Acetic Acid Market Size?

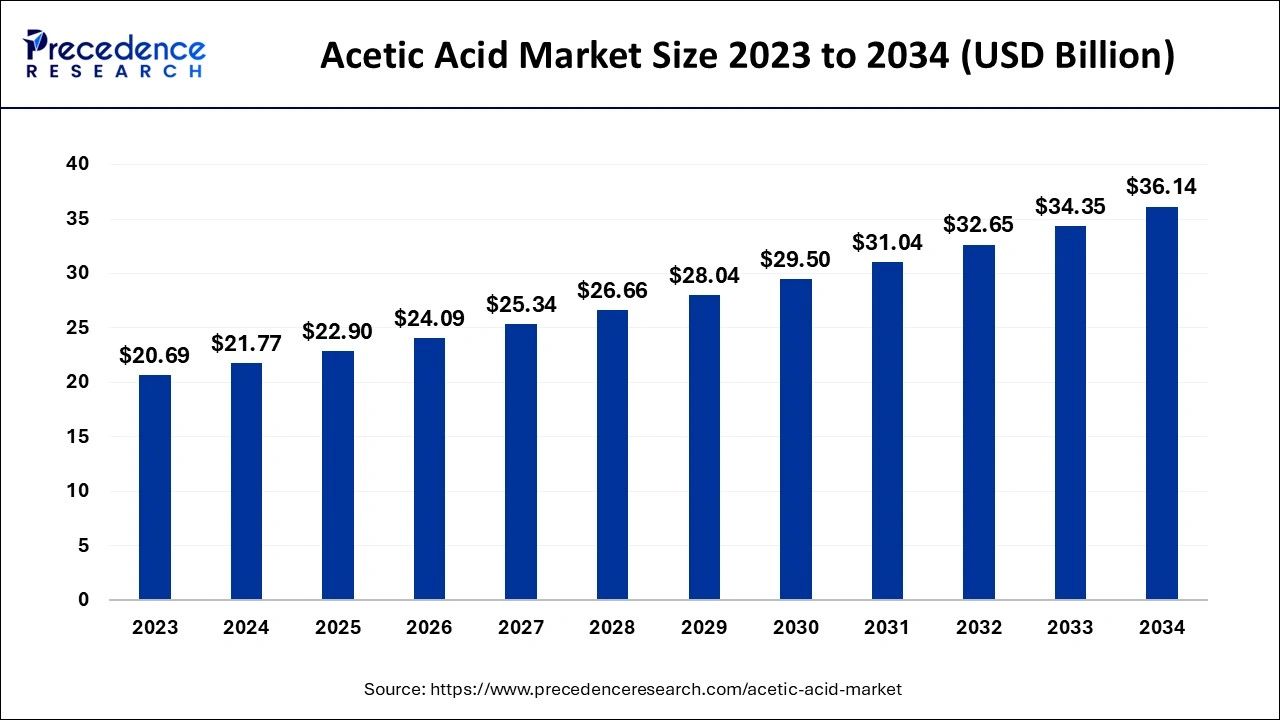

The global acetic acid market size is estimated at USD 22.90 billion in 2025 and is predicted to increase from USD 24.09 billion in 2026 to approximately USD 37.87 billion by 2035, expanding at a CAGR of 5.16% from 2024 to 2034.

Acetic Acid Market Key Takeaways

- By application, the vinyl acetate monomer segment accounted highest revenue share of around 45.3% in 2025.

- The acetic anhydride application segment has contributed 19.5% revenue share in 2025.

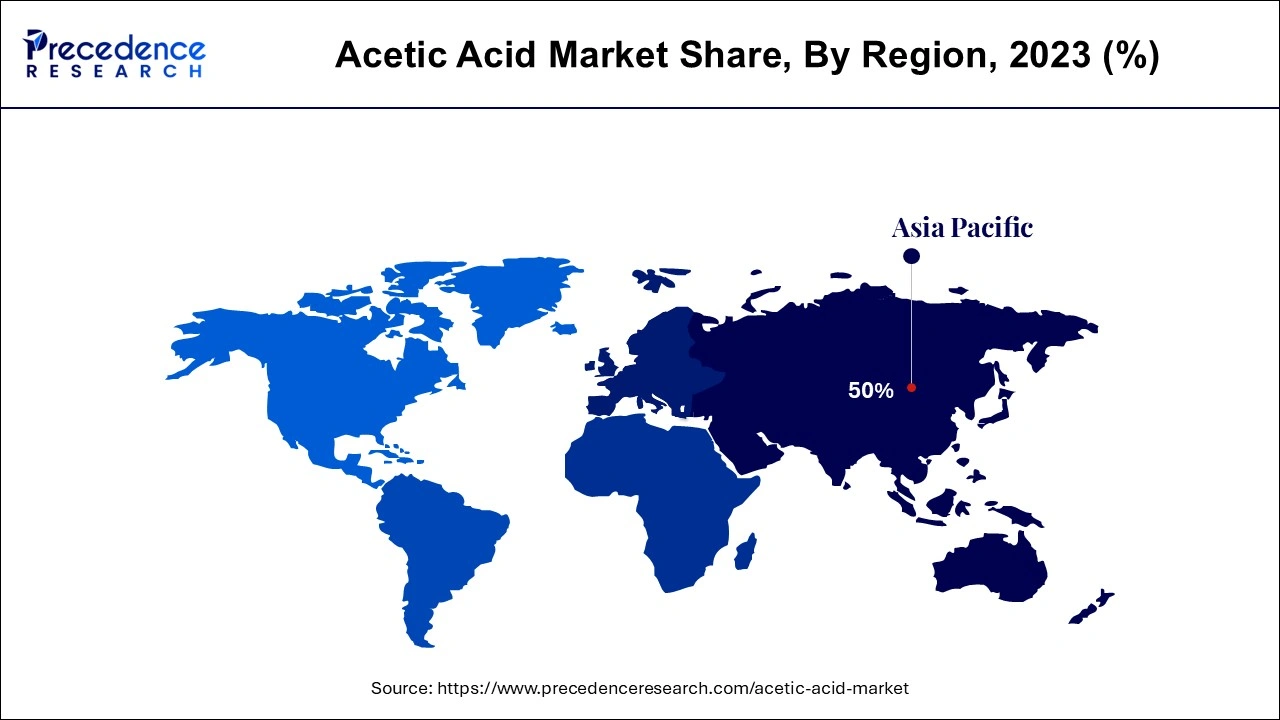

- The Asia Pacific has accounted revenue share of around 50% in 2025.

Market Overview

Acetic acid (CH3COOH), often referred to as ethanoic acid or methane carboxylic acid, is an organic chemical that is colorless and has a pungent, harsh, and sour smell. It is one of the most significant chemical reagents and industrial chemicals used in the manufacturing of volatile organic esters such as ethyl and butyl acetates, vinyl acetate, cellulose acetate, and metal acetates. The growing use of acetic acid in the manufacture of terephthalic acid is anticipated to support market expansion throughout the anticipated time frame. In the production of polyester resins, which are widely utilized in polyester films, PET resins, and polyester fibers, terephthalic acid plays a key role as a building component. Terephthalic acid is also used in the production of textiles including bed sheets, clothing, and curtains, as well as in home furnishings.

The market size is anticipated to increase during the assessment period due to the expanding usage of acetic acid in the production of several products, including vinyl acetate monomers (VAM) and pure terephthalate acid. Vinyl acetate monomers, which are made from acetic acid, are frequently used to make resins and polymers for textiles, paints, coatings, adhesives, films, and other end-use goods.

Acetic Acid Market Growth Factors

A clear organic liquid, acetic acid is sometimes referred to as ethanoic acid. The second most straightforward carboxylic acid, acetic acid has methyl as its functional group. It is used in the synthesis of several chemical compounds as a chemical reagent. The production of vinegar, acetic anhydride, vinegar, and vinyl acetate monomer are the main products made from acetic acid. It serves as an important industrial chemical and chemical reagent in the manufacture of synthetic fibers, textiles, and photographic film. As a result, the acetic acid market is growing due to the expansion of the textile sector.

- The growing end-user demand

- Increasing advancements in acetic acid

- End-user industries, including textiles, packaging, and food, have a flurry of demands on acetic acid, thereby impacting steady growth.

- Industrial applications are entering a new phase as vinyl acetate monomer, acetic anhydride, and other derivatives use more acetic acid.

- Growth in the textile sector and a rise in acceptance for its application in synthetic fibers and fabrics sustain the long-term demand.

- Advancements made in the field of acetic acid production are upping productivity and thus increasing its applications.

- Market potential continues to be buoyed by the rising importance of acetic acid as the foremost industrial chemical and reagent across applications.

Major Trends

- Increasing adoption of bio-based and low-carbon acetic acid in response to regulatory mandates and consumer pressure for greener products drives the market.

- There is a rising use of innovative catalysts and optimized processes to convert waste into high-purity acetic acid, improving efficiency and reducing energy consumption.

- Growing demand for high-purity and specialty acetic acid in pharmaceuticals, food, and personal care sectors contributes to the market.

Strong emphasis on waste recovery and reuse of by-products to support sustainable and circular production practices also supports market expansion.

Market Outlook

- Industry Growth Overview: The global acetic acid market is growing due to rising demand in pharmaceuticals, food & beverages, and personal care products, alongside increasing industrial applications in solvents and chemical intermediates. Advancements in production technology and high-purity grades are further driving market expansion.

- Sustainability Trends: The market is being reshaped by a strong shift toward bio-based and low-carbon acetic acid, driven by regulatory mandates and consumer demand for greener products. Additionally, circular manufacturing practices, waste recovery, and process optimization are enabling more energy-efficient and environmentally responsible production.

- Global Expansion: The market is expanding worldwide as manufacturers adopt advanced production techniques and integrated facilities to meet growing industrial and consumer demand. Emerging regions such as Asia-Pacific and Latin America present significant opportunities due to rapid industrialization, expanding chemical industries, and increasing consumption of specialty acetic acid grades.

- Major Investors: Key investors include global chemical manufacturers, private equity firms, and venture capital funds focused on green chemistry. Their investments support expansion of integrated production facilities, development of bio-based acetic acid, and adoption of advanced process technologies, driving innovation and market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.90Billion |

| Market Size in 2026 | USD 24.09 Billion |

| Market Size by 2035 | USD 37.87Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.16% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Application, End-Use, Geography |

| Region Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa (MEA) |

Market Dynamics

Key Market Drivers

- Rising expansion of the textile sector - Acetic acid, also known as ethanoic acid, is frequently used to make vinyl acetate and metal acetate, which are then used to make chemical reagents for textiles, photographic films, paints, and volatile organic esters. Acetic acid is a common component in the printing and dyeing of textiles in the textile industry. To reach US$291.22 billion in 2020, China's textile and apparel exports climbed by 9.6%, according to the Ministry of Industry and Information Technology of China. Moreover, the U.S. Department of Commerce reports that from January to September 2021, shipments of clothing jumped by 28.94% to US$4.385 billion while exports of products from textile mills increased by 17.31% to US$12.365 billion. The production of synthetic fibers in the textile industry uses vinyl acetate monomer. As a result, the demand for textiles is increasing globally, which is driving the expansion and is anticipated to account for a sizeable portion of the acetic acid market.

- Vinegar used in the food business has increased - The rise in demand for food products has been brought on by the rapid population growth and the adoption of a sustainable and nutritious diet, which has raised the level of food production worldwide. Global vegetable output reached 1128 million tonnes, up 65% from 2000, while fruit production increased to 883 million tonnes, up 54% from that year. In order to make vinegar, which is a common component in foods and personal care items, acetic acid is mostly used. Pickling solutions, marinades, and salad dressings all contain vinegar. Additionally, it lessens the possibility of salmonella infection in meat and poultry products. A further application for acetic acid and its sodium salts is food preservation. As a result, the market for acetic acid is growing as a result of the spike in the usage of vinegar in the food business.

Key Market Challenges

- Fluctuating costs of raw materials - The acetic acid market has identified fluctuating costs for the raw materials needed to make the acid as a significant barrier. As a result, enterprises that produce alumina are observing fluctuations in their profit margins, which makes it challenging for them to plan for growth. The irrationality of development strategies will definitely prevent market growth.

Key Market Opportunities

- Increasing opportunities in different sectors - The acetic acid market is expected to grow rapidly in emerging nations. The economies of these countries are rapidly growing, and chemical, textile, and coating manufacturing facilities have increased dramatically. Because of the rise of these projects, the demand for acetic acid has a very promising future.

Segment Insights

Application Insights

On the basis of application, the vinyl acetate monomer (VAM) segment has dominated the market in 2023. Currently, one of the most quickly expanding uses for acetic acid, which accounts for the majority of its total worldwide use, is vinyl acetate monomer (VAM), an intermediary in the manufacturing of a variety of chemical derivatives. In the composition of paints and coatings, vinyl acetate monomer is frequently used. VAM is polymerized to create polyvinyl acetate or other polymers that are crucial components in the paints industry. Acetic acid is in high demand since it is used as a crucial chemical reagent in the industrial sector.

Polyester, including polyester fiber, polyester film, and polyethylene terephthalate (PET) bottles, is produced using purified terephthalic acid (PTA). Additionally, textiles and food and beverage containers employ this polyester. Coatings and other composite materials are a few examples of further PTA uses. Population growth has raised the need for food and drink, which has boosted the need for plastic bottles and containers made of polyester. The demand for this kind of acid is also quite large internationally because of this feature.

End-Use Insights

On the basis of end users, the food & beverages segment has dominated the market and it will continue to grow well in terms of revenue. Acetic acid is used to produce PET bottles, which are subsequently used to hold food and beverages. In food processing facilities, acetic acid is frequently used as cleaning and disinfecting agents. Acetic acid is the main component of vinegar, a popular culinary ingredient used in sauces and the pickling of vegetables. As a consequence of advancements in the food and beverage industry, the acetic acid market is growing.

The market for acetic acid worldwide that is increasing with the significant rate is paints and coating segment. When VAM is polymerized to create polyvinyl acetate or other vital components of the paints industry, paint and coating compositions require a significant amount of the vinyl acetate monomer that is created.

Regional Insights

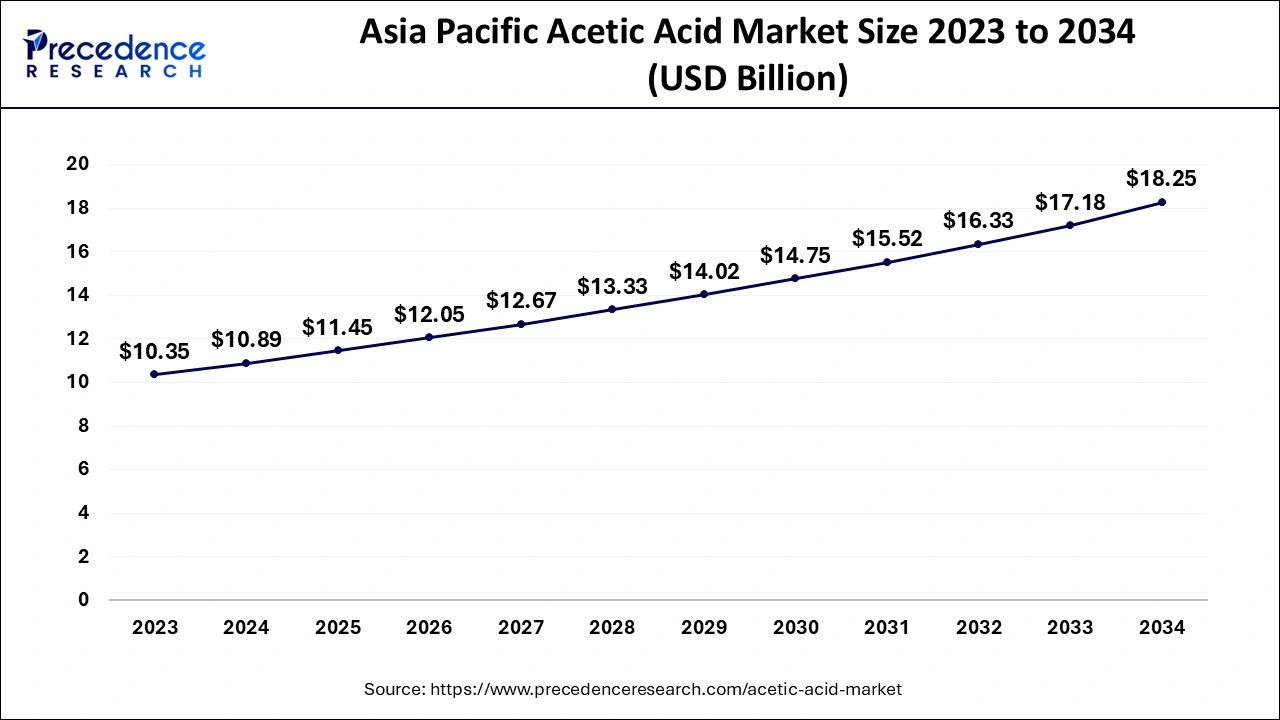

What is the Asia Pacific Acetic Acid Market Size?

The Asia Pacific acetic acid market size is evaluated at USD 11.45 billion in 2025 and is predicted to be worth around USD 19.17 billion by 2035, rising at a CAGR of 5.29% from 2026 to 2035.

On the basis of geography, Asia-Pacific has accounted for the majority revenue share in the market throughout the projection period. Numerous end-use sectors like textile, food and beverage, agricultural, home cleaning goods, polymers, and paints and coatings are primarily responsible for this increase. The region's industrial expansion has also been aided by a rise in urbanization and disposable income in the area. Acetic acid is widely used to make vinegar, vinyl acetate, and metal acetates, which are then employed in a variety of end-use industries. Additionally, Asia-Pacific is one of the key areas for producing plastic, which offers significant chances for regional businesses to flourish. China produced 32% of the plastic used in the globe, according to Plastic Europe. Consequently, the region's strong expansion in a number of end-use sectors is also driving the rise of acetic acid market.

How is the Opportunistic Rise of Europe in the Acetic Acid Market?

Europe is experiencing an opportunistic rise in the market due to its focus on sustainability, advanced production technologies, and integrated chemical manufacturing facilities. Strong demand for high-purity and specialty grades in pharmaceuticals, food, and personal care sectors, combined with regulatory support for low-carbon and bio-based chemicals, is driving growth. Additionally, recovery and reuse of by-products in circular production models are helping European manufacturers strengthen their market position and reduce dependency on volatile raw material imports.

Up to 2034, the North American market might see positive growth. Ethanoic acid is being used more often in a variety of applications as a result of the expansion of the chemical industry and increased demand from end-use industries including the textile and construction sectors. The ethanoic acid market has expanded as a result of rising investments and expanding production facilities from big businesses like Celanese and BP Plc. Additionally, a rise in consumer spending and disposable income is driving the expansion of the textile and construction industries. Due to the U.S. dominating the fashion sector, the pace of chemical consumption is supported by an increase in the textile industry. There will likely be a considerable increase in North America as a result of these causes.

Trade Analysis

- The world exported 72,270 shipments of Acetic Acid (HSN Code 2915) via 7,477 exporters to 9,784 buyers.

- The top destination countries for these exports are India, Vietnam, and Mexico.

- The leading exporters globally are:

- China – 20,861 shipments

- India – 8,683 shipments

- U.S. – 5,132 shipments

Value Cain Analysis

- Feedstock Procurement

Feedstock procurement for acetic acid involves sourcing the primary substances that enter into its manufacture. The most common feedstock is methanol.

Key Players: Celanese, Eastman Chemical, INEOS - Chemical Synthesis and Processing

It is the industrial methods of manufacturing and purifying on a large scale.

Key Players: LanzaTech and Zeachem Inc - Compound Formulation and Blending

Compound formulation and blending of acetic acid refer to processes of admixture of acetic acid with other substances to get a final product with particular characteristics.

Key Players: Biorefineries, Cargill, and LanzaTech - Waste Management and Recycling

Waste management and recycling of acetic acid processes involve treating, recovering, and reusing the acetic acid from industrial waste streams, often with the help of advanced technologies like fractional distillation, liquid-liquid extraction, and extractive distillation.

Key Players: BP, Celanese, and SINOPEC - Regulatory Compliance and Safety Monitoring

Regulatory compliance and safety monitoring of acetic acid means maintaining the production, handling standards under national and international standards concerning the environmental impact of acetic acid.

Key Players: Celanese Corporation, Eastman, LyondellBasell)

Acetic Acid Market Companies

- Eastman Chemical Company

- Celanese Corporation

- LynodellBasell Industries

- Holding B.V.

- SABIC

- Indian Oil Corporation Ltd

- Gujrat Narmada Valley Fertilizers & Chemicals Limited

- Pentokey Organy

- Ashok Alco Chem Limited

- DAICEL CORPORATION

- The Dow Chemical Product

- HELM AG

- Airedale Chemical Company Limited

- DubiChem

- INEOS

Recent Developments

- In July 2025, Petrobras revealed plans to build acetic acid and monoethylene glycol (MEG) plants in Rio de Janeiro as part of its USD 6.08 billion capex program (2025–2029), aiming to reduce Brazil's reliance on imported acetic acid.

(Source- https://www.icis.com/) - In September 2025, Premier Green Innovations and Entity 1 Value Emission formed a strategic alliance to convert agricultural and industrial waste into key products using Microbial Electrochemical Cell technology.(Source- https://sahyadristartups.com)

- In December 2024, Lenzing Group is partnering with Italian chemicals manufacturer CPL Prodotti Chimici and Calzedonia brand owner Oniverse to introduce biobased acetic acid for fabric dyeing.(Source- https://www.globaltextilesource.com)

Segments Covered in the Report

By Application

- Vinyl Acetate Monomer

- Acetic Anhydride

- Acetate Esters

- Purified Terephthalic Acid

- Ethanol

- Others

By End-Use

- Food and beverages

- Paints and coating

- Plastics & Polymers

- Pharmaceutical

- Chemicals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting