What is the Alkaline Water Electrolysis Market Size?

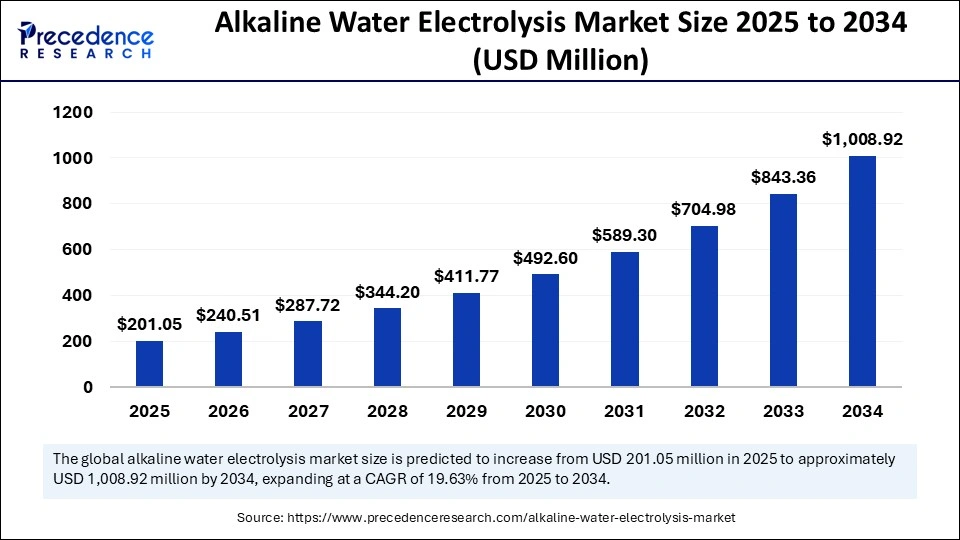

The global alkaline water electrolysis market size is calculated at USD 201.05 billion in 2025 and is predicted to increase from USD 240.51 billion in 2026 to approximately USD 1,008.92 billion by 2034, expanding at a CAGR of 19.63% from 2025 to 2034.

Alkaline Water Electrolysis Market Key Takeaways

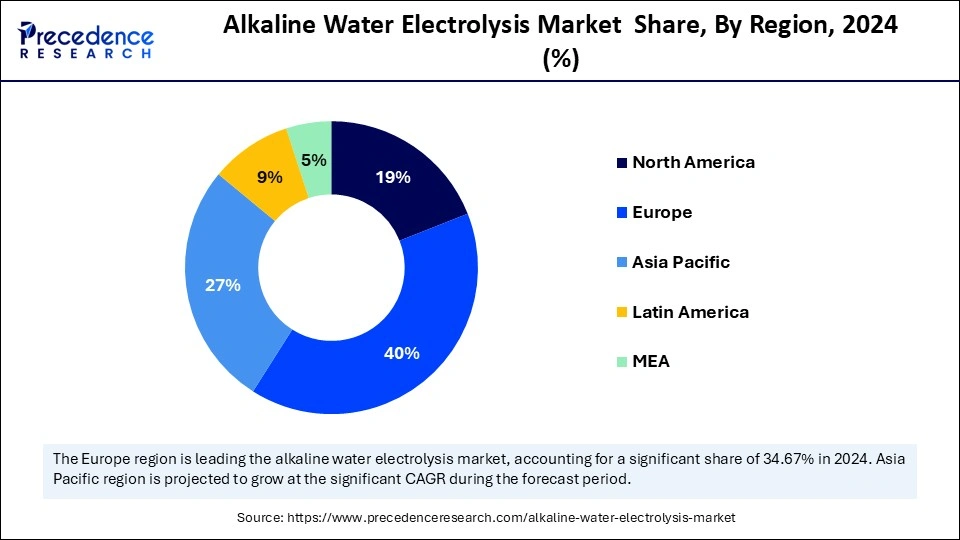

- Europe dominated the global market with largest market share of 40% in 2024.

- North America market is anticipated to grow at the fastest CAGR during the forecast period.

- Asia Pacific emerged as a significant player in the global market.

- By type, the < 50 m3/h segment held the biggest market share in 2024.

- By application, the power plants segment captured the largest market share in 2024.

- By application, the industrial gases segment is expected to witness the fastest CAGR of growth during the predicted timeframe.

What are the Substantial Goals in the Alkaline Water Electrolysis?

The alkaline water electrolysis market has witnessed significant growth driven by various factors like increased demand for efficiency and cost-effectiveness in green hydrogen production. Global industry expansion in automotives, chemicals, pharmaceutical companies, power generation, and energy storage has increased the need for hydrogen. The trend of sustainability and clean energy is driving focus on the production of green hydrogen.

Global decarbonization and renewable energy integration goals are promoting the use of green hydrogen, driving the need for alkaline water electrolysis systems to improve efficiency, scalability, and cost-effectiveness. Additionally, the government worldwide is providing significant support in promoting hydrogen technologies and industrial developments, enabling technological advancements and initiatives for the research and development sector.

- In January 2024, the Union Cabinet approved the National Green Hydrogen Mission; the approval helped the Indian government to launch pilot projects to use green hydrogen in long-haul transportation, showcasing the practical applications of alkaline water electrolysis technology.

What are the Substantial Goals in the Alkaline Water Electrolysis?

Artificial intelligence (AI) is a significant tool for improving the efficiency and advancements of the alkaline water electrolysis market in several ways, including its predictive maintenance, process optimization, quality control, and energy management abilities. AI helps to detect potential issues in the system, helps to reduce downtime, and improves efficiency. Process optimization improves efficiency and reduces energy consumption. Additionally, AI can manage energy consumption in alkaline water electrolysis systems, helping to reduce cost and energy usage.

AI in research and development accelerates alkaline water electrolysis by analyzing a large database and practical outcomes, helping to advance research activities. Integration of AI algorithms, like artificial neural networks (ANNs), with computational fluid dynamics (CFD) models improves predictions of AWE cell performance. The real-time adjustments in changing operating conditions drive the need for an AI algorithm to ensure better and more effective working of the alkaline water electrolysis system.

Alkaline Water Electrolysis Market Outlook:

- Global Expansion: An escalating demand for green hydrogen as a clean energy source, powered by government policies and private investment in decarbonization, is fostering the overall progression.

- Major Investor: In January 2025, Sunfire GmbH received a significant Series E funding round of $206 million from investors, such as Societe Generale and Electranova Capital, to place an emphasis on hydrogen production.

- Startup Ecosystem: In March 2025, Power to Hydrogen, a US-based startup, secured a $20 million Series A funding round to encourage its solutions for hydrogen generation using renewable energy.

Alkaline Water Electrolysis Market Growth Factors

- Demand for clean energy: The increased demand for clean and sustainable energy has driven focus on the production of green hydrogen for various applications, including automotive, chemicals, power generation, and pharmaceuticals, driving demand for alkaline water electrolysis.

- Renewable energy integration and decarbonization: The world's surge for renewable energy sources and reduction of carbon emissions has driven the need for efficient hydrogen production methods.

- Government initiatives: The world shift toward renewable energy and decarbonization is boosting, along with government initiatives and support for hydrogen production projects and advancements in hydrogen technologies.

- Industrial expansion: Expanding industrial applications like chemical processing, power generation, transportation, and energy storage are driving the adoption of alkaline water electrolysis.

- Research and development investments: Rising sustainable investments in research and development to improve the efficiency, scalability, and cost-effectiveness of alkaline water electrolysis, expanding the alkaline water electrolysis market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,008.92 Million |

| Market Size in 2025 | USD 201.05 Million |

| Market Size in 2026 | USD 240.51 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.63% |

| Dominated Region | Europe |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Decarbonization and renewable energy integration goal

The adoption of hydrogen is high in industrial applications, transportation, energy storage, and power generation, causing a high risk of carbon emissions. The global shift toward decarbonization and renewable energy storage is driving demand for green hydrogen production. Green hydrogen replaces fossil fuel and reduces carbon emissions. The need for clean energy sources further contributes to the demand for green hydrogen. The use of green hydrogen has increased for energy storage to stabilize the grid and ensure a reliable energy supply. The government initiatives and technological advancements fueling green hydrogen production are driving demand for alkaline water electrolysis.

Restraint

High initial and production costs

The major restraint of the alkaline water electrolysis market is the high cost associated with the production of green hydrogen. The high initial investments in alkaline water electrolysis hinder its adoption in various companies. The production of green hydrogen with alkaline water electrolysis is expensive compared to conventional methods. The industries with thin profit margins hamper the adoption of the alkaline water electrolysis system. Additionally, the technology often faces competition from grey hydrogen production with a cost-effective nature. However, technological advancements and government initiatives can help reduce costs and improve efficiency.

Opportunity

Large-scale Hydrogen Production

The trends of decarbonization, renewable energy integration, and clean energy storage demand have increased the demand for green hydrogen. This demand has increased the need for large-scale production to reduce costs and increase efficiency. The large-scale production of green hydrogen is aimed at reducing greenhouse gas emissions. Increased industrial use of green hydrogen fuel requires large-scale production. The utilization of alkaline water electrolysis is increasing to meet large-scale hydrogen production demands. Moreover, technological advancements such as improving the efficiency, reducing the cost, enhancing the durability, and developing new and improved materials for electrolytes and separator membranes in alkaline water electrolysis systems are enabling the scaling up of large-scale hydrogen production.

Segment Insights

Type insights

The < 50 m3/h segment held the largest alkaline water electrolysis market share in 2024 and is projected to dominate in the forecast period due to increased demand for small-scale hydrogen. The < 50 m3/h is flexible and affordable compared to a large-scale system. The increased emphasis on green hydrogen production and decarbonization drives demand for < 50 m3/h alkaline water electrolysis. Additionally, technological advancements enabling efficiency, scalability, and cost reduction of the segment, driving industrial shift toward the < 50 m3/h alkaline water electrolytes.

Application Insights

The power plants segment dominated the alkaline water electrolysis market with the largest share in 2024 due to increased demand for green hydrogen and government initiatives in decarbonization and renewable energy sources. Power plants are being exclusively used for the production of green hydrogen to provide a clean fuel alternative. Technological advancements in electrolysis are improving efficiency and cost reduction, increasing adoption in the energy sector.

- In February 2025, Waaree Group started a 300 MW electrolyzer manufacturing facility in Valsad, Gujarat, aligned with the National Green Hydrogen Mission, aiming to enhance domestic production and reduce import dependence.

The industrial gases segment is expected to witness the fastest rate of growth during the predicted timeframe due to the increased need for hydrogen in various industries. The industrial gases are the key application for alkaline water electrolyzers. The demand for hydrogen has increased in chemical manufacturing, metallurgy, and oil refining. The rising industrial activities and the need for efficient carbon-free hydrogen production are fueling segment growth.

Regional Insights

Europe Alkaline Water Electrolysis Market Size and Growth 2025 to 2034

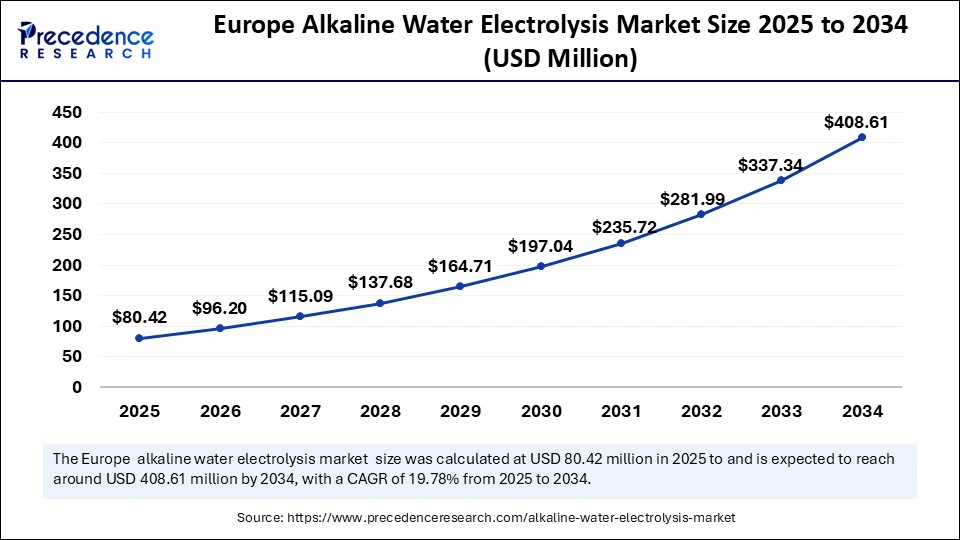

The Europe alkaline water electrolysis market size is exhibited at USD 80.42million in 2025 and is projected to be worth around USD 408.61 million by 2034, growing at a CAGR of 19.78% from 2025 to 2034.

How are Government Policies driving European Alkaline Water Electrolysis Plants?

Europe dominated the alkaline water electrolysis market in 2024. It is the key area for renewable energy and clean energy demands. The government support for hydrogen production and infrastructure developments is the major factor contributing to increased emphasis on alkaline water electrolysis. The government is providing spectacular funding and support for hydrogen production and infrastructure advancements for production, storage, and distribution. Countries like Germany, France, and the Netherlands are heavily investing in large-scale hydrogen initiatives, increasing demand for alkaline water electrolysis.

Germany Alkaline Water Electrolysis Market Trends

Germany is leading the market in Europe due to high demand for hydrogen in various industries, including transportation, chemicals, and energy. Germany has a strong industrial base and hub for well-established research institutions and companies, actively developing and enhancing alkaline water electrolysis technologies. The shift toward renewable energy and government initiatives in promoting hydrogen technology developments is driving the market.

- In August 2025, the 5th International Conference on Electrolysis, ICE 2025, will be held in Freiburg, Germany. The event will encourage industry, academic researchers, and PhD students to demonstrate solutions in water electrolysis and technology for green hydrogen production.

Brazil's Hydrogen Ambition

Driven by the need to decarbonize industry, Brazil is investing heavily in green hydrogen production via alkaline electrolysis, fueled by abundant renewable energy sources like hydro and solar.

Why did North America hold a Major Share of the Market in 2024?

The North America alkaline water electrolysis market is anticipated to grow at the fastest CAGR during the forecast period due to substantial investments in green hydrogen projects and research. The increased demand for hydrogen in various industries like chemical, pharmaceutical, and automotive has driven a focus on large-scale renewable energy projects and advancing hydrogen infrastructure. The region is trending toward the production of green hydrogen by using renewable energy sources, driving demand for alkaline water electrolyzers. Additionally, factors like increased adoption of fuel cell electric vehicles and government policies encouraging investors in research and development.

The Green Hydrogen Industry Shift: To Drive the U.S. Market

The U.S. leads the regional market, driven by several factors, including countries' strong focus on renewable energy, the presence of key market vendors, government support, and demand for green hydrogen. Well-established and expanding industrial infrastructure is driving demand for green hydrogen, making the U.S. focus on the production of green hydrogen by using renewable energy sources. The U.S. government has launched initiatives to promote the development of a hydrogen strategy. The countries focus on hydrogen infrastructure developments, leading to collaborative approaches between research & development institutions and companies.

- In April 2025, The Alkaline Water Company, Inc., a leader in the beverage industry known for its purified alkaline water enhanced with Himalayan rock salt, announced a national distribution agreement with a leading wholesale grocery distributor.

Expanding South American Footprint

The wider South America alkaline water electrolysis market is expanding rapidly, with countries like Chile and Colombia leveraging their renewable potential and supportive government policies to position themselves as key global green hydrogen suppliers.

Rapid Industrialization Increased Adoption of Alkaline Water Electrolysis in Asia

Asia Pacific emerged as a significant player in the global alkaline water electrolysis market. Asia Pacific has witnessed rapid industrialization and energy demands. Countries like China, Japan, and India's industrialization has surged in energy consumption. Industrialization had increased the demand for clean hydrogen production. Sustainability goals and government investments in hydrogen production technologies and infrastructure developments fuel the need for clean hydrogen production by alkaline water electrolysis.

China's Large-Scale Hydrogen Production Initiatives

China dominates the market in Asia due to various factors like industrial applications and government initiatives. China has well-established automotive, power generation, and pharmaceutical industries, driving heavy adoption of hydrogen. Counties that focus on clean energy and green hydrogen initiatives are driving the adoption of alkaline water electrolysis. Additionally, the rapid industrialization has shifted the government's focus to large-scale green hydrogen production and energy storage, and grid stability projects. China is exploring large-scale hydrogen production to support industrial applications.

Powerful Green Hydrogen Project is Exploring MEA

Recently, the MEA market has been bolstered with one of the world's biggest green hydrogen developments, known as the NEOM Green Hydrogen Project, leveraged by a joint venture among Air Products, ACWA Power, and NEOM. It will use nearly 4 GW of wind and solar power to run 2.2 GW of alkaline electrolyzers delivered by Thyssenkrupp.

Ongoing Ventures and Other Projects: Elevates the African Market

Especially, Morocco & Egypt have started joint ventures to introduce a major alkaline electrolysis capacity, with plans for more than 300 MW by 2025, exploring their high solar output. Whereas Namibia's Hyphen Project is one of Africa's most pioneering ventures, the Hyphen Hydrogen Energy project strategies to establish multi-gigawatt solar and wind generation to generate hydrogen for export as ammonia.

Alkaline Water Electrolysis Market: Value Chain Analysis

1.Resource Extraction

This mainly encompasses the process for extracting hydrogen gas (H2) and oxygen gas (O2) from purified water using direct current (DC) electricity.

- Key Players: Nel ASA, thyssenkrupp nucera, Cummins Inc., etc.

2.Energy Storage Systems

The players cover the use of renewable energy to split water into hydrogen and oxygen, storing the hydrogen for later use, and then recombining the gases in a fuel cell to generate electricity.

- Key Players: Enapter, Green Hydrogen Systems, McPhy Energy, etc.

3.Regulatory Compliance and Energy Trading

- This is especially led by national and regional hydrogen plans, grid integration protocols, and safety standards.

Key Players: Air Products and Chemicals, Inc., Linde plc, Adani Green Energy Ltd., etc.

Alkaline Water Electrolysis Market Companies

- ITM Power: Specifically, it facilitates products based on Proton Exchange Membrane (PEM) electrolysis technology.

- Asahi Kasei: A leader unveiled the larger-scale Aqualyzer-C3 (1 to 7.5 MW), and a large 10 MW system previously installed at the Fukushima Hydrogen Energy Research Field (FH2R).

- Hydrogenics: It was integrated into the Cummins hydrogen technologies portfolio, which focuses on PEM technology.

- NEL Hydrogen: This company leverages large-scale, highly reliable A Series electrolyzers and the Aqualyzer product, which is modular and scalable.

- Teledyne CARES: It has explored the TITAN EL and TITAN HMXT series of hydrogen generators, which use alkaline technology.

Other Major Key Players

- McPhy Energy

- Thyssenkrupp Uhde Chlorine Engineers

- Green Hydrogen Systems

- Enaex

- SunHydrogen

- 718th Research Institute of CSIC

Recent Developments

- In December 2024, Asahi Kasei received governmental support for the expansion of its manufacturing capacity for cell frames and membranes of alkaline water electrolyzers for the production of green hydrogen at its plant site in Kawasaki, Japan. This step will help to achieve the country's goal of carbon neutrality by 2050.

- In March 2025, an innovative nickel-iron-aluminum (Ni-Fe-Al) catalyst to improve water electrolysis performance, demonstrating excellent stability and efficiency in large-scale processes, was developed by the researchers at POSTECH.

- In April 2025, Panasonic Corporation announced that its Living Appliances and Solutions Company (Panasonic) has confirmed that green tea made with alkaline ionized water contains up to 2.8 times more polyphenols than green tea made with natural drinking water.

Segments Covered in the Report

By Type

- < 10 m3/h

- < 30 m3/h

- < 50 m3/h

- < 80 m3/h

- ≥ 80 m3/h

By Application

- Power Plants

- Steel Plants

- Electronics and PV

- Industrial Gases

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting