What is the Application Performance Management Market Size?

The global application performance management market size accounted for USD 7.12 billion in 2025 and is predicted to increase from USD 8.11 billion in 2026 to approximately USD 26.26 billion by 2035, expanding at a CAGR of 13.94% from 2026 to 2035. This market is growing due to the rising adoption of cloud-based applications and the need for real-time performance monitoring to ensure a seamless user experience.

Market Highlights

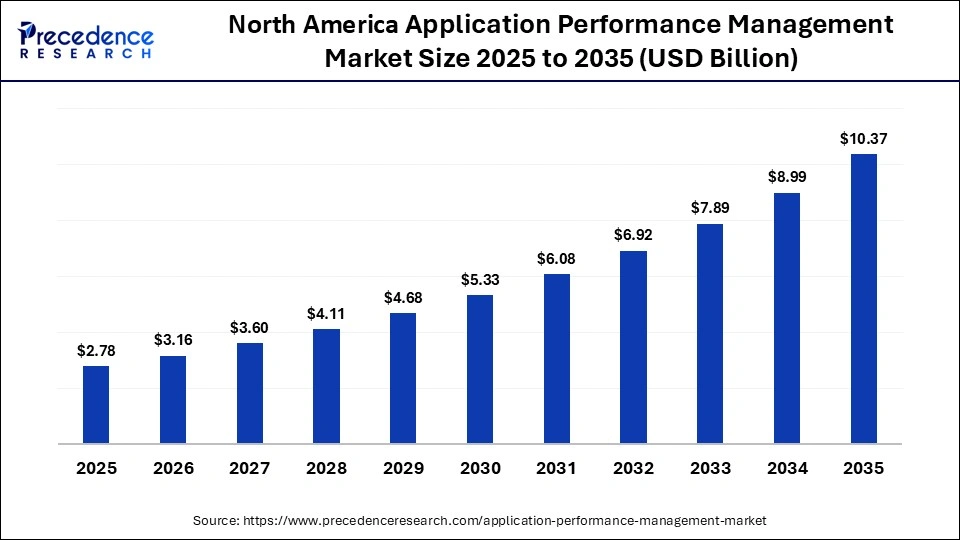

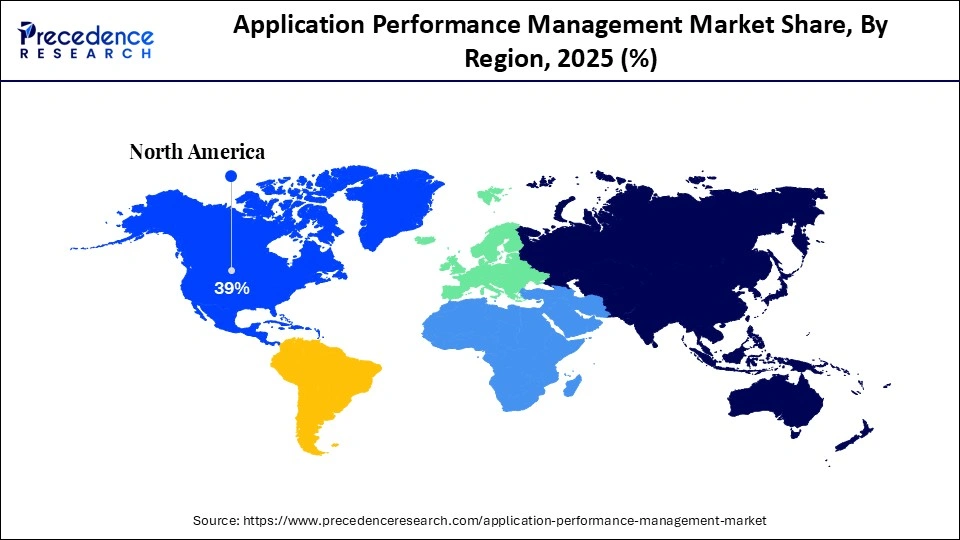

- North America dominated the market with the largest market share of 39% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

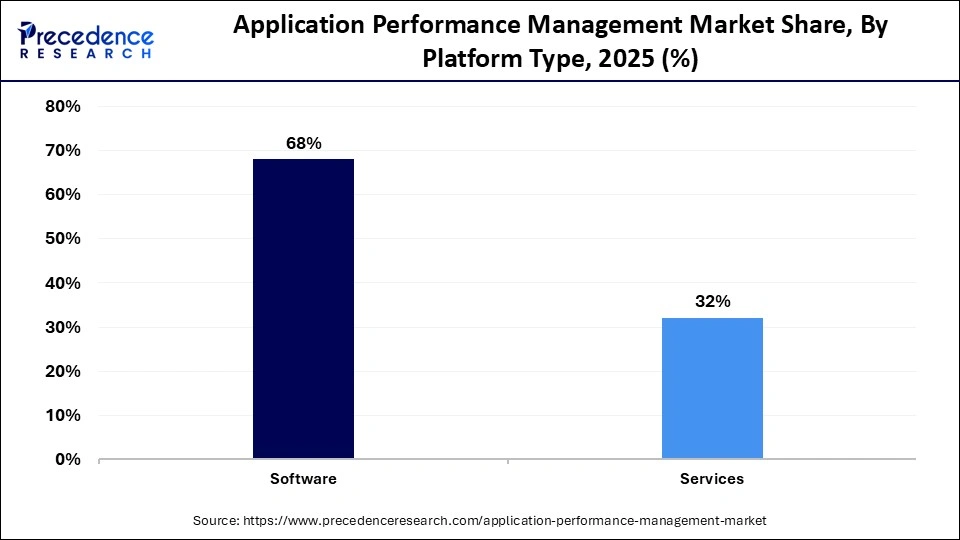

- By platform type, the software segment held the major market share of 68% in 2025.

- By platform type, the services segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By deployment mode, the cloud segment contributed the highest market share of 54% in 2025.

- By deployment mode, the on-premises segment is expected to grow at a significant CAGR in the upcoming period.

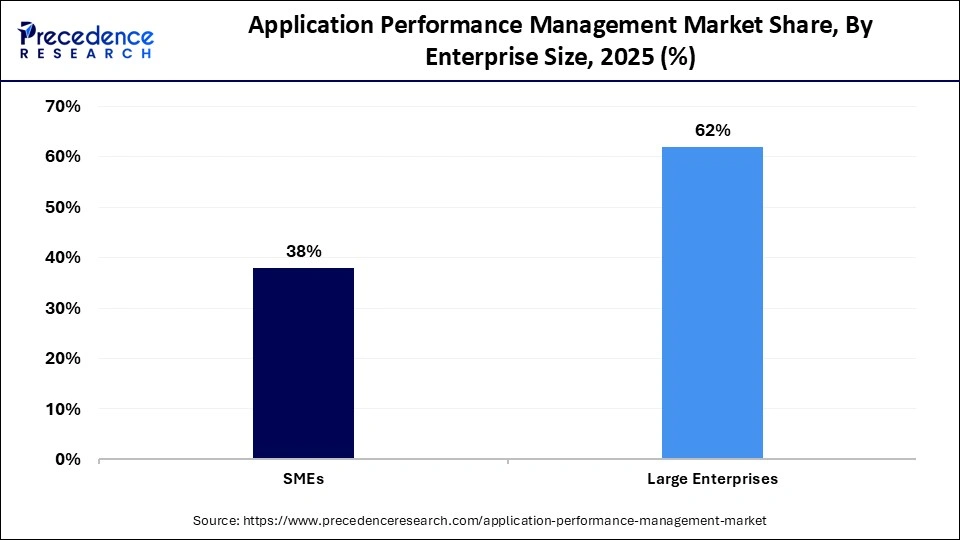

- By enterprise size, the large enterprises segment accounted for the biggest market share of 62% in 2025.

- By enterprise size, the SMEs segment is expected to expand at the fastest CAGR from 2026 to 2035.

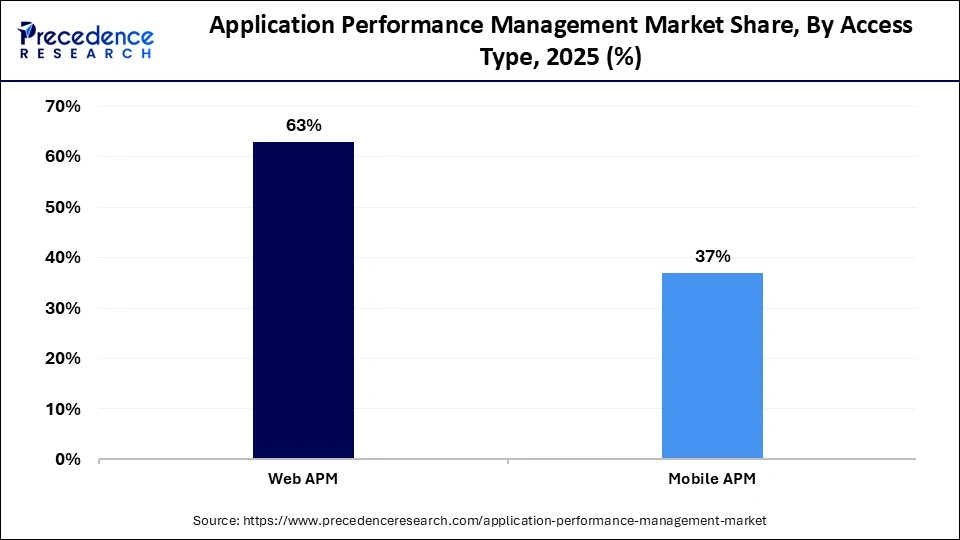

- By access type, the web APM segment held the largest market share of 63% in 2025.

- By access type, the mobile APM segment is expected to expand at the fastest CAGR between 2026 and 2035.

Why is the application performance management market gaining momentum?

The application performance management market is expanding as businesses concentrate on providing flawless digital experiences by consistently tracking, evaluating, and improving application performance in cloud-based premises and hybrid environments. Growing adoption of DevOps, CI/CD, and observability practices, along with AI-driven analytics, enables organizations to detect and resolve issues faster, improving user experience and operational efficiency. Additionally, the rising importance of customer experience and business continuity is driving enterprises to invest in APM solutions to maintain reliability, compliance, and competitive advantage.

What are the Major Trends in the Market?

- AI-Powered Predictive Analytics: Expand offerings with advanced AI/ML capabilities to provide predictive insights, automated anomaly detection, and intelligent remediation suggestions.

- Cloud-Native APM Solutions: Develop specialized tools for monitoring containerized, serverless, and Kubernetes environments to support digital transformation initiatives.

- Observability Enhancements: Integrate logs, metrics, and traces into unified platforms for deeper visibility and actionable insights across complex IT infrastructures.

- User Experience Monitoring: Build or enhance digital experience monitoring features that directly connect application performance to customer satisfaction and business KPIs.

- Industry-Specific Solutions:Customize APM features for key verticals such as finance, healthcare, retail, and telecommunications to address industry-specific performance challenges.

- Edge & IoT Monitoring: Expand capabilities into edge computing and IoT performance management, providing real-time insights for emerging use cases.

How is AI Transforming the Application Performance Management Market?

By facilitating predictive analytics, automated root cause analysis, and real-time anomaly detection across complex application environments, artificial intelligence is transforming the application performance management market. AI-driven APM solutions minimize manual intervention and operating expenses while assisting businesses in proactively identifying performance problems, cutting downtime, and improving user experience.

Unlocking the Future Growth Potential

- AI-driven automation is gaining traction for real-time anomaly detection, predictive insights, and faster root cause analysis, which is expected to drive market growth in the coming years.

- Rising adoption of cloud native and microservices architectures is increasing demand for scalable, flexible APM solutions.

- The shift toward full-stack observability is enabling unified monitoring of applications, infrastructure logs, and user experience.

- Proactive and predictive monitoring is replacing reactive approaches to minimizing downtime and performance disruptions.

- Growing focus on end-user experience monitoring is helping businesses directly link application performance to customer satisfaction.

- Integration with DevOps and CI/CD pipelines supports faster application development and continuous performance optimization.

How Does Application Performance Management Deliver Positive ROI?

By assisting organizations in minimizing application downtime, lowering mean time to resolution, and preventing revenue losses brought on by performance failures, application performance management offers a strong positive return on investment. AI-driven insights and proactive monitoring make it possible to identify problems early on before they affect users, reducing support and operational costs. Additionally, increased applications of responsiveness raise customer satisfaction, retention, and conversion rates, enabling businesses to directly connect APM investments to quantifiable business performance and long-term cost effectiveness.

How is Sustainability and Resilience Shaping the Application Performance Management Market?

Application performance management solutions are increasingly being leveraged to enhance sustainability and operational resilience in IT environments. APM tools assist companies in lowering carbon footprints, optimizing server utilization, and reducing energy consumption by continuously monitoring system performance and resource usage. By proactively identifying possible failures, reducing downtime, and guaranteeing continuous service across crucial applications, they also improve business reliability. Demand for intelligent automated APM platforms in industries like banking, healthcare, and cloud services is driven by this dual focus on eco-efficiency and system reliability.

- In January 2025, Dynatrace launched APM features with energy-efficient monitoring and predictive resilience capabilities, enabling clients to reduce operational overhead and environmental impact.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.12 Billion |

| Market Size in 2026 | USD 8.11 Billion |

| Market Size by 2035 | USD 26.26 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform Type,Deployment Mode,Enterprise Size,Access Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Platform Type Insights

Why did the software segment dominate the application performance management market?

The software segment dominated the market while holding a major revenue share in 2025. This is due to its crucial function in real-time application performance optimization, diagnostics, and monitoring in intricate IT environments. Businesses use APM software extensively to identify performance bottlenecks, obtain end-to-end visibility into application behavior, and guarantee a consistent user experience. Demand for scalable and sophisticated APM software platforms has increased due to the widespread use of cloud native apps and microservices.

The services segment is expected to grow at the fastest CAGR in the upcoming period, as businesses need professional assistance for APM implementation, customization, and continuous performance improvement. The need for consulting managed services and ongoing monitoring support is growing due to the complexity of hybrid and multi-cloud environments. To lessen internal IT burden and speed up time to value, businesses are increasingly outsourcing APM management, boosting the demand for professional services.

Deployment ModeInsights

Why did the cloud segment dominate the application performance management market?

The cloud segment dominated the market with the largest share in 2025 due to its scalability, affordability, and simplicity of deployment. Real-time monitoring across dispersed applications is made possible by cloud-based APM platforms. Cloud APM adoption has been further accelerated by the growing use of SaaS cloud native apps and remote work settings.

The on-premises segment is expected to grow at a rapid pace in the coming years, as businesses in regulated sectors look for more authority over compliance and data security. On-premises APM solutions are preferred by businesses with sensitive workloads and legacy systems because they preserve performance visibility without disclosing vital information to outside parties. On-premises deployments are becoming increasingly popular due to growing investments in private IT infrastructure.

Enterprise Size Insights

What made large enterprises the dominant segment in the application performance management market?

The large enterprises segment dominated the market by capturing the largest share in 2024. This is because of their heavy reliance on continuous digital services and intricate application ecosystems. To support mission-critical operations, guarantee system reliability, and manage massive workloads, these organizations need sophisticated APM solutions. Widespread deployment of enterprise-grade APM platforms is made possible by robust IT budgets and committed performance management teams.

The SMEs segment is expected to experience rapid growth over the forecast period, driven by increasing adoption of cloud-based applications and digital platforms. Scalable and cost-effective APM solutions enable small and medium-sized enterprises to monitor application performance, enhance customer experience, and compete with larger organizations. As SMEs recognize the direct impact of performance on revenue, they are adopting APM solutions at an accelerating pace.

Access Type Insights

Why did the web APM segment dominate the market?

The web APM segment dominated the market in 2025 because web-based applications are widely used in a variety of industries. To guarantee flawless digital experiences, businesses rely on web APM tools to track page load times to serve responses and user interactions. The demand for web APM solutions is still high due to the quick expansion of online banking, e-commerce, and web-based enterprise platforms.

The mobile APM segment is expected to grow at the fastest rate during the projection period due to the growing reliance on mobile applications and smartphone adoption. Businesses are spending money on mobile APM to keep an eye on user experience latency and app crashes on a variety of devices and operating systems. The growth of digital payments on demand services and mobile commerce is accelerating the adoption of mobile APM.

Regional Insights

How Big is the North America Application Performance Management Market Size?

The North America application performance management market size is estimated at USD 2.78 billion in 2025 and is projected to reach approximately USD 10.37 billion by 2035, with a 14.07% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Application Performance Management Market?

North America dominated the market by holding the largest share in 2025. This is because of the early adoption of cutting-edge IT monitoring solutions and the robust presence of top technology providers. Businesses in the area place a high priority on digital performance optimization to facilitate cloud adoption, DevOps procedures, and customer-focused applications. The region's market dominance is also reinforced by its high IT spending and established cloud infrastructure.

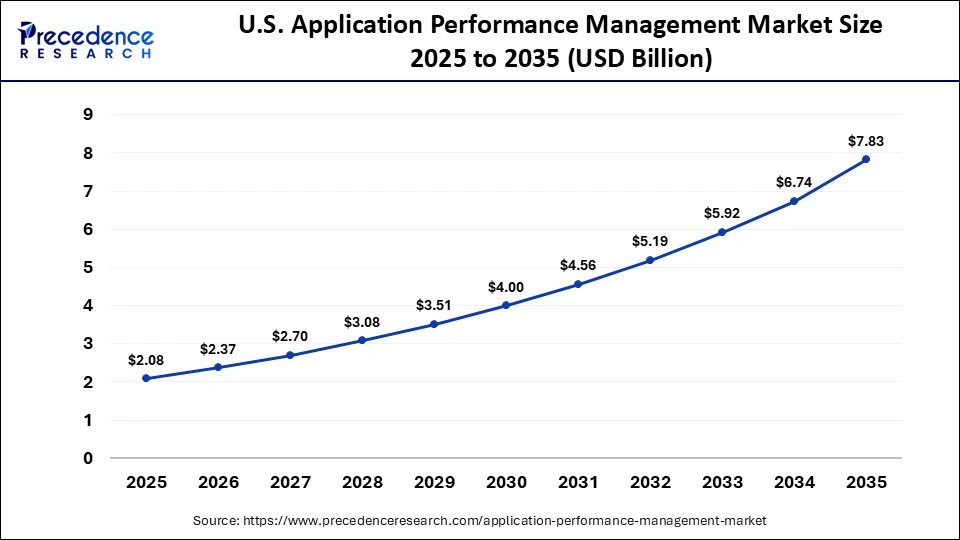

What is the Size of the U.S. Application Performance Management Market?

The U.S. application performance management market size is calculated at USD 2.08 billion in 2025 and is expected to reach nearly USD 7.83 billion in 2035, accelerating at a strong CAGR of 14.17% between 2026 and 2035.

U.S. Application Performance Management Market Trends

The U.S. dominates the North American application performance management market due to the early adoption of cloud computing, DevOps procedures, and cutting-edge monitoring tools. Performance monitoring solutions are consistently in demand due to the strong presence of top APM vendors, high IT spending, and widespread use of web and mobile applications. Businesses in the retail healthcare, IT, and BFSI industries mainly rely on APM tools to guarantee application security, dependability, and excellent user experience.

How is the Opportunistic Rise of Asia Pacific in the Application Performance Management Market?

Asia Pacific is expected to grow at the fastest CAGR throughout the forecast period, driven by rapid digital transformation, expanding cloud adoption, and growing use of mobile and web applications, which are driving strong demand for performance monitoring tools. The demand for APM solutions is being driven by rising e-commerce, fintech, and mobile application usage. The emergence of technology startups and government-led digital initiatives is driving market expansion in the area.

India Application Performance Management Market Trends

The market in India is growing, propelled by the expansion of cloud adoption, the quickening pace of digital transformation, and the rise of mobile-first apps. The need for scalable and affordable APM solutions is growing as e-commerce, fintech, SaaS platforms, and IT services become more widespread. Strong market growth in India is also being supported by increased startup activity, government-led digital initiatives, and growing awareness of the impact of application performance on customer experience.

What Drives the Market in Latin America?

The market in Latin America is growing at a steady rate, driven by rapid digitalization in banking, retail, and telecom sectors and increasing adoption of cloud technologies. Businesses are implementing APM tools to ensure application stability and enhance end-user experiences. Rising investments in SaaS platforms and cloud data centers, coupled with growing demand for real-time performance monitoring from mobile apps and e-commerce, are further fueling market expansion.

Brazil Application Performance Management Market Trends

Brazil is a major player in the Latin American market, fueled by the extensive digital transformation of financial institutions and businesses. To manage complex application environments and minimize service interruptions, organizations are implementing APM solutions. APM adoption is accelerating due to strong growth in fintech e-commerce and digital banking. The need for sophisticated monitoring and analytics tools is growing as hybrid and multi-cloud architectures are used more frequently.

What Potentiates the Application Performance Management Market in the MEA?

The market in the Middle East & Africa (MEA) is driven by the increasing use of cloud computing and digital services across various industries. Organizations are using APM tools more frequently to guarantee application reliability and lower experience. Wider APM adoption is supported by rising data center and enterprise IT modernization investments. Furthermore, the need for end-to-end application visibility is growing due to the move toward hybrid and multi-cloud environments.

UAE Application Performance Management Market Trends

In the UAE, the market is expanding rapidly, driven by smart government programs, cloud-first strategies, and cutting-edge IT infrastructure. Businesses are using APM solutions to maintain high performance standards, support digital services, and manage complex applications. Proactive performance monitoring is becoming increasingly necessary due to the growing use of AI, IoT, and real-time digital platforms. The aviation, e-commerce, and BFSI industries' strong demand supports market expansion.

Who are the Major Players in the Global Application Performance Management Market?

The major players in the application performance management market includeAkamai Technologies, AppDynamics, Broadcom Inc., Datadog Inc., Dynatrace LLC, IBM, OpenText Corporation, Microsoft, New Relic Inc., and Oracle

Recent Developments

- In April 2025, Honeycomb announced the acquisition of Grit, an open-source query system and AI agent, aimed at accelerating the adoption of custom instrumentation for software systems. This move seeks to remove barriers to OpenTelemetry adoption through AI-driven auto-instrumentation, enabling customers to gain value from telemetry data more rapidly. (Source:https://www.honeycomb.io)

- In December 2025, Palo Alto Networks and Google Cloud announced a significant expansion of their strategic partnership, including a multibillion-dollar agreement for secure AI and cloud initiatives. This collaboration will involve deeper integration of security solutions, the migration of key Palo Alto Networks workloads to Google Cloud, and the use of Google's AI for security copilots. (Source:https://finance.yahoo.com)

- In November 2025, Palo Alto Networks announced a definitive agreement to acquire Chronosphere, a leader in next-generation observability, for approximately $3.35 billion. This acquisition intends to integrate Chronosphere's observability platform with Palo Alto Networks' Cortex AgentiX to provide real-time, AI-driven remediation and enhanced visibility for modern cloud and AI workloads. (Source:https://www.paloaltonetworks.in)

Segments Covered in the Report

By Platform Type

- Software

- Services

- Deployment and Integration

- Training and Education

- Support and Maintenance

By Deployment Mode

- On Premise

- Cloud

- Hybrid

By Enterprise Size

- SMEs

- Large Enterprises

By Access Type

- Web APM

- Mobile APM

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content