What is the AI Agents in Financial Services Market Size?

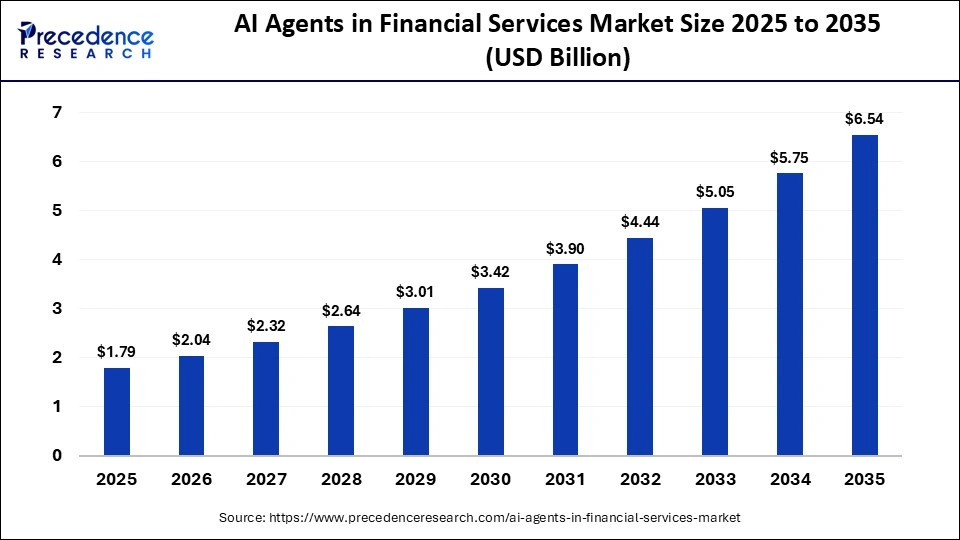

The global AI agents in financial services market size accounted for USD 1.79 billion in 2025 and is predicted to increase from USD 2.04 billion in 2026 to approximately USD 6.54 billion by 2035, expanding at a CAGR of 13.84% from 2026 to 2035. The market growth is attributed to the increasing adoption of intelligent automation and machine learning solutions by financial institutions to enhance operational efficiency and customer engagement.

Market Highlights

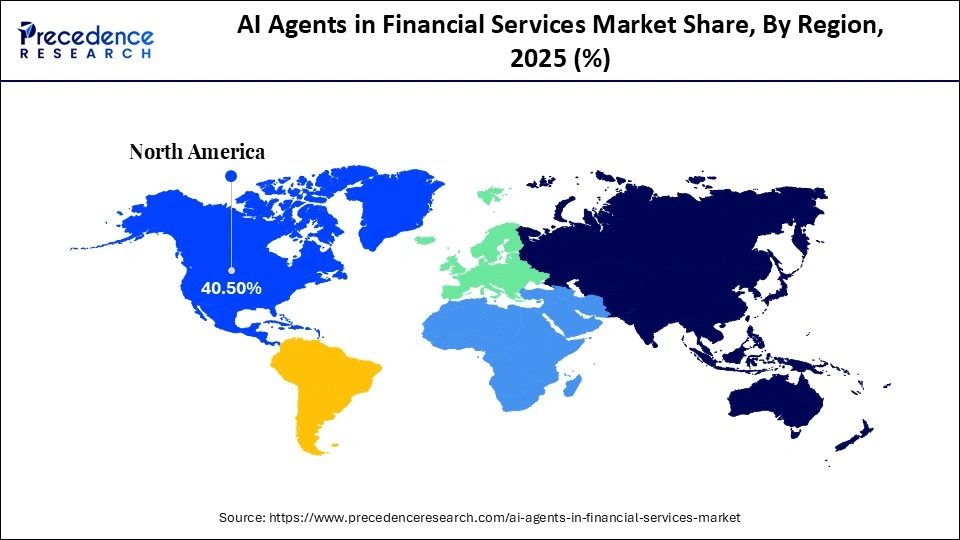

- North America dominated the global market in 2025, capturing nearly 40.5% of the market share.

- The Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By type, the conventional agents segment held the largest market share of 42.7% in 2025.

- By type, the autonomous decision-making agents segment is growing at a strong CAGR between 2026 and 2035.

- By technology, the machine learning segment led the market, accounting for 40.4% share in 2025.

- By technology, the generative AI segment is poised to grow at a significant CAGR from 2026 to 2035.

- By application, the customer service & chatbots segment dominated the market, accounting for 32.5% market share in 2025.

- By application, the fraud detection & prevention segment is expanding at a healthy CAGR from 2026 to 2035.

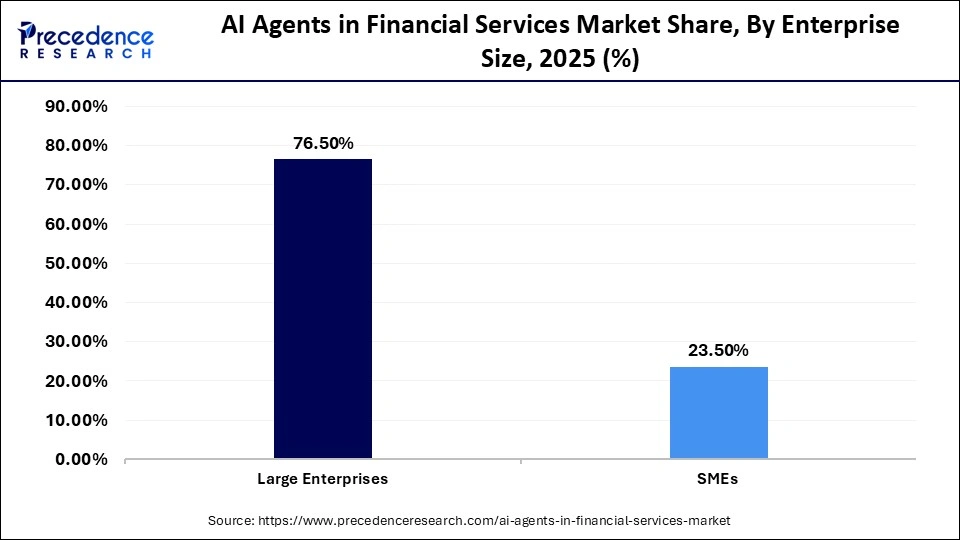

- By enterprise size, the large enterprises contributed the biggest market share 76.5% in 2025.

- By enterprise size, the SMEs segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By end-user, the banks segment captured a 40.5% market share in 2025.

- By end-user, the fintech firms segment will gain a significant share at a 28.5% CAGR between 2026 and 2035.

Market Overview

AI agents in financial services market refer to the intelligent autonomous systems used across banking, insurance, investment, and fintech operations. These agents perform tasks such as customer support, fraud detection, credit decisions, wealth advisory, compliance monitoring, and process automation. Rapid deployment of intelligent automation and machine learning solutions across banking, insurance, and capital markets is fueling market growth. AI-powered agentic systems automate customer service, improve credit assessments, detect fraud, and enhance compliance monitoring across diverse financial workflows.

Enhanced AI tools are transforming credit decisions, risk management, compliance, and portfolio management. According to the IMF, many financial institutions now use AI for activities like fraud detection and customer engagement. Additionally, the growing reliance on AI in strategic operations and risk management fosters further innovation and investment in the market.

AI Agents in Financial Services Market Growth Factors

- Rising Adoption of Cloud-Based Solutions: The increasing deployment of cloud infrastructure is propelling AI agent integration across banking and fintech platforms.

- Growing Demand for Personalized Financial Services: Customer expectations for tailored recommendations are driving the development of advanced conversational and predictive AI agents.

- Boosting Cybersecurity and Fraud Prevention Measures: Heightened regulatory scrutiny and rising financial crimes are fueling AI-driven fraud detection and prevention adoption.

- Propelling Real-Time Data Analytics Capabilities: The need for instant insights from transactional and market data is driving the growth of machine learning-powered AI agents.

- Expanding Fintech and Digital Banking Ecosystems: Rapid expansion of digital financial services is growing the deployment opportunities for automated customer service and advisory AI solutions.

Intelligent Finance: Global AI Agents Driving the Future of Banking, Trading, and Fintech Innovation

- North America, especially the U.S. and Canada, leads global AI adoption in financial services, with studies showing up to 98% of North American banks using AI in at least one operational process by 2025, and North America capturing the largest share of global AI in banking and fintech activity.

- Europe accounts for approximately 27–30% of AI used in the financial services market, with strong adoption in compliance automation, fraud detection, and customer analytics. Additionally, 86% of European banks report integrating AI into core functions like compliance and service systems.

- By 2025, over 65% of global financial institutions are expected to use machine learning and AI algorithms for portfolio management, trading insights, or operational analytics, making finance one of the fastest sectors for enterprise AI adoption worldwide.

- AI chatbots and conversational agents gained widespread adoption worldwide in 2025, with approximately 92% of North American banks and over 79% of Asia-Pacific banks implementing AI chatbot systems for customer service functions.

- Industry surveys reveal that 74% of financial institutions have appointed or intend to appoint senior executives responsible for AI ethics, governance, and regulatory compliance oversight, reflecting increased governance expectations.

- By 2025, about 87% of global financial institutions will have implemented AI-powered fraud detection systems, up from 72% in early 2024, showing widespread adoption in core fraud monitoring roles.

- Over 70% of Tier-1 banks plan to increase AI budgets for fraud detection and AML modernization by 2026. This rise in funding boosts the revenue prospects for AI developers focusing on transaction intelligence, anomaly detection, and real-time behavioral analytics.

- Over 88% of successful cyberattacks in 2024 resulted from human error or slow detection. This vulnerability drives institutions to implement AI agents for continuous monitoring and proactive defense, thereby increasing market penetration.

AI Agents in Financial Services Market Outlook

- Industry Growth Overview: The AI agents in financial services market is experiencing rapid expansion as banks, fintechs, and insurance companies increasingly adopt intelligent digital assistants for customer service and fraud detection. The growing need for real-time data processing, automated processes, and customized financial services is driving businesses to implement AI agents in retail banking and corporate finance.

- Global Expansion:The market is expanding worldwide. The adoption of AI agents is expanding across North America, Europe, and the Asia-Pacific region. Regulators and governments across North America, Europe, and the Asia-Pacific are funding large digital transformation initiatives. This is further speeding up adoption, with natural language processing, machine learning, and advanced analytics helping improve operational efficiency and customer interactions. Additionally, banks are employing AI agents to streamline transaction monitoring, credit ratings, and compliance reporting.

- Major Investors:Private equity firms, venture capitalists, and strategic corporate investors are increasingly funding AI agent platforms in the financial sector. Investment flows are directed toward scalable AI solutions in banks, payment systems, insurance companies, and wealth management firms. The latest acquisitions highlight a focus on conversational AI startups, predictive analytics tools, and automated compliance systems. Additionally, investor activity indicates optimism about the market's potential to improve operational efficiency, comply with regulations, and deliver high-quality customer experiences.

- Startup Ecosystem:The startup ecosystem in the market is growing quickly, fueled by advances in conversational AI, natural language processing, machine learning, and autonomous decision-making. Startups focus on intelligent customer support, AI-driven wealth advice, automated loan processing, and fraud detection. Additionally, progress in responsible AI is being pushed forward through collaboration among startups, research institutions, and fintech incubators. This teamwork helps develop solutions that enhance transparency, efficiency, and personalization in financial services worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.79 Billion |

| Market Size in 2026 | USD 2.04 Billion |

| Market Size by 2035 | USD 6.54 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Technology, Deployment, Application, Enterprise Size, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Conversational Agents Segment Lead the AI Agents in Financial Services Market?

The conversational agents segment led the market with the largest share of 42.7% in 2025, as financial institutions focused on real-time customer engagement and automated support. According to the ScienceDirect 2025 report, more than 48% of companies incorporated some form of intelligent automation into regulated operations by the end of 2024. Additionally, ongoing improvements to adaptive learning and integration with CRM and core banking systems are expected to boost the demand for conversational agents.

The autonomous decision-making agents segment is expected to grow at the fastest rate in the coming years, owing to their ability to process complex financial data and execute strategic decisions with minimal human oversight. These agents are reshaping functions like risk management, credit underwriting, and portfolio optimization. Additionally, their adoption is sped up by strategic deployments from tech leaders such as Microsoft, Google Cloud, and AWS, which offer scalable platforms optimized for agentic workflows.

Technology Insights

What Made Machine Learning the Dominant Segment in the AI Agents in Financial Services Market?

The machine learning segment dominated the market in 2025, accounting for 40.4% share. This is mainly due to its proven ability to derive insights from large, structured financial datasets. Additionally, the major international banks and financial technology companies implemented machine learning as part of their transaction monitoring and AML compliance programs, thereby facilitating segment growth.

The generative AI segment is expected to grow at the fastest CAGR in the coming years, owing to its ability to generate new, contextually relevant content and insights that support strategic outcomes beyond pattern recognition. The adoption of generative AI is also growing, as it creates new, contextually relevant content and information that drive and support strategic outcomes beyond mere pattern recognition. Additionally, financial institutions are testing generative models to generate synthetic data for robust testing and to deliver engaging customer experiences that enable more personalization at scale.

Application Insights

How Does the Customer Service & Chatbots Segment Dominate the AI Agents in Financial Services Market?

The customer service & chatbots segment dominated the market, holding the largest revenue share 32.5% in 2025. The segmental dominance is attributed to financial firms seeking to improve customer engagement, reduce wait times, and provide 24/7 support. Furthermore, the adoption of these technologies was driven by regulatory compliance, data privacy, and secure authentication frameworks that ensured sensitive financial data remained secure.

The fraud detection & prevention segment is expected to grow at a significant CAGR in the coming years, driven by rising cyber threats, identity theft, and financial crime across various countries. The use of AI agents in financial institutions to track transactions, detect anomalies, and even identify suspicious programs is becoming increasingly common in the financial sector.

Machine learning algorithms analyze both past and current data streams to identify patterns of fraud, improving detection speed, accuracy, and reducing false positives. In 2024, the European Banking Authority (EBA) 2023 report stated that 1.5 million debit transactions were reported as fraudulent, helping financial institutions implement AI-driven fraud monitoring systems.

Enterprise Size Insights

How Does Large Enterprises Lead the AI Agents in Financial Services Market?

The large enterprises segment led the AI agents in financial services market in 2025, accounting for an estimated 76.5% share. This is mainly due to their large-scale operations, large customer base, and the need for a high level of efficiency in their work with complex financial processes. Large banks, multinational insurers, and international fintech firms used AI agents to enhance customer service, automate back-office tasks, and strengthen risk management systems. Additionally, continuous investment in talent, AI model training, and cross-border system integration helped these large enterprises stay ahead in deploying intelligent agents across financial services.

The SMEs segment is expected to grow at the fastest CAGR in the coming years. The segmental growth is driven by the increasing accessibility of AI technologies for SMEs through cloud platforms, AI-as-a-Service offerings, and modular deployment models. Additionally, improvements in low-code AI integration, machine learning APIs, and real-time analytics are expected to accelerate AI adoption among SMEs in the coming years.

End-User Insights

Why Did Banks Dominate the AI Agents in Financial Services Market?

The banks segment dominated the market with the largest revenue share of 40.5% in 2025, as banks are considered early adopters of intelligent automation solutions to enhance customer experience and internal efficiency. Many banking institutions use AI chatbots as the first line of service. They handle most routine customer questions, reducing congestion at traditional service points and allowing employees to focus on complex tasks. Additionally, industry experts estimate that ongoing improvements in adaptive AI strengthen banks' competitive positions by enhancing customer satisfaction and operational resilience, thereby driving the adoption of AI agents.

The fintech firms segment is expected to grow at a significant CAGR in the coming years, owing to their digital-first models and strong demand for AI-powered automation across payments, lending, compliance, and engagement services. Cloud solutions, generative AI systems, and real-time analytics enabled these companies to scale their services with minimal infrastructure costs. Additionally, the Adaptive AI systems helped fintechs automate compliance processes and provide personalized customer experiences, further supporting market growth in the coming years.

Regional Insights

How Big is the North America AI Agents in Financial Services Market Size?

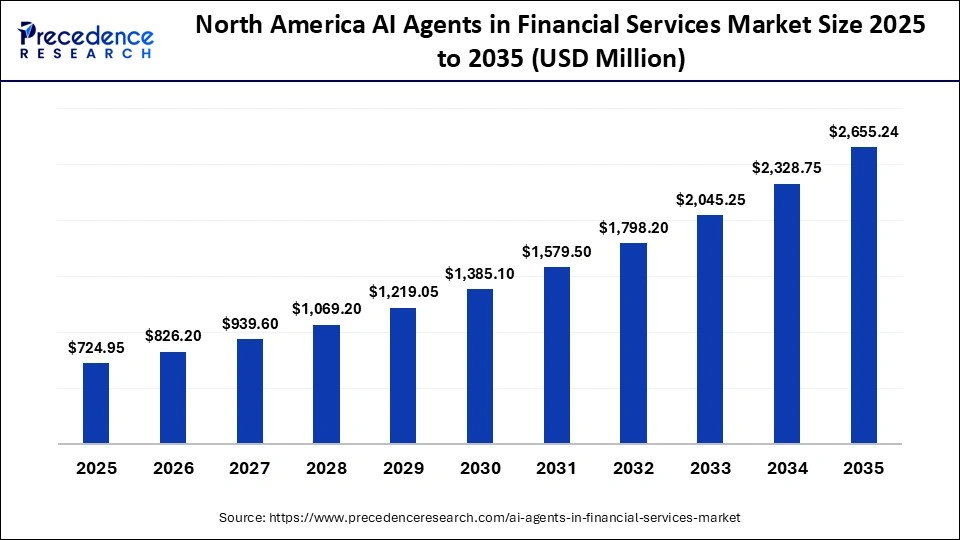

The North America AI agents in financial services market size is estimated at USD 724.95 million in 2025 and is projected to reach approximately USD 2,655.24 million by 2035, with a 13.86% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the AI Agents in Financial Services Market?

North America dominated the AI agents in financial services market, capturing the largest revenue share of 40.5% in 2025. This is mainly due to the heightened integration of AI across core banking functions, widespread operational deployment, and strong institutional support for intelligent automation. The regulators of the U.S. Federal Reserve and Canada promote the use of AI agents. These technologies are enhancing customer engagement, streamlining loan processing, and boosting fraud detection.

According to the Bank for International Settlements' 2025 analysis states that the use of AI has led to improvements in real-time analytics and risk management capabilities. Additionally, North American banks such as JPMorgan Chase, Bank of America, and Citigroup have rapidly developed AI agents using cloud and AI providers, thereby supporting the market in this region.

What is the Size of the U.S. AI Agents in Financial Services Market?

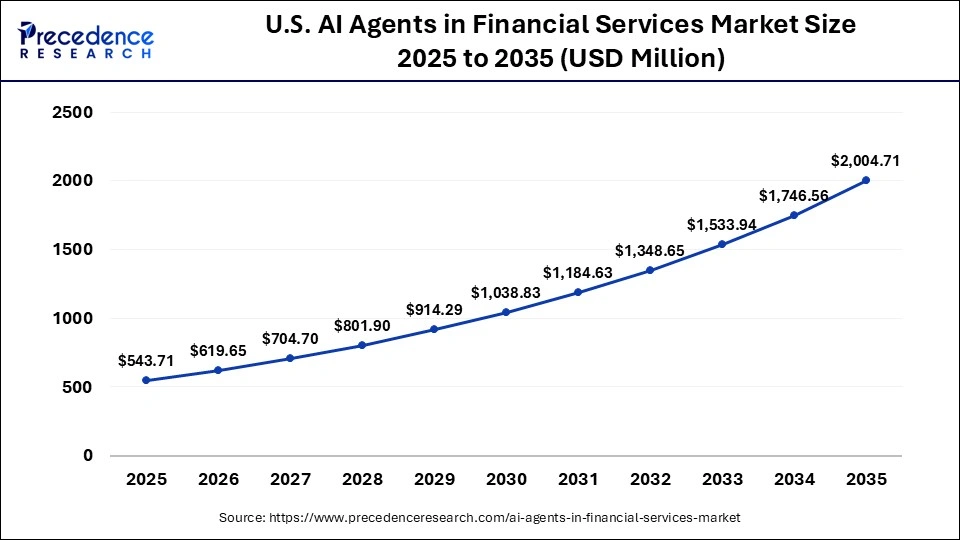

The U.S. AI agents in financial services market size is calculated at USD 543.71 million in 2025 and is expected to reach nearly USD 2,004.71 million in 2035, accelerating at a strong CAGR of 13.94% between 2026 and 2035.

U.S. AI Agents in Financial Services Market Analysis

The U.S. is a key player in the market, thanks to its advanced banking infrastructure, widespread adoption of cloud technologies, and high investments in AI-driven automation. Major banks like JPMorgan Chase, Bank of America, and Citibank have implemented conversational AI, predictive analytics, and fraud detection tools to improve customer service and boost operational efficiency. Additionally, AI agents used by Fintech companies such as Stripe, Square (Block), and Robinhood for personalized customer engagement, digital payments, and risk monitoring have contributed to the growing use of AI in the regional market.

Why is Asia Pacific Considered the Fastest-Growing Region in the AI Agents in Financial Services Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to widespread digital transformation, high acceptance of generative AI, and increasing pressure to combat fraud and financial crime across various nations. Studies in 2025 showed that frontline employees in Asia Pacific used generative AI tools much more often than employees in other digitally advanced countries, with 78% using AI regularly.

Asian banks are accelerating their AI investments to enhance generative AI in their current services and plan for larger GenAI implementations in 2025 compared to the previous year, reflecting strong confidence in AI's strategic importance. Additionally, the development of AI-driven fraud detection, customer relationship management, and credit risk automation is poised to make the Asia-Pacific region a high-growth market for intelligent financial services.

China AI Agents in Financial Services Market Analysis

China is leading in Asia Pacific, fueled by rapid digitalization, government initiatives in AI, and widespread mobile payments. Asian commercial banks and major fintechs like Ant Group, Tencent, and WeBank have integrated AI agents into customer service, loan application review, and fraud detection. Additionally, fintech innovation, AI-friendly policies, and government-backed digital banking projects are expected to drive further growth in China.

What Makes Europe a Notably Growing Area in the AI Agents in Financial Services Market?

Europe is projected to grow at a notable rate in the market due to strong regulatory frameworks, expansion of digital banking, and increased investment in intelligent automation across both established banks and emerging fintechs. Additionally, regulatory support, advanced AI technology, and growing fintech presence are expected to keep Europe on its path toward becoming a leading regional AI market in financial services.

Germany AI Agents in Financial Services Market Analysis

Germany leads the market due to its strict regulatory environment, the rise in AI use in financial services, and strong AI investments from both traditional banks and fintech startups. Banks like Deutsche Bank, Commerzbank, and DZ Bank have implemented conversational AI, machine learning-based credit risk models, and predictive analytics systems to improve operational efficiency and compliance. Additionally, generative AI platforms and cross-industry collaborations are expected to continue boosting AI adoption, solidifying Germany's status as a leading European AI market.

AI Agents in Financial Services Market Value Chain

Top Companies in the AI Agents in Financial Services Market & Their Offerings

- IBM (U.S.): IBM is a global leader in AI and cognitive computing solutions, offering advanced AI agents for risk management, fraud detection, and customer engagement in financial services.

- Microsoft (U.S.): Microsoft provides AI-driven platforms such as Azure AI and Dynamics 365, enabling banks and fintechs to deploy intelligent agents for automation, analytics, and digital customer experience.

- Google (U.S.): Google delivers AI and machine learning solutions, including TensorFlow and generative AI models, which support predictive analytics, trading insights, and fraud prevention in finance.

- AWS (U.S.): Amazon Web Services offers cloud-based AI tools and services that power scalable AI agents for real-time payments, risk assessment, and personalized financial services.

- Salesforce (U.S.): Salesforce integrates AI agents through its Einstein platform, enhancing CRM, customer service automation, and financial advisory capabilities for banks and fintechs.

- Oracle (U.S.): Oracle provides AI-powered cloud applications and analytics solutions that streamline compliance, risk intelligence, and operational automation in the financial sector.

- FIS (U.S.): FIS delivers AI-driven banking and payment solutions, including fraud detection, AML monitoring, and predictive analytics platforms for global financial institutions.

- Fiserv (U.S.): Fiserv offers AI-enabled platforms for digital payments, core banking, and customer engagement, leveraging intelligent agents to optimize financial workflows.

Other Major Companies

- SAS Institute

- Cognizant

- Infosys

- Tata Consultancy Services (TCS)

- H2O.ai

- DataRobot

- Kyndryl

Recent Developments

- In July 2025, CaixaBank launched a generative AI agent for its mobile banking app. The agent guides users on products, compares options, and helps select the best fit. Built on Google Cloud AI, it interacts directly with customers. The functionality, initially for card transactions, has rolled out to 200,000 users.(Source: https://www.caixabank.com)

- In June 2025, SAP Fioneer announced its AI Agent for financial services institutions. The agent automates core operations and provides real-time insights. It uses natural language to enhance decision-making without sharing data externally. Banks and insurers can leverage it to streamline processes and boost operational efficiency.(Source: https://www.sapfioneer.com)

- In December 2025, SecurityPal AI launched Concierge Agents, starting with "Libby", the Knowledge Librarian. Libby serves as a 24/7 extension of enterprise security, compliance, and GTM teams. The AI agent ensures superior assurance for customers, teams, and partners. Nine more specialized agents are planned to cover additional enterprise functions.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Type

- Conversational Agents

- Autonomous Decision-Making Agents

- Predictive Analytics Agents

- Compliance & Risk Monitoring Agents

- Robotic Process Automation (AI-RPA) Agents

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Reinforcement Learning

- Generative AI

By Deployment

- On-premises

- Cloud

By Application

- Customer Service & Chatbots

- Fraud Detection & Prevention

- Credit Scoring & Underwriting

- Wealth Management & Advisory

- Trading & Portfolio Optimization

- Compliance & Regulatory Reporting

- Insurance Claims Automation

By Enterprise Size

- Large Enterprises

- SMEs

By End-User

- Banks

- Insurance Companies

- Fintech Firms

- Investment & Asset Management Firms

- Payment Service Providers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting