What is the Ascorbic Acid Market Size in 2026?

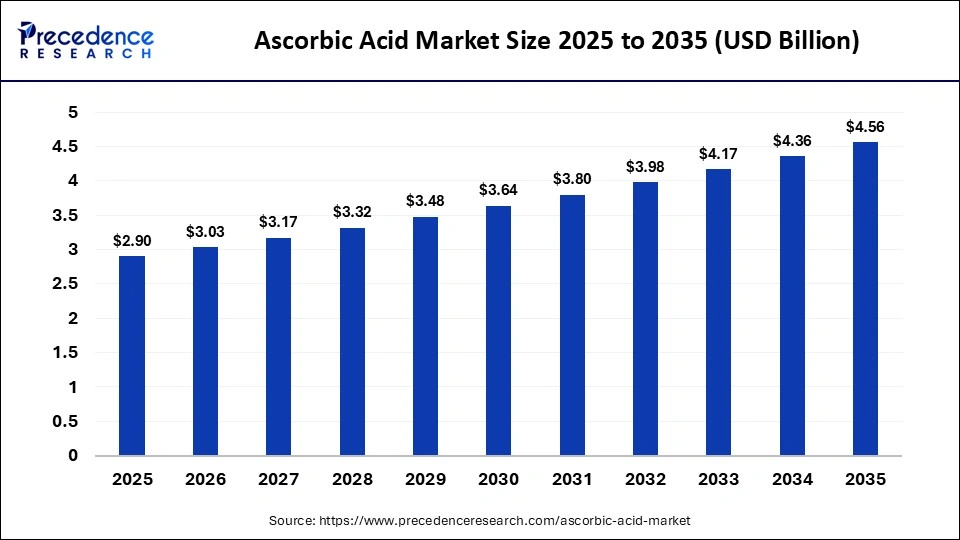

The global ascorbic acid market size was estimated at USD 2.90 billion in 2025 and is predicted to increase from USD 3.03 billion in 2026 to approximately USD 4.56 billion by 2035, expanding at A CAGR of 4.63% from 2026 to 2035. This market is growing due to rising demand for vitamin C in food, pharmaceuticals, and personal care products.

Key Takeaways

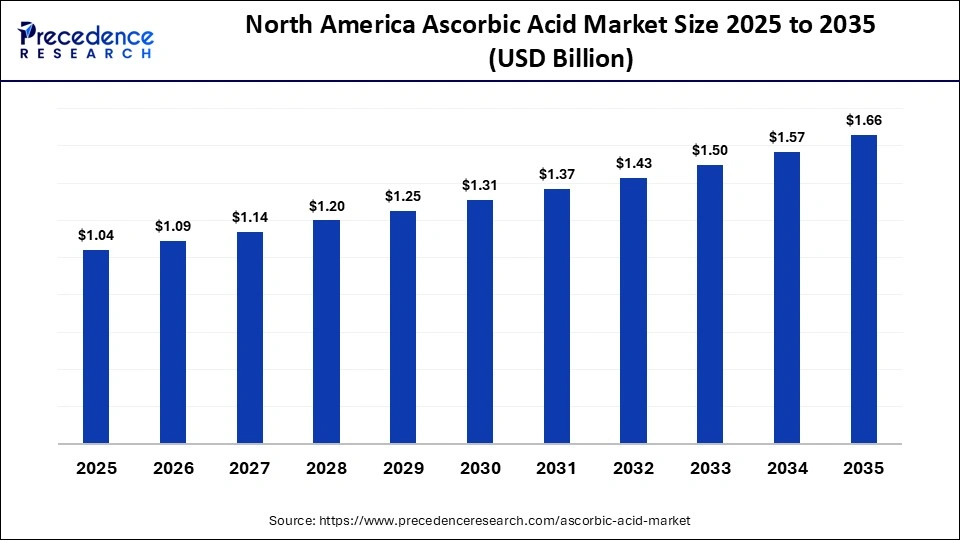

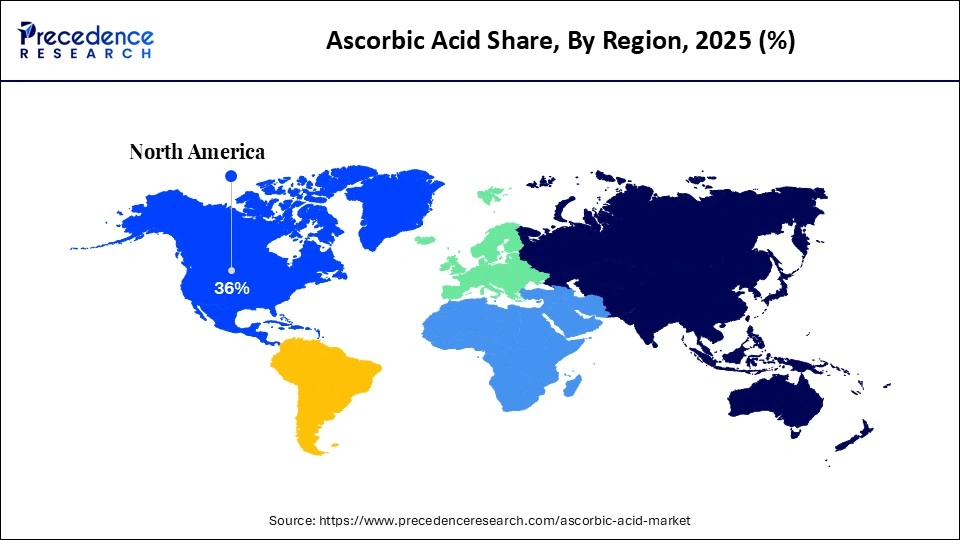

- North America dominated the market with the largest market share of 36% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By form, the powder segment held the biggest market share in 2025.

- By form, the granules segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By application, the food and beverages segment contributed the highest market share in 2025.

- By application, the pharmaceuticals segment is expected to grow at a strong CAGR between 2026 and 2035.

- By end-user, the food and beverage manufacturers segment held a major market share in 2025.

- By end-user, the pharmaceutical companies segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By grade, the food grade segment held the largest market share in 2025.

- By grade, the pharmaceutical grade segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By packaging, the bags segment held a major market share in 2025.

- By packaging, the sachets segment is expected to expand at the fastest CAGR from 2026 to 2035.

Market Overview

The ascorbic acid market deals with the production and sale of Vitamin C, a water-soluble nutrient widely used in pharmaceuticals, food & beverages, and personal care products. Valued for its antioxidant properties, immune-boosting effects, and role in collagen synthesis, ascorbic acid enhances product quality, shelf life, and health benefits across multiple applications. The market is growing due to the increasing consumer awareness of immunity and wellness, rising demand for fortified foods and beverages, expanding pharmaceutical use in injectable and oral formulations, and the growing popularity of cosmetic products containing Vitamin C for skin health. Furthermore, its extensive use as a preservative and antioxidant in processed foods and drinks is sustaining a stable demand worldwide.

How is Artificial Intelligence Transforming the Ascorbic Acid Market?

Artificial intelligence is transforming the ascorbic acid market by lowering manufacturing costs, enhancing quality control, and streamlining production procedures. The food and nutraceutical industries benefit from AI-based demand forecasting tools that help manufacturers manage inventory and react swiftly to shifting consumer preferences. Additionally, the creation of novel vitamin C formulations for medications, functional foods, and dietary supplements is accelerated by AI-driven research.

Major Market Trends

- Rising Demand for Immunity-Boosting Products:Consumers are increasingly seeking vitamin C supplements to strengthen immunity.

- Growth in Functional Foods and Beverages: Food manufacturers incorporate ascorbic acid into fortified products.

Expansion of the Nutraceutical Industry:The growing dietary supplement sector is driving demand for high-quality vitamin C ingredients. - Clean-Label and Natural Ingredient Preference:Consumers prefer naturally sourced and transparent ingredient formulations.

- Increasing Pharmaceutical Applications:Ascorbic acid is widely used in tablets, capsules, injections, and syrups.

- Growing Cosmetic and Skincare Usage:Vitamin C is gaining popularity in anti-aging and skin-brightening products.

- Technological Advancements in Manufacturing:Automation and AI are improving production efficiency and quality control.

- Rising Demand in Emerging Economies:Increasing health awareness and disposable income support market growth.

Future Market Outlook - Development of Advanced Formulations:Liposomal and sustained-release vitamin C products offer higher bioavailability and differentiation.

- Expansion into Plant-Based and Organic Segments:Naturally derived vitamin C can attract health-conscious consumers.

- Strategic Partnerships with Food and Beverage Brands:Collaboration with functional food manufacturers can expand product reach.

- Pharmaceutical-Grade Production Expansion:Increasing demand for high-purity vitamin C creates opportunities for specialized manufacturing.

- Investment in R&D for Innovative Applications:Research into new therapeutic and preventive uses can open additional revenue streams.

- Private Label and E-Commerce Growth:Online supplement sales provide new distribution channels.

- Sustainable Production Practices:Adoption of eco-friendly manufacturing processes can enhance brand positioning and meet regulatory standards.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.90 Billion |

| Market Size in 2026 | USD 3.03 Billion |

| Market Size by 2035 | USD 4.56 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Form, Application, End-User, Grade, Packaging, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Form Insights

What Made Powder the Dominant Segment in the Ascorbic Acid Market?

The powder segment dominated the market with the largest share in 2025 because it is easy to transport, has a longer shelf life, and is highly stable. High usage of powdered ascorbic acid in pharmaceuticals, food processing, and dietary supplements also bolstered the segment. Its versatility across various industrial applications also raised its demand. Powdered Vitamin C allows precise dosing, convenient storage, and cost-effective transport compared to liquid forms. Its stability during processing and compatibility with tablets, capsules, and fortified foods further reinforce its widespread adoption and market leadership.

The granules segment is expected to grow at the fastest CAGR in the coming years because of the rising demand for convenient dosing formats. Granules are increasingly used in instant beverage mixes and nutraceuticals, offering improved solubility, reduced dust, and easier handling. Growing consumer preference for ready-to-mix and single-serve vitamin products, along with expanding retail distribution, is further driving adoption. Additionally, advancements in granulation technology are enhancing product quality and consistency, supporting market growth.

Application Insights

Why Did the Food and Beverage Segment Dominate the Ascorbic Acid Market?

The food and beverage segment dominated the market in 2025 because ascorbic acid is frequently used as an antioxidant and preservative in food products. It improves the nutritional value of processed foods, keeps them fresh, and stops oxidation. Segment dominance was greatly bolstered by the rising demand for packaged foods and fortified beverages. Urban populations' growing consumption of convenience foods increased usage even more.

The pharmaceuticals segment is expected to grow at the fastest CAGR in the coming years due to increasing demand for immunity-boosting supplements, vitamin C-based therapies, and preventative healthcare products. Growth is fueled by rising health awareness, expanding clinical research on Vitamin C applications, and the aging global population requiring nutritional and therapeutic support. Additionally, the growing popularity of online pharmacies and e-commerce platforms is improving accessibility, further driving adoption in pharmaceutical applications.

End-User Insights

How Does the Food and Beverage Manufacturers Segment Dominate the Ascorbic Acid Market?

The food and beverage manufacturers segment dominated the market in 2025 because of the widespread consumption of packaged and processed foods that contain ascorbic acid. This ingredient is essential for improving texture, nutritional value, and shelf life. Global food production has increased significantly, driving the demand for this acid. The segment was further strengthened by strong demand from beverage producers and bakery producers.

The pharmaceutical companies segment is expected to grow at the fastest CAGR in the coming years due to rising demand for immune-boosting formulations and vitamin C supplements. The use of ascorbic acid in pharmaceuticals is increasing, as people are becoming more aware of the importance of immunity building and preventive healthcare. Additionally, the growth of e-pharmacies and online sales channels is improving accessibility, further boosting demand from pharmaceutical end users.

Grade Insights

Why Did the Food-Grade Segments Dominate the Ascorbic Acid Market?

The food-grade segment dominated the market in 2025 because processed and packaged foods contain a lot of ascorbic acid. Its role in enhancing shelf life, maintaining color, and improving nutritional value makes it essential for large-scale food production. Its high levels of consumption were also influenced by the growth in packaged food exports. Additionally, growing consumer demand for fortified and health-focused foods, along with the expansion of the packaged food and beverage industry, has reinforced the dominance of the food-grade segment.

The pharmaceutical-grade segment is expected to grow at the fastest CAGR in the coming years due to the increasing production of over-the-counter vitamin products and dietary supplements, as well as rising investments in nutraceutical manufacturing. Another major factor propelling the segment's growth is the growing emphasis on health and wellness. Ongoing advancements in formulation technologies are boosting the efficacy and availability of pharmaceutical-grade ascorbic acid.

Packaging Insights

What Made Bags the Leading Segment in the Ascorbic Acid Market?

The bags segment led the market in 2025. This is because of their cost-effectiveness and suitability for packaging large quantities of ascorbic acid. For both large-scale storage and transportation, bags are convenient. Foods and pharmaceutical manufacturers frequently use them. They are appropriate for industrial use due to their exceptional durability and moisture-resistant qualities. Segment dominance is further reinforced by the benefits of stacking and easy handling.

The sachets segment is expected to grow at the fastest CAGR in the coming years due to growing consumer demand for convenient, single-serve packaging formats in dietary supplements, functional foods, and beverage mixes. Sachets offer easy portability, precise dosing, and improved product stability, appealing to health-conscious consumers and on-the-go lifestyles. Additionally, the expanding retail and e-commerce channels for ready-to-mix and personalized nutrition products are further driving the adoption of sachet packaging.

Regional Insights

North America Ascorbic Acid Market Size and Growth 2026 to 2035

The North America ascorbic acid market size surpassed USD 1.04 billion in 2025 and is projected to cross around USD 1.66 billion by 2035 with a CAGR of 4.79% from 2025 to 2035.

Why Did North America Dominate the Ascorbic Acid Market?

North America dominated the ascorbic acid market with a major revenue share in 2025 because of the widespread use of dietary supplements and fortified food. Regional leadership was supported by the robust presence of food processing and pharmaceutical industries. The demand for this acid has been increasing across the region due to preventive healthcare measures and growing health consciousness. Production capabilities were improved by advanced manufacturing infrastructure. Moreover, easy access through retail and e-commerce channels reinforces North America's leading position.

U.S. Ascorbic Acid Market Size and Forecast 2026 to 2035

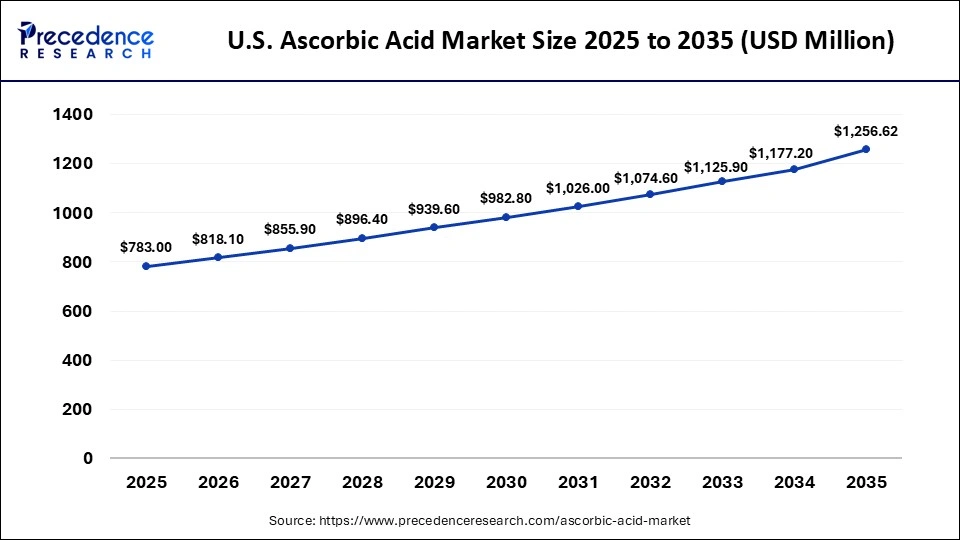

The U.S. ascorbic acid market size was calculated at USD 783 million in 2025 and is projected to attain around USD 1,256.62 million by 2035 with a CAGR of 4.84% from 2025 to 2035.

U.S. Ascorbic Acid Market Trends

The market in the U.S. is driven by rising demand for immune-boosting formulations, dietary supplements, and fortified food and drinks. Steady market growth is supported by strong pharmaceutical manufacturing capabilities, well-established hospital and retail pharmacy networks, and growing consumer focus on preventive healthcare. In addition, the rising adoption of functional foods and clean-label products is boosting the use of vitamin C as a natural antioxidant. Technological advancements in formulation, including sustained release and liposomal variants, are further enhancing product effectiveness and market expansion.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to rapid growth in the food & beverage, pharmaceutical, and nutraceutical sectors. Expanding healthcare infrastructure, increasing health awareness, and rising demand for fortified foods and dietary supplements are driving market growth. Additionally, supportive government initiatives, growing urban populations, and low-cost manufacturing capabilities are attracting investments, while collaborations with global players are further accelerating regional growth.

India Ascorbic Acid Market Trends

India's ascorbic acid market is expanding due to growing health consciousness, rising consumption of supplements, and the expansion of the domestic pharmaceutical industry. Market growth is supported by higher exports of pharmaceutical ingredients, improved distribution networks, and expanded healthcare access. Additionally, rising disposable incomes and a growing middle class are boosting spending on preventive healthcare and wellness products.

Ascorbic Acid Market Value Chain Analysis

- R&D: This stage focuses on improving bioavailability, stability, and development of new formulations such as liposomal and injectable vitamin C products.

- Key players:BASF SE and DSM-Firmenich.

- Raw Material Sourcing:This stage involves procuring high-quality raw materials such as glucose, sorbitol, or starch, which are the primary inputs for industrial Vitamin C production.

- Key players: DSM (Netherlands), BASF SE (Germany), and Koninklijke DSM N.V.

- Manufacturing / Production:The production stage converts raw materials into ascorbic acid through chemical synthesis or fermentation processes, ensuring pharmaceutical, food-grade, or cosmetic-grade standards.

- Key players: TCI Chemicals, Zhejiang NHU Co., Ltd., and Shandong Luwei Pharmaceutical Co., Ltd.

- Distribution to Hospitals & Pharmacies: Pharmaceutical distributors ensure the timely supply of ascorbic acid products to hospitals, retail pharmacies, and online platforms.

- Key players: McKesson Corporation and Cardinal Health.

- Patient Support and Services: Companies provide educational programs, dosage guidance, and awareness campaigns about vitamin C supplementation benefits.

- Key players: Pfizer Inc. and GSK plc.

Ascorbic Acid Market Companies

- CSPC Pharmaceutical Group

- Shandong Luwei Pharmaceutical

- Northeast Pharmaceutical Group (NEPG)

- DSM-Firmenich

- BASF SE

- Zhejiang NHU Co., Ltd.

- North China Pharmaceutical Group (NCPC)

- Anhui Tiger Biotech Co., Ltd.

- Shandong Tianli Pharmaceutical Co., Ltd.

- Hebei Welcome Pharmaceutical Co.

- BBCA Group

Recent Developments

- In February 2026, Rodan + Fields launched Pure C Serum, a Vitamin C skincare innovation designed to support long-term skin health and visible longevity. Featuring 10% pure ascorbic acid, the clinically tested formula neutralizes free radicals and delivers science-backed, measurable results across all ages. (Source:https://www.morningstar.com)

- In July 2025, Oncofit Solutions launched Ascotfit – HD, a high-dose Ascorbic Acid (Vitamin C) injection for clinical use in integrative oncology, anti-aging, wellness, and functional medicine. Each 50 ml vial delivers 25 grams of pharmaceutical-grade Vitamin C (500 mg/ml) and is manufactured in a GMP-certified facility to meet international quality and safety standards.

(Source: https://thewire.in) - In October 2024,STASKA Pharmaceuticals, Inc. voluntarily recalled one lot of Ascorbic Acid Solution for Injection (500 mg/mL, 50 mL vials) due to the presence of glass particulates in the affected batch.

(Source: https://www.fda.gov)

Segments Covered in the Report

By Form

- Powder

- Granules

- Crystals

- Sodium Ascorbate

- Calcium Ascorbate

Others

By Grade

- Food Grade

- Pharmaceutical Grade

- Cosmetic Grade

- Industrial Grade

By End User

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Cosmetics Manufacturers

- Animal Feed Producers

- Other Industrial Users

By Packaging

- Bags

- Drums

- Tubes

- Sachets

- Other Packaging Formats

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Animal Feed

- Other Industrial Uses

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting