Battery Separator Market Size and Forecast 2025 to 2034

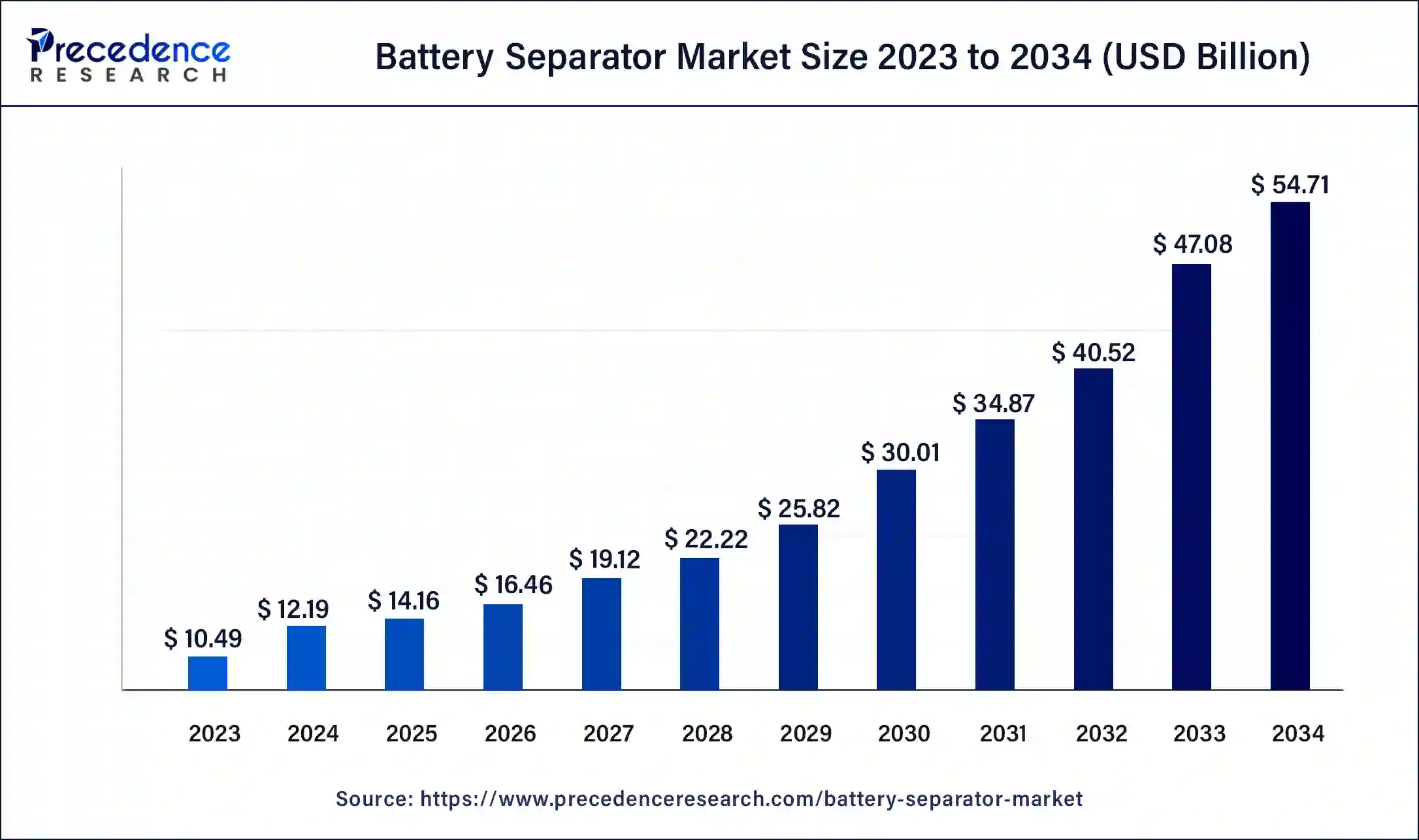

The global battery separator market size accounted at USD 12.19 billion in 2024, and is expected to reach around USD 54.71 billion by 2034, expanding at a CAGR of 16.20% from 2025 to 2034. The rising demand from the consumer electronics industry is observed to drive the market's expansion in the upcoming years.

Battery Separator Market Key Takeaways

- The global battery separator market was valued at USD 12.19 billion in 2024.

- It is projected to reach USD 54.71 billion by 2034.

- The battery separator market is expected to grow at a CAGR of 16.20% from 2025 to 2034.

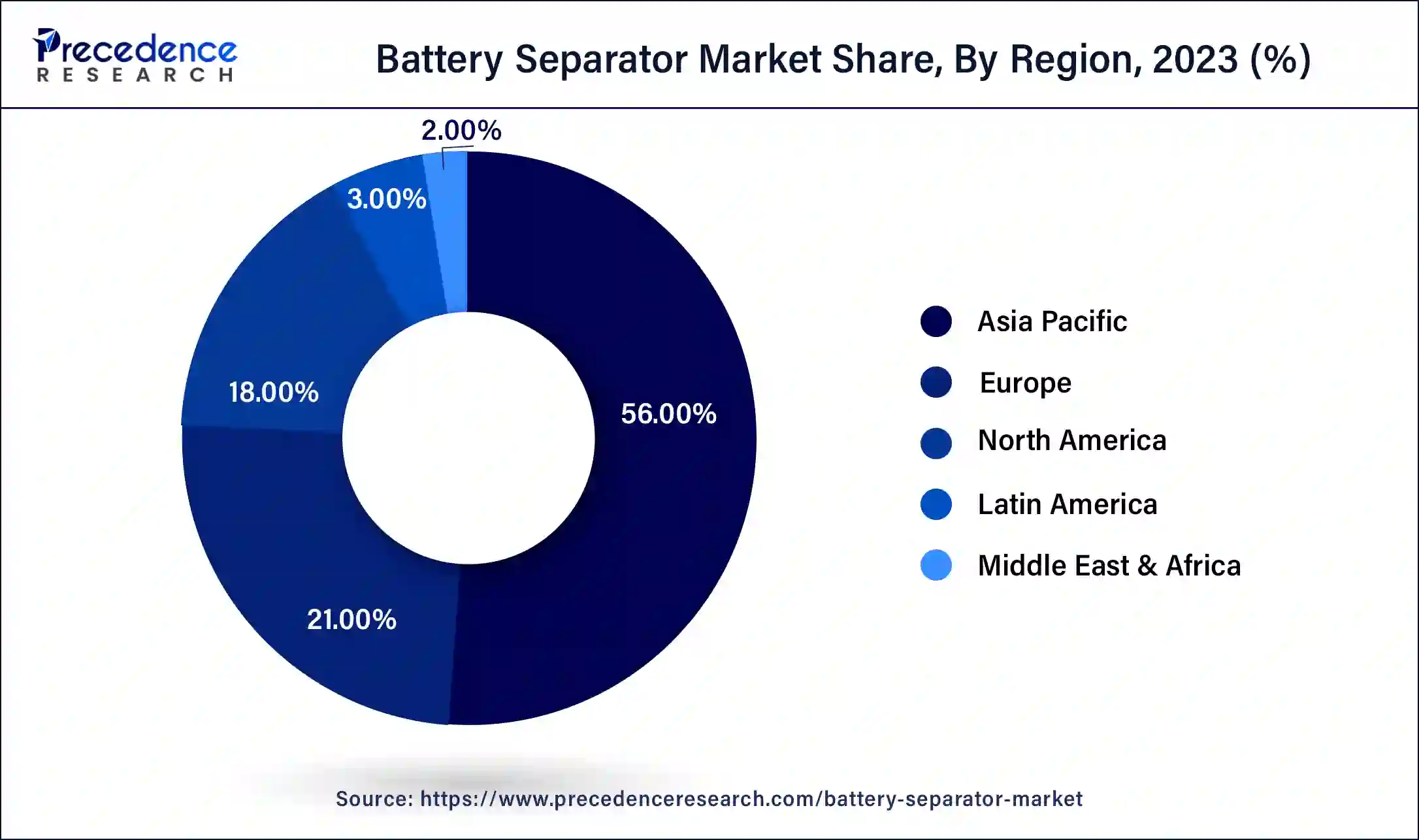

- Asia Pacific led the market with the largest share of 56% in 2024.

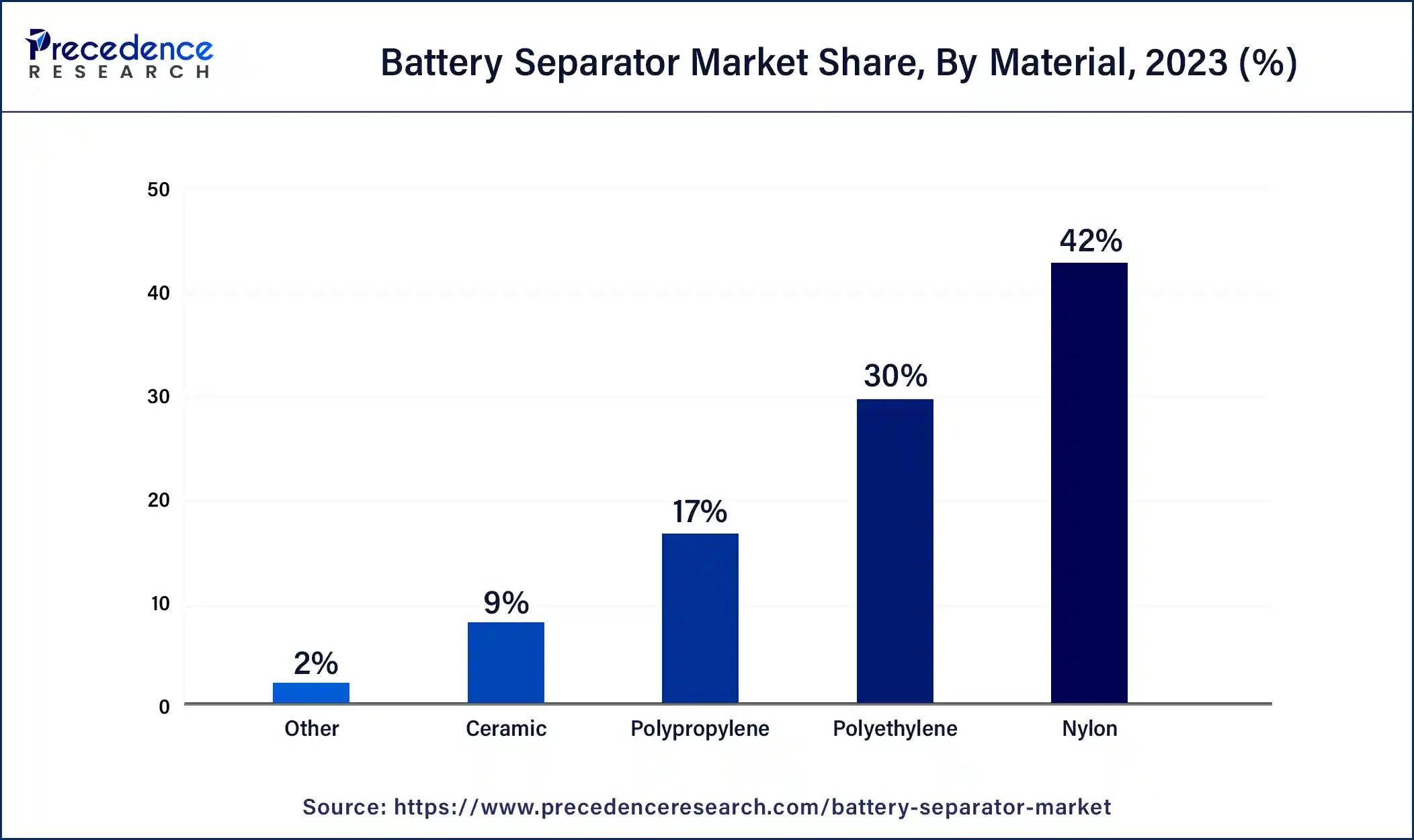

- By material, the nylon segment held the largest share of 42% in 2024.

- By battery, the lithium-ion battery segment held the largest market share of 57% in 2024.

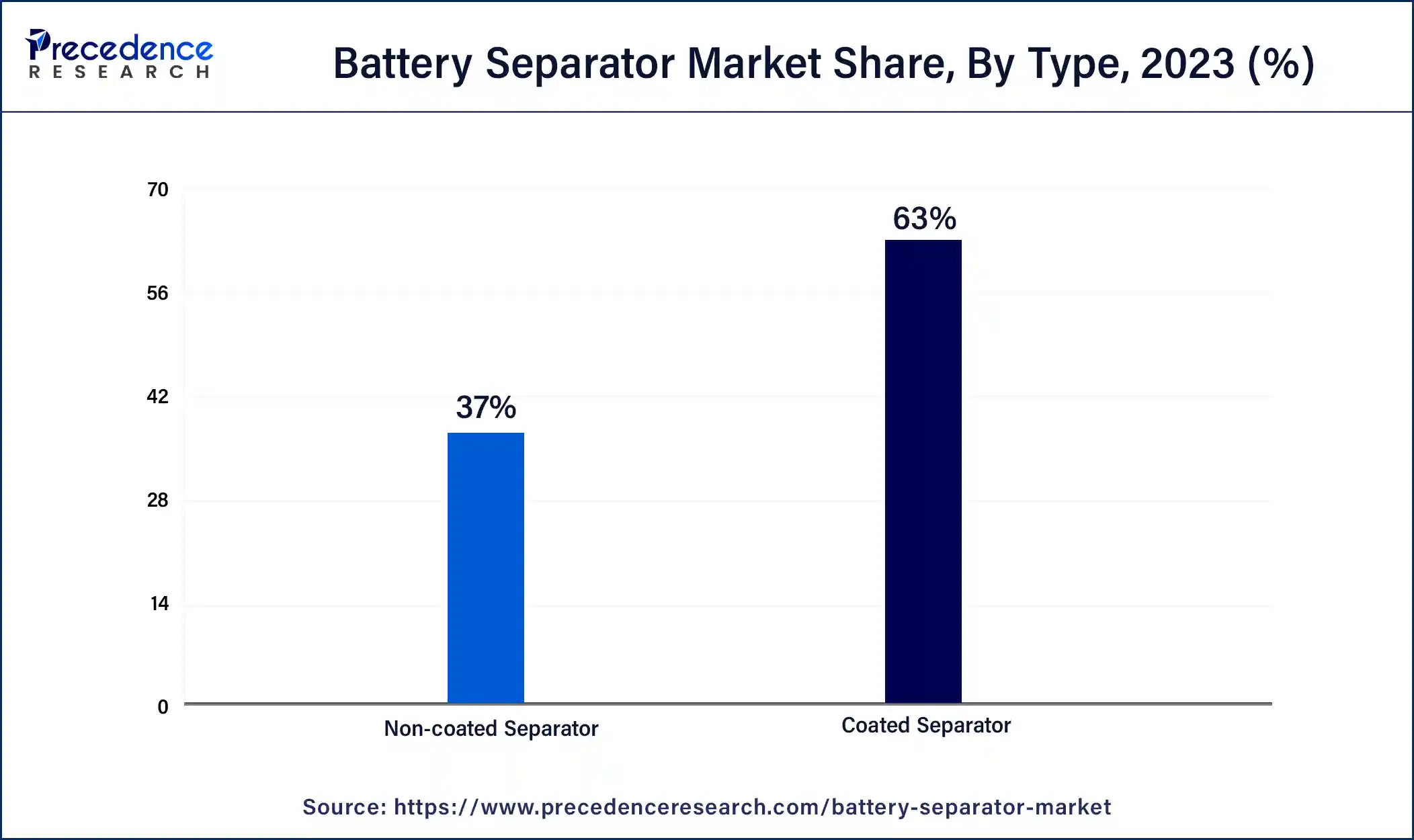

- By type, the coated separator type segment has contributed more than 63% of the market share in 2024.

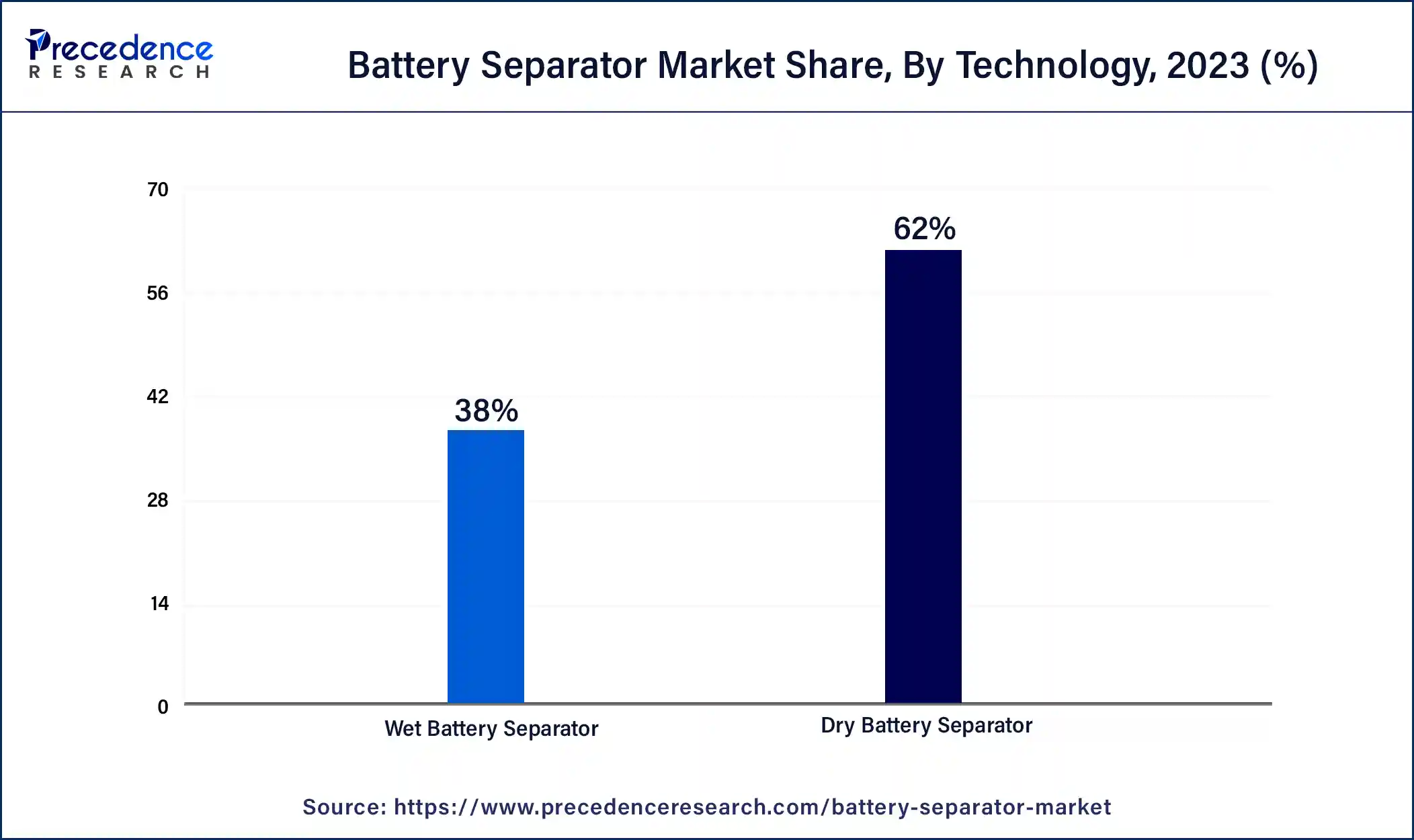

- By technology, the dry battery separator segment has generated more than 62% of the market share in 2024.

- By end-user, the automotive segment has recorded the highest market share of 44% in 2024.

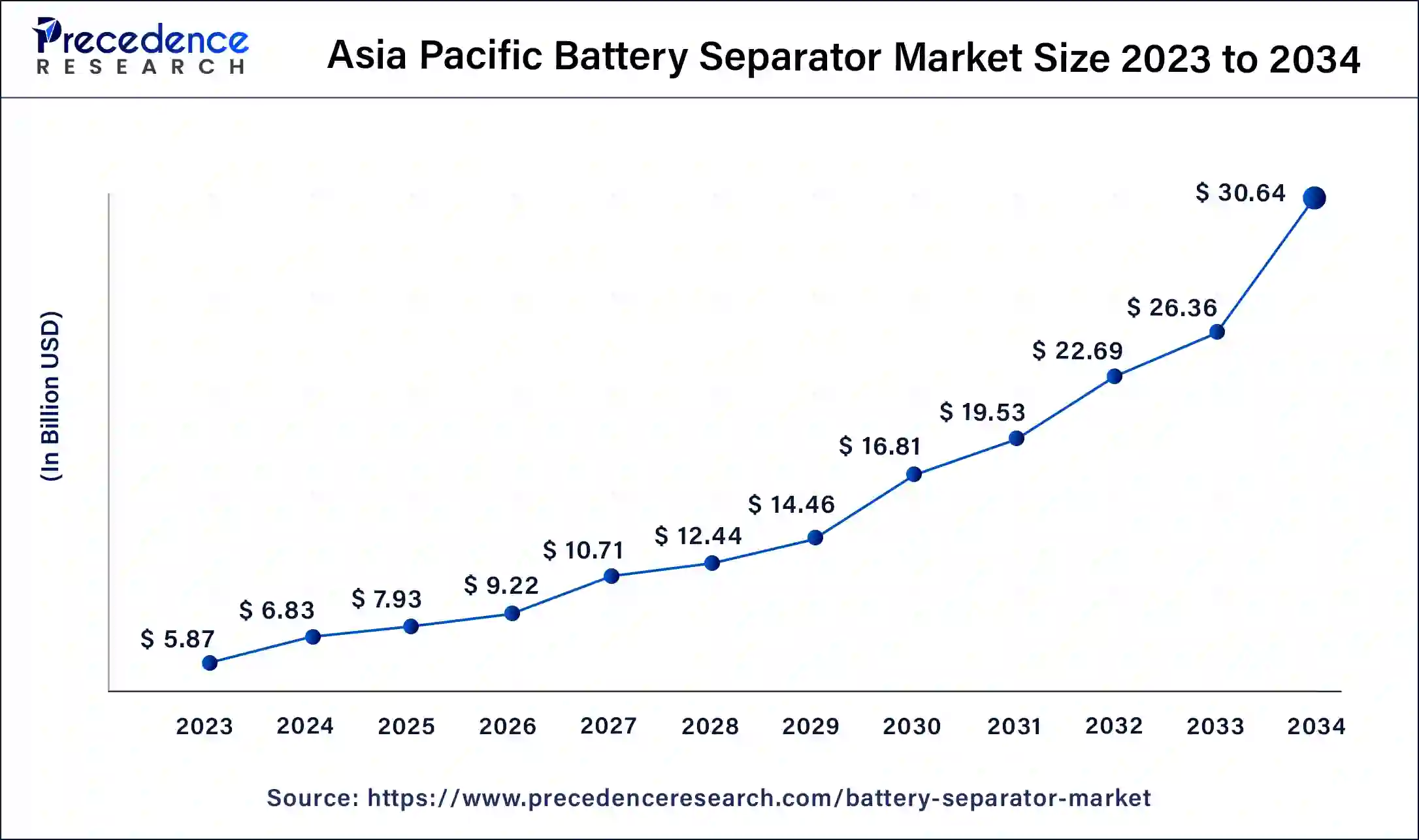

Asia Pacific Battery Separator Market Size and Growth 2025 to 2034

The Asia Pacific battery separator market size was estimated at USD 6.83 billion in 2024 and is predicted to be worth around USD 30.91 billion by 2034, at a CAGR of 16.30% from 2025 to 2034.

Asia Pacific led the battery separator market with the largest market size in 2024. The growth of the market in the region is owing to the increasing industrialization and the development in the end-use industries which are fostering the demand for the battery separator market. The rising technological development in the electronic segment are further propelling the growth of the market in the region. The expansion of automotive industry is observed to create a sustained potential for the market in Asia Pacific. Countries like India, China and Japan are expected to witness a notable rate of growth with the rising investment in research and development in the industry. Moreover, the increasing application of lithium-ion batteries, especially in the automotive sector, promotes the expansion of the market.

North America is expected to witness the fastest growth in the battery separator market during the forecast period. The growth of the segment is attributed to the well-developed commercial infrastructure and the rising demand for consumer electronics that drives the growth of the market. The rise in electric vehicle adoption due to the supportive policies on purchasing EVs and rising awareness about the environment in the people are fostering the growth of the battery separator market in the region.

Market Overview

The global battery separators market revolves around the development, research and distribution of battery separator materials that are generally being adopted by various industries. The battery separator is the polymeric membrane wall between the positively charged anode and negatively charged cathode which helps in prevention from electrical short circuiting.

The battery separator is designed to shut down the batteries of the appliances or instruments at the time of short circuit, and overheating. Lithium-ion is considered as the preferred choice of battery in consumer electronics due to its beneficial properties such as longer life cycle, higher energy density, and lower self-discharging rates. The rising demand for consumer electronics, automotive, and other industries for lithium-ion batteries are driving the demand for the battery separator market.

Battery Separator Market Growth Factors

- The increasing demand for the battery separator from the various industrial operations such as in automotive, electronics, etc. are driving the growth of the market.

- The shift in lifestyle and the rising urbanization in the economically developing countries are driving the adoption of consumer electronic products such as domestic or household electronic appliances are contributing in the expansion of the market.

- The rising growth for the automotive industry due to the higher demand for electric vehicles due to its lower carbon emission and environmentally friendly properties are driving the growth of the market.

- The rise in technological advancements in batteries and the increasing investment in research and development activities in electronics development are driving the expansion of the battery separator market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.20% |

| Market Size in 2024 | USD 12.19 Billion |

| Market Size in 2025 | USD 14.16 Billion |

| Market Size by 2034 | USD 54.71 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Battery Type, By Type, By Technology, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand from the automotive industry

The rising global population and the rising disposable income, especially in the economically developing countries, are driving the higher demand for transportation solutions while promoting the expansion of the automotive industry. Relatively, the expansion of the automotive industry promotes the growth of the battery separators market.

The rising advancements in the automobile sector and the increasing demand for the electric vehicles by the population due to the rising awareness regarding the environmental issues and the rising global warming are fueling the adoption of the electronic vehicles market. The rising use of electronic vehicles is driving the demand for lithium-ion batteries, which directly promotes the production of battery separators. Thereby, the factor is observed to act as a driver for the battery separators market.

Restraint

Supply chain disruptions

The battery separator market experienced disruptions in the supply chain due to various factors such as trade tensions, geopolitical uncertainties, and logistical challenges. These disruptions, exacerbated by the COVID-19 pandemic, led to delays in raw material procurement, manufacturing operations, and product distribution, hindering market growth and causing supply shortages. The battery separator industry faced escalating raw material costs, particularly for key materials such as polyethylene (PE) and polypropylene (PP), which are used in separator manufacturing. Fluctuations in oil prices, currency exchange rates, and supply-demand dynamics contributed to the volatility in raw material prices, putting pressure on profit margins and limiting investment in production capacity expansion.

Opportunity

Technological advancements

The technological advancements in batteries are driving the demand for specialized battery applications, including battery separators which can work on higher temperatures, provide increased ion conductivity, and higher thermal stability. The rising investments in research and development activities in the innovation in the technologies by multiple manufacturers is observed to create a sustained potential for the battery separator market. Additionally, the higher demand from the end-user industries like automotive, consumer electronics, electronics, and others are driving the demand for the battery separator. The rising demand for the various efficient batteries by the various end-use applications are driving the growth of the market.

Material Insights

The nylon segment dominated the battery separator market in 2024. The segment is observed to sustain the position throughout the forecast period. Nylon separators exhibit superior mechanical properties, including high tensile strength, tear resistance, and puncture resistance. These qualities enhance the structural integrity of the battery separator, preventing short circuits and mechanical failures during battery operation.

As a result, nylon separators are preferred for high-performance battery applications where reliability is paramount. Nylon-based battery separators offer excellent thermal and chemical stability, making them well-suited for demanding applications in lithium-ion batteries. They can withstand high temperatures and resist degradation from exposure to corrosive electrolytes, ensuring reliable performance and safety in battery systems.

The polyethylene segment is observed to grow at a notable rate in the battery separator market during the forecast period. Polyethylene separators are engineered with a highly porous structure, which allows for efficient ion transport and electrolyte permeability within batteries. This porous network facilitates the movement of ions between the cathode and anode, enabling smooth electrochemical reactions and enhancing battery efficiency and performance. Polyethylene is a widely available and cost-effective material compared to alternative separator materials such as ceramic or composite membranes. The abundance of raw materials and established manufacturing processes for polyethylene separators contribute to lower production costs, making them economically viable for large-scale battery production.

Battery Type Insights

The lithium-ion battery segment dominated the battery separator market in 2024. The growth of the segment is attributed to the rising consumption of lithium-ion batteries in the consumer electronics industry and the automotive industry which propels the growth of the lithium-ion battery market. The rising investment in lithium-ion batteries in the automotive industry due to the rise in the electronic vehicle market which positively influenced the growth of the lithium-ion battery.

The lead-acid battery type segment is observed to grow at a notable rate during the forecast period. Lead-acid batteries are being adopted in the automotive industry. Heavy vehicles are prone to utilize lead-acid batteries, this promotes the expansion of the segment. Newer technologies are observed to make battery separators for lead-acid batteries inexpensive. Moreover, the focus on robust design and recyclability creates a potential for the segment to grow.

Type Insights

The coated separator type segment led the battery separator market with the largest share in 2024. Coated separators have gained widespread acceptance and adoption in the battery industry due to their proven performance advantages and compatibility with existing battery manufacturing processes. Many battery manufacturers have standardized the use of coated separators in their product lines, driving market growth and innovation in coated separator technologies.

Coated separators are well-suited for use in advanced battery chemistries, including lithium-ion, lithium-sulfur, and lithium-air batteries, where stringent performance requirements must be met. The tailored coatings can accommodate the specific characteristics and challenges of these chemistries, such as high energy density, fast charging/discharging rates, and prolonged cycle life, enabling the development of next-generation batteries with improved performance and safety.

Technology Insights

The dry battery separator segment led the battery separator market in 2024. Dry battery separators offer cost-effective solutions for battery manufacturers, as they are produced using efficient manufacturing processes and readily available materials. The scalability of dry battery separator production allows for large-scale manufacturing to meet the growing demand from various industries, including consumer electronics, automotive, and energy storage.

The need for energy storage solutions has grown with the integration of renewable energy sources such as solar and wind power into the electricity grid. Dry battery separators are used in rechargeable batteries deployed for energy storage applications, including residential energy storage systems, grid-scale energy storage projects, and off-grid power systems.

The wet battery separator segment is observed to grow at a notable rate of growth during the forecast period. The utilization of advanced solutions in the battery separators has promoted the expansion of the segment. However, the complex manufacturing process and expensive process of production have limited the expansion of the segment in the industry.

End-user Insights

The automotive segment held the largest share in the battery separator market in 2024. The dominance of the segment is attributed to the rising adoption of the battery separator in the industry due to the higher demand for the batteries. Moreover, the rising penetration of electric vehicles across the globe has boosted the demand for batteries that are sustainable and environmentally friendly, which promotes the market's growth.

The requirement for battery separators in the automotive sector has boosted with the rising demand for batteries with longer life. Battery separators act to maximize the efficiency of the battery. Battery separators play a crucial role in preventing short circuits in electric vehicles, thereby the expansion of electric vehicles industry creates a potential for the segment to grow.

Battery Separator Market Companies

- Toray Battery Separator Film Korea Limited

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- SK Innovation Co., Ltd

- Freudenberg Performance Materials

- ENTEK International, LLC

- W-Scope Corporation

- UBE Corporation

- Bernard Dumas

- Dow, Inc.

- Mitsubishi Paper Mills, Ltd.

- Teijin Limited

- Eaton Corporation plc

- Ahlstrom

- Sinoma Lithium Film Co., Ltd.

Recent Developments

- In April 2024,Nissan introduced the in-construction all-solid-state battery pilot line to the media members at its Yokohama Plant in Kanagawa Prefecture. The battery line is having the vision of expansion in innovation and development in manufacturing technologies in the batteries.

- In April 2024, Bounce Infinity introduced its portable liquid cooled-battery technology for e-scooter with the collaboration with Clean Electric, an energy storage solution startup. The aim of the launch is to increase the usability and performance of e-scooters.

- In April 2024,Lectrix EV, an electric mobility of the well-known SAR Group launched the revolutionary E2W at just INR 49,999. It is the first OEM in India which can separate the battery from vehicle and serves customers as as service.

- In April 2024, the German luxury automobile brand launched the updated top-tier electronic sedan 2024 Mercedes-Benz EQS with the larger battery size which allows th vehicle to go farther in single charge.

- In April 2024,Kia Corporation and Hyundai Motor Company signed the MOU (Memorandum of Understanding) for the strategic collaboration with a leading battery company in India ‘Exide Energy Solutions' for the expansion of their electric vehicle in the country.

Segments Covered in the Report

By Material

- Polyethylene

- Polypropylene

- Ceramic

- Nylon

- Others

By Battery Type

- Lithium-ion Batteries

- Lead acid Battery

- Others

By Type

- Coated Separator

- Non-coated Separator

By Technology

- Dry Battery Separator

- Wet Battery Separator

By End-user

- Automotive

- Consumer Electronics

- Power Storage Systems

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting