What is Wrapping Machine Market Size?

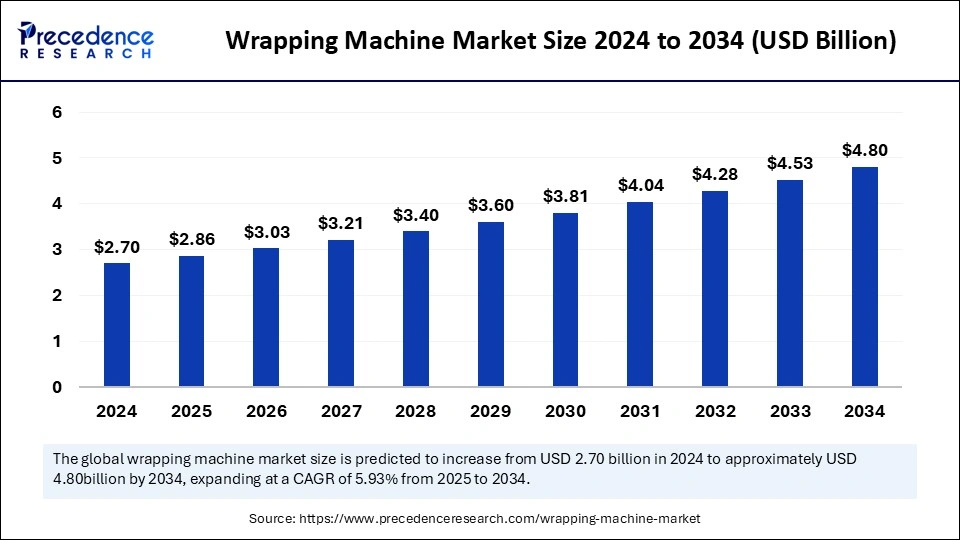

The global wrapping machine market size is valued at USD 2.86 billion in 2025 and is predicted to increase from USD 3.03 billion in 2026 to approximately USD 4.80 billion by 2034, expanding at a CAGR of 5.93% from 2025 to 2034. Rising investments in the food and beverage sector are the key factor driving market growth. Also, increasing industrialization coupled with technological advancements in wrapping machines can drive market growth further.

Market Highlights

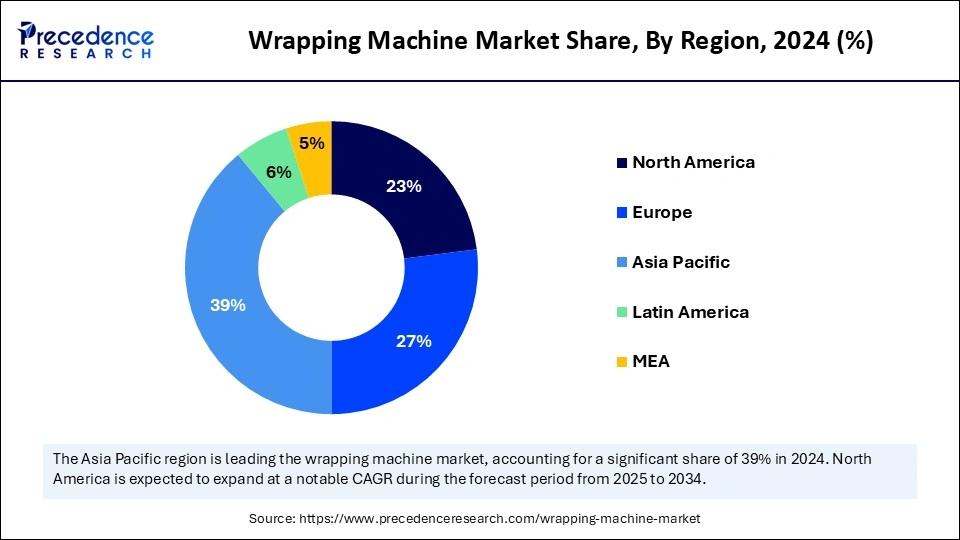

- Asia Pacific dominated the global market with the largest market share of 39% in 2024.

- Latin America is expected to grow at the fastest CAGR in the market over the projected period.

- By machine type, the stretch machine segment contributed the highest market share of 41% in 2024.

- By machine type, the shrink machine segment is anticipated to grow at the fastest CAGR over the forecast period.

- By application, the food application segment captured the biggest market share of 32% in 2024.

- By application, the pharmaceutical application segment is estimated to grow fastest during the projected period.

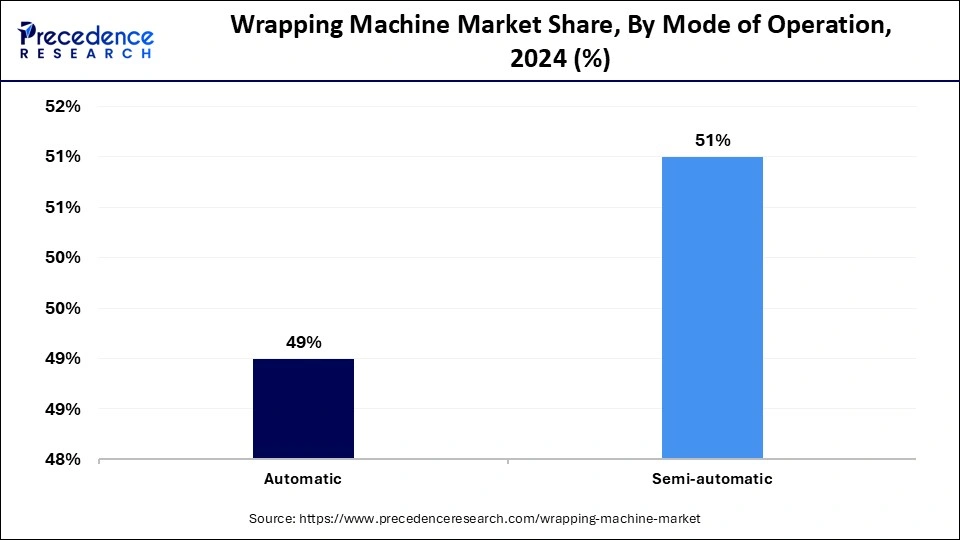

- By mode of operation, the semi-automatic segment generated the major market share of 51% in 2024.

- By mode of operation, the automatic segment is projected to grow at the fastest CAGR during the forecast period.

Market Overview

Wrapping machines are utilized in the manufacturing and packaging industry to pack items in stretch film to maintain product quality and achieve high manufacturing rates. Wrappers are available in various sizes and shapes, such as stationary, ring, vertical, and orbital wrappers. The major requirement for the wrapping machine market was recently noticed in huge manufacturing economies like Germany, Italy, the UK, and the U.S. Wrapping machines utilize a series of sealing and folding operations to encapsulate a material completely.

Role of Artificial Intelligence (AI) in Sustainable Plastics Packaging

Artificial intelligence provides the capability to assess and diagnose issues in packaging to make quick adjustments to prevent loss. AI in the wrapping machine market makes it convenient to track products from start to end of the process. Furthermore, AI-driven predictive maintenance can monitor wear and tear in real-time and make changes in the system accordingly. It also ensures that all packaging lines are running smoothly and optimized in a proper manner.

- In January 2025, HiFlow Solutions, a packaging industry software specialist, launched an advanced AI-driven module for the purchase order (PO) management process to improve handling workflows with added efficiency, accuracy, and scalability.

Wrapping Machine Market Growth Factors

- Increased awareness regarding environmental issues is expected to boost the growth of the wrapping machine market further.

- The rising demand for customized wrapping machines specific to the market can propel its growth soon.

- The surge in the e-commerce industry across the globe will likely contribute to the market expansion over the forecast period.

Wrapping machine market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the increasing demand for high-quality wrapping machines from the packaging sector coupled with rapid expansion of the e-commerce industry globally.

- Major Investors: Numerous market players are actively entering this market, drawn by collaborations, R&D and business expansions. Several wrapping machine brands such as Orion Packaging Systems LLC, Lantech, Phoenix Wrappers, Durapak, Matco International, and some others have started investing rapidly developing wrapping machines in different parts of the world.

- Startup Ecosystem: Various startup brands are engaged in manufacturing wrapping machines for the end-users. The prominent startup companies dealing in wrapping machines consists of Innovative WrapTech Pvt. Ltd, Atomic Engineers, Dematics Technology and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.86 Billion |

| Market Size in 2026 | USD 3.03 Billion |

| Market Size by 2034 | USD 4.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Latin America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Mode Of Operation, Machine Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increase demand for safe transport and packaged goods

An automated wrapping machine can wrap the whole pallet without using any lifting machines. Hence, the wrapping machine market is anticipated to grow smoothly in the upcoming years because of the surging demand for safe transportation of commodities and packaged goods. In addition, the packaging market is witnessing substantial growth in product wrapping, which further fuels the demand for wrapping machines. These machines are mostly preferred by organizations that specialize in one product.

- In June 2024, Mespack will unveil innovative packaging solutions at Snack and BakeTec. The company launched the RM 260, a compact and versatile machine tailored for the Indian market. Known for its innovative packaging solutions, Mespack India showcased various cutting-edge technologies and solutions designed to revolutionize the food and beverage industry.

Restraint

Higher cost

The high cost associated with innovative wrapping machines is challenging for small organizations to afford, which is the major factor hampering the wrapping machine market. The rising market competition also strengthens a hard business environment, which can reduce the overall profit rate of the company. However, this high cost of wrapping machines can also impact other areas in the market, such as the packaging of goods and storage.

Opportunity

Increasing use of pneumatic technology

The wrapping machine market extensively uses pneumatic technology to boost motion and actuate the machine series, hence enhancing the safe operating performance of the equipment. This technology is compact, reliable, and lightweight, offering cost-effective actuation and control. Furthermore, pneumatic technology is primarily used for the impactful performance of point-to-point and high-speed movements like indexing and sorting.

- In September 2024, Koehler Group launched a new high?quality product range made for tea packaging, offering the perfect solution to the high demand for organic tea and sustainable packaging alternatives in the tea market. The different types of flexible packaging paper cover a broad range of requirements.

Segment Insights

Machine Type Insights

The stretch machine segment dominated the wrapping machine market in 2024. The dominance of the segment can be attributed to the rising need for efficient packaging options across many industries, especially in pharmaceuticals and food and beverage. Additionally, innovations in technology like smart features and automation improve the reliability and function of stretch machines, which makes them more appealing to market players.

The shrink machine segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing demand for secure packaging that holds products tightly. This kind of wrapping is especially favored for its capability to safeguard items from damage and dust while keeping a visually appealing presentation. Also, advancements in shrink film technology are enhancing efficiency and sustainability.

- In January 2025, Kite Packaging announced an upgrade to its range of shrink-wrap machines. The new range features four models from Robopac, namely the Micra L, Micra M, 5040 M, and 6050 M. The new machines are designed to deliver improved efficiency and reliability in comparison to previous ranges.

Application Insights

The food application segment led the wrapping machine market in 2024. The dominance of the segment can be linked to the growing utilization of wrapping machines in the food industry as they used to pack many food items like confectioneries, cookies, chocolates, fruits, and bakery products. Moreover, destroyable food products with fewer lives, including dairy, bakery, and allied items, are prone to contamination, waste, and climatic changes. Which in turn results in further segment expansion.

The pharmaceutical application segment is estimated to grow at the fastest rate during the projected period. The growth of the segment can be driven by increasing demand for compliant and secure packaging solutions for healthcare and medicines products. The pharmaceutical industry necessitates high grades of safety and hygiene, which can be offered by wrapping machines through innovative technology.

Mode Of Operation Insights

In 2024, the semi-automatic mode of operation segment dominated the wrapping machine market by holding the largest market share. The dominance of the segment is due to the lower initial investment costs required than the automatic systems. Semi-automatic mode offers flexibility in overall packaging processes, which makes it convenient for organizations with changing production volumes. Furthermore, the adaptable nature of these machines improves their appeal in many industries.

The automatic mode of operation segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because of the growing market demand for automation among a range of industries. Automated wrapping machines have several advantages, such as quicker packing, less human interference, and efficient wrapping of many items, enhancing efficiency.

Regional Insights

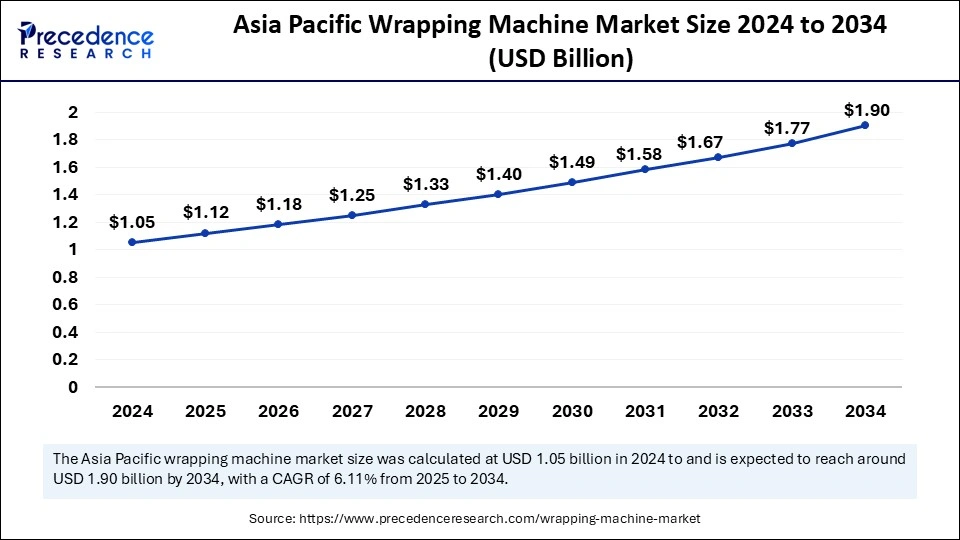

Asia Pacific Wrapping Machine Market Size and Growth 2025 to 2034

The Asia Pacific wrapping machine market size is exhibited at USD 1.12 billion in 2025 and is projected to be worth around USD 1.90 billion by 2034, growing at a CAGR of 6.11% from 2025 to 2034.

Asia Pacific dominated the wrapping machine market in 2024. The dominance of the segment can be attributed to the growth in the food and beverage industry coupled with the ongoing industrialization and urbanization in the region. These machines are in high demand in many sectors, such as food manufacturing, pharmaceutical products, and consumer electronics and products. In Asia Pacific, China led the market, owing to the government strategies supporting industrial automation and advancements.

- In Feb 2024, IMA Group announced the optimization of packaging machinery efficiency with new AI solutions, including the IMA Sandbox for algorithm development and the IMA AlgoMarket for acquiring industrial AI algorithms.

Latin America is expected to grow at the fastest rate over the projected period. The growth of the region can be credited to the market players' increasing shift towards automation in packaging processes, which improves efficiency and decreases labor costs. However, countries like Brazil are leading the market in the region due to ongoing industrial development and the growing demand for innovative wrapping machines.

Why Europe held a significant share of the market?

Europe held a significant share of the industry. The increasing demand for semi-automatic wrapping machines from the chemicals industry in several nations including Germany, UK, France, Italy and some others has driven the industrial expansion. Moreover, the growing demand for sustainable wrapping solutions from the packaging sector is expected to foster the growth of the wrapping machine market in this region.

What made North America to hold a considerable share of the market?

North America held a considerable share of the industry. The growing sales of automatic wrapping machines in several countries such as the U.S., Canada, Mexico and some others has driven the market growth. Additionally, rapid investment by wrapping machine companies for opening new production centers is expected to boost the growth of the wrapping machine market in this region.

How did Middle East and Africa held a notable share of the industry?

The Middle East and Africa held a notable share of the market. The rising demand for shrink wrapping machines from the pharma sector in several industries such as UAE, Saudi Arabia, Qatar and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the e-commerce industry is expected to propel the growth of the wrapping machine market in this region.

Key Players in Wrapping Machine Market and Their offerings

- Robopac: Robopac is a global leader in end-of-line packaging solutions, specializing in stretch-film wrapping machines for palletized loads, as well as shrinkwrappers, case packers, and other automated systems. It provides a wide range of tailor-made solutions for diverse industries, with a strong focus on high-performance, flexible, and reliable technology.

- Orion Packaging Systems LLC: Orion Packaging Systems LLC is a leading manufacturer of heavy-duty industrial stretch wrapping equipment, including semi-automatic and automatic machines, designed to secure palletized products for transport. The company focuses on providing durable, cost-efficient, and high-performance solutions with advanced pre-stretch film delivery systems to protect products and reduce material costs.

- Lantech: Lantech is a company that started in 1972 by inventing the stretch wrapper, a product that revolutionized the packaging industry by improving the way palletized goods are unitized for shipment. Lantech designs and builds both case handling machines (in the Netherlands) and stretch wrapping machines (in the US).

- Phoenix Wrappers: Phoenix Wrappers is a manufacturer of pallet stretch wrap machines that designs and produces both semi-automatic and fully automatic systems for industries like food and beverage, pharmaceuticals, and distribution. It offers a wide range of solutions from semi-automatic machines to high-speed, fully automatic, and custom-engineered material handling systems.

- Durapak: Durapak is an Indian company that provides a wide range of packaging machinery and solutions, including shrink-wrapping, stretch-wrapping, and strapping machines, to industries like pharmaceuticals, FMCG, and e-commerce. This company focuses on supplying high-quality equipment from global leaders to help clients improve efficiency, productivity, and product protection.

- Matco International: Matco International is a Dutch company specializing in end-of-line packaging solutions, particularly semi- and fully automatic pallet wrapping and strapping machines. It offers a full range of services, including machine installation, maintenance, training, and the sale of consumables like stretch film, and pride themselves on being a flexible, brand-independent service provider for the packaging and intralogistics industries

- ProMach Inc.: ProMach Inc. is a manufacturer of packaging and processing machinery and integrated solutions, serving industries like food, beverage, pharmaceutical, and personal care. The company offers a wide range of products and services, from filling and capping to labeling and end-of-line systems.

Wrapping Machine Market Companies

- Robopac

- Orion Packaging Systems LLC

- Lantech

- Phoenix Wrappers

- Durapak

- Matco International

- ProMach Inc.

- Coesia S.p.A

- I.M.A. Industria Macchine Automatiche S.p.A.

- Syntegon Technology GmbH

Latest Announcement by Market Players

- In October 2023, Matco Tools, a leading provider of premium tools, announced the launch of its newest diagnostic scan tool - the Maximus Plus. Designed with automotive technicians in mind, the Maximus Plus is the ultimate diagnostic scan tool that provides complete coverage flexibility, OE-level functionality, and the power of Android™ at your fingertips.

- In June 2024, the global brand of aseptic process solutions, Spain-based Telstar, announced plans to join Germany-based Syntegon. They announced the acquisition by Syntegon, as well as by the current owners of Telstar, Japan-based Azbil Corporation.

Recent Developments

- In November 2025, Global Industrial launched mobile robot stretch wrap machine. This machine is designed to enhance wrapping of different products.

(Source: https://roboticsandautomationnews.com) - In September 2025, Signode launched prestige stretch wrapper machine. This machine is developed for increasing the capabilities of wrapping.

(Source: https://www.packagingstrategies.com) - In February 2025, Elite Pack launched a new range of high-speed wrapping machines. These machines are capable of finishing 60 pieces every minute.

(Source: https://www.printweek.in) - In August 2023, Orion Packaging Systems unveiled its redesigned MA Series, a fully automatic rotary stretch wrapping machine, at PACK EXPO 2023. This innovative wrapping machine is engineered for high throughput in end-of-line applications and accommodates various load types. Key features include a four-legged design for stability, enhanced safety measures, and a user-friendly control system.

- In June 2024, Cama Group launched a new top-loading packaging machine, which enhances productivity and reduces machinery footprint in the multipack market. The main motive behind launching this was to handle multiple food items in the food industry.

Segments Covered in the Report

By Machine Type

- Stretch

- Shrink

- Others

By Mode of Operation

- Automatic

- Semi-automatic

By Application

- Food

- Beverages

- Chemicals

- Personal Care

- Pharmaceuticals

- Others

By Regions

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content