3D Rapid Liquid Printing Market Size and Forecast 2025 to 2034

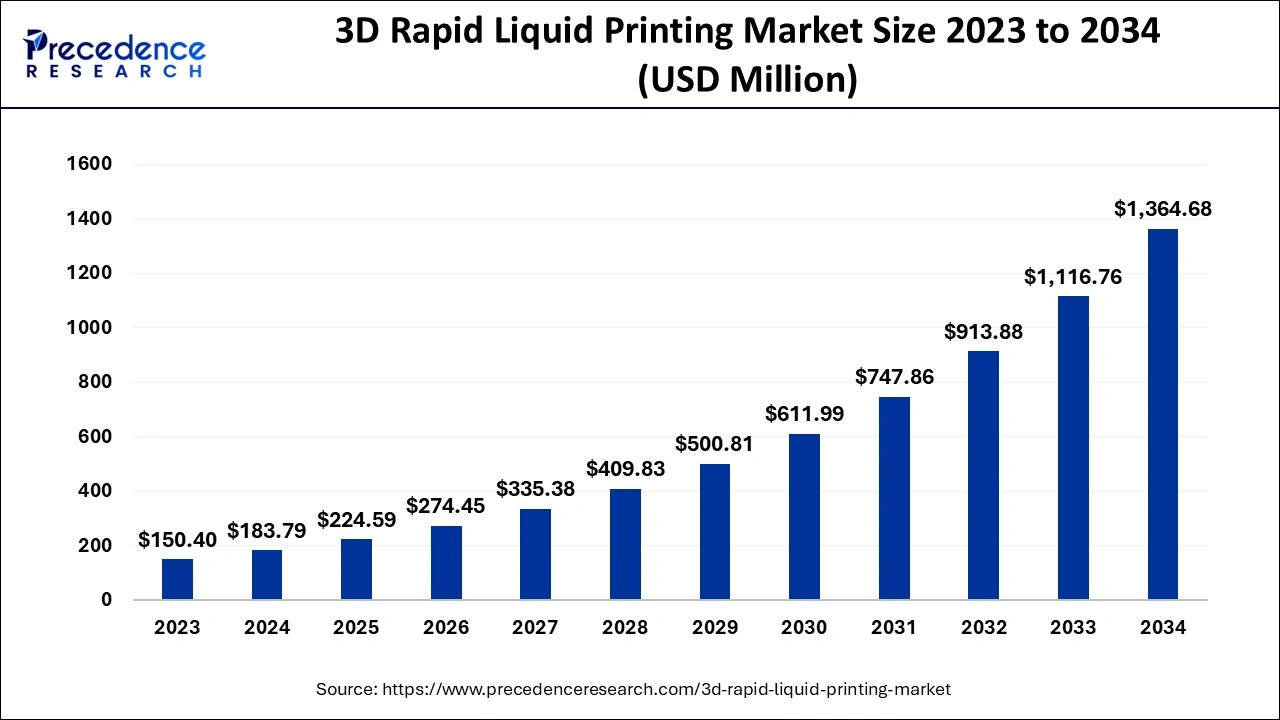

The global 3D rapid liquid printing market size was valued at USD 183.79 million in 2024 and is estimated to hit around USD 1,364.68 million by 2034, growing at a double-digit CAGR of 22.20% from 2025 to 2034. The 3D rapid liquid printing market is growing because of improved technology, the need to create products based on customers' requirements, cheaper solutions, and new materials, as well as applications in the sectors of healthcare, avionics, and the automobile industry.

3D Rapid Liquid Printing Market Key Takeaways

- The global 3D rapid liquid printing market was valued at USD 183.79 million in 2024.

- It is projected to reach USD 1,364.68 million by 2034.

- The 3D rapid liquid printing market is expected to grow at a CAGR of 22.20% from 2025 to 2034.

- North America dominated the 3D rapid liquid printing market in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By component, the printers segment accounted for the biggest share of the market in 2024.

- By component, the materials is projected to grow at a significant CAGR during the forecast period.

- By application, the prototyping segment held the largest market share in 2024.

- By application, the manufacturing segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use, the automotive segment accounted for the highest share of the market in 2024.

- By end-use, the aerospace and defence segment is anticipated to grow significantly during the forecast period.

How is Artificial Intelligence (AI) Changing the 3D Rapid Liquid Printing Market?

The emerging technology impacting the 3D rapid liquid printing market is artificial intelligence in the spheres of design, manufacturing, and materials. AI uses these algorithms to improve design careers, and with machine learning, the generation of complex structures and optimum geometry in the shortest time with less scrap is achieved. It also manages or controls the process of printing in order to achieve higher accuracy, uniformity, and quality because of the real-time operational algorithms provided by artificial intelligence. AI breaks down the time and cost of finding and creating new, stronger, or more adaptable materials that broaden the scope of applications for RLP.

Market Overview

The 3D rapid liquid printing market provides the ability to quickly create three-dimensional structures out of fluids such as polymers or hydrogels. Rapid liquid printers build an object by laying down materials successively using technologies like inkjet printing heads to produce. Physical objects from digital designs. Manufacturing industries, healthcare, automotive, and consumer product industries are responsible for areas such as prototype production, tooling, anatomical models, and design validation. The objective of rapid liquid printing is to develop technology that will enable large-scale products to be produced at a fast rate and also to enable the customer to design and put the product into production.

3D Rapid Liquid Printing Market Growth Factors

- Advancements in technology: Backing up advanced speed, precision, and widening of materials because of innovative development.

- Demand for customization and prototyping: RLP is useful for companies that need to build prototypes in the automotive, aerospace, and health industries.

- Cost reduction: The manufacturing method practiced in order to produce Apple's product also greatly cuts down on the wastage of materials hence cutting down on the cost of the materials to be used.

- Industrial and consumer applications: RLP technology is applied in electronics manufacturers, consumer products industries, aerospace, and construction industries, among others.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,364.68 Million |

| Market Size in 2024 | USD 183.79 Million |

| Market Size in 2025 | USD 224.59 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Metal component manufacturing growth

Many car makers and aircraft makers are using metal 3D printing in making light alloy brackets, engine clamps, valves, and turbo blades for aircraft engines. They are capable of using ultrahigh-intensity liquid printing techniques to produce metal components that are stronger but have less weight than casting parts.

The high pace of development of metal component production, especially in the automotive and aerospace industries, is one of the key factors driving the rapid growth of the 3D rapid liquid printing market. As 3D printing technology advances and the components used in metals begin to develop, metal additive manufacturing is gradually shifting towards the areas of low-volume production runs and custom component fabrication.

Restraint

The cost involved in manufacturing printers

The main obstacles to the development of the 3D rapid liquid printing market are excessive expenditures to fabricate the printer and materials compatible with liquid printing. Further, the technologies demand serious research and developmental undertakings in order to obtain increasingly sharper resolutions and enhanced rates of printing. The system also demands advanced apparatus such as optical systems and highly specially designed mechanisms for handling fluids, which calls for a much higher capital investment for RLP-3D.

Opportunity

Growing applications

The 3D rapid liquid printing market can deliver multiple solutions for the aerospace, healthcare, automotive, and consumer electronics industries. Due to its ability to create prototypes and make parts within a short space of time, it is preferable in industries in which the design and manufacturing should be very flexible. Furthermore, medical applications, including custom implants, prosthetics, and tissue engineering, will also find advantages in using RL-3D in terms of the capability of the printer to print with bio-compatible material with incredibly fine details. Future development could be inspired by its application in fashion, architecture, and education sectors, thus providing affordable, eco-friendly solutions with opportunities for customizing products.

Component Insights

The printers segment dominated the global 3D rapid liquid printing market in 2024. The printers are classified into two types, namely, desktop printers and industrial printers. It is divided into design and inspection, printing, and scanning aspects of the software. Industrial 3D printers use CAD to construct 3D objects from liquids such as hot plastic or powder substances, which can be small office-built equipment or large construction-sized printers. The adoption of end-use parts with the help of rapid liquid printers is attributed to this segment's growth.

- In October 2024, Lynxter the elastomer focused 3D printing technology company is bringing in high-performance filament 3D printing with the new machine launched S300X – FIL11 | FIL 11. The ‘speed king' IDEX system is developed to work at high revolving speeds and handle industrial thermoplastics.

The materials segment is expected to witness significant growth in the 3D rapid liquid printing market during the forecast period. Rapid liquid printing (RLP) is one type of additive manufacturing or 3D printing technique that employs inorganic liquids such as polymers and hydrogels. RLP is made of industrial materials, and it can develop goods of high volumes and specifications. Substrate materials, which include plastics, metals, ceramics, and biomaterials, are getting used in additive manufacturing strategies that preserve special features which include strength, flexibility, conductivity, and biocompatibility, thereby enhancing the opportunity for their use in all forms of industry, including aerospace, automotive, energy and medical among others.

Application Insights

The prototyping segment held the largest share of the 3D rapid liquid printing market in 2024. Rapid liquid printing is an experimental 3D printing technique that is used for prototyping and mass customization. Rapid prototyping (RP) is a technique of direct tooling manufacturing process of solid objects from computer-generated models. The physical prototypes can be easily developed using RLP. Rapid prototyping can be described as the set of processes or technology that is employed in the creation of a real part from a three-dimensional model. In rapid prototyping, an engineer and designer can build the final product faster by incorporating several design loops of virtual models and physical prototypes at a minimal cost.

The manufacturing segment is expected to grow at the fastest rate in the 3D rapid liquid printing market over the forecast period. The 3D printing in manufacturing has advantages over the traditional techniques. Advantages of 3D printing or AM include lower waste, increased speed, design versatility, and a variety of materials at lower costs. 3D printing is a manufacturing technique that uses an object's digital model to build a three-dimensional object layer by layer. Additive manufacturing is revolutionizing manufacturing because it allows the on-demand production of parts and products without expensive tools and molds.

End-Use Insights

The automotive segment dominated the 3D rapid liquid printing market in 2024. Additive production is revolutionizing automobile manufacturing with the help of easing the generation of lightweight, complicated, and customized design elements, fixing automobile performance, fuel economy, and structure modulation, besides decreasing manufacturing costs and time required for prototyping and spare parts production. The potential for creating components that are both low in weight and high in strength can deliver benefits to various characteristics of vehicles and within the automotive industry by using environmentally friendly and efficient solutions to create vehicles.

- In November 2022, Materialise N.V. declared that seven additional partners had joined its CO-AM platform. These solutions support design and pre-printing automation, traceability, printing, and post-processing for 3D-printed parts.

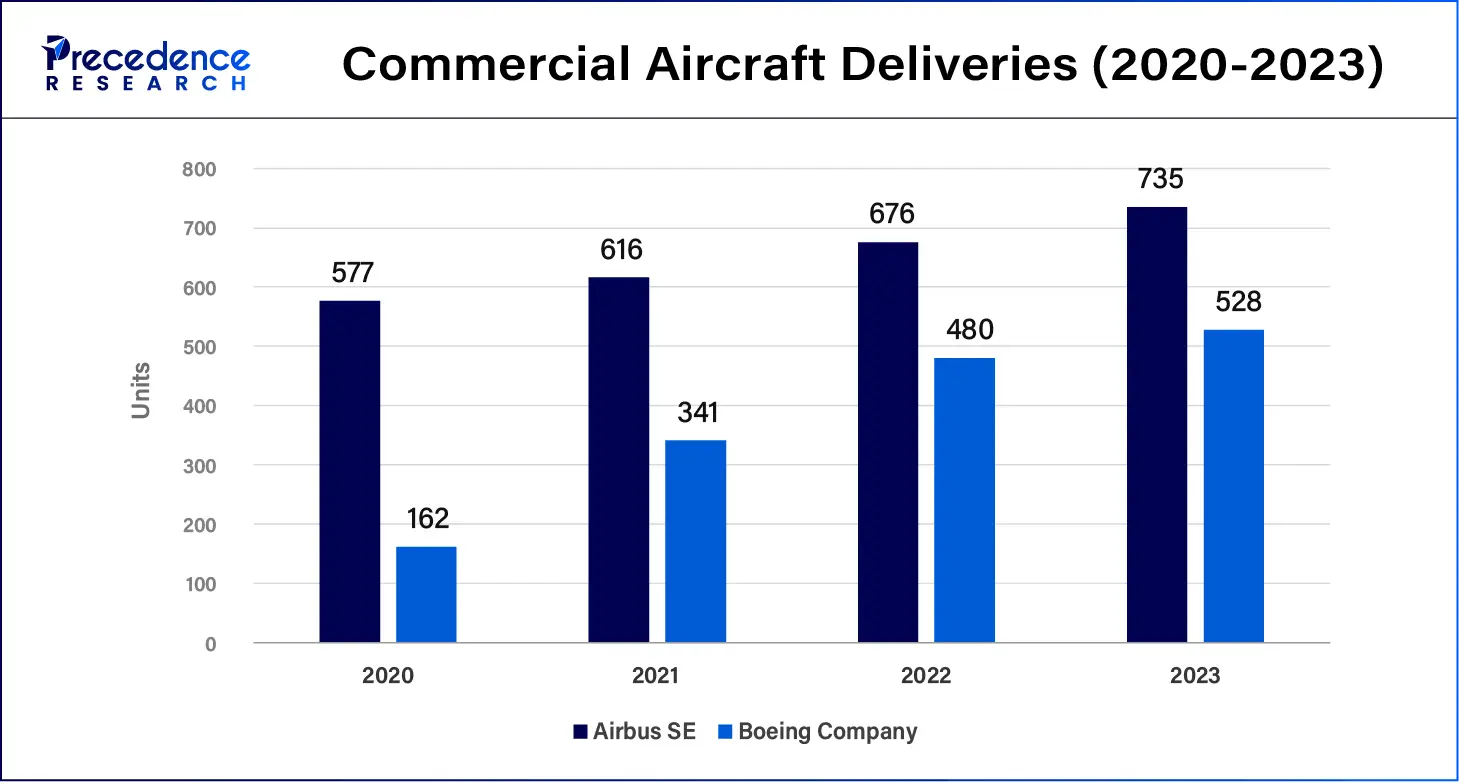

The aerospace & defense segment is anticipated to grow significantly in the 3D rapid liquid printing market during the forecast period. 3D printing certainly makes prototypes and has end-use applications in the aerospace and aviation sectors. Components built using additive manufacturing can be stronger and lighter than the components built using mechanical manufacturing techniques. The driving force behind the aerospace 3D printing market is continually changing as the aerospace industry demands new products that can be produced both quickly and cheaply for commercial, military, space, and UAV applications. The ability to utilize 3D printing to create lightweight and high geometric density parts with optimized structures affects the aircraft production process, especially the aircraft parts of commercial, business, and special purpose aviation, including helicopters.

- In October 2023, The Boeing Company and ASTRO America are ready to flight test a 3D-printed main rotor system for the AH-64 Apache attack helicopter next spring. The new rotor link assembly with the largest 3D metal printer all over the world reduces the supply chain lead time of one year to a mere eight hours.

Regional Insights

North America led the global 3D rapid liquid printing market in 2024. The rapid growth in the aerospace & defense industry in the North American region and the availability of key printing material manufacturers are the factors for the growth of the rapid liquid printing market. The region has been on the front line for research, development, and marketing of additive production. The research businesses were active in developing additive manufacturing techniques, which include RLP in aerospace, automobile, and healthcare fields, due to the availability of leading technology solutions providers and high technology take-up rates in the verticals of aerospace, automobile, and healthcare. The emphasis is placed on research and development activities, together with technological enhancements in the region.

Asia Pacific is anticipated to grow notably in the 3D rapid liquid printing market during the forecast period. Because of a higher demand for 3D printing technologies in the automotive, aerospace and defense, healthcare industries, and other industries due to rapid industrialization in this region, there has been increased investment in advanced manufacturing technologies and the increasing demand for complex and innovative products. In advanced manufacturing technologies, there is a growing demand for customized and innovative products. Current technological giants, including China, Japan, and South Korea, are among the most technologically developed nations in the region.

3D Rapid Liquid Printing Market Companies

- Stratasys

- 3D Systems

- Materialise

- EOS GmbH

- HP Inc.

- SLM Solutions

- GE Additive

- ExOne

- Voxeljet

- Renishaw

- Proto Labs

- Carbon, Inc.

- Formlabs

- Desktop Metal

- Markforged

- Ultimaker

- XYZprinting

- Tiertime

- EnvisionTEC

- BCN3D Technologies

Latest Key Players Announcement

- In March 2024, Rapid Liquid Print, an MIT spin-off, received USD 7 million in its series of funding. The investment round saw Germany's HZG Group take the lead with BMW I Ventures and MassMutual via its MM Catalyst Fund. Schendy Kernizan, co-founder and CEO at RLP, says: The HZG Group has identified an investor who will fully appreciate the capabilities of our technology and has its own experience in a record of setting standards with the introduction of metal 3D printing on an industrial scale.

Recent Developments

- In November 2024, Supernova, a recently spun out of Spanish 3D printer manufacturer BCN3D, released its new Pulse Production Platform for high-viscosity resins. The company has also launched Viscogels, a group of photopolymer materials developed as a part of the company's own intellectual property that has better mechanical properties than competitive resins.

- In October 2024, Coperni presented the Ariel Swipe bag, made of silicone and created from liquid using the 3D technique. Shown during the Coperni Spring Summer 2025 collection, the bag is created by pouring liquid silicone into a mold in a gel suspension, which keeps the silicone in a specific form until it has set.

Segments Covered in the Report

By Component

- Printers

- Materials

- Software

- Services

By Application

- Prototyping

- Manufacturing

- Customization

- Others

By End-Use

- Automotive

- Aerospace

- Healthcare

- Consumer Goods

- Construction

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting