What is the Atomic Layer Deposition Market Size?

The global atomic layer deposition market size is calculated at USD 3.18 billion in 2025 and is predicted to increase from USD 3.68 billion in 2026 to approximately USD 10.71 billion by 2035, expanding at a CAGR of 12.91% from 2026 to 2035

Market Highlights

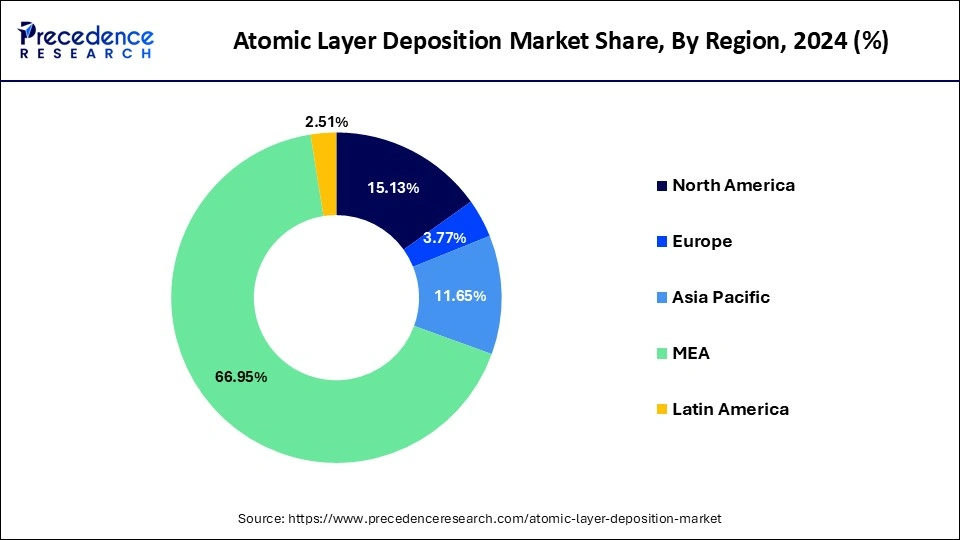

- Middle East & Africa has held the highest revenue share of 66.95% in 2025.

- North America region is estimated to observe the fastest expansion between 2025 and 2035.

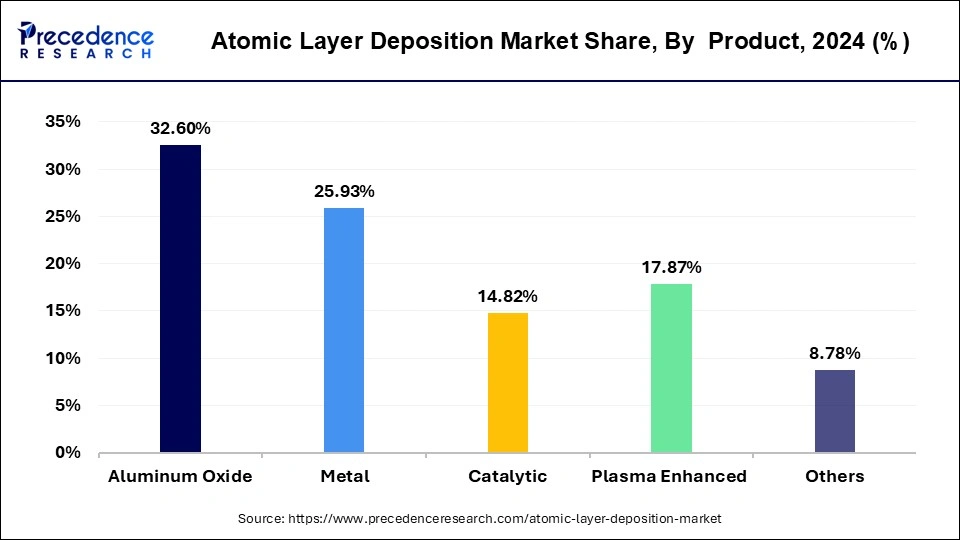

- By Product, aluminium oxide segment contributed 32.63% of revenue share in 2025.

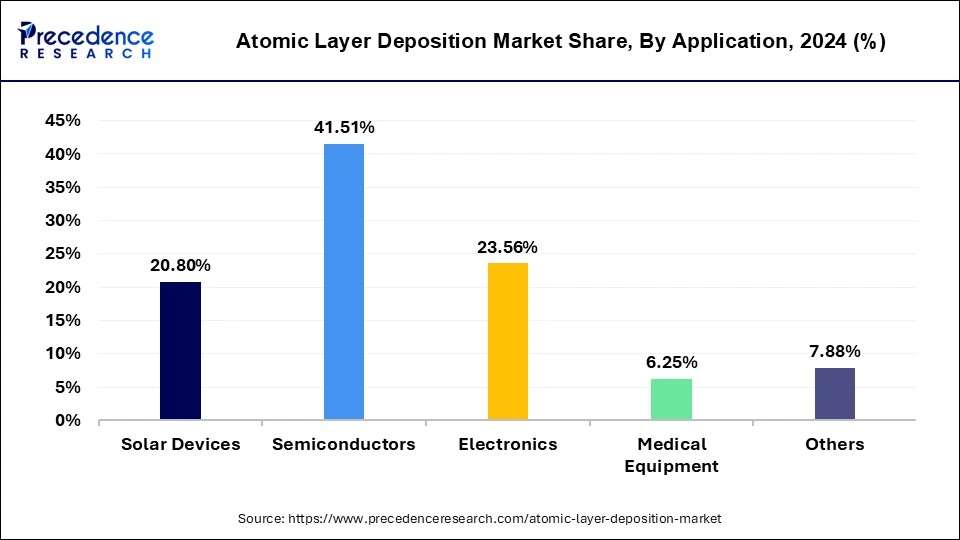

- By Application, the semiconductors segment captured the largest market share of 41.46% in 2025.

Smarter at Every Layer: How AI Is Redefining the Future of Atomic Layer Deposition

The market of atomic layer deposition is growing and improving due to the growing demand for high-performing semiconductor devices, flexible electronics, and energy storage. One of the notable trends is the development of Artificial Intelligence into ALD. AI can increase the level of process optimization through real-time monitoring, predictive maintenance, and automatic quality control. Machine learning algorithms may use both a large amount of deposition data to extrapolate to predict results, defect identification to decide what has gone wrong, and adjustment of process parameters to achieve a desired uniformity in films and associated high throughput.

With ALD systems driven by AI, R&D also becomes faster via computer simulation of deposition conditions and results, and avoids laborious cycles of experimentation. Driven by constant pressure to make the semiconductor industry go smaller and more complex, the combination of ALD and AI will start unfolding as one of the best innovation and scale providers in the environment of advanced manufacturing, and AI will play an essential role as a technology in the future of thin-film deposition technologies.

Layers of Growth: Inside the Forces Powering the Atomic Layer Deposition Revolution

The growing demand for the atomic layer deposition is driven by the rising usage of atomic layer deposition in the manufacturing of the new and advanced designed chips. Atomic layer deposition is one of the best methods for the production of thin films. Atomic layer deposition is an important method in the semiconductor device fabrication. Further, the growth of the global atomic layer deposition market is exponentially driven by the growing adoption of compact or miniature equipment and devices. With the growth of the various smart and energy efficient technologies, the demand for the small and portable devices increased rapidly all over the world. The utmost growth of the miniature electronic devices has significantly fueled the production and consumption of the atomic layer deposition technique.

The atomic layer deposition market is highly influenced by the rapid growth of the semiconductors and the electronics industry across the globe. The growing demand for the miniature electronics from the automotive sector is positively fostering the growth of the atomic layer deposition market across the globe. The growing popularity and demand for the newly introduced electric vehicles is expected to boost the growth of the atomic layer deposition market across the global automotive industry. Moreover, the growing applications of atomic layer deposition in solar devices are augmenting the market growth. Nations like India and Japan, where energy costs are high are increasingly investing of the development of the solar infrastructure that would boost the demand for the atomic layer deposition technique. A number of companies uses atomic layer deposition to produce mini components at a cheaper cost. This propels the growth of the atomic layer deposition market globally.

Atomic Layer Deposition Market Outlook

- Industry Growth Overview: The atomic layer deposition market is expected to experience significant growth between 2025 and 2030 due to the high demand for sub-5nm semiconductor nodes, advanced packaging, and emerging display technologies. ALD is currently a key process in high-volume semiconductor manufacturing, enabling ultra-thin, conformal films that are crucial for transistor scaling, gate dielectrics, and 3D NAND structures.

- Sustainability & Green-Chemistry Trends: Sustainability has become a key trend in developing the ALD process. OEMs and material suppliers focus on environmentally friendly chemistry and energy-efficient tool designs. Researchers at organizations such as imec, Fraunhofer, and KAIST are developing precursor formulations that minimize hazardous byproducts and carbon emissions during deposition. Additionally, low-temperature ALD is being developed to enable flexible electronics production and reduce power consumption.

- Global Expansion: The ALD ecosystem is increasingly broadening geographically due to the shift in the semiconductor sector toward distributed manufacturing and regional supply chain resilience. The aggressive sovereignty of chips in China, driven by the Made in China 2025 policy, has fueled the development of domestic ALD systems by companies like NAURA and Piotech. This local diversification is strengthening resilience and lowering the risk of overreliance on East Asian supply centers.

- Major Investors & Strategic Backers: The growth in investment in the ALD industry is driven by a mix of corporate R&D budgets, sovereign semiconductor funds, and individual capital to acquire strategic deep-tech assets. This combination of public and private funding indicates that ALD is a critical process technology in the global semiconductor industry's strategies.

- Startup & Innovation Ecosystem: The ALD startup ecosystem is evolving rapidly due to the demand for flexibility in processes, their ability to scale, and the diversification of their applications. In the United States, Forge Nano is also expanding its particle ALD systems to EV batteries and aerospace coatings, with support from ARPA-E and investors. The recent growth in collaboration between startups, national laboratories, and large OEMs highlights a new kind of innovation: quick, iterative development that connects academic research to industrial-scale manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.18 Billion |

| Market Size in 2026 | USD 3.68 Billion |

| Market Size by 2035 | USD 10.71 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.91% |

| Dominating Region | Middle East & Africa |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Solar Energy

Top 10 Solar Companies Shaping the Future of Energy in 2024

| Rank | Company | Total Solar Capacity (MWdc) |

| 1 | Meta Platforms, Inc. | 5,177 |

| 2 | Amazon | 4,668 |

| 3 | 2,595 | |

| 4 | Apple Inc. | 1,156 |

| 5 | Walmart Inc. | 860 |

| 6 | Target Corporation | 598 |

| 7 | Microsoft | 551 |

| 8 | Digital Realty | 435 |

| 9 | Verizon | 391 |

| 10 | Home Depot | 343 |

Atomic Command: How Global R&D, IP, and Trade are Shaping the Future of Microfabrication

- Global exports of semiconductor manufacturing equipment increased by 10% YoY in 2023, surpassing USD 117 billion, with ALD systems playing a significant role in advanced node fabrication.

- U.S. export value for semiconductor process equipment reached USD 7.68 billion in 2024, according to U.S. Census Bureau trade data, with ALD tools accounting for an increasing share.

- The U.S. leads in patent exports and process innovation for ALD. According to USPTO data in 2023–2024, a high number of ALD-related patent applications were filed, primarily by Applied Materials, Lam Research, KLA Corporation, and IBM Research.

- India's imports of semiconductor fabrication tools reached approximately USD 1 trillion in FY30, supported by the government's Semicon India initiative and increasing investments in pilot-scale foundries.

- In 2024, EU exports of chemicals and related products to non-EU countries hit a record €560 billion, creating a broad trade base that European precursor manufacturers can use to expand ALD-grade metal-organic and specialty reagents for advanced nodes.

- ASM International N.V. signed a five-year partnership with the University of Helsinki to establish an “ALD Centre of Excellence,” doubling funding and expanding its R&D team to focus on atomic layer processes for future semiconductor technologies.

- Tokyo Electron (TEL) and the University of Tokyo's Institute for Industrial Science launched a joint laboratory for ALD and ALE (atomic layer etching) process integration, supported by Japan's Ministry of Economy, Trade and Industry (METI). The initiative received ¥2.4 billion (approximately USD 16 million) for research and development on next-generation device miniaturization.

Microelectronics deals with creating miniaturized electronic elements such as transistors, capacitors, diodes, and resistors, which are among the basic building blocks of devices, including smartphones, laptops, tablets, and wearable gadgets, among others. With this technology, it is possible to fabricate smaller, more efficient parts that fulfill performance and low energy-level requirements in the electronics of the future. The intense growth of media, including the IoT, AI, 5G, and advanced computing, has augmented the significance of accurate techniques of fabrication like the ALD in recent years. Furthermore, the global ALD market is also being driven by the tendency toward flexible and foldable electronics, as well as the innovations in display andsensor technologies.

Rising Demand for Solar Energy

The increasing trend of clean energy and environmental sustainability across the world has advanced the pace of solar energy systems at an alarming rate, which has made high-efficiency solar panels and cells imperative globally. Since governments and industries across the globe are also spending on renewable energy infrastructure, there has been a rise in the need to utilize manufacturing technologies. The atomic layer deposition has become an essential element in this area, especially when it comes to the performance and durability of the solar cells. As the solar technology continues to advance and the cost of solar modules decreases, ALD will likely continue to be a major enabler towards developing solar cells of the next generation, such as thin-film solar cells and perovskite cells.

Restraint

High Initial Investment Costs

The high cost of initial investment in the technology is one of the greatest limitations that is limiting the growth of the global atomic layer deposition market. The mechanisms of ALD are complicated and involve the use of sophisticated equipment, a cleanroom environment, and intensive research and development. Such requirements amount to a high rate of capital expenditure, particularly in the small- and medium-scale enterprises. The price of installing the ALD systems and most likely maintaining stable high precise deposition procedures can be quite prohibitive. The increase in the price of the products because of the high cost of implementing ALD can also reduce the profit margin, thereby becoming a drawback to the overall adaptation.

Opportunity

Trend of Miniaturization

Miniaturization is the increasing reduction in size of electronic, mechanical, and optical devices, without loss of performance. Since demand for consumer-related products of various corners, smartphones, wearables and medical implants, portable electronics, and other products that need compact, lightweight, and very functional structures keeps rising, the necessity of precise and consistent fabrication methods is growing. In addition, the emerging nanotechnology advancements are widening the potential of incorporating functional nano-devices into both consumer- and manufacturing-oriented products. ALD makes the transition more attainable, as it succeeds in making the nano-scale structures more robust, performative, and efficient

Segment Insights

Product Insights

The aluminium oxide segment led the global atomic layer deposition market with a remarkable revenue share of in 2025 and is anticipated to retain its dominance throughout the forecast period. The production of aluminium oxide thin film through atomic layer deposition helps to encapsulate organic light emitting devices or the OLEDs. Thegrowing demand for the OLEDs from the electronic industry has significantly propelled the segment growth in the past years.

On the other hand, the plasma enhanced is estimated to be the most opportunistic segment during the forecast period. The plasma enhanced atomic layer deposition technique facilitates deposition at extremely lower temperatures that helps to develop films with better properties as compared to any other conventional atomic layer deposition. Furthermore, the enhance plasma atomic layer deposition technique can be used to modify surface by modifying nucleation and adhesion through plasma exposure. This is considered to be a versatile method that facilitates nanoscale production in the emerging applications.

Application Insights

The semiconductors segment led the global atomic layer deposition market with a remarkable revenue share of around 41.46% in 2025 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the extensive and growing usage of semiconductors in electronics, transistors, andintegrated circuits. Semiconductors efficiently control the flow of electricity and have wide applications owing to its low cost, reliability, miniature size, and power efficiency.

On the other hand, the solar devices segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the growing government initiatives to shift towards the extensive uses of green energy. The growing environmental concerns due to the emissions from the conventional devices and fuels. Therefore the growing popularity and adoption of solar devices is expected to fuel the growth of this segment during the forecast period.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved services. Moreover, they are also focusing on maintaining competitive pricing.

- In July 2021, Hermes-Epitek Corporation Pte, a Taiwan-based distributor of high-tech equipment, entered into a partnership with Picosun Group that aimed at expanding Picosun Group's sales and service networks across the globe.

These developmental strategies are undertaken by the key market players operating in the global atomic layer deposition market in order to expand their business and acquire market share.

Regional Insights

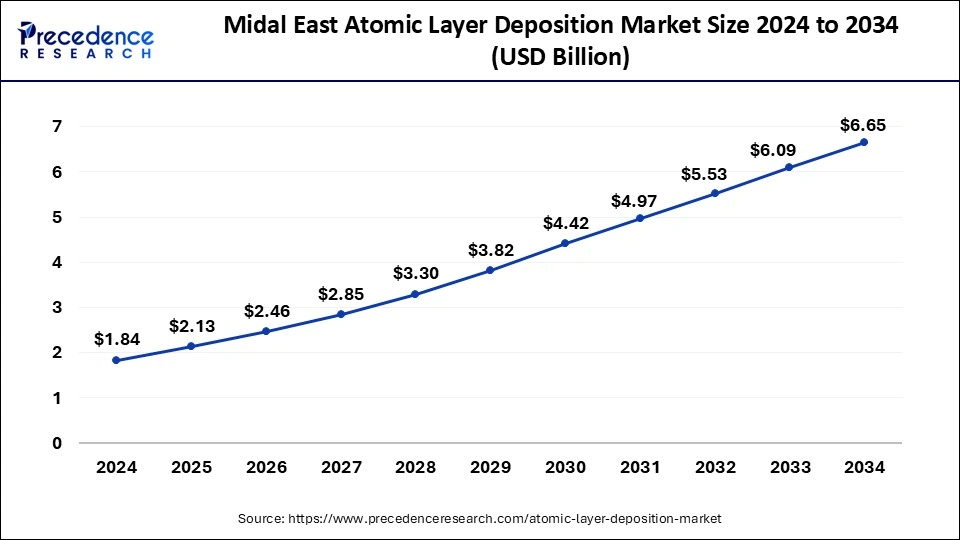

Middle East & Africa Atomic Layer Deposition Market Size from 2026 to 2035

The Middle East & Africa atomic layer deposition market size is exhibited at USD 2.13 billion in 2025 and is projected to be worth around USD 7.21 billion by 2035, growing at a CAGR of 12.97% from 2026 to 2035.

Based on the region, the Middle East & Africa dominated the global atomic layer deposition market in 2025, in terms of revenue, and is estimated to sustain their dominance during the forecast period. On the other hand, North America is the second largest region for the atomic layer deposition market. North America is one of the highest consumers of electronics across the globe. Further, the growing investments in research and development on solar energy are boosting the growth of the atomic layer deposition market across North America. Furthermore, the increased penetration of automotive in the region owing to the higher demand for transportation facilities is indirectly boosting the demand for the atomic layer deposition technique in the region.

Moreover, in Asia Pacific, the atomic layer deposition market is witnessing several notable trends. Asia Pacific is the manufacturing hub for the electronics, medical equipment, semiconductors, and solar industries. The major economies such as China, Japan, South Korea, and Taiwan, where the production of electronics and semiconductors are huge, have resulted in an increased consumption the atomic layer deposition technique, thereby leading to the growth of the market in the region. The further investments and government policies in economies like India are attracting FDIs for setting up various industrial manufacturing units. This would further propel the consumption of the atomic layer deposition.

South Korea Atomic Layer Deposition Market Analysis

The market in South Korea is primarily driven by memory semiconductor giants Samsung Electronics and SK Hynix, which have extensively utilized ALD for depositing oxide and nitride layers in DRAM capacitors and 3D NAND. With ongoing fab expansions in Yongin and Pyeongtaek and the development of next-generation DRAM, South Korea is poised to further strengthen its leadership in ALD technology.

UAE Market Analysis

The UAE was the most active ALD ecosystem in the Middle East over the past year, as targeted research at Khalifa University and Masdar Institute developed nanocoatings for renewable and aerospace uses. It is likely that industrial diversification efforts are expected to shift R&D toward pilot manufacturing, positioning the UAE as a key hub for ALD energy-related innovation in the Middle East.

South Africa Market Analysis

The African ALD landscape last year was led by South Africa, which has its own materials science research initiatives and early industry applications. South Africa's resource-rich economy, with a need for durable surface layer solutions, shows high potential for scaling niche ALD technologies to industrial use.

What Makes North America the Fastest-Growing Area in the Market?

North America is expected to experience the fastest growth in the upcoming period. The demand for single-wafer thermal and plasma-enhanced deposition instruments has increased in the region over the past year. This growth is largely due to the need for foundry and logic fabs to maintain top-tier tool-level process control and on-site metrology for manufacturing sub-5 nm nodes. Significant investments in OEM R&D and domestic fab builds have been focused on high-precision platforms to meet these requirements.

U.S. Atomic Layer Deposition Market Analysis

The U.S. is leading the market within North America, driven primarily by advancements in semiconductor production and investments in front-end process tools. The U.S. is expected to maintain its technological leadership, thanks to strong integration among national laboratories, OEMs, and fab producers

What Factors Contribute to the Growth of the Latin American Atomic Layer Deposition Market?

In recent years, ALD activity in Latin America has been primarily focused on research labs, university consortia, and a few pilot plants. Most capital expenditures were allocated to academic validation of the technology and to small-scale sensor, MEMS, and PV R&D, rather than to high-volume wafer fabs. However, continued academic-to-industry translation and targeted funding for specialized pilot projects are expected to transition ALD from lab demonstrations to vertically integrated energy and display manufacturing applications.

Brazil Atomic Layer Deposition Market Trends

Brazil is a major contributor to the market within Latin America, with research consortia and national innovation programs focused on nanomaterials and clean-energy applications. Emerging partnerships with European technology firms and the national scaling of ALD-coated electrode pilot lines are expected to boost industrial adoption in Brazil. The country's high level of academic and industrial diversification positions it as Latin America's ALD hub in the next decade.

How is the Opportunistic Rise of Europe in the Atomic Layer Deposition Market?

Europe's opportunistic rise in the market is attributed to a combination of strategic investments, technological innovation, and a growing emphasis on advanced semiconductor manufacturing. As the demand for smaller, more efficient transistors and high-performance components increases, European companies and research institutes are positioning themselves as leaders in next-generation materials and deposition techniques.

Germany Atomic Layer Deposition Market Trends

Germany has the strongest ALD base in Europe over the past year, driven by a robust advanced materials ecosystem and extensive R&D infrastructure. Helmholtz Centers and the Fraunhofer Society led collaborative efforts on conformal ALD coatings for sensors and optics, while OEMs like Beneq and Picosun (Applied Materials) expanded their European operations. The well-established industrial sector and Germany's emphasis on green chemistry sustainability make it a leader in the next phase of ALD commercialization in Europe.

What Are the Key Trends Driving the European Atomic Layer Deposition Market?

The European atomic layer deposition market is expected to account for a substantial market share in 2024. Energy innovation and sustainability are factors that are promoting the usage of ALD in Europe. The European research centers and institutions are also extending ALD uses in photonics and optoelectronics, as well as advanced memory devices, further driving the market. The intensification of relationships between academic research institutes and ALD equipment manufacturers is promoting innovation in the biomedical devices field, including implantable sensors and drug delivery platforms, supporting the idea that ALD is becoming an essential technology in the European sophisticated manufacturing sector.

Germany, through its powerful renewable energy and energy-efficient system drive, is placing great emphasis on battery technologies and fuel cells, which require ALD coating to perform better and last longer.

Atomic Layer Deposition Market Companies

- Lam Research Corporation

- Applied Materials, Inc.

- Tokyo Electron Ltd.

- ASM International

- Veeco Instruments, Inc.

- Denton Vacuum, LLC.

- Picosun Group

- ALD NanoSolutions, Inc.

- Beneq Oy.

- Kurt J. Lesker Company

- Canon Anvela Corporation

Recent Developments

- In August 2024, Kalpana Systems is a Dutch thin film equipment manufacturer, which introduced spatial Atomic Layer Deposition (sALD) equipment into roll-to-roll production, such as in solar photovoltaics and organic LED, battery, and packaging. With atomic layer precision, the sALD technology pioneered by Kalpana enables high-quality industrial speed (up to 10 meters per minute) thin layer deposition on web scale.

- In May 2024, at I2FIT-Mo, the Hanwha Precision Machinery company said they are working on developing a thermal Atomic Layer Deposition system to deposit molybdenum to be used in semiconductor fabrication. Compared to tungsten, molybdenum has a lower resistivity and does not leave fluoride residues, which potentially positions the former as an alternative to manufacture DRAM in the future, addressing the needs of customers like Samsung, SK Hynix, and Micron.

- In February 2024, Applied Materials launched a partnership with its vendors in the semiconductor sector that will fast-track the migration to building a sustainable semiconductor ecosystem in India. This endeavour suggests hastening the creation of subsystems and elements of semiconductor equipment by joining together the engineers and home and foreign suppliers with research and scholastic associations at the Engineering Centre.

Segments Covered in the Report

By Product

- Aluminium Oxide

- Metal

- Catalytic

- Plasma Enhanced

- Others

By Application

- Solar Devices

- Semiconductors

- Electronics

- Medical Equipment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting