What is Anatomic Pathology Market Size?

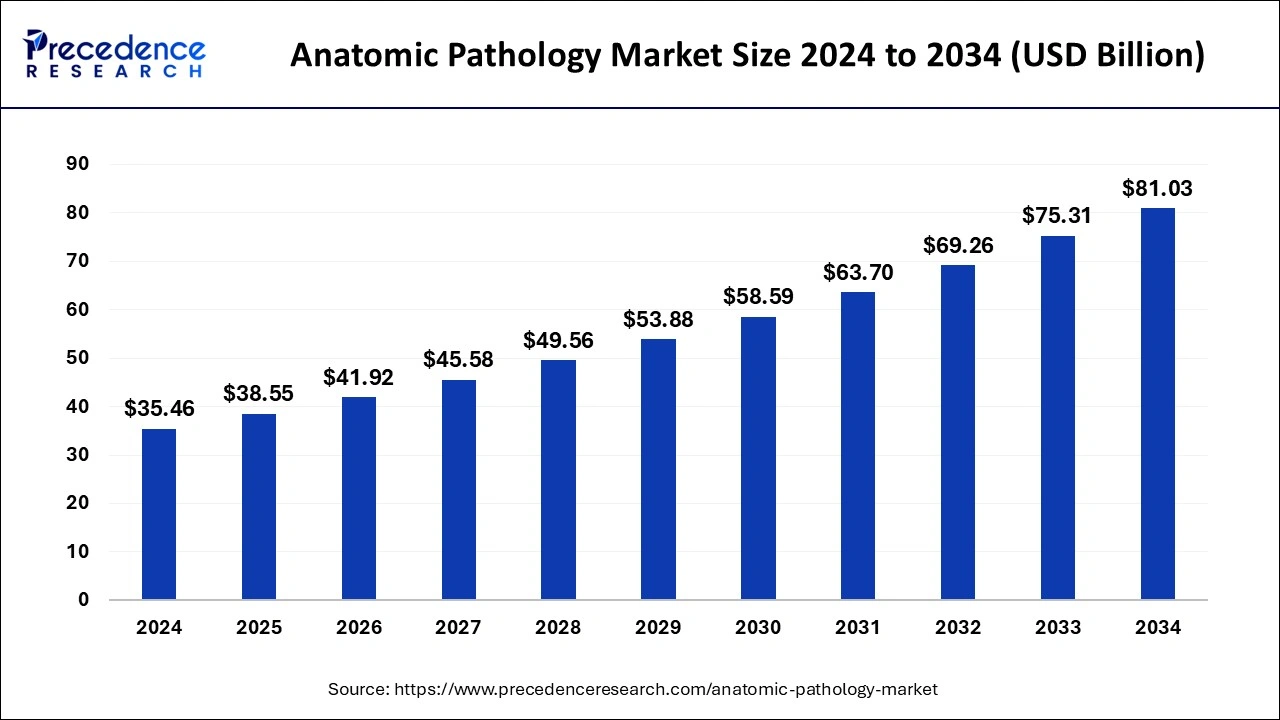

The global anatomic pathology market size is estimated at USD 38.55 billion in 2025 and is predicted to increase from USD 41.92 billion in 2026 to approximately USD 86.97 billion by 2035, expanding at a CAGR of 8.48% from 2026 to 2035. The anatomic pathology market is driven by the growing dependence on pathology propelled by biomarkers.

Market Highlights

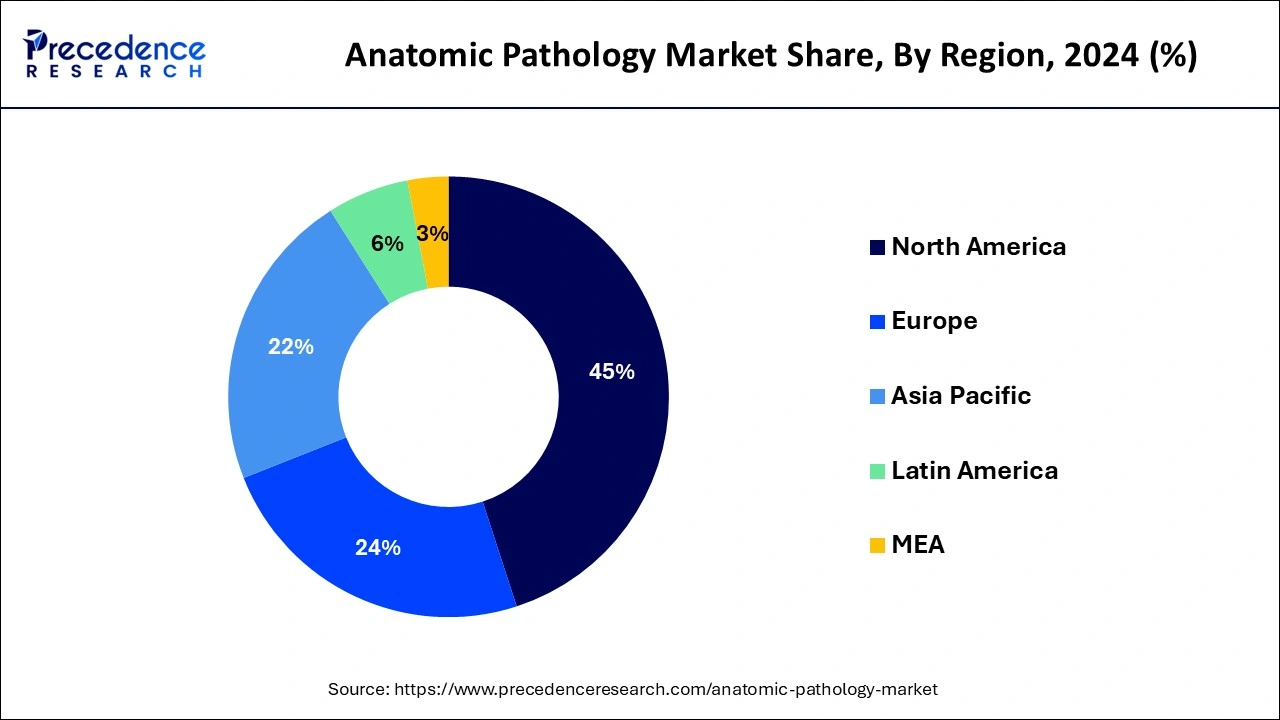

- North America dominated the market with the largest market share of 45% in 2025.

- By product & services, the consumables segment has contributed more than 70% of market share in 2025.

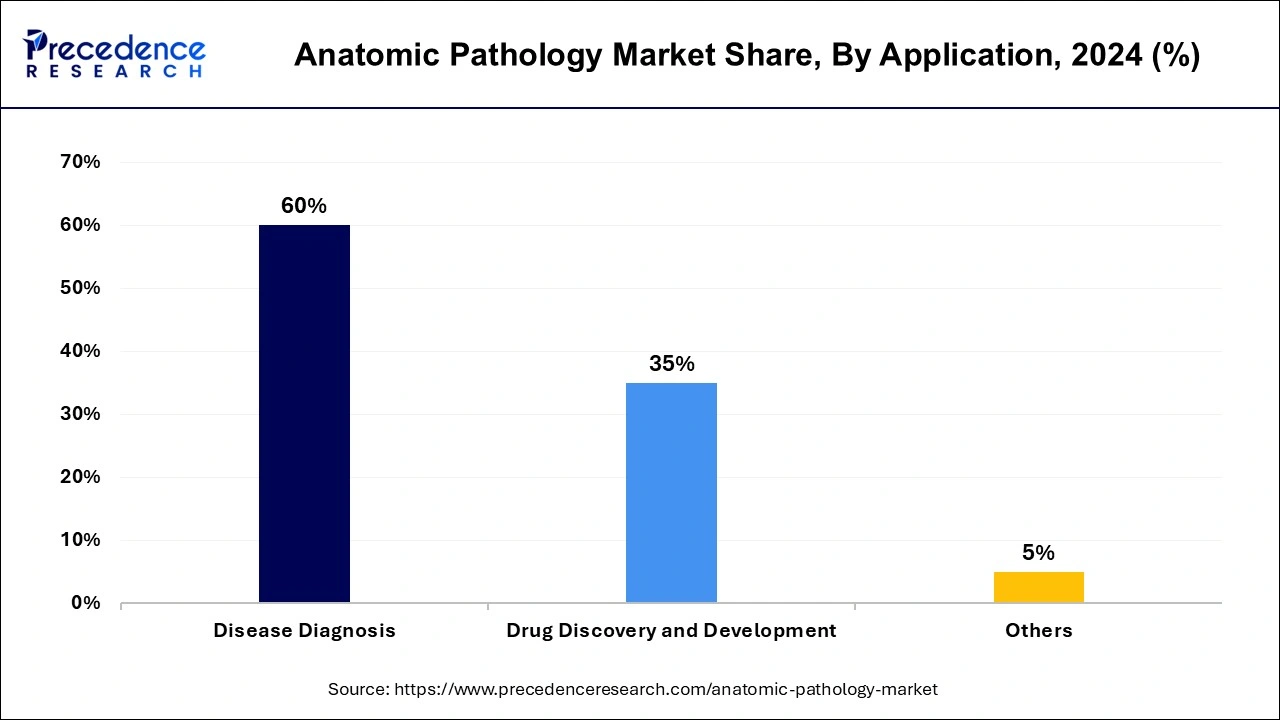

- By application, the disease diagnosis segment has held a market share of 60% in 2025.

- By end-use, the hospitals segment led the market with the biggest market share of 49% in 2025.

Market Overview

The area of medicine known as anatomical pathology examines how diseases affect the structural integrity of body organs. Its primary goal is to find anomalies that can aid in disease diagnosis and treatment management. Anatomic pathology uses a microscope to examine tissues and cells to diagnose diseases. These comprise, among many other things, autoimmune illnesses, malignancies, and infectious diseases. A proper diagnosis is necessary to design the best course of treatment.

- In April 2023, an agreement has been made to provide a fully interoperable solution between Indica Labs' HALO AP image management software platform and Lunit's suite of AI pathology products. US-based Indica Labs is a leader in the industry for quantitative digital pathology and image management innovations. Lunit is a leading medical artificial intelligence (AI) software platform focused on cancer biomarkers. The precision oncology business Guardant Health already uses the combination solution.

Anatomic Pathology Market Data and Statistics

- According to the World Health Organization, there are projected to be 20 million new cases of cancer and 9.7 million fatalities in 2022; 53.5 million people are predicted to still be alive five years after receiving a cancer diagnosis.

- In April 2024, with great pleasure, Medline, a renowned producer and provider of medical supplies and solutions, announced that it is now Epredia's direct distributor. Epredia is a part of the PHC Group. Epredia is a world leader in anatomical pathology, offering complete solutions for tissue diagnostics and precision cancer diagnosis. Epredia provides many solutions that have revolutionized the anatomic pathology market and will do so in the future.

Anatomic Pathology Market Growth Factors

- Higher cancer incidence, especially in older people, promotes the growth of the anatomic pathology market.

- Rising incidence of long-term conditions needing pathological diagnosis.

- Emphasis on cancer screening initiatives and preventive healthcare support the market's growth.

- Better patient outcomes result from early diagnosis aided by anatomic pathology.

- Increasing focus on modifying care according to unique patient attributes.

- Identifying biomarkers for targeted treatments is a critical function of anatomic pathology.

- Government programs and diagnostic test insurance coverage.

- Increases the accessibility of anatomic pathology services.

- Creation of cutting-edge instruments like automation and molecular diagnostics.

- These enhance productivity, accuracy, and efficiency in pathology labs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 38.55 Billion |

| Market Size in 2026 | USD 41.92 Billion |

| Market Size by 2035 | USD 86.97 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.48% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product & Services, By Application, and By End-use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of cancer

Accurate and quick cancer diagnosis are more in need as cancer incidence rates rise globally. Anatomic pathology is essential to diagnose cancer by analyzing tissue samples from biopsies, surgeries, or other procedures. Anatomic pathology services are in greater demand as more people seek treatment and diagnosis for cancer. Age plays a significant risk factor for many cancer types; the incidence of cancer is predicted to increase as the world's population ages. To correctly identify and treat cancer in aging populations, thorough anatomic pathology services are even more necessary considering this demographic trend.

- In April 2023, Leica Biosystems, a division of Danaher, declared that the FDA had approved its Bond MMR Antibody Panel under 510(k) procedures. With this panel, customers screening colorectal cancer (CRC) patients for possible Lynch syndrome have access to a high-performing immunohistochemistry (IHC) mismatch repair (MMR) option.

Up to 5% of instances of colorectal cancer may be caused by the uncommon genetic cancer susceptibility syndrome known as Lynch syndrome. Lynch syndrome raises the risk of colorectal cancer development.

Growing focus on personalized medicine

Anatomic pathology has seen a paradigm shift toward genetic profiling of cancers and other disorders with the introduction of genomic medicine. By examining the genetic composition of malignancies, pathologists can categorize patients into groups according to their molecular profiles, enabling more individualized treatment plans. Molecular profiling, for instance, can be used in cancer to pinpoint specific genetic abnormalities that fuel tumor growth and ultimately lead to the creation of tailored medicines. Personalized medicine can save significant long-term costs by lowering needless treatments, adverse medication responses, and hospitalizations. However, it may initially include more significant upfront expenditures related to molecular diagnostics and tailored therapies.

Restraint

Shortage of skilled professionals

The burden on current employees grows tremendously when there aren't enough skilled people to handle crucial duties like specimen preparation, staining, analysis, and interpretation. Patient care may ultimately suffer from exhaustion, burnout, and a decline in diagnosis precision. Thereby, the shortage of skilled professionals is observed to create a restraint for the anatomic pathology market.

Opportunities

Emerging technologies such as NGS, AI and ML in anatomic pathology

Biomarker analyses have been transformed by next-generation sequencing (NGS), which offers previously unheard-of multiplexing capabilities. In contrast to multiple test ordering required for PCR testing or capillary electrophoresis (CE)–based sequencing (often referred to as Sanger sequencing), NGS may multiplex to assess many genes simultaneously. NGS may help achieve precision medicine's goals of lower costs and better patient care.

It can also help advance prenatal and reproductive care, discover the causative variations of rare and inherited disorders, comprehend the genetic alterations within malignancies, and predict the potential side effects of a chosen medication. By examining the circulating tumor DNA (ctDNA) and, in certain situations, the circulating tumor cells (CTCs) that are present in the blood, NGS is being used to monitor disease.

AI/ML systems are trained to identify patterns in data and link them to clinical contexts, such as diagnoses or outcomes, utilizing predefined input data sets, which may include images. In some instances, they are used to use new data to perform valuable tasks like predicting diagnosis or prognosis.

Recommendations for cancer screening

Cancer screening recommendations generally support routine screenings for members of populations or those with increased risk factors. This causes a spike in the number of screening tests to be carried out, which raises the number of tissue samples that need to be examined pathologically. As a result, there is an increase in the demand for pathology laboratories' services, which presents potential for revenue development and expansion.

Segment Insights

Product & Services Insights

The consumables segment dominated the anatomic pathology market in 2024.The foundation of anatomic pathology labs is made up of supplies. Consumables are needed for every step of the diagnostic process, from tissue processing to slide staining and inspection. Because of this, the need for consumables never changes, even in the face of technological advancements or economic downturns. It is frequently renewed. Typically, anatomic pathology labs need customized supplies to fit test protocols or sample kinds. This personalization increases obstacles to entry for new competitors while cultivating client loyalty.

The instruments segment is the fastest growing in the anatomic pathology market during the forecast period. Anatomic pathology is one of the diagnostic services that is in greater demand due to the rising prevalence of chronic diseases like cancer. Accurate and prompt pathology diagnosis is becoming increasingly important as healthcare systems work to enhance patient outcomes and optimize treatment plans. As a result, pathology laboratories are investing in cutting-edge equipment to keep up with the increasing demand for diagnostic services.

Application Insights

The disease diagnosis segment dominated the anatomic pathology market in 2024. Designing a patient's care and course of therapy depends heavily on disease diagnosis. Anatomic pathology is essential for diagnosing illnesses by analyzing tissue samples from biopsies, surgeries, or autopsies. Accurate diagnosis is crucial for choosing the best course of action and keeping track of the condition's advancement. The field of anatomic pathology has been more closely linked to digital health technologies, such as telemedicine platforms and electronic health records (EHRs).

The drug discovery and development segment is observed to grow at the fastest rate during the forecast period. Molecular biology and genetics advances have led to an increasing focus on customized medicine. This paradigm change is greatly aided by anatomic pathology, which offers in-depth molecular insights into each patient's unique characteristics. Regulatory bodies understand how critical it is to support innovation in medication development and discovery to address public health issues.

As a result, laws and incentives have been implemented to expedite the approval process for novel therapies, especially those that aim to treat uncommon diseases or unmet medical needs. The rise in the anatomic pathology segment focused on drug discovery is driven by these regulatory actions that create a favorable environment for investment in research and development.

- In June 2022, NeoGenomics, Inc. obtained a perfect score on its CAP accreditation. NeoGenomics's strategy of providing its international pharmaceutical partners with the much-needed opportunity to use its Suzhou laboratories for patient-centered trials in China, ranging from translational research in early discovery to clinical trial work in oncology drug development programs, is complete with this certification.

End-use Insights

The hospitals segment dominated the anatomic pathology market in 2024. Hospitals provide care for many patients, from everyday outpatient situations to intricate inpatient situations. Hospitals can maintain high throughput in their pathology laboratories and enhance operational efficiency because of the continual influx of pathology specimens that require examination, which is generated by their diversified patient base. Hospitals benefit from economies of scale that allow them to invest in state-of-the-art technologies, negotiate advantageous price arrangements with vendors, and improve operational workflows for cost-effective pathology services because of their high patient traffic and extensive service offerings.

The diagnostic laboratories segment is the fastest growing anatomic pathology market during the forecast period. The need for cutting-edge diagnostic methods has increased with the introduction of customized medicine, which customizes treatment regimens to each patient's unique traits. Diagnostic laboratories are essential in this paradigm change by providing molecular diagnostics, genetic testing, and companion diagnostics to pinpoint specific biomarkers and direct-focused therapeutics. Diagnostic labs are expected to develop steadily as personalized treatment gains traction.

- In September 2023, A subsidiary of Lab Genomics Co., Ltd., Lab Genomics USA announced that it has acquired QDx Pathology, a leader in molecular and diagnostic pathology. The transaction is anticipated to impact significantly on the firm's and the industry's futures.

Regional Insights

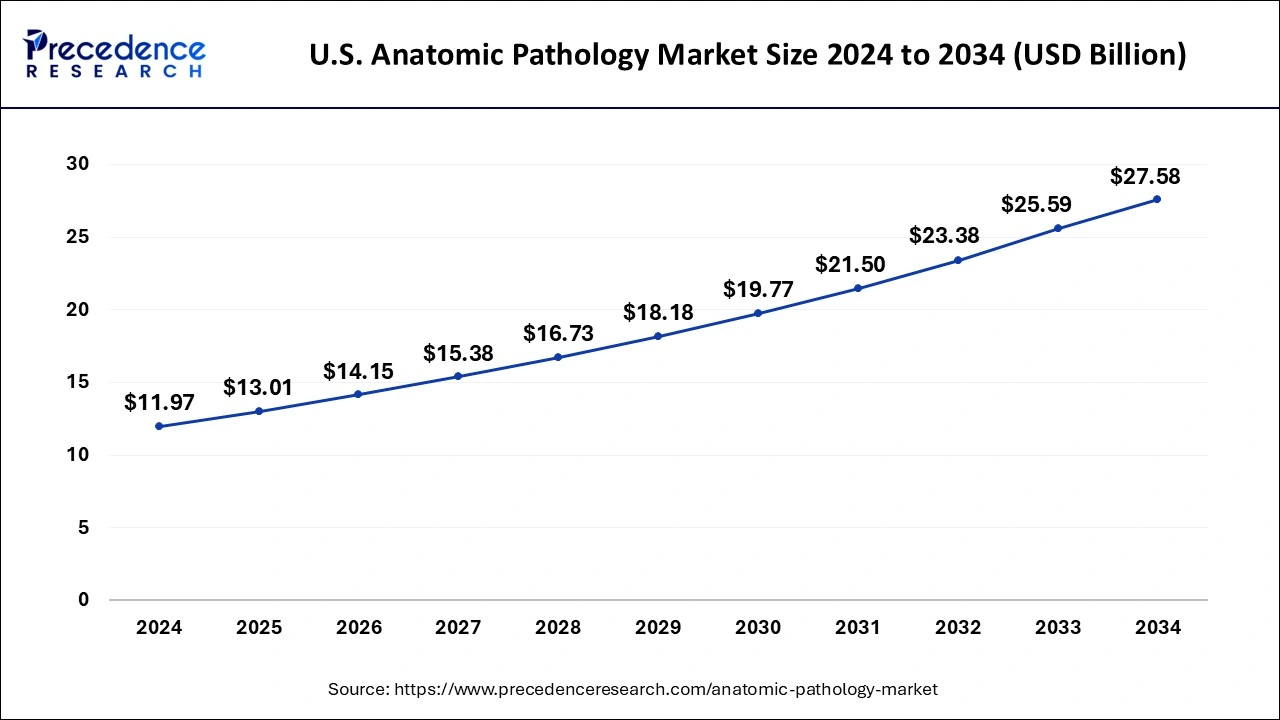

U.S. Anatomic Pathology Market Size and Growth 2026 to 2035

The U.S. anatomic pathology market size is estimated at USD 13.01 billion in 2025 and is predicted to be worth around USD 29.71 billion by 2035 with a CAGR of 8.61% from 2026 to 2035.

North America had the dominating share of the anatomic pathology market in 2024. The region is observed to sustain in the market throughout the forecast period. The region consistently introduces state-of-the-art technology in anatomic pathology, including digital pathology systems, improved imaging techniques, and molecular diagnostics, thanks to substantial investments in research and development. These innovations drive the demand for anatomic pathology services in the area, which improve patient outcomes, expedite processes, and increase diagnostic accuracy.

The region's dedication to providing comprehensive healthcare services and encouraging medical innovation is reflected in its high spending on healthcare. An increase in the need for anatomic pathology services is anticipated as healthcare spending rises due to population growth, technology improvements, and healthcare reforms.

- In March 2023, Aim-PDL1 algorithm and digital pathology platform for non-small cell lung cancer (NSCLC) were introduced by PathAI in collaboration with 13 top academic medical facilities, health systems, independent pathology institutions, and reference laboratories nationwide.

Asia-Pacific is observed to be the fastest growing anatomic pathology market during the forecast period. Spending on healthcare has increased in several of the region's growing economies. Governments and private sector entities are devoting more funds to pathology and other healthcare services to improve the need for high-quality healthcare. This investment, which helps develop and expand anatomic pathology services, fuels the market's growth.

Anatomic Pathology Market Companies

- Danaher

- PHC Holdings Corporation

- Quest Diagnostics Incorporated

- Cardinal Health

- Sakura Finetek USA, Inc.

- NeoGenomics Laboratories, Inc.

- BioGenex

- Bio SB

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche AG

- Agilent Technologies, Inc.

Recent Developments

- In November 2023, Dedalus Group, the top European provider of anatomic pathology information systems, and Ibex Medical Analytics, the industry leader in AI-powered cancer diagnostics, launched a wholly integrated End-to-End AI-powered Digital Pathology Solution for cancer diagnosis.

- In June 2023, the state-of-the-art Anatomical Pathology Laboratory at Sheikh Shakhbout Medical City (SSMC), and Mayo Clinic, was recently opened. With the help of AI-powered tools and applications, SSMC's expert-led pathology team will be able to diagnose diseases and complex conditions with the highest level of accuracy.

Segments Covered in the Report

By Product & Services

- Instruments

- Microtomes & Cryostat

- Tissue Processors

- Automatic Stainers

- Whole Slide Imaging (WSI) Scanners

- Other Products

- Consumables

- Reagents & Antibodies

- Probes & Kits

- Others

- Services

By Application

- Disease Diagnosis

- Drug Discovery and Development

- Others

By End-use

- Hospitals

- Research Laboratories

- Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting