What is the Whole Exome Sequencing Market Size?

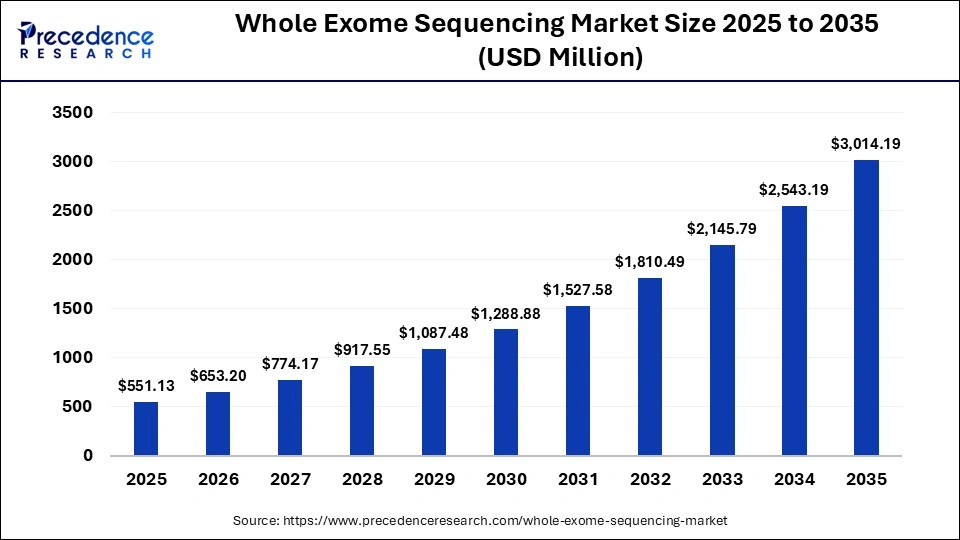

The global whole exome sequencing market size was estimated at USD 551.13 million in 2025 and is predicted to increase from USD 653.20 million in 2026 to approximately USD 3,014.19 million by 2035, expanding at a CAGR of 18.52% from 2026 to 2035. The whole exome sequencing market is driven by rising demand for precision medicine and genetic disorder diagnostics.

Market Highlights

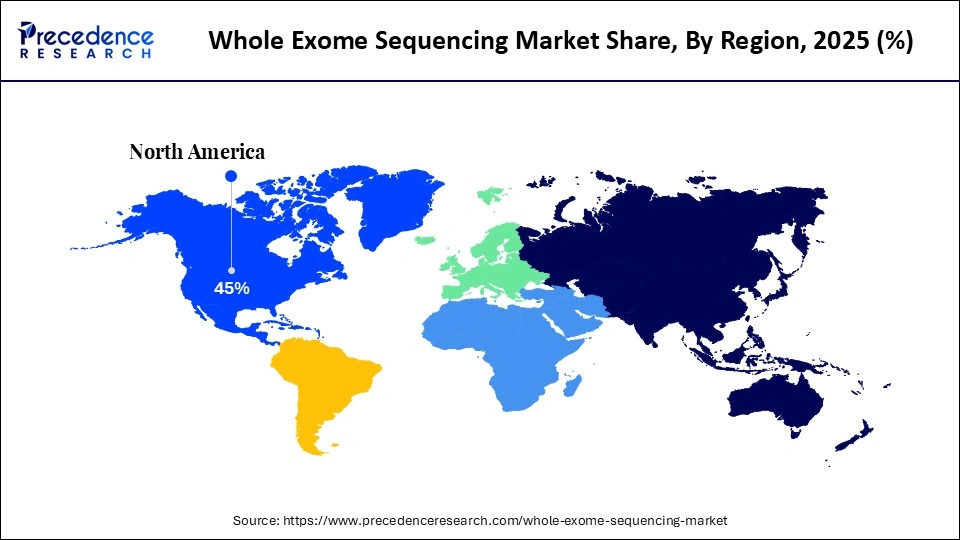

- By region, North America dominated the market, holding the largest market share of 45% in 2025.

- By region, Asia Pacific is expected to expand at the fastest CAGR of 18.5% between 2026 and 2035.

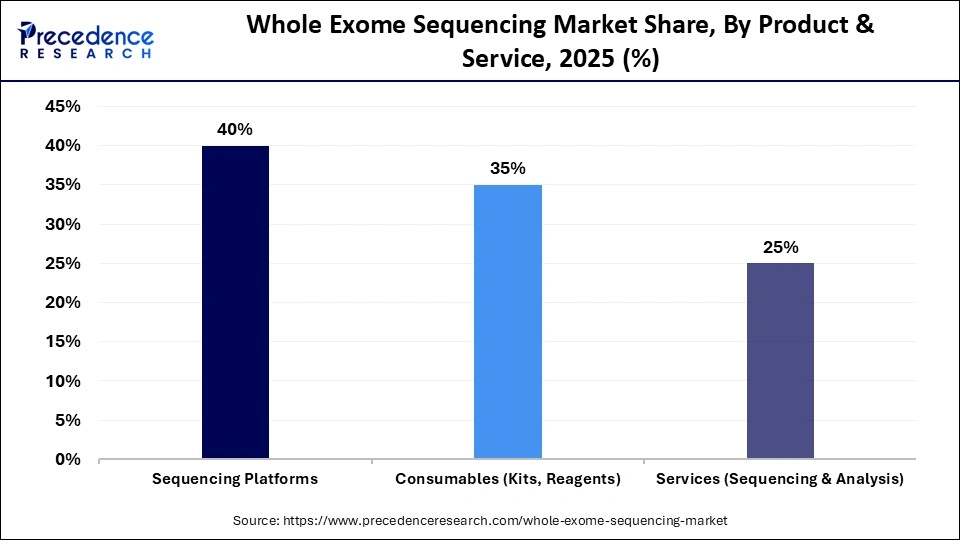

- By product & service, the sequencing platforms segment held the largest market share of 40% in 2025.

- By product & service, the services segment is expected to grow at the fastest CAGR of 17.1% during the forecast period.

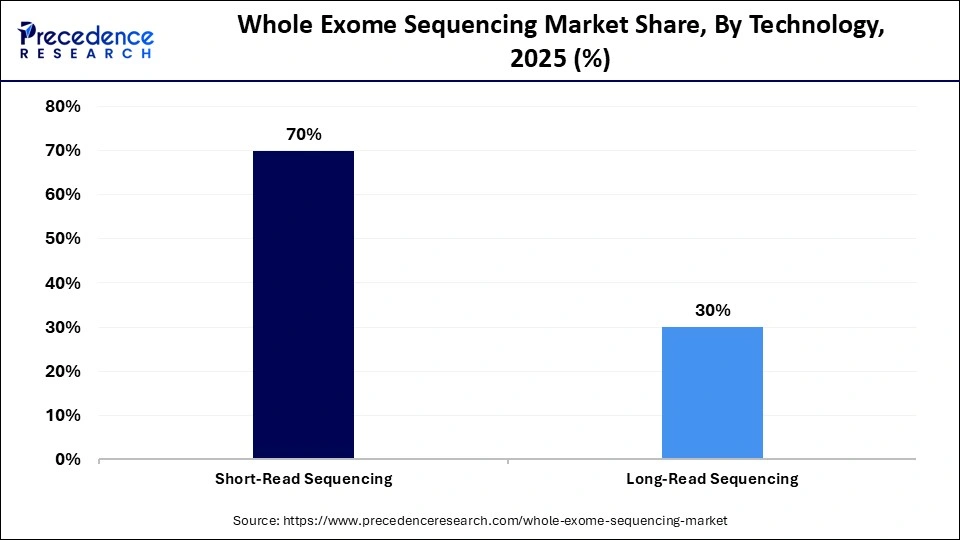

- By technology, the short-read sequencing segment held the largest market share of 70% in 2025.

- By technology, the long-read sequencing segment is expected to grow at the fastest CAGR of 16.8% in the coming years.

- By application, the rare genetic diseases segment held the largest market share of 45% in 2025.

- By application, the cancer & oncology segment is expected to grow at the highest CAGR of 17.2% between 2026 and 2035.

- By end user, the academic & research institutes segment held the largest market share of 40% in 2025.

- By end user, the clinical laboratories segment is expected to grow at the highest CAGR of 16.7% between 2026 and 2035.

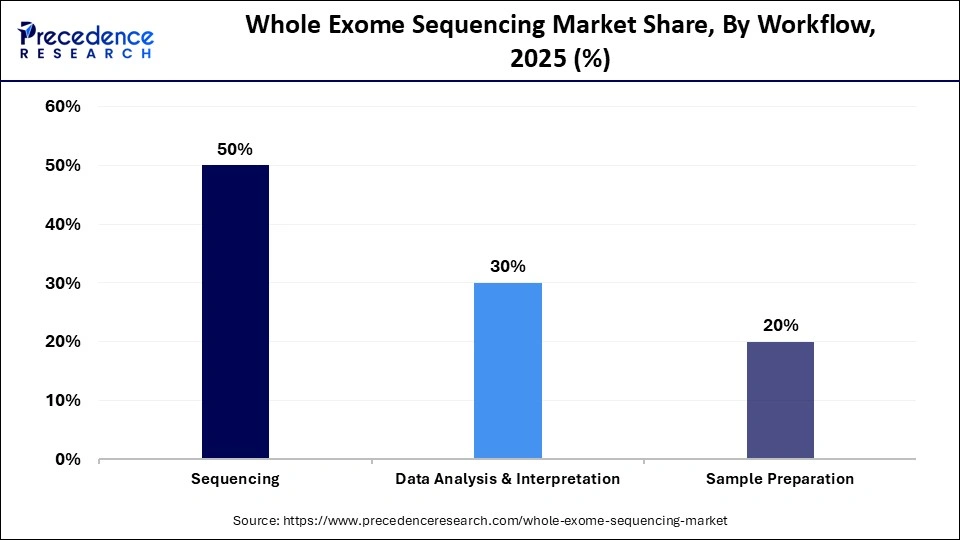

- By workflow, the sequencing segment held the largest market share of 50% in 2025.

- By workflow, the data analysis & interpretation segment is expected to grow at the fastest CAGR of 17.0% in the coming years.

Market Overview

The whole exome sequencing market encompasses technologies, platforms, and services designed to sequence the entire protein coding regions (exons) of the human genome, enabling the precise identification of disease-causing genetic variants. WES is gaining favor as an alternative to whole-genome sequencing, particularly in the diagnosis of rare diseases, oncology, pharmacogenomics, and clinical research. Key drivers of the market include the rising prevalence of genetic disorders globally and the growing demand for personalized and precision medicine. The adoption of WES is further bolstered by declining sequencing costs, government funding, favorable reimbursement policies, and increasing awareness among healthcare professionals.

How is AI Influencing the Whole Exome Sequencing Market?

The whole exome sequencing market is being transformed by the integration of AI, which enhances the analysis, interpretation, and clinical decision-making of genomic data in both research and diagnostics. AI plays a critical role in prioritizing genetic variants, annotating and filtering them, reducing false positives, and increasing diagnostic accuracy. Natural Language Processing (NLP) is also being utilized for automated literature mining, enabling the correlation of genomic discoveries with clinical evidence. Additionally, AI-powered applications streamline workflow automation, reducing time spent on analysis and making WES services more cost-effective for laboratories and hospitals.

Whole Exome Sequencing Market Trends

- There is an increasing adoption of WES in the diagnosis of rare and inherited disorders, which allows generating genomic information at a significantly accelerated and affordable rate. This significantly helps in making prompt decisions and carrying out further research activities worldwide.

- The significance of whole exome analysis in research and diagnostics lies in its ability to be performed faster, more accurately, and efficiently due to advancements in technology. Developments such as high-throughput sequencing systems, automated sample processing, and sophisticated bioinformatics tools have significantly enhanced the speed and precision of exome sequencing.

- The clinical adoption of WES is being witnessed across the globe, along with the rising number of hospitals, diagnostic units, and research centers. The growing screening programs for oncology, neurology, prenatal, and inherited disorders also drive the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 551.13 Million |

| Market Size in 2026 | USD 653.20 Million |

| Market Size by 2035 | USD 3,014.19 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product & Service, Technology, Application, End User, Workflow, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product & Service Insights

Why Did the Sequencing Platforms Segment Dominate the Whole Exome Sequencing Market?

The sequencing platforms segment dominated the market while holding the largest share of 40% in 2025 due to the high accuracy, scalability, and faster turnaround time of exome sequencing. Sequencing platforms are crucial in WES, enabling laboratories, hospitals, and research institutions to carry out comprehensive and targeted analyses. The efficiency and reliability of whole-exome sequencing platforms have been significantly improved through continuous innovations, including automated sample preparation, higher read accuracy, and high-throughput capabilities. Additionally, the presence of major global players offering robust systems, strong after-sales support, and comprehensive training programs has further driven the adoption of these platforms across research and clinical laboratories.

The services segment is expected to grow at the fastest CAGR of 17.1% over the forecast period. This is mainly due to the increasing outsourcing of the sequencing workflows and data interpretation to specialized service providers. Clinical labs, hospitals, and research institutes use these services as a way of obtaining high-quality sequencing without having to invest heavily in equipment. The increasing need for end-to-end solutions, which consist of sample processing, variant calling, annotation, and data reporting, also drives the segment. Moreover, service providers continually upgrade their analytical pipelines using artificial intelligence (AI) and machine learning (ML) to achieve more accurate variant interpretation, shorter turnaround times, and efficient management of large-scale genomic data.

Technology Insights

What Made Short-Read Sequencing the Leading Segment in the market?

The short-read sequencing segment led the whole exome sequencing market with the highest share of 70% in 2025. This is mainly due to its widespread use in most clinical and research applications, driven by its high throughput, cost-effectiveness, and proven accuracy. Short-read sequencing technology is excellent at detecting variants of single-nucleotide variants (SNVs) and small insertions and deletions, and is useful in diagnostics of rare genetic diseases, oncology panels, and in population genomics. Lower operational costs as well as wide availability of the platform have made technology popular among sequencing centers, academic institutions, and clinical laboratories.

The long-read sequencing segment is expected to grow at the fastest CAGR of 16.8% in the coming years. This is mainly because it has the ability to detect structural variants and complex mutations, which are challenging to identify using short-read sequencing. Long-read sequencing has become more useful in clinical studies and rare disease detection because it can sequence entire genomes, phase variants of haplotype more accurately, and also offer more characterization of difficult-to-sequence regions. Advances in accuracy, cost efficiency, and throughput continue to simplify the adoption of whole-exome sequencing. The introduction of AI-based bioinformatics tools has also made the analysis of long-read genomic data more effective and reliable.

Application Insights

Why Did the Rare Genetic Diseases Segment Lead the Whole Exome Sequencing Market?

The rare genetic diseases segment dominated the market while capturing a major revenue share of 45% in 2025. This is because WES is typically applied to detect pathogenic variants of the etiology of rare and inherited conditions and provide accurate diagnosis and treatment choices. It is more cost-effective, accurate, and has lower turnaround times than whole-genome sequencing, which makes it the preferred technique in clinical and research use in the identification of rare diseases. Adoption is also facilitated by the growing awareness of genetic testing among healthcare providers and patients, the government, and institutional funding programs. Strong bioinformatics pipelines of annotating, filtering, and interpreting variants also enhance the use of WES in the diagnosis of rare diseases.

The cancer & oncology segment is expected to grow at the highest CAGR of 17.2% during the projection period. This is because WES plays a crucial role in identifying genetic mutations that drive tumor development and progression. It enables precision oncology by helping clinicians select targeted therapies, monitor disease progression, and predict treatment response. The increasing incidence of cancer worldwide, combined with growing adoption of personalized medicine and the need for accurate molecular profiling, further fuels the demand for WES in oncology.

End User Insights

How Does the Academic & Research Institutes Segment Lead the Whole Exome Sequencing Market?

The academic & research institutes segment dominated the market while holding a 40% share in 2025, as these institutions rely on WES to discover novel genetic variants, understand disease mechanisms, and advance personalized medicine initiatives. The availability of advanced sequencing platforms, robust bioinformatics tools, and funding support for large-scale genomic studies further drives adoption in these institutes. Additionally, collaborations with hospitals, biotech companies, and government programs enhance their capacity to conduct high-throughput sequencing, making academic and research institutes key contributors to the market.

The clinical laboratories segment is expected to grow at a 16.7% CAGR throughout the forecast period. This is primarily due to the increase in WES adoption in routine diagnostics, rare disease detection, prenatal screening, and oncology. Outsourcing sequencing and bioinformatics is beneficial to laboratories, enhancing the turnaround time and operational efficiency. The increased clinical uptake of whole exome sequencing is further driven by growing awareness among healthcare professionals, the adoption of precision medicine, and favorable reimbursement policies. Technological advancements, automation, and AI-powered data interpretation are enhancing the speed, accuracy, and cost-effectiveness of sequencing, making WES an increasingly integral part of clinical protocols worldwide.

Workflow Insights

Why Did the Sequencing Segment Lead the Whole Exome Sequencing Market?

The sequencing segment led the market while holding a 50% share in 2025 because it forms the core of the WES workflow, enabling the accurate identification of genetic variants across the protein-coding regions of the genome. Advances in high-throughput sequencing technologies, improved read accuracy, and automation have increased efficiency, reliability, and throughput, making sequencing platforms highly adoptable in both research and clinical settings. Additionally, integration with AI and bioinformatics tools has enhanced variant analysis, reduced turnaround times, and lowered costs, further solidifying the dominance of the sequencing segment in the market.

The data analysis & interpretation segment is expected to expand at the highest CAGR of 17.0% throughout the forecast period. The increasing scale and complexity of exome sequencing data are driving the need for advanced bioinformatics tools, AI, and machine learning algorithms to accurately call, annotate, and prioritize genetic variants. Clinical and research laboratories are investing in integrated analytical pipelines to accelerate variant discovery, reduce errors, and support personalized medicine initiatives. The demand for data interpretation is further fueled by the expansion of sequencing services, precision oncology programs, and rare disease research worldwide.

Region Insights

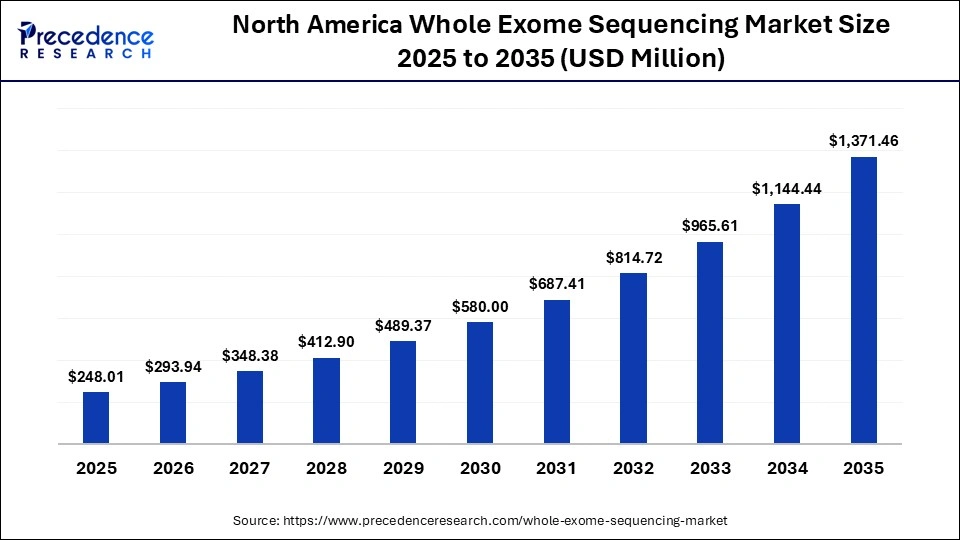

How Big is the North America Whole Exome Sequencing Market Size?

The North America whole exome sequencing market size is estimated at USD 248.01 million in 2025 and is projected to reach approximately USD 1,371.46 million by 2035, with a 18.65% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Whole Exome Sequencing Market?

North America led the market with a 45% share in 2025. This is mainly due to its well-developed healthcare infrastructure, high use of genomic technologies, and substantial investments in research & development. The region's dominance is further supported by significant investments in genomics research, as well as well-established regulatory frameworks and favorable reimbursement policies. Growth is also driven by high awareness among healthcare providers and patients regarding genetic disorders and personalized medicine. The presence of leading market players, advanced sequencing facilities, and strong collaborations between research institutions and healthcare providers also ensures the long-term growth of the market in the region.

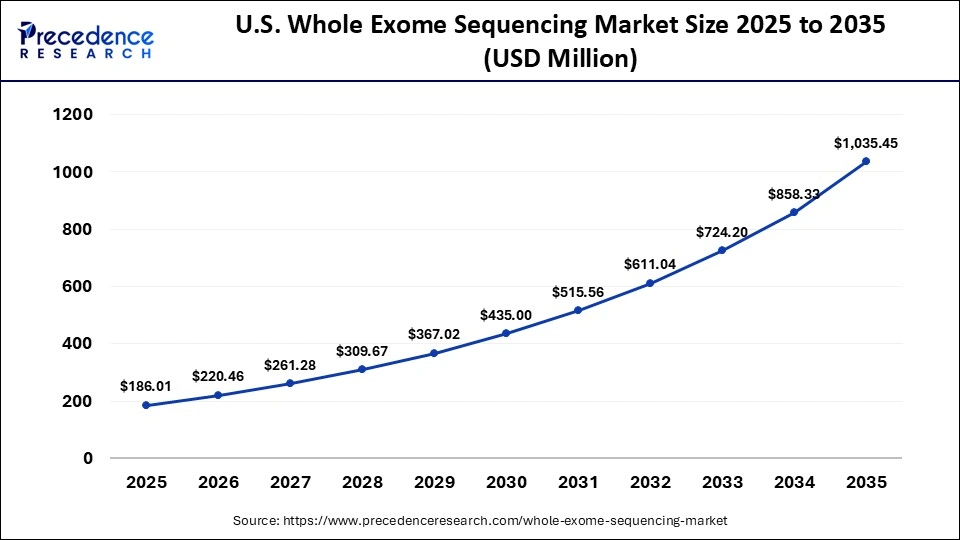

What is the Size of the U.S. Whole Exome Sequencing Market?

The U.S. whole exome sequencing market size is calculated at USD 186.01 million in 2025 and is expected to reach nearly USD 1,035.45 million in 2035, accelerating at a strong CAGR of 18.73% between 2026 and 2035.

U.S. Market Analysis

The whole exome sequencing market in the U.S. is growing due to increasing adoption of precision medicine and genomic research in clinical and research settings. There is a rising prevalence of genetic disorders, cancers, and rare diseases, which is driving the demand for accurate, cost-effective sequencing solutions. Additionally, collaborations between academic institutions, research organizations, and biopharma companies are expanding the use of WES for diagnostics, drug discovery, and personalized therapies, making the U.S. the leading market globally.

Why is Asia Pacific Considered the Fastest-Growing Region in the Whole Exome Sequencing Market?

Asia Pacific is expected to grow at the fastest CAGR of 18.5% in the coming years. This growth is driven by increasing awareness of genetic diseases, rising healthcare spending, and a surge in genomics research activities in countries such as China, India, Japan, and South Korea. Market expansion is further supported by government funding, public-private partnerships, and genomic medicine programs. Additionally, investments by both local and international sequencing firms are facilitating technology transfer, infrastructure development, and the availability of cost-effective services in the region.

Why is the European Whole Exome Sequencing Market Experiencing Notable Growth?

The European whole exome sequencing market is growing at a notable rate, driven by robust healthcare systems, governmental programs, and increasing acceptance of precision medicine. The region benefits from strong financing schemes that promote genomics research, including initiatives aimed at mapping population-specific genetic variations. The presence of established sequencing companies and collaborations between academic and healthcare institutions further fosters technological innovation. Additionally, growing investments in bioinformatics, data analytics, and AI-powered interpretation tools are enhancing the efficiency and accuracy of exome sequencing in the region.

Who are the Major Players in the Global Whole Exome Sequencing Market?

The major players in the whole exome sequencing market include Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Roche, BGI Genomics, Eurofins Scientific, Macrogen, Inc., Qiagen N.V., Berry Genomics, CD Genomics, Novogene Co., Ltd., Genewiz, Oxford Nanopore Technologies, Pacific Biosciences, and Illumina TruSeq / IDT.

Recent Developments

- In March 2023, Illumina Inc. released the NovaSeq 6000 v3 sequencing system, which is capable of providing better sequence accuracy, precision, scale, and faster processing capabilities. This superior platform will boost the market leadership of Illumina in the application of whole-exome and next-generation sequencing. (Source: https://www.illumina.com)

- In January 2023, QIAGEN Digital Insights (QDI) launched a new version of the QIAGEN CLC Genomics Workbench Premium to eliminate data-analysis bottlenecks in next-generation sequencing. The improved platform is much faster at the interpretation of whole genome, whole exome, and large panel sequencing results, enhancing researcher and clinical efficiency.(Source: https://corporate.qiagen.com)

Segments Covered in the Report

By Product & Service

- Sequencing Platforms

- Consumables (Kits, Reagents)

- Services (Sequencing & Analysis)

By Technology

- Short-Read Sequencing

- Long-Read Sequencing

By Application

- Rare Genetic Diseases

- Cancer & Oncology

- Mendelian Disorders Research

- Other Applications

By End User

- Academic & Research Institutes

- Clinical Laboratories

- Hospitals

- Pharmaceutical & Biotechnology Companies

By Workflow

- Sequencing

- Data Analysis & Interpretation

- Sample Preparation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content