What is the Electrification Market Size?

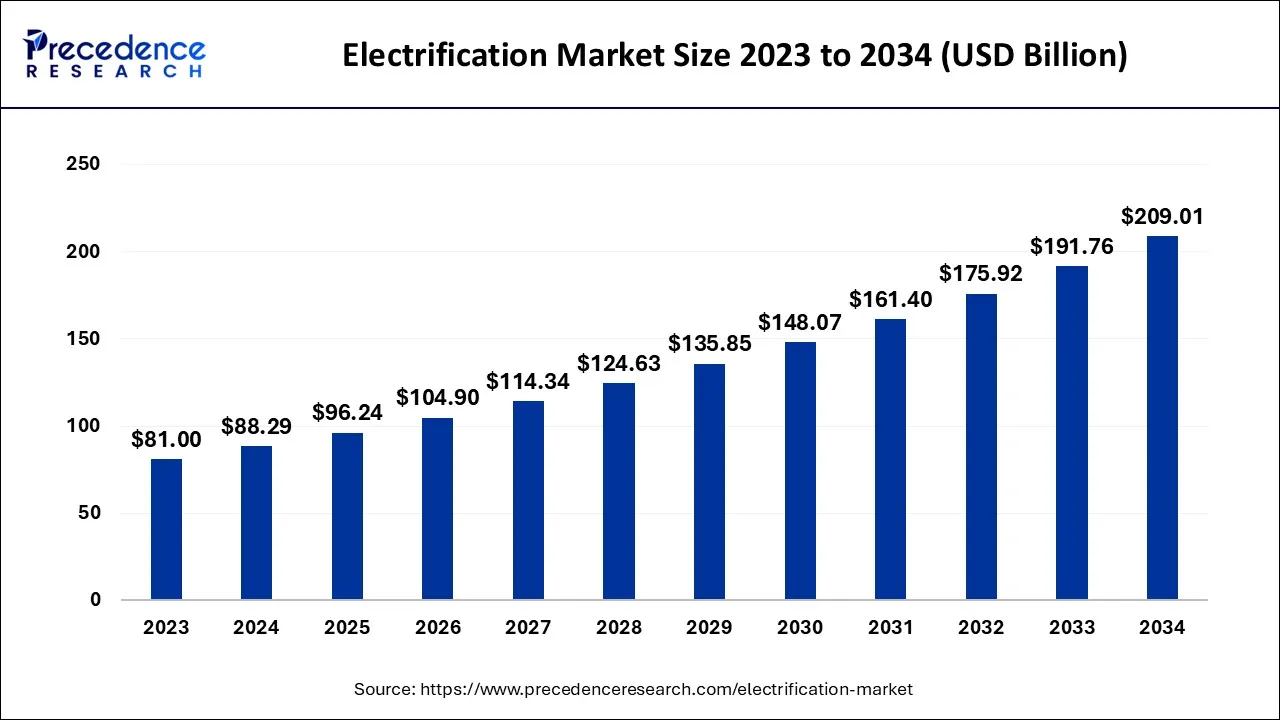

The global electrification market size is calculated at USD 96.24 billion in 2025 and is predicted to increase from USD 104.90 billion in 2026 to approximately USD 225.32 billion by 2035, expanding at a CAGR of 8.88% from 2026 to 2035.

Electrification Market Key Takeaways

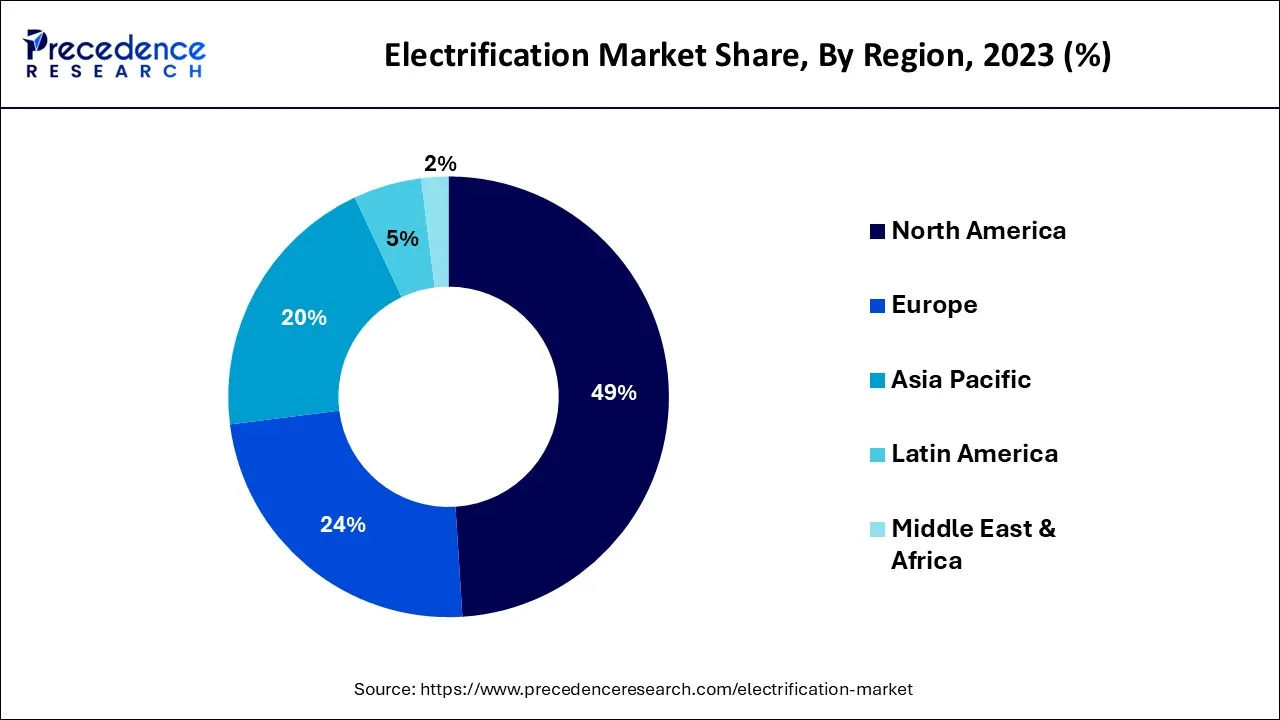

- North America captured the maximum revenue share in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By source, the renewable energy source segment held the largest revenue share in 2025.

- By source, the fossil fuels segment is predicted to grow at a moderate CAGR between 2026 and 2035.

- By application, the transportation segment captured the maximum market share in 2025.

- By application, the building segment is likely to grow at a remarkable CAGR from 2026 to 2035.

Market Overview

Electrification is the conversion of any non-electric energy source to electricity at the point of final consumption, and it is a major emerging trend in global energy markets. A combination of the introduction of newer electric end-use technologies, manufacturers, and a variety of policy objectives in various jurisdictions are driving this trend. Electrification is an important option to achieve net zero goals since it has a substantial potential to reduce emissions and decarbonize energy supply chains.

According to the International Energy Agency (IEA), in the Net Zero Emissions by 2050 Scenario, the electricity share in total final energy consumption rises to 27% in 2030 from 20% in 2021 as more energy end uses electrify. The share has been rising steadily in recent years, but to meet the Net Zero Scenario's deadline of 2030, this increased rate will need to almost quadruple.

The transition to electric transportation and the deployment of heat pumps can largely meet the demand. The greatest promise for electrification in the industry is in low-temperature heat processes. Industrial end uses electrification is taking longer than expected due to the fierce market competition and lengthy equipment lifespan.

How Artificial Intelligence (AI) is Impacting the Electrification Market?

Artificial Intelligence (AI) integration can assist in analyzing vast amounts of data to optimize energy usage, lower costs, and reduce waste. Real-time monitoring and predictive maintenance prevent faults and reduce downtime. AI integration in electricity grids offers a remarkable evolution in the energy sector, enhancing reliability, efficiency, and resilience. AI-powered smart meters redefine data collection, providing several possibilities for energy conservation and grid management. AI-powered energy management systems represent the advancement in electrification, providing a transformative approach to producing, distributing, and consuming energy. Integrating AI-powered systems allows customers to plan their energy consumption during a particular time of day (ToD). They also help to manage and optimize the grid and microgrids. Moreover, AI has the ability to detect faults using machine learning (ML) algorithms by analyzing real-time data, identifying anomalies, and facilitating a safer and faster response in isolating the fault and reducing outage durations.

Electrification Market Growth Factors

- The rising demand for electric vehicles (EVs) is expected to drive the growth of the market in the coming years.

- The growing inclination toward electrified sources, particularly in the transportation sector, is expected to boost the growth of the electrification market during the forecast period.

- The rising concerns about pollution and climate change can have a positive impact on the market.

- The rising adoption of renewable energy sources is expected to contribute to the overall growth of the market. Electrification through renewable energy sources helps reduce greenhouse gas emissions and promote sustainable development in the global energy landscape.

- Rising government policies to support the electrification of various sectors are projected to boost the market growth.

- The electrification involves the use of electric heating and cooling systems, as well as other electrical appliances such as lighting, water heaters, and refrigerators.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 88.29 Billion |

| Market Size in 2026 | USD 88.29 Billion |

| Market Size by 2035 | USD 209.01 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Source and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing focus on policy implementation by various economies

Many countries are approaching electrification from various perspectives, with the goal of increasing either electricity demand or the share of (renewable) electricity in the total energy supply. Some countries, primarily developing countries, are also addressing the distribution network, setting targets for the proportion of the population connected to the electricity grid or increasing the system's capacity.

Sweden recently published a strategy focused solely on electrification and how to further enable it. It focuses on increasing grid capacity, expanding the EV charging network, and developing the wind energy sector. Likewise, Japan issued a comprehensive response to power shortages.

Other electrification-related policy measures include: Many regions are working to strengthen their electricity network. Several governments, including India, the European Union, Hungary, and the United States, have established funds or frameworks to accomplish this in recent years. Canada and Australia have begun to fund smart- and micro-grid demonstration projects in order to improve the resilience and reliability of the power grid.

Some countries, such as Australia and India, have launched information and education campaigns to raise public awareness of electrification as well as its potential. Thus, the increasing electrification-related policy measures are likely to drive the growth of the electrification market in the years to come.

Restraints

Difficulties in building electrification and grid-responsiveness

The major hurdle for buildings is not the politics or implementation of electrification but transforming electrified buildings into responsive consumers that are in line with price and grid fluctuations. Buildings must behave like smart EV chargers, matching their use with renewable and other clean energy output, as electrification turns an even higher portion of constructing ultimate energy consumption into electricity. This presents two different sets of difficulties for the electrification market.

The first most is the economic that is resource aggregators and utilities must make sure that their value propositions to commercial and residential consumers are strong enough to win their support. This frequently entails an initial investment in smart equipment and the readiness to alter one's energy use habits.

The second difficulty is technical; the technical challenge associated with electrification lies in the complexity and non-uniformity of buildings, making it challenging to manage them in a scalable manner. Currently, commercial load control is facing a challenge similar to that of residential load control a decade ago, where it is reliant on manual intervention from occupants or the installation of retrofit devices, such as an air conditioner load switch. This is expected to restrain the growth of the electrification market within the estimated timeframe.

Opportunities

Improvements in technologies

Technological advancement is a key trend gaining traction in the electrification market. The advancements and improvements in the energy storage systems to reduce costs and increase efficiency make it easier to integrate renewable energy sources into the grid. Further, the development of smart grid technology has opened up possibilities for improved electric power generation, transmission, and distribution.

In comparison to conventional grids, it can be installed more quickly and takes up less area thanks to its adaptability. The goal of the smart grid design concept is to make the grid observable, make assets controllable, improve the performance and security of the power system, and especially to improve the financial elements of operations, maintenance, and planning. These advancements will create immense growth opportunities for the market in the years to come.

Segment Insights

Source Insights

The renewable energy source segment held maximum revenue share in 2023. This is owing to the rising environmental concerns and increasing pressure to reduce greenhouse gas emissions. Furthermore, the growing environmental regulations in both developed and developing economies is also expected to support the growth of the segment in the years to come. Energy storage systems and technological improvements in solar PV production are expected to present enormous prospects for the segmental growth of the market.

The rise in the demand for renewable energy further bolstered the segmental growth.

- According to the Global Energy Perspective 2023, Renewables are expected to continue to grow rapidly over the next decades to provide around 45% to 50% of generation by 2030 and 65% to 85% by 2050, depending on the scenario.

The fossil fuels segment is anticipated to grow at a moderate CAGR during the forecast period. The increase in world population has increased the demand for energy specifically in developing economies. Fossil fuels are still primary source of energy and currently supplies approximately 80% of the world energy requirement. Also, the increase in middle-class population in developing economies increases energy demand which in turn is likely to contribute to the segmental growth of the market.

Application Insights

Transportation segment generated the largest market share in 2023. Pressure to reduce carbon emissions in the transportation sector is growing as awareness of climate change and air pollution rises. One of the main solutions to this problem is the electrification of transportation, particularly with the usage of electric vehicles (EVs). Further, incentives and policies are being implemented by numerous countries to promote the use of EVs and other electric transportation technology.

These include tax breaks, credits, and requirements that automakers create a specific number of zero-emission automobiles. These factors are likely to contribute to the growth of the segment in the global electrification market.

- In December 2024, Hyundai Motor Group entered into strategic partnerships with three leading Indian Institutes of Technology (IITs) to advance research in batteries and electrification, reinforcing its commitment to strengthening the electric vehicle (EV) ecosystem in India. The collaboration involves IIT Delhi, IIT Bombay, and IIT Madras, with plans to establish a Hyundai Center of Excellence (CoE) at IIT Delhi. This initiative will be supported through sponsorships from Hyundai Motor Group, focusing on innovations tailored to India's unique market needs.

The building segment is likely to grow at the fastest CAGR during the forecast period. The technological possibilities are well developed in the construction industry, and heat pumps are now the most popular heating system in newly constructed homes. However, since heat pumps must be retrofitted into existing structures and since consumers prefer other options, there is still room for improvement in the adoption of this technology.

Regional Insights

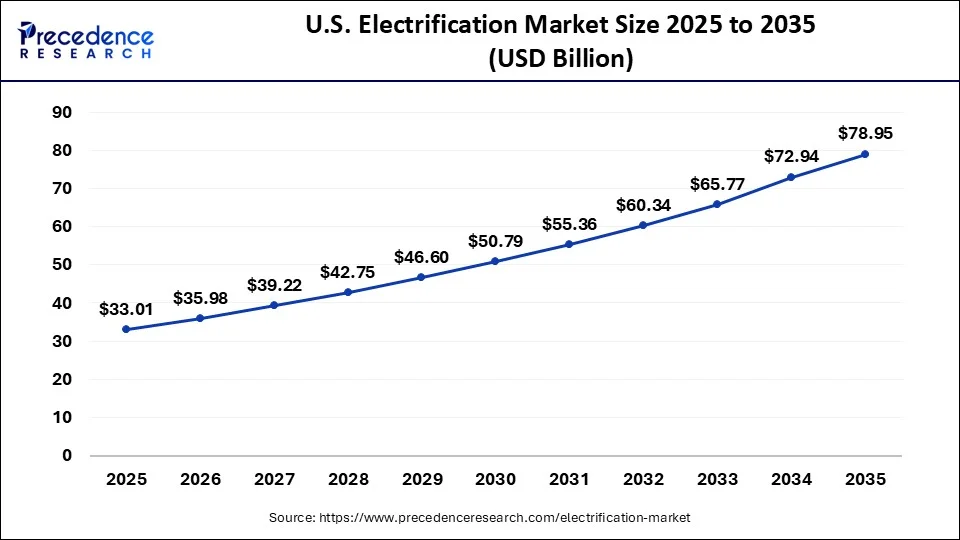

U.S. Electrification Market Size and Growth 2026 to 2035

The U.S. electrification market size is exhibited at USD 30.28 billion in 2025 and is projected to be worth around USD 72.94 billion by 2035, growing at a CAGR of 9.19% from 2026 to 2035.

North America held the largest share of the market in 2025. This is owing to the early adoption of technologies in the region. Also, there are various policies implemented in the region related to electrification. For instance, the introduction of the Inflation Reduction Act 2022: Sec. 13401 Clean Vehicle Credit in the US, it sets a Clean Vehicle Credit of up to $7,500 per vehicle to encourage and accelerate the use of electric vehicles and tries to minimize domestic inflation, particularly that caused by the global energy crisis.

The Ministry of Natural Resources also disclosed funding for the placement of EV chargers in neighborhood locations in Canada. The Zero-Emission Vehicle Infrastructure Program (ZEVIP), which aims to increase access to EV charging, will provide the funding for these improvements. After receivers have been chosen by each Action Center and TAF, EV chargers will be installed in public areas. Moreover, the rise in home electrification augmented the market in the region.

- In December 2024, LG Electronics, America's most reliable line of home appliances and now the number one appliance brand in the U.S., announced a new creative campaign educating consumers on the many benefits of home electrification and highlighting LG's suite of home appliances with heat pump technology designed to be more efficient.

What Makes Asia Pacific the Fastest-Growing Region in the Electrification Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is attributable to the increasing urbanization across the region. The region is home to some of the world's largest and fastest-growing cities, and this trend is expected to continue in the coming years. As more people move to cities, the demand for electrification solutions in buildings, transportation, and other areas will increase.

Many governments in the region are actively promoting electrification as a way to reduce carbon emissions and improve energy security. For instance, Australia's government has announced its Long-Term Emissions Reduction Plan with the aim of reaching net zero emissions by 2050. The plan outlines a technology-driven approach to achieving a net zero economy, while taking into account the impact on key sectors, geographic regions, and employment.

The plan is a part of a broader strategy to reduce emissions that is focused on the development and implementation of low-emissions technology. The Low Emissions Technology Statements and the Technology Investment Roadmap are important components of this approach. These policies and incentives are likely to encourage the adoption of electrification solutions. Moreover, rising government initiatives to support electrification drive the regional market growth in the coming years.

- Government of India launched Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA) with the objective to achieve the universal household electrification in the Country. Under SAUBHAGYA, all willing un-electrified household in rural areas and all willing poor household in urban areas of the Country were provided electricity connection.

- In April 2024, senior Railway Ministry announced that Indian Railway will achieve 100% electrification of its broad gauge network in the next few months, much before the end of this fiscal.

- The Japanese government has announced energy policies aimed to achieve carbon neutrality, or net-zero greenhouse gas (GHG) emissions, by 2050 by lowering emissions in the electric power, industrial, and transportation sectors.

How is the Opportunistic Rise of Europe in the Electrification Market?

Europe is experiencing an opportunistic rise in the market, supported by strict carbon reduction targets and energy transition frameworks. The region is focusing on electrifying transport systems and residential heating systems, along with a strong emphasis on reducing energy consumption, which also drives the market. Widespread adoption of heat pumps, electric mobility, and renewable-powered grids is reinforcing Europe's leadership in the market.

Germany plays a central role in Europe's electrification market, driven by its Energiewende policy and strong industrial base. The country is investing heavily in electric mobility, industrial electrification, and renewable grid integration. Germany's focus on electrified manufacturing processes, energy-efficient buildings, and advanced power electronics supports sustained market growth.

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

North America |

U.S. EPA; U.S. Department of Energy (DOE); U.S. Department of Transportation (DOT); Environment and Climate Change Canada (ECCC) |

Clean Air Act (vehicle emissions standards, electric vehicle incentives) |

EV adoption mandates |

Strong federal and state incentives in the U.S. are accelerating EV adoption and grid upgrades; Canada aligns with similar low-carbon transportation policies. |

|

Europe |

European Commission; Directorate-General for Energy (DG ENER); European Environment Agency (EEA) |

Fit-for-55 Package (incl. COâ‚‚ standards for vehicles) |

EV fleet targets |

Europe is aggressively pushing electrification via binding targets for EV sales, rapid deployment of EV chargers, and integration of renewables into grids. Certification schemes and interoperability standards (e.g., CCS/Type 2) are enforced. |

|

Asia Pacific |

China NDRC / NEA / MEE; Japan METI / MOE; India MoP / NITI Aayog; South Korea MoE |

China's New Energy Vehicle (NEV) policies |

EV incentives & subsidies |

China is the world's largest EV market with strong production quotas; India's FAME and state incentives are expanding EV adoption; Japan and Korea emphasize battery technology and electrified transport corridors. |

|

Latin America |

Brazil Ministry of Mines & Energy; Argentina Ministry of Energy; Chile Ministry of Energy |

National EV plans |

EV infrastructure development |

Latin American countries are early adopters, with Brazil and Chile including EV incentives and grid electrification plans tied to renewable energy goals. |

|

Middle East & Africa |

UAE Ministry of Energy & Infrastructure; Saudi Ministry of Energy; South African DFFE / DoE |

National energy strategies |

Electrification of transport |

Electrification policy is emerging; GCC countries (UAE/Saudi) tie electrification to broader energy diversification and net-zero targets; South Africa includes electrification in Just Energy Transition plans. |

Electrification Market Companies

- ABB: Provides electrification solutions, including power grids, electric vehicle charging infrastructure, and industrial automation systems, supporting global energy transition and efficiency.

- ZAPI Group: Designs and manufactures electric drive systems and motor controllers for industrial and commercial electric vehicles, enabling efficient electrified transport solutions.

- Powersys Solutions: Offers energy management and electrification software, tools, and consulting services to optimize electric mobility, industrial, and renewable energy systems.

Other Major Key Players

- Siemens

- Enel Spa

- Schneider Electric

- Duke Energy Corporation

- General Electric

- Enel X S.r.l.

- ICF International Inc.

Recent Developments

- In December 2024, MOPO, a UK-based company specializing in pay-per-use battery technology, is delighted to partner with The Health Electrification and Telecommunications Alliance (HETA), a key initiative of Power Africa, a USAID Global Development Alliance of the world's leading renewable energy, digital technology, and health solutions providers, to bring reliable, 24-hour electricity access to healthcare facilities in Sierra Leone.

- In December 2024, Turkiye's railway electrification project to boost Middle Corridor capacity. The World Bank's Board of Directors has approved a financial support package of US$ 660 million to support Turkiye's efforts in developing electric rail transport.

- In December 2024, Treehouse, a software-enabled installation platform for electrification projects, has enhanced its services with a turnkey, tech-enabled solution designed to streamline the deployment of residential electric vehicle (EV) charging infrastructure for fleet owners and management companies. Through this offering, Treehouse provides a seamless installation experience for fleet owners and their drivers that reduces operational overhead, ensures consistency of safe, high-quality installs, and helps to accelerate fleet electrification.

Segments Covered in the Report

By Source

- Renewable Energy

- Nuclear Power

- Fossil Fuel-based

By Application

- Transportation

- Industrial

- Buildings

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content