AI Shopping Assistant Market Size and Forecast 2025 to 2034

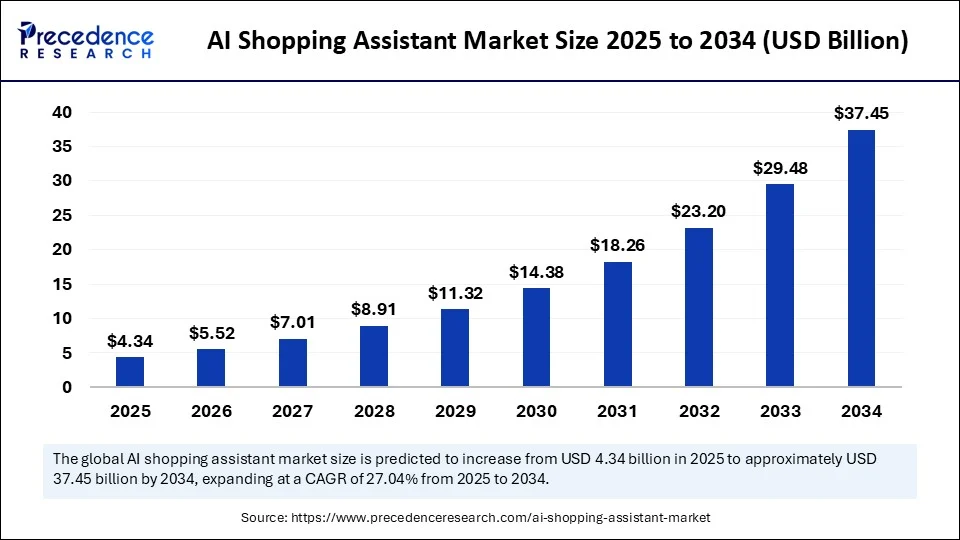

The global AI shopping assistant market size accounted for USD 3.42 billion in 2024 and is predicted to increase from USD 4.34 billion in 2025 to approximately USD 37.45 billion by 2034, expanding at a CAGR of 27.04% from 2025 to 2034.The market is experiencing a significant growth rate due to increased penetration of e-commerce platforms, digitalization across leading countries, a shift towards online shopping, and technological advancement in AI tools.

AI Shopping Assistant MarketKey Takeaways

- In terms of revenue, the global AI shopping assistant market was valued at USD 3.42 billion in 2024.

- It is projected to reach USD 37.45 billion by 2034.

- The market is expected to grow at a CAGR of 27.04% from 2025 to 2034.

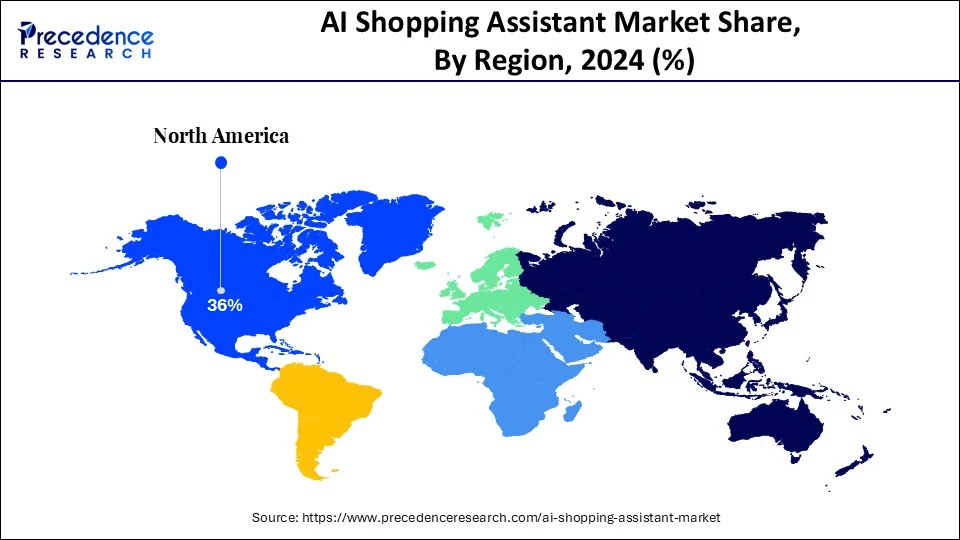

- North America held the largest market share of 36% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By technology type, the NLP segment held the largest market share of 28% in 2024.

- By technology type, the computer vision segment is expected to witness the fastest CAGR during the foreseeable period.

- By device integration, the smartphones & tablets segment held the largest market share of 46% in 2024.

- By device integration, the smart mirrors and screens segment is expected to witness the fastest CAGR during the foreseeable period

- By application, the product discovery & search segment held the largest market share of 32% in 2024.

- By application, the virtual try-on segment is expected to witness the fastest CAGR during the foreseeable period.

- By end user, the e-commerce platforms segment dominated the market in 2024.

- By end user, the fashion & apparel retailers segment is expected to witness the fastest CAGR during the foreseeable period.

- By retail format, the online segment dominated the market in 2024.

- By retail format, the omnichannel retailers segment is expected to witness the fastest CAGR during the foreseeable period.

- By deployment mode, the cloud-based segment held the largest market share of 64% in 2024.

- By deployment mode, the hybrid segment is expected to witness the fastest CAGR during the foreseeable period.

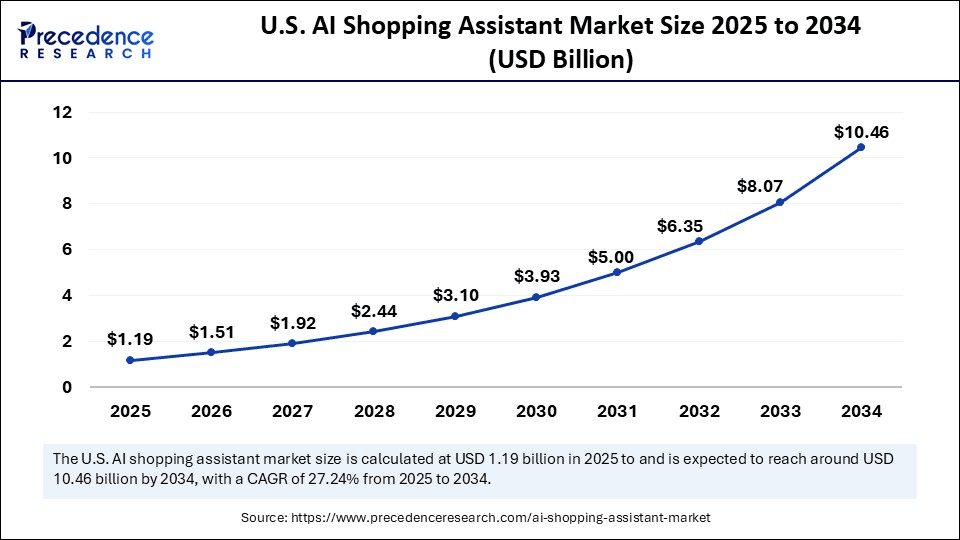

U.S. AI Shopping Assistant Market Size and Growth 2025 to 2034

The U.S. AI shopping assistant market size was exhibited at USD 0.94 billion in 2024 and is projected to be worth around USD 10.46 billion by 2034, growing at a CAGR of 27.24% from 2025 to 2034.

North America

What are the factors contributing to the dominance of North America in the AI shopping assistant market?

North America held the largest market share of 36% in 2024. Tech leaders and retailers in North America have acknowledged the potential of AI and its application as virtual assistants for seamless shopping very early, when AI was rising. They began to integrate AI-powered solutions for developing AI shopping on a global scale. A huge part of North America is highly established and uses cutting-edge tools and has embraced AI integration with e-commerce platforms, which again supports a convenient and personalize shopping experience. Online marketplaces and a wide range of online retailers are well-established e-commerce infrastructures that offer a thriving ground for the AI assistant in online shopping.

Moreover, major tech companies are residing in North America and heavily investing in research and development of AI-based products and applications, fostering innovation in the AI landscape with multiple possibilities. Companies like Microsoft, Nvidia, and IBM are some of the leading examples of enterprises that launch AI tools and platforms for different domains. Thus, virtual assistants like Alexa, Siri are frequently used by consumers out there for convenience, showcasing their early adoption of technologies, in turn, benefiting the expansion of the AI shopping assistant market in North America.

Asia Pacific

Why does the Asia Pacific AI shopping assistant market promise exponential future growth?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period. The region showcases significant growth potential due to a combination of factors. Asia Pacific, is encompasses countries that are growing in a technological landscape. Whether it's Internet of Things, 5G integration, or AI/ML adoption, it ultimately supports the growth of the AI shopping assistant market. E-commerce expansion, along with internet penetration, is a leading factor that drives the region's growth.

Consumers are also shifting their shopping practices due to busy schedules and increased disposable income, and looking for a personalized shopping experience that can be easily served by AI assistants. Increasing digitalization further creates a lucrative opportunity for market reach. Country-wise, China is a leader and major contributor in the Asia-Pacific AI shopping assistant market.

Market Overview

The Artificial Intelligence shopping assistant market refers to the ecosystem of software platforms, tools, and devices that leverage artificial intelligence to assist consumers in their shopping journey, either online or in physical stores. These assistants use natural language processing, computer vision, predictive analytics, and recommendation algorithms to enhance product discovery, comparison, and purchasing decisions. The market spans applications like conversational chatbots, virtual shopping concierges, smart mirrors, voice-activated assistants, and personalized recommendation engines. AI shopping assistants are used by retailers, e-commerce platforms, brands, and third-party solution providers to improve user experience, drive conversion rates, and optimize product engagement.

What are the Key Trends in the AI Shopping Assistant Market?

- Voice-based shopping and suggestions: One of the significant key trends of the AI shopping assistant market is AI-operated voice assistants such as Siri, Alexa, and Google assistants that are highly beneficial tools for online shopping to suggest different products with their descriptions, like offline retailers do, and this is possible due to NLP. They offer users free hands to search, order, sort out products, and cancel if it's not suitable to them, and provide personalized suggestions for shopping by allowing interaction with chatbots that are available all the time.

- Generative AI for Retail:Generative AI can offer product discovery, content creation, with recommendations on personalized styling. Generative AI can provide marketing copy, product descriptions, and product images that support online retailers to showcase and branding for their products on a global platform. AI further helps consumers to suggest new products as per their search history and preferences, even if consumers haven't searched for these new items explicitly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 37.45 Billion |

| Market Size in 2025 | USD 4.34 Billion |

| Market Size in 2024 | USD 3.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Deployment Mode, End-User, Application, Retail Format, Device Integration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing shit of personalized suggestions for shopping

An impacting driving factor of the AI shopping assistant market is the growing inclination of consumers towards a personalized shopping experience to find out expected products easily and as per demand. AI shopping assistants work on ML algorithms and data analysis, which allow them to understand consumers' needs and provide similar product suggestions which creating engagement and the possibility of purchase. Also, NLP offers highly natural and effective interactions between chatbots and consumers just as a human does, eliminating the need for continues human intervention. AI assistants further support consumers to navigate through a variety of options and compare them for the best possible purchase independently, while offering comfort to do this everything at their own pace and from anywhere in the globe.

Restraint

Possible biases by algorithms

Despite having several advantages, the AI shopping assistant market witnesses a few drawbacks, including algorithmic biases that may occur while searching specific product. Since AI is purely working on huge datasets only, and if the data has some biases, it will also reflect in its recommendations and product searches. So this method could be manipulative and unfair with some products and brands. AI that is trained on certain data from a specific location it will more likely to suggest products from that particular region, which is a hampering factor for the overall sector.

Opportunity

Penetration of the digital world

Digitalization and its increasing adoption by several leading and well-developed countries have affected many sectors in a positive way, including the AI shopping assistant market, by bridging the gap between local and international products and allowing consumers to access various products without limitations. More people are inclined to shop from online shopping platforms due to their convenience and efficient experience. Increased rate of internet usage with smartphones and laptops further creates space for market expansion. Thus, by embracing AI technology, retailers can stay at the forefront of global platforms by offering an efficient shopping experience with consumer-centric platforms.

Technology Type Insights

What is special about NLP that supports the growth of the AI shopping assistant market?

The NLP segment held the largest market share of 28% in 2024. NLP stands for natural language processing, and as the name suggests, it is built to understand user intent in their own, regional language. NLP can understand user input variations like slang, misspellings, and different phrases and making human-computer interaction easier and accessible to many at once. NLP is multilingual. This allows AI to deeply understand what exactly the user is looking for, even if they are not able to perfectly express it in words, which enhances the user experience with AI shopping assistants.

The computer vision segment is expected to witness the fastest CAGR during the foreseeable period. The segment is expanding as computer vision enhances and supports features like visual search, Augmented Reality, AR try-ons, along with in-store analysis to find out the same pattern and products that offer an immersive user experience. It further offers deep insights for in-store inventory management, leading to operational efficiency.

Device Integration Insights

Why is smartphone & tablet integration fueling the growth of the AI shopping assistant market?

The smartphones & tablets segment held the largest market share of 46% in 2024. Smartphones and tablets are the most commonly used electronic devices for online shopping. It provides online shopping access to users irrespective of location and time, which offers great convenience to users. On-device processing means the ability of mobile devices to manage complex AI algorithms without the need for cloud connectivity, allowing for quick responses. More AI-powered applications being integrated with mobile and smartphone applications are further expanding the market reach.

The smart mirrors and screens segment is expected to witness the fastest CAGR during the foreseeable period. By offering smart mirrors and screens, the gap between virtual and offline shopping experiences becomes smaller, and increases conversion rates further. These technologies are highly engaging and offer a personalized shopping experience as consumers can explore a range of products.

Application Insights

Why has product discovery & search seen hype in the AI shopping assistant market?

The product discovery & search segment held the largest market share of 32% in 2024. AI shopping assistants are not limited to a single channel and online platform; rather, they suggest various options from a number of channels at once, facilitating omnichannel retail business. Visual search and personalized suggestions can also be offered by them with voice searches for a seamless and user-engaging experience for shopping. Also, advancement in NLP allows Consumers to speak through voice searches for convenience and easy expression, further fueling the segment growth in the global market.

The AR try-on for the fashion & beauty sub-segment of the virtual try-on segment is anticipated to have the fastest growth. This growth is attributed to a couple of factors, like minimized uncertainty about product buying, increased consumer engagement, and minimized return rate while supporting real-time conversation to gain more clarity on products that consumers are planning to buy.

End User Insights

How are e-commerce platforms using AI as a shopping assistant?

The e-commerce platforms segment dominated the market in 2024, with the online marketplaces sub-segment holding a share of 38%. AI-based shopping assistants can minimize cart abandonment by offering support during the checkout process and offering rewards and discounts, which fuel business turnover on a large scale. E-commerce platforms are thriving due to their personalize offerings as per demand and seasonal products, and suggest products by analyzing user search history for a highly engaging and supportive shopping experience.

The fashion & apparel retailers segment is expected to witness the fastest CAGR during the foreseeable period. The fashion and apparel sector is majorly expecting personalized shopping experiences and products instead of readymade apparel, and AI shopping assistants are fulfilling this demand by providing data about relevant products as per consumers' preferences and bases like region, apparel choice, texture, and others.

Retail Format Insights

Why is online retail gaining traction in the global AI shopping assistant market?

The online segment dominated the market in 2024, with the only retailers' sub-segment holding a share of 41%. The increasing e-commerce platforms and their success rate, with a surge in digitalization in leading countries, are responsible for the segment growth. Many people are opting for online shopping due to AI assistance and personalized suggestions by focusing on time saving due to busy schedules, further creating higher demand for AI in online shopping. AI tools can again streamline processes like taking orders and resolving queries about products and location through chatbot conversations, and manage inventory as well.

The omnichannel retailers segment is expected to witness the fastest CAGR during the foreseeable period. Segment is growing due to the offerings of AI, such as integrated and consistent experiences across all channels, with faster customer support on all platforms. Also, AI algorithms can provide valuable insights by analyzing data from different sources as per consumers' preferences.

Deployment Mode Insights

Why is cloud-based deployment highly prevalent in the AI shopping assistant market?

The cloud-based segment dominated the market, with the SaaS AI shopping tools sub-segment holding a share of 64% in 2024. Cloud-based deployment is highly usable due to its increased scalability, easy integration, and real-time data synchronization with cost efficiency. Cloud platforms offer easily scale method for the required AI shopping assistant solutions, either up or down as per demand. Cloud deployment can easily integrate with e-commerce platforms that already exist. It can also connect with digital channels like websites, messaging channels/ platforms, while reducing the need for a large investment in IT infrastructure, and is highly beneficial for every business. The cloud + edge sub-segment of the hybrid segment is anticipated to have the fastest growth. The synergy of hybrid-cloud and edge AI provides real-time data analysis irrespective of data size, which is collected from edge devices. This method offers valuable insights about consumer behavior, demand, and interests.

AI Shopping Assistant Market Companies

- Amazon

- Microsoft

- IBM

- Apple

- Alibaba Group

- Baidu

- SAP SE

- Salesforce

- Shopify

- Oracle

- Walmart Labs

- eBay Inc.

- Pinterest (Shopping Lens)

- Clarifai

- ViSenze

- Syte AI

- Vue.ai

- TrueFit

- Farfetch

Recent Developments

- In August 2025, the CEO of Pinterest announced that the platform is ready to position itself as an AI-enabled shopping assistant during the recent “CAMBRAIN MOMENT” for AI and highlighted their efforts to responsible use AI.(Source: https://theaiinsider.tech)

- In August 2025, Generative AI like ChatGPT will be used for internet shopping with a checkout option, according to the sources. This will create a huge impact on the online shopping platforms. To support this, Gen AI search engine perplexity recently made a deal with PayPal to manage transactions inside its platform. (Source:https://www.cnbc.com)

Segments Covered in the Report

By Technology Type

- Natural Language Processing (NLP)

- Text-based chatbots

- Multilingual conversational AI

- Contextual sentiment analysis

- Computer Vision

- Visual product recognition

- Augmented reality try-on

- Visual search tools

- Machine Learning & Predictive Analytics

- Purchase behavior prediction

- Dynamic pricing models

- Demand forecasting

- Voice Recognition

- Voice shopping assistants

- Multi-device voice commerce

- Voice-enabled product search

- Others

- Hybrid AI models

- Gesture-based interfaces

By Deployment Mode

- Cloud-based

- SaaS AI shopping tools

- API-integrated solutions

- On-Premises

- In-store AI systems

- Proprietary AI engine hosting

- Hybrid

- Cloud + Edge AI deployments

- Data-localized AI solutions

By Application

- Product Discovery & Search

- Personalized recommendations

- Visual search engines

- Price Comparison & Deals

- Real-time deal alerts

- AI-driven coupon finding

- Virtual Try-On

- AR try-on for fashion & beauty

- 3D product visualization

- Customer Support

- Pre-purchase queries

- Return/exchange assistance

- Checkout & Payments

- AI-enabled one-click checkout

- Fraud detection in payments

- Others

- AI-driven loyalty programs

- Subscription management

By End-User

- E-commerce Platforms

- Online marketplaces

- D2C brand platforms

- Retail Chains

- Supermarkets & hypermarkets

- Specialty stores

- Consumer Electronics Brands

- Fashion & Apparel Retailers

- Grocery & Food Delivery Services

- Others

- Automotive retail

- Home furnishing stores

By Retail Format

- Online-Only Retailers

- Omnichannel Retailers

- In-store Digital Kiosks

- Pop-up/Experience Stores

- Others

By Device Integration

- Smartphones & Tablets

- Smart Speakers & Voice Devices

- Smart Mirrors & Screens

- In-store IoT Devices

- Wearables

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting