What is the ADAS Simulation Market Size?

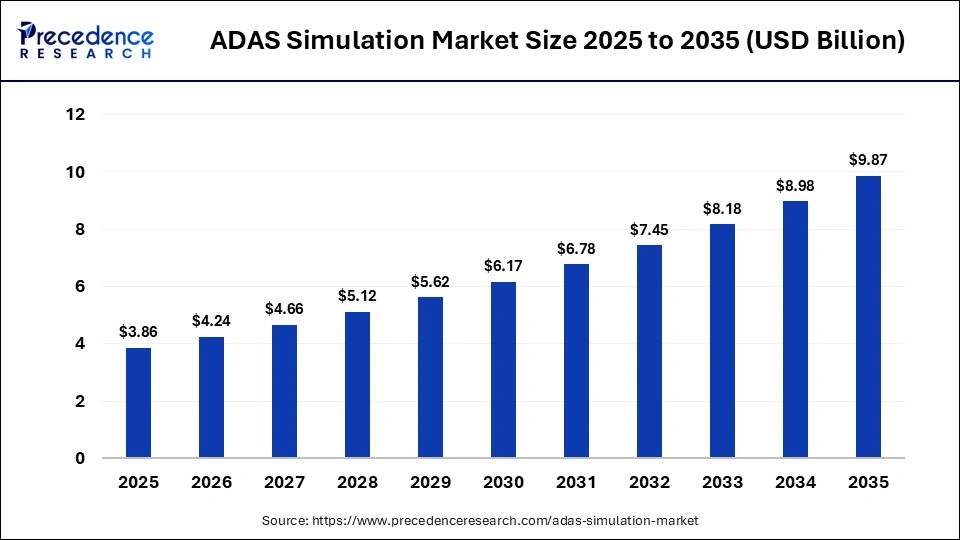

The global ADAS simulation market size was calculated at USD 3.86 billion in 2025 and is predicted to increase from USD 4.24 billion in 2026 to approximately USD 9.87 billion by 2035, expanding at a CAGR of 13.57% from 2026 to 2035. The market is witnessing substantial growth due to regulatory pressure, autonomous vehicle demand, and tech innovation like AI/ML, offering scalable, cost-effective virtual testing for complex ADAS systems.

Market Highlights

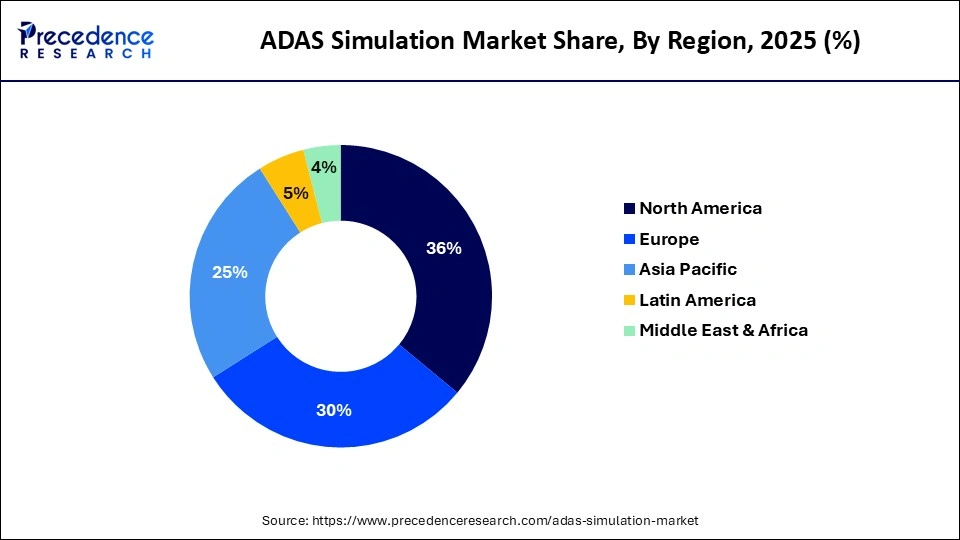

- North America dominated the market with a major share of around 36% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 14.0% between 2026 and 2035.

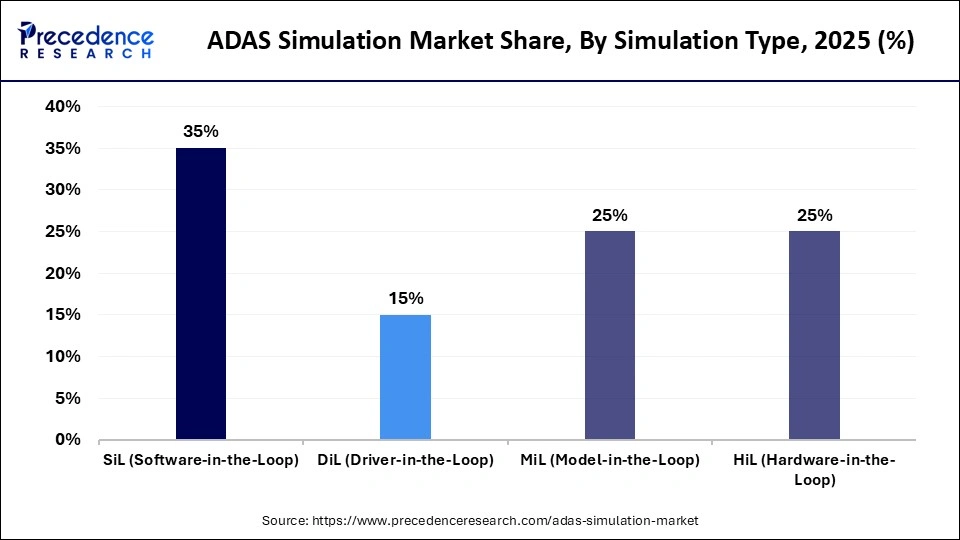

- By simulation type, the (SiL) software-in-the-loop segment held the biggest market share of around 35% in 2025.

- By simulation type, the (HiL) hardware-in-the-loop segment is expected to expand at the fastest CAGR of 13.0% between 2026 and 2035.

- By offering, the software segment accounted for the largest market share of about 60% in 2025.

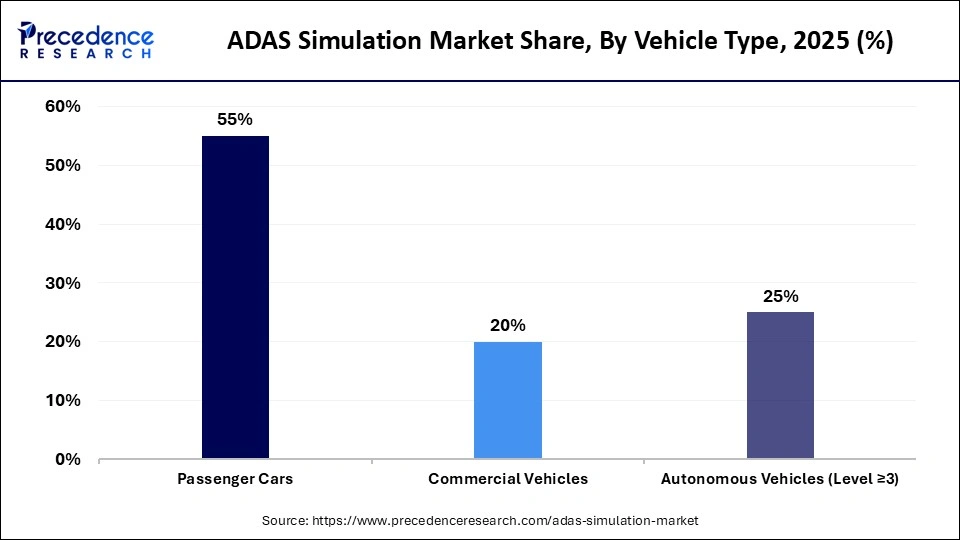

- By vehicle type, the passenger cars segment contributed the highest market share of around 55% in 2025.

- By vehicle type, the autonomous vehicles segment is expected to grow at a strong CAGR of 12.7% between 2026 and 2035.

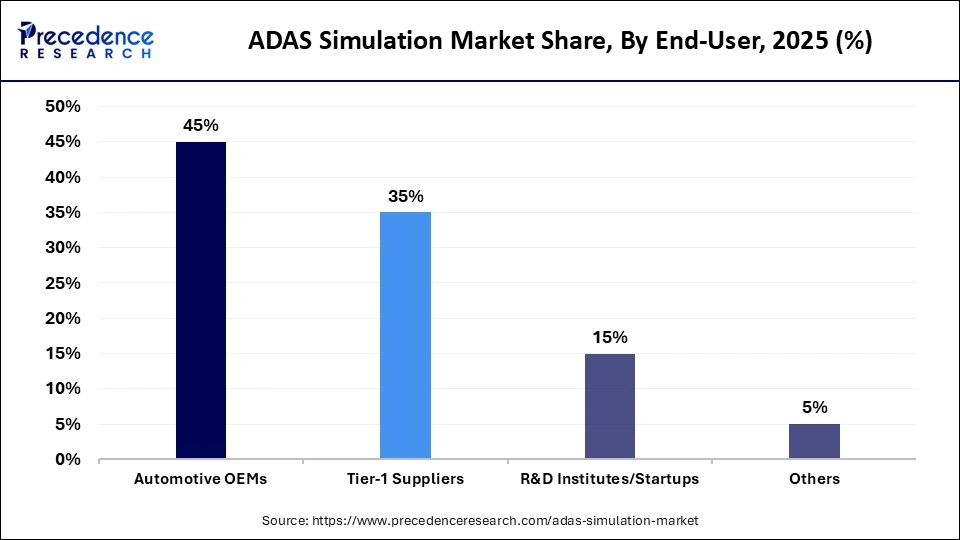

- By end-user, the automotive OEMs segment held a major market share of around 45% in 2025.

- By end-user, the R&D institutes/startups segment is expected to expand at a healthy CAGR of 12.6% from 2026 to 2035.

What is the ADAS Simulation Market?

The ADAS simulation market comprises software and services that create virtual environments to test and validate Advanced Driver Assistance Systems (ADAS) features before real-world deployment. It includes simulation types such as software-in-the-loop (SiL), hardware-in-the-loop (HiL), and digital twins to model sensors like cameras, radars, and lidar, as well as vehicle behavior across driving scenarios. Simulation helps OEMs, Tier-1 suppliers, and developers reduce development time, enhance safety, lower physical testing costs, and optimize ADAS performance under diverse conditions.

How Does AI Transform the ADAS Simulation Market?

Artificial intelligence (AI) is transforming the global market by creating realistic virtual worlds, automating the generation of complex scenarios, providing synthetic data for model training, and allowing faster, more efficient safety and validation testing. AI designs intricate and rare edge case scenarios, which reduces manual effort and ensures comprehensive testing. Moreover, AI algorithms analyze simulated sensor data to train systems for tasks such as object recognition, hazard prediction, and context-aware decision-making. AI also contributes to generating detailed 3D worlds, enhancing the accuracy of simulations.

Major Trends Influencing the ADAS Simulation Market

- Demand for Cloud-Native Platforms: The demand for cloud-native platforms is rising, enabling scalable, subscription-based, and pay-per-use ecosystems that can run millions of test scenarios in parallel.

- AI and Digital Twins: The integration of AI and digital twins allows manufacturers to replicate complex real-world driving conditions, including sensor behavior and edge-case scenarios, for more accurate testing.

- Shift to Software-in-the-Loop (SiL): There is a shift toward Software-in-the-Loop (SiL) validation, which facilitates early testing of control and sensor algorithms before physical hardware is available.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.86 Billion |

| Market Size in 2026 | USD 4.24 Billion |

| Market Size by 2035 | USD 9.87 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.57% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Simulation Type, Offering, Vehicle Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Simulation Type Insights

How Does the SiL (Software-in-the-Loop) Segment Lead the ADAS Simulation Market in 2025?

The SiL (software-in-the-loop) segment led the market with around 35% share in 2025, primarily because it enables early, rapid, and cost-effective validation of complex Advanced Driver Assistance Systems (ADAS) algorithms and software by running actual code in a virtual environment, leading to quicker and less expensive testing. SiL tests can be reused and integrated into hardware-in-the-loop (HiL) testing, creating a seamless virtual-to-physical testing pipeline. Advanced SiL platforms are capable of simulating complex sensor data and vehicle dynamics, often operating faster than real-time, which provides valuable insights.

The HiL (hardware-in-the-loop) segment is expected to grow at the fastest CAGR of 13.0% during the forecast period. This growth is driven by the increasing complexity of autonomous features that require real-time validation. HiL connects real hardware, such as electronic control units and sensors, to simulated environments, allowing for the validation of control software under dynamic conditions and diverse scenarios. HiL also facilitates safe testing of fault conditions, which helps to meet stringent automotive safety standards and New Car Assessment Program requirements.

Offering Insights

What Made Software the Dominating Segment in the ADAS Simulation Market in 2025?

The software segment dominated the market by holding approximately 60% share in 2025 and is expected to maintain its growth trajectory with a CAGR of 13.2% in the coming years. This is because of its critical role in developing, testing, and validating advanced driver-assistance system algorithms. Complex ADAS features necessitate extensive virtual testing for safety, efficiency, and cost reduction, with cloud-based solutions accelerating development. Virtual testing in software significantly lowers the costs associated with physical road testing and prototypes.

The growing complexity of ADAS mandates advanced software for comprehensive scenario testing, which is difficult to achieve with hardware alone. Furthermore, cloud-based simulation offers scalability, remote access, and cost-effectiveness, promoting rapid adoption for complex testing. Additionally, the scalability, flexibility, and frequent updates offered by software solutions allow automakers to run extensive simulations efficiently, making it the leading segment in the market.

Vehicle Type Insights

Why Did the Passenger Cars Segment Dominate the ADAS Simulation Market in 2025?

The passenger cars segment dominated the market with about 55% market share in 2025, primarily due to high production volumes resulting in a greater total number of ADAS systems, thereby increasing the demand for validation software. Passenger vehicles are transitioning toward SDV architectures, where ADAS functions are continually updated. This evolution requires ongoing, agile virtual testing rather than a single pre-production evaluation. Passenger cars must also comply with strict regulatory requirements, such as the EU's General Safety Regulation and revised NCAP protocols, which demand extensive virtual scenario generation and validation.

The autonomous vehicles segment is expected to grow at the fastest CAGR of 12.7% in the upcoming period. This growth is attributed to the increasing complexity of self-driving systems, which require extensive virtual testing and validation across millions of driving scenarios. Simulation enables automakers and technology providers to safely test edge cases, sensor fusion, and decision-making algorithms that are difficult or risky to replicate in real-world conditions. Additionally, rising investments in Level 3-Level 5 autonomy development are driving strong demand for advanced ADAS simulation platforms to accelerate development timelines and reduce costs.

End-User Insights

What Made Automotive OEMs the Leading Segment in the ADAS Simulation Market in 2025?

The automotive OEMs segment led the market with around 45% share in 2025. This dominance stems from the use of simulation to expedite the development of complex, next-generation vehicles while managing stringent safety regulations. OEMs utilize simulation to test and calibrate these systems in virtual environments, which is more efficient than traditional physical testing methods. By using simulation, OEMs significantly reduce the need for physical prototypes and extensive on-road testing, thereby lowering research & development costs and speeding up the creation of new, safer vehicle models.

The R&D institutes/startups segment is expected to grow at the fastest CAGR of 12.6% over the forecast period, as these organizations rely heavily on simulation-based testing to develop and validate innovative ADAS and autonomous driving technologies without the high costs of physical prototypes. Simulation platforms provide flexible, cloud-based, and scalable environments that enable rapid experimentation, algorithm training, and scenario generation. Additionally, increased venture funding, academic-industry collaborations, and government-backed research programs are accelerating the adoption of ADAS simulation tools among startups and research institutions.

Regional Insights

How Big is the North America ADAS Simulation Market Size?

The North America ADAS simulation market size is estimated at USD 1.39 billion in 2025 and is projected to reach approximately USD 3.60 billion by 2035, with a 9.98% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the ADAS Simulation Market in 2025?

North America dominated the market by capturing the largest share of 36% in 2025. This dominance is mainly attributed to intense R&D investment, a high concentration of tech leaders, strict safety regulations, and advanced infrastructure. A mature cloud, AI, and high-speed connectivity infrastructure enables sophisticated simulation platforms. Initiatives by the U.S. Department of Energy and the National Science Foundation support the development of better simulation tools. The region is home to key technology and automotive giants, including Tesla, General Motors, Ford, NVIDIA, and Ansys, leveraging simulation for large-scale, virtual testing of millions of miles.

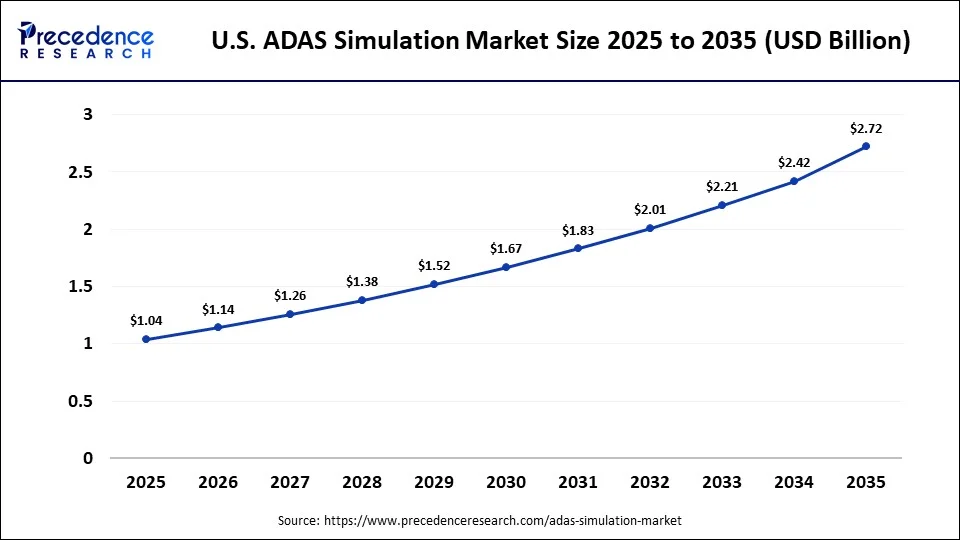

What is the Size of the U.S. ADAS Simulation Market?

The U.S. ADAS simulation market size is calculated at USD 1.04 billion in 2025 and is expected to reach nearly USD 2.72 billion in 2035, accelerating at a strong CAGR of 10.09% between 2026 and 2035.

U.S. ADAS Simulation Market Trends

The U.S. is a major contributor to the global market, driven by its strong base of autonomous vehicle developers and tech giants. The U.S. has a mature, robust cloud infrastructure that allows for large-scale, remote, and collaborative testing, critical for reducing reliance on costly physical road trials. Major U.S. players include NVIDIA, Ansys, and Applied Intuition. Recently, Applied Intuition has expanded its capabilities in AI-powered simulation by acquiring companies like EpiSci.

Why is Asia Pacific Considered the Fastest-Growing Region in the ADAS Simulation Market?

Asia Pacific is expected to grow at the fastest CAGR of 14.0% during the forecast period. This is mainly due to rapid electric vehicle adoption, expanding autonomous driving R&D, and the implementation of stricter vehicle safety regulations across major economies. Automakers and technology firms in countries such as China, Japan, South Korea, and India are investing heavily in high-fidelity simulation platforms to test advanced sensor suites and comply with evolving NCAP standards. Additionally, the need to localize ADAS validation for diverse traffic conditions and road environments is accelerating demand for advanced simulation solutions across the region.

India ADAS Simulation Market Trends

The market in India is growing due to a strong focus on validating systems for challenging, unstructured environments. Additionally, Indian companies, such as SimDaaS Autonomy, are building specific, local scenario databases to train AI to handle these conditions. India provides massive talent, producing vast numbers of computer science engineers annually, making it a hub for software development, particularly for global OEMs.

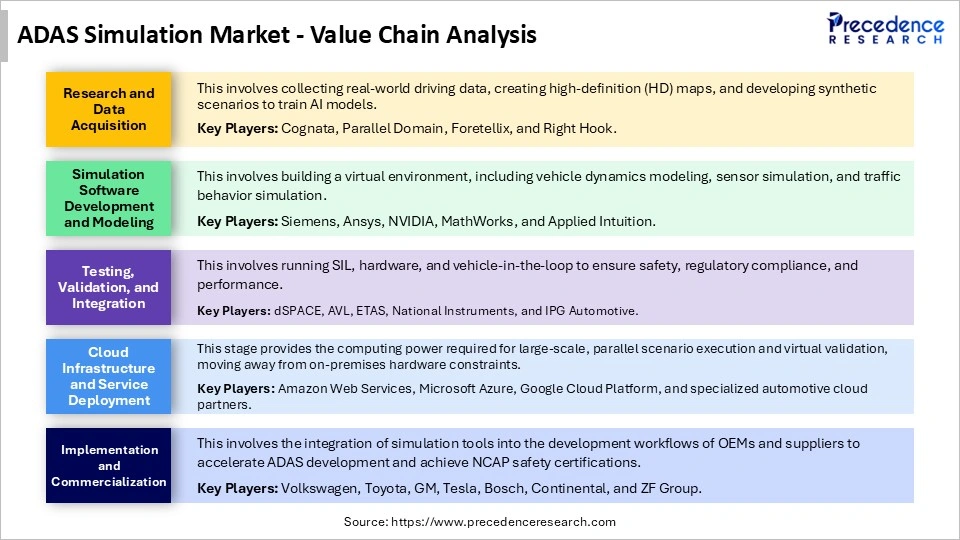

ADAS Simulation Market Value Chain Analysis

Who are the Major Players in the Global ADAS Simulation Market?

The major players in the ADAS simulation market include Siemens AG, Ansys, Inc., NVIDIA Corporation, dSPACE GmbH, AVL List GmbH, IPG Automotive GmbH, Applied Intuition, Inc., The MathWorks, Inc., Hexagon AB (MSC Software), Vector Informatik GmbH, Keysight Technologies, Dassault Systemes, Cognata Ltd., rFpro Ltd., and VI-grade Gmb.

Recent Developments

- In May 2025, LeddarTech Holdings Inc launched LeddarSim, a simulation platform designed to bridge the gap between virtual testing and real-world deployment for ADAS and autonomous driving development. It generates sensor-accurate, real-time renderings, enabling developers to train and validate perception models in environments that reflect real-life complexities. This launch, they achieved a near-zero simulation gap, remarked Pierre Olivier, CTO.(Source: https://investors.leddartech.com)

- In October 2025, Nexar introduced BADAS, a foundation model utilizing the largest open dataset of real-world driving events. This model enhances incident prediction accuracy and behavioral foresight, outperforming traditional models trained in labs. BADAS is a statement that the road to safety and autonomy runs through the real world, stated CEO Zach Greenberger.(Source: https://www.prnewswire.com)

- In December 2025, Siemens launched Pave360 Automotive, a digital twin software aimed at simplifying automotive hardware and software integration. This solution enables manufacturers to create software-defined vehicles quickly and efficiently, facilitating early, full-system virtual integration. “Pave360 Automotive empowers companies to innovate confidently and set the standard in the SDV space,” said Tony Hemmelgarn, CEO of Siemens Digital Industries Software.(Source: https://www.engineerlive.com)

Segments Covered in the Report

By Simulation Type

- SiL (Software-in-the-Loop)

- DiL (Driver-in-the-Loop)

- MiL (Model-in-the-Loop)

- HiL (Hardware-in-the-Loop)

By Offering

- Software

- Services

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Autonomous Vehicles

By End-User

- Automotive OEMs

- Tier-1 Suppliers

- R&D Institutes/Startups

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content