Automated Mining Equipment Market Size and Forecast 2025 to 2034

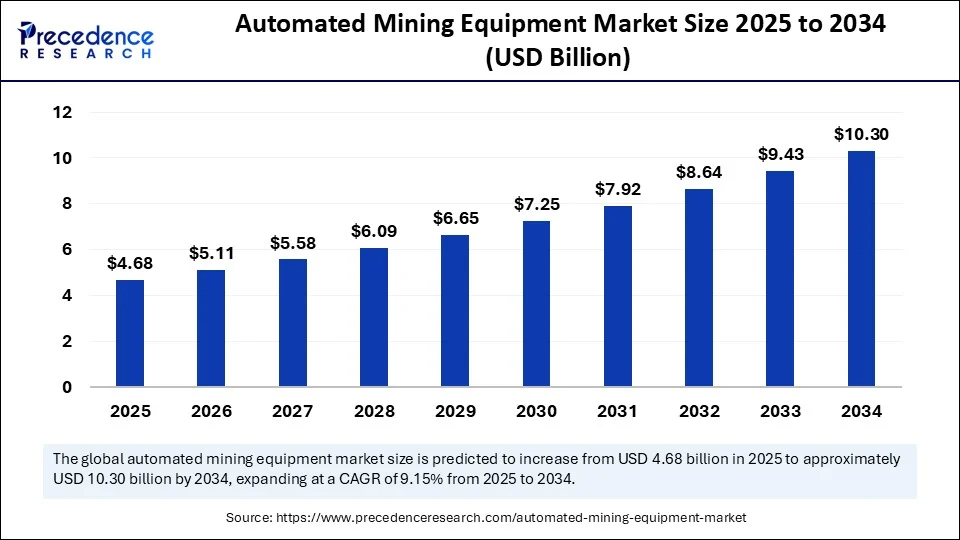

The global automated mining equipment market size accounted for USD 4.29 billion in 2024 and is predicted to increase from USD 4.68 billion in 2025 to approximately USD 10.30 billion by 2034, expanding at a CAGR of 9.15% from 2025 to 2034. The rising demand for minerals and metals is driving the growth of the automated mining equipment market. The growing emphasis on optimizing efficiency in mining operations further contributes to market growth.

Automated Mining Equipment Market Key Takeaways

- In terms of revenue, the global automated mining equipment market was valued at USD 4.29 billion in 2024.

- It is projected to reach USD 10.30 billion by 2034.

- The market is expected to grow at a CAGR of 9.15% from 2025 to 2034.

- Asia Pacific dominated the automated mining equipment market in 2024.

- Middle East & Africa (MEA) is expected to grow at a significant CAGR from 2025 to 2034.

- By equipment type, the autonomous haul trucks segment contributed the largest market share in 2024.

- By equipment type, the automated drilling rigs segment will grow at the highest CAGR between 2025 and 2034.

- By mineral type, the metallic (iron/copper) segment led the market in 2024.

- By mineral type, the rare earth minerals segment will grow at a significant CAGR between 2025 and 2034.

- By deployment mode, the OEM-integrated segment captured the biggest market share in 2024.

- By deployment mode, the retrofit automation segment will expand at a significant CAGR between 2025 and 2034.

- By level of automation, the semi-automated segment generated the major market share in 2024.

- By level of automation, the fully autonomous segment will grow at a significant CAGR between 2025 and 2034.

- By software solution, the fleet management segment held the highest market share in 2024.

- By software solution, the predictive maintenance segment will grow at the fastest CAGR between 2025 and 2034.

- By end-user, the surface mining segment held the major market share in 2024.

- By end-user, the underground mining segment is expected to grow at the fastest CAGR between 2025 and 2034.

Impact of the AI on the Automated Mining Equipment Market

Artificial intelligence integration is transforming the market, enabling the development of more sophisticated and advanced mining equipment with autonomous, predictive maintenance, and real-time monitoring capabilities. AI has proven its significant role in the optimization of various processes, from drilling and extraction to transportation. The rising emphasis on efficiency and productivity, and safety concerns, is driving the adoption of AI in automated mining equipment. The rising focus on sustainability is further adding to AI significance in automated mining equipment. The adoption of AI-powered mining robotics is gaining traction worldwide.

- More than 60% of the world's mining companies are projected to deploy AI-powered automation in core operations by 2025. The automated mining trucks segment is expected to increase its extraction efficiency with AI integration for up to 30% by 2025. (Source:https://farmonaut.com)

Market Overview

The automated mining equipment Market refers to the ecosystem of machinery and digital systems used in mining operations that function with minimal or no human intervention. These include autonomous drilling rigs, haulage trucks, loaders, robotic mining equipment, and advanced software for real-time monitoring, predictive maintenance, fleet management, and mine optimization.

Automation in mining enhances safety, improves productivity, reduces labor dependency, and supports 24/7 operations, especially in deep, hazardous, or remote locations. The market is growing rapidly due to digital transformation, labor shortages, and pressure to improve operational efficiency and sustainability.

The mining operations are facing spectacular challenges for safety standards, operational efficiency declining, and a shortage of critical workforce, leading to a gradual welcome of 5G networking. With the rise of smart mining, 5G networkers are playing a crucial role in the digital transformation of the mining industry. The emerging trend of smart mining operations is leading to an increasing emphasis on automated mining equipment.

What are the Key Trends of the Automated Mining Equipment Market?

- The Demand for Minerals and Metals: Rapid urbanization, industrialization, and technological advancements are driving demand for minerals and metals, leading to the need for efficient and productive mining operations.

- Operational Efficiency: The growing need for efficient operation, reducing costs, and improving productivity, several key companies are investing in automated mining equipment.

- Cost Reduction: The growing use of automated solutions in large-scale projects to reducing operational and labor costs, driving innovative approaches in development and the adoption of automated mining equipment.

- Technological Advancements: The technological advancements in automation, like AI, ML, and internet of things (IoT) devices, are enabling the development of specialized and efficient equipment, including automated mining equipment.

- Government Initiatives: The strong government support and investments in large-scale infrastructure projects and the production of critical minerals are allowing access to cutting-edge and more sophisticated automated mining equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.30 Billion |

| Market Size in 2025 | USD 4.68 Billion |

| Market Size in 2024 | USD 4.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Mineral Type, Deployment Mode, Level of Automation, Software Solution, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Focus on Safety and Sustainability in Mining

The focus on safety and sustainability in the mining industry has increased, driving significant adoption of automated mining equipment. The automated mining equipment is crucial in reducing the risk of injuries and accidents. The mining industry faces high challenges in hazardous environments. Automated equipment enables the reduction os such hazards and enhances overall optimization of operations and productivity. Automated mining equipment helps to reduce energy consumption and environmental footprints caused by traditional mining equipment. Additionally, the growing companies' emphasis on complying with safety and environmental regulations is driving the adoption of this equipment.

Restraints

High Cost

The high upfront cost associated with the development of automation infrastructure, AI systems, robotics, and sensor networks, and operational investments are the major restraints for the global automated mining equipment market. The high initial investments in automation and operations are hampering their use in several mining companies, particularly small-scale companies. Additionally, the expense associated with the maintenance and repair of automated equipment causes complexity and drives the need for specialized expertise, creating a barrier for small companies.

Opportunity

Expanding Remote Operations and Monitoring Capabilities

The mining industry has experienced significant demand for remote operations and advanced monitoring capabilities to enhance operational efficiency, reduce risk in hazardous environments, improve safety, and enable real-time decision making. Major key market vendors are investing heavily in digital solutions to enhance the efficiency of automated mining equipment. The remote monitoring and control enable 24/7 mining operations. The ongoing advancements in technologies like 5G connectivity, robust communication infrastructure, AI and ML integration, robotics, and digital twins are enabling sophisticated remote operation and monitoring capabilities in the automated mining equipment.

Equipment Type Insights

Which Equipment Maintained Stronghold in the Automated Mining Equipment Market in 2024?

The autonomous haul trucks segment dominated the market with the largest share in 2024, driven by their increased adoption rate in mining operations to achieve efficiency and safety. Autonomous haul trucks utilize advanced technologies, such as AI and sensors, enabling them to optimize routes, reduce fuel consumption, and enhance productivity. The rising emphasis on safety and cost reduction in the mining industry is driving the adoption of autonomous haul trucks. The ability of autonomous haul trucks to be deployed in various mining environments, including surface and underground mines, contributes to the segment's growth.

The automated drilling rigs segment is expected to grow at the fastest rate over the forecast period due to the increasing need to enhance operational efficiency. Automated drilling rigs can improve efficiency, safety, and reduce operational costs. They enable 24/7 operations, driving their adoption to enhance productivity. Technological advancements, such as AI and IoT technologies, are further enhancing drilling operations by providing real-time data analysis and enabling informed decision-making.

Mineral Type Insights

Why Did the Metallic Segment Dominate the Automated Mining Equipment Market in 2024?

The metallic segment dominated the market in 2024. This is primarily due to the crucial role of automated mining equipment in the extraction and processing of various metals, including iron, copper, gold, nickel, and others. Mining these metals often involves complex operations, necessitating the use of automated mining equipment that can operate in harsh environments. Since mining operations are inherently hazardous, there is a high demand for this equipment to minimize injuries to workers.

The rare earth minerals segment is expected to grow at the fastest rate in the upcoming period. This is primarily due to the growing demand for rare earth minerals in various industries, including consumer electronics, automotive, and energy. This creates the need for mining these minerals. Extraction of rare earth minerals involves exposure to radioactive materials and hazardous chemicals. Thus, this operation requires automated mining equipment to reduce hazards to human laborers.

Deployment Mode Insights

How Does the OEM-Integrated Segment Lead the Automated Mining Equipment Market?

The OEM-integrated segment led the market in 2024, accounting for a significant revenue share, due to its crucial role in enhancing efficiency, safety, and productivity in mining operations. OEMs offer specialized solutions in streamlining mining operations. The demand for AI and IoT technology-integrated automated mining equipment is high, driven by the need for real-time data analytics and informed decision-making in mining operations. The major OEMs (Original Equipment Manufacturers) are investing heavily in innovative autonomous technologies, such as haulage systems, drills, and loaders.

The retrofit automation segment is expected to grow at the fastest rate over the projection period, driven by a growing focus on modernizing existing fleets. The retrofit automation is cost-effective compared to other technologies, making it easier to acquire new machines and reducing capital expenditures. The retrofit automation is able sot extend the lifespan of aging equipment and reduce waste, further adding to cost-effectiveness.

Level of Automation Insights

What Made Semi-Automated the Dominant Segment in the Automated Mining Equipment Market in 2024?

The semi-automated segment dominated the market while holding the largest share in 2024. This is due to the increased adoption of semi-automated mining equipment in certain industries, as well as applications that require a balance between automation and human oversight. Semi-automatic technology enables mining companies to integrate automation into their operations, reducing upfront investment costs. The semi-automated equipment is flexible and adaptable, allowing a gradual switch between manual and remote control.

The fully autonomous segment is expected to expand at the highest CAGR in the foreseeable period, driven by its crucial role in reducing costs and enhancing operational efficiency. The growing adoption of autonomous vehicles, remote-control equipment, and cutting-edge software solutions is contributing to the segment's growth. The fully autonomous equipment is highly used in hazardous environments for more efficiency and safety.

Software Solution Insights

How Did the Fleet Management Segment Dominate the Automated Mining Equipment Market in 2024?

The fleet management segment held the largest share of the market in 2024. This is mainly due to their excellent operational efficiency, cost-effectiveness, and safety. The fleet management software solutions enable optimization of routes, enhance vehicle use, increase efficiency & productivity, and reduce fuel consumption. This solution provides real-time visibility into vehicle location, performance, and status, enabling real-time decision-making.

The predictive maintenance segment is expected to register the fastest CAGR over the forecast period, due to its significant role in extending equipment lifespan and reducing downtime. Predictive maintenance software solutions enable real-time data analytics and monitoring, helping mining companies identify potential equipment failures, schedule proactive maintenance, and reduce costs. This solution integrates cutting-edge technologies like data analytics, ML, and sensors.

End-User Insights

Which End-user Maintained its Stronghold on the Automated Mining Equipment Market?

The surface mining segment dominated the market with the largest share in 2024 due to the increased deployment of automated technologies in open-pit and strip-mining operations. Surface mining businesses heavily invest in equipment, such as autonomous haulage systems and drilling rigs, to achieve greater efficiency and operational productivity. Automated mining equipment enables surface mining operations to reduce labor costs, maintenance expenses, and environmental impact. The automated mining equipment is crucial in surface mining for reducing the risk of injuries and accidents.

The underground mining segment is likely to expand at a rapid pace in the upcoming years, due to the increased adoption of advanced technologies, such as autonomous vehicles and remote-controlled machinery, in underground mining to improve the efficiency and safety of mining operations. Underground mining faces challenges of several hazardous environments, driving the need for automated technologies to reduce the risk of accidents and injuries and enhance overall safety. The rising demand for minerals and metals, along with strict environmental regulations, is driving the adoption of comprehensive automated mining equipment in underground mining operations.

Regional Insights

Asia Pacific Automated Mining Equipment Market

Asia Pacific dominates the global automated mining equipment market due to rapid industrialization, rising mining activities in countries like Australia, China, and Indonesia, and strong government support in promoting the adoption of automation technologies. Asia has experienced growth in mining investments and increased demand for energy minerals. The rapid adoption of digital technologies for enhanced efficiency, safety, and productivity contributes to this growth. The government investments in the mining industry enable key companies to develop and adoption of cutting-edge automated mining equipment.

- In March 2025, IndiaAI and GSI launched the IndiaAI Hackathon on Mineral Targeting 2025 to explore the identification of novel potential areas of critical minerals like copper, REE, Ni-PGE, and other commodities like iron, diamond, manganese, and gold within a 39,000 sq. km pre-defined area in the Karnataka and Andhra Pradesh states. (Source:https://www.pib.gov.in)

China is a significant player in the regional market, contributing to growth due to the strong presence of various domestic manufacturers and their large production range of automated equipment. A robust mining industry and government investments in technological advancements are enabling sophisticated equipment in the Chinese mining industry. Chinese initiatives like Belt and Road are adding to the increased demand for automated mining equipment. However, the country has been experiencing several barriers to market growth due to U.S. President Donald Trump's tariffs on the export of rare earth minerals and elements products.

- In response to the U.S. tariff on Chinese products, China's Ministry of Commerce imposed restrictions on seven rare earth elements and magnet exports, which are used in the defense, automotive, and energy sectors, in April 2025. (Source: https://www.csis.org)

Australia is also a significant player in the regional market, growth driven by countries' robust mining industry and large-scale investments in mining innovations. Australia is leading globally in mining innovations, with large-scale developments of mining software in the country. Australian companies are rapidly adopting automation technologies, including automated mining equipment, to enhance safety and efficiency in the mining industry. Countries' significant role in the export of mining technologies and prior deployments of autonomous trucks is fostering the growth. Additionally, ongoing competition with China is contributing novel innovative approaches in the Australian market.

Middle East and Africa Automated Mining Equipment Market

The Middle East and Africa region is the fastest-growing market, driven by large demand for minerals, growing mining activities, supportive government initiatives, and technological advancements in automation and digitalization. The mining activities in the Middle East and Africa have taken a boost, driven by increased demand for minerals, metals, and construction minerals. Countries like South Africa, Saudi Arabia, and the United Arab Emirates are contributing to regional growth with countries' strong focus on automation and technology adoption. With growing investments in the mining and metal industry, the adoption of automated mining equipment is rising.

The African Mining Week, Africa's premier event for the mining sector, has been scheduled for October 2025, in Cape Town. The Middle East and Africa Roundtable will bring public and private stakeholders from both regions together under the theme of “Strengthening Middle East and Africa Partnership in Mining for Sustainable Growth. (Source: https://energycapitalpower.com)

South Africa is a major player in the regional market, contributing to growth due to the country's robust mining industry and strong efforts in modernization. South Africa has a strong mining industry, especially in platinum, gold, and diamonds. With strong government support and countries' focus on modernization in mining operations, there is a drive the adopt automated equipment.

North America Automated Mining Equipment Market

North America is a notable player in the global market, growth driven by the rapid adoption of advanced technologies in the mining industry. The extensive mining operations and early adoption of advanced technologies are contributing to the growth. Additionally, the strong presence of key market vendors in countries like the U.S. and Canada is driving innovation in the emerging market. Additionally, the regulatory compliance regarding safety in mining operations is fueling the adoption of automated equipment.

The U.S. is a major player in the regional market, fostering growth with the well-established mining industry and strong focus on the extraction of minerals like iron, gold, copper, and coal. The government and key companies are investing heavily in research & development, enabling the development of advanced automation technologies. Countries' competition with China is further leading to innovations and developments of sophisticated automated mining equipment.

Automated Mining Equipment Market Companies

- Caterpillar Inc.

- Komatsu Ltd

- Sandvik AB

- Epiroc AB

- Hitachi Construction Machinery Co., Ltd.

- Volvo Group

- Liebherr Group

- Hexagon AB

- RPMGlobal Holdings

- ABB Ltd.

- Siemens AG

- Trimble Inc.

- Autonomous Solutions Inc. (ASI

- MineSense Technologies

- Scania AB

- Atlas Copco

- Rajant Corporation

- 3D-P (A Epiroc company)

- Wenco International Mining Systems

- Hitachi Vantara

Recent Developments

- In July 2025, Topnotch Crypto launched its comprehensive AI Mining V3.0.3 to unveil a transformative leap in cloud mining. This solution has set the global standards for automated mining and intelligence, for anyone and anywhere to participate. (Source:https://www.manilatimes.net)

- In January 2025, Scott Technology secured the third automation project with Rio Tinto in Australia, now automating the minerals laboratory at the West Agnelas mine site. The project is aiming to enhance safety and optimize laboratory operations, leading to better operational results across the entire site, and has aligned with Rio Tinto's commitment to sustainable mining practices. (Source:https://im-mining.com)

Segment Covered in the Report

By Equipment Type

- Autonomous Haul Trucks

- Automated Drilling Rigs

- Autonomous Loaders

- Robotic Mining Equipment

- Dozers and Excavators

- Automated Blasting Systems

- Remote-Controlled Equipment

- Others (Grinders, Crushers, Graders)

By Mineral Type

- Metallic (Gold, Copper, Iron, Nickel, etc.)

- Non-Metallic (Limestone, Potash, Phosphate)

- Coal

- Rare Earth Minerals

By Deployment Mode

- On-Site (Fully Autonomous Sites)

- Retrofit Automation

- OEM-Integrated Solutions

By Level of Automation

- Semi-Automated

- Fully Autonomous

- Remote-Controlled

By Software Solution

- Fleet Management

- Navigation & Guidance

- Collision Avoidance & Safety

- Tele-remote Operations

- Predictive Maintenance

- Energy & Emissions Monitoring

By End-User

- Surface Mining

- Underground Mining

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting