What is the Generative AI Market Size?

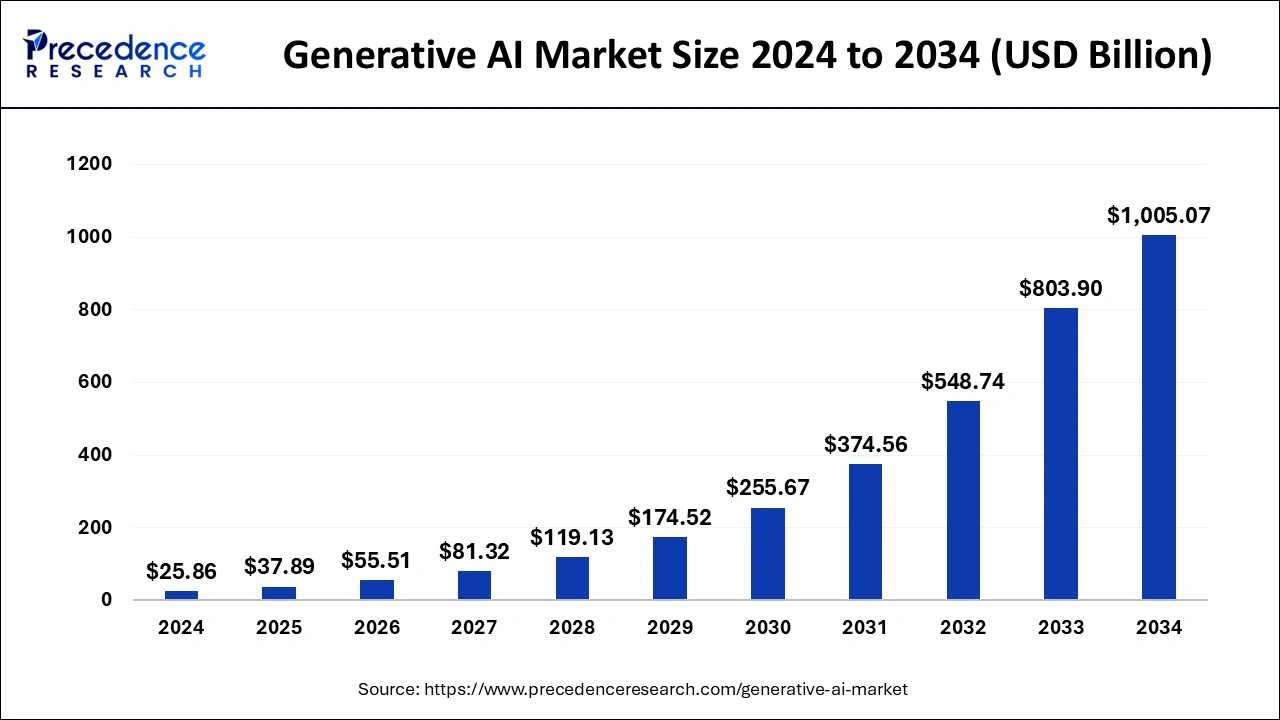

The global generative AI market size is calculated at USD 37.89 billion in 2025 and is predicted to increase from USD 55.51 billion in 2026 to approximately USD 1,206.24 billion by 2035, expanding at a CAGR of 36.97% from 2025 to 2034. Using technologies like superior resolution, text-to-image, and text-to-video conversion drives the demand for generative AI. Furthermore, the expanding need to modernize workflow, including automation and remote monitoring across industries, will drive generative AI market growth.

Generative AI Market Key Takeaways

- In terms of revenue, the generative AI market is valued at $37.89 billion in 2025.

- It is projected to reach $1,206.24 billion by 2035.

- The generative AI market is expected to grow at a CAGR of 36.97% from 2026 to 2035.

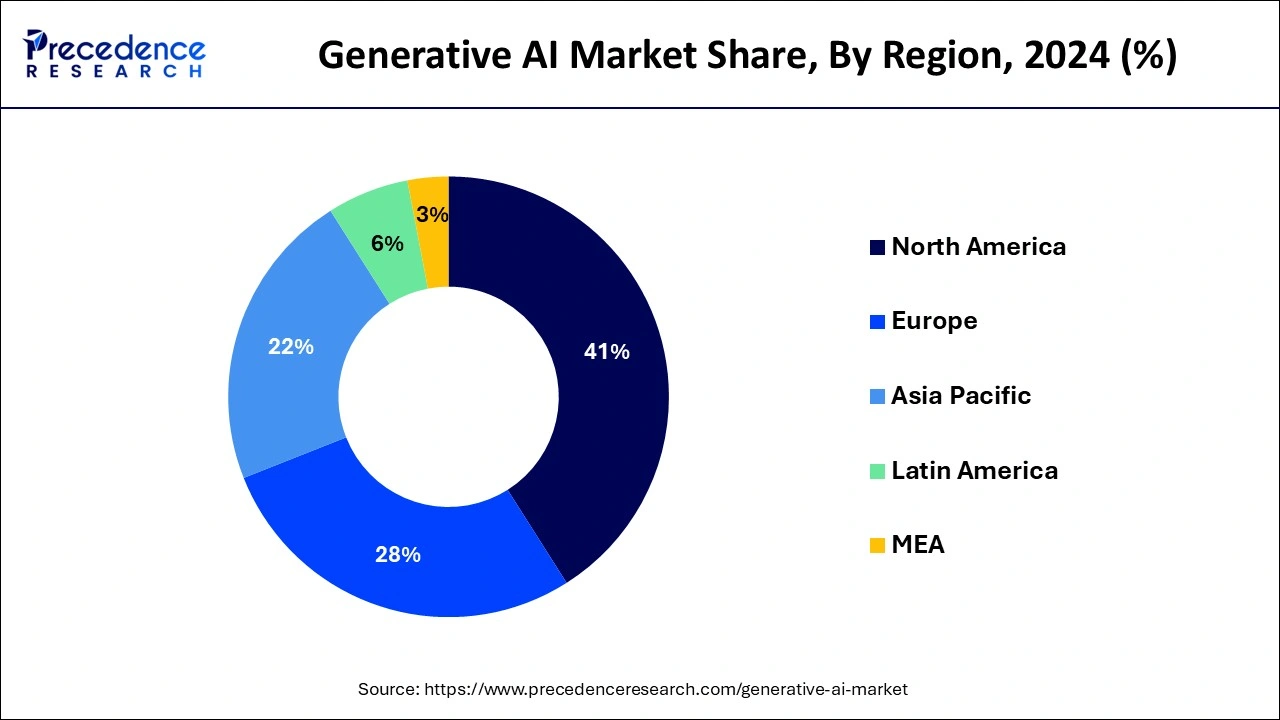

- The North America market captured 41% revenue share in 2025.

- Asia Pacific market will reach at a CAGR of 27.6% from 2026 to 2035.

- By component, the software segment captured more than 65.50% revenue share in 2025.

- By technology, the transformers segment accounted for the highest revenue share, exceeding 42% in 2025.

- By end-use, the media & entertainment segment captured more than 34% of revenue in 2025.

- By end-use, the business and financial services segment is expected to grow at the fastest rate of 36.4% from 2026 to 2035.

What is Generative AI?

A technique that uses AI and machine learning (ML) to create algorithms for generating new digital videos, images, texts, audio, or code is referred to as generative AI. It is powered by algorithms that recognize an underlying input pattern and generate similar outputs. Several advantages of generative AI include the following:

- Creating high-quality content.

- Improving identity protection.

- Enhancing comprehension of abstract theories.

- Reducing financial & reputational risks.

As a result, it is used widely in various industries, including healthcare, information technology, robotics, banking, and finance.

The demand for generative AI applications is increasing across industries due to factors corresponding to the expanding applications of technologies like super-resolution, text-to-image conversion, and text-to-video conversion, as well as the growing need to modernize workflow across firms. A significant growth-inducing factor in the healthcare sector is the increasing product adoption of 3D printing technologies to create various products, including organic molecules and prosthetic limbs, from scratch.

For instance, in 2022, Jen Owen founded the organization known as Enable, often referred to as Enabling the future, in the United States. This project aims to unite makers and enthusiasts to build a global network of prosthetics models that can be quickly 3D printed. Along with this, the market is also being driven forward by the rising popularity of generative AI, which helps chatbots create effective conversations and increase customer satisfaction. A generative chatbot is an open-domain program that generates original language combinations rather than selecting from pre-defined responses.

Technological Advancement

Technological advancements in the generative AI market feature computer vision, deep learning, multimodal AI, and natural language processing (NLP). Computer vision enables AI to influence and generate videos and images accordingly. Natural language processing advancement, especially with large language models (LLMs), helps in generating and understanding human-like text. Deep learning algorithms are known for their continuous development consists of reinforcement learning, generative adversarial networks (GANs), and variational autoencoders (VAEs).

Multimodal AI allows content generation to access video, text, and images from various media sources. The implementation of the popular technology in various markets is in heavy demand. The enhancement and development of the generative AI market boost existing and new businesses and accelerate the approach, leading to expansion.

Generative AI MarketStatistics

- As of June 2023, McKinsey, a global consulting company which has approximately 30,000 employees across 67 countries stated that almost 50% (half of) its total employees use ChatGPT and other such generative AI tools.

- Altman Solon in its recent survey stated that one in every four companies in the United States are utilizing generative AI tools.

- According to State of AI report, by September 2023, generative audio tools are expected to attract over 1,00,000 developers.

- Gartner stated in its report on generative AI that by 2025, approximately 30% of newly discovered drugs will be discovered with the help of AI tools.

- China's search engine Baidu announced to invest fund of approximately 1 billion Yuan ($140 million) in nurturing its interest in AI self-reliance.

- Micron Technology announced to invest up to $ 3.6 billion in Japan along with a close support from the Japanese government, the massive investment will focus on the innovation of generative AI chips in Japan.

- In April 2023, the prime Minister of Japan stated that the country is openly supporting the use of industrial generative AI such as ChatGPT techniques.

- In April 2023, Pwc announced to invest over $1 billion to expand the scale of generative AI, the company has planned to showcase this investment for next 3 years.

- By March 2023, Microsoft has already invested $13 billion in OpenAI.

Market Outlook

- Industry Growth Overview: The generative AI market in the U.S. grows immensely, and the reason for this is the increased usage and demand for AI-produced content.

- Global Expansion: America is at the forefront of AI adoption, and it is the one to dictate the trends in enterprise AI across other areas.

- Major Investors: The likes of Andreessen Horowitz, Sequoia Capital, Microsoft, Google, Nvidia, and SoftBank Vision Fund are the prominent investors through which U.S.-based generative AI is receiving support.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.89 Billion |

| Market Size in 2026 | USD 55.51 Billion |

| Market Size by 2035 | USD 1,206.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 36.97% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Technology, End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers

Audio synthesis - Generative AI can transform any computer-generated voice into one that sounds authentically human. Synthesis is one of the most well-known and influential AI text-to-speech generators; with just a few clicks, anyone can create a polished AI voiceover or movie. This platform is at the forefront of developing algorithms for videos with text-to-voiceover and usage in advertising. Imagine having a natural human voice to improve website explainer films or product tutorials in minutes, with the help of Synthesis Text-to-Video (TTV) and Text-to-Speech (TTS) technologies, which turn a script into engaging media presentations.

Application in healthcare

When actuated by 3D printing, CRISPR, and other technologies, generative AI can create prosthetic limbs, organic molecules, and other items from the start. It can also lead to earlier detection of potential cancers and more effective treatment plans. For instance, in June 2020, IBM used this technology to investigate antimicrobial peptides (AMP) in searching for COVID-19 drugs.

The growing demand for advanced manufacturing with complex designs and the need to reduce size while improving automotive performance is expected to drive the growth of the global generative AI market. It compels automotive manufacturers to increase their R&D investments and use generative design, which fuels market growth.

Identity protection as well as image processing

In October 2022, generative AI avatars were deployed in news reports regarding the prejudice towards LGBTQ people in Russia to obfuscate the identities of interviewees. The LGBTQ community has been under threat in Russia for quite a while, and generative AI helped some community members protect their identity and ensure their safety.

Restraints

Lack of skilled personnel

While generative AI allows machines to create new content effectively, it also has some limitations. Generative AI is still in its early stages, necessitating a trained workforce and significant investment in implementation. According to IBM's global AI adoption index report 2022, approximately 34% of respondents thought that a shortfall of AI knowledge, skills, or expertise prevented industries from adopting AI. As a result, the need for an experienced workforce and high implementation expenses are anticipated to hinder the market's growth.

Opportunities

Investment in R&D and technological advancement

Major market players such as Apple and Microsoft, based in the US, are increasing their investments in R&D. Additionally, these businesses are investigating technologies such as AI and machine learning (ML). Worldwide Technology, an AI service provider, launched an initiative focused on AI and ML in May 2020, with some of the most advanced experiments and work on generative AI planned.

The market is anticipated to experience promising growth opportunities as many businesses are continually developing & experimenting with embedding generative AI in their services and products. The global generative AI market will be driven by the rising use of generative AI for building virtual worlds in the metaverse. Additionally, the increasing trend of creating digital artworks using only text-based descriptions will augment market growth.

- In November 2024, Language-learning platform Duolingo announced it to introduce its generative AI-powered video-calling feature, 'Call with Lily,' in India as part of its strategy to drive monetization. The feature allows users to engage in interactive, conversation-based practice with Lily, a virtual character, offering an immersive language-learning experience.

Challenges

Control limitations

The Generative AI technique may appear unstable at times or in certain situations, resulting in uncontrollable behavior. For instance, a Generative Adversarial Network (GAN) may produce output that fails to meet expectations without providing an understandable explanation, making it challenging to find the best solution to the problem.

- Pseudo image generation - While the Generative AI algorithm uses a large amount of data to perform tasks, it cannot create genuinely new images because the image it created is simply a combination of information gathered in novel ways.

- Security concern - Since generative AI can generate fake photos and images identical to the real ones, it may increase identity theft, fraud, and counterfeiting cases.

- Data privacy concerns - Generative AI in healthcare may raise data privacy concerns because it involves collecting personal information.

Component Insights

The industry is split into software and services. The software sector, which had the most significant value share of 65.50% in 2024, will likely dominate the market during the forecast period. The expansion of the software market can be attributable to several variables, including an increase in fraud, capabilities overestimation, unforeseen results, and growing privacy concerns. Generative artificial intelligence (AI) is a technology consisting of algorithms that may produce new material, including audio, code, pictures, text, modelling, and videos. ChatGPT is only one user-friendly example of this technology. Generative AI uses foundation models, which are deep learning models that can perform several complicated tasks concurrently, to produce new information rather than just categorizing and recognizing existing data. Given that it is growing more potent thanks to strong ML models, generative AI software is anticipated to play a key role in a variety of businesses and sectors, such as fashion, entertainment, and infrastructure. For instance, when a group of fashion designers from the Laboratory for Artificial Intelligence in Design (AiDLab) in Hong Kong staged a fashion exhibition showcasing creations aided by generative AI in December 2022.

On the other hand, the service sector is expected to grow at the fastest CAGR during the projected period. Increasing concerns about stock exchange trading forecasts, data security, fraudulent activity detection, and modeling of risk factors will drive growth. Cloud-based generative artificial intelligence services are anticipated to rise in popularity as they offer flexibility, scalability, and affordability, fueling the expansion of the service market. For instance, the U.S.-based IT service administration business Amazon Web Service (AWS) introduced Amazon Bedrock and a number of generative AI services in April 2023. Additionally, Amazon Web Services Inc. announced the inclusion of new features to its cloud platform on June 20, 2022. Programmers can effectively create code, train datasets, and incorporate AI into their applications thanks to its capabilities.

Technology Insights

The generative AI technology is divided into variational auto-encoders, GANs, diffusion networks, and transformers. In 2025, transformers generated the highest revenue share exceeding 42%, driven by the growing popularity of transformer applications such as text-to-image. Transformer models are created to learn the contextual links between the words in a phrase or a group of words in a text. They accomplish this learning by employing a technique known as self-attention, which enables the model to evaluate the relative weights of various words in a sequence according to their context. This approach differs from conventional recurrent neural network (RNN) models in that it sequentially processes input sequences and lacks a global understanding of the sequence. For instance, the transformer DALL-E comprehends text and converts it to an image. One transformer developed by the OpenAI team, a San Francisco-based artificial intelligence research group, is GPT-3. This model can write emails and poems as well as produce material that looks to have been authored by a person.

The diffusion network is expected to grow at the fastest CAGR during the projected timeline. Image creation has become crucial to many industries to deliver high-value services to the private sector, the public sector, and the government to meet the growing demands of image creation. Artificial intelligence (AI) has captured the attention of the world, especially because of recent developments in natural language processing (NLP) and generative AI, and with good reason. These innovative technologies can increase daily productivity for many types of jobs. For instance, OtterPilot automatically creates meeting notes for executives, GitHub Copilot enables coders to quickly build complete algorithms, and Mixo enables business owners to quickly establish websites.

The transformer-based models segment held the largest share of 42.60% in the 2024 global generative AI market. The segment includes diffusion models, vision transformers and large language models (LLMs). The segment acts as a native to the modern generative AI revolution, allowing development in natural language processing (NLP), innovation and image generation. With the history back in 2017, introducing the ‘attention is all you need' paper replaced old RNNs that process data more sequentially. This self-attention mechanism will further lead to scalability, efficiency and improved potential to analyse context of long sequences.

The reinforcement learning-augmented models segment is expected to grow at a CAGR of 24.10% during the forecast period. This segment is critical in the global generative AI pipelining. This moved the target from creating new content to generating outputs that are linked with human preferences, critical real-world needs and the goals. This could be gained via reinforcement learning from human feedback (RLHF). This is fundamental for the simple tuning of vast scale models.

End-Use Insights

The end-user segment includes media & entertainment, healthcare, business & financial services, IT & telecom, and automotive & transportation. The other smaller segments include security, aerospace, and defense. Media & entertainment generated more than 34% revenue in 2023, exceeding USD 1.5 billion, where generative AI helps improve advertisement campaigns. A variety of industries, including banking and healthcare, have been touched by generative AI, which creates new data or content using machine learning algorithms. A boom of innovation and new ways to express oneself is brought about by the use of technology to produce new kinds of literature, music, and art. Additionally, generative AI is used to create novel medications and therapies, as well as to analyze medical imagery and aid in diagnostics. Additionally, it is employed in the development of new financial services and products, the analysis of financial data, and market forecasting. Additionally, audience data may be analyzed and personalized content can be produced using generative AI.

During the forecast period, the business and financial services segment is expected to grow at the fastest rate of 36.4%. The market expansion in this sector is attributed to the growing use of artificial intelligence (AI) and machine learning (ML) in the industry to stop fraud, secure data, and satisfy the changing demands of various stakeholders in financial services.

Modality Insights

The text segment held the largest share of 37.90% in the 2025 global generative AI market. The text segment is consistent with its role in the expansion and development of generative AI. The segment has strengthened its footprint since the revolutionary time of a natural language processing tool and is now becoming an essential part of the multimodal systems that create video, images and audio. With the technology advancement and generative AI, the translation, summarisation, code generation, and conversational agents like chatbots have accelerated this market.

The multimodal segment is expected to grow at a CAGR of 23.40% during the forecast period. The segment has evolved due to the demand for conversion required mainly in the media and entertainment, IT and telecom industries. The text-to-image, video-to-text, image-to-text and multimodal search features help the segment to lead in the forefront of generative AI. The segment holds the potential to transform the segment with the advanced approach and discover a shift in the growth of multimodal.

Deployment Mode Insights

The cloud-based segment held the largest share of 71.80% in the 2024 global generative AI market. The segment varies with the different cloud-based options, such as public, hybrid and private cloud. Most of the large organisations deploy cloud-based systems into their operation for reliability and performance growth. The segment is a crucial elevator for the growth and development of generative AI. The cloud-based deployment provides crucial computational power, accessibility and scalability needed for huge AI models. The development relies on the strong collaboration between AI developers and cloud providers.

The edge-based/ device-local segment is expected to grow at a CAGR of 21.50% during the forecast period. The segments deployment in generative AI consists of operating AI models on the local hardware. This operation is better than depending fully on the centralised cloud servers. This idea is fueling the growth with the major benefits like alleviating latency, improving data privacy and diminishing the bandwidth costs.

End-user Insights

The IT and telecom segment held the largest share of 20.60% in the 2025 global generative AI market. The IT and telecom industry has been largely adopting the generative AI tools and features in their workflow. Following this, the segment is pivotal to the deployment and development of generative AI. This delivers the crucial connectivity, data processing and infrastructure potential. The IT firms are leading at the forefront with the adoption of generative AI, and telecom companies are also experiencing increased scalability in the same. This uncovers a new revenue pipeline and develops personalised services.

The healthcare and life sciences segment is expected to grow at a CAGR of 21.70% during the forecast period. The healthcare and life sciences industry has entered a transformative era with the adoption of generative AI. The generative AI leverages drug discovery, allowing space for personalised medicine. It also helps to advance the administrative efficiency. The adoption also involves the design of new proteins and molecules, automating research analysis and more. Alongside, it enables virtual assistants for patient support and monitoring. The major development includes the GenAI usage for super precision, cost mitigation and quick research.

Regional Insights

U.S. Generative AI Market Size and Growth 2026 to 2035

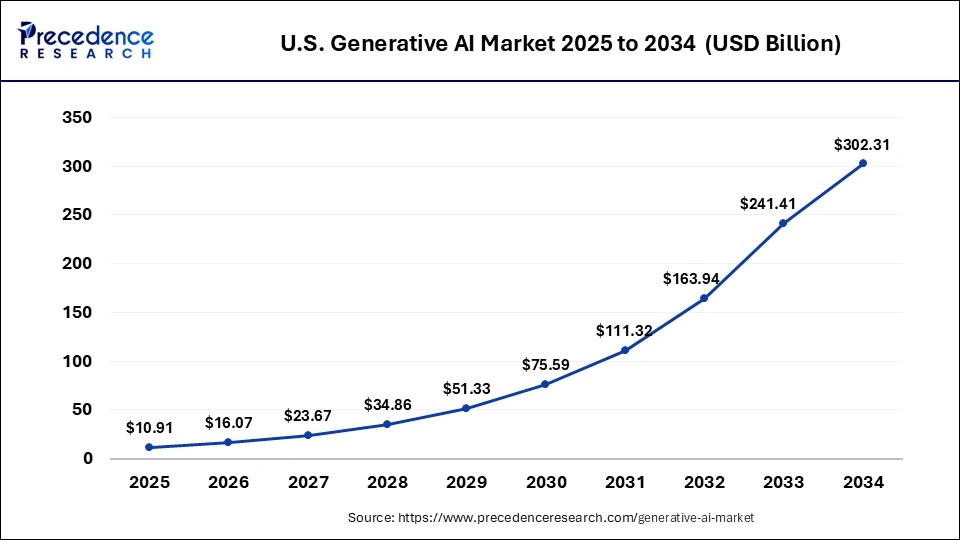

The U.S. generative AI market size was estimated at USD 10.91 billion in 2025 and is predicted to be worth around USD 363.21 billion by 2035, at a CAGR of 37.53% from 2026 to 2035.

North America led the market and generate more than 41% revenue share in 2025. The trend is expected to continue during the forecast period, owing to the increasing adoption of pseudo-imagination and rising banking frauds. Furthermore, companies such as Meta, Google LLC, and Microsoft are anticipated to drive the generative AI market development.

North America is dominating the generative AI market. With the large number of contributions to the advancement in innovations, risk management strategies, and governance, the region is participating in advancements with confidence and economic support. In North America, the Department of Homeland Security is a center of appreciation, which provides safety and security to artificial intelligence across the nation.

During the forecast period, Asia Pacific will grow at the fastest CAGR. The region's growth in generative AI is fueled by expanding government initiatives and a rise in the deployment of AI-based applications.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be attributed to the ongoing technological innovations coupled with the growing adoption of this technology in emerging economies such as China, Japan, and South Korea. In addition, these companies are heavily investing in AI, which can optimize the growth of the sectors, including commerce, manufacturing, and media. Also, governments in the region are increasingly supporting AI R&D, propelling market expansion.

- In October 2024, IndiaAI and Meta announced the establishment of the Center for Generative AI, Srijan at IIT Jodhpur, along with the launch of the “YuvAi Initiative for Skilling and Capacity Building” in partnership with the All-India Council for Technical Education (AICTE), for the advancement of open-source artificial intelligence (AI) in India.

What Are the Driving Factors of the Generative AI Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Ethical AI regulations and compliance with the EU AI Act are one of the receptive supports of the growth momentum in Europe. Germany, France, and the UK are investing in industrial healthcare and finance applications. The businesses have a great beginning with robust research institutions and regulatory backing, which is also an object of public business hope that is emerging in every sector of the economy.

Germany Generative AI Market Trends:

Germany is enjoying the fruits of the industrial applications area of AI that which already has a significant presence because of its manufacturing, automotive, and Industry 4.0 experience. The already powerful regulatory frameworks and companies practice the use of AI, which is ethical and responsible, with the help of regulations that are supported by the government. The nation integrates technological creativity with the sense of population and enterprise optimism, which promotes the establishment and business startups to embrace the generative AI solutions that cut across industries.

North America: U.S. Generative AI Market Trends:

This is enabled by the confluence of colossal amounts of personal capital and the availability of the highest-quality innovation systems in the world. The current proliferation of AI into technology, finance, healthcare, and defense is motivated by the leading technology companies, research centers, and access to a skilled workforce. The governmental contact offers the moral AI implementation, and the eminent demand of the AI specialists only increases the rivalry and makes the expenses higher.

Asia Pacific: India Generative AI Market Trends:

India has been winning over as the most important outlet in Asia-Pacific, with quick digital acceptance and integration of enterprises. The technology-friendly government is rendering AI ubiquitous in e-commerce, manufacturing, media, and services, and most of the Indian population is purchasing the AI-powered products. The Indian market is becoming the global leader in AI consumer usage as generative AI is providing it with the aspects of automation, personalization, and productivity.

Top Companies in the Generative AI Market & Their Offerings:

- Synthesia: Synthesia delivers an artificial video platform with the closest to human avatars, support for many languages, and professional content creation for industries in the U.S.

- MOSTLY AI Inc.: MOSTLY AI creates very similar synthetic data for U.S. companies, allowing the training of algorithms that are safe and simultaneously private and compliant.

- Genie AI Ltd.: Genie AI uses huge language models to supply AI-based legal support, including contract creation, checking, and analyzing for American clients.

Generative AI Market Companies

- Synthesia

- MOSTLY AI Inc.

- Genie AI Ltd.

- Amazon Web Services, Inc.

- IBM

- Google LLC

- Microsoft

- Adobe

- Rephrase.ai

- D-ID

Recent Developments

- In May 2025, LinkedIn launched a generative AI tool that lets users uncover tailored job listings just by describing their ideal role in their own words. The technological initiative in applications is allowing individuals to explore and develop their expertise.

- In May 2025, IBM Think 2025 highlighted Watson X.data's role in generative AI. The data platform will address roadblocks in scaling generative and agent-based AI, contributing to the growth of the generative AI market.

- In May 2025, Kama.ai launched trustworthy AI hybrid agents. The merging of deterministic and generative AI delivers trusted, brand-safe virtual agents. It is guided by human values, with a new enterprise retrieval augmented generation (RAG) process.

- In February 2025,Google Cloud and Accenture launched the Generative AI Center of Excellence in Saudi Arabia, providing businesses with industry expertise, technical knowledge, and product resources to build and scale applications using Google Cloud's generative AI portfolio and accelerate time-to-value.

- In April 2025, the Cannes Film Market launched Village Innovation, a new venue dedicated to technology and innovation (including Gen AI) in the film industry. The venue will bring together the bulk of activities from Cannes Next, the market's flagship program dedicated to innovation in the film industry, as well as activities stemming from the all-new ImmersiveMarket, which revolves around XR and immersive professionals.

- In May 2025, TalentSprint, a global leader in DeepTech education, announced an executive-friendly, four-month Generative AI Foundations and Applications program. Created for both emerging and current working professionals, the program provides cutting-edge AI skills and hands-on experience in the rapidly evolving world of Generative AI.

- SXiQ, an Australia-based digital transformation services company with expertise in cloud applications, platforms, and cybersecurity, was acquired by IBM in November 2021.

- ALTAIR ENGINEERING INC announced the release of Thea Render V3.0 in March 2021. The Thea Render is a 3D renderer that uses state-of-the-art and unbiased graphic refining unit engines.

- Altair announced in February 2021 that it had adopted GE Aviation's Flow Simulator.

- In May 2020, Archistar, an Australian property intelligence platform that combines architectural design with artificial intelligence to inform property decision-making, closed a USD 6 million Series A funding round led by AirTree to accelerate international growth and expand its product and engineering team.

Segments Covered in the Report

By Technology/Model Type

- Transformer-based Models

- Large Language Models (LLMs)

- Vision Transformers

- Diffusion Models

- Generative Adversarial Networks (GANs)

- Variational Autoencoders (VAEs)

- Autoregressive Models

- Flow-based Models

- Hybrid Architectures

- Reinforcement Learning-augmented Generative Models

By Modality

- Text

- Natural Language Generation

- Code Generation

- Summarization

- Translation

- Conversational Agents (Chatbots)

- Image

- Image Synthesis

- Image Inpainting

- Style Transfer

- Super Resolution

- Audio

- Music Generation

- Voice Cloning

- Text-to-Speech (TTS)

- Video

- Video Generation

- Video Prediction

- Animation Generation

- 3D & AR/VR

- 3D Model Generation

- Virtual Environment Design

- Multimodal

- Text-to-Image

- Image-to-Text

- Video-to-Text

- Multimodal Search

By Deployment Mode

- Cloud-based

- Public Cloud

- Private Cloud

- Hybrid Cloud

- On-Premises

- Edge-based / Device-local

By End-user Industry

- IT & Telecom

- Media & Entertainment

BFSI (Banking, Financial Services, Insurance) - Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Automotive

- Education

- Government & Defense

- Legal Services

- Marketing & Advertising Agencies

- Gaming

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting