What is Trifluoroacetic Acid Market Size?

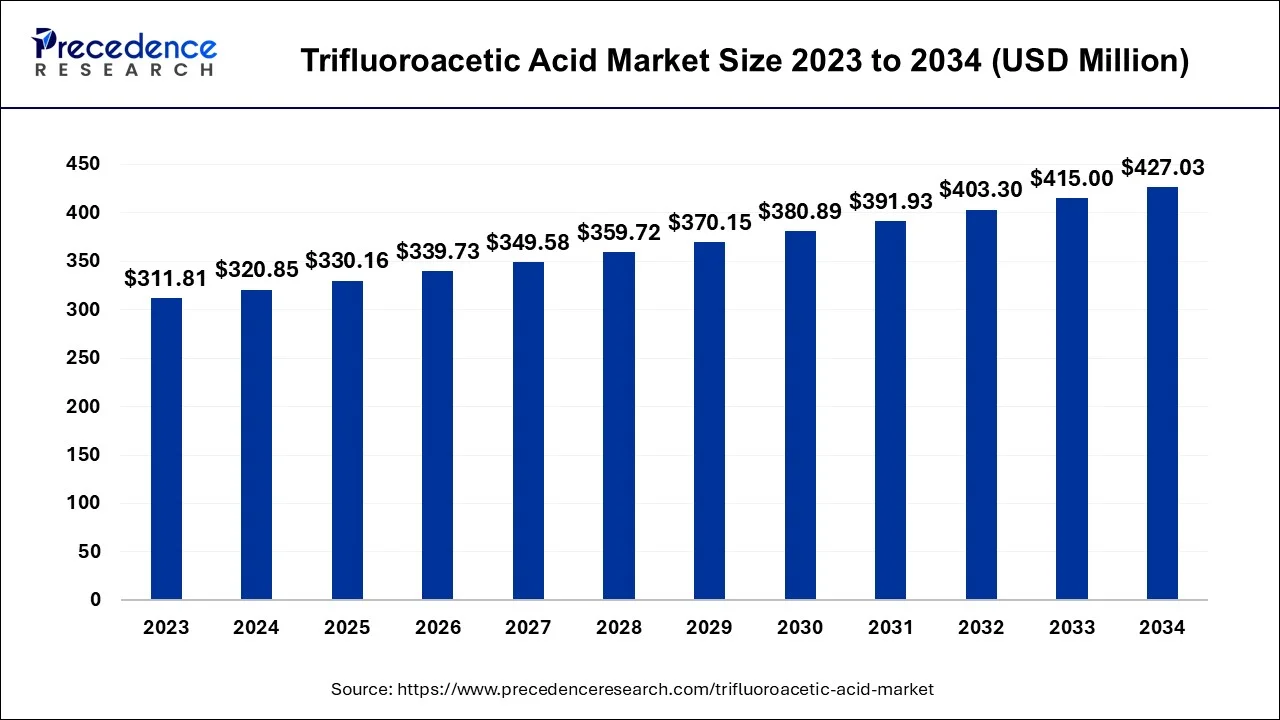

The global trifluoroacetic acid market size ie estimated at for USD 330.16 million in 2025 and is anticipated to reach around USD 438.84 million by 2035, rising at a CAGR of 2.89% between 2026 to 2035.

Market Highlights

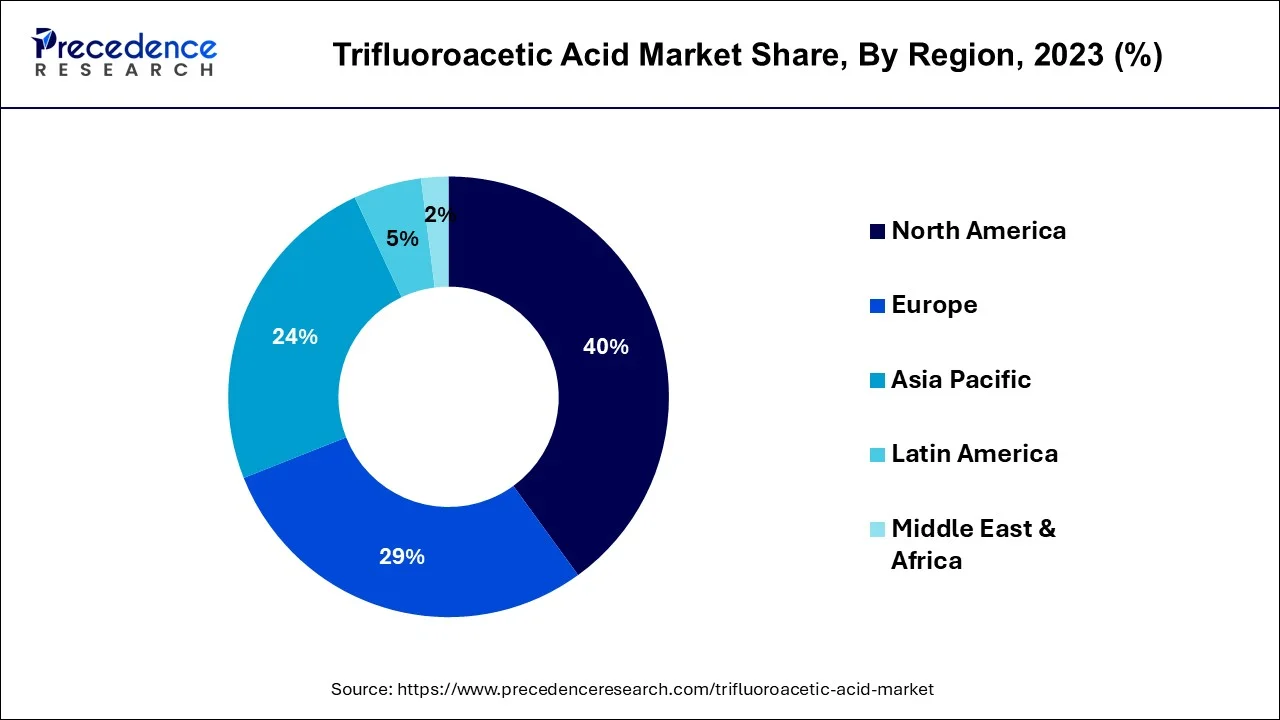

- North America contributed more than 40% of revenue share in 2025.

- Asia Pacific is estimated to expand at the fastest CAGR between 2026 to 2035

- By type, the 99.5% trifluoroacetic acid segment has held the largest market share of 55% in 2025.

- By type, the 99.9% trifluoroacetic acid segment is anticipated to grow at a CAGR of 3.8% between 2026 to 2035

- By application, the medical intermediate segment had the largest market share of 32% in 2025.

- By application, the other segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The trifluoroacetic acid (TFA) market pertains to the global sector focused on trifluoroacetic acid, a potent organic acid widely applied in pharmaceuticals, agrochemicals, and chemical synthesis. TFA's strong acidity and versatile chemical attributes make it a crucial component in various industries. Market size is primarily influenced by demand from these sectors and ongoing research and development endeavors. Growth in the pharmaceutical industry and the expansion of chemical synthesis processes play pivotal roles in shaping market trends. TFA is typically available in diverse forms, such as solutions or solids, and market stakeholders encompass chemical manufacturers, distributors, and end-users who rely on TFA for their production needs.

Trifluoroacetic Acid Market Growth Factors

- The pharmaceutical sector's continuous growth fuels demand for trifluoroacetic acid, an essential reagent in drug development and synthesis.

- Trifluoroacetic acid is utilized in the formulation of agrochemicals, benefiting from the expanding agricultural sector.

- Widening chemical synthesis processes across industries, including materials and specialty chemicals, drives TFA demand.

- Ongoing R&D efforts in academia and industry create opportunities for TFA application in innovative projects.

- TFA plays a part in clean energy innovations, aligning with the global shift toward sustainable energy sources.

- TFA's use in specialty resin and coating formulations supports market growth in these segments.

- The overall expansion of healthcare services and facilities drives demand for TFA in medical equipment production.

- Advances in analytical techniques and instrumentation increase TFA's relevance in analytical chemistry applications, enhancing market prospects.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 330.16 Million |

| Market Size in 2026 | USD 339.73 Million |

| Market Size by 2035 | USD 438.84 Million |

| Growth Rate from 2026 to 2035 | CAGR of 2.89% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Pharmaceutical industry demand

The pharmaceutical industry stands as a paramount driver behind the remarkable growth of the market. This sector is intrinsically reliant on TFA due to its indispensable role in drug development, manufacturing, and research. TFA's exceptional attributes as a reagent, solvent, and catalyst are vital in various pharmaceutical applications, facilitating the synthesis of intricate compounds, pharmaceutical intermediates, and active pharmaceutical ingredients (APIs).

The ever-expanding pharmaceutical landscape, driven by factors such as an aging global population and the unceasing quest for innovative drugs, continuously amplifies the demand for TFA. The pharmaceutical industry is characterized by dynamic research and development initiatives, with TFA playing a pivotal role in the optimization of chemical reactions, thereby contributing to the discovery of novel drugs. Its versatility positions it as an enabler for innovative pharmaceutical solutions, supporting the development of therapeutic agents, which cater to the ever-evolving healthcare needs of society. In essence, the symbiotic relationship between the pharmaceutical industry and the TFA market ensures that the latter thrives as an essential component in the pharmaceutical innovation ecosystem.

Restraint

Stringent regulatory oversight

Rigorous regulatory scrutiny exerts a pronounced constraint on the burgeoning trifluoroacetic acid (TFA) market. This stringent oversight emanates chiefly from environmental concerns and the global resolve to combat the detrimental impacts of certain chemicals on the Earth's delicate ecosystems and the precarious balance of the ozone layer. TFA and its various derivatives have cast a shadow of environmental apprehension, particularly concerning their potential to participate in ozone depletion and contribute to the ongoing challenges of global warming.

Consequently, a multitude of international accords and protocols, most notably the montreal protocol, have been enacted to stringently control and confine the use of ozone-depleting substances, encompassing specific TFA-related compounds. These regulatory strictures not only curtail the production and application of select TFA derivatives but also usher in a paradigm shift in favor of more eco-friendly chemical alternatives.

Moreover, to comply with these stringent regulations, TFA manufacturers must invest significantly in process modifications and eco-centric protective measures, escalating their operational expenditures. This, in turn, augments the cost structure of TFA, influencing its competitive edge and market dynamics. While these regulatory measures undoubtedly play a pivotal role in safeguarding the environment, they unquestionably constitute a formidable impediment to the unbridled expansion of the TFA market by virtue of their constrictive constraints and fiscal implications.

Opportunity

Custom synthesis services

Custom synthesis services have emerged as a pivotal catalyst for creating lucrative opportunities within the trifluoroacetic acid (TFA) market. These bespoke services cater to the specific needs of various industries, fostering a symbiotic relationship between TFA manufacturers and diverse market segments. By tailoring TFA solutions to the unique requisites of customers, custom synthesis services extend the applicability of TFA into previously unexplored niches. This flexibility allows TFA to become a versatile and indispensable chemical in an array of applications, from pharmaceuticals and agrochemicals to materials science and beyond.

Furthermore, custom synthesis services facilitate collaborative endeavors and innovations. TFA manufacturers can partner with research institutions and industrial players to co-create novel TFA-based products and processes, expanding the market's boundaries and capitalizing on uncharted opportunities. This customer-centric approach not only broadens the utility of TFA but also bolsters its market position, making it an essential component in the chemical toolbox of numerous industries. It leverages adaptability and collaboration to unlock the full potential of TFA in a dynamic and evolving market landscape.

Impact of COVID-19

- The COVID-19 pandemic disrupted global supply chains, affecting the production and distribution of chemicals like TFA. Restrictions on movement, reduced workforce availability, and logistic challenges led to interruptions in the supply of raw materials and hindered TFA production. This resulted in supply shortages and potential price fluctuations.

- The pharmaceutical sector, a significant consumer of TFA, experienced both challenges and opportunities. While there was a surge in demand for pharmaceuticals, clinical trials, and vaccine development, other aspects of the industry, such as drug manufacturing and research, were impacted. This fluctuation in pharmaceutical demand influenced TFA usage.

- The pandemic necessitated new safety measures and hygiene protocols in manufacturing facilities. Maintaining social distancing and ensuring the well-being of workers became a priority, impacting production efficiency. The cost of implementing these safety measures is also added to operational expenses for TFA manufacturers.

- The economic uncertainties stemming from the pandemic affected businesses across industries. TFA manufacturers faced challenges related to investment, expansion, and research and development efforts. Financial constraints and uncertainty about future market conditions influenced strategic decisions within the TFA market.

Segment Insights

Type Insights

According to the type, the 99.5% trifluoroacetic acid segment has held a 55% revenue share in 2023. The 99.5% trifluoroacetic acid (TFA) segment holds a major share in the TFA market due to its high purity and versatile applications. This ultra-pure form of TFA is crucial in the pharmaceutical industry for synthesizing pharmaceutical intermediates and active ingredients, where impurities are intolerable. Its remarkable purity also makes it valuable in high-precision research and development. Moreover, stringent quality requirements in pharmaceuticals and other industries drive the demand for this highly purified TFA, ensuring its dominant market position as a preferred choice for critical applications.

The 99.9% trifluoroacetic acid segment is anticipated to expand at a significant CAGR of 3.8% during the projected period. The 99.9% trifluoroacetic acid (TFA) segment commands a significant share of the TFA market due to its exceptional purity and versatility. Its high purity makes it ideal for critical applications in pharmaceuticals, where even trace impurities can be detrimental. TFA of this grade is a crucial reagent in drug development and manufacturing. Moreover, it finds use in other precision industries like electronics and materials science. Its reputation for reliability and performance positions the 99.9% TFA segment as a cornerstone in the TFA market, underpinned by stringent quality requirements in various sectors.

Application Insights

The medical intermediates segment is held the largest market share of 32% in 2025. The medical intermediates segment commands a substantial growth in the trifluoroacetic acid (TFA) market due to its critical role in pharmaceutical and healthcare applications. TFA is a pivotal reagent in the synthesis of pharmaceutical intermediates, enabling the production of essential drugs and therapies. With the pharmaceutical industry's continuous growth and increasing demand for novel medicines, TFA remains in high demand.

Its use in pharmaceutical research and development, coupled with the evolving healthcare landscape, solidifies the medical intermediates segment's dominance, as TFA is integral to the development of life-saving drugs and medical solutions, making it an indispensable component of the pharmaceutical value chain.

The others segment is projected to grow at the fastest rate over the projected period. The other segment's dominance in the market can be attributed to its extensive market share, driven by the multifaceted utility of TFA in applications that defy categorization into well-defined sectors. TFA's exceptional attributes, including its potent acidity and dissolving capabilities, render it adaptable for a multitude of specialized applications spanning diverse industries like advanced materials, specialty chemicals, and cutting-edge electronics. This comprehensive array of uses, complemented by bespoke synthesis services, positions TFA as a versatile solution to address a myriad of unique and evolving demands, thus underscoring the preeminence of the segment within the TFA market.

Regional Insights

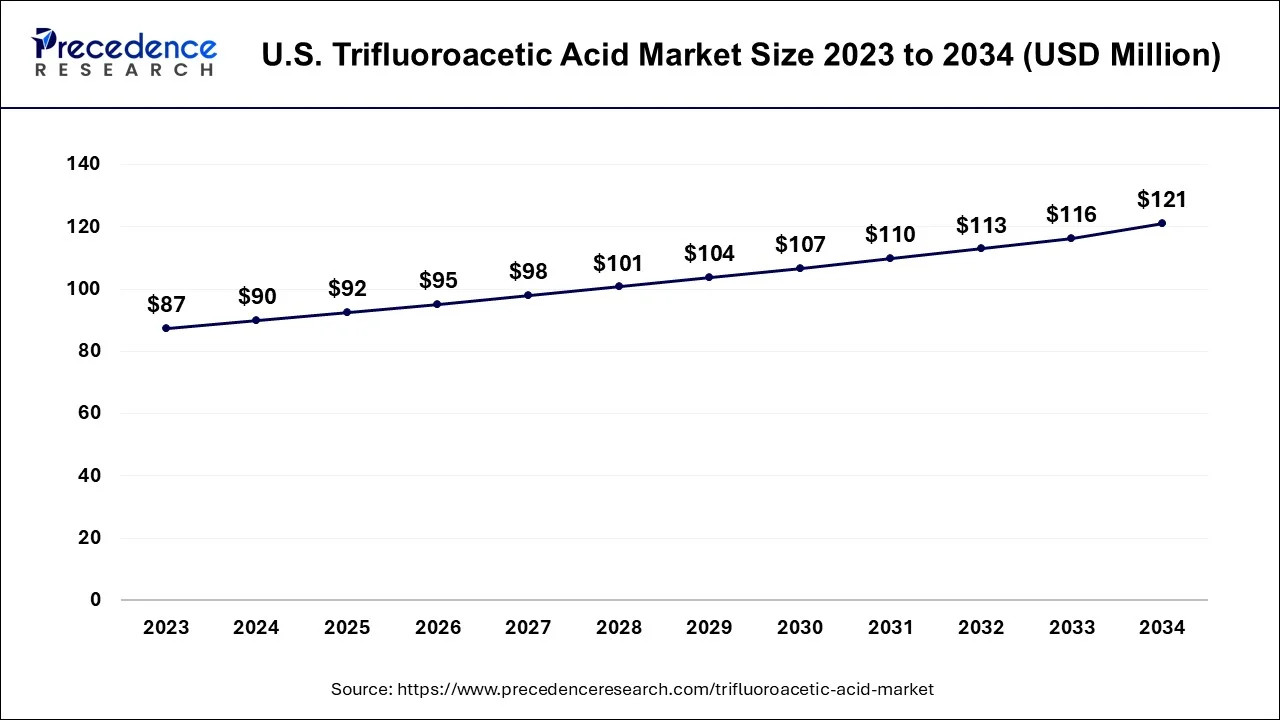

U.S. Trifluoroacetic Acid Market Size and Growth 2026 to 2035

The U.S. trifluoroacetic acid market size accounted for USD 92 million in 2025 and is expected to reach USD 124 million by 2035, poised to grow at a CAGR of 3.03% from 2026 to 2035

U.S. Market Analysis

The U.S. trifluoroacetic acid market is growing due to high demand from the pharmaceutical and chemical industries for drug development, peptide synthesis, and research applications. Strict environmental regulations promote TFA as a safer alternative, while advanced manufacturing infrastructure, robust R&D activities, and increasing adoption in specialty chemicals and agrochemicals further drive market expansion.

North America has held the largest revenue share of 40% in 2025. North America's prominence in the trifluoroacetic acid (TFA) market can be attributed to several factors. First, the region is a hub for pharmaceutical and chemical industries, which are significant consumers of TFA. The United States, in particular, hosts numerous pharmaceutical companies and research institutions, driving substantial demand for TFA in drug development and manufacturing.

Moreover, North America's stringent environmental regulations have encouraged the adoption of TFA as a safer alternative in various applications. Its well-established infrastructure, technological advancements, and strong research and development activities further solidify its leading position in the TFA market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is estimated to observe the fastest expansion. The region commands a substantial share in the trifluoroacetic acid (TFA) market due to several key factors. This region's dominance is attributed to its robust pharmaceutical and chemical industries, which are significant consumers of TFA. The expanding population, coupled with increasing healthcare needs, drives the demand for pharmaceuticals, while agricultural and industrial growth bolsters the agrochemical and chemical sectors. Additionally, cost-effective TFA production facilities in Asia Pacific and its role as a global manufacturing hub further enhance the region's market position. The region's economic growth and evolving industrial landscape make it a pivotal player in the TFA market.

India Market Analysis

India's trifluoroacetic acid market is growing due to the rapid expansion of the specialty chemical sector. Growing investments in biotech, increasing peptide and fine chemical production, and rising exports of pharmaceutical intermediates drive the demand for TFA. Additionally, partnerships between international chemical manufacturers and improvements in domestic production capabilities are accelerating market growth across India.

How is the Opportunistic Rise of Europe in the Market?

Europe is expected to grow at a significant rate over the projection period due to the strong presence of the pharmaceutical, agrochemical, and specialty chemical industries, which are major end-users of TFA. The region's focus on research and development, coupled with stringent regulatory standards for chemical quality and safety, is driving demand for high-purity TFA. Additionally, the growth of contract manufacturing, innovation in fluorinated intermediates, and increasing applications in peptide synthesis and fine chemicals are creating new opportunities for market expansion across Europe.

UK Market Analysis

The trifluoroacetic acid market in the UK is expanding due to increasing pharmaceutical and biotech research, rising demand for peptide synthesis, and diverse specialty chemical applications. Growth is further supported by investments in advanced chemical manufacturing, supportive regulatory frameworks, and collaborations between research institutions and industry players. Additionally, innovations in sustainable and efficient production methods are enhancing adoption, driving the overall expansion of the market across the country.

Top Companies & Their Offerings

- Daikin Industries: Produces high-purity trifluoroacetic acid (TFA) and specialty fluorochemicals for pharmaceutical, chemical, and industrial applications, emphasizing quality and compliance with global standards.

- Sigma-Aldrich (MilliporeSigma): Supplies laboratory-grade TFA and chemical reagents for research, synthesis, and analytical applications in pharmaceuticals, biotechnology, and academic labs.

- Halocarbon Products Corporation: Offers high-quality TFA and related fluorochemicals for industrial, laboratory, and pharmaceutical uses with a focus on safety and purity.

- TCI Chemicals: Provides TFA and specialty reagents for chemical synthesis, research, and pharmaceutical development with global distribution and quality assurance.

- Apollo Scientific: Delivers TFA and specialty chemicals for research, chemical synthesis, and industrial applications, supporting innovation and laboratory efficiency.

- Sterlitech Corporation: Supplies high-purity TFA and chemical materials for laboratory and industrial applications, emphasizing performance, reliability, and technical support.

Other Trifluoroacetic Acid Market Companies

- Solvay

- Honeywell

- Pure Chemistry Scientific

- King Scientific

- Apollo Scientific Ltd

- SACHEM Inc.

- Oakwood Products, Inc.

- J&K Scientific

- Loba Chemie

Recent Developments

- In September 2024, Solvay announced plans to halt TFA and derivative production at its Salindres, France, site due to weak financial performance. The closure may impact 68 jobs between early and October 2025, with a €52.4 million provision recorded in Q3 2024 and most costs expected from 2025 onward.

- In May 2021, Biesterfeld Spezialchemie secured distribution rights for Solvay Special Chem's CF3 product line, marking immediate effectiveness. This agreement pertains to the distribution of TFE, TFA, TA, and TAA in drum quantities across Germany, France, Switzerland, and Austria. Biesterfeld Spezialchemie is now authorized to handle the distribution of these trifluorochemical products within this specific region, expanding its role in the chemical distribution landscape for Solvay Special Chem's offerings.

Segments Covered in the Report

By Type

- 99.5% Trifluoroacetic Acid

- 99.9% Trifluoroacetic Acid

By Application

- Medical Intermediates

- Pesticide Intermediates

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting