platforms provide clinics with tools to automate claim reviews, reduce denial rates, and recover lost revenue. Furthermore, as outpatient care continuous to expand in the U.S., clinics are handling a growing share of patient interactions, making accurate and efficient claims management essential. This growing dependence on digital solutions to safeguard revenue streams is fuelling the segment's strong momentum in the market.

U.S. Payment Integrity Market, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Pre-payment | 193.07 | 247.94 | 318.62 |

| Post-payment | 386.13 | 488.04 | 617.32 |

| FWA | 154.45 | 195.51 | 247.68 |

| Others | 38.61 | 48.51 | 60.99 |

Mode of Delivery Insights

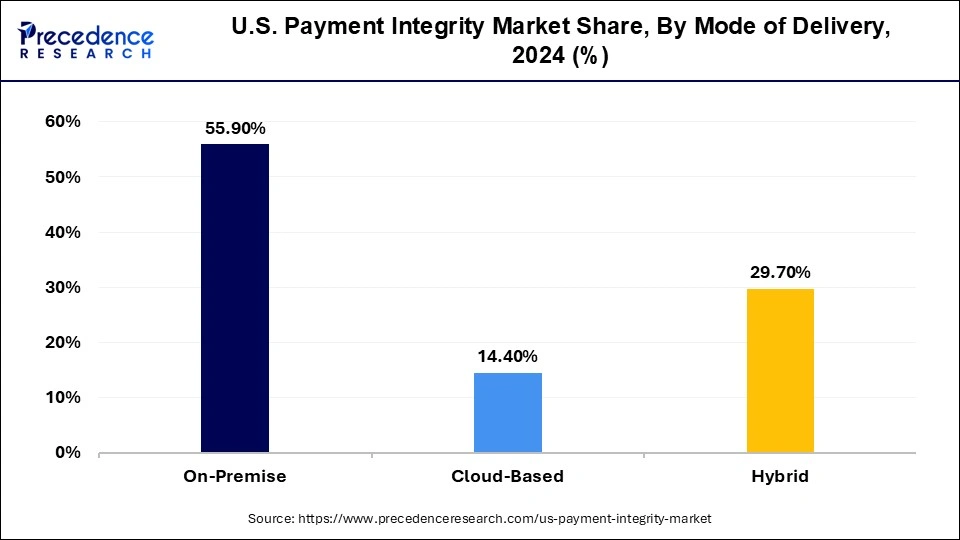

On the basis of the mode of payment, the on-premises sector is expanding at the highest CAGR from 2025 to 2034. Many companies opt for an on-premises mode of delivery for its numerous advantages such as it allows big corporations to have control over the server hardware without requiring third-party involvement. Additionally, the annual maintenance and one-time license charges are cheaper than compared cloud software, and there is no requirement for internet connectivity like that of cloud software.

The cloud-based segment is anticipated to expand at the fastest rate during the projected period. Cloud-based software enables the organization to manage and build IT resources. Additionally, the cloud-based segment requires no capital expense as well as no maintenance cost. Furthermore, cloud-based software performs all the software backups and processing, so the company needs no additional in-house IT team. Besides that, the security protocols of cloud-based are highly advanced with the internet connection that gives the advantage to the user for remote working.

Cloud based delivery is expected to be the fastest growing mode in the payment integrity market as organizations transition away from traditional, on-premises systems. The shift is being fuelled by the scalability, flexibility, and cost efficiency that cloud models provide. Healthcare organizations and payers are increasingly managing vast amounts of claims data across distributed systems, and cloud platforms allow for seamless integration and real time processing. They also reduce the burden of infrastructure management while enabling faster updates and innovation cycles. Additionally the rising need fr remote accessibility and secure data sharing has reinforced cloud adoption. As more enterprises recognize these advantages, cloud based delivery is becoming the prefeered pathway for modernization and growth.

U.S. Payment Integrity Market, By Mode of Delivery, 2022-2024 (USD Million)

| By Mode of Delivery | 2022 | 2023 | 2024 |

| On-Premise | 432.47 | 548.31 | 695.73 |

| Cloud-Based | 108.12 | 139.16 | 179.22 |

| Hybrid | 231.68 | 292.53 | 369.55 |

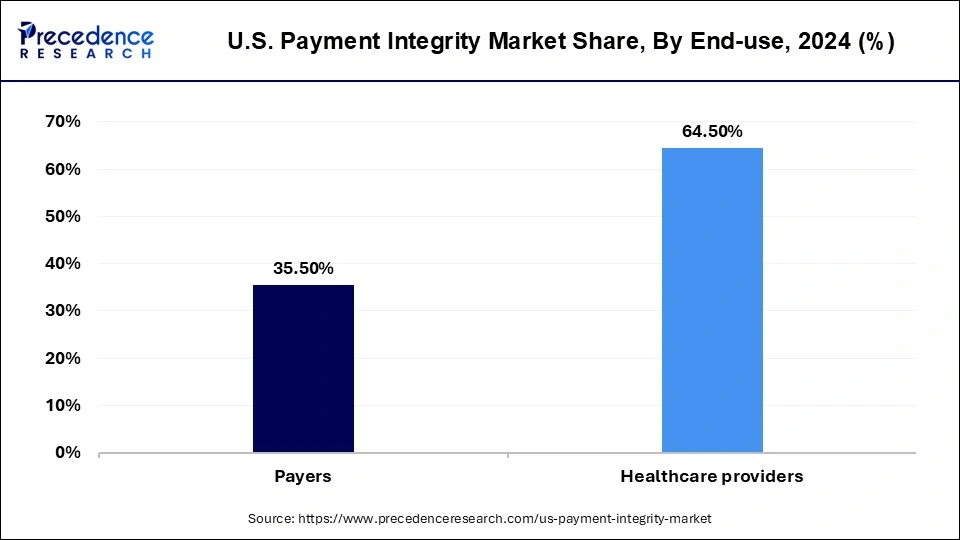

End-User Insights

The payer segment is anticipated to grow at the highest rate from 2025 to 2034. In the U.S. healthcare system, payers refer to organizations that pay for healthcare services, such as insurance companies, government programs like Medicare and Medicaid, and self-insured employers. Payers play a crucial role in the healthcare system by providing financial coverage for medical expenses incurred by patients.

Some of the key types of payers in the U.S. healthcare system include Private insurance companies: Private insurance companies provide coverage for healthcare services through employer-sponsored plans, individual policies, and other types of plans. These companies negotiate rates with healthcare providers and pay for medical expenses incurred by patients.

Within end users, payers are expected to be the fastest growing group adopting payment integrity solutions. Insurance companies, government health programs, and managed care organizations are under increasing pressure to curb wasteful spending, detecting fraud, and assure accurate reimbursements. Payers are turning to advanced payment integrity systems to streamline claims processing, minimize errors, and identify fraudulent activities before they result in financial losses. The push toward value based care and outcome driven reimbursement models further intensifies the need for prayers to have robust oversight mechanisms. By embedding payment integrity into their operations, payers are better positioned to control costs, improve trust with providers, and enhance the efficiency of the overall healthcare system.

Recent Developments

- In April 2023, NTT DATA was introduced by NTT DATA To Help Organizations Deliver Bold Digital Experiences.

- In April 2023, Conduent launched First-of-Their-Kind Digital Payment Solutions for Tolling and Other Transportation Uses

- In March 2023, NTT, NTT DATA, And INDYCAR Extended Entitlement Partnership with Multi-Year Agreement.

- In December 2022, Cognizant acquired Integration.

- In September 2022, CyberCube announced a partnership with EXL.

- In September 2022, Zelis Completed the Acquisition of Payer Compass

- In March 2022, Orono acquired CERIS Group to Develop Its Activities in the Healthcare, Pharmaceuticals, and Biotechnology Sectors

- In December 2021, EXL acquired Clairvoyant, adding scale in data, AI, and cloud engineering.

U.S. Payment Integrity Market Companies

- Cotiviti

- Optum / Change Healthcare

- Zelis

- Availity

- MultiPlan

- Ceris

- Cognizant

- EXL

- Performant

- Syrtis

- Varis

- ClarisHealth

- ClaimLogiq

- Rialtic

- HealthEdge

Recent Developments:

- Optum underscores that payment integrity is reaching a critical crossroads, driven by surging healthcare spending, rising stakeholders demands, and evolving regulations. The piece emphasizes that advanced technologies like real time integrations and API driven workflows are reshaping how health plans approach accuracy and efficiency in claims processing.

(Source: Trends driving payment integrity to a critical inflection point | Fierce Healthcare) - Cotiviti has launched its “Payment Integrity Pulse” webinar series, offering quarterly insights onto the rapidly changing landscape of codes., coverage and specialty drug utilization. The initiate aims to help payment integrity teams stay informed and adapt to regulatory shifts more effectively.

(Source: Payment Integrity Pulse: 2025 regulatory and market changes)

Segments Covered in the Report

By Component

- Software

- Services

By Function

- Query & Reporting

- OLAP & Visualization

- Performance Management

By Application

- Pre-Payment

- Claims Editing (1st pass)

- Claims Editing (2nd, 3rd, etc.)

- Coding Validation

- Post-Payment

- Complex/Clinical Provider Audit

- Coordination of Benefits (COB)

- Subrogation

- Data Mining

- FWA

- Provider Fraud, Waste & Abuse

- Special Investigations

- Others

- Reporting and Analytics

- Others

By Mode of Delivery

- On-Premises

- Cloud-Based

- Hybrid

By End Use

- Payers

- Healthcare Providers

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting