What is the Bio-based Packaging Market Size?

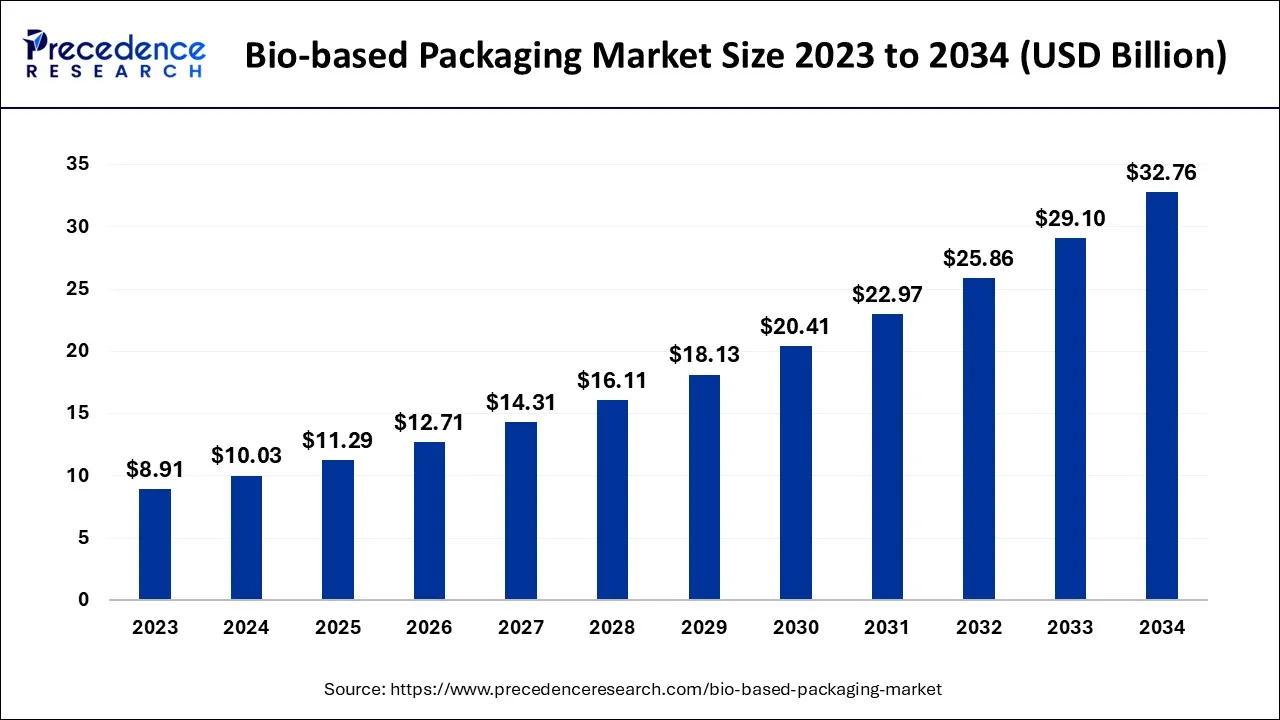

The global bio-based packaging market is accounted at USD 11.29 billion in 2025 and predicted to increase from USD 12.71 billion in 2026 to approximately USD 36.42 billion by 2035, representing a CAGR of 12.43% from 2026 to 2035.

Bio-based Packaging Market Key Takeaways

- Europe led the global market with the highest market share in 2025.

- By distribution channel, the e-commerce segment residential the biggest market share in 2025.

- By application, the food and beverage packaging segment has held the highest market share in 2025.

What are the Ongoing Trends in the Bio-based Packaging?

Bio-based packaging refers to packaging materials that are derived from renewable sources like plants, rather than traditional plastics made from fossil fuels. These materials are designed to be more sustainable and environmentally friendly compared to conventional packaging options.

We all used plastic-based packaging for several years but due to environmental effects, landfill issues, and disposal made us shift to sustainable materials that are easy to decompose and recycled. So for that reason, Bio-based packaging meets all the requirements and there are certain trends for sustainable packaging.

Plant-based materials like cellulose nanocrystals and biopolymers can replace non-recyclable layers in plastic packaging, improving recyclability. Companies like Earth Coating and TIPA create bio-based films and coatings. Bio-based drop-in plastics, such as bio-PE and bio-PP, offer the same performance as conventional plastics and are used in various applications like packaging and automotive parts. Consumers are accepting using of innovative materials like bio-based resins, and coatings, with enhanced durability. Also, the government is also encouraging the use of bio-based packaging and reducing plastic waste.

Talking about applications there is wide use of bio-based packaging in food and beverages, personal care and cosmetics packaging, pharmaceutical and healthcare packaging etc.

Food and beverage products such as fresh produce, dairy products, snacks, beverages, and processed foods. Examples include bio-based films, trays, containers, bottles, and pouches.

Pharmaceutical and healthcare industries utilize bio-based packaging for the packaging of medicines, medical devices, and healthcare products. Bio-based packaging materials ensure product safety, integrity, and compliance with regulatory requirements. Bio-based packaging solutions are gaining popularity in the e-commerce and retail sectors. They are used for shipping boxes, mailers, void fillers, and other packaging materials to minimize environmental impact.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.29 Billion |

| Market Size by 2035 | USD 36.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.43% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Distribution Channel and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing environmental awareness and government regulations

The bio-based packaging market is witnessing high growth due to the increasing recognition of environmental concerns and the implementation of government regulations worldwide. For instance, major companies like Nestlé, Coca-Cola, and Unilever have committed to using bio-based packaging materials as part of their sustainability initiatives. These companies aim to reduce their carbon footprint and enhance their environmental performance by adopting packaging solutions that are derived from renewable resources. Additionally, governments have implemented various regulations and policies to promote bio-based packaging.

In the European Union, the Single-Use Plastics Directive, enforced in July 2021, restricts the use of certain single-use plastic items and encourages the adoption of bio-based alternatives. Similarly, countries like France and Italy have implemented plastic bans and levies, creating incentives for businesses to shift towards bio-based packaging materials. These regulatory measures provide a favorable market environment for bio-based packaging manufacturers, stimulating innovation and investment in the sector. Overall, the bio-based packaging market's growth is driven by tangible actions taken by major corporations and governments to address environmental concerns and promote sustainable packaging practices, ultimately shaping the industry's trajectory toward a more sustainable future.

Restraint

High cost

The high cost of biobased packaging is a major restraint for the market. This is because biobased plastics are often more expensive to produce than traditional plastics. The cost of the raw materials used to produce biobased plastics, such as cornstarch and sugarcane, is higher than the cost of the raw materials used to produce traditional plastics, such as petroleum. Additionally, the manufacturing processes for biobased plastics are often more complex and require more specialized equipment. As a result, biobased packaging can cost up to 20% more than traditional plastic packaging. Also, the price of cornstarch, a common raw material used to produce biobased plastics, has increased by more than 50% in the past five years. Furthermore, the performance issue is another concern for bio-based packaging. They may not be as strong or durable as traditional plastics as the study by the University of California, Berkeley found that biobased plastics had a tensile strength of 20 MPa, while traditional plastics had a tensile strength of 30 MPa. This means that biobased plastics are 33% weaker than traditional plastics.

Opportunities

Increasing demand for sustainable packaging

The bio-based packaging market presents several opportunities for growth and innovation. Firstly, there is an opportunity to capitalize on the increasing demand for sustainable packaging solutions driven by environmental consciousness. As more consumers and businesses seek eco-friendly alternatives, there is a growing market for bio-based packaging materials derived from renewable resources. This demand creates an opportunity for companies to develop and offer a wide range of bio-based packaging options that cater to different industries and applications.

Furthermore, Advancements in technology and ongoing research provide promising opportunities for enhancing the performance and functionality of bio-based packaging materials. Material science innovations aimed at improving barrier properties, mechanical strength, and shelf life can enable the expansion of bio-based packaging into industries with more rigorous requirements. Additionally, there is a strong focus on developing bio-based materials that exhibit enhanced composability and recyclability, effectively addressing the challenges associated with the end-of-life management of packaging waste.

Distribution Channel Insights

E-commerce - e-commerce has emerged as a significant channel due to the exponential growth of online shopping. In this segment, bio-based packaging materials are utilized for shipping purposes, such as boxes, mailers, and cushioning materials. E-commerce businesses are increasingly opting for bio-based alternatives like corrugated cardboard made from recycled fibers or bio-based biodegradable plastics to minimize their environmental impact.

Traditional retail outlets - supermarkets, grocery stores, and specialty stores, continue to play a crucial role in the distribution of bio-based packaging materials. These materials are employed for product packaging, encompassing containers, bags, and labels. Retailers are progressively adopting bio-based packaging options like compostable bags or bioplastic containers, as they strive to offer sustainable packaging solutions to their customers.

Application Insights

Food and beverage packaging - The utilization of bio-based packaging is prevalent in the food and beverage industry, where it plays a crucial role in packaging various products. Plant-based plastics, biodegradable films, and compostable containers made from bio-based materials find wide application in packaging fruits, vegetables, meat, dairy products, beverages, and more. These packaging solutions not only help in preserving the freshness and quality of the food but also contribute to reducing the environmental impact. With the growing demand for sustainable and organic products, bio-based packaging aligns with consumer preferences in this sector.

Personal care and cosmetics packaging - The personal care and cosmetics industry is also recognizing the importance of sustainable packaging, and as a result, there is an increasing adoption of bio-based packaging materials. Bioplastics and biodegradable packaging films derived from renewable sources are now being used to package items such as lotions, creams, shampoos, soaps, and other beauty products. This shift towards bio-based packaging provides a renewable and compostable alternative to traditional plastic packaging, addressing the industry's concern about its environmental footprint. By opting for bio-based packaging, personal care, and cosmetics brands can meet the rising consumer demand for sustainable and natural products.

Pharmaceutical and healthcare sector - In the pharmaceutical and healthcare sector, bio-based packaging is gaining traction as well. Packaging materials made from bio-based polymers and biodegradable plastics are being employed to package medicines, medical devices, and healthcare products. These bio-based packaging solutions offer a sustainable alternative while ensuring the safety and integrity of the packaged items. By reducing plastic waste and promoting recycling, bio-based packaging supports environmentally responsible practices in the pharmaceuticals and healthcare industry. The adoption of bio-based packaging materials in this sector contributes to a more sustainable and eco-friendly approach to packaging.

Regional Insights

What Made Europe Dominant in the Market in 2024?

Europe - In Europe the bio-based packaging market is at the forefront, with the region implementing strict regulations and policies to promote the use of sustainable packaging materials. Countries such as Germany, France, and the Netherlands are leading the way in adopting bio-based packaging solutions. The European Union's Circular Economy Action Plan further emphasizes the need for eco-friendly packaging, creating a strong demand for bio-based alternatives. The growing trend of organic and natural products, coupled with increasing consumer consciousness about environmental issues, is propelling market growth in Europe. There is a wide range of bio-based packaging materials available in Europe, which makes it easier for businesses to find the right solution for their needs. Also, there are certain policies to promote sustainable packaging practices, which urge to use bio-based packaging materials and reduce the use of plastic packaging. Consumer awareness plays a significant role in driving the use of bio-based packaging solutions.

Rising Environmental Issues & Government Efforts are Driving the Asia Pacific

The Asia Pacific region offers immense potential for the bio-based packaging market due to factors such as rapid urbanization, population growth, and changing consumer lifestyles. Countries like China, India, and Japan are witnessing significant adoption of bio-based packaging materials, driven by increasing environmental concerns and government initiatives to reduce plastic waste. Furthermore, the rising middle-class population and their inclination towards eco-friendly products are contributing to market growth in this region.

Germany Bio-based Packaging Market Trends

Especially, German bioplastics company FKuR is demonstrating new materials and recyclates customized for the circular economy. This prominently comprises Bio-Flex N grades includes soil-biodegradable materials for agricultural products that prevent consistent microplastics.

India Bio-based Packaging Market Trends

In India, startups and researchers are using plenty of local agricultural waste, especially rice straw, sugarcane bagasse, and coffee grounds, in the development of packaging materials. Whereas, IIT-Madras created prototypes of mycelium-based composites grown on paddy waste to replace expanded polystyrene (Styrofoam).

Exploration of Large-Scale Commitments is Impelling North America

Many robust firms of this region, like PepsiCo, Coca-Cola, and Nestlé, have committed to using 100% reusable, recyclable, or compostable packaging by 2025 or earlier, which bolsters demand for substantial investment in bio-based alternatives across the region. Federal and state regulations in the U.S. and Canada, including bans on certain single use plastics and extended producer responsibility (EPR) programs, are pushing manufacturers and brands toward compostable, recyclable and biobased alternatives, accelerating market adoption and innovation.

U.S. Bio-based Packaging Market Trends

Specifically, the Magical Mushroom Company and Ecovative Design (U.S.) are expanding the production of protective, foam-like packaging grown from mushroom mycelium and agricultural waste. This material acts as a compostable option to boost polystyrene (EPS) for shipping electronics, cosmetics, and wine.

Bio-based Packaging Market- Value Chain Analysis

- Raw Material Sourcing

The company basically seeks renewable biomass, such as corn, sugarcane, potatoes (starches), cellulose (wood/plants), proteins (soy, wheat), lipids, and algae from agricultural waste (bagasse) or dedicated crops.

Key Players: Advance Bio Material, EcoBharat, Sea6 Energy, etc. - Material Processing and Conversion

The market focuses on the conversion of renewable resources (starch, sugar, biomass) into polymers, including PLA or PHA, through fermentation/polymerization, then employs conventional methods, like extrusion, molding, thermoforming, to shape them into films, containers, etc.

Key Players: NatureWorks, BASF, Corbion, etc. - Recycling and Waste Management

This prominently covers reuse, mechanical recycling, chemical recycling, and organic recycling (composting/anaerobic digestion), with "drop-in" bio-materials fitting into existing streams.

Key Players: Full Cycle Bioplastics, Notpla, Banyan Nation, etc.

Top Companies in the Bio-based Packaging Market & Their Offerings:

- Stora Enso- A company explored Fibrease, Papira and Trayforma, plus Performa Nova.

- BASF SE- This mainly facilitates bioplastic polymers, like its Ecovio.

- Tetra Pak- It widely employs FSC-certified paperboard, and sugarcane-derived polymers for caps, layers, and coatings.

- NatureWorks LLC- This usually facilitates its Ingeo biopolymer (polylactic acid, or PLA).

- Mondi plc- A firm that focuses on paper-based products made from sustainably managed forests.

Bio-based Packaging Market Companies

- Stora Enso

- BASF SE

- Tetra Pak

- NatureWorks LLC

- Mondi plc

- Smurfit Kappa Group

- Huhtamaki Oyj

- Novamont S.p.A.

- Braskem SA

Segments Covered in the Report

By Distribution Channel

- E-commerce

- Traditional Retail Outlets

By Application

- Food and Beverages Packaging

- Personal Care and Cosmetics Packaging

- Pharmaceutical and Healthcare Packaging

- E-commerce and Retail Packaging

- Sustainable Consumer Goods Packaging

- Industrial Packaging

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting