What is the Uterine Fibroid Drugs Market Size?

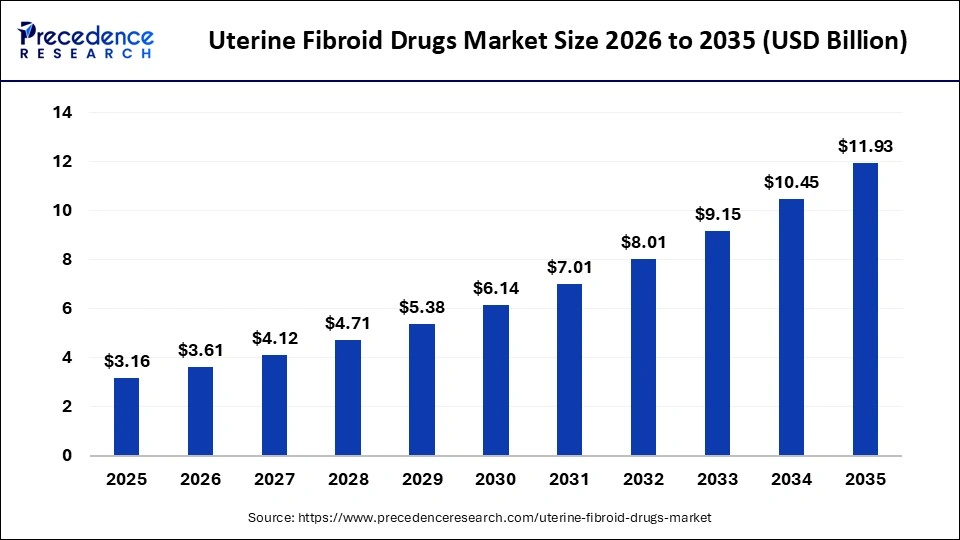

The global uterine fibroid drugs market size is calculated at USD 3.16 billion in 2025 and is predicted to increase from USD 3.61 billion in 2026 to approximately USD 11.93 billion by 2035, expanding at a CAGR of 14.21% from 2026 to 2035. This market is growing due to the increasing prevalence of fibroids among women of reproductive age and the rising demand for non-surgical, effective treatment options.

Market Highlights

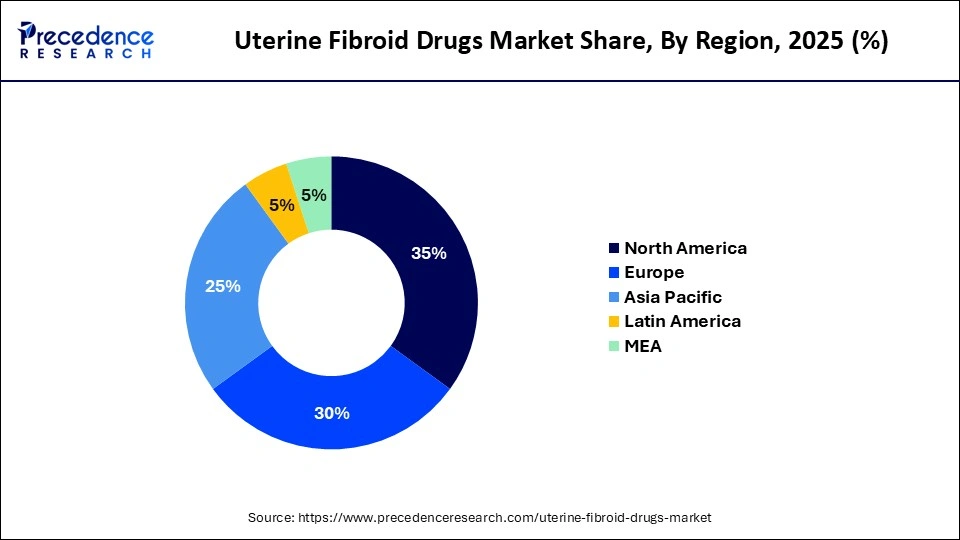

- North America dominated the uterine fibroid drugs market, having the biggest share of 35% in 2025.

- The Asia Pacific is expected to grow at a notable CAGR between 2026 and 2035.

- By product type, the GnRH agonists and antagonists segment contributed to the largest market share of 35% in 2025.

- By product type, the selective progesterone receptor modulators (SPERMs) segment is growing at a notable CAGR between 2026 and 2035.

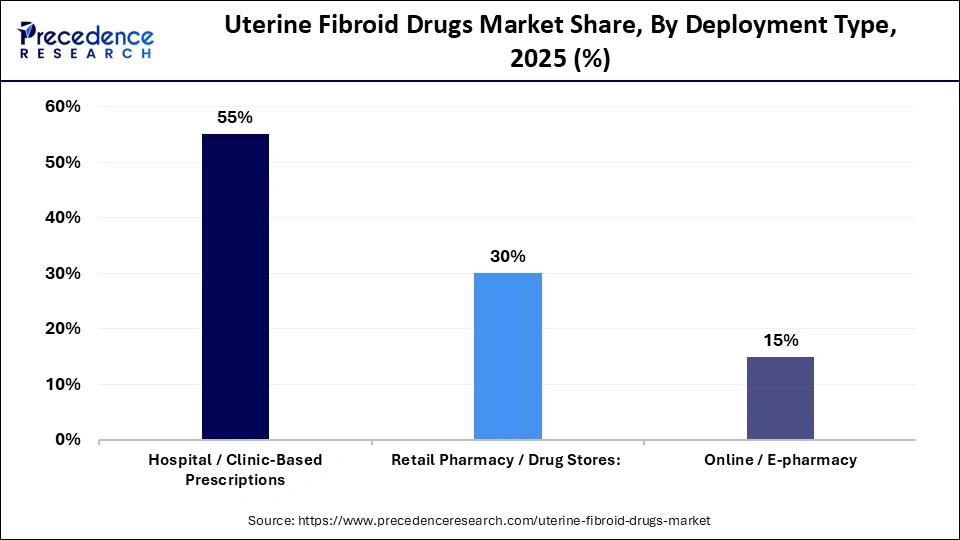

- By deployment type, the hospital/clinical-based prescriptions segment held the major market share of 55% in 2025.

- By deployment type, the retail pharmacy/drug stores segment is poised to grow at a strong CAGR between 2026 and 2035.

- By application, the symptomatic treatment (bleeding, pain) segment accounted for the largest market share of 50% in 2025.

- By application, the fertility & reproductive health segment is expanding at a notable CAGR between 2026 and 2035.

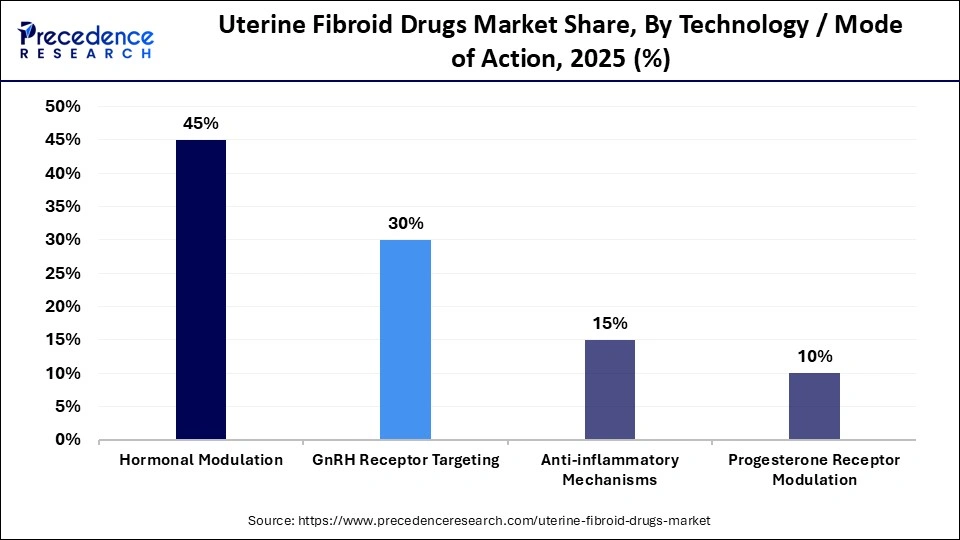

- By technology/mode of action, the hormonal modulations segment contributed the biggest share of 45% in 2025.

- By technology/mode of action, the GnRH receptor targeting segment will grow at a solid CAGR between 2026 and 2035.

- By end-user, the hospitals & specialty clinics segment recorded more than 50% of market share in 2025.

- By end-user, the gynecology & women's health centers segment is growing at a strong CAGR between 2026 and 2035.

Market Overview

Why is the Uterine Fibroid Drugs Market Growing So Rapidly?

The uterine fibroid drugs market is expanding as more women seek non-surgical pharmaceutical treatments to reduce symptoms such as heavy bleeding, pain, and pelvic pressure. Many patients prefer medical management because it allows them to avoid invasive procedures and maintain daily activities with fewer disruptions. This shift increases demand for therapies that offer predictable symptom control and support long-term quality of life.

Adoption is also rising due to better clinical awareness and improved diagnostic pathways. More healthcare providers use modern imaging tools and updated guidelines to identify fibroids earlier, which leads to earlier treatment discussions and a broader range of therapeutic options. Targeted hormonal treatments play a central role in this market. These therapies regulate hormone levels that influence fibroid growth, helping reduce bleeding and discomfort while maintaining a favourable safety profile.

Pharmaceutical companies continue to invest in clinical research and innovation to develop safer long-term treatment options. Research efforts focus on improving effectiveness, reducing side effects, and extending treatment duration without compromising safety.

Market Trends

- The preference for non-surgical treatments is increasing rapidly. Patients want less invasive, faster recovery options.

- Targeted hormonal therapies are gaining adoption. These offer better symptom control with fewer side effects.

- The focus on long-term symptom control is rising. Drugs are being designed to prevent recurrence and heavy bleeding.

- Movement toward personalized treatment plans is growing. Therapies are tailored based on age, fertility goals, and symptom severity.

- Increase in clinical research and new drug approvals. Pharmaceutical companies are investing heavily in innovation and safety.

- Better insurance and reimbursement support boost access. Coverage is improving drug-based treatments over surgical procedures.

Key Technological Shifts

| Technological Shift | Description | Impact on Market |

| Oral GnRH antagonists | Development of once-daily oral therapies replacing injectable hormones | Higher patient compliance and faster adoption |

| Add back therapy combinations | Use of hormonal add-back formulations to reduce side effects | Better safety profile and long-term usage feasibility |

| Non-hormonal drug development | Pipeline focused on targeting fibroid growth without hormonal disruption | Expands treatment options for patients with contraindications |

| Personalized dosing algorithms | AI/clinical data used to design individualized treatment plans | More effective symptom control and reduced adverse events |

| Novel drug delivery systems | Long-acting formulations, sustained release mechanisms | Improved therapeutic outcomes and reduced dosing frequency |

| Digital monitoring platforms | Apps and digital tools to track pain, bleeding, and treatment response | Better patient engagement and real-time care adjustment |

Uterine Fibroid Drugs Market Outlook

The uterine fibroid drugs market is growing due to rising cases of symptomatic fibroids and demand for non-surgical treatment options. New hormonal therapies with better safety and convenience are boosting adoption. Increased diagnosis and supportive regulatory approvals further accelerate market growth.

Sustainability efforts focus on greener manufacturing, recyclable packaging, and reduced pharmaceutical waste. Companies are adopting eco-friendly practices and improving access to affordable care. Regulatory pressure is driving higher environmental and ethical compliance.

Global expansion is driven by rising investments in merging markets and improved drug distribution networks. Companies are forming partnerships and local manufacturing setups to reduce costs and speed approvals. Taolored pricing strategies are increasing adoption across regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.16 Billion |

| Market Size in 2026 | USD 3.61 Billion |

| Market Size by 2035 | USD 11.93 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.21% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Deployment Type, Application, Technology/Mode of Action, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Which Future Demands Will Shape the Uterine Fibroid Drugs Market?

| Future Demand | Description | Why it Matters |

| Non-surgical drug therapies | Increased preference for oral, minimally invasive treatments | Reduces surgery burden and recovery time |

| Long-term symptom control solutions | Drugs that reduce recurrence, pain, and heavy bleeding | Improves patient quality of life and adherence |

| Better safety and tolerability | Low side effects, hormone-sparing therapies | Expands patient eligibility and acceptance |

| Affordable treatment alternatives | Cost-effective drugs for wider access | Enables adoption in emerging markets |

| Strong insurance and reimbursement support | Coverage for drug-based therapies | Boosts uptake of newer therapeutics |

| Faster regulatory approvals | Streamlined pathways for innovative drugs | Speeds commercialization and patient access |

Uterine Fibroid Drugs Market Segmental Insights

Product Type Insights

GnRH Agonists & Antagonists: The GnRH agonists & antagonists segment dominated the uterine fibroid drugs market, holding 35% market share due to their demonstrated effectiveness in reducing fibroid size and managing symptoms such as heavy menstrual bleeding. Physician preference has been strengthened by clinical research supporting long-term symptom relief, contributing to its dominant position. Furthermore, the accessibility of different formulations such as nasal sprays and injections has increased market penetration and enhanced patient compliance. Strong physician awareness and established treatment guidelines also benefit this segment.

Selective Progesterone Receptor Modulators: Selective progesterone receptor modulators (SPRMs) are the fastest-growing CAGR, driven by their favorable safety profile, targeted hormonal action, and growing patient demand for non-invasive treatment alternatives. Adoption is being further boosted by growing clinical evidence that supports fewer side effects and long-term safety. The SPRM market is also growing internationally due to on-going research and approvals in several nations.

Deployment Type Insights

Hospital / Clinic-Based Prescriptions: The hospital/clinic-based prescriptions segment dominated the uterine fibroid drugs market, accounting for 55%, because integrated diagnostic and post-treatment care services are available, and hormonal therapies require medical supervision. Hospitals are the best option for complicated fibroid cases because they provide access to cutting-edge imaging and surgical options. Additionally, the number of prescriptions for these treatments increases when patients trust hospital-based care.

Retail Pharmacy / Drug Stores: The retail pharmacy/drug stores segment is growing rapidly with a high CAGR, driven by rising patient awareness, easier access to outpatient prescription drugs, and an increase in the use of self-managed treatment options. The development of pharmacy networks and digital health platforms that facilitate medication delivery to homes also contributes to the growth. Patients are further facilitated in medication delivery to their homes, which also contributes to growth. Patients are further encouraged to select retail pharmacy channels by convenience and affordability.

Application Insights

The symptomatic treatment (bleeding, pain) segment dominated at 50% in the uterine fibroid drugs market. The high prevalence of patients seeking immediate relief and the availability of effective therapies supported this dominance. New combination therapies that simultaneously target multiple symptoms have also strengthened the segment. Increasing women's awareness of early symptom management has further driven demand.

The retail pharmacy/drug stores segment is growing rapidly, with the highest CAGR, since OTC remedies and self-managed treatment for uterine fibroid symptoms are becoming more and more popular. Patient education campaigns and the expansion of wellness and preventive care initiatives are also fueling this growth. Additionally, the availability of generic drugs in pharmacies makes treating symptoms more convenient and affordable.

Technology/ Mode of Action Insights

Hormonal Modulation: The hormonal modulation segment dominated with a 45% market share. These treatments control fibroid growth and symptoms by regulating hormone levels. Ongoing R&D improves formulation efficiency because of its proven effectiveness and consistent results. Clinicians prefer these treatments. Furthermore, the market position of hormonal modulation is strengthened by its wide applicability across various patient profiles.

GnRH Receptor Targeting: GnRH receptor targeting is the fastest-growing segment, with the highest CAGR, fueled by advancements in targeted hormonal therapy and better patient outcomes from accurate fibroid treatment. Improvements in combination therapies and drug delivery systems are lowering side effects and increasing efficacy. Patient preference for targeted, minimally invasive care accelerates market expansion.

End User Insights

Hospitals & Specialty Clinics: The hospitals & specialty clinics segment dominates the uterine fibroid drugs market with a 50% share. This dominance is attributed to specialized care, advanced treatment facilities, and the presence of experienced gynecologists for complex fibroid cases. The availability of multidisciplinary care teams also makes hospitals the first choice for high-risk patients. Rising healthcare expenditure in developed regions supports the adoption of hospital-based treatment.

Gynecology & Women's Health Centers: Gynecology and women's health centers are growing rapidly with a 25% CAGR. The growth is driven by the expansion of outpatient care services and rising patient preference for specialized clinics. These centers provide focused expertise, streamlined care pathways, and consistent follow-up, which appeal to women managing chronic gynecological conditions, hormonal issues, and reproductive health needs. More patients are being drawn in by improved accessibility, reduced wait times, and the availability of diagnostic and treatment services in a single location.

Uterine Fibroid Drugs Market Regional Insights

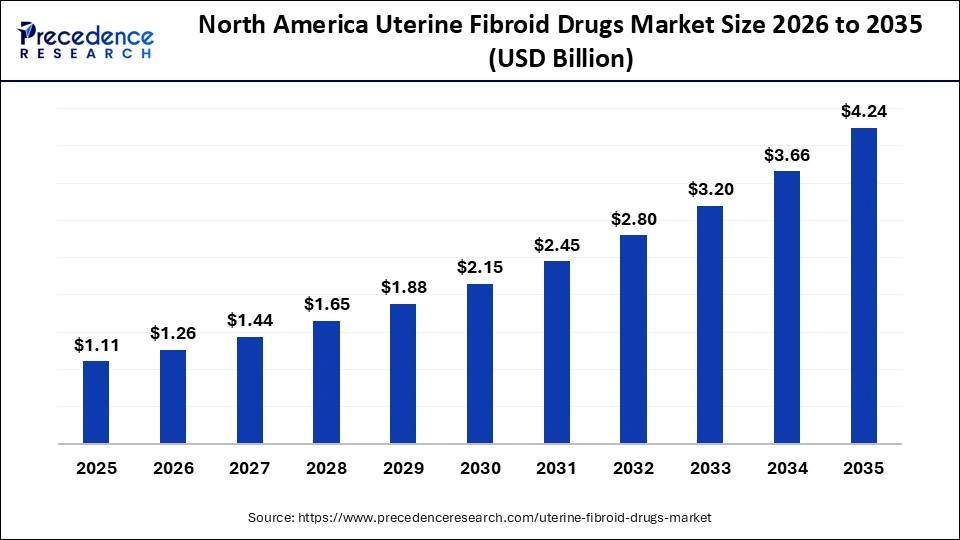

The North America uterine fibroid drugs market size is estimated at USD 1.11 billion in 2025 and is projected to reach approximately USD 4.24 billion by 2035, with a 14.34% CAGR from 2026 to 2035.

Why Does North America Dominate the Uterine Fibroid Drugs Market in 2025?

North America dominates the market with a 35% share, supported by high diagnostic penetration, cutting edge hormonal therapies, and a sophisticated healthcare infrastructure. Women in the region have broad access to imaging technologies, laboratory testing, and specialist consultations, which enables earlier detection of gynecological conditions and faster initiation of treatment. This diagnostic depth increases the number of women entering therapeutic pathways and strengthens overall market demand.

High treatment uptake is supported by robust insurance coverage, a sizable pool of gynecologists, and easy access to prescription drugs through retail and mail order pharmacy networks. These factors allow patients to begin and maintain therapy with fewer administrative barriers. Clinics and hospital systems across the region also follow structured care protocols, which encourage consistent use of guideline-supported treatments for conditions such as fibroids, endometriosis, and menopausal symptoms.

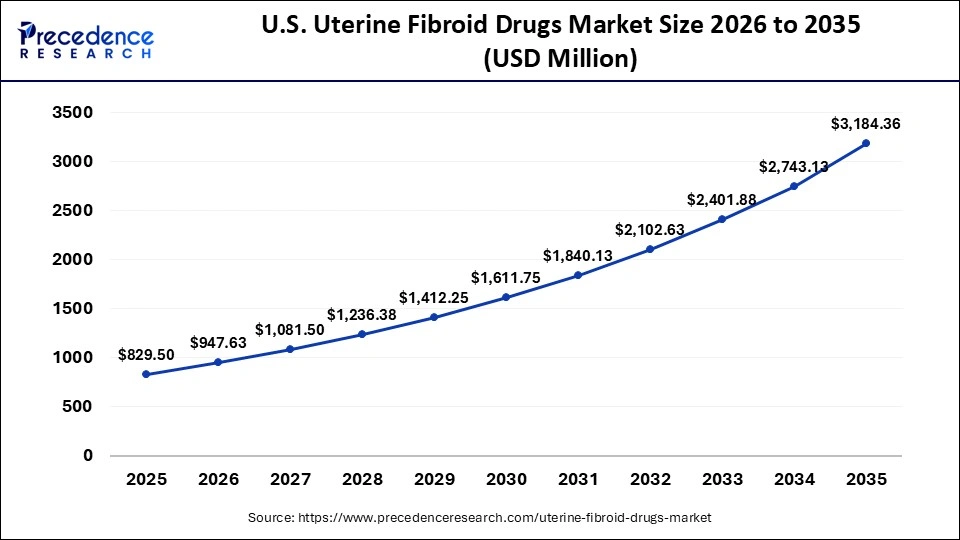

The U.S. uterine fibroid drugs market size is calculated at USD 829.50 million in 2025 and is expected to reach nearly USD 3,184.36 million in 2035, accelerating at a strong CAGR of 14.40% between 2026 and 2035.

U.S. Uterine Fibroid Drugs Market Trends

The U.S. dominates the uterine fibroid drugs market, supported by high diagnostic penetration, advanced hormonal therapies, and sophisticated healthcare infrastructure. High treatment uptake is supported by robust insurance coverage, a sizable pool of gynecologists, and simple access to prescription drugs. Furthermore, strong pharmaceutical R&D pipelines, supportive FDA approvals, and ongoing clinical trials all contribute to expanding therapeutic options and product innovation. Growth in the United States is also aided by rising screening rates and awareness of women's reproductive health.

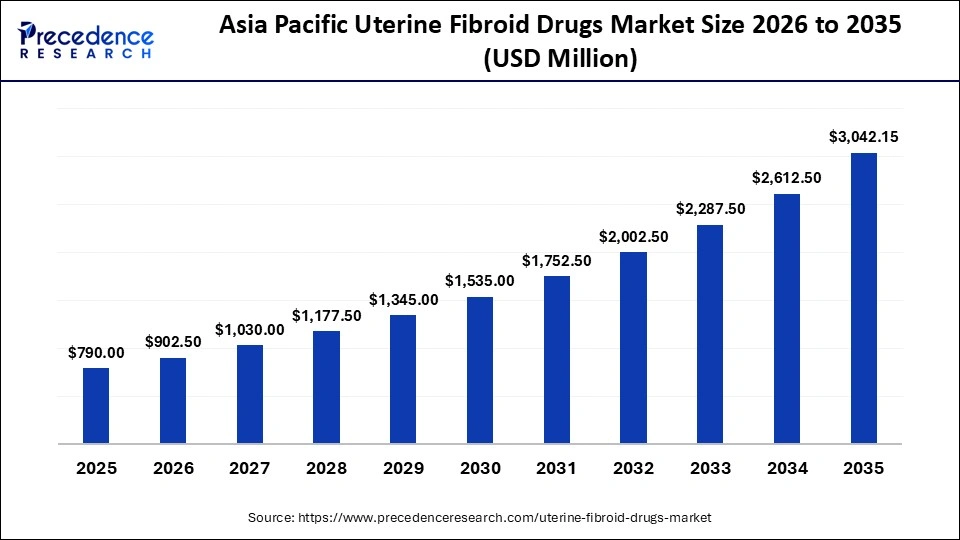

The Asia Pacific uterine fibroid drugs market size is expected to be worth USD 3,042.15 million by 2035, increasing from USD 790.00 million by 2025, growing at a CAGR of 14.43% from 2026 to 2035.

Why Is Asia Pacific Showing Rapid Growth in the Uterine Fibroid Drugs Market?

Asia Pacific is growing rapidly in the market with a 30% share, driven by increased awareness of women's health issues, rising healthcare spending, and higher diagnosis rates across key countries. Public and private campaigns focused on reproductive health, menstrual disorders, and chronic gynecological conditions encourage more women to seek clinical evaluation. As screening becomes more common, a larger share of the population enters formal treatment pathways, which strengthens overall market activity.

The market also benefits from the expansion of private healthcare facilities in urban and semi urban areas. These centres often offer shorter wait times, modern diagnostic tools, and access to gynecology specialists. Improved accessibility helps women receive earlier consultation and consistent follow up care. Growing medical infrastructure across India, China, Indonesia, Thailand, and Vietnam contributes to wider adoption of therapeutic options, including hormonal treatments used for fibroids, endometriosis, and menopausal symptoms.

India Uterine Fibroid Drugs Market Trends

India is growing rapidly, motivated by increased awareness of women's health issues, growing healthcare costs, and rising diagnosis rates. Additionally, the market is benefiting from the expansion of private healthcare facilities in urban and semi-urban areas, as well as from increased access to gynecology specialists. Price-conscious patient groups are adopting hormonal therapies and more affordable generic medications. In the upcoming years, a growing number of women in the workforce and government initiatives to enhance women's health infrastructure are anticipated to drive market demand.

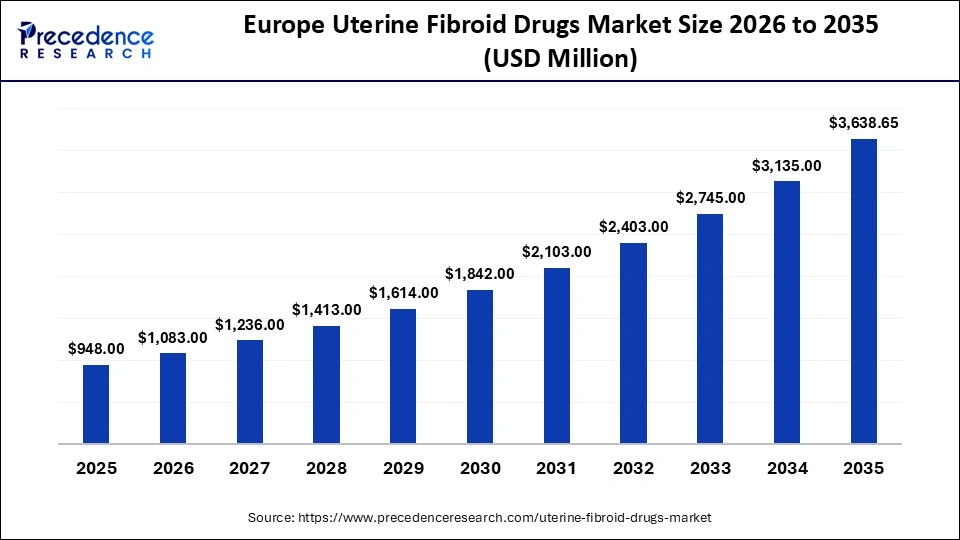

The Europe uterine fibroid drugs market size has grown strongly in recent years. It will grow from USD 948.00 million in 2025 to USD 3,638.65 million in 2035, expanding at a compound annual growth rate (CAGR) of 14.40% between 2026 and 2035.

Europe is growing rapidly because non-surgical treatment options are preferred, and fibroids are becoming more widely recognized. Instead of having surgery to treat symptoms like heavy bleeding and pelvic pain, more women are choosing to take medication. The region's market is steadily expanding due to the availability of these treatments made possible by a robust healthcare infrastructure, favorable regulatory policies, and payment systems.

Germany Uterine Fibroid Drugs Market Trends

Germany is the leading market for uterine fibroids, backed by cutting-edge gynecological healthcare services and a high diagnostic rate. There is a demand for both hormonal and non-hormonal drugs, particularly among women seeking alternatives to surgery. Germany is a major contributor to the expansion of the European market, thanks to its ongoing investments in research and cutting-edge medication formulations, as well as the widespread adoption of these products by physicians.

The MEA region is gradually expanding as awareness of women's reproductive health grows. More women in urban centres are seeking medical evaluation for symptoms linked to fibroids, endometriosis, hormonal imbalance, and menopausal changes. This shift increases the use of drug based treatments, especially in cities where specialist clinics and modern pharmacies are more accessible. Patients are choosing pharmaceutical options over surgical procedures when possible, largely due to shorter recovery times and lower overall treatment burden.

Although the market remains smaller than in Europe, improvements in healthcare infrastructure are strengthening growth. Several countries in the region are expanding diagnostic capabilities, upgrading women's health units, and investing in training programs for gynecology and reproductive health. These improvements bring more patients into structured care pathways and support wider adoption of hormonal therapies and other modern medications.

UAE Uterine Fibroid Drugs Market Trends

The UAE uterine fibroid drugs market is expanding as more women opt for non-surgical treatment options that help manage symptoms with fewer disruptions to daily life. Many patients prefer pharmaceuticals because they offer predictable relief from heavy bleeding, pelvic discomfort, and hormone-related changes without the need for invasive procedures. This preference increases demand for hormonal therapies, non hormonal agents, and other medications used in fibroid management.

Improved access to gynecologists strengthens this trend. The UAE has expanded its network of specialist clinics and hospital based women's health units, especially in major cities such as Dubai, Abu Dhabi, and Sharjah. These facilities offer earlier diagnosis through routine imaging, structured evaluations, and updated clinical guidelines. As diagnostic accuracy improves, more women are identified at earlier stages and guided toward medical management.

Top Uterine Fibroid Drugs Market Companies

- AbbVie Inc

- Pfizer Inc

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Gedeon Richter Plc.

- Myovant Sciences Ltd.

- Allergan (AbbVie subsidiary)

- Ferring Pharmaceuticals

- HRA Pharma

- Johnson & Johnson

- Novartis AG

- Astellas Pharma Inc.

- Eisai Co., Ltd.

- Lupin Limited

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris)

- Cadila Healthcare Limited

- Biocon Limited

- Glenmark Pharmaceuticals

- Sanofi S.A.

Recent Developments

- In February 2025, Kissei Pharmaceutical submitted a new drug application in Japan for Linzagolix, an oral GnRH antagonist designed to treat uterine fibroids. This regulatory step reflects growing investment in non-surgical and hormone-targeted therapies that improve patient quality of life. The move is expected to accelerate commercial rollout across Asia as approvals progress.(Source: https://www.kissei.co.jp)

- In August 2024, Theramex announced that NICE issued guidance recommending Linzagolix for adults with moderate to severe uterine fibroid symptoms in the UK. This update expands access to drug-based treatment through national health services, reducing reliance on surgery. It also positions Linzagolix as a competitive option in Europe's women's health market.(Source: https://www.pharmiweb.com)

- In September 2024, Theramex launched Yselty in Germany, marking its first commercial availability in the European market. This launch supports broader regional adoption of non-surgical therapy options, including treatments targeting heavy bleeding.

Uterine Fibroid Drugs Market Segments Covered in the Report

By Product Type

- GnRH Agonists & Antagonists

- Leuprolide

- Relugolix

- Selective Progesterone Receptor Modulators

- Ulipristal acetate

- Vilaprisan

- Hormonal Therapies

- Combined oral contraceptives

- Progestins

- Nonsteroidal Anti-Inflammatory Drugs

- Ibuprofen

- Naproxen

- Other Adjunctive Therapies

- Iron supplements

- Herbal/OTC remedies

By Deployment Type

- Hospital/Clinic-Based Prescriptions

- Retail Pharmacy/Drug Stores

- Online/E-pharmacy

By Application

- Symptomatic Treatment

- Fertility & Reproductive Health

- Pre-Surgical Management

- Post-Surgical Therapy

- Other Applications

By Technology/Mode of Action

- Hormonal Modulation

- GnRH Receptor Targeting

- Anti-inflammatory Mechanisms

- Progesterone Receptor Modulation

By End-User

- Hospitals & Specialty Clinics

- Gynecology & Women’s Health Centers

- Retail Pharmacies

- E-pharmacies/Online Platforms

- Other End-Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content