What is the Veterinary Oncology Market Size?

The global veterinary oncology market size was accounted at USD 1.82 billion in 2025 and is predicted to increase from USD 2.04 billion in 2026 to approximately USD 5.60 billion by 2035, expanding at a CAGR of 11.90% from 2026 to 2035. The growth of the market is driven by the rising incidence of pets with cancer and improving diagnostic and treatment approaches.

Market Highlights

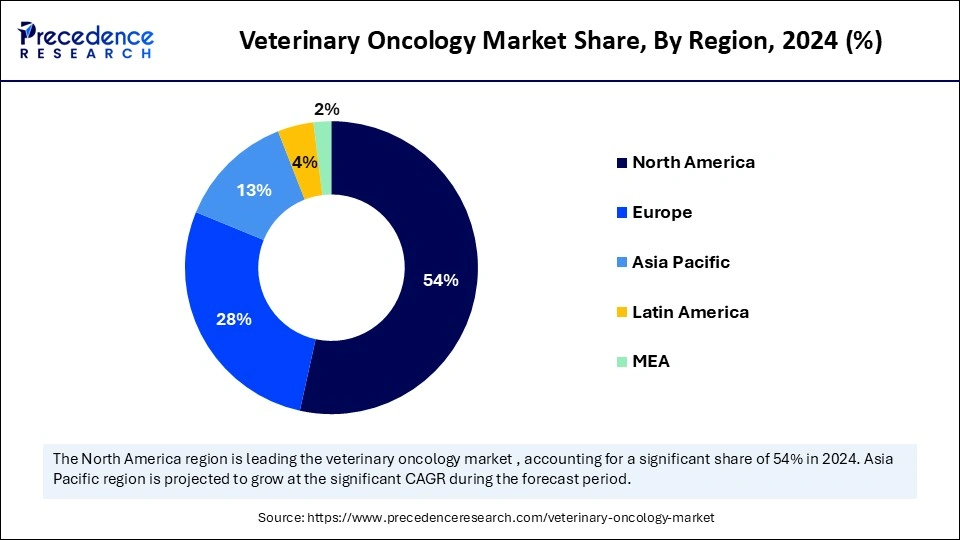

- North America dominated the veterinary oncology market with the largest revenue share of 54% in 2025.

- Asia Pacific is expected to grow at a notable CAGR of 12% during the forecast years.

- By animal type, the canine segment held the major revenue share of 87% in 2025.

- By animal type, the feline segment expects the significant growth in the market during the forecast period.

- By therapy, the surgery segment led the market in 2025.

- By therapy, the immunotherapy segment is expected to expand at a significant CAGR of 14.21% in the market during the forecast period.

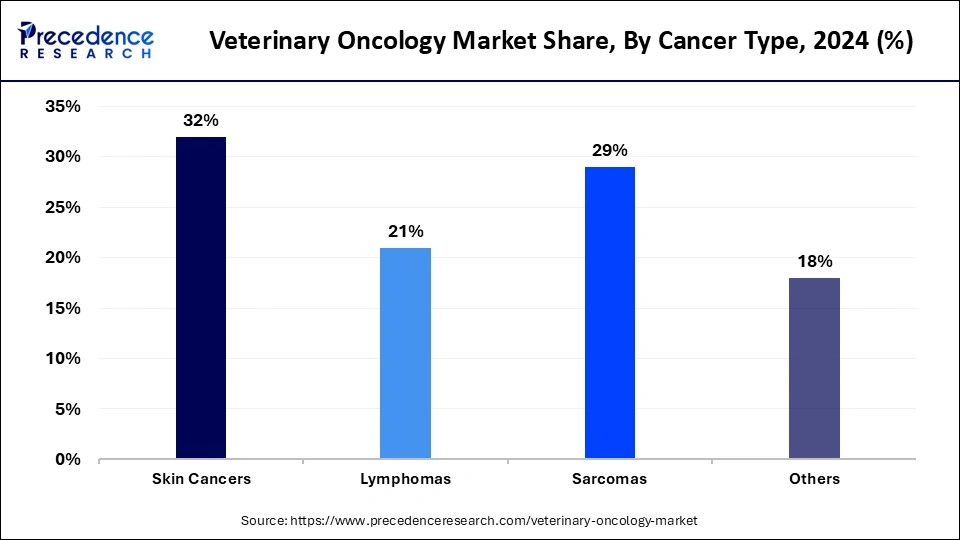

- By cancer type, the skin cancer segment dominated the market in 2025.

How is AI Integration Transforming the Veterinary Oncology Market?

Artificial Intelligence AI is most often used in medical imaging to analyze X-rays, CT scans, and MRIs and detect tumors more easily and quickly. AI supports personalized treatment plans by analyzing extensive sources of animal health data, genetic test results, as well as animal responses to treatment options. Thus, with AI, veterinary oncologists develop therapy plans that fit each patient while ensuring the safety and efficacy of those plans. With the aid of this technology, researchers can complete drug trials in much less time as well as find therapies sooner.

What are the Ongoing Efforts in Veterinary Oncology?

Veterinary oncology focuses on finding, treating, and preventing cancer in animals. Veterinary oncologists are equipped to find diseases such as skin tumors, lymphoma, and mammary gland tumors, and they treat them by using surgery, chemotherapy, radiation therapy, and immunotherapy. Experts in this field pay attention to both therapy and early diagnosis, correct staging, and personalized treatment plans for improved results. With better care for our pets, their lifespans grow, and more pets are diagnosed with cancer.

Due to better imaging, precise chemotherapy, and focused radiation treatments, caring for cancer in animals is becoming simpler and more successful. More pets are receiving special care because owners are more aware of their animals' health and are willing to pay for it. In addition, increased research and money being spent on veterinary oncology allow for new treatment methods and a wider range of clinical use. Besides, the field of pharmaceuticals is launching various new cancer drugs designed for animals, which in turn raises both the survival and healthy living standards of pets.

What Factors are Boosting the Growth of the Veterinary Oncology Market?

- Rising Cancer Prevalence in Animals: Many pets are developing cancer as they age due to improved general healthcare. An increase in cancer in pets makes owners seek out new and better treatments, so demand for skilled oncologists from veterinary colleges increases.

- Growing Owner Awareness: As many people consider their pets family, they're spending more time and money caring for them. Therefore, more people are looking for excellent care, early cancer screening, and individualized treatment options.

- Technological Advancements in Diagnosis and Treatments: The use of MRI, CT scans, and digital pathology advances allows veterinarians to catch cancer in animals at the earliest and most accurate stages. Improvements in therapies such as immunotherapy, targeted chemotherapy, and radiation therapy are improving outcomes for pets.

Veterinary Oncology Market Outlook

- Global Expansion: A rise in pet ownership, advances in liquid biopsies and AI-assisted imaging, along with more advanced treatments, like immunotherapy, chemotherapy, and radiation therapy, are leveraging the comprehensive progression.

- Major Investors: Numerous pharmaceutical & animal health firms, like Zoetis, Elanco Animal Health, are widely investing in R&D and the development, commercialisation of novel cancer treatments.

- Startup Ecosystem: In June 2025, Vetigenics introduced a study, CHECKMATE K9, which is the first dual immune checkpoint inhibitor study in dogs with solid tumors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.82 Billion |

| Market Size in 2026 | USD 2.04 Billion |

| Market Size by 2035 | USD 5.60 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Animal Type, Therapy, Cancer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Cancer in Pets

The rising incidences of cancer in pets are driving growth in the veterinary oncology market. With pets living longer, there are more age-related illnesses, such as cancer; common types are lymphoma, skin tumors, mammary gland tumors, and bone cancer. Because pet owners are more aware of their pets' health and want them to live well, there is a greater demand for cancer screening and treatment at an early stage. Because of this, veterinary clinics and hospitals are using more advanced cancer treatments. Also, improved ways of diagnosing, such as imaging and biopsy methods, lead to more awareness, detect cases earlier, and increase the need for specialized care.

Restraint

High Cost and Limited Accessibility of Advanced Treatments

A main factor holding back the veterinary oncology market is that most advanced cancer cures for animals are costly. The cost of chemotherapy, radiation, and immunotherapy can go from thousands to dollars, meaning that many middle- and low-income owners can't afford them. Moreover, most cutting-edge oncology care is found in metropolitan areas, which leaves outreach and assistance of this type limited for rural and underserved communities. There is not enough supply of accredited veterinary oncologists and of special machines such as CT, MRI, and molecular profiling.

Opportunity

Technological Innovations in Non-invasive Cancer Diagnostics

Making advancements in ways to detect animal cancers at an earlier stage without having to rely on invasive methods seems to be showing potential in the field of veterinary oncology. For example, utilizing liquid biopsies and other tests that depend on DNA, where identifying the presence of cancer involves assessing blood and blood markers, eases the need for more surgeries for veterinarians. In addition, the use of artificial intelligence and machine learning, along with radiographs, and then CT and MRI, there is a heightened degree of precision in identifying and describing cancers with those methods. Therefore, with these advancements, along with the potential of recognizing problems at an earlier time frame, the patient can potentially begin their treatment earlier and thus reduce costs for the care.

Segment Insights

Animal Type Insights

Why Did Canine Segment Dominated the Veterinary Oncology Market in 2025?

The canine segment dominated the veterinary oncology market by holding more than 87% of revenue share in 2025. Dog ownership is highest around the globe, and many breeds are more likely to develop lymphoma, mast cell tumors, and osteosarcoma. As a result, more people require advanced cancer treatments for dogs, such as surgery, chemotherapy, immunotherapy, and radiation therapy.

The research and clinical trials are quickly creating unique oncology treatments for dogs, leading to greater demand. Veterinary oncology is currently boosting efforts aimed at precision medicine for pets, such as using therapies selected by DNA analysis, which improves the chances of success during treatment. Now that diagnostic techniques are better and pet insurance is more easily available, the number of treatment options has grown.

The feline segment is expected to grow at a significant CAGR over the forecast period. The growing worldwide number of cats and the greater concern for their health. Feline oncology is experiencing growth because of better quality care for pets, greater awareness from pet owners, and more interest in specialized help. Due to recent developments in diagnostic imaging, molecular diagnostics, and less invasive screening, we and treating diseases earlier. Because people are increasingly living in towns and cities, more cats are being adopted, which strengthens the market's growth.

Therapy Insights

What Made Surgery Segment Dominant in the Veterinary Oncology Market in 2025?

The surgery segment dominated the market in 2025. Many types of cancer in pets are best treated by surgery, especially if the tumor is localized. Tumors can often be completely removed through surgery, and this allows veterinarians and pet owners to skip future therapies, making surgery the preferred way to treat animals. Because veterinary professionals are better educated, there are more advanced ways to diagnose cancer, and the demand for pet treatments is on the rise, more owners are now looking to surgical solutions for their pets with cancer.

The immunotherapy segment is expected to grow at a double-digit CAGR of 14.21% during the forecast period. With immunotherapy, the pet's immune system is granted the power to go after cancer, avoiding many of the side effects that happen with chemotherapy. Efforts aimed at discovering new immune therapies, such as cancer vaccines, monoclonal antibodies, and immune checkpoint inhibitors, are occurring at a rapid rate. Researchers and veterinary centers are using grants and funding to move forward with these new treatments and bring them to clinical use more quickly. The move toward less harmful cancer treatments in pets is likely to make immunotherapy a significant contributor to the growth of veterinary oncology, offering pets with cancer valuable new treatment choices.

Cancer Type Insights

Why Did Skin Cancers Segment Dominated the Veterinary Oncology Market in 2025?

The skin cancers segment dominated the market in 2025. Frequent skin cancers in pet animals include squamous cell carcinoma, mast cell tumors, and melanoma. A dog's age makes it more likely to develop skin tumors, often caused by years of exposure to harmful UV rays, whereas cats can get skin cancer on their face or toes.

The advanced ways to examine skin, such as dermoscopy and biopsy techniques, help vets accurately detect and stage skin cancers in their patients. Surgery, standard radiation, and new immunotherapy treatments are making it possible to treat more cancers successfully.

Regional Insights

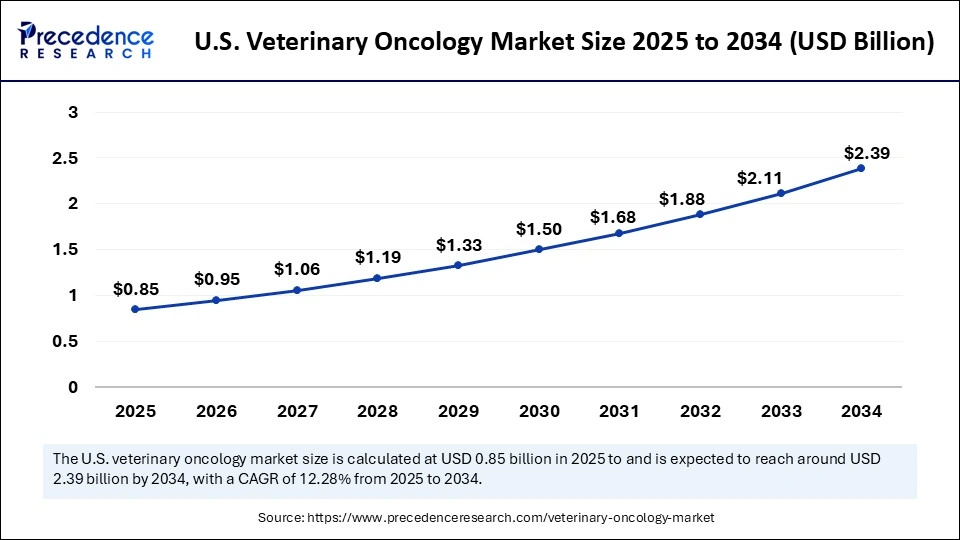

U.S. Veterinary Oncology Market Size and Growth 2026 to 2035

The U.S. veterinary oncology market size was exhibited at USD 0.85 billion in 2025 and is projected to be worth around USD 2.64 billion by 2035, growing at a CAGR of 12.00% from 2026 to 2035.

Advancing Diagnostics Solutions: Supports the U.S. Market

The U.S. is a major country in North America, which has been expanding with immersive advancements in diagnostic approaches, such as liquid biopsies. They are non-invasive blood tests that find circulating tumor DNA (ctDNA) or other biomarkers, enabling real-time monitoring of disease growth and treatment efficacy, like the OncoK9 test from PetDx and tests provided by VolitionRx.

Why Did North America Dominate the Veterinary Oncology Market in 2024?

North America dominated the market by holding more than 54% of revenue share in 2024. The more pet owners want the best for their animals; veterinary oncology has developed steadily as a branch of veterinary medicine. Many pets, especially dogs and cats, die each year from cancer, so there is a strong need for more oncological services. These centers provide advanced diagnostic equipment and strategies for treating pets, such as surgery, chemotherapy, radiation, and immunotherapy.

The more pets are protected by policies from insurers that help pet owners afford advanced treatments for their pets. In addition, regular advancements in the field, support from governments, and growing wealth among people support the expanding growth of veterinary oncology in North America.

Why is Asia Pacific Undergoing the Fastest Growth in the Veterinary Oncology Market?

Asia Pacific is projected to grow at a remarkable CAGR of 12% during the predicted period. A rise in middle-class families and increasing numbers of pet owners play a big role. In the region, animal owners are treating their pets more like family members and aiming for the highest level of veterinary help. Market growth is helped by policies that aim to ensure animal health and the active presence of industry players from around the world.

The growth of veterinary oncology in India is expected because more animals are getting cancer, and the government is playing a bigger role in managing these diseases. Immunotherapy, radiation therapy, and chemotherapy are some of the advanced treatment choices that are becoming known to Indian pet owners.

India Market Analysis

India's veterinary oncology market is growing due to rising pet ownership, increasing awareness of animal cancer, and improved access to advanced veterinary care. Higher disposable incomes, growing pet humanization, and the expansion of specialty veterinary clinics offering diagnostics, chemotherapy, and targeted therapies are further driving market growth.

What Are the Key Trends Driving the Europe Veterinary Oncology Market?

Europe is estimated to grow at a notable CAGR in the market during the forecast period. An increase in pet numbers in Europe, along with people willing to pay for their pets' health, is driving the market growth. Better equipment in veterinary hospitals, more sophisticated tests, and an increasing number of clinics with oncology services are all helping the sector grow.

UK: UK's Pet-Centric Oncology Sector Booming

The UK plays a major role in Europe because it has many pets. Since pets are often treated like family, their owners are eager for better healthcare, especially oncology. Moreover, pets in the UK receive lots of specialized care, as diagnostic methods and treatments are usually easy to access. Rising investment, government aid, and public income are helping to rapidly grow the veterinary oncology sector in Europe

Phenomenal Regulatory Support is Driving the MEA

The MEA veterinary oncology market is experiencing significant growth due to the major involvement of governments in regulating veterinary practices. The UAE's Ministry of Climate Change and Environment issued the Veterinary Practice Regulation (Ministerial Decree No. 384 of 2023), which mandates stricter standards for specialised care, especially in oncology, to ensure a raised quality of cancer treatment and professional standards.

Wider Biotechnology Applications: Impacts the African Market

Nowadays, the African research activities are exploring broader biotechnology applications, such as polymerase chain reaction (PCR) and bioinformatics for disease diagnosis and treatment delivery systems; however, initially, they emphasise infectious diseases in livestock, and the technology transfer potential to oncology.

UAE Market Analysis

The UAE veterinary oncology market is growing due to rising pet ownership, increasing awareness of advanced animal healthcare, and higher disposable incomes. The presence of modern veterinary hospitals, access to advanced diagnostic and treatment technologies, and a growing focus on pet wellness and preventive care are further driving demand for specialized cancer treatments for companion animals.

Veterinary Oncology Market Value Chain Analysis

- R&D

It basically comprises from identification of new compounds, biomarkers, or therapeutic strategies, to different preclinical & clinical phases & regulatory review stages.

Key Players: Boehringer Ingelheim, IDEXX Laboratories, Siemens Healthineers (Varian), etc. - Clinical Trials & Regulatory Approvals

Diverse phases are coupled with applications of INAD, NADA, and other post-marketing monitoring stages.

Key Players: The Rogosin Institute, South Valley University, Heartfulness Institute, etc. - Patient Support & Services

They usually offer palliative care, pain management, nutritional support, and other emotional and practical support to pet owners.

Key Players: The Cancer Vet, Veterinary Oncology Consultants, Lotus Pet Oncology, etc.

Veterinary Oncology Market Key Players Offerings

- Elanco: It explored Tanovea (rabacfosadine for injection), the first FDA conditionally approved treatment for lymphoma in dogs.

- Boehringer Ingelheim International GmbH: A major company offers investments in R&D and first-in-class therapies and cancer vaccines.

- Zoetis: Provides veterinary pharmaceuticals, biologics, and specialized oncology treatments, including chemotherapy and immunotherapy solutions for companion animals.

- Elekta AB: Develops advanced radiation therapy systems and software for precise cancer treatment, supporting veterinary and human oncology applications.

- PetCure Oncology: Offers mobile and in-clinic radiation therapy services for pets, including targeted cancer treatments with cutting-edge equipment and personalized care.

- Accuray Incorporated: Provides robotic and image-guided radiation therapy systems, enabling precise, non-invasive cancer treatment for animals and humans.

- Varian Medical Systems, Inc. (parent company: Siemens Healthineers): Supplies advanced radiotherapy solutions, linear accelerators, and oncology software platforms for veterinary and human cancer treatment.

- Virbac: Develops veterinary pharmaceuticals, vaccines, and supportive oncology products, focusing on companion animal health and cancer care management.

Other Major Key Players

- Merck & Co., Inc.

- Dechra Pharmaceuticals PLC

- NovaVive Inc.

- Ardent Animal Health, LLC (A Breakthrough Company)

Recent Developments

- In January 2025, IDEXX Laboratories launched IDEXX Cancer Dx, the first residual diagnostic panel for early lymphoma detection in dogs, targeting high-risk populations among North America's 20 million dogs. (Source: https://www.idexx.com)

- In March 2025, Privo Technologies Inc., a pioneering biopharmaceutical firm pleased to announce the formation of BeneVet Oncology, a new platform to achieve a sustained and continued improvement in the health of companion animals. BeneVet will combine the unique drug delivery platforms at Privo to address such unmet medical needs in veterinary medicine.(Source: https://www.prnewswire.com)

- In January 2025, IDEXX Laboratories, Inc., introduced the IDEXX Cancer Dx, the first-ever residual diagnostic panel for early detection of lymphoma in dogs, servicing the 20 million dogs in North America at higher cancer risks. (Source: https://www.pharmabiz.com)

- In September 2024, Saiba Animal Health AG was acquired by Boehringer Ingelheim International GmbH to consolidate its animal therapeutics range. The acquisition also incorporated Saiba's innovative vaccine development platform to potentially bolster the veterinary oncology space. (Source: https://www.boehringer-ingelheim.com)

Segments Covered in the Report

By Animal Type

- Canine

- Feline

- Equine

By Therapy

- Radiotherapy

- Stereotactic Radiation Therapy

- LINAC

- Other Types

- Conventional Radiation Therapy

- Surgery

- Chemotherapy

- Immunotherapy

- Other Therapies

- Stereotactic Radiation Therapy

By Cancer Type

- Skin Cancers

- Lymphomas

- Sarcomas

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting