What is the Agriculture Equipment Market Size?

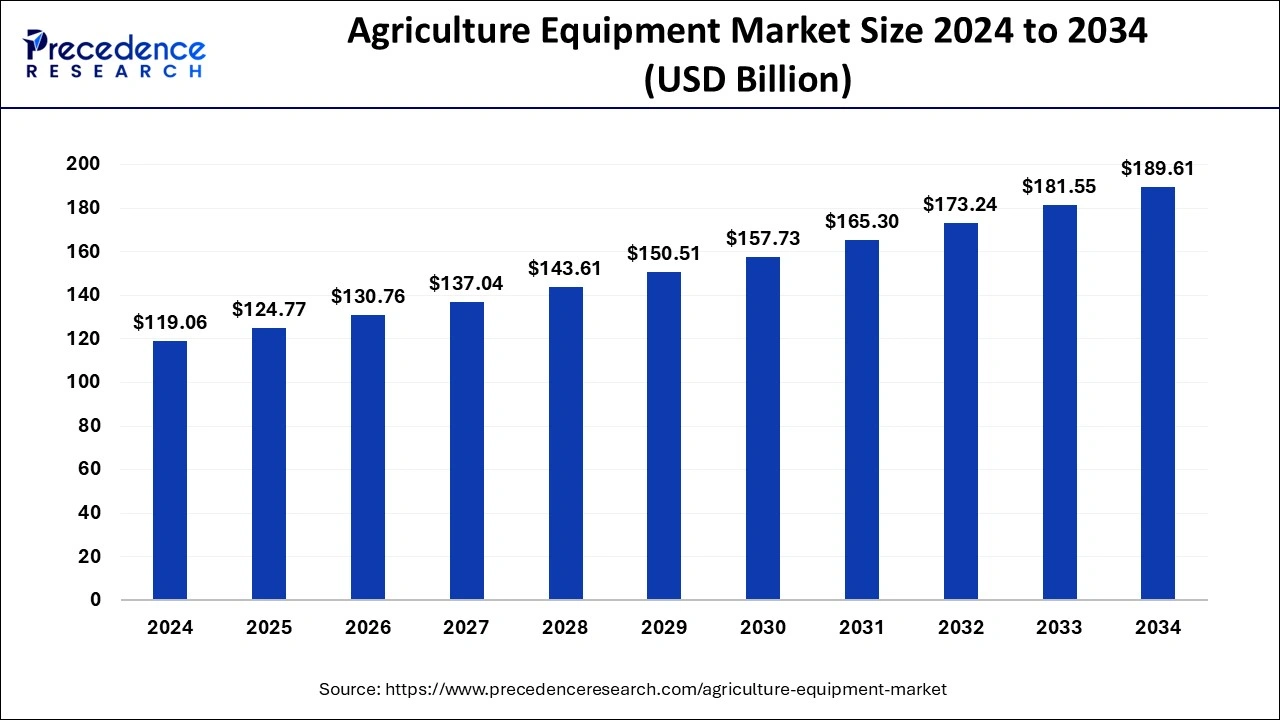

The global agriculture equipment market size is valued at USD 124.77 billion in 2025 and is predicted to increase from USD 130.76 billion in 2026 to approximately USD 189.61 billion by 2034, expanding at a CAGR of 4.80% from 2025 to 2034.The rising demand for tools to help farmers optimise productivity, reduce costs, and satisfy the requirements of the growing population requires adequate tools, which boosts the growth of the agriculture equipment market.

Agriculture Equipment Market Key Takeaways

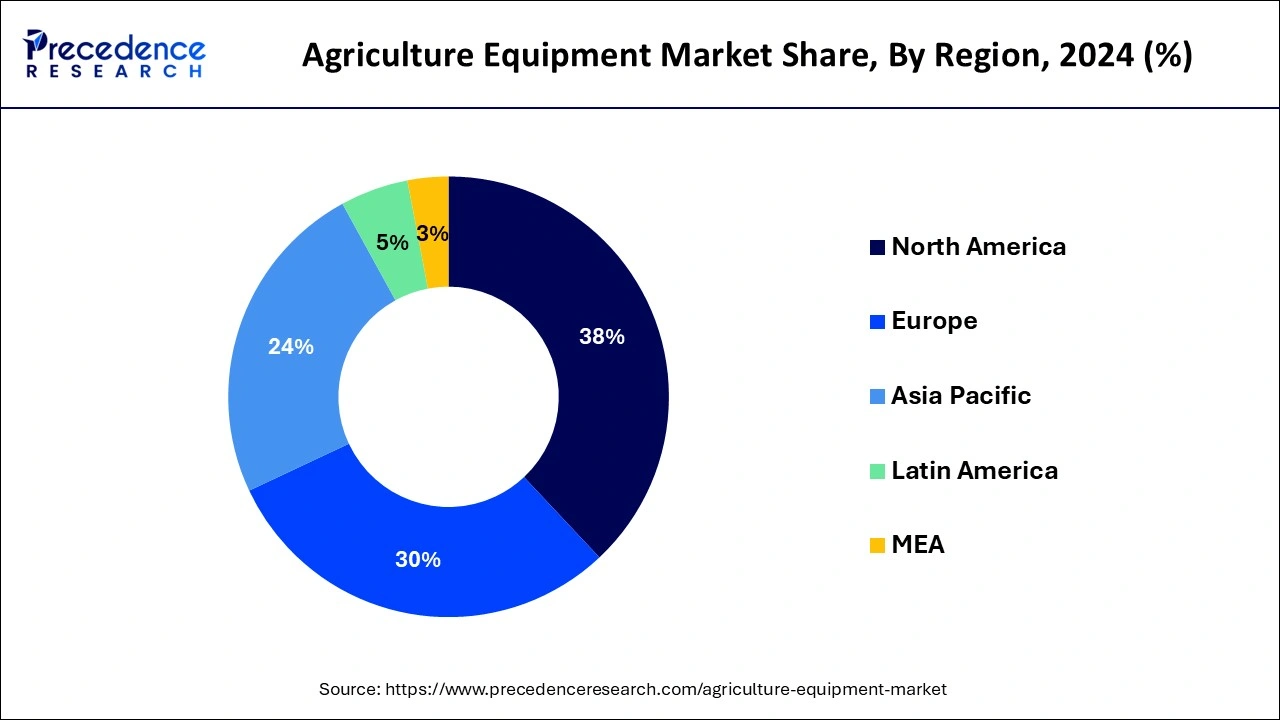

- North America led the global market with the highest market share of 38% in 2024.

- By product type, the tractors segment has held the largest market share of 25% in 2024.

- By product type, the harvesting segment is expected to grow at a remarkable CAGR during the forecast period.

- By application, the land development segment captured the biggest revenue share of 20% in 2024.

- By application, the plant protection segment is expected to expand at the fastest CAGR over the projected period.

- By automation, the manual segment registered the maximum market share in 2024.

Harvesting Innovation: The Changing Landscape of Agricultural Machinery due to AI

Integration of artificial intelligence into agriculture equipment is best used to conduct labour-intensive farming which spares farmers from indulging in other essential tasks. One of the biggest incorporations of AI in farming is noticed to be automated tractors or self-driving farmer equipment. These driverless tractors have the potential to harvest 24x7 and they are able to withstand any weather conditions resulting in lowering a farmer's stress. These tractors are lightweight and reduce soil compaction compared to the traditional heavy tractors.

Additionally, the primary function of artificial intelligence is to collect data, analyse it, and make the right decisions benefiting the farmers. The application of AI is diverse in the agricultural industry. Agricultural Bots are a combination of mechanics and software implementation that mitigates the need for manpower. An agricultural bot is applicable at several stages of framing including harvesting, weeding, potting, picking, and spraying, it makes a farmer's life easier.

- In February 2024, the engineering students from ICAR-DWR, Jabalpur built Rakshak, an AI-powered laser-weeding robot that combats weeds without tempering with the crops. The offers effective weed management, reduces cost and ensures even power distribution.

Market Outlook

- Industry Growth Overview: The agriculture equipment market is growing, driven by the move towards accurate agriculture, electrification, and growing spending from manufacturers. Robust technologies such as GPS-driven tractors, AI-driven machinery, and IoT-integrated technology are optimizing resource use and increasing productivity.

- Global Expansion: The agriculture equipment market is experiencing global expansion, as government support for mechanization and the consolidation of farmland necessitate larger, more efficient machinery. The Asia-Pacific (APAC) region dominates the market, as countries such as India and China are experiencing a growing transition from traditional farming to advanced mechanized practices.

- Major investors: Major investors in the agricultural equipment market include huge institutional spending firms and specialized venture capital and private equity funds. Institutional investors like Vanguard and BlackRock are significant shareholders in major equipment manufacturers.

Agriculture Equipment Market Growth Factors

The agriculture equipment is a significant tool used in the cultivation of crops to obtain higher yield by applying minimum efforts in farms. The growing population in developing and developed economies is a major factor building a pressure on the food supply chain due to the increasing demand for the agricultural food. The agriculture equipment such as tractors, harvesters, and crop processing equipment are increasing used in the agricultural activities across the globe to gain higher volume of yields faster and with minimal efforts. This is a primary driver of the global agricultural equipment market. Further, this agriculture equipment helps to reduce labor cost. Especially, the semi-automatic and automatic agriculture equipment helps to provide work efficiency and eliminate the use of excess labor, thereby propelling the demand for the agriculture equipment across the globe.

The technological advancements in the field of agriculture equipment and rising mechanization of different agricultural activities have fostered the development of various modern and automatic agriculture equipments. Further, the rising awareness regarding the benefits of using modern mechanized agriculture equipment has fostered the demand for the agriculture equipment among the farmers, all over the globe. The increasing demand for agricultural food from the food and beverage industry coupled with the rising population and increased demand for food has significantly propelled the demand for the agriculture equipment in order to produce higher yields in a short time period.

Trends of the Agriculture Equipment Market in 2025

- Inclination towards electric and autonomous machinery: The growing shift towards electric and autonomous machinery is witnessing a significant surge. Kubota's innovative Agri concept highlights this recent trend as it introduces fully electric and multipurpose vehicles. This vehicle is equipped with AI and real-time monitoring capabilities. This feature shows possible errors or faults, which helps reduce downtime and enhances the overall operational efficiency of the operation. Due to such innovations, farmers can expect reduced downtime, maximum profit, and cost-effective solutions for a healthy farming culture.

- Focus on the sustainability prime factor: The agricultural equipment market is expanding due to a growing focus on sustainable practices to achieve maximum and healthy yields. Leading manufacturers in the agriculture sector are acknowledging this trend and launching innovative products to mitigate environmental factors that are adversely affecting the cultivation of crops. By applying inputs like fertilizers and pesticides with surgical precision help optimize resources with farming technologies. Sustainable machinery offers sustainability and reduces overall operational costs as well. Thus, it is preferred by many farmers nowadays.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 189.61 Billion |

| Market Size in 2026 | USD 130.76 Billion |

| Market Size in 2025 | USD 124.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Automation, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Integration of robotics and automation

Automation and robotics have become essential parts of the agriculture equipment market. Since farming has been entirely dependent on labor in the past year, it was necessary to outgrow this dependency to combat labor shortages and offer a cost-effective solution for farming. Autonomous tractors are a game-changer for the expansion of farming practices. Similarly, the integration of IoT to derive real-time data about farming land is becoming a key driver for the market.

Restraint

Infrastructure and connectivity-related limitations

The market is witnessing challenges in terms of infrastructure limitations and low connectivity in rural areas. In 2025, the agricultural equipment market faces hurdles in terms of economic pressure, climate change, technological warfare, and changing social dynamics. Volatility in equipment pricing is another challenge for the market as it relies on the supply and demand chain.

Opportunity

New advancements in nanotechnology

Advanced biofertilizers are eco-friendly and beneficial for soil health, crop yield, and climatic stress tolerance. Nanotechnology is a preferred method for producing advanced biofertilizers. Also, next-gen sequencing and metagenomics detect and produce high-quality microbial strains that are used in biofertilizers. For instance, in August 2024, Rovensa introduced a soil-regenerating bio-fertilizer with the base of Bacillus subtilis strain, named Wiibio.

Product Type Insights

The tractors segment led the market with notable revenue share of more than 25% in 2024 and is expected to retain its dominance throughout the forecast period. This is attributed to the increased use of tractors in the primary and basic agriculture activities such as ploughing, harvesting, sowing, harrowing, and transporting.

On the other hand, the harvesting segment is expected to hit fastest CAGR during the forecast period. The increasing trend of mechanization is expected to propel the growth of the harvesters segment. Harvesters help in higher yields with limited dependency of the labors.

Application Insights

The land development segment dominated largest revenue share of more than 20% in 2024 and is expected to retain its dominance over the forecast period. The higher dependency on the labor as agriculture is a time taking process and labor-intensive sector is major factor behind the growth of this segment. The increasing cost of labor coupled with the lack of labor is fostering the growth of this segment.

On the other hand, the plant protection segment is estimated to witness highest CAGR during the forecast period. This is due to the growing importance of plant protection. The increasing demand for food and the higher yields are obtained by implanting proper modern mechanized equipment for protecting the plants.

Automation Insights

The manual segment led the market with largest revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the extensive use of labor in the major agriculture based developing and underdeveloped economies. Agriculture is a labor-intensive industry and hence the higher usage of labor in agricultural activities from the ancient times had resulted in its higher market share.

The automatic segment is expanding with a fastest growth rate in the market over the forecast period. The rising awareness regarding the benefits of using automatic agriculture equipment such as less labor, cost saving, and higher yields are the major factors that is expected to boost the adoption of the automatic agriculture equipment during the forecast period.

Regional Insights

U.S. Agriculture Equipment Market Size and Growth 2025 to 2034

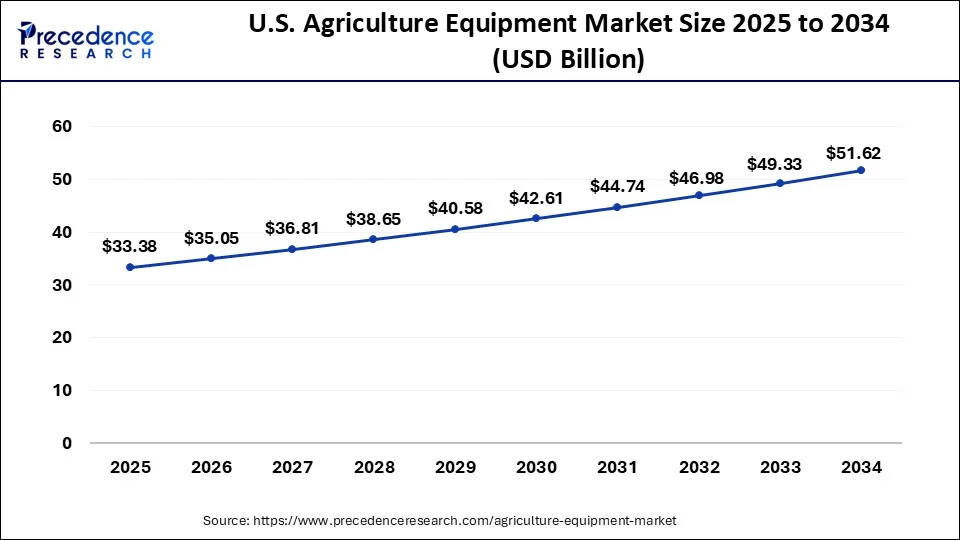

The U.S. agriculture equipment market size is exhibited at USD 33.38 billion in 2025 and is predicted to be worth around USD 51.62 billion by 2034, at a CAGR of 5% from 2025 to 2034.

North America accounted the largest revenue share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributed to the increased penetration of automatic equipment in agriculture and higher and faster adoption rate of latest technologies in the region. The increased focus of the government by introducing technological advancements in the agriculture sector has fostered the growth of the agriculture sector in the countries like the US and Canada. Therefore, North America is expected to sustain its position during the forecast period.

The highest agriculture equipment market shares are held by the United States, primarily due to the presence of key players such as John Deere, Case IH, New Holland, Caterpillar Inc., AGCO Corporation and many more, which bring technological innovations such as precision agriculture tools in the industry, the establishment of advanced tractors and harvests benefit the farming industry. With the help of industry leaders, the region is expected to witness the evolving integration of advanced technologies in the future, at both domestic and international levels.

The rising focus towards autonomous and electric vehicles offering more efficient and eco-friendly transport, enhancing the use of GPS and IoT to track real-time data and predict maintenance and logistics is anticipated to boost the market growth in the region.

- In January 2025, the United States government is collaborating with the United States Agency for International Development (USAID) and helping Kyrgyzstan's dairy industry by supporting their cattle management, fodder cultivation and artificial insemination initiatives.

- In March 2024, American farmers are rapidly adopting artificial intelligence technology in agriculture. Around 87% of businesses in the US agriculture industry are using AI for farming.

Asia Pacific was the second largest agriculture equipment market and is expected to grow at a considerable growth rate during the forecast period. Asia Pacific is also forecasted to be the fastest-growing market during the forecast period. This is attributed to the strong and growing economy of the major countries such as China, India, and Indonesia. China itself holds a major market share of over 30%. Further, the rising awareness, higher population, increased dependency of the majority of the population on agriculture, and growing government initiatives to boost the agricultural development are the major factors that made Asia Pacific the dominant and the fastest-growing market for the agriculture equipment in the global market.

The agriculture equipment market is propelling in China with the encouragement of Chinese government strategies which ensure the food is sufficient for the increasing population. China is also under top country for agriculture imported worldwide which includes land-intensive bulk commodities such as soybeans, sorghum and cotton, along with that China is increasingly meeting the demand for beef and beef products imported with an annual 48% of importers.

Europe's Smart Farming Revolution: Tech Fills Labor Gap

Europe is significantly growing in the agriculture equipment market, with a major shortage of physical labor, the rapid acceptance of advanced precision agriculture technology, and strong government support in the form of subsidies and grants. The incorporation of advanced technologies such as GPS-guided systems, the Internet of Things (IoT), sensors, data analytics, and AI is revolutionizing agriculture in Europe.

- In November 2025, AGCO, a global leader in the design, manufacture, and distribution of agricultural machinery and precision ag technology, will return to AGRITECHNICA 2025 to showcase its iconic machine and technology brands Fendt, Massey Ferguson, PTx, and Valtra at the world's largest indoor agricultural trade fair.

UK: Presence of Major Key Players

The presence of many major U.S. organizations and brands has set determined targets to use high percentages of recycled content, which drives the growth of the market. The U.S. is investing in advanced recycling technologies, including chemical recycling and AI-driven sorting systems, which improve the efficiency and quality of the recycled output.

South America's Farming Transformation: Automation Boosts Output

South America is significantly growing in the agriculture equipment market due to the requirement for automation to increase output and effectiveness, driven by factors such as increasing labor costs and government investment. The region's varied and significant agricultural production, particularly in crops such as soybeans and corn, is increasing demand for specialized and modern machinery.

- In November 2025, PepsiCo, in collaboration with Griffith Foods and Milhão, announced the launch of a pioneering direct farmer incentive pilot program to advance regenerative agriculture in Brazil's Cerrado region, one of the world's most biodiverse savannas and a vital agricultural frontier.

Mexico: The World's Leading Exporter of Key Produce

Mexico is a significangt worldwide manufacturer and exporter of agricultural products, capturing a significant share of the total world exports of citrus and melons (31%), tomatoes (24%), cucumbers (19%), and tropical fruit (22%), including pineapples, mangoes, avocados, and guavas For instance, Mexico's second-most valuable crop, with a production value of 60 billion pesos in 2023.

Agriculture Equipment Market - Value Chain Analysis

- Harvesting and Post-Harvest Handling:

Harvesting and post-harvest handling machinery that allows small- to medium-scale farmers to harvest and technology their crops rapidly, while quickly lowering drudgery and more importantly, agricultural losses.

Key Players: Deere & Company, and CNH Industrial - Storage and Cold Chain Logistics:

Cold chain logistics (CCL) is important for confirming the quality and safety of fresh agricultural products and lowering spoilage.

Key Players: AGCO Corporation - Export and Trade Compliance:

Exporting agricultural equipment needs complying with import and export licenses, obtaining an Import-Exporter Code (IEC), and making particular documents such as a commercial invoice, certificate of origin, and packing list.

Key Players: Escorts Kubota Limited and Agricxlab

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedproducts. Moreover, they are also focusing on maintaining competitive pricing.

- In September 2019, CNH Industrial opened its service center in China. This development was focused on the expansion of the business in China and to deliver the products and services at less time to the customers.

This type of strategical developments adopted by the key players operating in the global agriculture equipment market will open new avenues and opportunities of growth during the forecast period.

Top Vendors in the Agriculture Equipment Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

CNH Industrial N V |

Basildon, UK |

Strong brand portfolio and a strategic focus on advanced technology |

CNH integrates tractors and sprayers, and AI systems make complex decisions in real time, from steering vehicles to optimizing inputs, all to enhance productivity and yields. |

|

Mahindra and Mahindra Ltd. |

Mumbai, Maharashtra |

Strong emphasis on R&D and new technologies such as electric and sustainable vehicles |

Explore Mahindra Farm Equipment's wide range of tractors, implements, and machinery, designed to enhance productivity and efficiency. |

|

Deere & Company |

United States |

Strong brand reputation for quality and reliability |

John Deere India offers a broad range of reliable agricultural equipment and solutions. |

|

Kubota Corporation |

Osaka, Japan |

Strong problem-solving and customer-focused approach |

Kubota Group provides a full lineup of products that cover a broad range of general agricultural work |

|

AGCO Corporation |

Georgia, United States |

diverse and strong brand portfolio |

AGCO is a global leader in the design, manufacture, and distribution of agricultural machinery and precision technology. |

Latest Announcements by Industry Leaders

- In December 2024, Musick, factory engineering manager of Deere & Company commented on investing in the factory, “For our employees, each new project allows us to improve safety, ergonomics, and efficiency within the factory. For our customers, these investments deliver cutting-edge process technology and increased levels of quality control, which our customers expect from John Deere.”

Recent Development

- In September 2024, BiofuelCircle, pioneering the establishment of dedicated biomass supply chains for Compressed Biogas (CBG), launched the first-ever large-scale deployment of farmer equipment in Uttar Pradesh. It deployed over 40+ digitally networked machines, including balers, rakers, and slashers procured from Maschio Gaspardo.

- In January 2025, Türk Telekom, a Turkish telecommunication provider has launched a new 5G initiative for advanced smart agriculture in Turkey in partnership with Chinese vendor ZTE. This project claims that advance technologies such as drones and smart algriculture equipment are integrated into a 5G pilto network set up in particular areas.

- In January 2025, IIT Madras and Minitsry of Agriculture and Farmer Welfare have collaborated to create VISTAAR, a digital platform aimed to enhance agriculture extension sysyte,, provides farmers with Agri start-up technologies and help farmers production, marketing, supply chain management and access to government schemes.

Segments Covered in the Report

By Product Type

- Harvesters

- Tractors

- Irrigation & Crop Process equipment

- Planting Equipment

- Others

By Application

- Land & Development

- Weed Cultivation

- Plant Protection

- Sowing & Planting

- Harvesting & Threshing

- Post-Harvest Agro Processing

By Automation

- Manual

- Semi-Automatic

- Automatic

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting