Vendor Neutral Archive (VNA) Market Size and Forecast 2025 to 2034

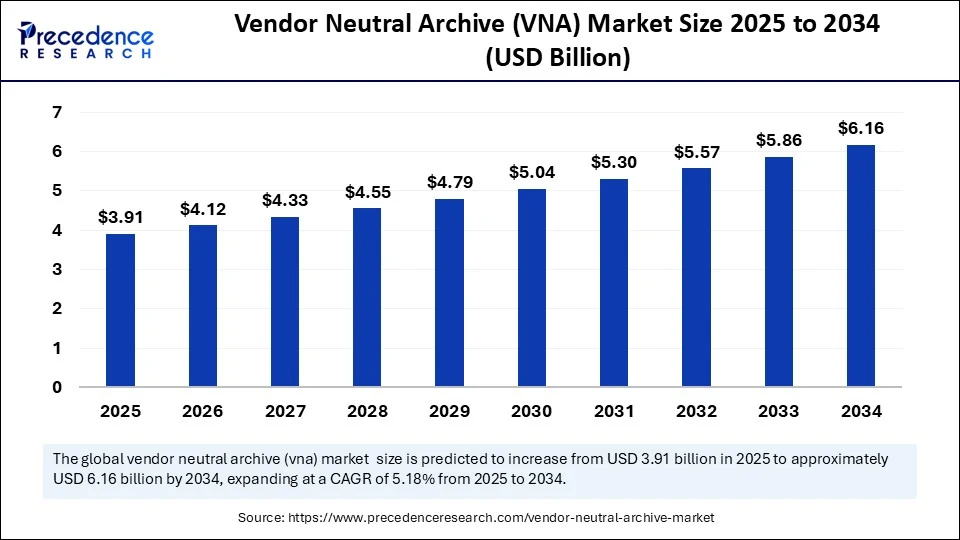

The global vendor neutral archive (VNA) market size accounted for USD 3.72 billion in 2024 and is predicted to increase from USD 3.91 billion in 2025 to approximately USD 6.16 billion by 2034, expanding at a CAGR of 5.18% from 2025 to 2034.The rising volume of medical imaging data is driving the demand for vendor neutral archive (VNA), which is boosting the growth of the market. The rising need for seamless data exchange and integration across different healthcare departments further supports market growth.

Vendor Neutral Archive (VNA) MarketKey Takeaways

- In terms of revenue, the global vendor neutral archive (VNA) market was valued at USD 3.72 billion in 2024.

- It is projected to reach USD 6.16 billion by 2034.

- The market is expected to grow at a CAGR of 5.18% from 2025 to 2034.

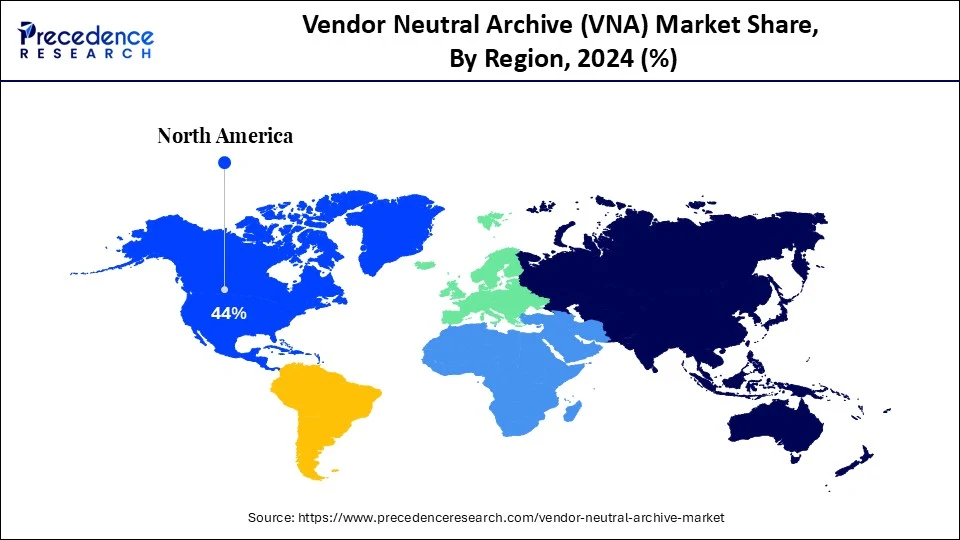

- North America dominated the global vendor neutral archive (VNA) market with the largest share of 44% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By deployment mode, the on-premise VNA segment contributed the biggest market share of 52% in 2024.

- By deployment mode, the cloud-based VNA segment will expand at a significant CAGR between 2025 and 2034.

- By vendor type, the independent vendors segment led the market while holding the highest market share of 46% in 2024.

- By vendor type, the EHR vendors segment will grow at a CAGR between 2025 and 2034.

- By end-user, the hospitals segment contributed the major market share of 63% in 2024.

- By end-user, the ambulatory surgical centers (ASCs) segment will expand at a significant CAGR between 2025 and 2034.

- By component, the software segment contributed the largest market share of 57% in 2024.

- By component, the services segment will expand at a significant CAGR between 2025 and 2034.

- By application, the radiology segment captured the highest market share of 48% in 2024.

- By application, the oncology segment will expand at a significant CAGR between 2025 and 2034.

- By imaging modality, the computed tomography (CT) segment held the major market share of 31% in 2024.

- By imaging modality, the ultrasound segment is expected to grow at a CAGR between 2025 and 2034.

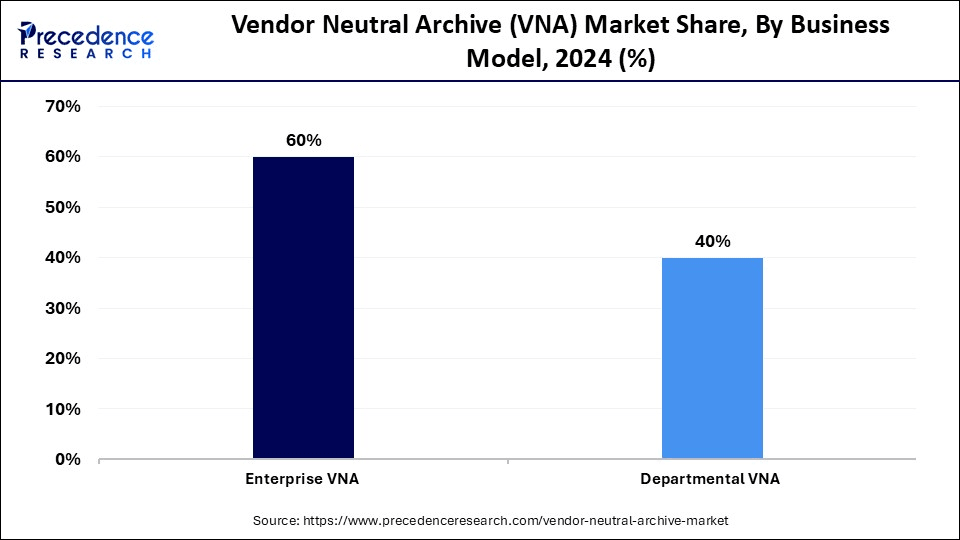

- By business model, the enterprise VNA segment generated the largest market share of 60% in 2024.

- By business model, the departmental VNA segment will expand at a significant CAGR between 2025 and 2034.

- By delivery model, the VNA integrated with PACS segment held the major market share of 41% in 2024.

- By delivery model, the standalone VNA segment will expand at a significant CAGR between 2025 and 2034.

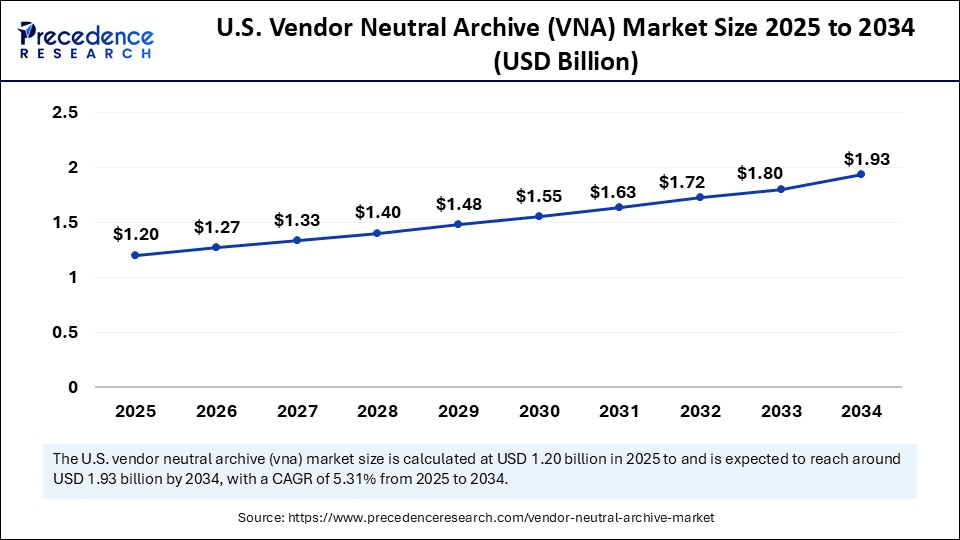

U.S. Vendor Neutral Archive (VNA) Market Size and Growth 2025 to 2034

The U.S. vendor neutral archive (VNA) market size was exhibited at USD 1.15 billion in 2024 and is projected to be worth around USD 1.93 billion by 2034, growing at a CAGR of 5.31% from 2025 to 2034.

What Made North America the Dominant Region in the Vendor Neutral Archive (VNA) Market in 2024?

North America dominated the global vendor neutral archive (VNA) market by holding the largest share in 2024, driven by its advanced healthcare infrastructure, high demand for efficient data management, the strong presence of key market players, and increased spending on healthcare facilities. North America has experienced rapid adoption of digital technologies in healthcare infrastructure. The growing volume of medical imaging data has driven the need for efficient storage and management solutions in the healthcare infrastructure. Government initiatives, such as the HITECH Act and meaningful use regulations, are supporting the adoption of modern healthcare IT solutions, including vendor-neutral Archer solutions.

The U.S. is a major contributor to the regional market. This is mainly due to its well-established healthcare infrastructure and a surge in digital technologies. Government support and funding for novel innovations in medical manufacturing technologies further contribute to market growth. The demand for cloud-based VNAs is growing in the U.S. due to their high flexibility, scalability, and cost-effectiveness. Ongoing focus on AI integration, strict regulatory requirements of data security and privacy, and strategic investments in manufacturing giants are transforming the growth.

Asia Pacific Vendor Neutral Archive (VNA) Market Trends

Asia Pacific is the fastest-growing region in the market. The market growth in the region is driven by rapid digital transformation, increasing healthcare expenditures, and the rising adoption of cloud-based solutions. The growing implementation of AI in various sectors is further adding to the adoption and advancements in vendor-neutral archive (VNA) solutions. Government initiatives and support for healthcare IT programs, including digital health policies and funding programs, are promoting the use of vendor-neutral archive solutions. The government investments in local manufacturing giants and a growing focus on the development of tailored medical imaging solutions are fostering the Asian market.

China is a major player in the regional market. This is mainly due to its digital environment and government initiatives. The growing tech-savvy population is driving the adoption of vendor-neutral archive solutions. Government initiatives like” Make in China 2025” and policies for the adoption of digital health technologies are driving innovations in the market.

India and Japan are significant players in the market. There is a strong emphasis on the advanced technologies in the healthcare sector. The rising investments to advance healthcare infrastructure further support market growth. The expanding healthcare infrastructure and massive investments in digitalization are driving the increased adoption of vendor-neutral archive (VNA) solutions.

Europe Vendor Neutral Archive (VNA) Market Trends

Europe is a notable player in the global vendor-neutral archive (VNA) market. This is primarily due to the rapid digitalization of healthcare and the existence of stringent data privacy regulations, such as GDPR. The need for interoperability has driven increased innovation and development of advanced technologies, including vendor-neutral archive solutions. The stringent regulations of Europe are promoting the adoption of secure and compliant vendor-neutral archive solutions. Additionally, government initiatives, including the adoption of healthcare IT solutions, funding programs & digital health policies, are shaping the market for vendor-neutral archive (VNA) solutions.

Germany leads the regional market, driven by its robust healthcare system and strong demand for advanced medical imaging solutions, including vendor-neutral archive (VNA). The increased spending on healthcare and the high adoption of cutting-edge technologies contribute to market growth. The UK and France are significant players adding to market growth due to the countries' strong focus on digital health initiatives and robust investments in healthcare IT infrastructure.

Market Overview

A vendor-neutral archive (VNA) is a medical imaging technology platform that stores images and data in a standard format with a standard interface, enabling interoperability across multiple Picture Archiving and Communication Systems (PACS), Electronic Health Records (EHRs), and imaging modalities. VNAs consolidate and archive medical images from disparate systems into a centralized, non-proprietary repository that allows clinicians, radiologists, and IT teams to access, manage, and share data across systems and locations, independent of the original vendor.

The vendor neutral archive (VNA) market refers to the ecosystem of solutions and services provided by technology vendors, healthcare IT companies, and service providers involved in delivering VNA platforms, storage systems, and integration services to hospitals, diagnostic imaging centers, and other healthcare organizations. Government initiatives are encouraging companies to invest in digital health adoption and data interoperability. The initiatives of healthcare providers in modern IT infrastructure contribute to market growth.

For instance, in January 2025, Children's Health Ireland (CHI) signed a five-year contract with medical imaging and cybersecurity company Sectra, following a four-month procurement process, to save healthcare teams timeaccessing diagnostic imaging and reports. According to the agreement, medical images will be allowed to be stored on individual devices where they can be captured, but will be consolidated in an accessible neutral archive, and CHI's electronic patient record integrated.(Source: https://www.digitalhealth.net)

What are the Major Growth Factors of the Vendor Neutral Archive (VNA) Market?

- Increasing Volume of Medical Imaging Data: The volume of medical imaging data has increased significantly, particularly in radiology and imaging departments, driving the demand for efficient storage solutions, including vendor-neutral archives.

- Growing Use of Imaging Technologies: The use of imaging technologies, such as X-rays, MRIs, and CT scans, has increased, driving the need for solutions like vendor-neutral archives.

- Technological Advancements: The evolving technological advancements and medical imaging technologies, driven by the increasing volume of imaging data and demand for efficient storage solutions, contribute to market growth.

- Integration with Electronic Health Records EHRs: Integration of VNAs with EHRs streamlines communication between various vendor PACS a further adding to the market growth.

- Adoption of Cloud-Based Solutions: The growing adoption of cloud-based PNA solutions for more scalability, flexibility, cost effectiveness, and efficient data management, boosting the market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.16 Billion |

| Market Size in 2025 | USD 3.91 Billion |

| Market Size in 2024 | USD 3.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Mode, Vendor Type, End User, Component, Application, Imaging Modality, Business Model, Delivery Modeland Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Need for Interoperability Between Healthcare Systems

The growing volume of medical data and the need for efficient storage and management of medical images in various healthcare systems are driving the growth of the vendor-neutral archive (VNA) market. The growing need for seamless data exchanges and enhanced partnerships among healthcare providers is boosting the adoption of VNA. Vendor-neutral archives enable healthcare providers to consolidate medical images from various sources, promote interoperability, and facilitate data sharing. Healthcare organizations are required to ensure and secure long-term storage of patient data. Government initiatives are enabling healthcare IT solutions to comply with data storage and management regulations by adopting vendor-neutral archives (VNAs).

Restraint

Data Security and Privacy Concerns

A healthcare organization handling sensitive patient data can be at risk of cyber threats. Therefore, concerns over the protection of sensitive patient data and ensuring stringent regulatory compliance can hinder the adoption and expansion of vendor-neutral archive (VNA) solutions. Strict regulations, such as HIPAA in the U.S. and GDPR in Europe, are hindering the adoption of vendor-neutral archive solutions. The safeguarding of medical data from cloud-based storage solutions can also hinder this growth. Additionally, the complexity of integrating diverse systems and cloud solutions drives the need for strong security measures.

Opportunity

Integration of AI and ML

The growing integration of AI and Machine Learning with vendor-neutral archive solutions holds significant opportunities for market growth. The emphasis on AI-driven analytics to enhance diagnostic accuracy, streamline workflow efficiency, and facilitate cutting-edge image analysis is gaining traction. AI and ML can analyze a broad amount of medical imaging data stored in vendor-neutral archive solutions, enabling healthcare providers to receive valuable insights and improve diagnostic accuracy. AI-powered, vendor-neutral archive solutions automate image categorization, routing, and annotation to streamline seamless clinical workflows and enhance accuracy. AI and ML help detect patterns in medical imaging data, enhancing predictive analytics and enabling early disease detection. AI and ML are bringing significant innovative opportunities in the vendor-neutral archive solutions.In recent years, more than 300 FDA approvals for AI solutions in imaging have bloomed. More than 50% of surveyed organizations have started to utilize AI algorithms for at least one imaging application.(Source:https://klasresearch.com)

Deployment Mode Insights

Which Deployment Mode Segment Dominate the Vendor Neutral Archive (VNA) Market?

The on-premises VNA segment dominated the market with the largest share in 2024 due to its high security and excellent control over data. Large healthcare providers are the prior adopters of the on-premises VNAs for better control over data and regulatory compliance. On-premises VNAs are essential for on-site data storage and management. The key role of on-premises VNAs in specialized integration with existing business systems, providing great security and control, makes them the preferred choice in a large-scale healthcare ecosystem.

The cloud-based VNA segment is expected to grow at the highest CAGR during the forecast period due to its scalability and cost-effectiveness. The cloud-based VNA offers remote access, making it suitable for the growing demand for telemedicine. The ability of cloud-based VNA to reduce the initial cost associated with conventional on-premise VNA solutions is raising its popularity. The adoption of cloud-based VNA is high in disaster recovery and business to enhance their capabilities.

Vendor Type Insights

Why did the Independent Vendors Segment Dominate the Vendor Neutral Archive (VNA) Market in 2024?

The independent vendors segment dominated the market in 2024, driven by its key role in offering specialized solutions. Independent vendors are developing innovative solutions and features tailored to meet the specialized healthcare needs of their clients. The expertise of independent vendors in areas such as data analytics, medical imaging, and interoperability is advancing vendor-neutral archive solutions. Additionally, the ongoing partnerships between independent vendors and healthcare organizations and bringing significant developments and implementation of vendor-neutral archive (VNA) solutions.

The EHR vendors segment is likely to grow at the fastest rate over the projection period due to their crucial role in different healthcare systems and departments. Vendor-neutral archive (VNA) solutions manage the rising volume of medical images and other data in EHR systems, helping to enhance interoperability and reduce their dependence on single-vendor solutions. The growing need for centralized data management solutions within EHRs is driving demand for vendor-neutral archive solutions.

End-User Insights

What Made Hospitals the Dominant Segment in the Vendor Neutral Archive (VNA) Market in 2024?

The hospitals segment led the market with a major revenue share in 2024 due to high demand for vendor-neutral archive (VNA) solutions in hospitals. Hospitals generate a large volume of medical imaging data, driving the need for efficient technologies to manage and store this data. Hospitals are integrating EHR systems in streamlined workflows to enhance patient safety and reduce errors. The growing adoption of EHRs and the need to comply with regulations necessitate the widespread adoption of VNAs in hospitals.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR in the upcoming period. This is mainly due to the increased adoption of vendor-neutral archive solutions in ambulatory surgical centers (ASCs) for efficient data management, cost-effectiveness, and interoperability. The growing demand for outpatient procedures is driving the need for efficient data management solutions. The growing focus on streamlined data management solutions has increased demand for VNAs in ambulatory surgical centers (ASCs).

Component Insights

Which Component Segment Leads the Vendor Neutral Archive (VNA) Market in 2024?

The software segment led the market in 2024 due to the increased demand for cloud-based and AI-powered VNA software. The increased digital transformation has heightened the demand for VNA software in the healthcare industry. VNA software is crucial for healthcare providers to share medical imaging data with various systems and departments. The increased need for seamless data sharing further bolstered the segmental growth.

The services segment is expected to expand at the highest CAGR in the coming years, driven by increasing demand for implementation, integration, consulting, and support & maintenance services. There is a high demand for expert services to implement vendor-neutral archive (VA) solutions with existing systems. The growing need for data migration and conversion services is further contributing to the segment's growth.

Application Insights

Why did the Radiology Segment Dominate the Vendor Neutral Archive (VNA) Market in 2024?

The radiology segment dominated the market, accounting for the largest revenue share in 2024, primarily due to the high volume of imaging data generated in the radiology department. The need for efficient image management solutions from different modalities has increased in the radiology departments. Vendor-neutral archive (VNA) solutions help radiology enhance its workflow efficiency and reduce storage expenses.

Oncology is the fastest-growing segment due to the increasing demand for solutions to manage the complex data generated during cancer diagnosis and treatment. The increasing prevalence of cancer has driven demand for cutting-edge medical imaging and data management solutions. Vendor-neutral archive solutions help integrate various imaging modalities, pathology data, and other information to enable specialized cancer care management.

Imaging Modality Insights

How Does the Computed Tomography (CT) Segment Dominate the Vendor Neutral Archive (VNA) Segment in 2024?

The computed tomography (CT) segment dominated the market, accounting for a significant share in 2024. This is mainly due to the increased adoption of computed tomography (CT) technologies in healthcare, driving the need for efficient image management solutions. Computed tomography (CT) generates a large volume of imaging data, making vendor-neutral archive (VNA) crucial in storage, management, and data sharing. The use of computed tomography (CT) in various diagnostic and treatment scenarios has increased, driving demand for scalable, vendor-neutral archive (VNA) solutions.

The ultrasound segment is expected to expand at the fastest CAGR in the market, driven by increasing demand for the ultrasound imaging modality. The increasing volume of medical imaging data drives demand for efficient data management and storage solutions. The growing utilization of ultrasound in obstetrics, cardiology, and point-of-care diagnostics clinical areas, driving demand for comprehensive vendor-neutral archive (VNA) solutions.

Business Model Insights

Why Did the Enterprise VNA Segment Dominate the Vendor Neutral Archive (VNA) Market?

The enterprise VNA segment dominated the market in 2024 due to the increased adoption of integrated healthcare solutions. The adoption of vendor-neutral archive (VNA) solutions is high in large enterprises for integrating imaging data in various departments and systems. The growing need for scalable and flexible solutions to manage a large volume of medical imaging data in enterprises is driving demand for vendor-neutral storage solutions. The enterprise VNA enables the standardization of interoperability in imaging data and collaboration.

The departmental VNA segment is expected to grow at the fastest CAGR over the forecast period, driven by increased demand for advanced imaging data management solutions in departments. The need for standardization and interoperability of medical imaging data has increased in departments, driving the adoption of vendor-neutral archive (VNA) solutions. Vendor-neutral archives (VNAs) facilitate easy access to and sharing of data across various departments.

Delivery Model Insights

Which Delivery Model Leads the Vendor Neutral Archive (VNA) Market in 2024?

The VNA integrated with PACS segment led the market while holding the largest share in 2024. This is primarily due to the growing demand for seamless management of medical images, which improves patient care and workflow efficiency. PACS (Picture Archiving and Communication Systems) enables the high functionality and efficiency of VNA (Vendor-Neutral Archive) solutions. Organizations with a growing need for streamlined workflow, enhanced data accessibility, and improved patient care are driving the adoption of VNA integrated with PACS solutions. The adoption of cloud-based VNAs and PACS solutions is gaining traction in the market.

The standalone VNA segment is expected to expand at the fastest rate over the projection period, due to increased demand for scalable and flexible medical imaging data management solutions in healthcare organizations. The standalone VNA plays a crucial role in addressing issues with data silos y offering a centralized repository for medical images. The standalone VNA offers vendor neutrality, enabling healthcare organizations to choose best-of-breed solutions and avoid vendor lock-in, thereby optimizing their IT infrastructure according to specific needs.

Vendor Neutral Archive (VNA) Market Companies

- Fujifilm Healthcare

- GE HealthCare

- Philips Healthcare

- Siemens Healthineers

- IBM Watson Health (Merge Healthcare)

- Sectra AB

- Agfa HealthCare

- Hyland Software

- Mach7 Technologies

- Carestream Health

- Lexmark Healthcare (Acquired by Hyland)

- BridgeHead Software

- INFINITT Healthcare

- Novarad Corporation

- Canon Medical Systems

- TeraMedica (Acquired by Fuji)

- Dell Technologies

- RamSoft

- Change Healthcare

- Konica Minolta Healthcare

Recent Developments

- In April 2025, the next generation of the Exa Platforms with an advanced version of Exa PACS|RIS with API platform features was launched by Konica Minolta Healthcare Americas, Inc. The platform is designed to leverage best-in-class partner solutions to amplify Exa PACS|RIS core. (Source:https://www.itnonline.com)

- In March 2025, GE HealthCare launched a novel portfolio of cloud enterprise imaging software-as-a-service (SaaS) solutions, Genesis solutions, at HIMAA 2025 in Las Vegas. The solutions will be combined with features like edge, storage, vendor neutral archive, and data migration.

(Source: https://www.itnonline.com) - In February 2024, a leading provider of diagnostic and enterprise imaging solutions, FUJIFILM Healthcare Americas Corporation's Synapse VNA and Synapse Radiology PACS was awarded #1 in the 2024 Best in KLAS Awards: Software and Services. (Source: https://www.itnonline.com)

Segment Covered in the Report

By Deployment Mode

- On-Premise VNA

- Hybrid VNA

- Cloud-based VNA

By Vendor Type

- Independent Vendors (Third-Party VNA Providers)

- PACS Vendors

- EHR Vendors

- Others (RIS Providers, Teleradiology Vendors)

By End User

- Hospitals

- Large Hospitals

- Medium Hospitals

- Small Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others (Research Institutions, Academic Medical Centers)

By Component

- Software

- Hardware

- Services

- Implementation Services

- Consulting Services

- Support & Maintenance

By Application

- Radiology

- Cardiology

- Oncology

- Pathology

- Orthopedics

- Ophthalmology

- Dental

- Others (Dermatology, Neurology)

By Imaging Modality

- X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Nuclear Imaging

- Others (Mammography, Fluoroscopy)

By Business Model

- Enterprise VNA

- Departmental VNA

By Delivery Model

- Standalone VNA

- VNA Integrated with PACS

- VNA Integrated with EHR

- Others (VNA with Cloud Gateway, Multi-tenant VNAs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting