Automotive Sunroof Market Size and Forecast 2025 to 2034

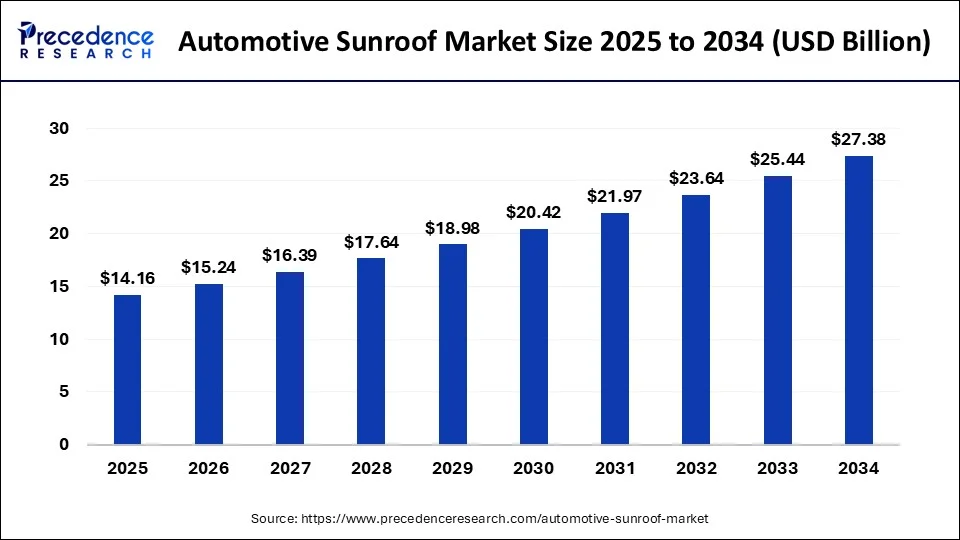

The global automotive sunroof market size is estimated at USD 13.16 billion in 2024 and is projected to worth USD 14.16 billoin by 2025, and is anticipated to reach around USD 27.38 billion by 2034, expanding at a CAGR of 7.60% from 2025 to 2034.

Automotive Sunroof Market Key Takeaways

- In terms of revenue, the market is valued at $14.16 billion in 2025.

- It is projected to reach $27.38 billion by 2034.

- The market is expected to grow at a CAGR of 7.60% from 2025 to 2034.

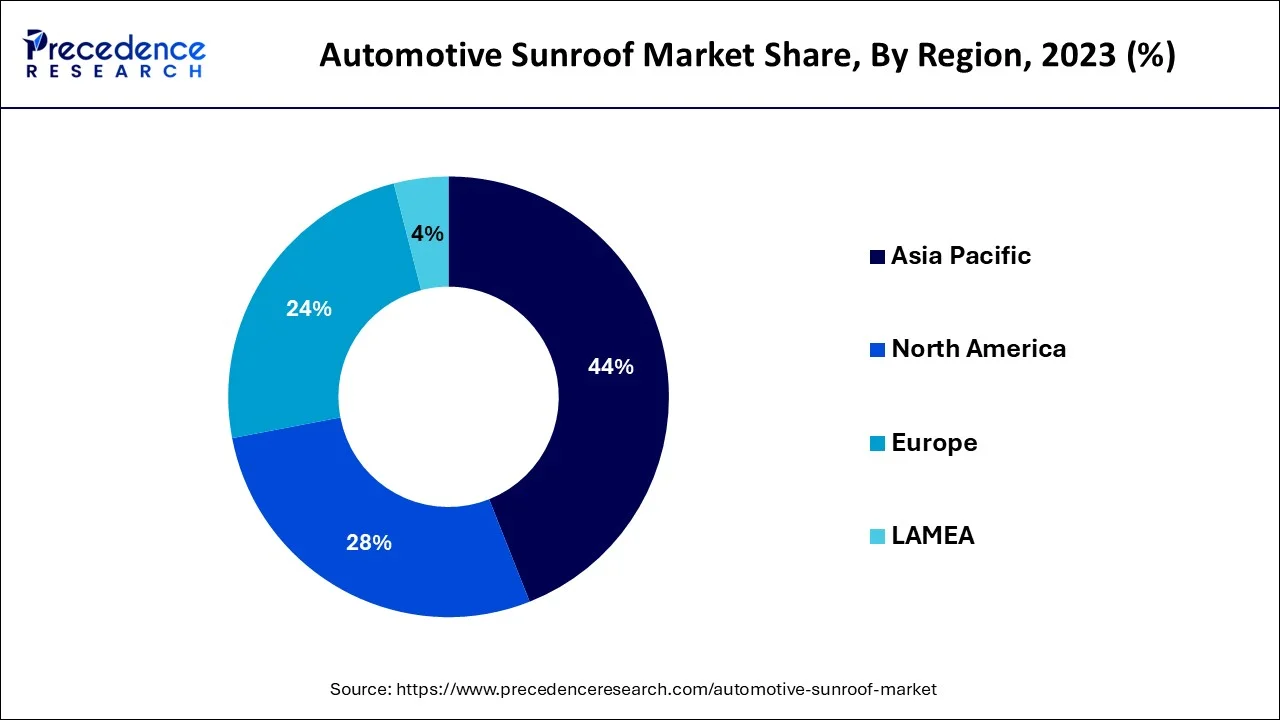

- By geography, the Asia-Pacific market is expected to report a sizable portion in the global market.

- By geography, Europe is the second-largest market and will continue to grow rapidly from 2025 to 2034.

- By sunroof type, the panoramic segment captured a sizable market share in 2024.

- By operation, the automatic segment is expected to grow drastically in the market from 2025 to 2034.

- By material type, the glass sunroof segment held the most significant market share of over 80% in 2024.

- By distribution channels, the OEM segment dominates the market.

- By vehicle type, the passenger car segment is predicted to grow significantly in the market.

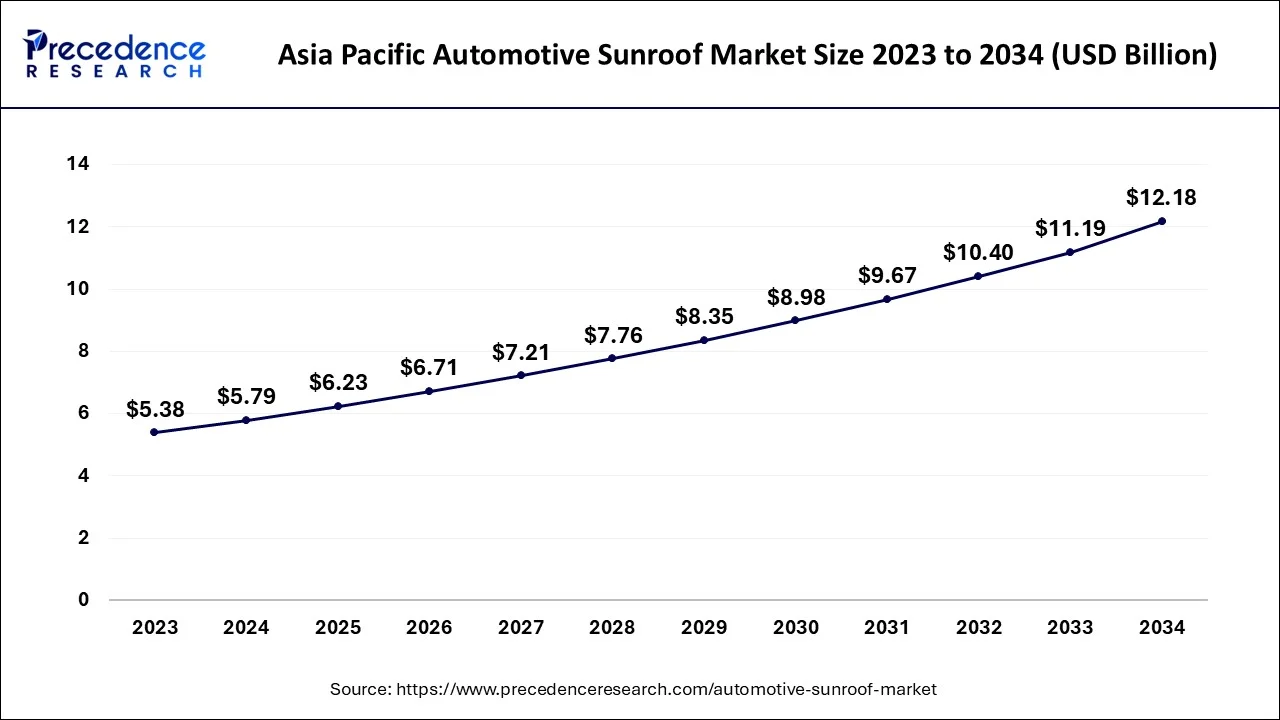

Asia Pacific Automotive Sunroof Market Size and Growth 2025 to 2034

The Asia Pacific automotive sunroof market size is estimated at USD 6.23 billion in 2025 and is expected to be worth around USD 12.18 billion by 2034, rising at a CAGR of 7.72% from 2025 to 2034.

Asia Pacific dominated the global automotive sunroof market.

Asia Pacific is dominating the automotive sunroof market. Asia Pacific manufacturers largest number of vehicles, which boosts the production of the automotive sector. The changing trends and preferences of the customers open the door for innovation and the development of new ideas. It enhances the lifestyle of the customers. The population holds the highest income rate, so the customer's demand and affordability rise.

The Society of Indian Automobile Manufacturers (SIAM) reports that in December 2021, automakers marketed 219,421 passenger vehicles in the local market, a 13% decline from the prior year.

Europe is the second-largest market and will continue to grow rapidly in the coming years. This is primarily due to the growing popularity of luxury vehicles and OEMs' tendency to include features that enhance the driving experience. Germany is anticipated to provide a favorable growth environment for the automotive sunroof market throughout the forecast period.

- In March 2024, Chinese EV maker Leapmotor started selling two electric vehicle models at Stellantis dealerships in Britain via its joint venture with the world's No. 4 automaker. Leapmotor has launched sales of the T03 compact electric car and the C10, a large electric SUV, with the B10 midsize SUV.

According to the German Trade & Invest report, in 2021, Germany produced 3.1 million passenger vehicles, producing it Europe's leading producer. Germany's market development is fueled by increased production of luxury automobiles, SUVs, and sales.

Technological Advancement

Technological advancements in the automotive sunroof market feature panoramic sunroofs, smart glass technology, electric sunroof systems, solar, and lightweight materials. Smart glass technology (electrochromic glass) enables to adjustment of sunroof glass tint manually or automatically to eliminate heat and light. This provides comfort to the passengers. The electric sunroof system is used for one-touch opening and closing and detects rain through automatic rain sensor closing. The solar sunroofs are an advancement on solar panels used in generating electricity, which can also be used to charge electronic devices and power auxiliary systems. This helps in reducing the load on the vehicle battery. The panoramic sunroofs are expensive and large. It provides comfort and a wider view, and a thrilling open-air experience. These technologies interest customers in approaching innovative vehicles, and so the automotive industry adopts these new advancements and technologies.

Market Overview

The demand for automotive sunroofs is increasing due to the development of advanced technologies by original equipment manufacturers (OEMs). The innovation in glass technology and an increase in demand for safety, comfort, and convenience are the primary factors fueling the global automotive sunroof market growth. Sport utility vehicles have become one of the most popular automobile segments due to a wide variety of cars with unique adaptability in range, power output, and features.

The glass sunroof segment had the largest market share in 2024 and is expected to expand rapidly throughout the projected period. In terms of sunroof type, the panoramic segment held a significant market share in 2024. The passenger car segment is expected to expand significantly in the market due to the introduction of cost-effective options and features such as natural ventilation and increased comfort. The high cost of the vehicle and the complex design and manufacturing process is expected to halt the growth of the global automotive sunroof market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.38 Billion |

| Market Size in 2025 | USD 14.16 Billion |

| Market Size in 2024 | USD 13.16 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.60% |

| Largest Market | Asia Pacific |

| Second Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sunroof Type, Operation, Material Type, Distribution Channels, Vehicle Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for passenger comfort, safety features, and convenience

Sunroof manufacturers are financing the advancement of solar panels, switchable glazing, and ambient lighting technologies. Polycarbonate incorporates more sensors and light sources than glass to reach properties such as transparency and 3D formability. Traditional technology has a high penetration rate in emerging countries due to its low expense and widespread accessibility.

Growth in glass technology innovations that support sunroof glassmakers in designing various forms of glasses is one of the key factors driving the global automotive sunroof market growth. Laminated glass, tempered glass, and green glass are UV-protective glasses. Mercedes-Benz, for example, equips the SLK model with a panoramic Vario-roof with magic sky control, which generates a comfortable environment inside the vehicle.

Moreover, this technology uses innovative new glass properties, like darker or translucent glass, to provide an open-air experience during cold weather while preventing direct sunlight from using shades. Furthermore, Webasto's novel, unique solar sunroof, combined with the new convertible panoramic sunroof used in the Volkswagen Eos, allows for greater flexibility in regulating natural light.

- In February 2025, MG Motor India launched the new 2025 MG Astor in the Indian market with prices starting from INR 9.99 lakh. The 2025 model gets new variants, features, and added safety, and the mid-spec Shine variant, now priced under INR 12.5 lakh, features a panoramic sunroof, making it one of the most affordable compact SUVs with this feature.

Restraints

High repair costs and reduction in fuel efficiency restrain the market growth.

The main focus of the manufacturers is on lowering weight in vehicles as it allows improved acceleration, braking, and fuel economy. Bulky items, which include the fuel tank, engine, and others, are generally positioned low to improve handling and vehicle stability. For example, panoramic glass roofs weigh greater as the glass is thicker and heavier than steel or aluminum roof panels. Therefore, the extra weight affects fuel efficiency significantly. Sunroofs are considerably expensive to integrate and fix in case of failure. Thus, these issues are anticipated to hamper the market growth.

Opportunity

Solar energy generation

Growing solar sunroof penetration in EVs and rising vehicle sales globally are expected to provide the market participants with abundant development opportunities in the global automotive sunroof industry throughout the projected period.

In the automotive industry, several manufacturers are concentrating on sustainability. Along with solar sunroofs, electric vehicles utilize the energy harvested from the sunroof to power some of the vehicle's features. For example, in January 2022, Mercedes-Benz unveiled the Vision EQXX, a novel electric car with thin crystalline solar cells on the roof that generate energy to power the car's lights, infotainment system, climate blower, and other characteristics.

- In November 2024, a much-anticipated panoramic sunroof was confirmed for the upcoming Kia Syros SUV. It will be a full electrical unit with voice control via the connected car system, and it will be the second one to get a panoramic sunroof. We have already got a glimpse of the second row of the car, where features like AC vents and the center armrest are.

Challenges

Fault in operational or setup procedures

The high integration and maintenance expenses are significant challenges to the global automotive sunroof market growth. A sunroof leaks or stops working due to various factors, such as faulty tracks, faulty motors, and chipped or cracked glass. Power-operated, aluminum or plastic handles, rain sensors, sliding glass panels, and other accessories cost less than carbon or steel fiber.

These parts are assembled on a single plate, adding to the sunroof's weight. Furthermore, they require regular maintenance, which is anticipated to limit the global automotive panoramic sunroof industry growth during the projected period.

Covid 19 Impact:

Due to the outbreak of COVID-19 in 2020, the automotive sunroofs market had an adverse impact. The pandemic severely affected nations such as China, Australia, and India. According to the ECDC, the number of COVID-19 cases reported in China, India, and Malaysia in January 2022 was 135,299 confirmed with 5,700 deaths, 36,582,129 confirmed with 485,350 deaths, and 2,798,917 confirmed with 31,750 deaths, respectively.

However, the situation is anticipated to improve during the forecast period due to various factors, such as automobile manufacturers' increased focus on developing new vehicles with advanced features, the rising adoption of advanced technologies, and an increase in the number of automobile manufacturers in countries throughout the region.

The post-COVID recovery of automobile sales in various regions is anticipated to push the automobile industry for newly developed adaptations and features from which sunroofs, a unique selling proposition, benefit from this revival.

Material Type Insights

Glass automotive sunroof to gain power amid the adoption of premium and luxury cars

The glass sunroof sector held the most significant market share of around 80% in 2023and is prone to rise at an impressive rate throughout the projected period. The segment's rise is attributed to advancements in technology, which supported the manufacturing of various forms of glassware, including tempered glass, laminated glass, and glass that protect against the ultraviolet rays of light.

Consequently, the market for the fabric segment is anticipated to decline over the anticipated period with falling sales of convertible cars. The sale of cars declines due to high maintenance costs and safety issues.

Sunroof Type Insights

Panoramic automotive sunroof rules the automotive sunroof market over the projected years.

In terms of sunroof type, the panoramic segment accounted for a sizable market share in 2022. To improve ventilation, several car manufacturers offer panoramic sunroofs. Hyundai, for example, introduced the Tucson model with panoramic sunroofs in 2020. In 2022, Inteva developed panoramic sunroofs and a 10% weight reduction. As a result of improved airflow and product improvements with sun-protective coatings, the category market share will increase. The expanding implementation of pop-up sunroof systems with automobile manufacturers for improved aesthetics is a key factor responsible for the growth. A more extensive consumer base is attracted to the aesthetic features, and hence the vehicle manufacturers are updating their vehicles.

The inbuilt segment is expected to increase owing to the additional functions such as sunshades, vents, and auto close, which enhance the comfort level of the vehicles. Inbuilt sunroofs are a kind of automotive sunroof built into the vehicle's roof and are also referred to as flush-mount sunroofs. Inbuilt sunroofs give the vehicle a sleek and stylish appearance as they are constructed to integrate seamlessly with the roof. Electric motors open and close these sunroofs, controlled by switches on the vehicle's ceiling or door panel. Inbuilt sunroofs come in various sizes and designs to fit multiple vehicle models.

Operation Insights

The automatic segment will boost the market over the predicted period owing to its smooth functionality.

Based on operation, the automatic sector is expected to grow drastically in the industry over the following period. This is because of the increasing demand for easy-to-use automobile technologies. The device operates with negligible driver intervention and is used remotely or in conjunction with a power system mounted in a vehicle. Additionally, integrated safety systems in sunroofs use sensors to distinguish an object or rain, which primarily increases its growth.

The manual sunroof is operated by hand using a lever or a crank to assist the sliding motion of the glass. The main issue related to manual sunroofs is the storage which might hamper the segment growth. Due to this, the demand for manual sunroofs has declined over the years.

Distribution Channels Insights

OEM, the ruler of the automotive sunroof market

The OEM sector ruled the market based on the distribution channel. The source of safety, higher durability, and excellent facility with decreased maintenance are important factors driving demand for the OEM segment. Furthermore, the market is expected to be caused by consumer preferences for dependability, product quality, and good after-sales services. Rising automobile manufacturing is another significant factor propelling the OEM automotive sunroof industry growth.

The aftermarket segment is also anticipated to grow significantly due to the high demand for aftermarkets due to accidents caused by electrical faults or damage to sunroof parts. A sunroof is incorporated into some car models after they are built, and it is an aftermarket item that the automaker does not provide. Some key factors driving the market for sunroofs are growing car customization trends and a younger population demanding aftermarket sunroof installations.

Vehicle Type Insights

Passenger cars are the major segment based on the vehicle type

The industry is divided into light commercial vehicles, passenger cars, and electric vehicles based on the vehicle type. The passenger car sector is projected to grow significantly in the market owing to cost-effective options being launched along with facilities such as natural ventilation and increased comfort.

The light commercial vehicle is predicted to grow over the projected period owing to the increased adoption of sports utility vehicles, particularly in developing nations. The adoption of light commercial vehicles is noticeable in many emerging markets due to tremendous growth in logistics and supply chain industries. In 2021, the e-commerce sector in the United States reached a Gross Merchant Value (GMV) of USD 870 billion, representing a 14.2% increase over 2020.

Automotive Sunroof Market Companies

- Webasto SE

- Inalfa Roof Systems B.V.

- Inteva Products LLC

- Aisin Seiki Co., Ltd.

- Magna International, Inc.

- CIE Automotive

- Wuxi Ming Fang AutoMobile Parts

- Wuhu Mosentek Automobile Technology

- Yachiyo Industry Co. Ltd

- Zhejiang Wanchao Electric Co. Ltd

- Johnan Manufacturing Inc.

Recent Developments

- In March 2025, Argotec and Miru introduced one of the world's largest electrochromic sunroof window devices for the automotive industry. This new development will elevate the automotive sunroof market.

- In June 2024, Minda Corporation signed a “Joint Venture Agreement” with HCMF for automotive sunroof solutions and closure systems. This partnership is a 50:50 joint venture between Minda Corporation and HCMF.

- In August 2024, the Hyundai Venue made sunroof affordable with the new S+ trim. Hyundai Motor India expanded its venue lineup by launching the S+ variant equipped with an electric sunroof at Rs 9.36 lakh.

- In June 2024, an auto components maker, Minda Corporation, inked a pact to form a joint venture with Taiwan-based HSIN Chong Machinery Works Co. to locally produce sunroofs for passenger vehicles. The 50:50 partnership aims to localize the production of sunroof and closure technology products.

- In May 2024, Tata Nexon announced its panoramic sunroof soon. The best-selling compact SUV is speculated to get a dual-pane sunroof soon. Currently, the Nexon is being offered with a single-pane electrically adjustable sunroof starting with the Smart+ S variant. The Tata Nexon is available in seven trim levels, namely, Smart, Smart+, Pure, Creative, Creative+, Fearless, and Fearless+.

- In June 2019, Webasto SE sunroof systems unveiled plans to expand its existing facility in Michigan, United States. This plan was carried out to improve the engineering and testing capabilities in the sunroof product catalog.

- Mahindra, a global automaker, will release the Mahindra "XUV 700" in 2021. The vehicle has the largest sky roof in the segment, measuring 1360 mm in length and 870 mm in width. This product launch is expected to help the business increase its operations and boost its customer base.

- KIA Corporation, a global automaker, released its unique "Kia Seltos" product in 2021. The vehicle is expected to have a panoramic sunroof, providing a new look. The product launch helps the company improve its product offering and increases its revenue share.

Segments Covered in the Report

By Sunroof Type

- Inbuilt Sunroof

- Panoramic Sunroof

- Spoiler Sunroof

- Pop-Up Sunroof

By Operation

- Passenger Cars

- Light Commercial Vehicles

- Automatic

By Material Type

- Glass

- Fabric

By Distribution Channels

- OEM

- Aftermarket

By Vehicle Type

- Passenger Cars

- Light weigh vehicles

- Electric Powered Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content