What is the Automotive Diagnostic Scan Tools Market Size?

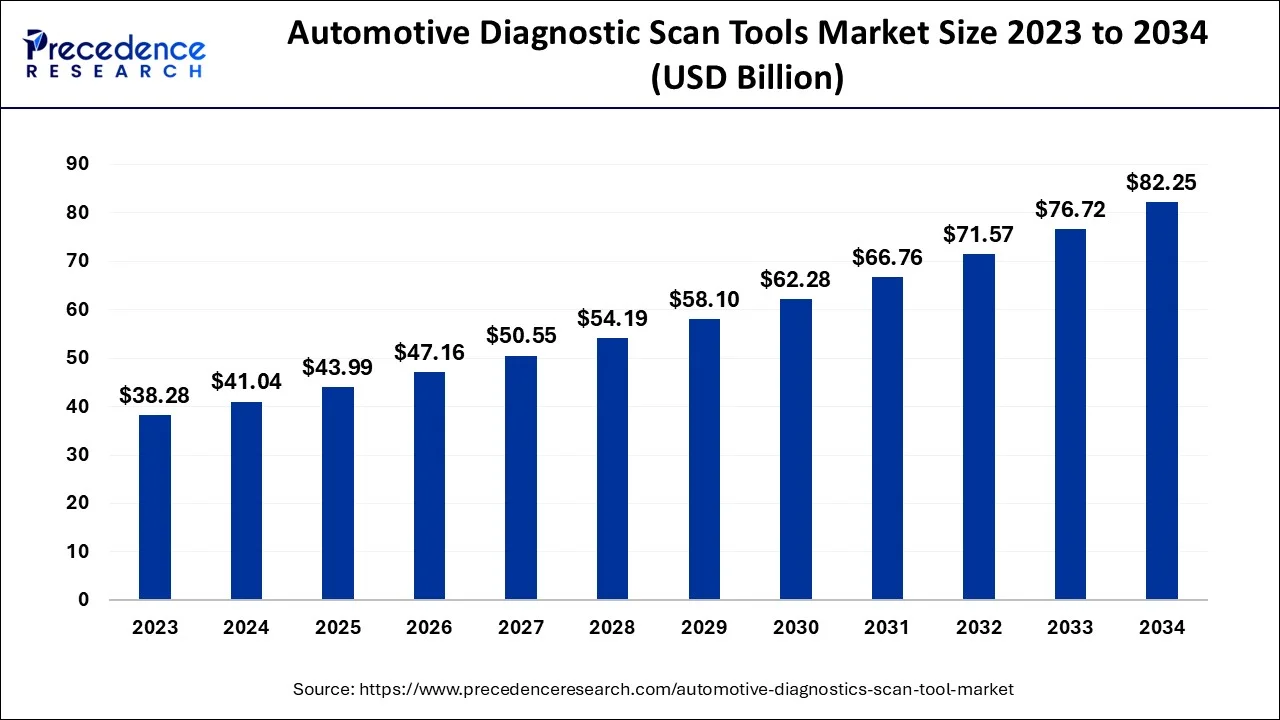

The global automotive diagnostics scan tool market size is calculated at USD 43.99 billion in 2025 and is predicted to increase from USD 47.16 billion in 2026 to approximately USD 87.53 billion by 2035, expanding at a CAGR of 6.96% from 2026 to 2035.The technology development, increased car complexity, rising automobile sales, mobile connectivity, and data and analytic demands, continue to fuel sales growth in the automotive diagnostics scan tool market.

Automotive Diagnostic Scan Tools Market Key Takeaways

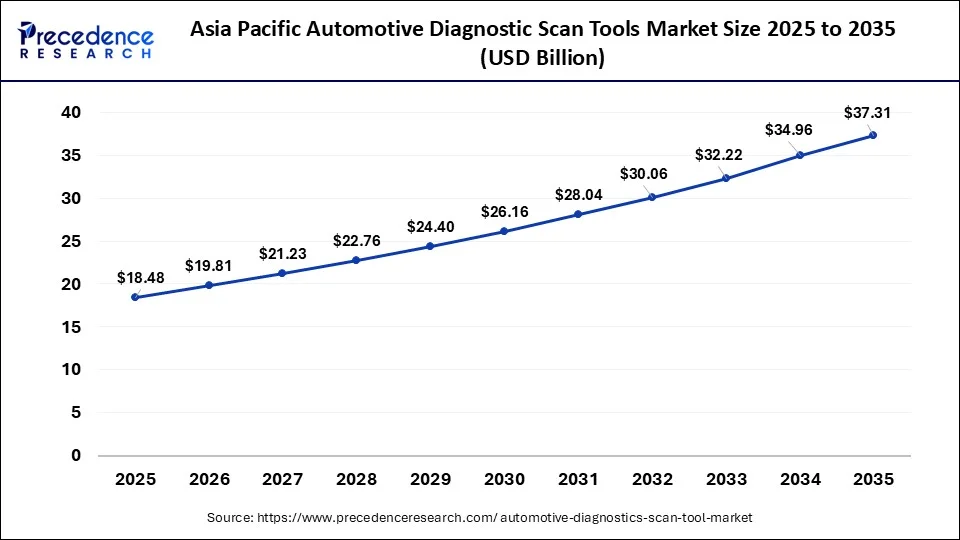

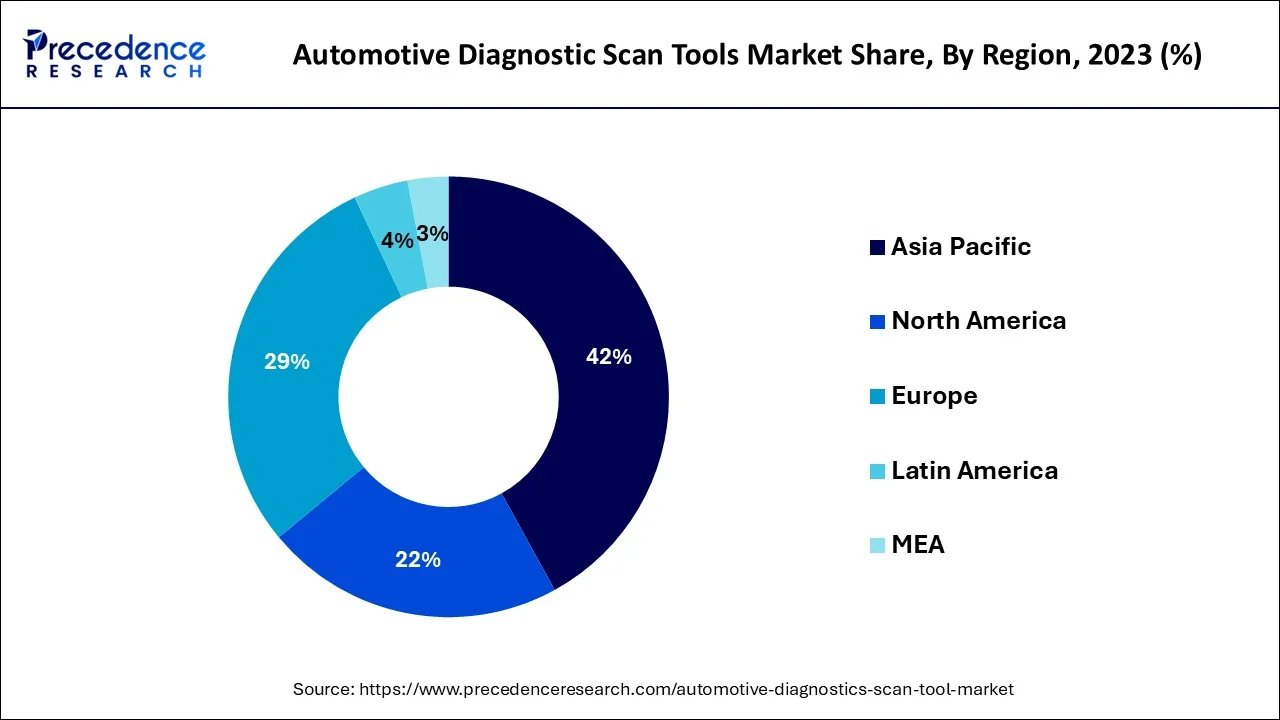

- Asia Pacific dominated the market with the largest share in 2025.

- By region, North America is expected to show the fastest growth during the forecast period.

- By offering type, the hardware segments dominated the market in 2025.

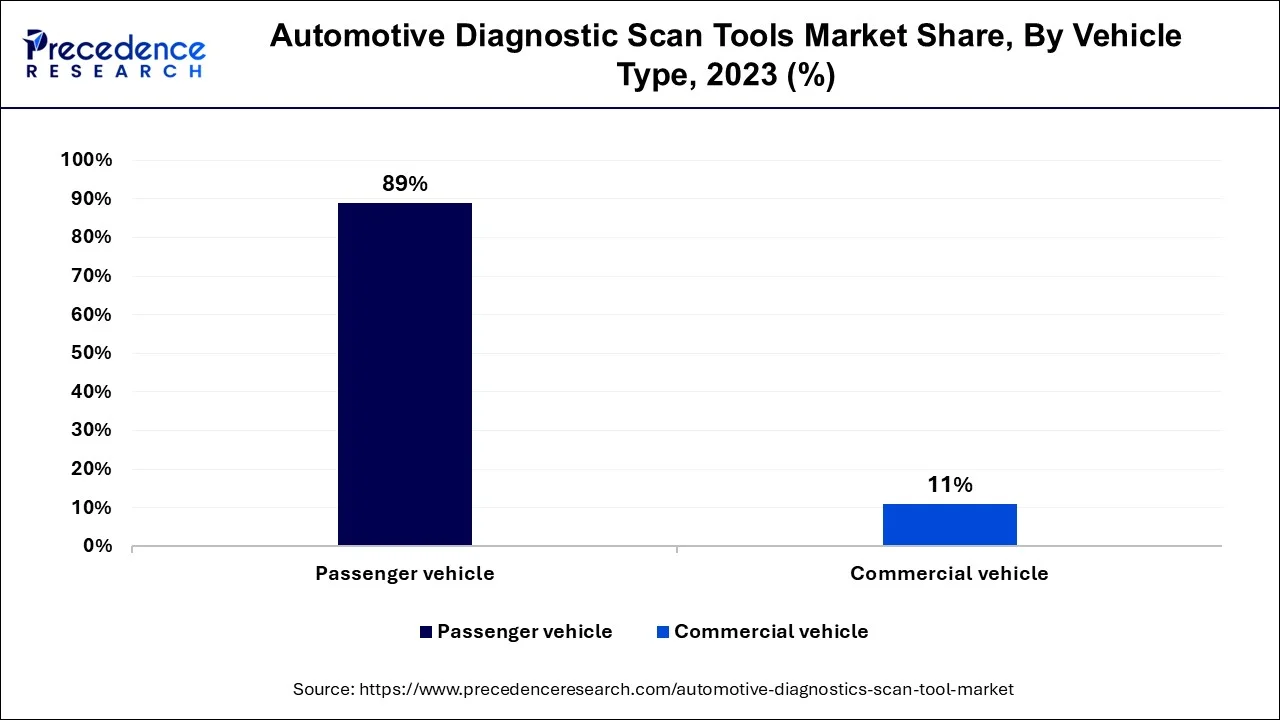

- By vehicle type, the passenger car segments dominated the market in 2025.

- By vehicle type, the commercial vehicle segment is expected to grow significantly during the studied period.

- By connectivity, the USB connectivity segment dominated the market in 2025.

Market Overview

The automotive scan tool is tool which diagnose the vehicles. It involves the electronic hardware devices and software that diagnose the problems in the vehicle. Detection and analysing of the faults in the vehicle before any trouble shoot situation appears and controlling of the fault and reprogramming the vehicle. It is used to give the information technically though a software utilization OBD On board diagnostics to detect the errors and faults in to the systems of the vehicle. Faults in engine, fuel system, battery, transmission and further more various electronics components of the vehicles.

The pandemic outbreak covid-19 situation has declined the market growth due to shut down of the industries overall and across various regions due to rules and regulations imposed by the government such as lock down, social distancing and other norms which ceased the transportation and supply of the needs affected the market growth and fall down of the share due to decreased demands for the vehicles and shut down of the industries. Thus, post pandemic situation there is increased market rate due to developed technologies and modifications in the automotive industry with increased value of the product which enhanced the automotive diagnostics scan tools market.

How does AI impact on Automotive Diagnostics Scan Tool Market?

Artificial intelligence AI technology is also affecting the vehicle repair sector through enhanced diagnosis time as well as the ability to predict the car or truck will require repair. AI diagnostic tools in diagnosing car problems are on the increase. These tools apply analytic models to calculate the input signals gathered from vehicle sensors, including temperature, engine operation, and fuel amounts. They also translate standard codes of the car's onboard computer to diagnose particular problems. Remote diagnostics can also provide for the real-time notification of the client on specific parts of a vehicle that may require replacement or servicing.

Automotive Diagnostics Scan Tool Market Growth Factors

- Technical advancements such as electric or hybrid automobiles to diagnose systems hence requiring advanced technologies in auto diagnoses.

- Advanced vehicle technologies and electronic system requires sophisticated tools for automotive diagnosis.

- The sales of cars across the world, especially in developing countries, require servicing or regular check-ups which drives the market.

- Mobile compatibility of the diagnostic tools, and scanners offers the ability to conduct tests, scan, or receive reports directly on mobile devices.

- Increasing consumer knowledge of vehicles and their maintenance needs and demands for early detection to enhance the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 |

USD 87.53 Billion |

| Market Size in 2025 |

USD 43.99 Billion |

| Market Size in 2026 |

USD 47.16 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.96% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | Asia Pacific |

| Segments Covered | Offering Type, Tool Type, Vehicle Type, Propulsion, Application, Workshop Equipment, Connectivity, Handheld Scan Tools, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

MarketDynamics

Drivers

Increased production of the vehicles- Increased population with rapid development of the automotive with increased demands from the market. Rapid urbanization and developing the emerged countries with improved production and manufacturing wIth increased features and scanning tools for identifying the errors have increased the market revenue share and accelerated the market growth. Increased research and development for producing the automotive diagnostics scan tool market with increased production and manufacturing with higher efficiency, easy access to the errors and faults occurred in the electronic components with developed electrification system.

Advanced technologies- Increased complexation in the electronic system with increased applications in automotive diagnostics tools with developed electronic modules. Identifying the errors is the challenging task for regular end user.

- Increased adoption of the newly developed vehicles with the new features.

- Increased complexity and electrification system.

- Enhanced number of services and workshop stations.

- Reducing carbon foot prints by increasing stringent emission norms.

- Do it your self-technology driven the market growth high.

Challenges

- Presence of skill work - Lack of skill among the people due to developing advancements in the automotive diagnostics scan tools low skill work may led to slow growth of the market and decrease the market rate. Skill upgradation is necessary with increased courses for developing the skill across the regions is necessary task should be carried out or it may challenge the growth of the market.

- Increased cost of the developed technology - Developed technologies with increased features in the vehicles and increased tools manufacturing which raised the rates of the developed technology where everybody cannot afford that costing which may decline the market size during the forecast period. High quality scanners with advance OBD2 with detailed diagnosis led to increased costing which may hinder the growth. Quality and the costing of the diagnostic tool should be equally maintained without any compromise in the efficiency of the diagnostic tool.

- Availability of the number of options to the electric vehicles and the automotive diagnostics tools may challenge the market for the growth of the market.

Opportunities

- Adapting newer technologies - The developed market growth in electrification system and developing, buying, producing, manufacturing tools for identifying the errors in the electrical components of the vehicle with increased rapid acceptance from the consumer for tools an early identification of the errors before any severe damage to the vehicle. Increased demand for OBD from the market. The demand for passenger vehicle increased in coming year during the forecast period.

- Government Support - Increased government support to develop the newly developed technologies and increasing the automotive diagnostics scan tools market with increased investment to increase the production and manufacturing of the tools for identifying the early errors to avoid the future major problems.

Segment Insights

Offering Type Insights

Based on offering type, the hardware segment to be the highest to hold the market share and necessary integration of the tools for identifying the faults and errors. OBD-II installed in all the passenger vehicle with increased development. Software diagnosis also to increase the market in next coming year with developed 5G connectivity will increase the market to a larger extent.

Vehicle Type Insights

The commercial vehicle segment is anticipated to grow significantly in the automotive diagnostics scan tool market over the projected period. Diagnostic tools are tools used in cars to ensure to identify and possibly rectify any faults within the system in the car. A car diagnostic tool, this tool runs and checks a car to avoid such major problems. On-board diagnostics are a computer system that gathers data from the various sensors in the car.

They can be used to scan commercial vehicles to detect virtually every type of electronic system. Commercial vehicle diagnostic tools are mainly applied to large commercial vehicle products and vehicles such as trucks and buses. Such automotive vehicles could be involved in carrying goods or passengers.

Connectivity Insights

Based on connectivity, the USB connectivity more rapidly utilized in the vehicles with OBD-II. OBD-II is on board computers that identify the speed, mileage, emission and other problems in the electronic system. USB is easy to use and less cost and monitoring the devices increase demands for wireless connections took place by bluetooth and wifi.

Applications Insights

Based on applications it involves controlling of the emission from the vehicles, early detection of the errors and solution to the faults with increased repair and maintenance, vehicle health alert a road side assistance to avoid the accidents, vehicle tracking, automatic crash notifications and others with increased developments in diagnostics tools have increased the market during the forecast period.

Workshop Equipment Insights

Based on workshop equipment involves engine analyser, pressure leak detection, fuel injection diagnostics, headlight tester, dynamometer, paint scan equipment, wheel alignment equipment, exhaust gas analyser.

Regional Insights

What is the Asia Pacific Automotive Diagnostic Scan Tools Market Size?

The Asia Pacific automotive diagnostics scan tool market size was valued at USD 18.48 billion in 2025 and is predicted to be worth around USD 37.31 billion by 2035, growing at a CAGR of 7.28% between 2026 and 2035.

Asia Pacific region to be highest position to hold the market size with developed technologies and increased demands from the market and increased investments from the governments for developing the scanning tools with increased automotive industry with improved manufacturing and production. Other regions initiatively developing with new technologies and increased awareness among the people such as North America, Latin America, Europe, Middle East and Africa also in process to contribute to increase the market size to a larger extent.

Japan Automotive Diagnostics Scan Tools Market Trends

With the growth of electric and hybrid vehicles in Japan, diagnostic tools are increasingly tailored for high-voltage system analysis, battery health monitoring, and specialized software updates. There is a growing need for handheld, ergonomic scan tools that offer quick navigation and even comprehensive diagnostic capabilities.

Wireless and Cloud-Connected Automotive Diagnostic Tools Trends in North America

North America is the fastest-growing market during the forecast period. It is driven by the demand for real-time data, remote diagnostics, and enhanced efficiency in repairing complex, connected, and electric vehicles (EVs). Bluetooth and Wi-Fi-enabled tools are now standard, providing mobility and allowing mechanics to connect diagnostic scanners directly to tablets, laptops, and smartphones.

Telematics-Integrated Diagnostic Systems Outlook in Europe

Europe shows a significant growth during the forecast period. It is driven by a change from reactive to proactive maintenance, regulatory mandates, and a structural pivot by automakers toward embedded connectivity. Due to growing fuel costs and driver shortages, logistics firms are using telematics to optimize routes, decrease idling, and improve driver behavior.

Italy Automotive Diagnostics Scan Tools Market Trends

As Italian and European automakers transition to EVs as well as hybrid models, diagnostic tools are evolving to manage specialized battery and inverter, along with electric powertrain diagnostics. The integration of artificial intelligence as well as machine learning allows tools to offer predictive insights, identifying potential issues before they become vital, which is crucial for reducing downtime.

Technological Advancements and Product Innovation Strategies in Latin America

Latin America shows a notable growth during the forecast period. It is driven by a rising middle class with disposable income, thus, paired with high social media usage, that has created a tech-savvy population eager for modern, and even digital-first products. The pandemic forced a massive, abrupt shift to digital, speeding up digital adoption by years. Small businesses were forced to accept online payment methods, e.g., Brazil's Pix system.

Automotive Diagnostic Scan Tools Market Companies

- SPX Corporation: SPX Corporation's offerings are aimed at high-voltage EV diagnostics, emission control, and even vehicle maintenance, facilitating ECU re-programming along with troubleshooting for professional workshops.

- Denso Corporation: Denso Corporation offers advanced automotive diagnostic solutions, which include the DST-PC platform for authorized service networks along with the DENSO-C platform for independent workshops.

- Delphi Technologies: Delphi Technologies' offerings involve wireless, bi-directional, and even cloud-connected hardware, which enables reading or clearing codes, live data, ECU reprogramming, along with secured gateway access.

Other Major Key Players

- Horiba Ltd

- SGA SA

- Continental AG

- Robert Bosch GmBH

- Softing AG

- Snap-on Incorporated

- ACTIA Group

- Autel Intelligent Technology Corp., Ltd

- AV List GmbH

- BMW AG

- Bosch Automotive Service Solutions

- DG Technologies

- Fluke Corporation

- Honda Motor Company

- Volkswagen AG

- Volvo Group

- KPIT Technologies

- Launch Tech

- Hickok Incorporated

Leaders Announcements

- In January 2025, Dealerslink, a leading innovator in automotive technology solutions, announced the launch of Dealerslink OBD, its On Board Diagnostic scanner, setting a new industry standard for vehicle diagnostic tools. OBD is the first product of its kind to be fully integrated with a best-in-class appraisal and inventory management platform, providing a seamless and intuitive diagnostic experience.

- In May 2025, leagend, a pioneer in battery-testing and monitoring solutions, announced the official launch of its most extensive OBD II Scanner lineup to date. Featured with 12 versatile tools from 2-in-1 OBD II scanners with integrated battery testers to Bluetooth-enabled code readers, memory savers, auto speedometers and trip computers this collection is engineered to meet the evolving demands of professional technicians, fleet managers and DIY enthusiasts around the globe.(Source: https://www.wjhl.com)

Recent Developments

- In April 2024, MAHLE Aftermarket introduces its sophisticated second-generation Diagnostic Tools for Auto Workshops: MAHLE TechPRO 2 and BRAIN BEE Connex 2. These next-gen tools, distinguished by innovative user interface and the market's smallest VCI connector with DoIP capabilities. The interface's strategic layout provides immediate visibility to essential tools, significantly abbreviating the time necessary for vehicle diagnostics. (Source: https://www.autoworldjournal.com)

- In November 2024, Opus IVS™, the leader in intelligent vehicle support solutions, proudly introduces DriveSafe2, the next-generation diagnostic tool created to enhance performance for collision repair professionals and multi-shop operators (MSOs). Based on the popular DrivePro2 platform, DriveSafe2 will launch in the collision market in 2025. MSOs and collision professionals are invited to preview DriveSafe2. Designed with durability in mind, DriveSafe2 is housed in an industrial-strength Opus IVS enclosure, offering configurations from 512GB to 2TB of internal storage, extended battery life, and an optional docking station for flexible shop use. (Source: https://www.prnewswire.com)

- In October 2024, XtoolOnline, a top player in cutting-edge automotive diagnostics, presented eight new tools, signifying a major achievement in the brand's development. The user-friendly interface allows easy access for beginners and experienced users, promoting smooth operation and improved productivity.

- In April 2024, MAHLE Aftermarket, a company from Germany, introduced two new workshop diagnostic tools, MAHLE TechPRO and BRAIN BEE Connex, which are second-generation tools.

- In July 2023, Innova Electronics Corporation launched its new professional automotive solutions, which include Smart Diagnostic System (SDS) Tablets and the RepairSolutionsPRO app.

- In January 2023, Autel unveiled its advanced automotive diagnostic tools and electric vehicle (EV) charging solutions at India's biggest automobile showcase, demonstrating innovative technology and industry expertise.

- In October of 2023, Matco Tools unveiled its latest diagnostic scan tool, the Maximus Plus. Created specifically for automotive technicians, the Maximus Plus is a top-of-the-line diagnostic scanner that offers full coverage flexibility, OE-level features, and the convenience of Android available at your fingertips.

- In October 2022, Reparify introduced the new all-in-one asTech solution, providing automotive diagnostic, calibration, and programming tools for local and remote use to streamline vehicle repair and maintenance.

Segments covered in the report

By Offering Type

- Diagnostic Hardware

- Scanner

- Analyzer

- Tester

- Code reader

- Others

- Diagnostic Software

- Vehicle system testing software

- Vehicle tracking and emissions analysis

- ECU diagnosis software

- Others

- Diagnostic services

- Vehicle Maintenance and repair

- Custom, training, support and integration

By Tool Type

- DIY diagnostic

- OEMS diagnostics

- Professional diagnostics

By Vehicle Type

- Passenger vehicle

- Commercial vehicle

By Propulsion

- ICE vehicles

- EVs

By Application

- Emission control

- Repair maintenance

- Vehicle health alert and road side assistance

- Vehicle tracking

- Automatic crash notification

- Others

By Workshop Equipment

- Engine analyser

- Pressure leak detection

- Fuel injecting diagnosis

- Headlight tester

- Dynamometer

- Painscan equipment

- Wheel alignment equipment

- Exhaust gas analyser

By Connectivity

- USB

- Wi- Fi

- Bluetooth

By Handheld Scan Tools

- Scanners

- Code Readers

- TPMS Tools

- Digital Pressure Tester

- Battery Analyzer

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting