Wireless Implants Market Size and Forecast 2025 to 2034

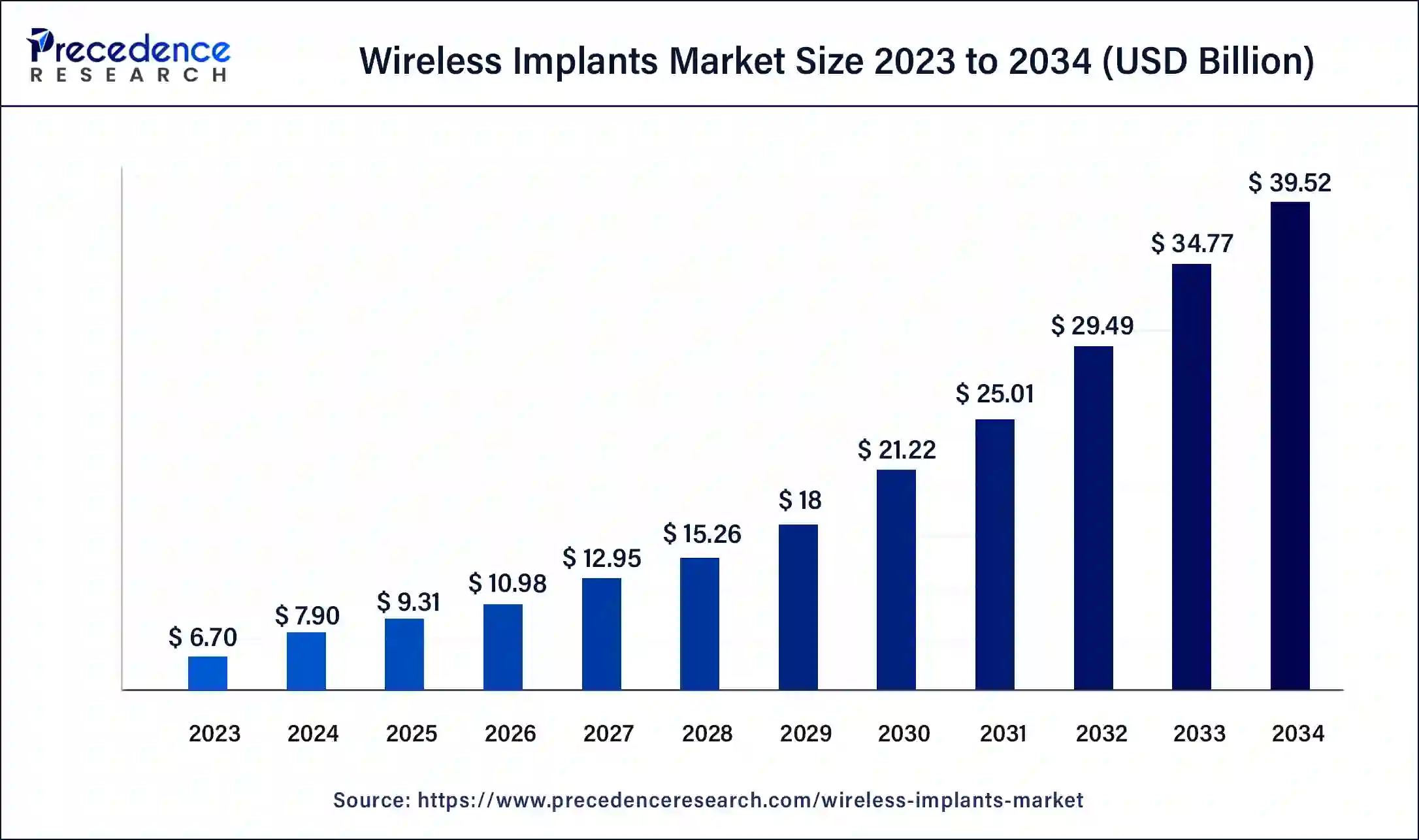

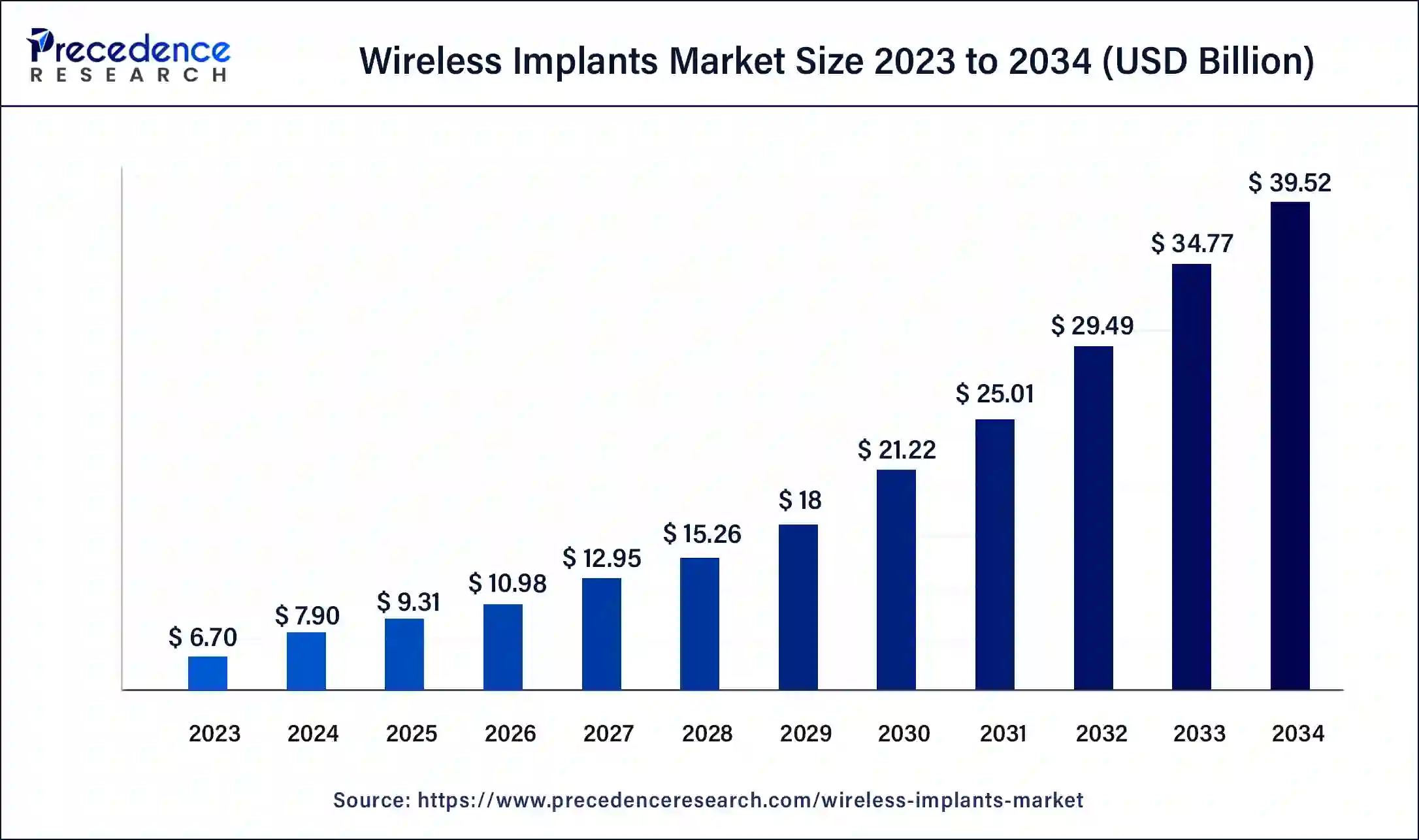

The global wireless implants market size accounte at USD 7.90 billion in 2024 and is anticipated to reach around USD 39.52 billion by 2034, growing at a CAGR of 17.47% from 2025 to 2034.

Wireless Implants Market Key Takeaways

- The global wireless implants market was valued at USD 7.90 billion in 2024.

- It is projected to reach USD 39.52 billion by 2034.

- The wireless implants market is expected to grow at a CAGR of 17.47% from 2025 to 2034.

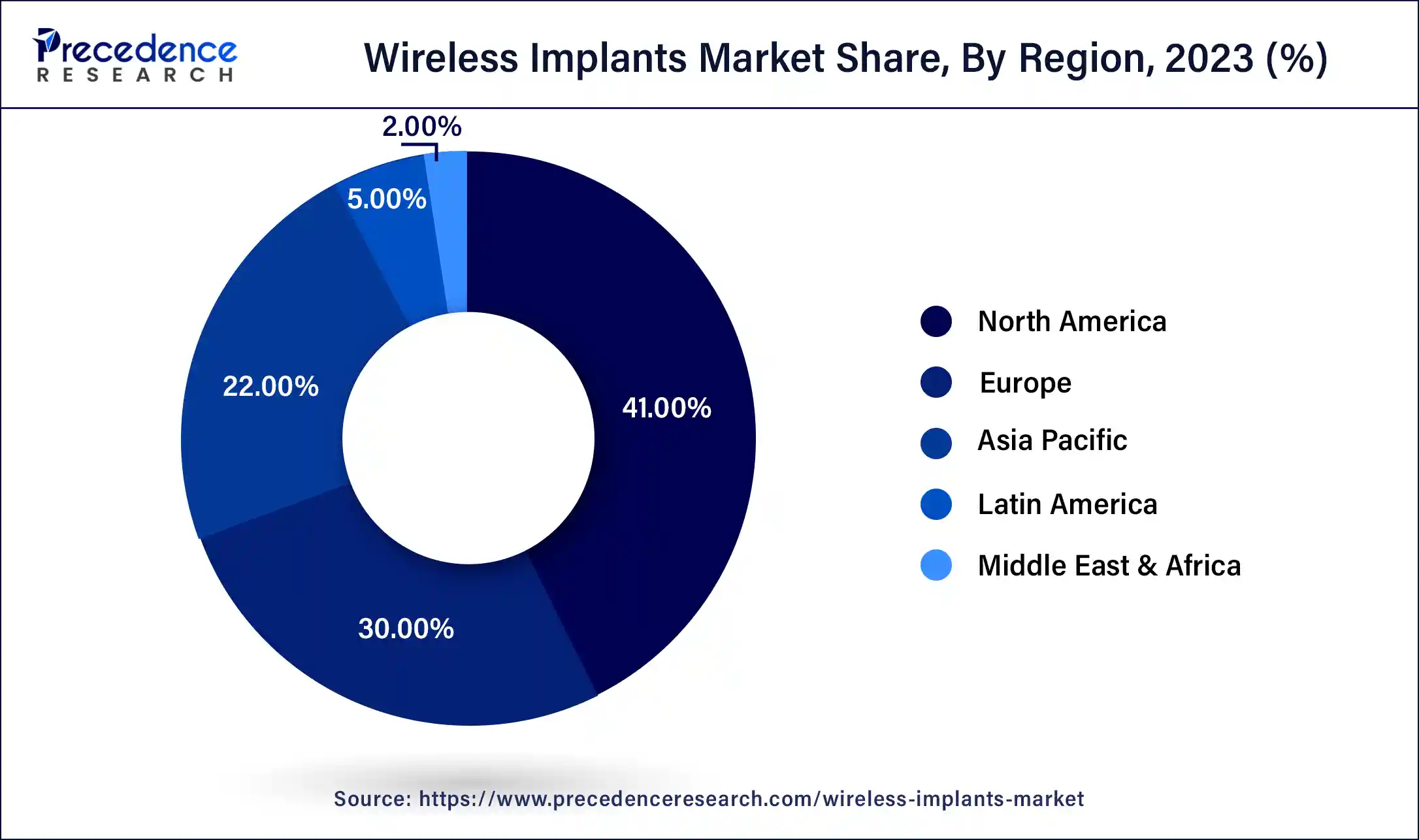

- North America contributed more than 41% of revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By application, the orthopedic implants segment has held the largest market share of 45% in 2024.

- By application, the cardiovascular implants segment is anticipated to grow at a remarkable CAGR of 18.4% between 2025 and 2034.

- By end-user, the hospitals segment generated over 36% of revenue share in 2024.

- By end-user, the clinics segment is expected to expand at the fastest CAGR over the projected period.

U.S. Wireless Implants Market Size and Growth 2025 To 2034

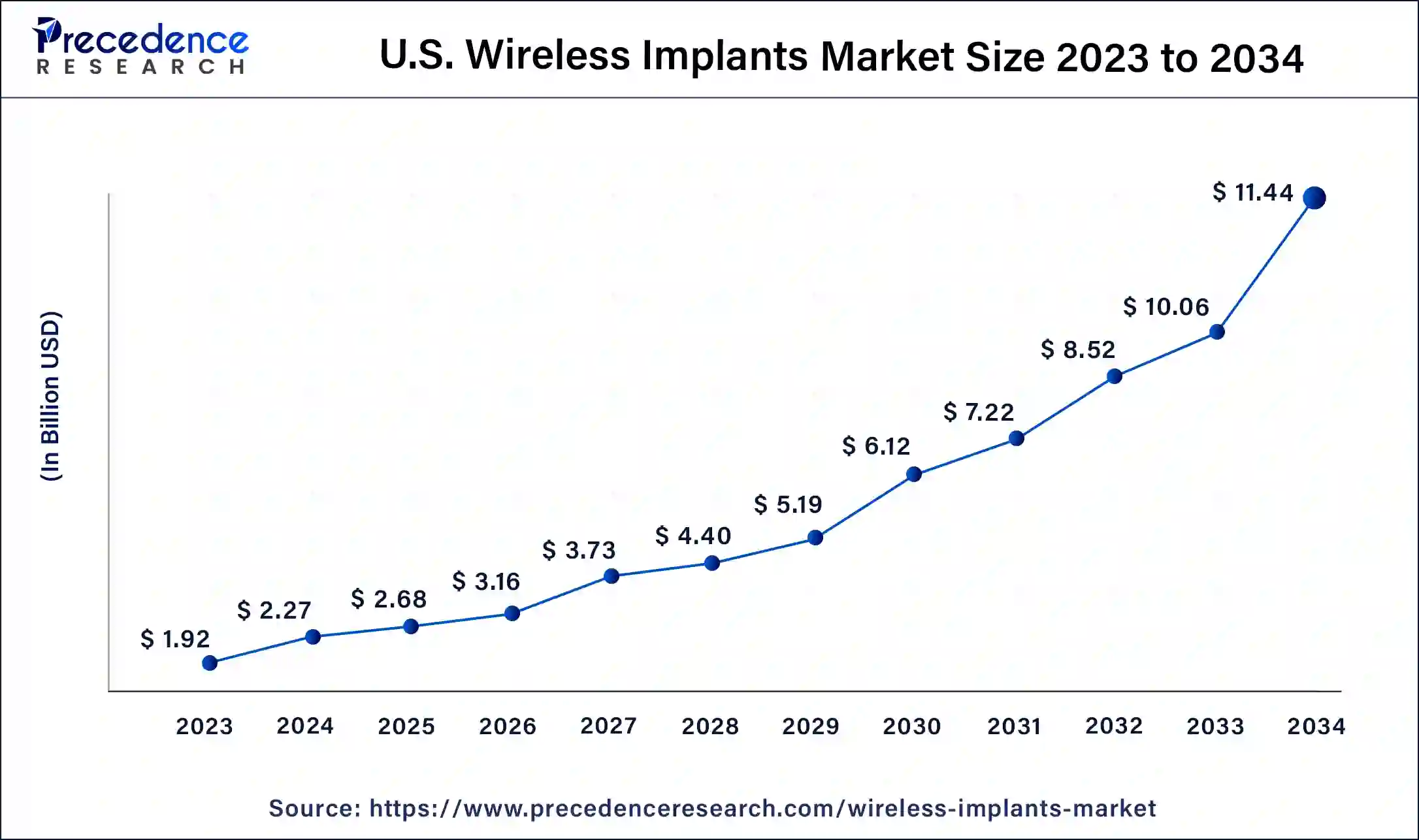

The U.S. wireless implants market size was valued at USD 2.27 billion in 2024 and is expected to be worth around USD 11.44 billion by 2034, at a CAGR of 17.55% from 2025 to 2034.

North America held the largest revenue share of 41% in 2024. North America dominates the wireless implant market due to advanced healthcare infrastructure, robust research and development activities, and high healthcare expenditure. The region's early adoption of innovative technologies, coupled with a favorable regulatory environment, propels the market forward. Additionally, a surge in chronic diseases, a tech-savvy population, and strong collaborations between industry players and research institutions contribute to the significant market share. The presence of major wireless implant manufacturers and a supportive reimbursement landscape further solidify North America's leading position in this dynamic and evolving healthcare sector.

Asia Pacific is estimated to witness the highest growth. Asia-Pacific dominates the wireless implants market due to factors such as a burgeoning aging population, rising prevalence of chronic diseases, and increasing healthcare investments. The region's robust technological infrastructure and a surge in healthcare awareness contribute to widespread adoption.

Moreover, favorable government initiatives, supportive regulatory frameworks, and collaborations with key industry players further propel the growth of the wireless implants market in Asia Pacific. The region's dynamic healthcare landscape and growing demand for advanced medical technologies position it as a key player in shaping the trajectory of the market.

Market Overview

A wireless implant is a compact electronic device designed for insertion into the human body or other living organisms, primarily for medical or research purposes. Unlike conventional implants that rely on wired connections, wireless implants leverage technologies such as radiofrequency or Bluetooth for communication with external devices. These implants serve diverse functions, ranging from monitoring physiological metrics to administering targeted therapies and augmenting sensory capabilities.

The wireless feature of these implants offers notable advantages, including a diminished risk of infection, enhanced mobility, and the ability to remotely manage or observe the implant without requiring physical access. Scientists and healthcare professionals are actively exploring the potential applications of wireless implants in areas such as neurostimulation for chronic condition management, continual health monitoring, and the improvement of interfaces for prosthetic devices. While technology holds significant promise for advancing healthcare and research, its development and deployment are accompanied by ethical considerations, data security, and privacy concerns.

Wireless Implants Market Growth Factors

- Increasing chronic health conditions: The rising prevalence of chronic diseases necessitates advanced monitoring and treatment options, driving the demand for wireless implants.

- Technological advancements: Ongoing innovations in wireless communication and sensor technologies enhance the capabilities and efficiency of implantable devices.

- Aging population: With a growing elderly population globally, there is an expanding market for wireless implants to address age-related health issues and improve quality of life.

- Miniaturization of devices: Advances in miniaturization allow for smaller and less invasive wireless implants, appealing to both patients and healthcare providers.

- Remote patient monitoring: The shift towards remote healthcare management amplifies the need for wireless implants to monitor patients' health conditions outside traditional medical settings.

- Rising healthcare expenditure: Increased healthcare spending worldwide contributes to the growth of the wireless implants market as patients and healthcare providers seek advanced and efficient solutions.

- Favorable regulatory environment: Supportive regulatory frameworks encourage innovation and expedite the approval process for wireless implantable medical devices.

- Integration with the Internet of Things (IoT): Wireless implants seamlessly integrating with IoT ecosystems enable real-time data exchange and analytics, enhancing overall healthcare outcomes.

- Expanded applications in neurology: Growing applications of wireless implants in neurostimulation therapies for conditions like Parkinson's and epilepsy drive market expansion.

- Patient preference for non-invasive solutions: The preference for minimally invasive procedures fosters the adoption of wireless implants, avoiding the need for extensive surgeries.

- Increasing awareness and acceptance: Growing awareness among both patients and healthcare professionals about the benefits of wireless implants contributes to market expansion.

- Proliferation of wearable technology: The popularity of wearable devices creates synergies with wireless implants, fostering a connected health ecosystem.

- Rapid data transmission: Advances in wireless communication technologies enable faster and more reliable transmission of critical health data from implants to external devices.

- Cost-efficiency: Improvements in manufacturing processes and materials contribute to cost reduction, making wireless implants more accessible to a broader population.

- Global telehealth adoption: The widespread adoption of telehealth services promotes the use of wireless implants for remote diagnostics and treatment.

- Collaborations and partnerships: Increased collaborations between technology companies, healthcare providers, and research institutions drive collective efforts for the development and adoption of wireless implant technologies.

- Customization and personalization: The ability to tailor wireless implants to individual patient needs enhances their effectiveness and widens their applicability across various medical conditions.

- Advancements in energy harvesting: Innovative energy harvesting technologies reduce the dependence on traditional power sources, extending the lifespan of wireless implants.

- Reduced complications and infections: Wireless implants, with their minimally invasive nature, contribute to a lower risk of complications and infections compared to traditional wired implants.

- Global connectivity: The increasing need for healthcare solutions that transcend geographical boundaries fuels the demand for globally connected wireless implants, ensuring seamless healthcare delivery on a worldwide scale.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.47% |

| Market Size in 2024 | USD 7.90 Billion |

| Market Size in 2025 | USD 9.31 Billion |

| Market Size by 2034 | USD 39.52 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Applicationm, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing chronic health conditions and miniaturization of devices

The escalating incidence of chronic health conditions, such as diabetes, cardiovascular diseases, and neurological disorders, acts as a primary catalyst for the burgeoning demand in the wireless implant market.

As chronic diseases require continuous monitoring and precise management, wireless implants offer a transformative solution by providing real-time data on patients' physiological parameters. This facilitates proactive healthcare interventions, timely adjustments to treatment plans, and improved overall patient outcomes. The increasing prevalence of chronic illnesses, coupled with the aging global population, propels the need for innovative and non-intrusive healthcare solutions, further amplifying the market demand for wireless implants.

Simultaneously, the miniaturization of devices plays a pivotal role in surging demand for wireless implants. Advancements in technology enable the development of smaller, more discreet implants that are less invasive during insertion. This not only enhances patient comfort and acceptance but also broadens the range of medical applications, making wireless implants suitable for diverse conditions.

The trend toward minimally invasive procedures aligns with the preferences of both healthcare providers and patients, fostering a conducive environment for the widespread adoption of wireless implants across various medical domains. The combination of increasing chronic health conditions and miniaturization positions the wireless implants market at the forefront of transformative healthcare solutions.

Restraint

Limited battery life and regulatory hurdles

Limited battery life and regulatory hurdles collectively impede the market demand for the wireless implants industry. The finite lifespan of batteries in these implants poses a practical constraint, as frequent replacements can lead to increased maintenance costs, inconvenience for patients, and potential health risks. The need for reliable, long-lasting power sources is crucial to ensure the sustained functionality of wireless implants and promote user confidence. Simultaneously, regulatory hurdles pose challenges in terms of market entry for new wireless implant devices. Stringent approval processes and compliance standards delay the introduction of innovative technologies to the market, hindering the pace of industry growth.

The protracted regulatory timelines may stifle investment in research and development, limiting the introduction of cutting-edge solutions. Overcoming these restraints requires concerted efforts from industry stakeholders, regulatory bodies, and technology developers to establish robust standards, streamline approval processes, and address the longevity of power sources for wireless implants, fostering a more conducive environment for market expansion.

Opportunity

Integration with Artificial Intelligence (AI) and global telemedicine growth

The integration of wireless implants with Artificial Intelligence (AI) represents a transformative opportunity for the market. AI can analyze vast amounts of data generated by wireless implants in real time, enabling more accurate diagnostics, personalized treatment plans, and proactive healthcare interventions. This synergy enhances the overall capabilities of wireless implants, positioning them as integral components of advanced, AI-driven healthcare ecosystems.

The convergence of AI and wireless implants not only improves patient outcomes but also opens doors for innovative collaborations between implant developers and AI technology providers. Global telemedicine growth is creating significant opportunities for the wireless implants market by aligning with the increasing demand for remote healthcare solutions. Wireless implants play a crucial role in telemedicine by facilitating remote patient monitoring, diagnostics, and treatment.

The seamless integration of wireless implants into telehealth platforms enhances the effectiveness of virtual healthcare, providing healthcare professionals with real-time patient data and enabling timely interventions. This trend capitalizes on the global shift towards telemedicine, presenting a substantial market opportunity for wireless implants as key enablers of remote healthcare services on a global scale.

Application Insights

In 2024, the orthopedic implants segment held the highest market share of 45% on the basis of the application. The orthopedic implants segment in the wireless implants market refers to the use of wireless technology in devices such as smart joint implants and bone health monitoring systems. These implants offer real-time data on movement, stress, and healing processes, aiding in post-surgical recovery and long-term orthopedic care.

Current trends involve the integration of sensors for monitoring joint conditions, promoting personalized rehabilitation programs, and enhancing patient outcomes. The wireless nature of these orthopedic implants streamlines data collection, allowing for more precise diagnostics and tailored interventions in orthopedic healthcare.

The cardiovascular implants segment is anticipated to witness highest growth at a significant CAGR of 18.4% during the projected period. Cardiovascular implants in the Wireless Implant market refer to devices designed for monitoring and managing heart-related conditions. These implants, utilizing wireless technology, enable continuous tracking of vital cardiovascular parameters, enhancing real-time diagnostics and personalized treatment plans.

In recent trends, cardiovascular wireless implants are witnessing advancements in miniaturization, allowing less invasive procedures, and are increasingly integrated into telehealth solutions for remote monitoring. The focus is on developing innovative technologies to address cardiac health, reflecting a growing demand for effective and connected solutions in cardiovascular care.

End-User Insights

According to the end-user, the hospitals segment has held 36% revenue share in 2024. In the wireless implants market, the hospital segment refers to healthcare institutions utilizing implantable devices for patient monitoring, diagnostics, and treatment. A notable trend in this segment involves the integration of wireless implants with hospital information systems, enhancing data accessibility for healthcare professionals.

As hospitals prioritize advanced technologies to improve patient care, wireless implants offer real-time monitoring capabilities, streamline workflows, and contribute to more efficient and personalized healthcare delivery within the hospital setting. The adoption of wireless implants in hospitals reflects a broader trend towards digital transformation in healthcare.

The clinics segment is anticipated to witness the highest growth over the projected period. In the wireless implants market, the clinics segment refers to medical facilities, often smaller than hospitals, offering a range of healthcare services. A notable trend in this segment involves the increasing adoption of wireless implants for in-clinic diagnostics, monitoring, and minor procedures. Clinics leverage wireless implant technologies to enhance patient care, streamline processes, and provide more comprehensive healthcare services. The convenience, reduced invasiveness, and improved data accessibility offered by wireless implants align with the evolving needs of clinics, driving their integration into routine clinical practices.

Wireless Implants Market Players

- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Cochlear Limited

- Zimmer Biomet Holdings, Inc.

- St. Jude Medical (now part of Abbott)

- Dexcom, Inc.

- Siemens Healthineers

- LivaNova PLC

- NXP Semiconductors

- Biotronik SE & Co. KG

- Ekso Bionics Holdings, Inc.

- MicroPort Scientific Corporation

- Nevro Corp.

- Sensirion AG

Recent Developments

- In May 2023, Medtronic made a strategic move by acquiring Ablation Frontiers, a pioneer in minimally invasive ablation technologies designed for treating atrial fibrillation. This acquisition is anticipated to reinforce Medtronic's standing within the cardiovascular implant market. By integrating Ablation Frontiers' innovative solutions, Medtronic aims to diversify its product portfolio, offering advanced treatments for a prevalent heart condition.

- In a parallel development in April 2023, Abbott Laboratories expanded its foothold in the healthcare sector by acquiring Verifi Medical. Verifi Medical specializes in developing neuromodulation devices tailored for chronic pain management. Abbott's acquisition is poised to broaden its range of pain management solutions and fortify its position in the competitive neuromodulation market, demonstrating the company's commitment to advancing medical technologies for enhanced patient care.

Segments Covered in the Report

By Application

- Orthopedic Implants

- Cardiovascular Implants

- Neurological Implants

- Other implants

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting