What is the Anesthesia Monitoring Devices Market Size?

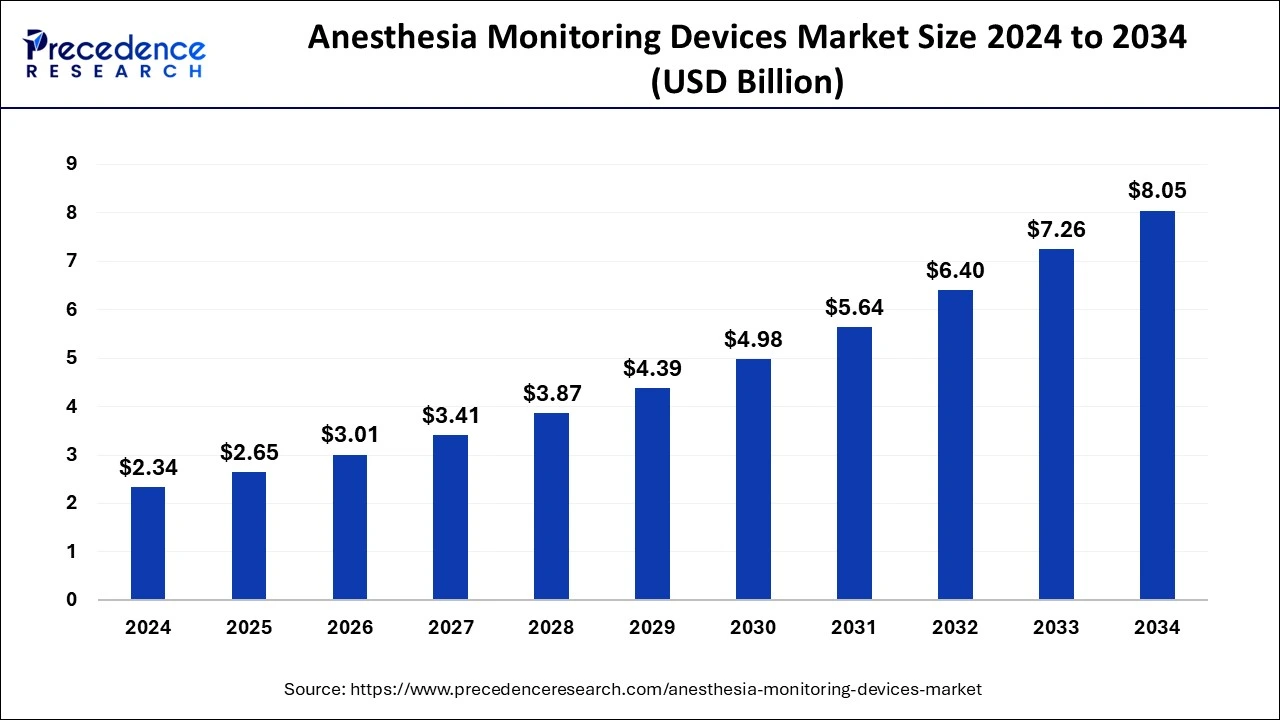

The global anesthesia monitoring devices market size is calculated at USD 2.65 billion in 2025 and is predicted to increase from USD 3.01 billion in 2026 to approximately USD 8.89 billion by 2035, expanding at a CAGR of 12.87% from 2026 to 2035.

Anesthesia Monitoring Devices Market Key Takeaways

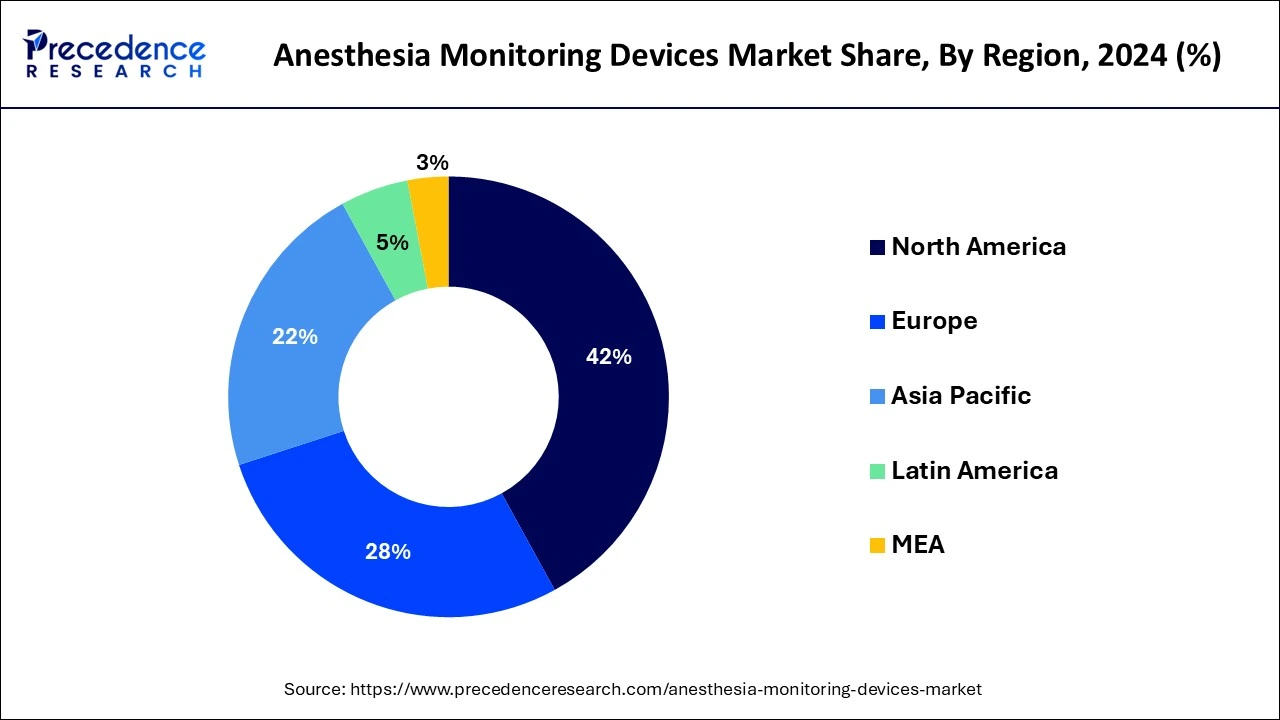

- Asia Pacific led the global market with the highest market share of 41.14% in 2025 and will maintain its dominance between 2026 and 2035.

- By Product Type, the advanced anesthesia monitor segment dominated the global market in 2025.

- By End User, the hospitals segment generated the maximum market in 2025.

- By Application, the cardiology segment contributed to the largest market share in 2025.

Market Overview

Anesthesia monitoring devices play an important role in modern anesthesia practice, providing real-time data to anesthesia care providers to assess patient status, detect any deviations from normal physiological parameters, and make informed decisions regarding anesthesia administration and patient management.

These devices assist in maintaining patient stability, preventing complications, and ensuring the safe and effective delivery of anesthesia, which is a critical aspect of patient care during surgical procedures. Factors such as the increasing number of surgical procedures worldwide, the growing emphasis on patient safety during anesthesia administration, advancements in technology leading to the development of more sophisticated and advanced monitoring devices, and the rising awareness among healthcare providers about the benefits of using anesthesia monitoring devices to improve patient outcomes are driving the market.

How is AI Influencing the Anesthesia Monitoring Devices Industry?

AI algorithms analyze massive, real-time datasets to predict potential adverse events, like hypotension or hypoxemia, minutes before they occur, giving anesthesiologists time to intervene. AI can identify subtle EEG waveform patterns that indicate consciousness changes more precisely than conventional indices, decreasing the risk of awareness during surgery.

AI tools such as ScanNav use computer vision to offer real-time, color-coded identification of anatomical structures in ultrasound images, assisting in needle guidance and reducing complications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.65 Billion |

| Market Size in 2026 | USD 3.01 Billion |

| Market Size by 2035 | USD 8.89 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.87% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End User, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of minimally invasive surgical techniques

Minimally invasive surgeries, such as laparoscopic and robotic-assisted procedures, offer several benefits over traditional open surgeries, including smaller incisions, reduced blood loss, faster recovery times, and shorter hospital stays. Anesthesia monitoring devices are essential in ensuring patient safety during these procedures. They allow continuous monitoring of vital signs and physiological parameters, such as heart rate, blood pressure, oxygen saturation, and carbon dioxide levels.

These devices provide real-time feedback to anesthesia care providers, helping them adjust anesthesia administration and patient management accordingly. The growing adoption of minimally invasive surgical techniques is driving the demand for anesthesia monitoring devices, as they are critical in optimizing patient outcomes, ensuring safe anesthesia administration, and supporting the growing trend towards less invasive surgical approaches.

Increasing prevalence of chronic diseases and comorbidities among the global population

According to WHO, CVD kills 41 million people each year, equivalent to 74% of all deaths globally. Each year, nearly 17 million people die from CVD before age 70 - 86%. Cardiovascular diseases account for most NCD deaths, or 17.9 million people annually, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, including kidney disease deaths caused by diabetes). Chronic diseases, such as cardiovascular diseases, diabetes, obesity, and respiratory diseases, significantly impact patients' physiological status and pose additional risks during anesthesia administration. Anesthesia monitoring devices play a crucial role in continuously monitoring vital signs and physiological parameters, allowing anesthesia care providers to detect any changes or deviations from normal and take timely interventions.

The rising prevalence of chronic diseases and comorbidities worldwide is driving the demand for anesthesia monitoring devices, as they are essential in ensuring safe anesthesia administration, optimizing patient outcomes, and managing patients with complex health conditions. As the global population continues to age and chronic diseases become more prevalent, the demand for anesthesia monitoring devices is expected to grow, propelling the growth of the market.

Restraints

High cost of advanced anesthesia monitoring devices

Advanced anesthesia monitoring devices often come with sophisticated features and technologies, such as multi-parameter monitoring, advanced connectivity options, and data analytics capabilities, which drives up their cost. Additionally, the need for regular maintenance, calibration, and updates adds to the overall cost of ownership.

The high cost of advanced anesthesia monitoring devices poses a challenge for healthcare facilities, especially in resource-constrained settings or regions with limited healthcare budgets. This potentially limits the adoption of advanced anesthesia monitoring devices, particularly in smaller healthcare facilities or developing markets, and hinders the overall growth of the anesthesia monitoring devices market.

Opportunity

Increasing adoption of remote and wireless monitoring technologies

Advancements in wireless communication, telemedicine, and cloud computing have enabled the development of remote monitoring solutions that allow healthcare providers to monitor patient's physiological parameters and vital signs in real time, even from a remote location. Remote anesthesia monitoring devices provide real-time data on patients' conditions, enabling anesthesia care providers to monitor multiple patients simultaneously, improve patient management, and make timely interventions. This results in improved patient outcomes, increased efficiency, and reduced healthcare costs.

The adoption of remote and wireless monitoring technologies presents an opportunity for manufacturers to develop innovative and cost-effective anesthesia monitoring devices that enhance patient care and expand the market reach, particularly in remote or underserved areas, ambulatory surgical centers, and home care settings.

- In June 2024, Israel-based firm Medasense, a global leader in pain monitoring solutions, announced a strategic collaboration with Nihon Kohden for the exclusive distribution of its revolutionary pain monitoring device in Japan. This partnership is intended to transform pain management practices across Japanese healthcare facilities, offering a significant advancement in patient care.

Segment Insights

Product Type Insights

Based on the product type, the anesthesia monitoring devices market is segmented into advanced anesthesia monitors, basic anesthesia monitors, and integrated anesthesia workstations. In 2025, the advanced anesthesia monitor segment dominated the market, accounting for the highest market share. Advanced anesthesia monitors are sophisticated devices that typically offer multi-parameter monitoring, advanced connectivity options, and data analytics capabilities. These devices are equipped with advanced features such as invasive and non-invasive blood pressure monitoring, pulse oximetry, capnography, electrocardiography, temperature monitoring, and other parameters, providing comprehensive monitoring of patients during anesthesia administration.

Advanced anesthesia monitors are widely used in hospitals, surgical centers, and other healthcare facilities for their ability to provide real-time, accurate, and continuous monitoring of patients' physiological parameters, enabling anesthesia care providers to make informed decisions and ensure patient safety. The demand for advanced anesthesia monitors is driven by the increasing emphasis on patient safety, advancements in technology, and the need for precise monitoring during complex surgical procedures, making it the dominant segment in the anesthesia monitoring devices market.

End-User Insights

Based on the end-user, the anesthesia monitoring devices market is segmented into hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, and Others. In 2025, the hospital segment accounted for the major market. Hospitals are the primary settings where surgeries and anesthesia administration are performed, and they typically require a wide range of anesthesia monitoring devices to ensure patient safety and optimal care.

Anesthesia monitoring devices are extensively used in hospitals for various surgical procedures, ranging from routine surgeries to complex and critical surgeries. Hospitals usually have well-equipped operation theaters and intensive care units (ICUs) where anesthesia monitoring devices are essential for continuous monitoring of patient's vital signs, such as heart rate, blood pressure, oxygen saturation, and other parameters, during anesthesia administration.

Furthermore, hospitals usually have a larger patient volume and a wide range of surgical specialties, including general surgery, orthopedics, cardiovascular surgery, neurosurgery, and others, which drive the demand for anesthesia monitoring devices. Hospitals also tend to have a higher budget for healthcare equipment procurement, making them the dominant end-user segment in the anesthesia monitoring devices market. Additionally, advancements in technology, increasing awareness about patient safety, and stringent regulatory guidelines in hospitals further contribute to the dominant market share of hospitals in the anesthesia monitoring devices market.

Application Insights

Based on the application, the market is segmented into Cardiology, Neurology, Dental, Ophthalmology, Urology, Orthopedics, and Others. In 2025, the Cardiology segment accounted for the major market share. Cardiology procedures, such as open-heart surgeries, cardiac catheterizations, and electrophysiology procedures, often require the use of anesthesia for patient comfort and safety. Anesthesia monitoring devices play a crucial role in monitoring and managing vital signs, anesthesia depth, and patient response during cardiology procedures to ensure optimal patient outcomes.

Moreover, with the increasing prevalence of cardiovascular diseases and the growing demand for cardiac surgeries and interventions, the Cardiology segment is expected to be the dominant segment in the anesthesia monitoring devices market. Advances in cardiology techniques, such as minimally invasive procedures and interventional cardiology, have also increased the demand for anesthesia monitoring devices in this segment. Moreover, the aging population and rising healthcare expenditure on cardiovascular care are further driving the need for advanced anesthesia monitoring devices in cardiology procedures.

COVID-19 Impact:

The COVID-19 pandemic had a major impact on the global anesthesia monitoring devices market. As the healthcare industry focused on managing the pandemic, there were disruptions in elective surgeries, cancellations of non-essential procedures, and reallocation of healthcare resources towards COVID-19 care, which affected the demand for anesthesia monitoring devices.

During the initial stages of the pandemic, many hospitals and healthcare facilities postponed or canceled elective surgeries to conserve resources, prioritize COVID-19 care, and minimize the risk of infection for patients and healthcare workers. This resulted in a decline in the demand for anesthesia monitoring devices as the volume of surgical procedures decreased.

Additionally, disruptions in the global supply chain, restrictions on movement and transportation, and temporary shutdowns of manufacturing facilities due to lockdowns and social distancing measures implemented to curb the spread of COVID-19 also affected the production and availability of anesthesia monitoring devices.

However, as the healthcare industry adapted to the new normal and resumed elective surgeries, the demand for anesthesia monitoring devices gradually recovered. The need for continuous monitoring of patients undergoing surgeries, including those related to COVID-19 complications, highlighted the importance of anesthesia monitoring devices in ensuring patient safety and optimizing outcomes. Moreover, the pandemic has also accelerated the adoption of telemedicine and remote monitoring technologies, including anesthesia monitoring devices, to minimize in-person interactions and reduce the risk of infection. This has opened up new opportunities for the development and utilization of innovative anesthesia monitoring devices that enable remote monitoring and data transmission, providing real-time information to healthcare professionals for timely decision-making.

Regional Insights

What is the U.S. Anesthesia Monitoring Devices Market Size?

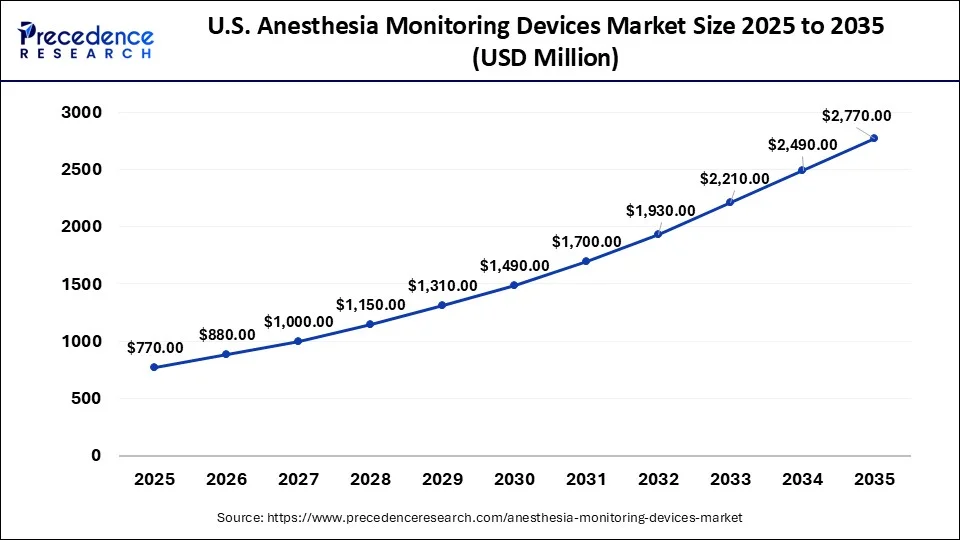

The U.S. anesthesia monitoring devices market size was evaluated at USD 770 million in 2025 and is projected to be worth around USD 2,770 million by 2035, growing at a CAGR of 13.66% from 2026 to 2035.

North America is the dominant region in the global anesthesia monitoring devices market, accounting for a major share. This region boasts a well-established healthcare infrastructure, a large patient population, and high healthcare expenditure, which collectively contribute to the demand for anesthesia monitoring devices. Additionally, the presence of key market players, advancements in technology, and favorable reimbursement policies further propel the growth of the anesthesia monitoring devices market in North America.

In particular, the United States stands out as a major market for anesthesia monitoring devices, driven by the high volume of surgeries performed, advanced healthcare facilities, and a significant prevalence of chronic diseases that require surgical interventions. Furthermore, increasing awareness about patient safety and the adoption of advanced anesthesia monitoring devices in healthcare settings further solidify the dominant position of North America in the global market.

- In March 2024, Medtronic plc, a global leader in healthcare technology, announced U.S. Food and Drug Administration (FDA) 510(k) clearance for the BIS™ Advance monitor. The new BIS™ Advance monitor delivers the clinically validated BIS™ algorithm with a completely redesigned interface that is easy to configure and use.

Advancements in Depth of Anesthesia Monitoring Devices in the Asia Pacific

Asia Pacific shows a significant growth in the anesthesia monitoring devices market during the forecast period. It is driven by rising surgical procedures, increasing awareness of patient safety, and technological advancements. The region's diverse healthcare infrastructure, coupled with a rising geriatric population, is leading to expanding healthcare expenditure.

China Anesthesia Monitoring Devices Market Trends

China's market is driven by rising surgical operations and an increasing geriatric population requiring surgical intervention, which are the main drivers for advanced, multi-parameter monitoring devices. There is a remarkable shift towards AI and machine learning for real-time, predictive anesthesia management to improve patient safety.

Europe

Europe is expected to grow at the fastest rate over the forecast period. The growth of the region can be credited to the increasing incidence of chronic illnesses, such as cancer, cardiovascular diseases, and diabetes. In addition, the health care system in Europe is focusing on cost-effectiveness and patient comfort with clinical efficiency, impacting the development of devices that can offer innovative products for long-term benefits.

Germany Anesthesia Monitoring Devices Market Trends

Germany's market is driven by evolving regulatory landscapes, technological innovation, and shifting healthcare priorities. The market's trajectory is shaped by the rising need for precision monitoring, growing adoption of smart solutions, and even expanding healthcare infrastructure.

Latin America: Advancing Perioperative Safety Standards:

In Latin America, the growth of this region is being driven by the continued modernization of healthcare and an increased focus on improving surgical safety protocols. An increased awareness of the need for proper management of the risks of anesthesia in public and private hospitals in the region.

Brazil Anesthesia Monitoring Devices Market Trends

Brazil is experiencing the fastest rate of growth among the Latin American nations. The growing surgical infrastructure in Brazil and increasing levels of investment in advanced medical equipment in urban health facilities have resulted in new sources of advanced technology being brought to Brazil to meet the growing demand for surgery.

Middle East & Africa (MEA): Emerging Opportunities in Critical Care:

The Middle East and Africa continue to represent a significant opportunity in hospital expansion, with an increasing number of chronic illnesses and a growing number of hospitals that are investing in advanced monitoring technologies used by tertiary hospitals and clinics. Investment in healthcare by governments and private players, along with increasing medical tourism in certain MEA countries, is further boosting market expansion.

Saudi Arabia Anesthesia Monitoring Devices Market Trends

Saudi Arabia is the fastest-growing country in the Middle East and Africa, with new healthcare transformation initiatives and the construction of hospitals supporting a rapidly increasing need for advanced anesthesia monitoring devices in the country. Government regulatory oversight and strengthened device standards aim to ensure quality while supporting market growth, although high costs and shortages of skilled professionals remain challenges.

Value Chain Analysis of the Anesthesia Monitoring Devices Market

- Manufacturing of Components/Sensors: Constructing the sensors, electrodes, and integrated circuits that will accurately monitor anesthesia using precision during the manufacturing process. Reliability and regulatory requirements at this stage also impact how the device will ultimately perform with respect to patient safety.

Key Players: Medtronic; Masimo Corporation. - Assembly of Device/Software/Mobile Apps: The manufacturing of the hardware components has been integrated with proprietary algorithms, artificial intelligence (AI) analytics, and simple-to-operate interfaces at this stage of the value chain.

Key Players: GE HealthCare; Philips Healthcare. - Distribution/Clinical Acceptance/Post-Installation Support: Distribution networks, partnerships with hospital systems, training programs for clinicians, and providing support after the device is installed are the key factors in ensuring long-term utilization of these devices.

Key Players: Dragerwerk AG, Nihon Kohden.

Anesthesia Monitoring Devices Market Companies

- Smiths Medical: Smiths Medical provides a diverse portfolio for the anesthesia monitoring market, aiming on patient safety, airway management, and even infusion therapy.

- Fisher & Paykel Healthcare Limited: Fisher & Paykel Healthcare Limited provides specialized solutions for anesthesia monitoring devices along with consumables market, aiming on Nasal High Flow therapy to improve oxygenation during general anesthesia, procedural sedation, and even post-anesthesia recovery.

- Spacelabs Healthcare: Spacelabs Healthcare offers comprehensive perioperative solutions for the anesthesia monitoring market, characterizing advanced, scalable monitors, Blease anesthesia delivery systems, and even multigas analyzers.

Other Major Key Players

- Medtronic

- GE HealthCare

- Koninklijke Philips N.V

- Dragerwerk AG & Co. KGaA

- Masimo

- Edwards Lifesciences Corporation

- NIHON KOHDEN CORPORATION

- Smiths Medical

- Fisher & Paykel Healthcare Limited

- Spacelabs Healthcare

Recent Developments

- In November 2024, Mindray, a leading medical equipment supplier from China, announced the launch of advanced upgrades for its existing anesthesia systems. The upgrades were added to the A5 and A7 anesthesia systems covered under Mindray's A Series Anesthesia product range.

- In January 2023, BOMImed Inc. announced a distribution agreement with Mindray North America. Through this agreement, BOMImed distributes Mindray's anesthesia, patient monitoring, and ultrasound devices in Canada. This broadened the customer base of both firms.

- In September 2023, Dräger, a leading medical safety product provider, announced the launch of a new range of anesthesia workstations for the United States market. The Atlan anesthesia workstation family can offer anesthesia delivery and management.

- In Jan 2023,Royal Philips, a global health technology, and Massimo, a global medical technology company, announced an expansion of their partnership to augment patient monitoring capabilities in home telehealth applications with Masimo W1 advanced health tracking watch.

- In May 2022,Fisher & Paykel Healthcare Corporation Limited, a global leader in innovative healthcare solutions, unveiled its latest breakthroughs in anesthesia technology with the introduction of two cutting-edge products. Developed exclusively for anesthesia applications, these groundbreaking additions to their hospital respiratory support segment promise to expand the market opportunity for their acclaimed Optiflow™ nasal high-flow system, Optiflow Switch™ and Optiflow Trace

- In June 2022,GE Healthcare and Medtronic received FDA 510(k) clearance and CE Mark approval for the integration of advanced INVOS™ regional oximetry and Micro stream™ capnography technologies on the CARESCAPE precision monitoring platform. This integration enables continuous monitoring of evolving respiratory compromise and helps clinicians predict and prevent perioperative complications more quickly. With access to continuous monitoring at the bedside, during transport, and integration with electronic medical records (EMR), providers can improve patient outcomes, enhance safety, and increase efficiency in delivering quality care.

Segments Covered in the Report

By Product Type

- Advanced anesthesia monitors

- Anesthesia gas monitors

- Monitors measuring the depth of anesthesia.

- Standalone capnography monitors

- Others

- Basic anesthesia monitors

- Integrated anesthesia workstation

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

By Application

- Cardiology

- Neurology

- Dental

- Ophthalmology

- Urology

- Orthopedics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting