Vapor Barriers Market Size and Forecast 2025 to 2034

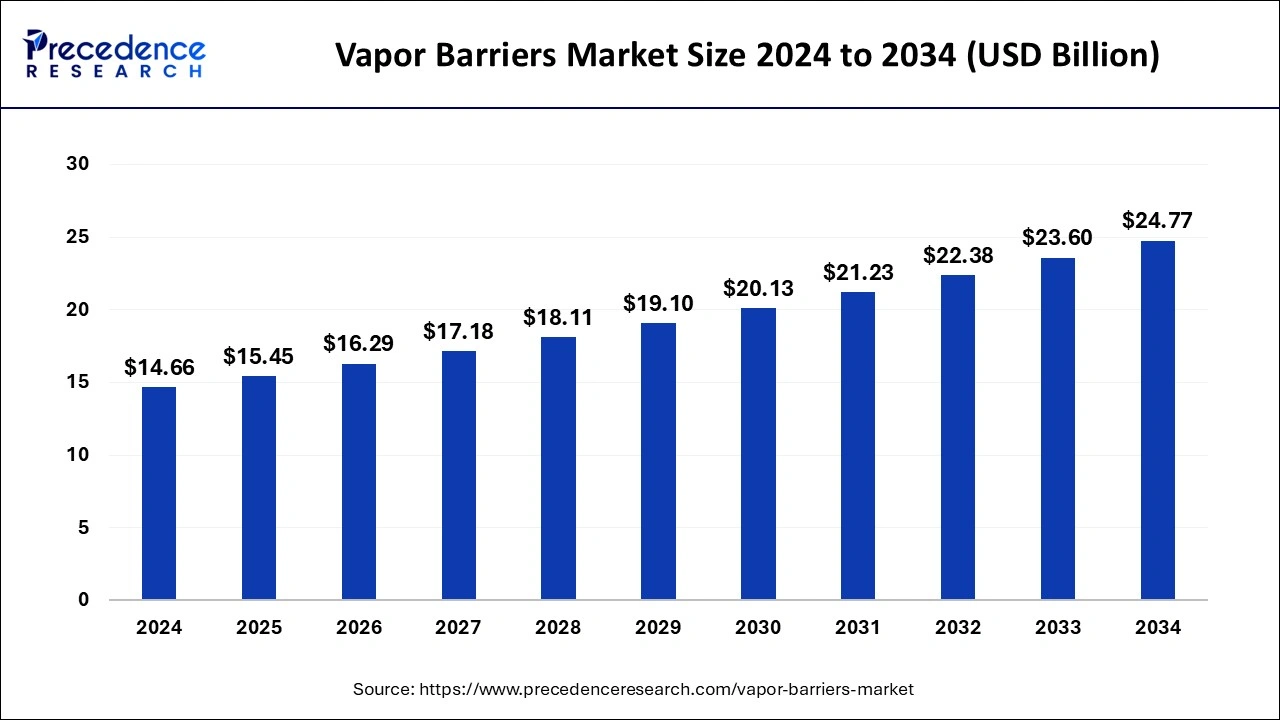

The global vapor barriers market size was estimated at USD 14.66 billion in 2024 and is predicted to increase from USD 15.45 billion in 2025 to approximately USD 24.77 billion by 2034, expanding at a CAGR of 5.39% from 2025 to 2034.

Vapor Barriers MarketKey Takeaways

- The global vapor barriers market was valued at USD 14.66 billion in 2024.

- It is projected to reach USD 24.77 billion by 2034.

- The vapor barriers market is expected to grow at a CAGR of 5.39% from 2025 to 2034.

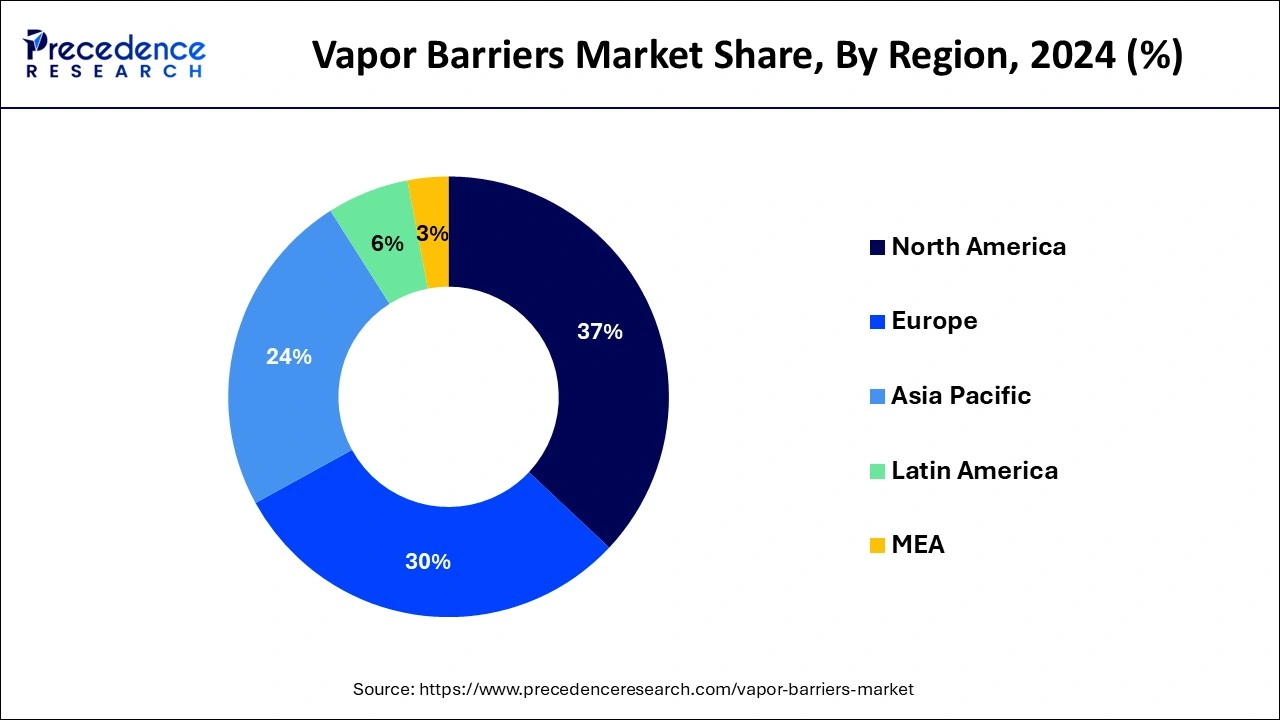

- North America held the dominant share of 37% in the vapor barriers market in 2024.

- Asia Pacific is observed to expand at a rapid pace during the forecast period.

- By material, the polymer segment accounted for the dominating share of around 52% in 2024.

- By material, the metal sheet segment is expected to witness a significant share during the forecast period.

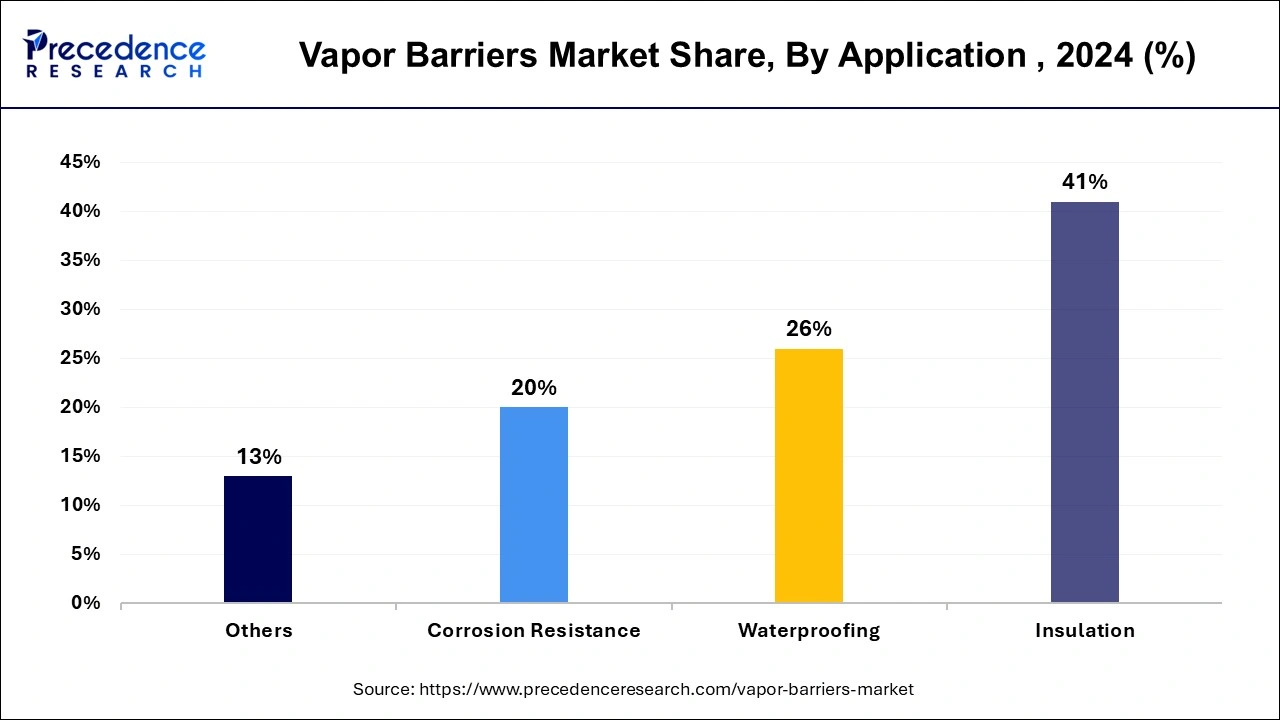

- By application, the insulation segment held the largest share of 41% in 2024.

- By installation, the membranes segment held the largest segment of the market in 2024.

- By installation, the cementitious waterproofing segment is expected to grow significantly during the forecast period.

- By end-use industry, the construction segment held the dominating share of the market in 2024.

- By end-use industry, the automotive segment is expected to grow notably.

U.S.Vapor Barriers Market Size and Growth 2025 to 2034

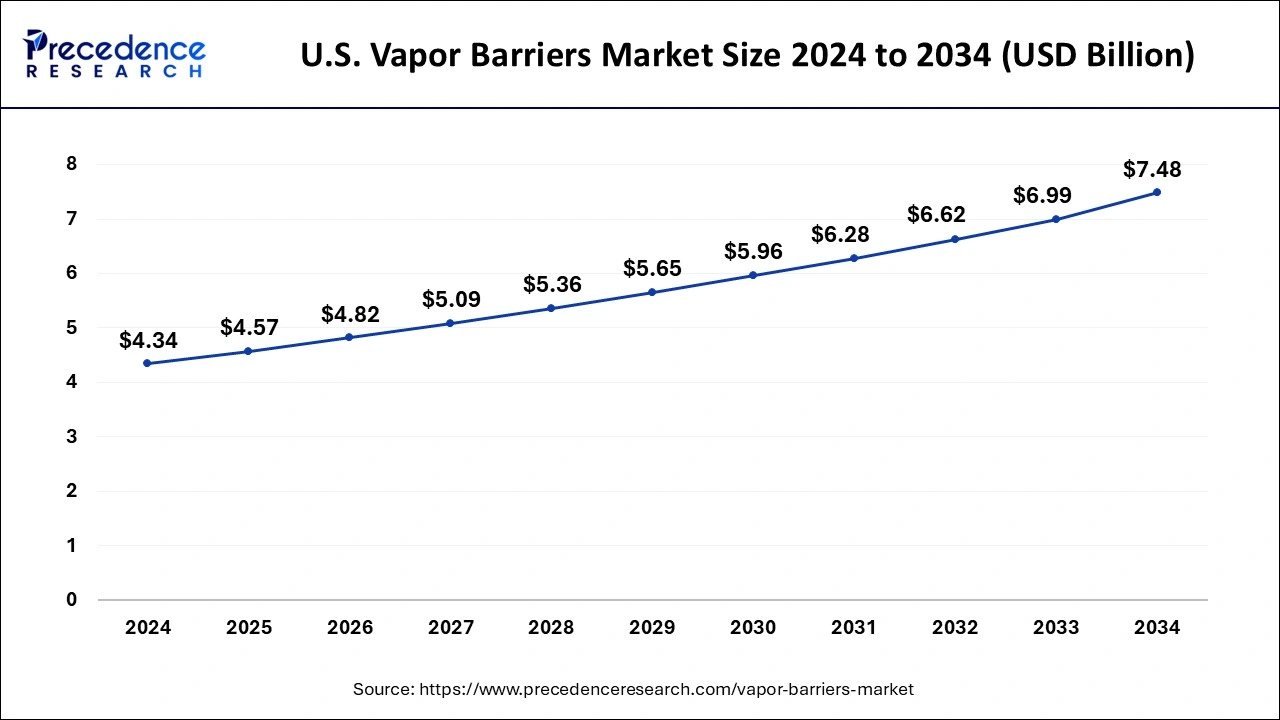

The U.S. vapor barriers market size surpassed USD 4.34 billion in 2024 and is expected to be worth around USD 7.48 billion by 2034 at a CAGR of 5.59% from 2025 to 2034.

North America held the dominant share of the vapor barriers market in 2024. The region is observed to witness prolific growth during the forecast period. The growth of the region is attributed to the rapid growth in the construction of residential and commercial buildings, rapid urbanization, the rising need to control moisture levels, and increasing awareness regarding the benefit of vapor barriers. The region has experienced the increasing adoption of vapor barriers due to the diverse climatic conditions, including cold winters and humid summers. Moreover, the stringent regulations and existence of building codes across North American countries, as well as the existence of energy certification bodies such as LEED and the U.S. Green Building Council, are bolstering the market revenue in the region.

The United States and Canada vapor barriers market is the major contributor to the market owing to the robust development in the end-use sector. The building and construction industry in the United States and Canada has considerably increased the demand for vapor barriers. The vapor barrier needs to remain updated, and new VOC emission regulations need to be integrated. Furthermore, the increasing development of green buildings is projected to fuel the market growth in the region. The severe cold weather conditions in the United States and Canada positively impact the market's expansion in the region.

- In June 2023, Polyglass USA announced the launch of the VertiWrap Air and Vapor Barrier Line of Products. Polyglass U.S.A. Inc., a leading manufacturer of roofing and waterproofing solutions, announced its newest line of products, VertiWrap Air and Vapor Barriers. The VertiWrap Air and Vapor Barrier system offers complete flexibility in selecting sheet and fluid-applied options for permeable and non-permeable project needs.

- In March 2024, Canada's federal budget is likely to allocate billions of dollars for investing in building homes and low-cost housing programs, according to Housing Minister Sean Fraser. Canada faces a housing affordability crisis as a rapidly increasing immigrant population has far outpaced the number of available homes.

Asia Pacific is observed to expand at a rapid pace during the forecast period owing to the robust growth of the construction industry, the rapid pace of urbanization in urbanization in countries such as China, Japan, and India, and the presence of prominent market participants in the country focusing on the supply of the product as the market demand is rising. Additionally, the government is investing in the infrastructure sector and in the construction of residential houses and buildings.

Many countries in the Asia Pacific region experience high levels of humidity and rainfall throughout the year. Vapor barriers play a crucial role in mitigating moisture-related issues in buildings, such as dampness, rot, and decay. The need for effective moisture control solutions is particularly pronounced in tropical and subtropical climates, where humidity levels can be challenging to manage without proper vapor barrier installation.

Market Overview

Vapor barriers play a crucial role in controlling interior moisture. In simple terms, a vapor barrier is a layer of material that prevents moisture from penetrating into a constructed structure. The barrier acts as a shield that safeguards the structure from water damage that can occur due to moisture seepage. Typically, vapor barriers are installed around walls, floors, and ceilings to prevent moisture from spreading and causing potential water damage. It should be noted that a high-quality vapor barrier completely obstructs moisture from passing through its material, which is measured by its moisture vapor transmission rate.

Vapor Barriers MarketGrowth Factors

- The increasing awareness about energy efficiency and sustainability coupled with rising demand for vapor barriers in residential and commercial buildings is observed to promote the vapor barriers market growth in the coming years.

- The growing concerns regarding moisture-related issues in buildings are majorly boosting the vapor barriers market's expansion during the forecast period.

- The presence of stringent government regulations and the existence of building codes compelling the use of vapor barriers in construction projects, which spurs the demand for vapor barriers during the forecast period.

- The rising adoption of sustainable and eco-friendly materials in the production of vapor barriers is expected to fuel the vapor barriers market.

- The rapid technological advancement assists manufacturers in developing innovative vapor barriers with improved performance and durability, which offers significant growth opportunities for the vapor barriers market during the forecast period.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.39% |

| Market Size in 2025 | USD 15.45 Billion |

| Market Size by 2034 | USD 24.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Application, By Installation, and By End-use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising environmental awareness

Rising environmental awareness is expected to boost the growth of the vapor barrier market during the forecast period. Awareness regarding environmental sustainability, as well as the increasing need to reduce carbon emissions, has significantly increased the adoption of eco-friendly and renewable vapor barrier film solutions. Therefore, growing awareness about energy efficiency and sustainability is fueling their demand in commercial and residential buildings during the forecast period.

Restraint

Fluctuation in the prices of raw materials

The fluctuation in the prices of raw materials is projected to hamper the growth of the vapor barriers market. In addition, the lack of awareness among builders and contractors regarding the benefits of vapor barriers, particularly in undeveloped countries, is also likely to limit the expansion of the global vapor barriers market during the forecast period.

Opportunity

Robust growth of the construction sector

The rising construction activities are projected to offer a lucrative opportunity for the growth of the vapor barriers market during the forecast period. The vapor barrier is one of the necessary components in the construction sector to protect buildings by preventing water vapor from reaching building ceilings, walls, crawlspaces, and roofs. These barriers act as shields in protecting structures from the infiltration of moisture and preventing issues, including structural damage, mold growth, and rot.

Additionally, the market has witnessed an increasing demand for effective moisture management solutions due to the growth of the construction industry globally. Thereby driving the growth of the vapor barriers market.

According to the data provided by Invest India, the construction Industry in India is expected to reach USD 1.4 trillion by 2025.The construction industry market in India works across 250 sub-sectors with linkages across sectors. An estimated 600 million people are likely to be living in urban centers by 2030, creating a demand for 25 Mn additional mid-end and affordable units. Schemes such as the revolutionary Smart City Mission (target 100 cities) are expected to improve quality of life through modernized/technology-driven urban planning. Under NIP, India has an investment budget of USD 1.4 trillion on infrastructure - 24% on renewable energy, 18% on roads & highways, 17% on urban infrastructure, and 12% on railways.

Material Insights

The polymer segment is expected to dominate the industry by 2024 due to its superior moisture-resistant properties, durability, and cost-effectiveness. These properties make polymer vapor barriers highly effective in the construction industry, specifically for under-slab applications. Such barriers help prevent water vapors from seeping up from the ground and causing damage to buildings. They mitigate the risk of mold and mildew formation, which can lead to the release of airborne mold spores and cause serious respiratory ailments, as well as damage to building materials. To increase the life of buildings and prevent these risks, the construction industry has increasingly started using polyethylene vapor barrier films in new constructions, as well as refurbishing walls, ceilings, floors, and under slabs.

The metal sheet segment is observed to grow significantly during the forecast period owing to its superior properties, which include durability, corrosion resistance, cost-effectiveness, and recyclability. While metal vapor barriers may have a higher initial cost compared to alternative materials, their durability and longevity often result in long-term cost savings. Metal sheets require minimal maintenance and are less prone to degradation over time, reducing the need for frequent replacements or repairs and lowering lifecycle costs for building owners and operators.

Installation Insights

The membranes segment held the largest segment of the market in 2024,and the segment is expected to sustain its position throughout the forecast period. Membrane installation is gaining significant popularity in the vapor barriers market owing to its effectiveness in avoiding moisture damage to buildings or other structures. Vapor barrier membranes are widely used on the warm side of the insulation and are highly suitable for indoor swimming pools, bathrooms, launderettes, and industrial kitchens.

The cementitious waterproofing segment is expected to grow significantly during the forecast period.Cementitious waterproofing is used to protect structures from water penetration and prevent damage by forming a rigid and seamless barrier on concrete surfaces. Cementitious waterproofing systems are known for their durability and longevity. Once applied, they create a strong, impermeable barrier that effectively prevents the passage of moisture and vapor through concrete structures. This durability ensures long-lasting protection against water infiltration, making cementitious waterproofing a preferred choice for many construction projects.

Application Insights

The insulation segment accounted for the highest share in the vapor barriers market in 2024,owing to the increasing need to maintain the interior of the building. Proper insulation resists and prevents moisture from entering walls and ceilings and assists in improving indoor air quality. Insulation plays a crucial role in improving energy efficiency by reducing heat transfer between the interior and exterior of buildings. Vapor barriers, often integrated with insulation materials, help prevent moisture from penetrating the building envelope, thus enhancing the overall thermal performance of the structure.

The waterproofing segment is expected to grow fastest in the vapor barriers market during the forecast period.Vapor barriers are materials utilized in the construction industry as waterproofing agents. They act as damp-proofing materials that prevent moisture from diffusing through the walls, ceilings, and floors of a building. Vapor barriers find their application in various fields, including corrosion resistance, insulation, microbial & fungal resistance, waterproofing, and others, but waterproofing is a vital application in the global market. A significant rise in the construction of both residential and commercial buildings worldwide is driving the demand for vapor barriers as waterproofing material. These factors are expected to fuel the growth of the segment during the forecast period.

End-use Industry Insights

The construction industry held the largest share of the vapor barriers market in 2024.The growth of this industry is driven by the increasing demand for commercial, industrial, and residential buildings. Vapor barriers are used to help regulate indoor climate by reducing air leakage and uncontrolled airflow through the building envelope, and by preventing moisture from getting in.

Construction regulations and standards often mandate the use of vapor barriers to mitigate moisture-related issues such as mold growth, structural damage, and indoor air quality problems. Building codes and industry standards require vapor barriers in various building assemblies, including walls, roofs, and floors, to ensure the long-term durability and performance of structures. Compliance with these regulations drives the demand for vapor barriers in the construction sector.

The automotive segment is expected to grow at a notable rate in the vapor barriers market. The automotive industry generally relies on vapor barriers to prevent moisture intrusion into vehicle components, such as sensitive electronic components and other electrical systems. The vapor barrier films benefit the automotive industry in applications that generally require moisture resistance, contribute to the integrity and longevity of automotive components, and ensure reliable performance.

Vapor Barriers Market Companies

- Glenroy Inc.

- Celplast Metallized Product Ltd.

- Polifilm Group

- ProAmpac Holdings

- Optimum Plastics, Inc.

- 3M Company

- Amcor Limited

- SAES Getters S.p.A.

- Kalliomuovi Oy

- GLT Products

- UFP Industries, Inc.

- W.R. Meadows, Inc.

- BMI Icopal

- Carlisle Companies Inc.

- Reflectix, Inc.

- Layfield Group Ltd.

- Reef Industries, Inc.

- Visqueen Building Product

- RPM International Inc.

- DuPont de Nemours, Inc.

- BASF SE

Recent Developments

- In August 2022, Americover Inc. launched its newest product, the Pro Crawl Anti-Mold Vapor Barrier embedded with Mold Prevention Technology. This product is the second generation of high-performance vapor barriers, which began with the Original Pro Crawl Barrier, designed to reduce vapor transmission in the crawl space significantly.

- In March 2024, Toppan announced the launch of the Indian production of BOPP-based barrier film. Toppan has developed GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP). GL-SP is a new addition to the range of products for sustainable packaging in the Toppan Group's GL BARRIER1 series of transparent vapor-deposited barrier films, which enjoy a leading share of the global market, according to Toppan. Toppan and TSF have a focus on markets in the Americas, Europe, India, and the ASEAN region.

Segments Covered in the Report

By Material

- Glass

- Metal Sheet

- Polymers

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

By Application

- Insulation

- Waterproofing

- Corrosion Resistance

- Others

By Installation

- Membranes

- Coatings

- Cementitious Waterproofing

- Stacking and Filling

By End-use Industry

- Construction

- Packaging

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting