What is Aircraft Tube and Duct Assemblies Market Size in 2026?

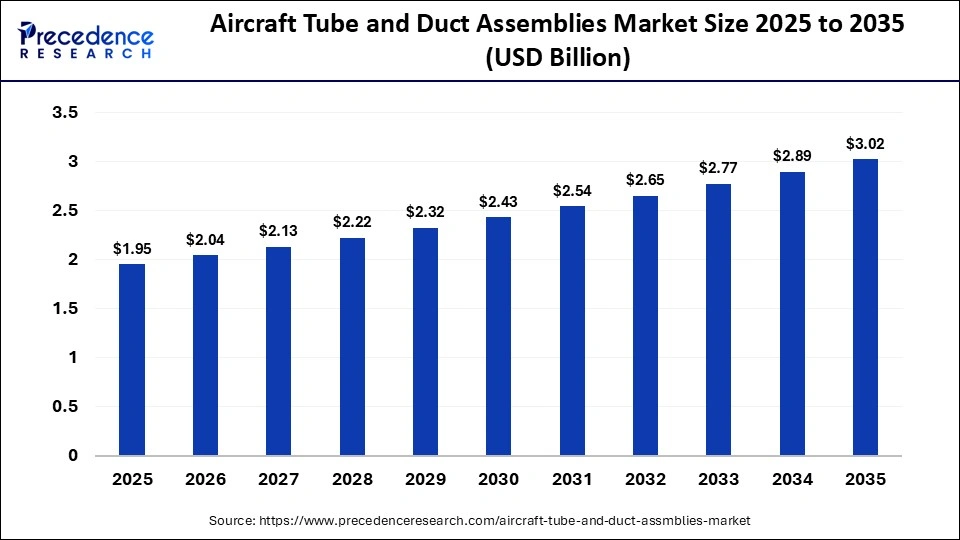

The global aircraft tube and duct assemblies market size was calculated at USD 1.95 billion in 2025 and is predicted to increase from USD 2.04 billion in 2026 to approximately USD 3.02 billion by 2035, expanding at a CAGR of 4.47% from 2026 to 2035. The aircraft tube and duct assemblies market is observed to grow rapidly due to higher demand for commercial airplanes, along with a focus on the production of airplanes, aiding fuel efficiency, light-weight materials, and elevated performance. The market also observes growth due to higher demand for efficiency, paired with safety, further propelling the growth of the market.

Key Takeaways

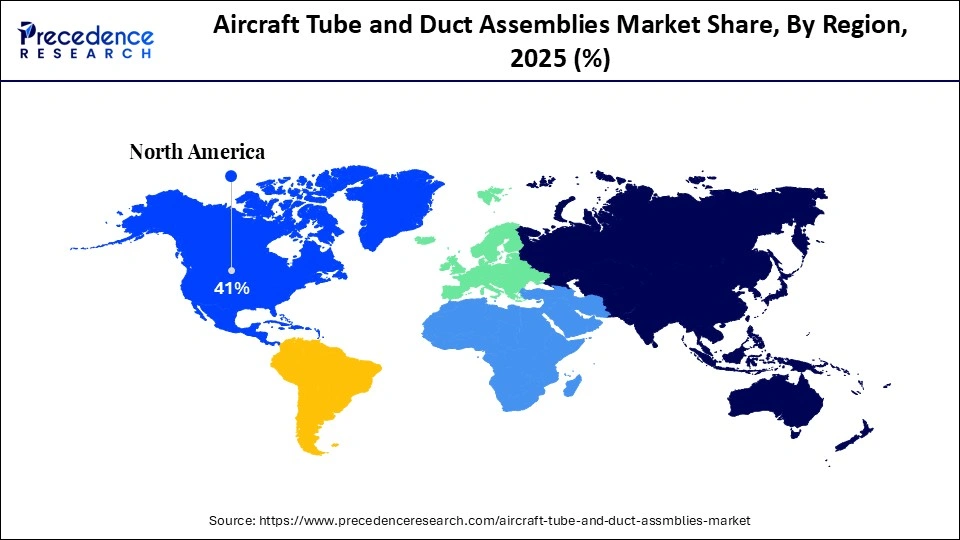

- North America led the global aircraft tube and duct assemblies market with approximately 41% market share in 2025.

- Asia Pacific is observed to be the fastest-growing region in the foreseen period.

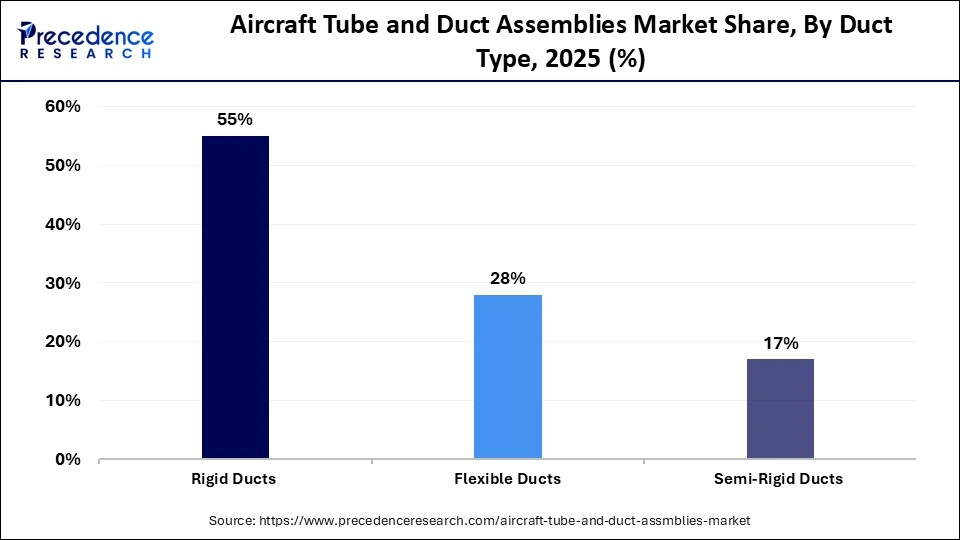

- By duct type, the rigid ducts segment led the market with approximately 55% in 2025.

- By duct type, the flexible ducts segment is observed to be the fastest-growing segment in the forecast period.

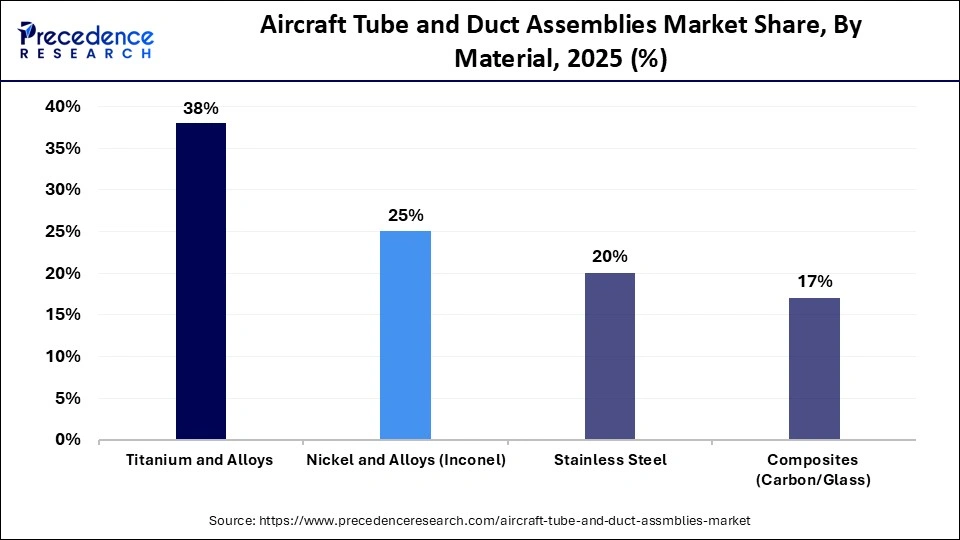

- By material, the titanium and alloys segment led the global market with approximately 38% in 2025.

- By material, the composites (carbon/glass) segment is observed to be the fastest-growing in the foreseen period.

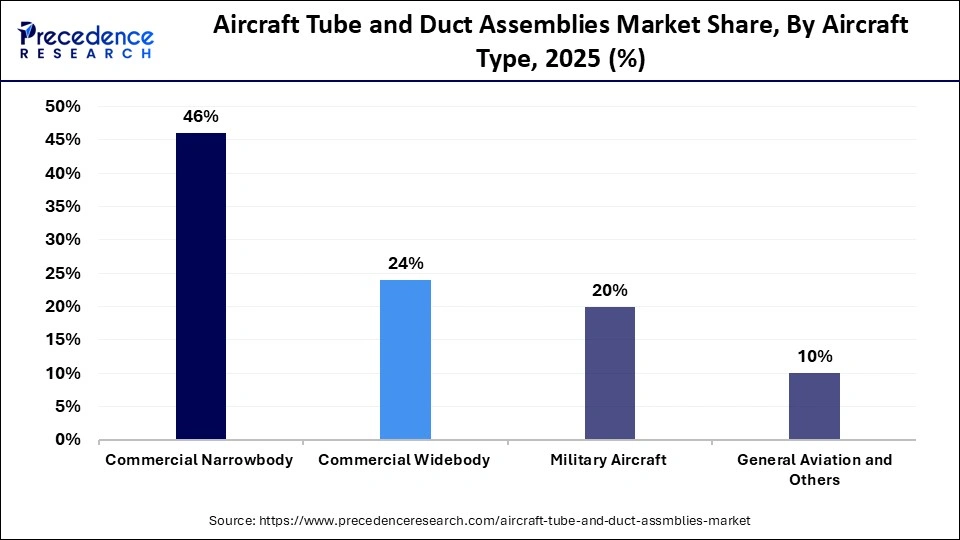

- By aircraft type, the commercial narrowbody segment led the global market with approximately 46% in 2025.

- By aircraft type, the military aircraft segment is observed to be the fastest-growing segment in the foreseen period.

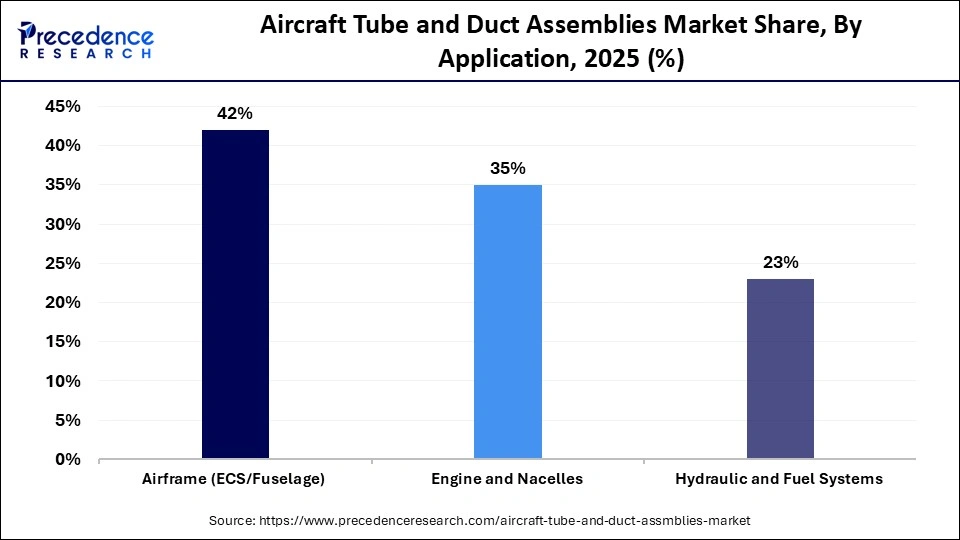

- By application, the airframe (ECS/fuselage) segment dominated the global aircraft tube and duct assemblies industry with approximately 42% market share.

- By application, the hydraulic and fuel systems segment is observed to be the fastest-growing in the foreseen period.

What is the Aircraft Tube and Duct Assemblies Market?

The aircraft tube and duct assemblies market comprises the design and manufacturing of specialized conduits, made from high-performance alloys or composites that facilitate the critical transport of fluids, air, and gases. These assemblies ensure the operational integrity of essential subsystems, including fuel delivery, hydraulic systems, environmental control systems (ECS), and engine bleeds under extreme pressure and temperature variations. Higher demand for lightweight, corrosion-resistant, and efficient performance materials in the case of high-pressure and high-temperature situations also helps to fuel the growth of the market. Functionality and type of materials have a major role in the growth of the market.

Role of Technology in the Growth of Aircraft Tube and Duct Assemblies Market

Technological advancements have a major role in the growth of the market. Technologies in the form of innovation in lightweight materials, 3D printing, and smart sensor integration, for predictive maintenance, are some of the major factors fueling the growth of the market. Such technologies also help to enhance thermal management, improve fuel efficiency, and ensure safety in complex, electrified aerospace systems, which is helpful for the growth of the market. Major shifts of the industry from heavy metals to advanced composites, titanium, and high-grade alloys are also some of the major factors fueling the growth of the market.

Aircraft Tube and Duct Assemblies Market Trends

- Higher Demand for Lightweight Materials: Higher demand for lightweight materials like titanium to reduce overall aircraft weight, enhancing fuel efficiency, and lowering emissions.

- Technological Advancements: Higher demand for electric and modern design aircraft with sophisticated duct designs helps to reduce weight and enhance safety.

- Expansion of Narrow-Body Aircraft: Higher demand for narrow-body aircraft, driven by short to medium haul travel, leading to higher demand for specialized tube and duct assemblies, also helps to fuel the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.95 Billion |

| Market Size in 2026 | USD 2.04 Billion |

| Market Size by 2035 | USD 3.02 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Duct Type,Material,Aircraft Type,Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Duct Type Insights

Which Duct Type Segment dominated the market in 2025?

The rigid ducts segment led the global aircraft tube and duct assemblies market in 2025 with approximately 55%, due to the higher demand for lightweight, durable components in high-pressure, high-temperature, environmental control systems. Higher demand for hydraulic systems, high-pressure fuel lines, lightweight and high-quality materials for the manufacturing of aircraft parts and other essential accessories, and environmental control systems in aerospace applications further help to propel the growth of the segment. Technological advancements leading to the industry's shift towards 3D printing of composite materials for rigid ducts, providing superior strength, quality, and durability in high-pressure environments, are another major boost.

The flexible ducts segment is observed to be the fastest-growing segment in the forecast period. Factors such as lightweight, easy installation in aircraft environmental systems, and air distribution are the main reasons behind the segment's fastest growth. Flexible ducts are also helpful to navigate tight spaces, manage low-pressure systems, windscreen demisting, and avionics cooling, including air cabin conditioning, and lower vibrations in an aircraft. The segment also observes growth as flexible ducts are manufactured from lightweight materials, rubbers, and advanced composites, aiding low-fuel efficiency.

Material Insights

Why did the Titanium and Alloys Segment Lead the Global Market in 2025?

The titanium and alloys segment led the global aircraft tube and duct assemblies market in 2025 with approximately 38% market share due to higher demand for lightweight and high-strength materials. Titanium alloys are highly utilized for the manufacturing of engine bleed air systems, hydraulic lines, and environmental control systems. These materials perform efficiently under high-pressure situations and high-temperature applications. Titanium also aids in weight savings compared to other heavy metals, such as steel or nickel-based alloys, which are helpful to manage fuel efficiency. Major shift of the aircraft manufacturing industry towards carbon fiber reinforced plastic fuselages, titanium's thermal expansion coefficient helps to prevent galvanic corrosion, leading to the heavy usage of titanium and alloys.

The composites (carbon/glass) segment is observed to be the fastest-growing segment in the foreseen period, mainly due to the industry's major shift towards lightweight, fuel-efficient, and corrosion-resistant materials. The carbon composites and glass composites hold a major share in the segment due to their efficient performance in low-pressure applications, such as cabin air recirculation, along with good mechanical performance at a lower cost. Such composites are also preferred for low-temperature and high-pressure applications.

Aircraft Type Insights

Which Component of the Aircraft Type Segment Leads the Global Industry in 2025?

The commercial narrowbody segment led the global aircraft tube and duct assemblies market with approximately 46% share in 2025 due to increased manufacturing of the Airbus A320neo and Boeing 737 MAX. Commercial demand is higher for titanium due to its usage in composite materials for hydraulic, pneumatic, and environmental systems to improve fuel efficiency. Higher demand for engine bleeds, thermal anti-ice, environmental control systems, and waste systems also helps to fuel the growth of the segment.

The military aircraft segment is observed to be the fastest-growing segment in the forecast period, due to higher demand for lightweight, corrosion-resistant, and highly durable materials such as stainless steel and titanium to support combat conditions. Another major factor propelling the growth of the segment is the growing demand for the modernization of military aircraft fleets. Military aircraft have a higher demand for lightweight and fuel-efficient materials in conditions such as high-pressure, high-temperature, and high-stress applications.

Application Insights

Why did Airframe (ECS/Fuselage) Segment Lead the Global Industry in 2025?

The airframe (ECS/fuselage) segment dominated the aircraft tube and duct assemblies market with approximately 42% market share. The segment also observes growth due to its higher demand in cabin pressurization, cabin sidewall riser ducts, windscreen demisting, avionics ventilation, and bleed air systems. Higher production of narrow-body and wide-body commercial aircraft, with bleed air applications fueling the growth of the segment. Major factors such as extensive networks of conduits to manage cabin air quality, thermal regulation, and structural safety also aid the growth.

The hydraulic and fuel systems segment is observed to be the fastest growing in the foreseen period, due to higher demand for lightweight and leak-proof fluid conveyance in aerospace applications. Rising aircraft production, increasing fuel efficiency, and the need for robust hydraulic control systems are also increasing the production of hydraulic and fuel systems. Titanium alloys and nickel-chromium alloys are highly useful for efficient performance under high-pressure and high-temperature situations, whereas aluminium and steel are used for specific pressure and weight needs.

Regional Analysis

North America Aircraft Tube and Duct Assemblies Market Size and Growth 2026 to 2035

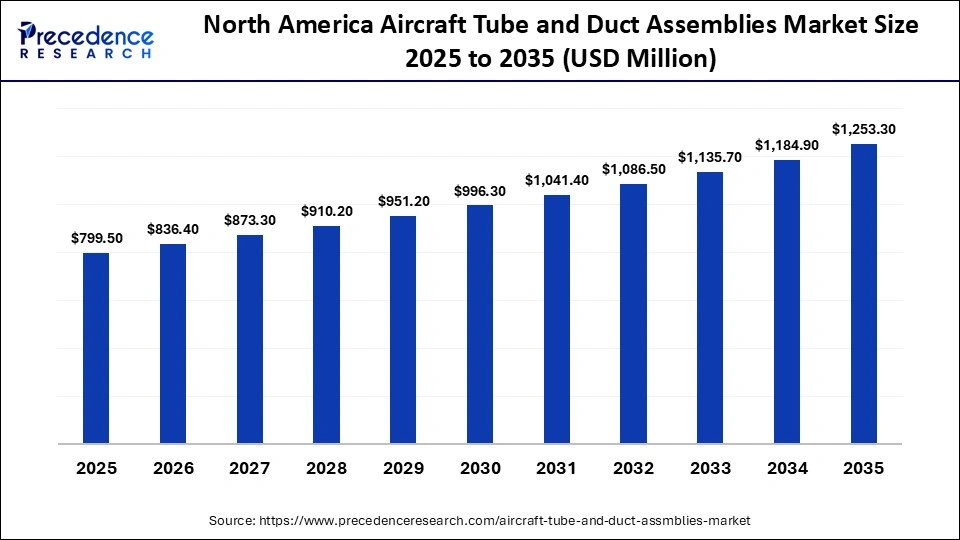

The North America aircraft tube and duct assemblies market size is estimated at USD 799.50 million in 2025 and is projected to reach approximately USD 1,253.30 million by 2035, with a 4.60% CAGR from 2026 to 2035.

Why did North America lead the Global Market in 2025?

North America leads the global aircraft tube and duct assemblies market in 2025 with approximately 38-41% share. The region has a huge and growing aerospace manufacturing base, proving a major driver and focus for the growth of the market. Growing demand for commercial aircraft with engine bleed applications also helps to fuel the growth of the market. A major concentration of aerospace OEMs and engine manufacturers, along with a strong recovery in commercial aircraft production and military modernization programs, also propels the growth of the market in the foreseen period. The higher demand for different types of ducts, especially flexible ducts to manage the working of the aircraft in high-temperature and high-pressure conditions, also helps to fuel the growth of the market.

U.S. Aircraft Tube and Duct Assemblies Market Size and Growth 2026 to 2035

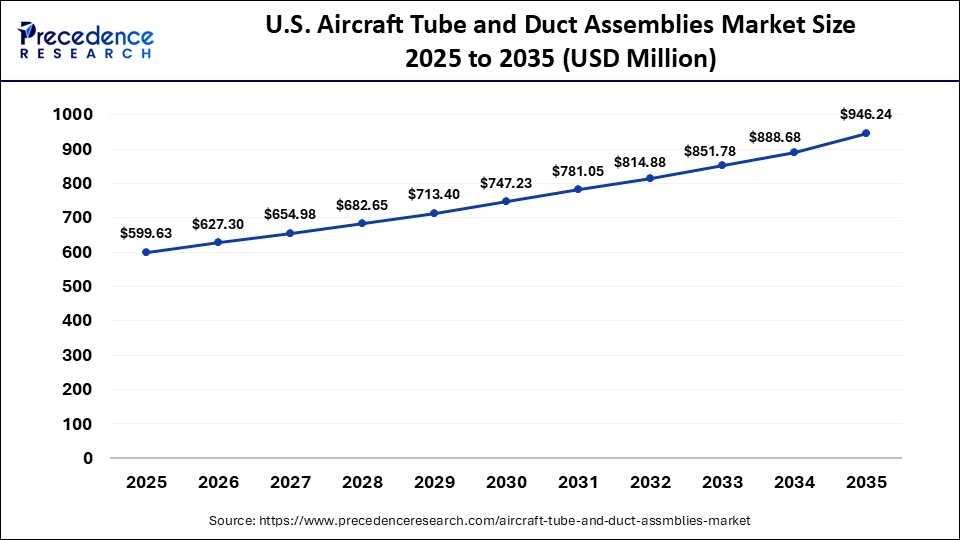

The U.S. aircraft tube and duct assemblies market size is calculated at USD 599.63 million in 2025 and is expected to reach nearly USD 946.24 million in 2035, accelerating at a strong CAGR of 4.67% between 2026 to 2035.

The U.S. Aircraft Tube and Duct Assemblies Market Trends

The U.S. has a major contribution to the growth of the market due to the higher demand for lightweight, corrosion-resistant, and efficient air management systems, which help propel the growth of the market. Higher demand for fuel-efficient aircraft, increasing cabin comfort needs, and aging fleet replacements also help propel the growth of the market in the region. Higher demand for titanium for high-pressure lines due to its strength-to-weight ratio, along with higher demand for composites and aluminium to dominate low-pressure ducting, also helps to fuel the growth of the market

Why is the Asia Pacific Observed to be the Fastest-Growing Region in the Foreseen Period?

Asia Pacific is observed to be the fastest-growing region in the aircraft tube and duct assemblies market in the foreseen period with the highest CAGR. The market is expected to grow in the foreseen period due to higher demand for rising air traffic, increased aircraft production, and a strong, growing aftermarket. The market is also expected to grow significantly due to factors such as higher demand for short-to-medium haul routes in the region.

The ramp-up of domestic aircraft production, leading to massive demand for localized supply chains for advanced tubing systems, also helps to propel the growth of the market in the foreseeable period. A major shift of the industry towards composite materials and titanium to replace traditional aluminium also helps to boost the growth of the market. Higher demand for lightweight materials and materials aiding fuel efficiency are also some of the major factors driving the growth of the aircraft tube and duct assemblies market in the foreseeable period.

China Aircraft Tube and Duct Assemblies Market Trends

China has a major contribution to the growth of the market due to growing domestic aircraft production (COMAC C919/ARJ21), along with fueling demand for maintenance, repair, and overhaul, further expanding the growth of the market. Higher demand for titanium and its alloys for their superior strength-to-weight ratio for critical structural appliances also helps to fuel the growth of the market in the foreseeable period.

Aircraft Tube and Duct Assemblies MarketValue Chain Analysis

- Raw Material Sourcing: Raw material sourcing underpins aircraft tube and duct assemblies, requiring titanium, stainless steel, and nickel alloys meeting aerospace standards. Allegheny Technologies and Carpenter Technology supply certified materials ensuring strength, corrosion resistance, regulatory compliance, and supply reliability.

Companies involved- Allegheny Technologies and Carpenter Technology - Component Manufacturing: Component manufacturing involves precision bending, welding, machining, and testing of tubes and ducts for hydraulic, fuel, and air systems. Eaton Corporation and AMETEK FMH Aerospace enhance value through lightweight designs and customization.

Companies involved- Eaton Corporation, AMETEK FMH Aerospace - Aftermarket Services and Upgrades: Aftermarket services include maintenance, repair, overhaul, and system upgrades extending product lifecycles and ensuring safety. Eaton Corporation plc, Parker Hannifin Corporation, Senior plc, Meggitt PLC, and Safran S.A. provide replacements and technical support.

Companies involved- Eaton Corporation plc, Parker Hannifin Corporation, Senior plc, Meggitt PLC, and Safran S.A.

Top Companies of Aircraft Tube and Duct Assemblies Market

- Senior plc

- Parker-Hannifin Corporation

- Eaton Corporation plc

- Safran S.A. (Aerosystems)

- Ametek, Inc. (FMH Aerospace)

- Triumph Group, Inc.

- Smiths Group plc (Flex-Tek)

- GKN Aerospace

- Hutchinson SA

- Arrowhead Products

- PFW Aerospace GmbH

- ITT Inc.

- Collins Aerospace (RTX)

- Leggett & Platt (Piping Systems)

- FACC AG

Recent Developments

- In December 2025, the long-term engagement of Rangsons Aerospace with Airbus has designated Rangsons Aerospace as the first Indian Tier-1 company to manufacture critical aviation tubes and duct assemblies.(Source- https://www.manufacturingtodayindia.com)

- In July 2025, a partnership between Alphavest Capital and Boeing decided to launch five centers of high-precision manufacturing in Morocco.

(Source- https://www.arabnews.com)

Segments Covered in the Report

By Duct Type

- Rigid Ducts

- Flexible Ducts

- Semi-Rigid Ducts

By Material

- Titanium and Alloys

- Nickel and Alloys (Inconel)

- Stainless Steel

- Composites (Carbon/Glass)

By Aircraft Type

- Commercial Narrowbody

- Commercial Widebody

- Military Aircraft

- General Aviation and Others

By Application

- Airframe (ECS/Fuselage)

- Engine and Nacelles

- Hydraulic and Fuel Systems

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting