Wireless Occupancy Sensors Market Size and Forecast 2025 to 2034

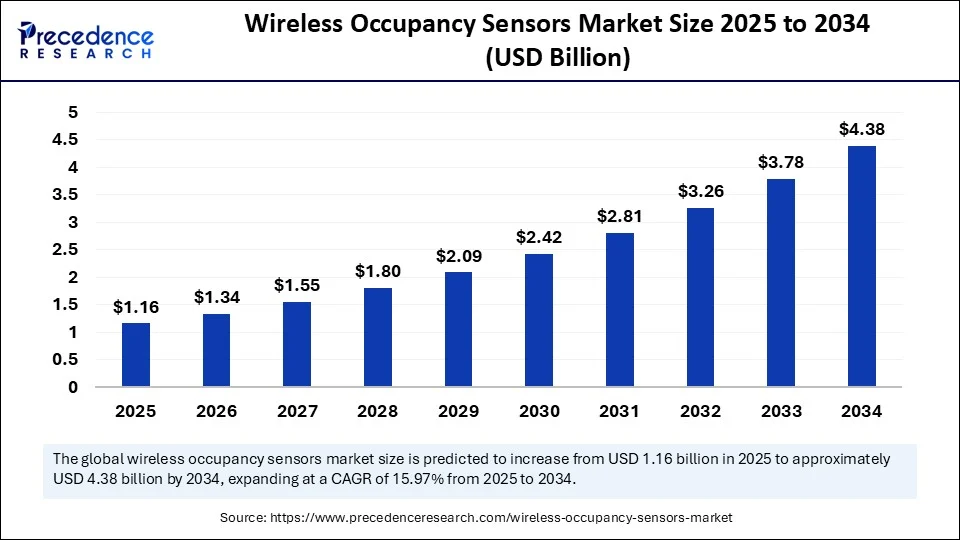

The global wireless occupancy sensors market size accounted for USD 1.00 billion in 2024 and is predicted to increase from USD 1.16 billion in 2025 to approximately USD 4.38 billion by 2034, expanding at a CAGR of 15.97% from 2025 to 2034. The growing demand for energy efficiency, rising shift towards smart buildings, and integration of advanced technologies of AI and IoT are expected to drive the growth of the global wireless occupancy sensors market over the forecast period. Additionally, the market is rapidly expanding in various developing and developed regions, particularly North America, fuelled by a supportive regulatory environment, increasing awareness of energy efficiency, and increasing investment in sustainable urban development.

Wireless Occupancy Sensors Market Key Takeaways

- In terms of revenue, the global wireless occupancy sensors market was valued at USD 1.00 billion in 2024.

- It is projected to reach USD 4.38 billion by 2034.

- The market is expected to grow at a CAGR of 15.97% from 2025 to 2034.

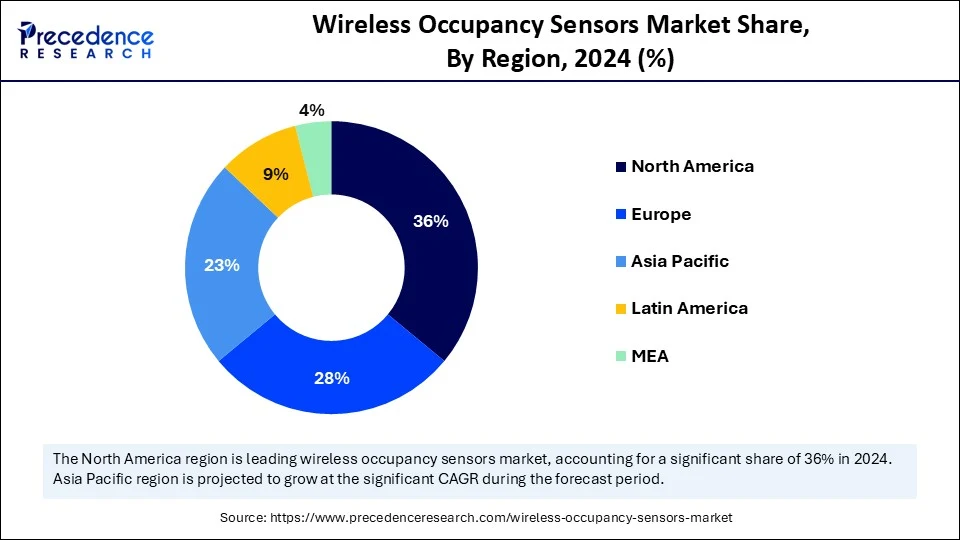

- North America dominated the wireless occupancy sensors market with the largest market share of 36% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By technology, the passive infrared (PIR) segment accounted for the significant market share of 44% in 2024.

- By technology, the dual technology segment is expected to witness a significant share during the forecast period.

- By product type, the wall-mounted sensors segment held the largest market share in 2024.

- By product type, the ceiling-mounted sensors segment accounted for considerable growth over the forecast period.

- By application, the lighting control segment captured the biggest market share of 59% in 2024.

- By application, the HVAC control segment is expected to grow significantly during the forecast period.

- By end-user / building type, the commercial buildings segment accounted for the highest market share of 54% in 2024.

- By end-user / building type, the healthcare institutions segment is expected to witness remarkable growth during the forecast period.

How Can Artificial Intelligence Integration Improve the Wireless Occupancy Sensors Market?

In today's rapidly evolving technological landscape, artificial intelligence emerges as a game-changer and holds great potential for the rapid growth of the wireless occupancy sensors market. An AI-powered sensor is effective for detecting occupancy and monitoring environmental conditions. AI and ML efficiently process raw sensor data to identify complex patterns, predict user behaviors, and assist in optimizing systems for enhanced energy efficiency, increased comfort, and improved security. AI-powered solutions analyze historical and real-time data to predict occupancy and adjust building systems accordingly. AI processes real-time datasets from wireless sensor networks (WSNs) to obtain valuable insights on space utilization. AI-driven systems respond dynamically to immediate changes in the environment.

- In November 2023, Ingolstadt-based full-service provider Infsoft introduced the AI Occupancy Sensor, a hardware device that enables intelligent identification of people and objects through an integrated optical sensor. The AI Occupancy Sensor enables sophisticated analysis of particular areas, where the sensor captures images that are then analyzed and evaluated using artificial intelligence while conforming to privacy regulations. The hardware component is flexible and can be used in various scenarios.(Source: https://www.infsoft.com)

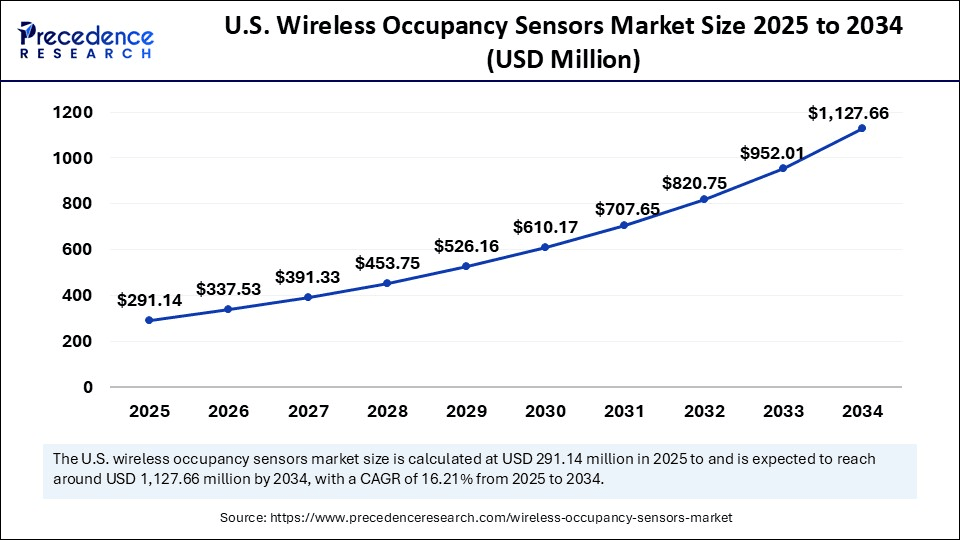

U.S. Wireless Occupancy Sensors Market Size and Growth 2025 to 2034

The U.S. wireless occupancy sensors market size was evaluated at USD 251.14 million in 2024 and is projected to be worth around USD 1,127.66 million by 2034, growing at a CAGR of 16.21% from 2025 to 2034.

North America Is Dominating the Market With the Majority of the Share

North America held the dominant share of the wireless occupancy sensors market in 2024. The region's growth is majorly attributed to the growing consumer demand for smart homes and buildings, rising public awareness of sustainability, increasing investment in energy efficiency and green infrastructure, and the increasing integration of advanced technologies such as AI and IoT. The rising focus of key players on the development of advanced sensor technologies that offer greater accuracy, convenience, and functionality is bolstering the region's growth. The increasing investment and improvement in wireless network infrastructure in the region have significantly increased the deployment of wireless occupancy sensors, particularly in the U.S. and Canada. Moreover, supportive government initiatives for energy efficiency and green infrastructure have led to an increasing adoption of occupancy sensors to monitor and manage energy consumption for lighting and HVAC systems. Furthermore, the expansion of the Internet of Things (IoT), AI, and smart city initiatives creates a favourable environment for the growth of the wireless occupancy sensors market by optimizing resource allocation and enabling real-time monitoring.

Asia Pacific Is Expected to Grow at the Fastest Rate in the Market

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the increasing focus on improving energy management for HVAC and lighting systems, increasing awareness of stringent energy regulations, rising expansion of electronics manufacturing capacity, a surge in R&D budget of key players, rapid urbanization, surging investment in sustainable urban development, and growing popularity of wireless network connectivity in commercial and residential buildings. The rising innovations in sensor technology by the efforts of the prominent key players are substantially enhancing the accuracy and functionality of these devices. Asia-Pacific countries such as India, Japan, and China are the major contributors to the market. Additionally, supportive government initiatives and investment in smart cities contribute to the increased adoption of wireless sensors in the region. Such a combination of factors drives the growth of the wireless occupancy sensors market in the region.

- India's impressive rank, as third in the US Green Building Council's list of countries for Leadership in Energy and Environmental Design (LEED) certification in 2023, underscores its advancements in eco-friendly construction practices. With 248 approved projects spanning more than 7.23 million gross square meters (GSM), India is showcasing its dedication to sustainability.(Source: https://www.ibef.org)

- According to the article published by the Ministry of Housing & Urban Affairs in December 2024, as of 15.11.2024, under the Smart Cities Mission (SCM), work orders have been issued in 8,066 projects amounting to ₹1,64,669 crore, of which 7,352 projects (i.e. 91% of total projects) amounting to ₹1,47,366 crore have been completed, as per the data provided by 100 Smart Cities.(Source: https://www.pib.gov.in)

Market Overview

The wireless occupancy sensors market comprises sensor devices that detect human presence or movement without requiring physical wiring. These sensors, including technologies like Passive Infrared (PIR), Ultrasonic, Dual-Technology, Microwave, and others, are widely deployed across applications such as lighting control, HVAC optimization, security monitoring, space utilization analysis, and building automation in both commercial and residential settings.

What Are the Latest Trends in the Wireless Occupancy Sensors Market?

- The rapid urbanization, along with the stringent sustainability regulations, is expected to drive the market expansion during the forecast period.

- The rapid advancements in sensor technology make wireless occupancy sensors a crucial component of modern, sustainable construction, significantly boosting the market during the forecast period.

- The integration of smart technology in residential and commercial buildings is anticipated to accelerate the market's revenue during the forecast period.

- The surging global energy demands and favourable government incentives for green buildings are expected to propel the expansion of the wireless occupancy sensors market in the coming years.

- The rapid innovations in technology, such as IoT and AI, are anticipated to contribute to the overall growth of the wireless occupancy sensors market. AI and IoT technology are increasingly responsible for advancing the global transition towards a more sustainable infrastructure development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.38 Billion |

| Market Size in 2025 | USD 1.16 Billion |

| Market Size in 2024 | USD 1.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product Type, Application, End-User / Building Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Need for Energy Efficiency and Sustainability Impacting the Market's Growth?

The increasing need for energy efficiency and sustainability is expected to boost the growth of the wireless occupancy sensors market during the forecast period. Wireless occupancy sensors are widely deployed in offices, meeting rooms, campuses, commercial spaces, and homes to optimize lighting and climate control by detecting occupancy, which significantly reduces energy consumption. The adoption of wireless occupancy sensors enhances efficiency, comfort, and proper space utilization. The passive infrared technology detects occupancy within a particular space and triggers lighting, and it is one of the most popularly used wireless occupancy sensor technologies in residential and commercial buildings. Moreover, the market is experiencing increasing adoption of AI-powered sensors for detecting occupancy and monitoring environmental conditions, which also enables smart automation and remote management.

- In September 2024, UnaBiz announced the launch of three innovative solutions targeting the Smart Building sector at BEX Asia 2024. These IoT solutions are designed to automate monitoring, optimise operations, and help building owners meet their sustainability goals by minimising wastage and enhancing efficiency, all while reducing operational and maintenance costs.(Source: https://www.unabiz.com)

Restraint

High Initial Investments

The high initial investment is anticipated to hamper the market's growth. The huge upfront capital is required for purchasing and installing advanced wireless occupancy sensors, which can be a barrier to limited financial resources. The high initial investment can often be a barrier, particularly for small and medium-sized commercial businesses with limited budgets. In addition, the installation complexity and interoperability problems are likely to limit the expansion of the global wireless occupancy sensors market.

Opportunity

Supportive Government Initiatives and Regulations

The supportive government policies and increasing focus on sustainability are projected to offer lucrative growth opportunities to the wireless occupancy sensors market during the forecast period. Several governments around the world are implementing stringent energy regulations, which promote the construction of green buildings. Wireless occupancy sensors play a crucial role in achieving green building certifications such as LEED, which represents a commitment towards sustainable practices. These wireless occupancy sensors optimize energy efficiency by automating HVAC and lighting systems, which reduces costs and carbon footprints. Government policies promoting energy efficiency and green building standards, such as the U.S. EPA's Energy Star program, accelerate the adoption of occupancy-based sensors. Therefore, the government's push towards smart buildings and the integration of IoT technology has significantly increased the usage of wireless occupancy sensors to efficiently manage HVAC, lighting, and security systems.

- LEED-certified buildings widely use smart energy management systems to cut electricity costs by nearly 20-30 percent, energy-efficient HVAC, LED lighting, and smart automation.

- According to a study by Business Standard, green buildings have the potential to reduce emissions by 35% and lower maintenance costs by 20%.

(Source: https://www.ibef.org)

Technology Insights

Which Segment Is Dominating the Market by Technology Type in the Wireless Occupancy Sensors Market?

The passive infrared (PIR) segment dominated the global wireless occupancy sensors market in 2024. Passive infrared (PIR) sensors are most commonly used in applications such as workstations, offices, libraries, and restrooms owing to their cost-effectiveness and their ability to accurately detect heat movement. Moreover, favourable government policies are increasingly promoting energy conservation and efficiency in buildings, which increases the adoption of passive infrared (PIR) sensors. On the other hand, the dual technology is expected to witness remarkable growth during the forecast period. The growth of the segment is attributed to the growing demand for accurate presence detection, increasing focus on energy efficiency, and the integration of these advanced sensors into smart building systems. Dual-technology Occupancy Sensors utilize a combination of passive infrared (PIR) and ultrasonic sensing technologies to detect human presence in a designated or specific area. The adoption of dual-technology occupancy sensors improves overall energy efficiency in smart buildings.

Which Wall-Mounted Sensors Segment Led the Market by Product Type in the Wireless Occupancy Sensors Market?

The wall-mounted sensors segment led the global wireless occupancy sensors market in 2024, owing to the rising demand for energy-efficient smart building solutions and increasing investment in smart infrastructure. Wall-mounted wireless occupancy sensors generally include switch-plate and wall-surface-mounted designs that are installed on a wall to detect various environmental changes, such as sending security alerts, open doors, and triggering actions like turning on lights. These sensors are ideal for smaller spaces such as private offices, restrooms, and other residential and commercial environments. On the other hand, the ceiling-mounted sensors segment is expected to witness remarkable growth during the forecast period. Ceiling-mounted sensors are widely utilized for automatic control of lighting solutions and HVAC systems and for energy management. Ceiling-mounted sensors are often deployed in meeting rooms, warehouses, offices, and classrooms, where they allow for energy savings by adjusting lights and temperature based on occupancy. Ceiling-mounted sensors enhance overall convenience, comfort, and provide data on space utilization.

What Causes the Lighting Control to Dominate the Wireless Occupancy Sensors Market?

The lighting control held a dominant presence in the wireless occupancy sensors market in 2024. Lighting control sensors accurately detect occupancy and automatically turn lights on when someone enters the space or the space is occupied and off after a certain period of vacancy if no movement is detected, which saves energy and ultimately reduces electricity cost. Occupancy-driven lighting controls are cost-effective in locations that are widely used, like stairwells, laboratories, warehouses, breakrooms, classrooms, conference rooms, and restrooms. On the other hand, the HVAC control segment is expected to grow at a notable rate, owing to the growing demand for energy-efficient buildings and smart homes. The growth of the segment is mainly driven by its ability to optimize energy consumption by adjusting heating, ventilation, and air conditioning based on real-time occupancy data. Wireless occupancy sensors detect the presence and movement of people within spaces or zones, enabling the HVAC system to adjust temperature settings, ventilation, and air conditioning proactively. These sensors save energy by only heating or cooling occupied spaces, which reduces unnecessary energy consumption and operational costs.

How Commercial Buildings Segment Make Up the Largest Share of the Wireless Occupancy Sensors Market in 2024?

The commercial buildings segment held the largest share in the wireless occupancy sensors market in 2024. Wireless occupancy sensors are widely deployed in various commercial settings, including meeting rooms, offices, restrooms, and other shared or communal areas. Wireless occupancy sensors in commercial buildings detect people in a space to automate lighting control, HVAC, and other building systems, which optimizes energy usage, enhances occupant comfort, and improves space utilization. They are often easy to install, provide customizable configurations, and provide valuable insights for facilities managers to improve building efficiency. On the other hand, the healthcare institutions segment is expected to grow significantly in the coming years. Wireless occupancy sensors are widely used in healthcare institutions to improve patient care and enhance operational efficiency by automatically controlling or adjusting lighting control and HVAC systems, as well as efficiently monitoring patient presence. These sensors ensure optimal conditions in patient rooms, which assists in reducing energy consumption while improving comfort and convenience. These sensors leverage advanced technologies like passive infrared, ultrasonic, dual technology, microwave, and others to create connected systems that enhance comfort, safety, and resource management within healthcare facilities or settings.

Wireless Occupancy Sensors Market Companies

- Honeywell International Inc

- Schneider Electric

- Johnson Controls

- Legrand

- Eaton Corporation

- Acuity Brands

- Lutron Electronics

- Siemens AG

- Leviton Manufacturing

- Hubbell Inc.

- Texas Instruments

- Philips

- General Electric

- Butlr Technologies

- EnOcean (EnOcean GmbH)

- Carrier

Recent Developments

- In October 2024, XY Sense unveiled a new wireless solution for real-time monitoring of compact office spaces. XY Sense Presence is a cutting-edge, wireless sensor designed specifically for real-time occupancy monitoring in small meeting rooms, phone booths, and other compact office spaces. With XY Sense Presence, unlock valuable utilization data for spaces that are often overlooked, without the need for a wired install.(Source: https://xysense.com)

- In June 2025, aerial.ai, a pioneer in Wi-Fi sensing technology, and nami.ai pte Ltd, an innovator in fusion sensing and AIoT solutions, announced a strategic cooperation aimed at delivering end-to-end solutions for monitoring residential and commercial premises through embedded software engines. Such a partnership of both companies' strengths to develop scalable, privacy-preserving systems that are contactless and unobtrusive, supporting independent living for seniors and enabling smart infrastructure across various industries(Source: https://www.newswire.ca)

Segmentation Covered in the Report

By Technology

- Passive Infrared (PIR)

- Ultrasonic

- Dual Technology (e.g., PIR + Ultrasonic)

- Microwave / Optical / Image-Based / Others

By Product Type

- Wall-mounted sensors

- Ceiling-mounted sensors

- Integrated sensors (embedded into fixtures)

By Application

- Lighting Control

- HVAC Control

- Security & Surveillance

- Energy Management

- Building Automation

By End-User / Building Type

- Residential Buildings

- Commercial Buildings (offices, retail, hospitality, etc.)

- Industrial Facilities

- Healthcare Institutions, Education, Government, etc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content