Water Treatment Membrane Market Size and Forecast 2025 to 2034

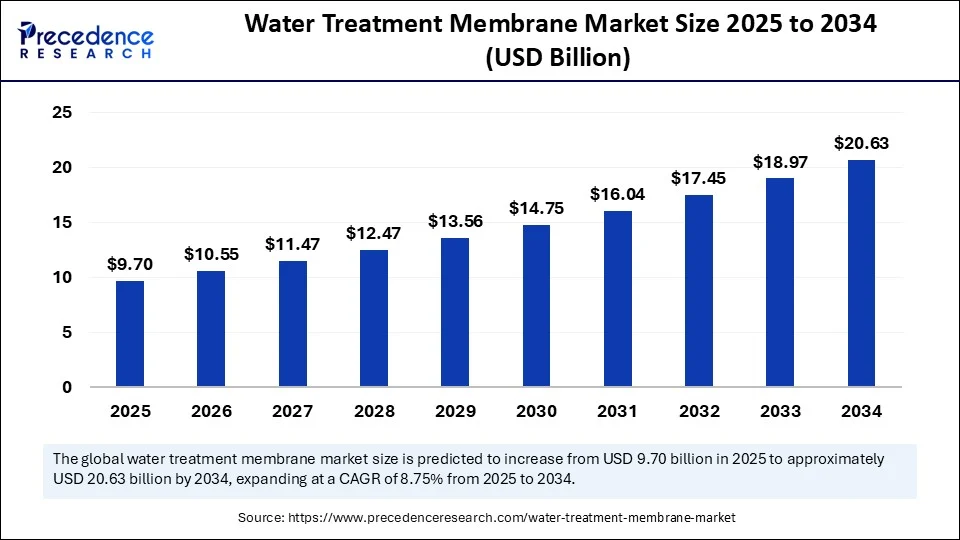

The global water treatment membrane market size was estimated at USD 8.92 billion in 2024 and is predicted to increase from USD 9.70 billion in 2025 to approximately USD 20.63 billion by 2034, expanding at a CAGR of 8.75% from 2025 to 2034. The growth of the market is attributed to rising demand for efficient, compact, and sustainable water purification solutions across industrial, municipal, and residential sectors.

Water Treatment Membrane Market Key Takeaways

- In terms of revenue, the global treatment membrane market was valued at USD 8.92 billion in 2024.

- It is projected to reach USD 20.63 billion by 2034.

- The market is expected to grow at a CAGR of 8.75% from 2025 to 2034.

- North America dominated the global water treatment membrane market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By technology, the reserve osmosis (RO) membrane segment held a major market share in 2024.

- By technology, the nanofiltration membrane segment is projected to grow at a significant CAGR between 2025 and 2034.

- By sales channel, the aftersales segment contributed the biggest market share in 2024.

- By sales channel, the original equipment manufacturers (OEM) segment is expanding at a significant CAGR between 2025 and 2034.

- By end use, the industrial water treatment segment contributed the highest market share in 2024.

- By end use, the municipal water treatment segment is expected to grow at a significant CAGR over the projected period.

Impact of Artificial Intelligence on the Water Treatment Membrane Market

Artificial intelligence (AI) is revolutionizing the water treatment membrane market by improving the precision, reliability, and sustainability of the water treatment systems. With the help of AI-driven models, engineers and operators can observe membrane health in real time, and thus foiling, scaling, and other performance degradation can be caught early. Through such predictive tools, unplanned downtimes can be minimized, and the life of the membranes can be increased through optimized cleaning or replacement schedules. Moreover, AI helps discover new materials for membranes and speed up the development of membranes with greater selectivity, durability, and chemical stress resistance.

Market Overview

The water treatment membrane market is witnessing rapid growth, driven by the increasing need for clean water across the world. This, in turn, boosts the demand for superior membrane-based filtration systems in the municipal, industrial, and home settings. Water treatment membranes, including reverse osmosis (RO), ultrafiltration (UF), nanofiltration (NF), and microfiltration (MF), work by selective separation of contaminants, microorganisms, and dissolved solids into water under pressure using semi permeable material. These technologies offer precision, scalability, and chemical-free treatment, establishing them as a key technology in desalination and wastewater recycling.

According to the World Health Organization (WHO), about 1 in 3 people globally do not have access to safe drinking water. The WHO estimated that more than 2.2 billion people lacked access to safely managed drinking water. This creates a high need for water treatment solutions. Furthermore, rising public investment in advancing water treatment infrastructure, including membranes technologies, through government scheme, such as the Jal Jeevan Mission in India and the Clean Water State Revolving Fund (EPA) in the U.S., are contributing to market growth.

(Source: https://www.who.int)

Water Treatment Membrane Market Growth Factors

- Rising Demand from Cold Chain and Food Processing Units: Increasing water purity requirements in temperature-sensitive food industries are boosting membrane filtration installations.

- Growing Emphasis on ESG Compliance: Corporate sustainability commitments and ESG reporting standards are fueling investment in cleaner water treatment technologies.

- Boosting Role of Industrial Internet of Things (IIoT): Integration of IIoT-enabled sensors and remote diagnostics is propelling the adoption of smart membrane systems.

- Driving Shift Toward Circular Water Economy: Focus on water reuse and zero-liquid discharge models is driving broader application of membrane-based recycling systems.

- Expanding Waste-to-Resource Projects: Municipalities and industries are leveraging membranes to recover energy and nutrients, growing their appeal in circular infrastructure.

- Accelerating Adoption in Remote and Military Operations: Membrane-based mobile units are gaining traction in defense and disaster-prone zones, boosting market penetration.

- Surging Innovation in Low-Energy Membrane Designs: Advances in energy-efficient membrane configurations are enhancing cost-effectiveness, fueling end-user transition from conventional methods.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.63 Billion |

| Market Size in 2025 | USD 9.70 Billion |

| Market Size in 2024 | USD 8.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Does Rising Global Demand for Clean Water Drive the Growth of the Water Treatment Membrane Market?

Increasing demand for clean and safe water is expected to accelerate the growth of the market in the long run. As the demand for clean and safe water rises, so does the need for membrane technologies in both industries and municipalities. Growing shortage of freshwater on a global scale due to high population and urbanization are urging government and private entities to invest in efficient water treatment solutions.

Infrastructural advancement in modern cities and emerging economies, coupled with concerns regarding potable water quality, suggest that upgrades will likely favor membrane filtration over traditional techniques. The 2024 Global Water Security Assessment by the World Bank revealed that more than two billion people in the world reside in nations experiencing high water stress, increasing the need for sustainable solutions to treat wastewater. In its 2024 update on water quality, the European Environment Agency stressed that more than 30% of the water bodies are not in good condition. This encourages municipalities to utilize and install efficient membrane systems to ensure compliance, fueling the market growth.

(Source: https://www.worldbank.org)

(Source: https://www.eea.europa.eu)

Restraint

Membrane Fouling and Degradation Restrain Operational Efficiency and Lifecycle

Membrane fouling and degradation issues are projected to reduce system efficiency and increase maintenance requirements, thus hindering the market. A prevalent issue for water treatment membranes is performance loss due to scaling, biofouling, and chemical damage. To maintain consistent production, operators often resort to chemical cleaning or membrane replacement, which elevates the product's lifecycle costs. The membrane fouling process accelerates in industries dealing with complex effluents, such as food processing and pharmaceuticals, due to high organic loads and suspended solids. This technical limitation compromises reliability, further impeding market expansion.

Opportunity

Are Desalination Projects Reshaping the Future of the Water Treatment Membrane Market?

Increasing investments in desalination projects create immense opportunities for key players competing in the water treatment membrane market. Regions facing severe water shortages, such as the Middle East, parts of Africa, and the Asia-Pacific, are increasingly utilizing seawater desalination for domestic and agricultural water supply. A key technology employed is reverse osmosis (RO) membranes, known for their high energy efficiency in removing salts and dissolved impurities. Major desalination plants are actively funded by governments and private consortia, integrating highly efficient membrane modules to enhance project performance. A 2024 World Bank Water Security Report noted increased spending on desalination infrastructure by Gulf Cooperation Council (GCC) countries. This is driven by the decline in freshwater availability, with a focus on energy-efficient membrane systems. The long-term effects of these developments are projected to fuel market growth in arid and semi-arid regions.

(Source: https://www.worldbank.org)

Technology Insights

Why Did the Reverse Osmosis (RO) Membrane Segment Dominate the Water Treatment Membrane Market in 2024?

The reverse osmosis (RO) membrane segment dominated the water treatment membrane market with the largest share in 2024. This is mainly due to the high utilization of these membranes in municipal and industrial desalination plants. These types of membranes have high salt and contaminant removal rates, which make them suitable for treating brackish water and seawater. Governments and private entities in the arid and semi-arid zones, where water shortage is serious problem, favored RO systems because of their effectiveness in providing high-quality potable water.

The RO technology has been used in industries that need high-quality water, which include electronics, drug manufacturing, and food processing. Its robust design, enhanced energy efficiency, and incorporation into large-scale infrastructure projects enhanced its market leadership. The 2024 Water Security Review by the World Bank highlighted that RO membranes continued to be central to new desalination structures in drought-stricken coastal areas, mainly in Sub-Saharan Africa and South Asia.

(Source: https://www.worldbank.org)

The nanofiltration (NF) membrane segment is expected to grow at the fastest rate during the forecast period, owing to its selective characteristics of removing divalent ions and organic compounds with micropollutants and rejecting useful minerals. Industries are increasingly adopting NF membranes to comply with regulatory water safety regulations and address contaminants like pesticides, pharmaceuticals, and emerging contaminants. These membranes operate at reduced pressures than those of RO systems, resulting in reduced energy consumption and operating costs. Additionally, nanofiltration technology is a key component of the next-generation water treatment systems, facilitating segmental growth.

Sales Channel Insights

What Made Aftersales the Dominant Segment in the Market in 2024?

The aftersales segment dominated the water treatment membrane market with the largest revenue share in 2024, driven by the increased need to optimize operational efficiency of existing water treatment systems and membrane replacement. The widespread use of service contracts, membrane refurbishments, and diagnostics help industries and municipalities avoid forced shutdowns, thus reducing downtime. Aftersales providers offer specific technical skills, remote monitoring services, and predictive technologies to enhance the membrane performance and lower the life-cycle costs. Furthermore, with more older systems shifting to smarter and data-driven varieties of maintenance procedures, the demand for third party aftersales services is rising.

The OEM segment is expected to grow at significant CAGR in the upcoming period, owing to the high demand for complete integrated systems in new industrial as well as municipal projects. OEMs offer customized end-to-end solutions accompanied by additional membrane modules, housing, pumps, and controllers that facilitate easy cross-compatibility and simple installation. OEMs used to have long term contracts with governments, the EPC contractors and independent utilities that further improved their base as far as global deployment is concerned. The increasing focus on infrastructure expansion in developing countries, where a central water system requires large volume units, also contributes to segmental growth.

End Use Insights

Why Did the Industrial Water Treatment Segment Dominate the Water Treatment Membrane Market in 2024?

The industrial water treatment segment dominated the market in 2024 due to stringent regulations regarding waste management and high demand for water in various industrial processes. Chemicals, pharmaceuticals, food and beverage, textiles, and semiconductors are among the key industries that rely heavily on membrane technology. This technology is crucial for meeting stringent discharge standards as well as producing high-purity process water. Industries often use membranes to meet stringent environmental regulations.

The municipal water treatment segment is expected to grow at the highest CAGR during the forecast period. The growth of the segment is attributed to the increases in city populations and the growing investment by the community in evergreen and non-central treatment systems. Membrane-based technology is becoming more dominant in emerging cities and advanced economies to replace old methods of sand filtration and chlorination. These technologies aid utilities in coping with the emerging water quality standards, reducing treatment costs, and enhancing pathogen removal rates. Additionally, rising investments in Mediterranean countries to modernize existing municipal water treatment infrastructure fuels segmental growth.

Regional Insights

What Made North America the Dominant Region in the Water Treatment Membrane Market in 2024?

North America led the water treatment membrane market, capturing the largest revenue share in 2024. This is mainly due to the strict measures put in accordance with the environmental policy and the extensive use of the membrane technologies across industries. There is a strong focus on upgrading existing water treatment facilities to meet the changing water quality standards of federal and state governments. In 2024, the U.S. Environmental Protection Agency (EPA) issued new drinking water regulations called “National Primary Drinking Water Regulations” to address emerging contaminants PFAS and other substances. This led to an increase in the demand for advanced nanofiltration and reverse osmosis membranes through an increase in the advanced membranes in public utilities. Furthermore, the rising government funding for compact membrane filtration unit water projects is expected to ensure the loing-term growth of the market in this region.

(Source: https://www.epa.gov)

Asia Pacific is expected to grow at the fastest rate in the water treatment membrane market during the forecast period, owing to rapid industrialization, rising scarcity of fresh water, and increasing infrastructure development in emerging economies. Southeast Asian countries, Japan, China, and India are experiencing high necessity of water treatments due to the increasing pollution rates, industrial effluent, and the rising urban population.

In 2024, the People's Bank of China (PBoC) published its green financing plan, which entailed a large-scale upgrading of water treatment, thereby encouraging investments in the membrane systems. The 2024 Asia Sustainability Coverage launched by Reuters highlighted government investments in Vietnam, Indonesia, and the Philippines, boosting the implementation of membrane-based desalination and recycling of wastewater as water stress grows in these nations. Furthermore, the growing investments in efficient water treatment technologies in rural regions are expected to fuel the growth of the market.

(Source:https://greenfdc.org)

(Source: https://www.reuters.com)

The Middle East & Africa is expected to grow at a notable rate in the upcoming period due to the rising dependency on desalination, rising public-private partnerships, and growing focus on water security. Nations like Saudi Arabia, UAE, and Israel are heavily investing in the construction of ultra-capacity desalination plants, creating the need for reverse osmosis membranes as a remedy against a very little abating fresh water supply. In its North Africa Green Financing Outlook 2024, the European Investment Bank has sanctioned multi-million-euro funding to fund Egypt and Morocco membrane-based municipal treatment networks to achieve the EU-linked standards of water quality. Furthermore, the rising demand for clean and potable water is expected to drive market growth within the region.

(Source: https://www.eib.org)

Water Treatment Membrane Market Companies

- Asahi Kasei Corporation

- DuPont

- Hydranautics

- Koch Separation and Solutions

- Pall Corporation

- Pentair

- Suez Water Technologies and Solutions

- Toray Industries Inc

- LG Chem Ltd

Recent Developments

- In May 2025, Egypt signed a new financing agreement with the African Development Bank Group (AfDB) for the fourth phase of the Abu Rawash Water Treatment Plant project. This phase will expand the plant's treatment capacity from 1.6 million to 2 million cubic meters per day, aiming to improve water and sanitation services for Giza's residents.

(Source: https://smartwatermagazine.com) - In March 2025, Memsift Innovations, a leader in advanced membrane technologies, partnered with the Murugappa Group to introduce the GOSEP ultrafiltration membrane. Coinciding with the product launch, both companies inaugurated a state-of-the-art membrane manufacturing facility, marking a major advancement in separation and water treatment technologies. This strategic alliance enables broader access to advanced membrane chemistry, underscoring Memsift's mission to reshape separation solutions across diverse industries.

(Source: https://chemindigest.com) - In June 2024, Asahi Kasei revealed that it began commercial sales of a membrane system designed to produce WFI (water for injection), a sterile-grade water essential for injectable pharmaceuticals. The system replaces traditional distillation by utilizing the Microza hollow-fiber membrane, renowned for its water treatment precision. By reducing steam consumption, this technology helps cut CO2 emissions and lowers production costs. Microza membranes are already trusted in pharmaceutical, biotech, food, and environmental sectors for delivering high purity and operational reliability.

(Source: https://www.businesswire.com) - In January 2025, Toray Industries, Inc. introduced a high-efficiency separation membrane module tailored for biopharmaceutical manufacturing (see note 1). The new design achieves more than double the filtration output of conventional units by minimizing clogging, raising yields beyond 90% and enhancing purification. Toray plans to provide prototypes to selected clients for evaluation in purification stages (note 2) of gene therapy processes (note 3), aiming to accelerate market readiness. As the industry shifts from small-molecule drugs to biopharmaceuticals, the high production cost of these advanced therapies remains a barrier this innovation seeks to overcome.

(Source: https://www.toray.com)

Latest Announcement by Industry Leader

- In March 2025, DuPont Water Solutions has unveiled WAVE PRO, an advanced online modeling platform designed for diverse ultrafiltration (UF) water treatment applications, including drinking water, industrial utility water, wastewater, and seawater desalination. As the next evolution of the Water Application Value Engine (WAVE), WAVE PRO for UF supports water professionals in navigating the design process for ultrafiltration systems. Its powerful calculation engine enables users to perform complex system designs with high precision, aiding water treatment planners in optimizing productivity and simplifying operations. “We are extremely proud to offer our municipal and industrial customers WAVE PRO, the latest generation of water-treatment design tools for ultrafiltration,” said Gary Gu, Global Technology Leader, DuPont Water Solutions. “Our DuPont Water Solutions team is continuously advancing the performance of our membranes, resins, systems, and complementary digital design and optimization planning tools to best help our customers meet their operational and financial goals.”

(Source: https://www.dupont.com)

Segments Covered in the Report

By Technology

- Ultrafiltration Membrane

- Microfiltration Membrane

- Reverse Osmosis (RO) Membrane

- Nanofiltration Membrane

By Sales Channel

- Aftersales

- Original Equipment Manufacturers (OEM)

By End Use

- Residential Water Treatment

- Municipal Water Treatment

- Industrial Water Treatment

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting