Digital Pathology Slide Scanner Market Size and Forecast 2025 to 2034

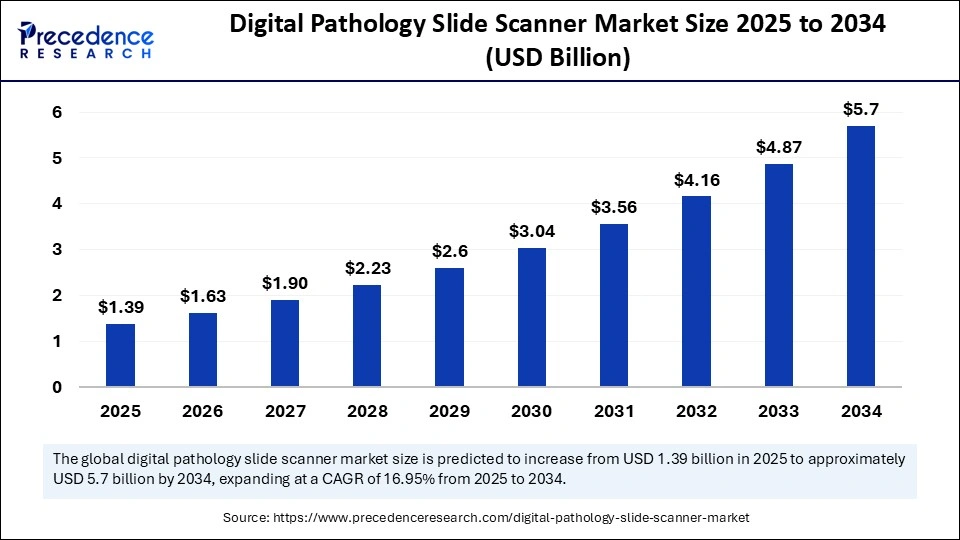

The global digital pathology slide scanner market size accounted for USD 1.19 billion in 2024 and is predicted to increase from USD 1.39 billion in 2025 to approximately USD 5.70 billion by 2034, expanding at a CAGR of 16.95% from 2025 to 2034. The market is growing due to the increasing adoption of AI-driven diagnostic tools and rising demand for remote pathology consultations.

Digital Pathology Slide Scanner Market Key Takeaways

- In terms of revenue, the global digital pathology slide scanner market was valued at USD 1.19 billion in 2024.

- It is projected to reach USD 5.70 billion by 2034.

- The market is expected to grow at a CAGR of 16.95% from 2025 to 2034.

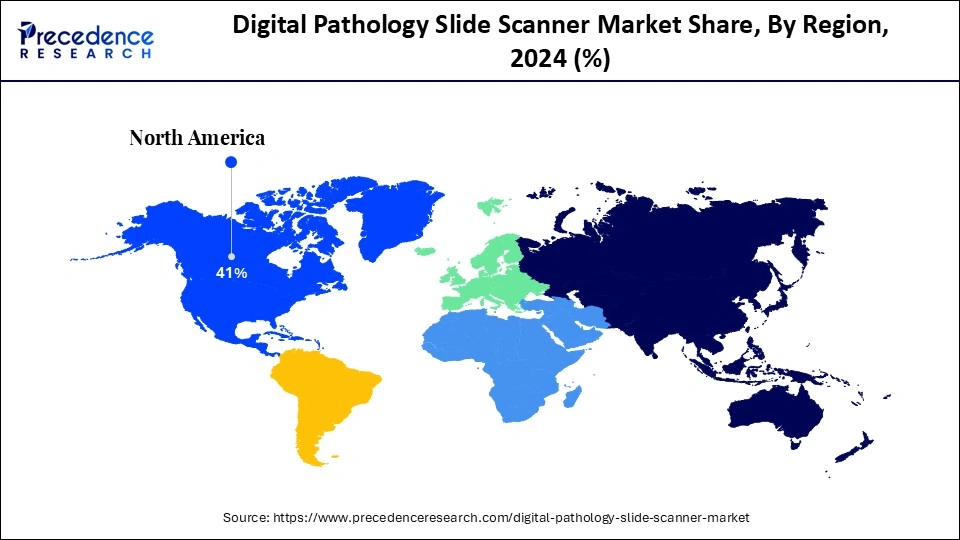

- North America dominated the digital pathology slide scanner market with the largest share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the coming years.

- By product type, the brightfield slide scanners segment held the biggest market share of 58% in 2024.

- By product, the hybrid slide scanner segment is expected to grow at the fastest CAGR during the forecast period.

- By slide capacity, the medium capacity slide scanners (101–300 slides) segment captured the highest market share of 42% in 2024.

- By slide capacity, the high-capacity slide scanners (>300 slides) segment is expected to grow at the fastest CAGR in the upcoming period.

- By technology, the whole slide imaging (WSI) segment contributed the major market share of 66% in 2024.

- By technology, the Z-stack/focus stacking segment emerges as the fastest-growing during the forecast period.

- By application, the disease diagnosis segment held the largest share of 49% in 2024.

- By application, the telepathology/remote consultation segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the hospitals & reference labs segment generated the major market share of 46% in 2024.

- By end user, the pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR during the forecast period.

- By interface/integration, the integrated with LIS/KIMS/PACS segment accounted for the significant market share of 54% in 2024.

- By interface/integration, the cloud-enabled scanners segment is expected to expand at the fastest CAGR during the projection period.

How is AI transforming the digital pathology slide scanner market?

Faster, more accurate, and scalable diagnostic workflows made possible byartificial intelligence are drastically changing the landscape of digital pathology slide scanners. AI is capable of analyzing entire slide images more quickly and reliably than traditional manual evaluations, thanks to sophisticated image recognition and deep learning algorithms. AI reduces diagnostic errors and frees up pathologists to concentrate on complex cases instead of routine assessments.

Moreover, AI-powered scanners can automatically detect patterns, quantify biomarkers, and flag abnormalities, accelerating the turnaround time for pathology reports. The integration of AI also facilitates remote diagnostics and telepathology, making expert analysis accessible in underserved regions. As a result, AI is not just enhancing the capabilities of digital pathology scanners; it is redefining how pathology services are delivered worldwide.

U.S. Digital Pathology Slide Scanner Market Size and Growth 2025 to 2034

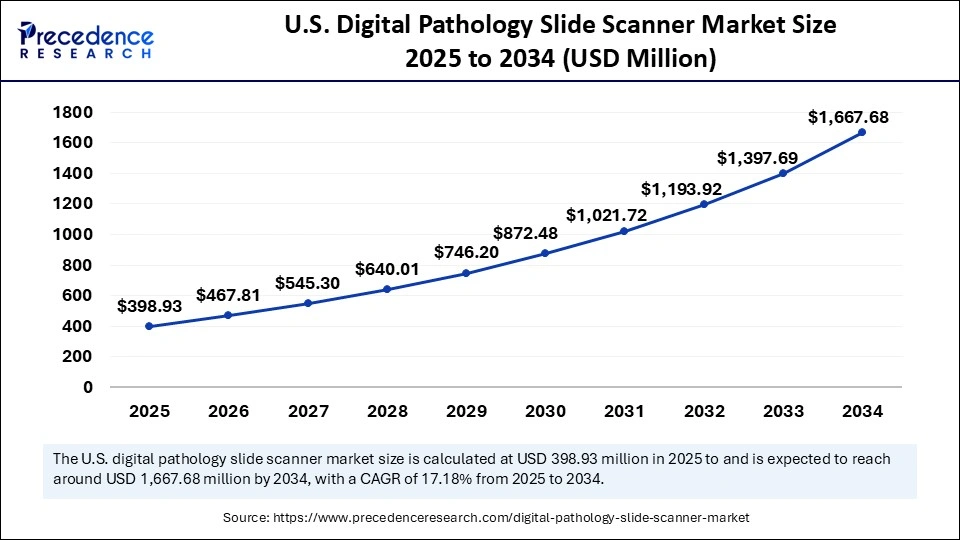

The U.S. digital pathology slide scanner market size was evaluated at USD 341.53 million in 2024 and is projected to be worth around USD 1,667.68 million by 2034, growing at a CAGR of 17.18% from 2025 to 2034.

What made North America the dominant region in the digital pathology slide scanner market in 2024?

North America dominated the digital pathology slide scanner market with the largest share in 2024. The region's dominance stems from its sophisticated healthcare system, leading digital pathology suppliers, and supportive regulatory frameworks such as the FDA's approval of WSI in primary diagnosis. Digital scanners are now commonplace in research and diagnostics due to the region's significant investments in interoperability platforms and precision medicine. The existence of sizable academic hospitals and commercial labs maintains demand. Ongoing partnerships between tech and healthcare behemoths further stimulate innovation.

Asia Pacific is expected to grow at the fastest rate in the coming years, driven by increased access to pathology services in underserved and rural areas, an aging population, and more funding for healthcare digitization. Government initiatives and private investments in digital health technologies are facilitating the rapid adoption of digital pathology in emerging markets. The localization of scanner manufacturing is lessening reliance on imports. Adoption rates are also increasing as a result of digital pathology training programs.

Market Overview

The digital pathology slide scanner market encompasses medical imaging systems designed to convert physical pathology slides into high-resolution digital images for diagnosis, research, and education. These scanners facilitate whole slide imaging (WSI), enabling pathologists to view and analyse tissue samples remotely and with enhanced precision. The market is driven by the growing adoption of AI-powered diagnostics, increasing cancer prevalence, telepathology trends, and the integration of digital pathology into clinical workflows.

Digital Pathology Slide Scanner Market Growth Factors

- Rising Adoption of AI and Machine Learning: AI enhances image analysis, pattern recognition, and diagnostic accuracy, learning to greater adaptation of digital slide scanners in clinical workflows.

- Growing Demand for Remote Pathology and Teleconsultation: Digital scanners enable remote access to slide images, supporting telepathology and addressing the shortage of pathologists in rural and underserved areas.

- Increasing Prevalence of Cancer and Chronic Diseases: Higher diagnostic needs due to rising cancer and chronic disease rates are pushing healthcare providers to adopt high-throughput, digital pathology solutions.

- Technological Advancements in Scanning Resolution and Speed: Improved scanner performance, faster slide digitization, and better image resolution make them more attractive for both clinical and research use.

- Integration with Laboratory Information Systems (LIS): Seamless integration of digital pathology systems with LIS enhances data management and supports streamlined diagnostic workflows.

- Regulatory Approvals and Standardization: Favorable regulatory moves and standardization efforts are encouraging hospitals and labs to transition from analog to digital pathology.

- Increased Investment in Healthcare Digitization: Governments and private players are increasingly funding digital health infrastructure, further supporting the adoption of digital pathology platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.70 Billion |

| Market Size in 2025 | USD 1.39 Billion |

| Market Size in 2024 | USD 1.19 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Slide Capacity, Technology, Application, End User, Interface / Integration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Telepathology

The rising demand for telepathology is a major factor driving the growth of the digital pathology slide scanner market. Traditional diagnostics are being revolutionized by AI-driven digital pathology slide scanners, which provide intelligent automation, high-resolution imaging, and quicker turnaround times. In addition to increasing accuracy, these systems allow for remote consultations, which makes professional pathologists available at any time and from any location. Worldwide adoption is speeding up due to increased disease prevalence and healthcare digitization. These scanners are now being used by hospitals to decrease reliance on manual slide reviews and expedite pathology workflows. Standardized, repeatable image analysis driven by AI is advantageous for research labs. Additionally, their impact is being further expanded by the increasing number of regulatory approvals that are promoting their use in clinical practice.

With the help of these tools, pathologists can view and examine slides from anywhere, improving the flexibility and efficiency of diagnosis. The ability to access slides from anywhere improves the flexibility and efficiency of diagnosis. The need for slide scanners keeps growing as healthcare systems adopt the possibility of physical slide loss or damage while streamlining case tracking. Scanners can accommodate expanding lab volumes and research requirements thanks to improved image quality and scalable storage. To fulfill accreditation and quality control requirements, institutions are also using digital pathology.

Adaptation to Workflow Change

The use of digital pathology in clinical trials, education, and medical research is growing. To create digital libraries, educate students, and support group research, institutions are spending money on slide scanners. Beyond clinical diagnostics, this trend creates a steady and expanding demand niche. Digitized content is useful in academic settings for virtual microscopy exams, pathology curriculum development, and simulation-based learning. In addition, researchers use digital slides for retrospective analysis and cross-institutional studies. Scanner manufacturers have the chance to offer customized education-focused solutions thanks to these use cases.

Restraint

High Initial Investment and Integration Challenges

The upfront investment required for procuring high-resolution slide scanners, including sophisticated optics, robotics, and imaging software, can be prohibitive for smaller pathology labs and hospitals. Ongoing maintenance, calibration, and software licensing fees further drive up the total costs of ownership. This financial barrier slows broader adoption, especially in emerging markets where budget constraints are more acute. Moreover, integrating digital pathology systems with existing laboratory information systems is challenging, limiting the growth of the market.

Opportunity

Demand for Personalized Medicine and Companion Diagnostics

Digital slide scanners are becoming increasingly necessary because of the move toward personalized medicine, which mainly depends on precise and thorough tissue analysis. The integration of these scanners with genomic and molecular data facilitates the creation of tailored treatments and strengthens the function of pathology in precision medicine. The use of pathology data to choose the best companion diagnostic in rare diseases and oncology. Retrospective trials and biomarker validation are also made possible by digitally preserved slides, opening new avenues for cooperation between biotech companies and scanner manufacturers.

Product Type Insights

Why did the brightfield slide scanners segment dominate the market in 2024?

The brightfield slide scanners segment dominated the digital pathology slide scanner market with the largest share in 2024. The dominance of brightfield slide scanners stems from their extensive use for standard histopathological examinations in clinical and academic settings. These scanners are appropriate for the majority of pathology labs since they provide high-resolution imaging at a low cost and complexity. The industry standard, particularly in large hospitals and diagnostic centers handling high slide volumes, is their ability to produce clear, color-rich digital slides of stained tissue sections.

The hybrid (brightfield + fluorescence) slide scanners segment is expected to grow at the fastest CAGR during the projection period, driven by their multi-modality imaging capabilities, combining brightfield, fluorescence, and other imaging techniques. These scanners are gaining traction in research and oncology due to their versatility in analyzing complex tissue samples. Their integration with AI and machine learning tools for advanced tissue characterization is accelerating their use in both research institutions and high-end diagnostic applications.

Slide Capacity Insights

How does the medium-capacity slide scanners (101–300 slides) segment dominate the digital pathology slide scanner market in 2024?

The medium-capacity slide scanners (101–300 slides) segment held the largest share of the market in 2024 due to their ability to balance affordability, space efficiency, and throughput. They are perfect for hospital-based pathology departments and mid-sized labs that process a moderate volume of slides every day. They are a popular option for diagnostic workflows needing efficiency and dependability without the high costs of large-scale systems because of their automated features and compatibility with lab information systems (LIS).

The high-capacity slide scanners (>300 slides) segment is expected to experience rapid growth in the upcoming period due to the increasing demand from reference laboratories and centralized diagnostic facilities. These scanners can process hundreds of slides at once, making them indispensable for high-volume pathology environments. As digital pathology adoption scales, the ability to digitize entire batches quickly and integrate with cloud storage and AI analytics is fueling the need for these high-throughput solutions.

Technology Insights

What made whole slide imaging (WSI) the dominant segment in the digital pathology slide scanner market in 2024?

The whole slide imaging (WSI) segment dominated the market in 2024 because of its function as the basis for digital pathology. It makes it possible to fully digitize glass slides at high resolution, facilitating analysis, sharing, and storage without the need for physical handling. Widely used in diagnostic, educational, and archival contexts, WSI is approved by regulations in nations such as the U. S. has strengthened its standing as the leading digital pathology technology.

The Z-stack scanning/focus stacking segment is expected to expand at the highest CAGR over the forecast period. This technology allows multiple layers of tissue to be captured at varying focal depths. This is especially valuable in cytopathology and hematology, where depth of field is critical. Its utility in enhancing 3D visualization and improving diagnostic accuracy is driving demand, particularly in research, oncology, and complex case assessments.

Application Insights

Why did the disease diagnosis segment dominate the digital pathology slide scanner market in 2024?

The disease diagnosis segment remained dominant in the market in 2024, as traditional workflows in hospitals and diagnostic labs are gradually being replaced by digital ones. Early and precise disease detection is supported by the ability of digital pathology slide scanners to facilitate remote consultations and speedier analysis. Their integration with AI for pathology speeds up turnaround times and lowers human error. They encourage adherence to clinical documentation guidelines as well.

The telepathology/remote consultation segment is expected to grow at the fastest rate in the upcoming period, as medical providers seek to fill geographic gaps in expertise. With the help of digital slide scanners scanned slides can be shared instantly, allowing for timely treatment decisions, subspecialty input, and remote second opinions. Cross-border diagnostics and international medical partnerships are changing as a result of this trend. The lack of qualified pathologists in rural and developing areas is another factor driving demand.

End User Insights

How does the hospitals & reference labs segment dominate the market in 2024?

The hospitals & reference labs segment dominated the digital pathology slide scanner market in 2024 because they use digital scanners extensively for intra-hospital consultations, academic research, and routine diagnostics. To provide prompt and accurate diagnoses, these settings support the full-scale digitization of pathology workflows by placing a high priority on high-throughput systems and seamless LIS integration. Their investments in infrastructure enable the deployment of enterprise-level scanners. The adoption of digital scanners is further accelerated by ongoing efficiency pressure.

The pharmaceutical & biotechnology companies segment is likely to expand at the fastest CAGR over the projection period because they are increasingly using digital pathology in clinical trials, toxicological research, and drug discovery. These organizations value high-resolution quantitative slide analysis for therapeutic evaluation and biomarker identification, which fuels demand for sophisticated digital pathology infrastructure. Digital slide archives support reproducibility and regulatory submissions. These companies are also investing in AI-driven annotation tools to enhance trial endpoint data analytics.

Interface/Integration Insights

How does the integrated with LIS/LIMS/PACS segment lead the market in 2024?

The integrated with LIS/LIMS/PACS segment led the digital pathology slide scanner market in 2024 because it makes it possible for faster reporting, centralized data access, and optimized workflows. Particularly in large institutions with numerous departments and large volumes of slides, this integration is essential for preserving the accuracy of clinical data and assisting in diagnostic decisions. These systems also support digital audit trails and automated case tracking. Administrative burden and reporting delays are decreased by interoperability.

The cloud-enabled slide scanners segment is expected to expand at the highest CAGR in the upcoming period due to their ability to store, access, and share digital slides across global locations in real-time. They are particularly valuable in supporting telepathology, multi-site research collaborations, and centralized data management, making them a game-changer for scalable and flexible pathology solutions. Their remote diagnostic capabilities support 24/7 global consultations. Subscription-based models are increasing affordability for smaller labs.

Digital Pathology Slide Scanner Market Companies

- Leica Biosystems (Danaher Corporation)

- Philips Healthcare

- Hamamatsu Photonics

- 3DHISTECH Ltd.

- Roche (Ventana Medical Systems)

- Olympus Corporation

- Nikon Corporation

- Indica Labs

- Huron Digital Pathology

- OptraSCAN

- Mikroscan Technologies

- Epredia (formerly Thermo Fisher's pathology division)

- Glencoe Software

- Visiopharm

- Sectra AB

- Akoya Biosciences

- Inspirata

- ContextVision

- PathAI

- Proscia Inc.

Recent Developments

- In May 2025, Leica Biosystems announced a collaboration with Danaher and AstraZeneca to jointly develop and commercialize AI-enabled diagnostics and digital pathology tools, accelerating oncology research and companion diagnostics deployment.(Source: https://www.leicabiosystems.com)

- In April 2025, South Korean vendor Vieworks secured CE IVDR certifications for its VISQUE DPS LH10 ultra high-speed digital slide scanner (capacity up to 510 slides, 83 WSI/hour), clearing the path for sales and expansion across Europe.(Source: https://www.vieworks.com)

Segments Covered in the Report

By Product Type

- Brightfield Slide Scanners

- Fluorescence Slide Scanners

- Hybrid (Brightfield + Fluorescence) Slide Scanners

- Others (e.g., Polarized Light Scanners)

By Slide Capacity

- Low-Capacity Slide Scanners (≤100 slides)

- Medium-Capacity Slide Scanners (101–300 slides)

- High-Capacity Slide Scanners (>300 slides)

- Others (Custom Modules, Robotic Feeders)

By Technology

- Whole Slide Imaging (WSI)

- Live View Scanning

- Z-Stack Scanning / Focus Stacking

- Confocal Scanning

- Others (3D Imaging, Real-time AI Integration)

By Application

- Disease Diagnosis

- Research & Drug Discovery

- Telepathology / Remote Consultation

- Education & Training

- Others (Archival & Quality Control)

By End User

- Hospitals & Reference Labs

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Others (Veterinary Clinics, Government Labs)

By Interface / Integration

- Standalone Systems

- Integrated with LIS / LIMS / PACS

- Cloud-enabled Scanners

- Others (Portable Modules, AI-Augmented Interfaces)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting