Industrial Electrification Market Size and Forecast 2025 to 2034

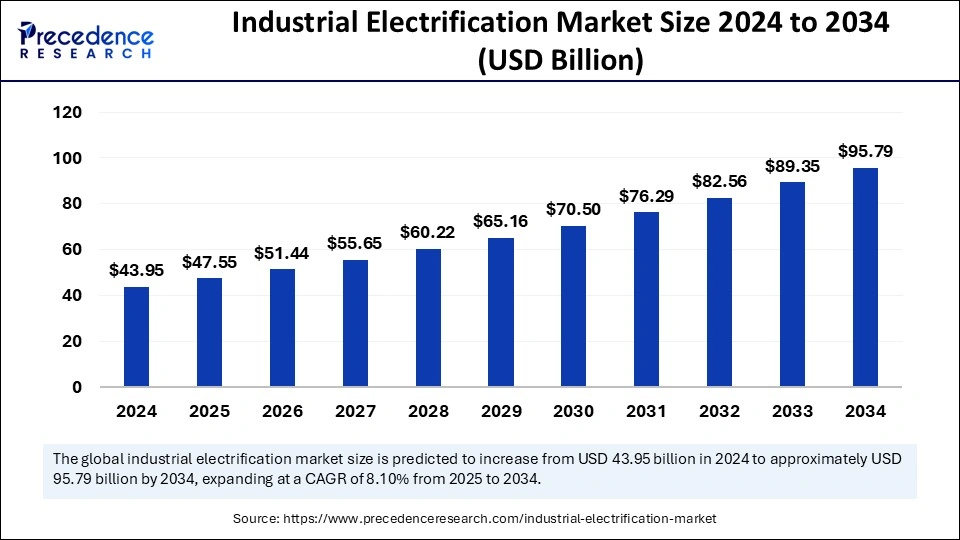

The global industrial electrification market size was estimated at USD 43.95 billion in 2024 and is predicted to increase from USD 47.55 billion in 2025 to approximately USD 95.79 billion by 2034, expanding at a CAGR of 8.10% from 2025 to 2034. The market growth is attributed to rising industrial automation, stringent decarbonization policies, and increasing adoption of energy-efficient electrification technologies.

Industrial Electrification Market Key Takeaways

- In terms of revenue, the global industrial electrification market was valued at USD 43.95 billion in 2024.

- It is projected to reach USD 95.79 billion by 2034.

- The market is expected to grow at a CAGR of 8.10% from 2025 to 2034.

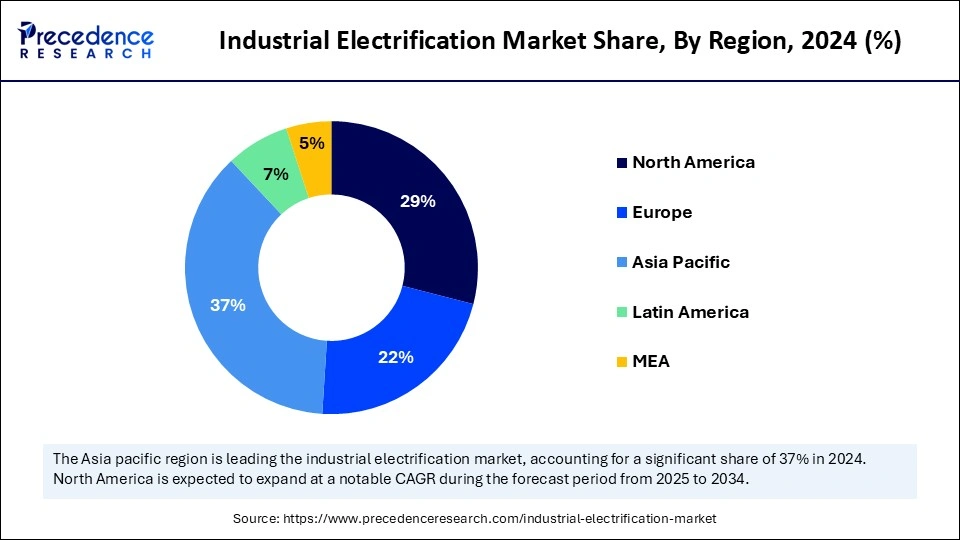

- Asia Pacific dominated the market with the largest market share of 37% in 2024.

- Europe is projected to grow at a CAGR of 8.1% in the coming years.

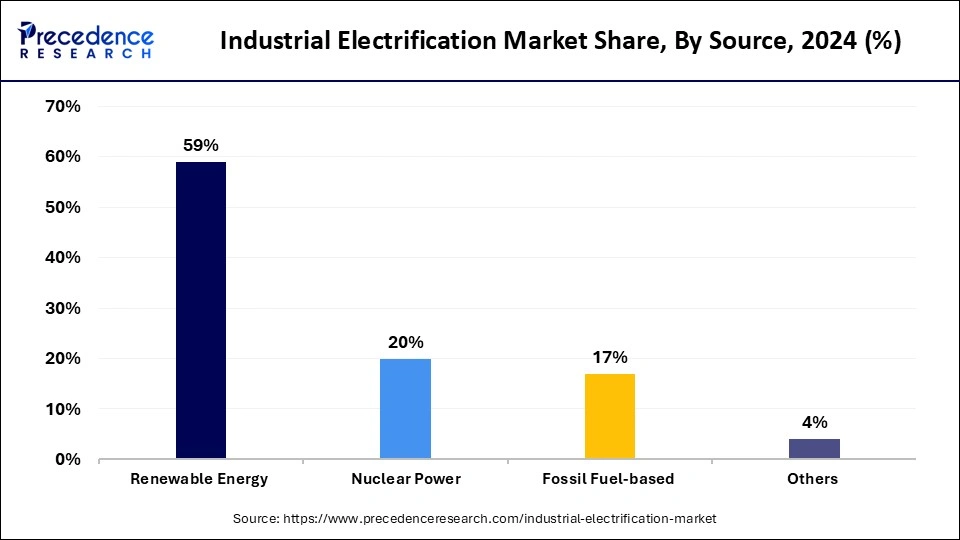

- By source, the renewable energy segment contributed the biggest market share of 59% in 2024.

- By source, the nuclear power segment is expected to grow at a solid CAGR of 8.5% during the forecast period of 2025 to 2034.

- By technology, the heat pump segment contributed the highest market share of 35% in 2024.

- By technology, the electric resistance heating segment is anticipated to grow with the highest CAGR of 8.5% during the studied years.

- By end-use industry, the manufacturing segment held the major market share of 29% in 2024.

- By end-use industry, the construction segment is projected to expand at a notable CAGR of 8.4% in the coming years.

Impact of Artificial Intelligence on the Industrial Electrification Market

Modern-day industrial electrification receives transformative power from artificial intelligence through its ability to improve energy management while maximizing maintenance predictions and optimizing operational processes. AI analytical systems enhance power grid stability through improved predictions that optimize the delivery of energy to multiple industrial facilities.

By utilizing AI-powered automation systems, industrial facilities minimize downtime since these systems detect impending system failures to perform scheduled maintenance ahead of time. Power consumption patterns that are enhanced through machine learning algorithms assist industries in reducing their waste output while reaching sustainability objectives. The real-time monitoring and decision-making functions of smart grid technology become superior through AI integration, thereby boosting operational efficiency.

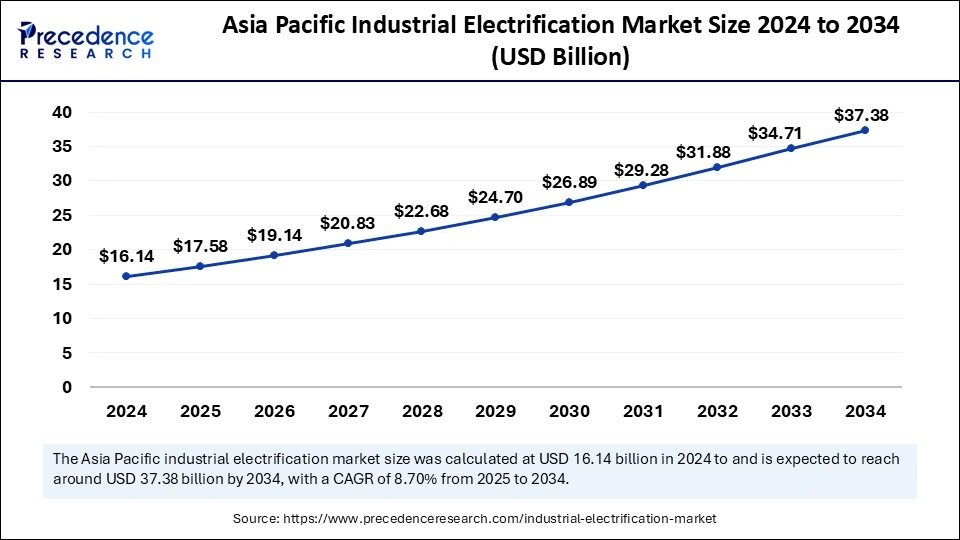

Asia Pacific Industrial Electrification Market Size and Growth 2025 to 2034

The Asia Pacific industrial electrification market size was exhibited at USD 16.14 billion in 2024 and is projected to be worth around USD 37.38 billion by 2034, growing at a CAGR of 8.70% from 2025 to 2034.

Asia Pacific held the dominating share of the industrial electrification market in 2024 due to its fast-paced industrial development, together with urban expansion. The region expanded because government policies encouraged renewable energy integration and industrial processes toward electrical operation. The need for sustainable practices triggered industrial operators to implement electric machinery while they improved energy efficiency and cut down carbon emissions. The World Health Organization confirmed that solar photovoltaic systems paired with battery storage systems evolved into economical, adaptable solutions, which accelerated the power-up process across the region.

China and India released remarkable growth in their manufacturing operations together with infrastructure development, which caused electricity demand to increase. The nation achieved its most substantial renewable energy infrastructure expansion while advancing its manufacturing sector through electrical transformation, thus further fuelling the demand for the industrial electrification market.

- The electrical demand in China increased by 6.4% in the year 2023 due to growing industrial activities, as per the IEA 2024 report.

Europe is projected to host the fastest-growing industrial electrification market in the coming years as governments continue to back this sector while patients adopt digital healthcare solutions and scientists conduct advanced biomedical research. The European Commission's Digital Health Strategy promotes smart medical device integration with AI diagnostics to create increased demand for flexible electronics in remote patient monitoring and telehealth applications. Under the United Kingdom's National Health Service (NHS) Long-Term Plan, the organization supports the implementation of wearable biosensors within preventive healthcare systems to increase early disease detection capabilities. The European Medicines Agency (EMA) supports flexible medical implants along with diagnostic tools, which creates optimal market conditions.

The World Health Organization (WHO) documented fundamental digital healthcare transformation progress during 2023 throughout Europe. The Spanish healthcare sector dedicates funding to digital platforms for health and supports telemedicine development and flexible biosensor-based remote patient tracking. Italy drives the growth of smart hospitals and upgrades healthcare tracking through wearable medical devices and electronic patches. Furthermore, Europe demonstrates its dedication to healthcare innovation through these developments, which establish its position as a market leader for flexible electronics products.

North America holds a notable presence in the global industrial electrification market, owing to the governments investing heavily in clean industry sectors and creating favorable policies. The implementation of greenhouse gas emission reduction goals and energy independence initiatives hastened industrial electrification throughout numerous business sectors. North America shows excellent potential for industrial electrification advancement due to its dedication to sustainable practices and technological improvements. The Inflation Reduction Act of 2022 created powerful financial boosts that encouraged businesses to electrify their operations, which reinforced regional strength.

The policies of Canada at both the federal and provincial levels pushed for industrial electrification through programs that built clean energy distribution networks and electrified transportation systems. The government aims to eliminate power plants that generate electricity through unclean fossil fuel sources but simultaneously support industrial electrification. Furthermore, the government continues to develop its electrical infrastructure by enhancing renewable power generation systems specifically for manufacturing purposes, thus further fuelling the market in this region.

- The 2023 Clean Electricity Regulations released by the Government of Canada established detailed targets. The Government of Canada finalized the Clean Electricity Regulations (CER) on December 17, 2024. These regulations replace the 2023 draft and aim to achieve a net-zero electricity grid by 2035, contributing to economy-wide net-zero emissions by 2050.

Market Overview

The industrial electrification market is expanding rapidly due to worldwide efforts in sustainability, which combine electric power with decarbonization initiatives. Electric technologies replace fossil fuels in production processes while making operations efficient and decreasing atmospheric GHG emissions. According to the International Energy Agency shows that businesses implementing electricity in low- to medium-heat processing units achieve optimal results for reducing industrial carbon emissions, covering more than half of the sector.

High-temperature heat pumps and electric arc furnaces have been installed across food and beverage factories, paper producers, and light industrial facilities to support the electrification movement. The International Energy Agency projects that global electricity usage will rise at its highest annual rate this century as manufacturing expands. According to IEA reports, converting industrial operations to electric power presents a fundamental chance to reduce pollution while increasing process efficiency, especially for applications using heat below 500 degrees Celsius that generate fifty percent of industrial emissions. The essential part played by industrial electrification remains crucial to global sustainability initiatives.

Industrial Electrification Market Trends

- In 2023, renewable energy capacity additions reached a record high of 507 gigawatts (GW), which represents a 50% increase compared to 2022.

- Solar photovoltaic (PV) technology accounted for three-quarters of these global additions. This information comes from the IEA's Renewables 2023 report, which highlights significant growth in the adoption of clean energy.

- Global entities signed agreements at the COP28 UN Climate Change Conference in December 2024 to develop renewable power capacity threefold through 2030 while demonstrating worldwide support for sustainable energy initiatives according to stated agreements.

- The power transmission market attracted approximately USD 140 billion in 2023 as investments rose by 10% while Europe, the United States, China, India, and Latin American components became members of this expansion, as per the IRENA 2023 report.

- According to the IEA 2024 report, recent findings of new construction projects are predicted to reach high levels of electrification in their systems, leading to decreased environmental impact by 2024.

Industrial Electrification Market Growth Factors

- Expanding industrial automation: The increasing adoption of automation and robotics in manufacturing is expected to accelerate the demand for electrified industrial processes.

- Government decarbonization policies:Stricter emission reduction targets and carbon neutrality commitments are anticipated to push industries towards full-scale electrification.

- Advancements in battery technology: Innovations in energy storage solutions, such as solid-state and lithium-ion batteries, are projected to enhance industrial electrification capabilities.

- Rising grid modernization efforts: Upgrades to smart grids and digital substations are expected to improve energy efficiency and support the integration of electrified industrial operations.

- Electrification of heavy industries: The transition from fossil fuel-based machinery to electric-powered equipment in sectors like mining and metallurgy is likely to drive market expansion.

- Growth in green hydrogen integration: Increasing investments in hydrogen-powered industrial applications are anticipated to complement electrification strategies across various industries.

- Surging demand for sustainable supply chains: The emphasis on reducing carbon footprints in global supply chains is expected to encourage industries to adopt electrified logistics and manufacturing processes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 95.79 Billion |

| Market Size in 2025 | USD 47.55 Billion |

| Market Size in 2024 | USD 43.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Technology, End-Use Industry, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing adoption of renewable energy sources

Growing reliance on renewable energy sources is projected to drive the industrial electrification market as industries seek sustainable and cost-effective power solutions. Such transformations improve national security in energy supplies while decreasing world reliance on fossil fuels. The adoption of government policies focused on emission reduction and carbon neutrality speeds up the industrial process transition to electrical operations.

The modernization of heavy industry and manufacturing alongside transportation moves toward sustainable objectives as it facilitates progress to sustainable energy methods. Furthermore, the rapid expansion process of renewable energy acceptance and growing investment in these types of renewable technology further creates demand for industrial operations, thus fuelling the market.

Annual Investment in Clean Energy by Countries and Regions for 2024

| Country/Region | Investment (USD billion) |

| China | 359 |

| United States | 85 |

| European Union | 106 |

| India | 37 |

| Latin America | 41 |

| Southeast Asia | 15 |

| Africa | 22 |

Restraints

High Upfront Investment Costs

One of the most significant restraints in the industrial electrification market is the substantial upfront capital investment required for infrastructure upgrades and equipment replacement. Electrifying industrial operations often means retrofitting or replacing long established fossil fuel systems with electric alternatives such as electric boilers, induction heating systems, or advanced drives. This transition involves not only the purchase of expensive equipment but also reconfiguring facilities, upgrading grid connections, and in some cases strengthening local energy distribution networks to handle higher loads. For many industries operating on thin margins, specially in sectors like metals, chemicals, or heavy manufacturing, these high initial costs can act as a strong deterrent despite the long term savings and efficiency benefits electrification may provide.

Grid Capacity and Reliability constraints

Another major obstacles lies in the lamentations of existing power grids, which are often not equipped to handle the sharp increase in demand caused by large scale industrial electrification. Many industrial sites require extremely high, stable loads and sudden spiked or outages can disrupt production and damage equipment. In regions where the grid is already strained or heavily reliant on fossil fuels, the additional demand from electrified electricity. Moreover, delays in permitting and expanding transmission and distribution infrastructure can further hinder the pace of electrification. Until utilities and policymakers can ensure more robust, reliable and renewable based grids, industries many be hesitant to fully commit to electrification at scale.

Opportunities

Integration of Renewable Energy with industrial operations

A major opportunity lies in the growing availability of renewable energy sources that can directly power industrial processes. As solar, wind, and hydropower become more affordable and scalable, industries are increasingly able to electrify their operations without depending solely on fossil fuel based grids. This opens doors for onsite renewable installation, such as solar arrays paired with battery storage, which not only reduce carbon footprints but also improve energy security by cutting reliance on fluctuating fuel markets. Industries with high and consistent energy needs, such as steel, cement and chemicals, stand to gain the most from combining electrification with renewable integration, as it positions them to meet north regulatory demand and sustainability goals.

Advancement in Smart and Digitalized Industrial Systems

Another powerful opportunity comes from the convergence of electrification with digital technologies, particularly in automation, sensors, and data driven energy management. Smart electrified systems allow industries to monitor energy use in real time, adjust loads dynamically, and optimize processes for maximum efficiency. With the rise of Industrial IoT and artificial intelligence, companies can predict equipment performance, minimize downtime, and significantly reduce energy waste. This not only drives operational efficiency but also gives industries a competitive edge in cost management and productivity. As global markets shift toward smart manufacturing and Industry 4.0, the electrification of industrial systems becomes a cornerstone of digital transformation, creating a strong growth pathway.

Component Insights

By component, the electrical transformers segment dominated the market in 2024, as these systems remain indispensable for power distribution and energy conversion in industrial settings. Their ability to step up or step down voltages ensures smooth integration of renewable sources, grid stability, and reliable power delivery across facilities. Industries depend heavily on transformers to maintain operational continuity, making them the backbone of industrial electrification.

Looking forward, the variable speed drives segment is expected to grow at the fastest rate during 2025 to 2034. This growth will be driven by the rising adoption of automation and digital control across industries. Variable speed drives enable more efficient motor control, reduce energy consumption, and improve process flexibility all of which align with the global push toward sustainability and cost optimization. As industries modernization and seek smarter solutions, this segment is set to expand rapidly.

Source Insights

The renewable energy segment held a dominant presence in the industrial electrification market in 2024 due to the growing global efforts to reduce carbon emissions and the increasing cost-competitiveness of renewable technologies. The International Energy Agency (IEA) reported that renewable energy's contribution to global power generation increased from 22% in 2023 to 25% in 2025, reflecting a substantial shift toward cleaner energy sources.

Under the renewable energy segment, the solar energy sub-segment holds a significant market share due to declining photovoltaic costs and supportive government policies, making it an attractive option for industrial applications. Furthermore, the exceptional development of solar energy resulted from falling photovoltaic prices together with government backing, which established it as an ideal industrial choice.

The nuclear power segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. Advancements in nuclear technologies, such as small modular reactors, are expected to enhance safety and reduce costs, making nuclear energy a viable option for industrial use. Additionally, the consistent output of nuclear power complements the intermittent nature of renewable sources, including solar and wind, ensuring a reliable energy supply for industrial operations. These factors collectively position nuclear power as a key contributor to the future growth of industrial electrification.

- The IEA forecasts that nuclear power will maintain a steady 19% share in global power generation through 2025, underscoring its role in providing a stable and low-carbon energy supply.

Industrial Electrification Market Revenue, By Source, 2022-2024 (USD Billion)

| Source | 2022 | 2023 | 2024 |

| Renewable Energy | 22.32 | 23.90 | 25.81 |

| Nuclear Power | 7.50 | 8.08 | 8.78 |

| Fossil Fuel-based | 6.05 | 6.51 | 7.00 |

| Others | 1.46 | 1.55 | 1.65 |

Technology Insights

The heat pump segment accounted for a considerable share of the industrial electrification market in 2024 due to its high energy efficiency characteristics while offering process heat at 160°C maximum temperature, which sufficed to meet 44% of industrial process heat demands. The paper and food and chemicals industries represent the industrial segments with the biggest heat pump potential, as these sectors have a major total heating capacity that heat pumps satisfy.

The electric resistance heating segment is anticipated to grow with the highest CAGR during the studied years. The technological features of precise temperature control and speedy heating allow its use in different industrial processes. Electric resistance heating systems integrate into current industrial setups through minimal modifications, which makes them desirable to implement. The speed of electric resistance heating adoption rises as industries need to decarbonize while utilizing renewable energy sources and achieving efficiency. Furthermore, the industrial importance of electric resistance heating continues to rise due to new breakthroughs.

Industrial Electrification Market Revenue, By Technology, 2022-2024 (USD Billion)

| Technology | 2022 | 2023 | 2024 |

| Heat Pumps | 13.30 | 14.24 | 15.38 |

| Electric Resistance Heating | 4.87 | 5.24 | 5.69 |

| Electric Arc Heating | 9.66 | 10.37 | 11.23 |

| Electric Boilers | 5.30 | 5.70 | 6.17 |

| Energy Storage | 3.78 | 4.06 | 4.39 |

| Others | 0.97 | 1.02 | 1.09 |

Application Insights

By Application, the energy efficiency and optimization segment captured a significant portion of the market in 2024, owing to the global emphasis on reducing energy consumption and operational costs. Industrial players are increasingly investing in technologies that hel them minimize waste, maximize output, and meet stricter environmental regulations. This segment's leading position reflects the critical importance of efficiency as industries transition toward more sustainable and electrified operations.

In contrast, the process automation and control segment is projected to experience the fastest growth from 2025 to 2034. With industries adopting advanced automation systems, sensors, and digital controls, electrification is becoming more tightly integrated worth industrial processes. This segment benefits from the convergence of electrification worth industry 4.0 trends, where data driven operations and intelligent systems are transforming the industrial landscape. Its rapid expansion is tied of the growing demand for precision, scalability, and reliability in production.

Product Insights

By Product, the starter motor and alternator segment maintained a leading position in the market in 2024, reflecting its critical role in industrial machinery and automotive applications. These components are widely deployed across multiple industries, ensuring reliable operation of vehicles and heavy equipment. Their broad usage and consistent demand cemented their dominance in the electrification market during the year.

Meanwhile, the fastest growing product segment during the forecast period is anticipated to be test to advanced electrification solutions, particularly those that align with energy transition and sustainable mobility trends. Components designed to enhance efficiency, integrate with renewable energy sources, and support electrified industrial systems are expected to expand rapidly. As industries shift toward cleaner technologies and greater electrification, these next generation product categories will likely gain significant momentum.

End-Use Industry Insights

In 2024, the manufacturing segment led the global industrial electrification market, as businesses chose sustainable operations along with efficient production processes. The growing implementation of electric machinery with industrial heat solutions has created a reduction in fossil fuel dependence as it supports international decarbonization efforts. The adoption of electrified manufacturing technologies increased extensively as the industrial energy transition policies enhanced market leadership. Furthermore, official government documents demonstrated how industrial electrification worked to minimize emission levels in specific facilities while maintaining industrial sector control.

The construction segment is projected to expand rapidly in the coming years as electric heavy equipment and green building technologies gain quick market acceptance. The rising number of environmental regulations meant to decrease project emissions created a necessity for this industrial shift. Different industry reports from 2023 demonstrated the growing acceptance of solar-powered construction sites combined with battery-operated machinery throughout various regions.

Industrial Electrification Market Companies

- ABB

- AISIN CORPORATION

- Bharat Bijlee Limited

- Bonfiglioli Transmissions Private Limited

- BorgWarner Inc.

- Continental AG

- DENSO CORPORATION

- General Electric

- Johnson Electric Holdings Limited

- Kirloskar Electric Company

Latest Announcements by Industry Leaders

- February 2025 – Baker Hughes

- Executive Vice President– Baker Hughes

- Announcement - Baker Hughes announced three new electrification technologies that aim to enhance reliability, increase efficiency, and reduce emissions for both onshore and offshore operations. “Hydrocarbons will continue to be key sources of global energy for decades, and it is crucial that we produce these resources with a minimal carbon footprint,” said Amerino Gatti, Executive Vice President of Oilfield Services and Equipment at Baker Hughes. “By electrifying the production value chain, we can make our operations cleaner, safer, and more efficient while still meeting the world's energy demands.”

Recent Developments

- In June 2024, Schneider Electric, a global leader in the digital transformation of energy management and automation, released a report projecting that the electrification of the U.S. industry will increase from 30% to 45% by 2030. This represents a 50% growth.

- In April 2024, Siemens Smart Infrastructure launched Electrification X, a new suite of applications within their SaaS and IoT portfolio. This offering is designed to help renewable generators, transmission system operators (TSOs), distribution system operators (DSOs), industries, and infrastructure customers enhance productivity, reliability, asset utilization, energy efficiency, and sustainable innovation.

- In May 2024, the National Energy Transition Task Force formally introduced the Energy Efficiency and Electrification Working Group (E3WG) as part of the Just Energy Transition Partnership (JETP).

Segments Covered in the Report

By Source

- Renewable Energy

- Solar Energy

- Wind Energy

- Hydropower

- Geothermal

- Nuclear Power

- Nuclear Fission

- Nuclear Fusion

- Fossil Fuel-based

- Others

By Technology

- Heat Pumps

- Electric Resistance Heating

- Electric Arc Heating

- Electric Boilers

- Energy Storage

- Others

By End-Use Industry

- Manufacturing

- Steel and Cement

- Mining

- Chemicals

- Construction

- Oil and Gas

- Pulp and Paper

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content