What is AI Voice Lab Market Size?

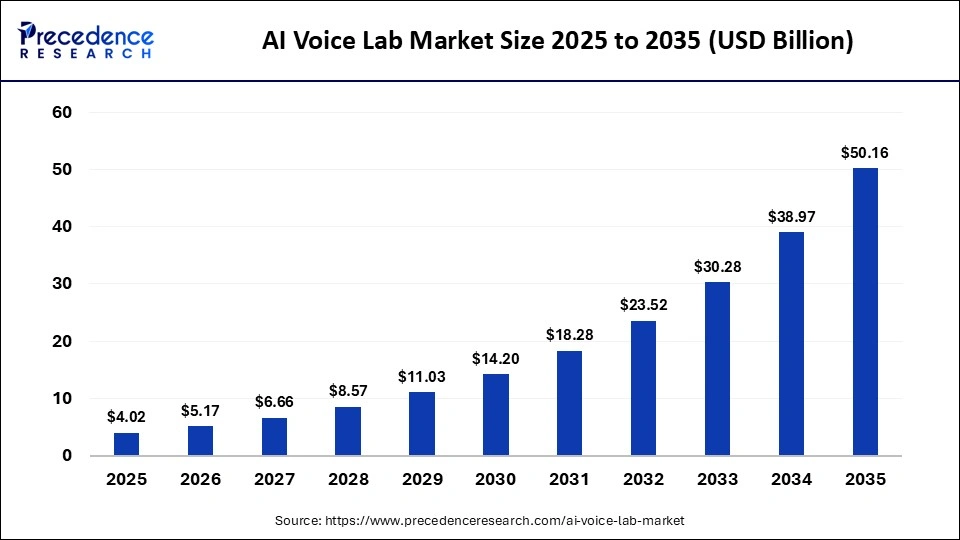

The global AI voice lab market size was calculated at USD4.02 billion in 2025 and is predicted to increase from USD5.17 billion in 2026 to approximately USD50.16 billion by 2035, expanding at a CAGR of 28.71% from 2026 to 2035. This market is growing due to increasing demand for advanced voice recognition, speech synthesis, and AI-powered audio solutions across industries such as media, customer service, healthcare, and smart devices.

Key Takeaways

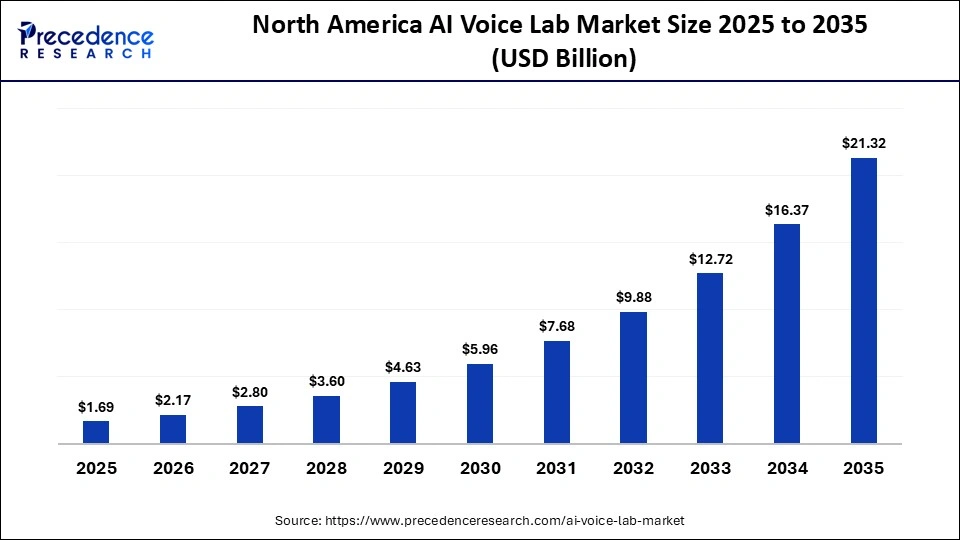

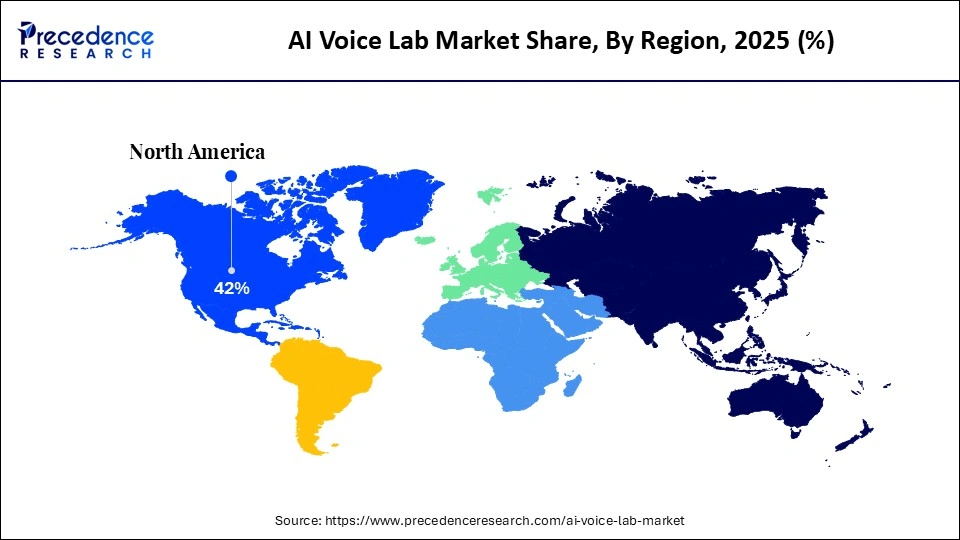

- North America dominated the global market with the largest market share of 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By solution, the platform segment held the biggest market share in 2025.

- By solution, the services segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By deployment, the on-premises segment contributed the highest market share in 2025.

- By deployment, the cloud-based segment is expected to grow at a robust CAGR between 2026 and 2035.

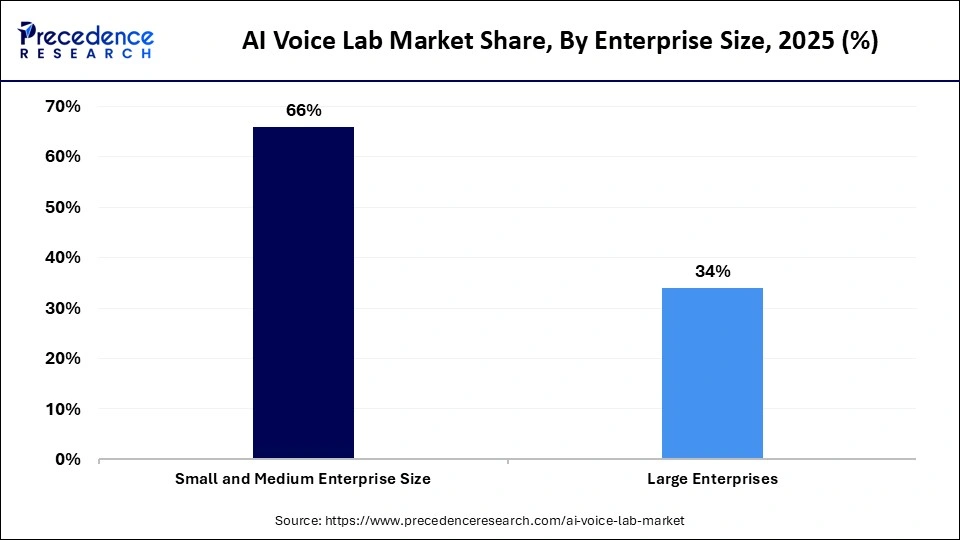

- By enterprise size, the large enterprises segment held a major market share of 66% in 2025.

- By enterprise size, the small and medium enterprise segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By industry, the banking, financial services and insurance (BFSI) segment held the biggest market share in 2025.

- By industry, the retail and e-commerce segment is expected to expand at a significant CAGR between 2026 and 2035.

What Drives the AI Voice Lab Market?

The market is majorly driven by the growing need for AI solutions across industries for real-time audio processing, voice synthesis, and speech recognition. AI-powered voice solutions are being used by businesses to improve customer service, automate operations of call centers, power virtual assistants, and produce customized digital content. Multilingual support, emotion detection, and voice accuracy have all improved due to ongoing advancements in deep learning and natural language processing.

Key Trends Influencing the Market

- The increasing adoption of advanced speech recognition and voice biometric technologies for secure user authentication across various industries.

- The integration of generative artificial intelligence models is transforming voice applications by enabling more natural, human-like, and context-aware conversational interactions.

- The rising demand for multilingual and vernacular voice solutions is encouraging companies to develop inclusive systems that cater to diverse linguistic populations worldwide.

- Organizations across banking, healthcare, retail, and customer service sectors are increasingly deploying voice-enabled virtual assistants to enhance operational efficiency and customer engagement.

- There is a strong shift toward cloud-based AI voice platforms, as they offer scalability, flexibility, and cost-effective deployment compared to traditional systems.

- Real-time voice analytics are gaining traction as businesses seek to derive actionable insights from customer conversations and improve sentiment analysis capabilities.

- Companies are placing greater emphasis on data privacy, regulatory compliance, and secure voice data storage to address growing concerns around cybersecurity risks.

- Investments in edge computing technologies are increasing to enable faster processing speeds and low-latency performance for real-time voice applications.

Future Market Outlook

- Rising adoption of AI voice technologies in emerging economies presents significant opportunities for market players to establish a strong presence in untapped regions.

- The growing use of voice-enabled automation in contact centers is creating new revenue opportunities by improving efficiency and reducing operational costs.

- The development of industry-specific AI voice solutions for sectors such as healthcare and financial services offers strong potential for customized and high-value applications.

- The increasing popularity of smart devices and Internet of Things (IoT) integration is broadening the scope of voice-based applications across consumer and industrial environments.

- The rising demand for personalized and seamless customer experiences is creating opportunities for advanced voice analytics and customer behavior analysis tools.

- Strategic collaborations and partnerships between AI technology providers and enterprises can accelerate innovation and expand the deployment of customized voice solutions.

- Continuous advancements in deep learning and neural network algorithms are enabling the development of more accurate, adaptive, and efficient voice recognition systems.

- The increasing demand for professional consulting, integration, and managed services in AI voice implementation provides long-term growth opportunities for service providers.

How Does Using an AI Voice Lab Lead to a Return on Investment?

AI voice labs lead to strong ROI by significantly reducing operational costs through automation of customer interactions, call handling, transcription, and voice analytics, minimizing the need for large human support teams. They also increase revenue opportunities by improving customer experience, enabling 24/7 support, accelerating response times, and providing personalized voice-based engagement that boosts conversion and retention rates. Additionally, AI voice labs generate actionable insights from voice data, helping businesses optimize marketing, product development, and service strategies, resulting in measurable efficiency gains and faster payback periods.

How Do Government Initiatives Contribute to the AI Voice Lab Market?

Through national AI strategies, research grants, and funding programs targeted at advancing speech and language technologies, governments are bolstering the market for AI voice labs. Public investments in digital infrastructure, innovation hubs, and startups are enabling the development of voice-based AI solutions. Additionally, initiatives in accessibility, multilingual AI, and language preservation, along with regulatory support for cybersecurity, ethical AI, and data protection, are boosting adoption and fostering trust across public and private sectors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.02 Billion |

| Market Size in 2026 | USD 5.17 Billion |

| Market Size by 2035 | USD 50.16 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 28.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution,Deployment,Enterprise Size,Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Solution Insights

What Made Platform the Dominant Segment in the AI Voice Lab Market?

The platform segment dominated the market with the largest share in 2025 because it offers comprehensive voice model development, testing, and deployment capabilities. Businesses favor integrated platforms that facilitate multilingual processing, voice biometrics, and speech recognition all within one ecosystem. These platforms allow for scalable AI experimentation and quicker innovation cycles. The segment's dominance in the market is further reinforced by the high demand for secure and adaptable voice AI systems.

The services segment is expected to grow at the fastest CAGR in the coming years due to the growing difficulty of implementing and refining AI voice solutions. To guarantee performance accuracy, organizations look for professional consulting services for system integration and continuing maintenance assistance. Additionally, the growing demand for compliance and voice data management services is driving segmental growth. With managed services, businesses can lower operating expenses while maintaining ongoing model improvement.

Deployment Insights

Why Did the On-premises Segment Dominate the AI Voice Lab Market?

The on-premises segment dominated the market in 2025 because of increased worries about privacy, data security, and regulatory compliance. To retain complete control over sensitive voice data, sectors like banking and healthcare favor in-house deployment. System integration with legacy IT infrastructure and increased customization are provided by on-premises solutions. The segment leadership is further reinforced by high demand for on-premises solutions from big businesses with well-established data centers.

The cloud-based segment is expected to grow at the fastest CAGR in the coming years because of its adaptability, scalability, and reduced initial investment needs. Remote access, automatic updates, and smooth integration with AI development tools are advantageous to businesses. The segment growth is being accelerated by the growing use of Software-as-a-Service (SaaS) voice platforms. Cloud infrastructure also enables international collaboration and quicker experimentation.

Enterprise SizeInsights

What Made Large Enterprises the Leading Segment in the AI Voice Lab Market?

The large enterprises segment led the market while holding the largest share in 2025 because of their large budgets and emphasis on digital transformation tactics. These organizations make significant investments in analytics tools, automated customer engagement, and cutting-edge voice AI research. Their proficiency in handling intricate data ecosystems facilitates more seamless AI integration. Their market dominance is further reinforced through strategic alliances with AI vendors.

The small and medium enterprise size segment is expected to grow at the fastest CAGR in the coming years, as cloud-based voice AI solutions become more widely available and reasonably priced. SMEs are increasingly adopting AI voice labs to enhance operational efficiency, automate workflows, and improve customer service. Growth is further supported by government initiatives promoting digital adoption and startup ecosystems, as well as flexible subscription models that make advanced voice technologies affordable for smaller businesses.

Industry Insights

Why Did the Banking, Financial Services and Insurance Segment Dominate the Market?

The banking, financial services and insurance (BFSI) segment dominated the AI voice lab market with a major share in 2025 because financial institutions heavily used voice AI for customer service automation, fraud detection, and personalized financial assistance. AI voice labs enable banks and insurers to deploy virtual assistants, IVR systems, and real-time analytics that improve customer engagement while reducing operational costs. The high volume of customer interactions, the need for 24/7 support, and stringent compliance requirements have made BFSI early adopters of AI-powered voice technologies, reinforcing their leading position in the market.

The retail and e-commerce segment is expected to grow at the fastest CAGR in the coming years because these businesses are increasingly adopting voice AI to enhance customer experiences through personalized shopping, voice-based search, and real-time support. AI voice labs enable retailers to deploy virtual assistants, chatbots, and voice-enabled recommendation systems that streamline purchasing and reduce operational costs. The rise of online shopping, demand for omnichannel engagement, and the push for faster, more interactive customer service are driving rapid adoption in this segment.

Regional Insights

North America AI Voice Lab Market Size and Growth 2025 to 2035

The North America AI voice lab market size is estimated at USD 1.69 billion in 2025 and is projected to reach approximately USD 21.32 billion by 2035, with a 28.85% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the AI Voice Lab Market?

North America dominated the AI voice lab market by holding the largest share in 2025. This is mainly due to its early adoption of advanced AI technologies and substantial investments in research and development. The presence of major AI solution providers and tech innovators has facilitated the rapid deployment of voice AI across industries. Widespread enterprise integration for automation, analytics, and customer engagement, along with a supportive regulatory environment and strong digital infrastructure, further solidifies the region's market leadership.

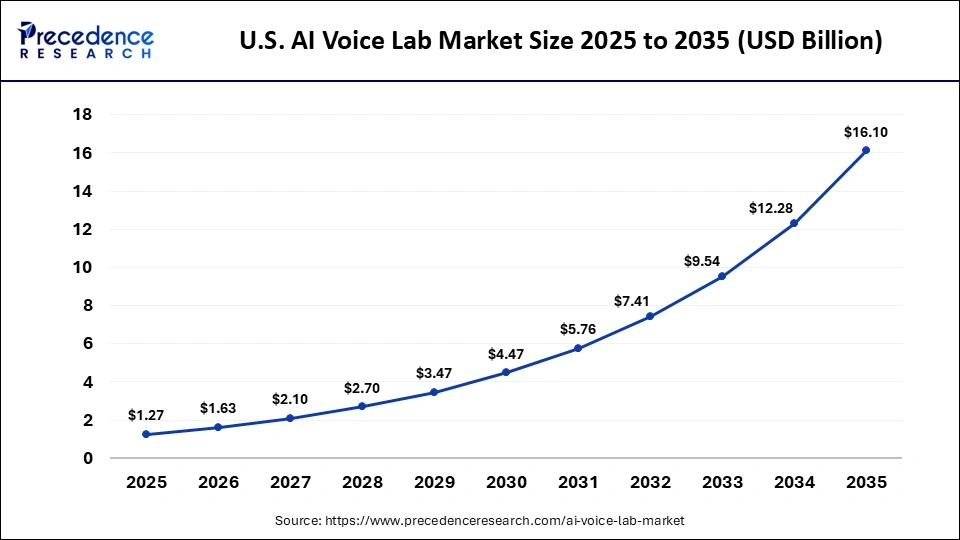

U.S. AI Voice Lab Market Size and Growth 2025 to 2035

The U.S. AI voice lab market size is calculated at USD 1.27 billion in 2025 and is expected to reach nearly USD 16.10 billion in 2035, accelerating at a strong CAGR of 28.91% between 2026 to 2035.

U.S. AI Voice Lab Market Trends

The U.S. dominates the North American AI voice lab market due to substantial investments in artificial intelligence research and advanced cloud infrastructure. The presence of startups and leading AI technology providers is accelerating innovations in speech recognition and voice biometrics. Enterprises across retail, healthcare, and BFSI sectors are increasingly leveraging voice AI for automation and customer engagement, while the emphasis on data security, AI governance, and ethical AI development further supports market growth.

How is the Opportunistic Rise of Asia Pacific in the AI Voice Lab Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to rapid digitalization, government-led AI initiatives, and increasing cloud adoption across industries. Rising investments in startups, innovation hubs, and multilingual voice AI solutions are driving market expansion. Additionally, growing demand for AI-powered customer service, smart devices, and accessibility technologies is supporting adoption across retail, BFSI, healthcare, and education sectors.

India AI Voice Lab Market Trends

The market in India is expanding, driven by its expanding startup ecosystem and rapid digital transformation across sectors. Adoption is being fueled by voice-enabled fintech, e-commerce platforms, and automated customer support solutions. Government initiatives supporting AI innovation and digital infrastructure, along with rising demand for multilingual and vernacular voice applications, are further boosting market expansion.

AI Voice Lab Market Companies

- IBM Corp

- ElevenLabs

- lovo.ai

- Replica Studios Inc.

- Synthesia Limited.

- Google LLC

- Nuance Communications

- Microsoft Corp.

- Descript

- LumenVox

- CandyVoice

Recent Developments

- In February 2026, BharatGen announced the launch of Param2 17B, a sovereign AI model specifically engineered to support 22 Indic languages. This multimodal model provides high-fidelity voice and text capabilities designed to bridge the digital divide for India's diverse linguistic landscape. The launch at the India AI Impact Summit marks a major step in the country's "AI for All" initiative, focusing on data sovereignty and local innovation. (Source: https://punemirror.com)

- In February 2026, ElevenLabs announced the launch of the industry's first AI Agent insurance policy alongside a dedicated "ElevenLabs for Government" portal. This innovative coverage, backed by AIUC-1 certification, protects enterprises and public sector agencies from financial liabilities caused by AI voice agent errors or hallucinations. The initiative marks a significant shift toward professional-grade accountability in the ElevenLabs voice lab market. (Source:https://www.prnewswire.com)

- In January 2026, Unicommerce announced the launch of Catalyst, an AI voice agent designed to recover abandoned e-commerce carts and confirm Cash-on-Delivery orders. The agent uses natural language processing to call shoppers directly to address purchase hurdles and verification needs for Indian retailers. By integrating this into its platform, Unicommerce aims to reduce manual outreach costs and lower Return-to-Origin rates for digital businesses. (Source:https://www.indiablooms.com)

Segments Covered in the Report

By Solution

- Platform

- Services

- Professional Services

- Implementation and Integration

- Consulting and Training Services

- Support and Maintenance Services

- Professional Services

- Managed Services

By Deployment

- Cloud-Based

- On Premises

By Enterprise Size

- Small and Medium Enterprise Size

- Large Enterprises

By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Automotive

- Healthcare

- Retail and E-commerce

- IT and Telecom

- Aerospace and Defense

- Others (Utilities, Media, and Entertainment)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting