What is the Bioactive Ingredients Market Size?

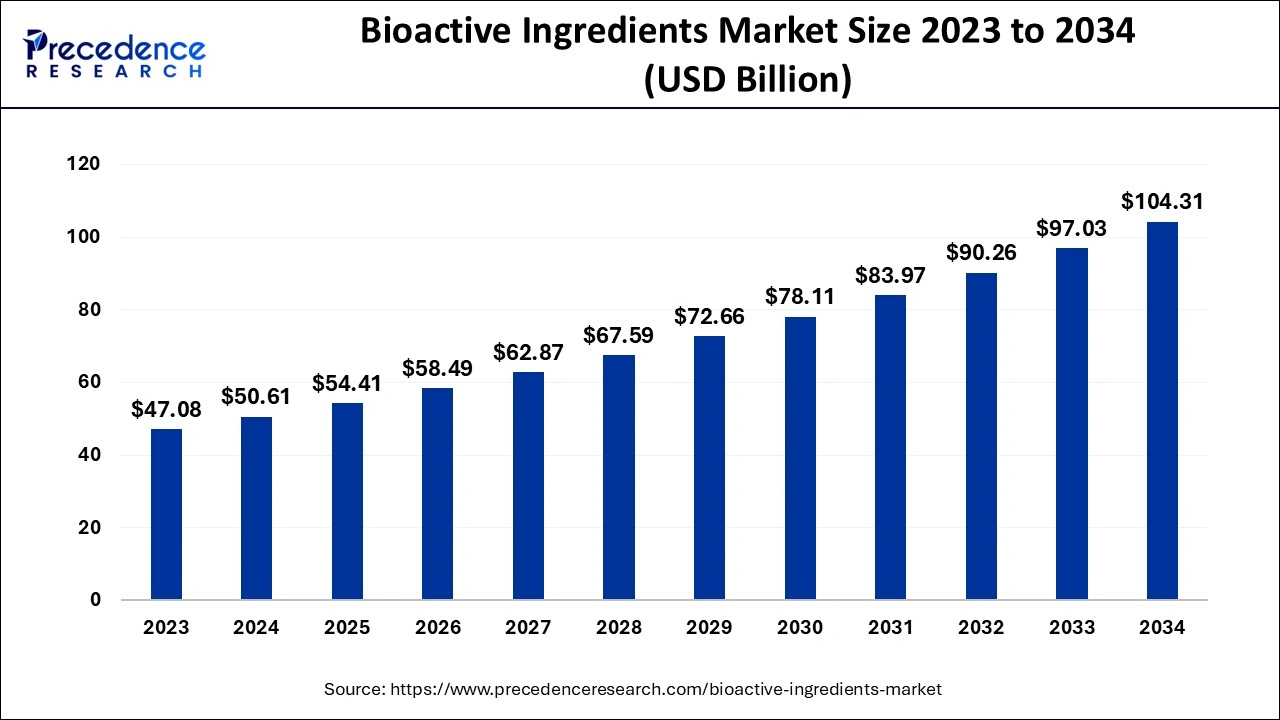

The global bioactive ingredients market size is calculated at USD 54.41 billion in 2025 and is predicted to increase from USD 58.49 billion in 2026 to approximately USD 111.25 billion by 2035, expanding at a CAGR of 7.41% from 2026 to 2035.

Bioactive Ingredients Market Key Takeaways

- By product, fiber product segment has accounted maximum revenue share of 25% in 2025.

- By application, the functional food and beverage segment has accounted for the largest share of more than 29.5% of the total revenue in 2025.

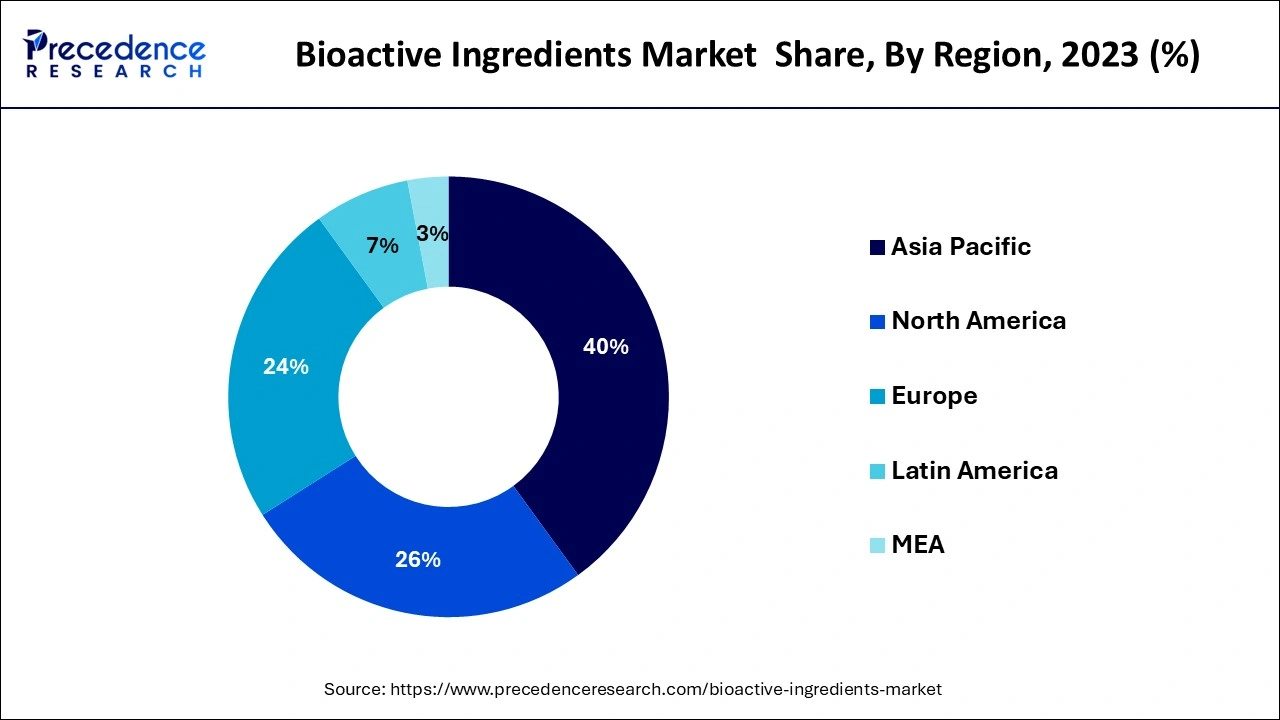

- Asia Pacific region has dominated the market in 2022 with revenue share of 39.5% in 2025.

What are Bioactive Ingredients?

Bioactive ingredients are natural compounds that are found in fruits, vegetables, nuts, and whole grains that deliver positive physiological effects on the human body. These ingredients act as a natural medium for promoting health and preventing disease by interacting with cells and tissues. There are several types of bioactive ingredients available in the market, comprising prebiotics, probiotics, amino acids, peptides & proteins, omega 3 & structured lipids, phytochemicals & plant extracts, minerals, vitamins, fibers & specialty carbohydrates, and carotenoids & antioxidants.

What is the role of AI in the Bioactive Ingredients Market?

AI is revolutionizing the bioactive ingredients industry by enhancing discovery, analyzing efficacy, improving production capabilities, and streamlining formulations. It also enables faster development of novel ingredients by identifying plant peptides and designing personalized nutrition solutions by reducing R&D costs. Thus, AI has played a vital role in shaping the bioactive ingredients market in a positive direction.

- In May 2025, Haleon partnered with Brightseed. This partnership is aimed at developing an AI-based platform for accelerating the discovery of bioactive ingredients.

(Source: https://www.nutraceuticalsworld.com )

Bioactive Ingredients Market Growth Factors

The growth of the global bioactive ingredients market is being driven by the surge in demand for functional ingredients. These kinds of ingredients help to get rid of certain illnesses and ailments. In addition, the growing prevalence of obesity and diabetes is also boosting the expansion of the global bioactive ingredients market. As per the World Health Organization (WHO), diabetes was the tenth biggest cause of mortality in 2019, accounting for an estimated 1.5 million deaths and fatalities. Overweight individuals aged 18 and up accounted for roughly 1.9 billion adults in 2016. Over 650 million of these people were overweight or obese. The growth of the global bioactive ingredients market is attributed to rising technological advancements. The bioactive ingredients are protected from undesired interactions and oxidation using recent technical breakthroughs such as microencapsulation. The major market players are increasingly looking for solutions that will increase productivity while maintaining appropriate product quality.

One of the significant factors contributing to the growth of the global bioactive ingredients market is the growing trend of veganism. Moreover, consumers are also preferring natural and organic ingredients for gut health and well-being. In most health and dietary supplements, bioactive ingredients are used on a large scale. When nutritious components are employed in animal feed, the manufacturers of animal feed get higher output from their animals, which is driving the growth of the global bioactive ingredients market. The increased awareness of bioactive ingredients among healthcare providers as well as a thriving personal care industry that incorporates bioactive ingredients into their products is some key aspects boosting the global bioactive ingredients market forward.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.41 Billion |

| Market Size in 2026 | USD 58.49 Billion |

| Market Size by 2035 | USD 111.25 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.41% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

By Type,By Application |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

Key Market Developments

- As their position in the bioactive ingredients industry has been evaluated, the major market players have been progressively depending on product innovation as a primary tactic to expand their consumer base. In recent years, there has been significant funding in research and development, which has resulted in the launch of various new goods in the bioactive ingredients market under consideration. The major manufacturers have been developing new products to meet market demands for functional ingredients throughout many end-user industries such as animal nutrition, food and beverage, and nutritional supplements. Key market corporations like Archer Daniel Midland Company and Dupont De Nemours have been at the forefront of the latest product launch and creation.

- Proclaim Resources Ltd. will show off prototypes of its CapsoilFoodTech platform, which turns bioactive oil molecules into water-soluble powders including fat-soluble vitamins, lipid-based minerals, and nutritional oils. The CapsoilFoodTech platform can turn oil-based compounds into ultra-fine, self-emulsifying powder, and water-soluble making them simpler to include in a variety of drinks, foods, and extended forms of nutritional supplements.

Segment Insights

Type Insights

The omega-3 and structured lipids segment dominated the bioactive ingredients market in 2022. Eicosatetraenoic acid, Alpha-linolenic acid, and docosahexaenoic acid are the three primary omega-3 lipids. Plant oils such as soybean, flaxseed, and canola oils are high in alpha-linolenic acid. The fish and other types of seafood include eicosatetraenoic acid and docosahexaenoic acid. They are extensively distributed in nature and have a major function in human food and physiology as essential elements of animal lipid metabolism.

The probiotics segment is the fastest-growing segment of the bioactive ingredients market in 2022. The probiotics are yeast and bacteria that assist people and animals keep a healthy microbial balance in their guts. The probiotics element promotes the body's natural digestive enzymes and juices, ensuring optimal digestion. They can be taken as supplements or taken orally. The main aspect influencing the segment expansion is the rise in consumer preference for organic and natural products. The probiotics segment is expanding as consumers' concerns about preventative health care and the usefulness of probiotic bacteria on health development. The need for probiotics has risen as a result of a rise in the consumption of functional food products, which in addition to offering basic nourishment, have the ability to enhance health.

Application Insights

The food and beverage segment dominated the bioactive ingredients market in 2022. The growth of the segment is attributed to the advantages provided by bioactive ingredients. The bioactive ingredient-based food and beverage items are high in vitamins, fiber, and minerals while still being low in calories. The bioactive ingredients have the ability to modulate metabolic processes and have favorable features such as enzyme induction, antioxidant activity, and gene inhibition.

The animal nutrition segment is the fastest-growing segment of the bioactive ingredients market in 2022. Animal nutrition is required for effective milk and meat production, healthy bone construction, and reproduction, and includes vitamins, macronutrients, dietary minerals, amino acids, enzymes, and eubiotics. The protein synthesis, transport, and storage of other nutrients all require amino acid supplementation resulting in high-quality animal-based food products such as milk, eggs, and meat. As per the International Dairy Federation, dairy product intake is anticipated to rise by 25% between 2015 and 2024. As a result, dairy processes are increasing their use of amino acids to meet the immediate requirements, interrupting the animal nutrition segment.

Regional Insights

What is the Asia Pacific Bioactive Ingredients Market Size?

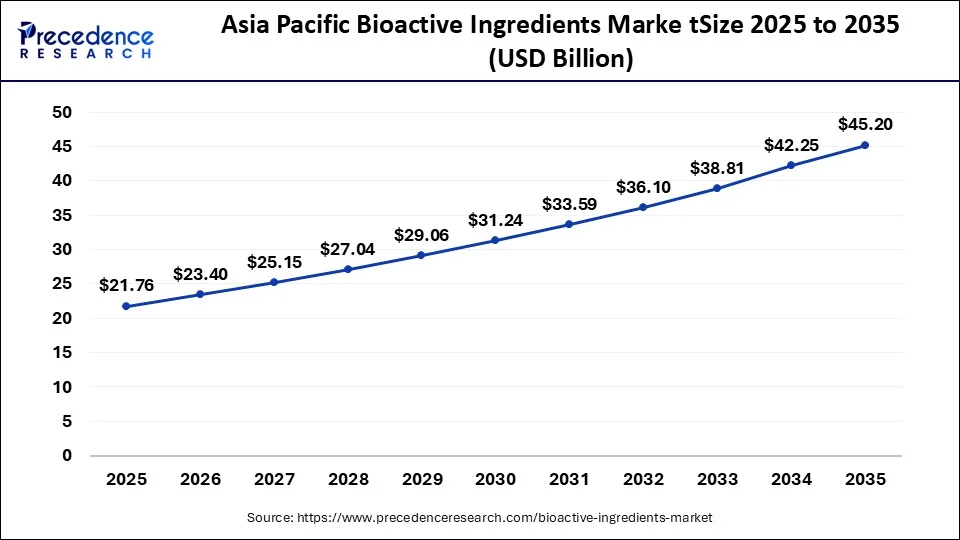

The Asia Pacific bioactive ingredients market size accounted for USD 21.76 billion in 2025 and is expected to be worth around USD 45.20 billion by 2035, expanding at a CAGR of 7.58% between 2026 and 2035.

What Made Asia Pacific the Dominant Region in the Bioactive Ingredients Market?

Asia-Pacific dominated the bioactive ingredients market in 2025. China and India dominated the bioactive ingredients market in the Asia-Pacific region. One of the primary factors driving the growth of the Asia-Pacific bioactive ingredients market is the surge in demand for functional ingredients. Thus, the market players are launching innovative products in the bioactive ingredients market. For example, Shenzhen Qianhai XiaozaoTechnology Co. Ltd, a Chinese ingredient manufacturer has begun producing algal omega-3 with highly eicosapentaenoic acid components, thereby diversifying their bioactive ingredients offers. The market players are also adopting business expansion strategies to increase their market reach. For example, Neptune Bioresources of Quebec has formed a joint venture with Koyo Chemical of Japan to sell and manufacture glucosamine and krill oil supplements for joint health in Japan.

China Bioactive Ingredients Market Trends

China leads the market within Asia Pacific with strong manufacturing capacity, abundant agricultural raw materials, and rapid growth of domestic nutraceutical brands. The government's focus on healthy aging, functional foods, and herbal-based ingredients boosts consumer demand. Local companies are also expanding bioprocessing technologies, reinforcing China's position as a global supplier.

What Makes Europe the Fastest-Growing Region in the Bioactive Ingredients Market?

Europe is projected to grow at the fastest rate from 2023 to 2032. The factors such as growing demand for organic and natural ingredients as well as growing healthcare expenditure are driving the growth of Europe's bioactive ingredients market. Due to rising health concerns, people are avoiding consuming synthetic ingredients. This is directly boosting the demand for bioactive ingredients in the region. In addition, the existence of a large number of market players is also contributing to the expansion of the bioactive ingredients market in the Europe region.

Germany Bioactive Ingredients Market Trends

Germany is a major contributor to the market within Europe. The market in Germany is driven by strong demand for functional foods, pharmaceuticals, and personal care products. High purchasing power and preference for premium, science-backed ingredients support market growth. The country's advanced biotechnology infrastructure enables the development of novel bioactives, especially probiotics and bio-fermented compounds.

North America: A Notably Growing Region

North America is expected to grow at a notable rate over the forecast period. This is mainly due to rising demand for bioactive ingredients, driven by strong penetration of functional foods, dietary supplements, and beauty-from-within products. High consumer awareness around immunity, metabolic health, and clean-label ingredients strengthens market uptake. Innovations in plant-based extracts, probiotics, and peptides drive advanced product development.

U.S. Bioactive Ingredients Market Trends

The U.S. dominates the market within North America due to a strong nutraceutical ecosystem, extensive R&D capabilities, and stringent quality regulations that support premium product growth. High consumer spending on supplements, personalized nutrition, and fortified foods drives strong demand for ingredients, particularly omega-3s, antioxidants, probiotics, and botanical extracts.

How is the Opportunistic Rise of Latin America in the Bioactive Ingredients Market?

Latin America is expected to expand at a considerable CAGR during the forecast period. The growing demand for vitamin-based supplements across several nations, including Argentina, Brazil, Venezuela, and Peru, is boosting the market expansion. Also, numerous government initiatives aimed at developing the animal healthcare sector, along with the surging demand for high-quality fairness cream from women, are playing a vital role in shaping the market landscape. Moreover, the rising investment by market players for opening new probiotics production centers is expected to drive the growth of the market.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents significant opportunities for the bioactive ingredients market. These opportunities arise from the increasing demand for dietary supplements from consumers living in the UAE, Saudi Arabia, South Africa, Qatar, and Bahrain. Also, the rising investment by the government for strengthening the food and beverage industry, as well as the growing demand for personal care products, is contributing positively to the market.

Bioactive Ingredients Market - Value Chain Analysis

- Ingredient Processing: Bioactive ingredients are created through methods like plant extraction, microbial fermentation, enzymatic processing, concentration, microencapsulation, spray drying, and purification for use in nutraceuticals, pharmaceuticals, and functional foods.

Key players: DSM-Firmenich, BASF SE, Kerry Group, Cargill Incorporated. - Quality Testing and Certification: Bioactive ingredients require certifications to confirm purity, safety, biological activity, and regulatory compliance. Key certifications include ISO 22000 (food safety), HACCP, GMP, GRAS approval, and EFSA/FDA regulatory validation.

Key players: ISO (International Organization for Standardization), FDA (U.S. Food and Drug Administration), EFSA(European Food Safety Authority), UL Solutions. - Distribution to Industrial Users: Bioactive ingredients are provided to manufacturers of functional foods, dietary supplements, cosmetics, pharmaceuticals, and animal nutrition products.

Key players: Archer Daniels Midland (ADM), Givaudan, Lonza Group.

Bioactive Ingredients Market Companies

- BASF SE: BASF is a leading global supplier of bioactive ingredients used in nutrition, personal care, and functional food products. Its portfolio includes vitamins, carotenoids, omega-3 fatty acids, plant sterols, and bioactive peptides. The company prioritizes science-backed formulations that enhance immunity, support heart health, and promote skin wellness.

- DuPont (IFF – International Flavors & Fragrances): IFF (formerly DuPont Nutrition & Biosciences) offers a broad range of bioactive components, including probiotics, enzymes, plant-based bioactives, and fibers. These ingredients are widely used in dietary supplements, functional beverages, and digestive health products, supported by strong R&D and clinical validation.

- Kerry Group plc: Kerry Group provides a wide selection of bioactive ingredients, including probiotics, botanical extracts, protein derivatives, and fermented bioactives. Its solutions target immunity, cognitive health, sports nutrition, and gut health, with strong applications across beverages, supplements, and fortified foods.

- Archer Daniels Midland Company (ADM): ADM supplies plant-based bioactive ingredients, including soy isoflavones, phytosterols, fibers, and natural extracts. The company uses advanced extraction technologies to serve dietary supplements, functional foods, and wellness-focused nutrition markets.

- Royal DSM (DSM-Firmenich): DSM-Firmenich offers vitamins, omega-3 lipids, carotenoids, and specialty bioactives supported by clinical research. Its products promote immune health, metabolic wellness, skin health, and cognitive function. The company highlights sustainable sourcing and precise nutritional solutions.

Other Major Key Players

- FMC Corporation

- Ingredion Incorporated

- Mazza Innovation Ltd.

- Roquette

- Sabinsa Corporation

- Archer Daniel Midland

- Cargill

- BASF SE

- AJINOMOTO CO

- Arla Foods

Recent Developments

- In November 2025, SMACC+ launched a new range of microalgae-based bioactive compounds. These microalgae-based bioactive compounds find application in the nutraceuticals and cosmeceuticals industry.

(Source: https://finnova.eu ) - In September 2025, Novella Innovative Technology launched Novella Strawberry. Novella Strawberry is a new generation of bioactives derived from strawberry cells.

(Source: https://www.prnewswire.com ) - In February 2025, Layn launched Galacan. Galacan is a beta-glucan ingredient that helps in supporting gut health, managing blood sugar, and enhancing stamina in human beings.

(Source: https://www.feedandadditive.com )

Segments Covered in the Report

By Type

- Prebiotics

- Probiotics

- Amino acids, peptides & proteins

- Omega 3 & structured lipids

- Phytochemicals & plant extracts

- Minerals

- Vitamins

- Fibers & specialty carbohydrates

- Carotenoids & antioxidants

- Others

By Application

- Food and beverages

- Dietary supplements

- Animal nutrition

- Personal care

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting