What is the Sensor Market Size?

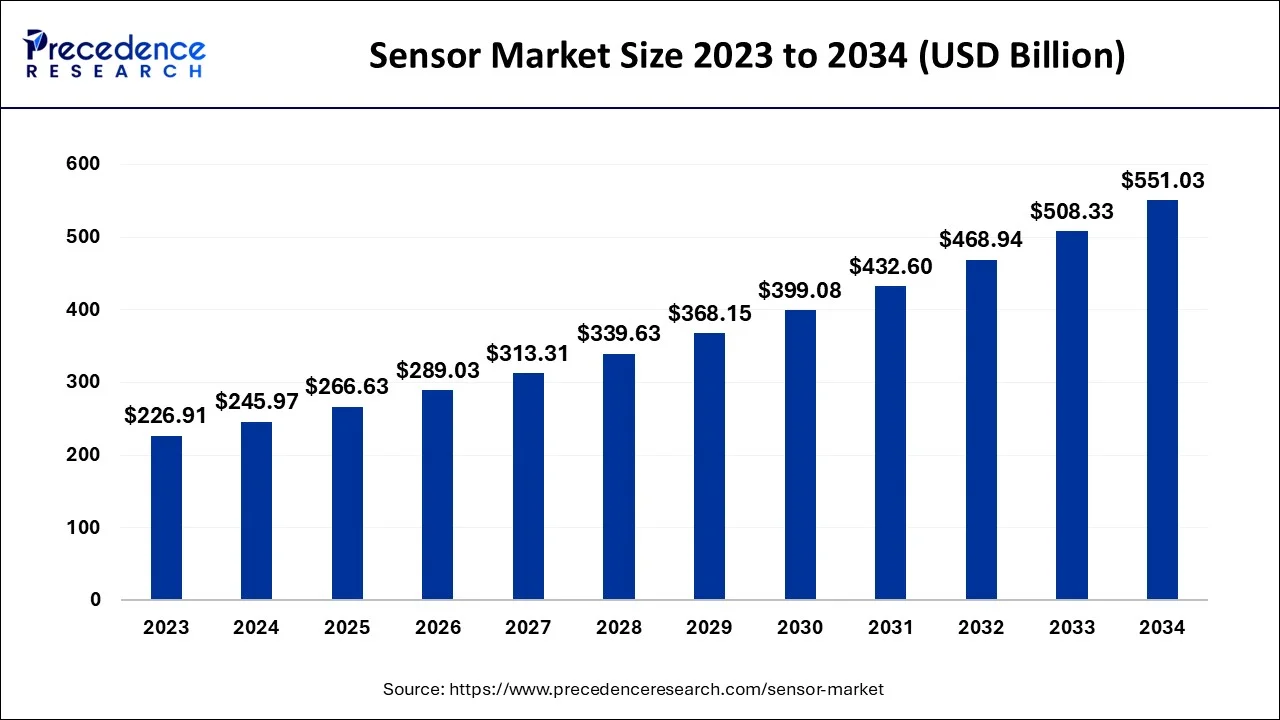

The global sensor market size accounted for USD 266.63 billion in 2025 and is predicted to increase from USD 289.03 billion in 2026 to approximately USD 591.52 billion by 2035, expanding at a CAGR of 8.29% between 2026 to 2035.

Sensor Market Key Takeaways

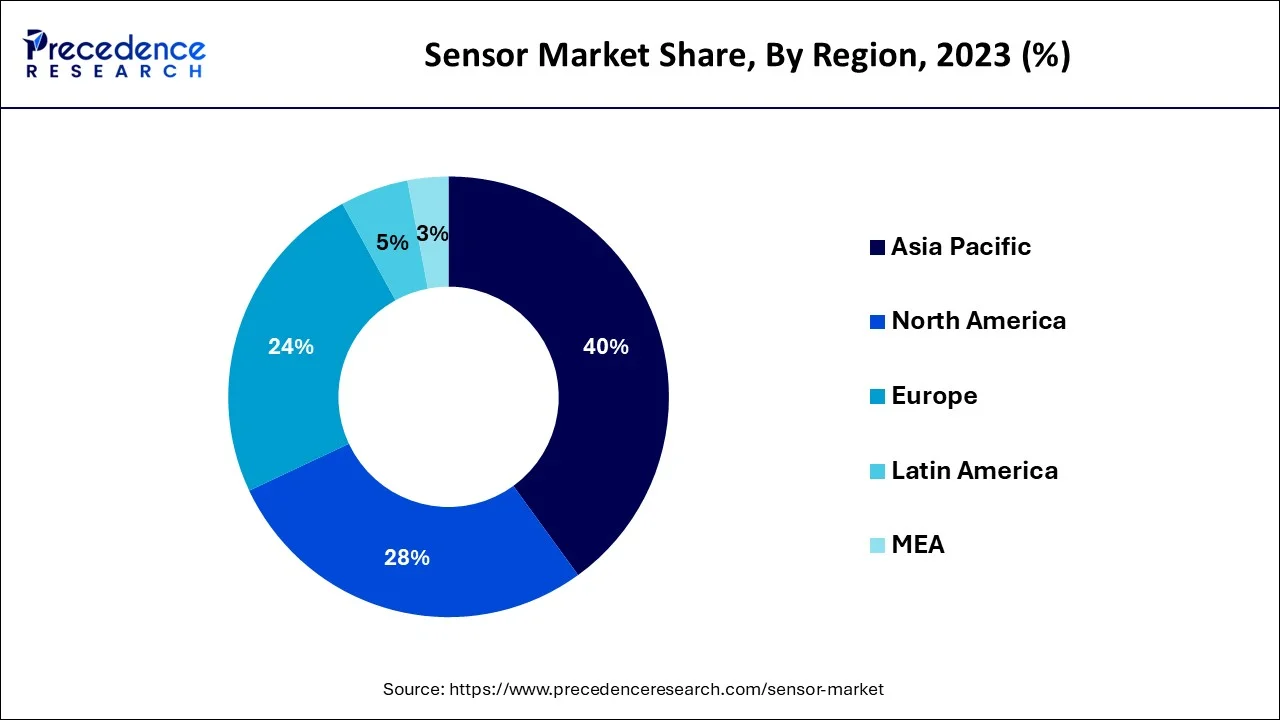

- By geography, The Asia Pacific generated more than 40% of the revenue share in 2025.

- By geography, the North American sensors market is projected to expand at a CAGR of 8.2% from 2026 to 2035.

- By type, thebiosensor segments is predicted to dominate the market from 2026 to 2035.

- By technology, the CMOS segments is considered to hold the maximum share in 2025.

- By end user, the industrial segments is projected to lead the market from 2026 to 2035.

What is the Sensor?

The market for sensors is expanding due to several factors, such as the increasing demand for surveillance cameras, consumer electronics, indoor navigation applications, high-accuracy motion sensors in video games, and the rising adoption of green energy technologies. The market is also augmenting due to increasing focus on research & development of new products. The Internet of Things (IoT) and enhanced image sensors used in various applications, including gas sensors, cameras, etc., are significant phenomena fueling the sensors market development.

How is AI contributing to the Sensor Industry?

AI transforms sensors into intelligent systems through various techniques such as pattern recognition, edge processing, sensor fusion, noise reduction, predictive maintenance, autonomous decision-making, and energy optimization to enable industrial, automotive, and environmental applications to have faster responses, greater accuracy, shorter lag times, and reliable information in real-time.

Market Outlook

- Industry Growth Overview: The global sensor market is constantly gaining momentum because of IoT prevalence, automation enhancement, and smart infrastructures.

- Sustainability Trends: Energy-efficient products, sustainable raw materials, prolonged lifetimes, and recyclability are becoming more and more important in the strategic picture.

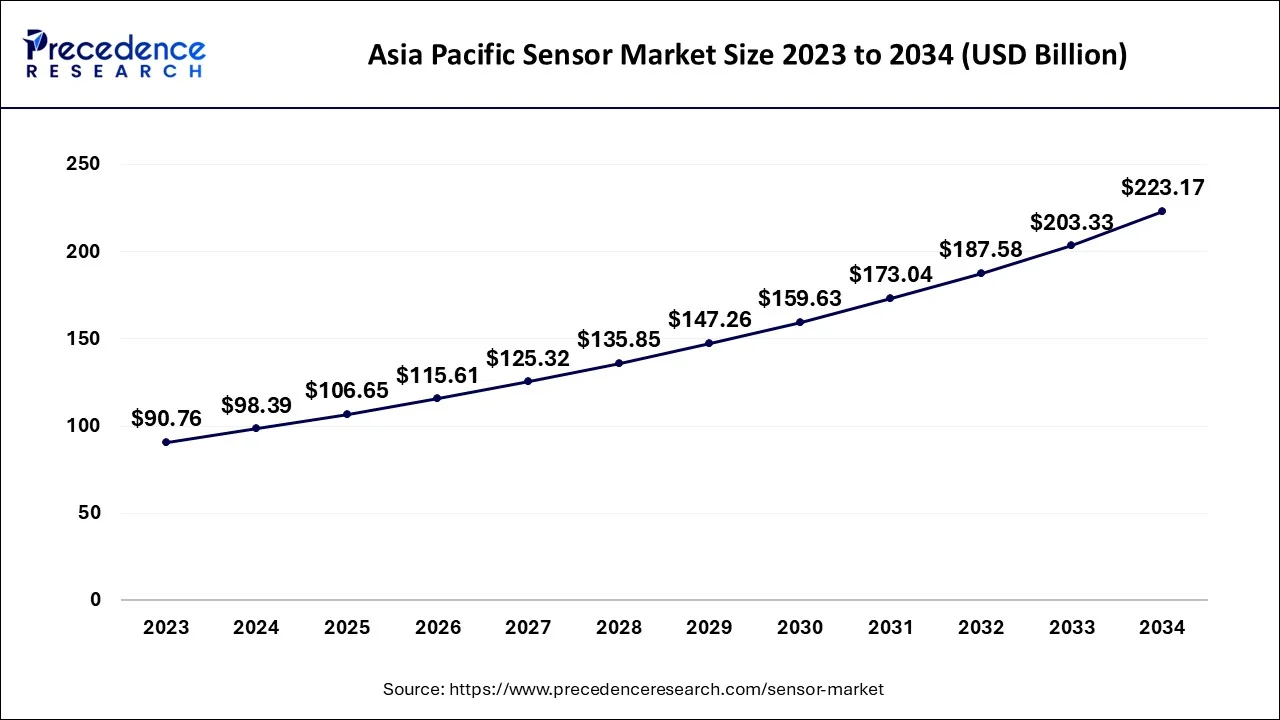

- Global Expansion: The Asia-Pacific region is the main player in the growth of the global market through its manufacturing and urban projects, whereas North America is still a considerable market.

- Major Investors: Bosch, Siemens, Texas Instruments, and Tiger Global Management are making progress in the sector through their funding and support of the most innovative ideas.

- Startup Ecosystem: Innovative startups are contributing to the development of very precise sensors for AI, aerospace applications, and environmental monitoring.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 266.63Billion |

| Market Size in 2026 | USD 289.03 Billion |

| Market Size by 2035 | USD 591.52Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.29% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Technology and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Improvements in sensor technology for the healthcare sector:

Patient treatments are being given at home more frequently as individuals expect to live longer and with a superior quality of life. Healthcare equipment is becoming more affordable to create, smaller, smarter, and easier to operate. A significant force driving advances in intelligent connected medical devices is the expansion of patient care outside of the hospital and into the home.

These intelligent, networked devices have various sensors utilized to collect essential data. This data is compiled and examined for rapidly diagnosing infections and delivering therapy. These smart gadgets use the most recent sensor technology, which offers better precision, reduced power consumption, repeatability, and digital output. These sensors facilitate the development of smaller and cheaper medical devices by streamlining innovative designs, lowering development costs, and accelerating supply chain efficiency. As a result, this increases the demand for sensors, propelling the market in the near future.

Restraint

Short shelf life of sensors:

Based on the gas to be detected and the environment it is used in, the sensor generally has a shelf life of six months to a year. For instance, if stored at optimal temperatures of 20o C, electrochemical sensors typically have a specified life span of six months from the manufacturing date. A small percentage of this time must inevitably be spent on producing the gas detector and exporting it to the consumers. Consequently, this aspect can limit the expansion of the sensor market.

Opportunities

Technological advancements in the automotive sector by manufacturers:

Sensors have asserted themselves as a necessary part of autonomous driving systems over the previous few decades. Although expensive, light detection and ranging (LIDAR) sensors are usually considered the essential technology for completely autonomous driving. Modern sensors can now detect the surroundings with greater detail because of recent advancements in radar technology, which significantly improves the environment perception quality of a sensor fusion system. Future autonomous vehicles will need sophisticated sensors because of their dependability, performance, and affordability.

Many more automobiles will provide hands-free and partially automated highway driving assistance systems in the coming year. For instance, Ford introduced its BlueCruise technology on the F-150 and Mustang Mach-E in 2021, and while it is less advanced than Super Cruise, has launched several Ford and Lincoln models in 2022. As a result, the market for sensors will benefit from the growing need for sensors in the automobile industry.

COVID-19 Impact

Due to severe lockdowns, a drop in sales of products, and halted vehicle production, the COVID-19 pandemic has had a detrimental impact on the sensor industry. Various industry manufacturers are making up for their losses due to declining sales and a disturbed ecosystem. Major market companies are spending money and increasing their production capacity to use cutting-edge sensors.

Major global sensor market competitors are concentrating on designing affordable sensor technologies to gain more clients worldwide. During the forecast period, the considerable presence of market participants active in the sensors market will also help fuel market expansion.

Sensor Market Share, By Type, 2022 (%)

| Revenue | 2021 |

| Biosensor | 11.43% |

| Optical Sensor | 3.91% |

| RFID Sensors | 3.42% |

| Image Sensor | 5.37% |

| Temperature Sensor | 3.13% |

| Touch Sensor | 2.44% |

| Flow Sensors | 2.69% |

| Pressure Sensor | 4.44% |

| Level Sensor | 2.72% |

| Others | 60.45% |

Segment Insights

Type Insights

The market for sensors is segregated into biosensors, optical, RFID, image, temperature, touch, proximity, pressure, and level sensors based on type. The biosensor is estimated to dominate the sensors market in the anticipated period. Nanotechnology-enhanced biosensors are highly profitable in various industrial applications, including imaging processes, microbial activity monitoring, and food analysis. Additionally, there is a rising need for efficient biosensors due to the increasing popularity of point-of-care testing methods. As a result, the market expansion for sensors is driven by biosensors' features.

Technology Insights

The sensors market is segmented into three major categories based on technology, viz., CMOS, MEMS, and NEMS. Digital cameras, CCTV cameras, and digital video cameras mostly use CMOS sensors to produce images. These electronic chips are also in barcode readers, astronomical telescopes, and scanners. It is possible to create low-priced consumer electronics thanks to CMOS's low cost of production. Robotics, machine vision, and embedded imaging applications use CMOS sensors.

For instance, 2D barcode scanners are used by robotic devices that pick and arrange items or move them from one location to another to identify the objects or bins they are carrying and move around a factory floor. Nonetheless, the CMOS is considered to hold the largest share in 2022.

End User Insights

The sensors market is divided into segments based on end-users, including healthcare, IT/telecom, automotive, industrial, and aerospace & defense. The industrial sector is predicted to lead the market among them in the near future. Due to the fast-growing automotive and electronics sectors, the industrial segment has most of the market share. For instance, sensors are crucial to developing intelligent, highly automatic products in industrial automation.

Machines can detect, process, analyze, and measure various positions, heights, appearances, lengths, and displacements in manufacturing facilities. These sensors also meet the requirements of many sensing applications. With sensors, manufacturers can monitor machine performance and get early warnings of any potential irregularities or issues, allowing them to be solved before they become serious.

Regional Insights

What is the Asia Pacific Sensor Market Size?

The Asia Pacific sensor market size is exhibited at USD 106.65 billion in 2025 and is expected to be worth around USD 240.28 billion by 2035, expanding at a CAGR of 8.46% between 2026 to 2035.

During the forecast period,the North American sensors market is anticipated to expand at a CAGR of 8.2%.Consistent adoption of industrial automation, expected to fuel the demand for sensors, is one of the primary trends in the North American region. Additionally, there is a significant increase in smartphone and wearable sales across North America, including smartwatches and fitness trackers. Over the projected period, this is anticipated to fuel the demand for proximity sensors.

It is expected that the United States will have the most significant market share during the projected period since businesses like Fitbit Inc. and Apple Inc. generate considerable profits. For instance, in 2022, Apple Watch held a majority of the global market for smartwatches. The main forces behind the lucrative expansion of the sensors market in the United States are the ever-expanding smartphone industry and a significant increase in capital investments.

Additionally, according to the Consumer Technology Association (CTA), activity fitness trackers with conventional functions like heart rate monitoring, GPS tracking, and calorie tracking are present in about 22% of Canadian households and are utilized in a fitness-related context. These gadgets are among the most widely used wearables in Canada.

How Is Asia-Pacific Leading in The Sensor Market?

The Asia-Pacific dominated the sensor market due to the manufacturing base, the embrace of smart factories, and investments in smart cities. The electric vehicles, renewable energy equipment, and consumer electronics markets are increasingly in demand, driving the need for technologies in the region with technology-conscious societies and rapid integration of industrial automation.

What Are the Driving Factors of The Sensor Market in Europe?

Europe is expected to grow at a remarkable rate during the forecast period. The sensor market in Europe is dictated by the necessity of energy-efficient solutions, environmentally friendly operations, and safety in industries. One of the growth areas is the high demand for smart transport, automation of industries, and high-efficiency sensors of electric vehicles and advanced factories.

Germany Sensor Market Trends

The market in Germany portrays a significant shift in the industry due to the automobile sector's prevailing position. The use of precise sensors in the industry increases not only production but also ensures safety and the acceptance of electric vehicles. The Research Faculties that have been established are the basis of the growth of MEMS, the use of edge computing, and AI-enabled predictive maintenance.

Value Chain Analysis of the Sensor Market

- Raw Material Procurement: Getting silicon wafers and other basic materials that are necessary for the production of efficient and reliable sensors.

Key players: Siltronic, SUMCO, GlobalWafers - Wafer Fabrication: Making electrical circuits on semiconductor wafers in the cleanest and most controlled chemical manufacturing environments.

Key players: TSMC, Intel, Samsung - Photolithography and Etching: Transferring circuit designs to the wafers and cutting off layers to create sensor shapes.

Key players: ASML, Applied Materials, Lam Research - Doping and Layering Processes: Changing the properties of semiconductors and putting layers in order to make them electrically functional and connect them.

Key players: Tokyo Electron, KLA Corporation - Assembly and Packaging of Sensor: Dividing wafers into small pieces, shielding components, and getting sensors ready for testing and installation.

Key players: Amkor Technology, ASE Group

Sensor Market Companies

- STMicroelectronics NV: Produces semiconductors, microcontrollers, and sensor solutions used in the automotive, industrial, and consumer electronics applications across the world.

- Bosch Sensortec GmbH.: Designs MEMS sensors in consumer electronics and IoT-connected devices and relies on them for high-quality results.

- ABB Group: Its products are used in complex environments to offer industrial automation, electrification, robotics, and advanced sensors.

Other Major Key Players

- Siemens AG

- OMRON Corporation

- Texas Instrumental Incorporated

- Drägerwerk AG & Co. KGaA

- Samsung Electronics Co Ltd.

- International Sensor Technology

- DENSO Corporation

- NXF Semiconductors

- Honeywell International Inc.

Recent Developments

- In January 2026, Agereh Technologies Inc. released new sensors to enhance data collection accuracy for digital twins in transportation networks. These patent-pending solutions expand Agereh's offerings, positioning the company at the forefront of sensing, simulation, and innovation within the transportation industry. (Source: https://www.globenewswire.com )

- In September 2025, Smart Meter launched iAmbientHealth, a radar-based ambient sensor for monitoring patients' vital signs without wearables or cameras. It enables real-time health insights while addressing challenges in remote patient monitoring, including privacy and usability.

(Source: https://www.medicaleconomics.com ) - In March 2022, SensiML Corporation, a well-known supplier of AI solutions for building intelligent Internet of Things (IoT) endpoints, will support the Arduino Nicla Sense ME mini form factor board, which integrates Bosch Sensortec sensors.

- A brand-new, accurate navigation sensor for use in aircraft and other industries was unveiled by Honeywell in March 2022. The aerospace and defence sectors are the intended uses for the MV60 micro-electro-mechanical system (MEMS) accelerometer. Even so, it might also be useful in industrial and military applications that require very precise, navigation-grade accelerometers that are portable, light, and power-efficient.

- STMicroelectronics released The Intelligent Sensor Processing Unit (ISPU) in February 2022. This device combines a MEMS sensor and a Digital Signal Processor (DSP) capable of running AI algorithms on the same silicon.

- The quickest, most precise moisture monitoring was provided by ABB's High-Performance Infrared-Reflection (HPIR-R) moisture sensor in January 2022. The sensor enables mills to increase throughput while reducing operational expenses by providing precise, high-resolution measurement at up to 5,000 readings per second.

- A new rate sensor from Honeywell, the HG4934 Space Rate Sensor, was introduced in June 2021 to help small spacecraft navigate increasingly crowded orbits above the surface of the Earth. The new micro-electromechanical system (MEMS)-based product is a fantastic fit for customers that are developing smaller, less expensive satellites. It will be more affordable and use less power while still performing at a high level.

Segments Covered in the Report

By Type

- Biosensors

- Optical Sensor

- RFID Sensors

- Image Sensor

- Temperature Sensor

- Touch Sensor

- Flow Sensors

- Pressure Sensor

- Level Sensor

- Others

By Technology

- CMOS

- MEMS

- NEMS

- Others

By End User

- Healthcare

- IT/Telecom

- Automotive

- Industrial

- Aerospace & Defense

- Others

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content