What is the Biomass Power Generation Market Size?

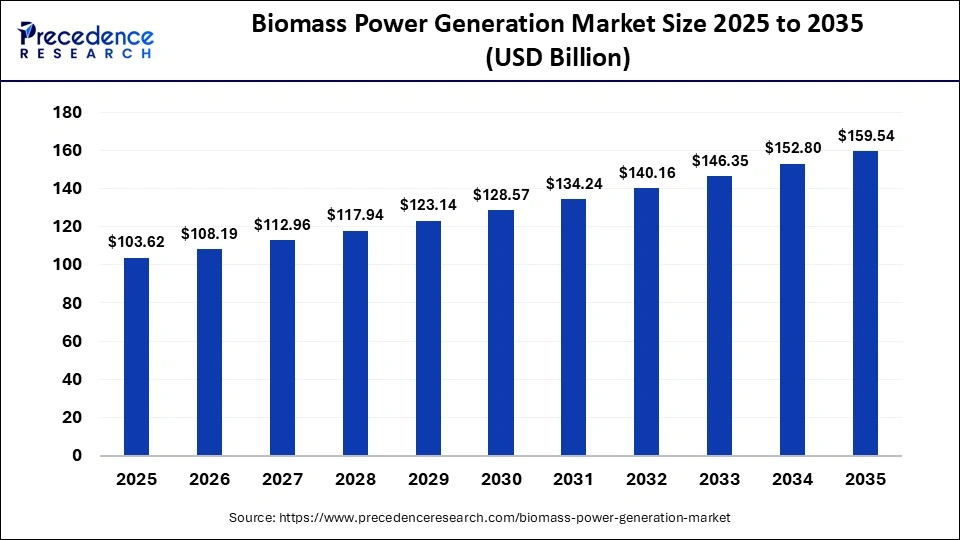

The global biomass power generation market size accounted for USD 103.62 billion in 2025 and is predicted to increase from USD 108.19 billion in 2026 to approximately USD 159.54 billion by 2035, expanding at a CAGR of 4.41% from 2026 to 2035. The market growth is attributed to increasing government support for renewable energy production and advancements in efficient biomass conversion technologies.

Market Highlights

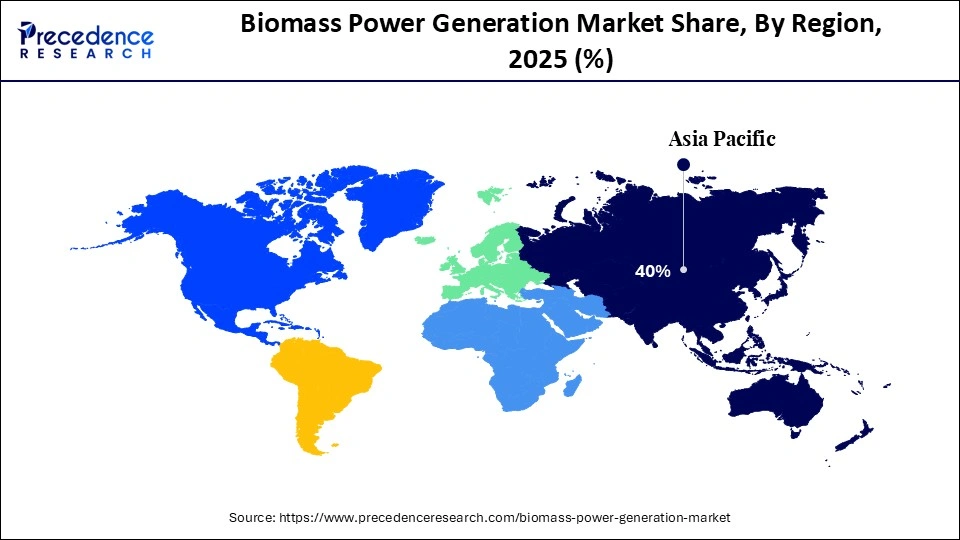

- Asia Pacific dominated the biomass power generation market, holding more than 40% of market share in 2025.

- North America is expected to grow at a significant CAGR from 2026 to 2035.

- By feedstock, the forest waste segment accounted for a considerable share of the market in 2025.

- By feedstock, the agriculture waste segment is expected to experience the fastest growth between 2026 and 2035.

- By technology, the combustion segment led the market in 2025.

- By technology, the gasification segment is growing at a strong CAGR from 2026 to 2035.

- By fuel, the solid fuel segment registered its dominance in 2025.

- By fuel, the liquid fuel segment is expanding at a solid CAGR from 2026 to 2035.

Market Overview

The ongoing growth in global renewable energy use is accelerating the development of biogas power. Organic feedstock-based electricity is gaining popularity as it becomes more cost-effective and reliable, complementing intermittent sources like wind and solar. According to the World Bioenergy Association's Global Bioenergy Statistics Report 2025, global bioenergy electricity generation reached 698 TWh in 2024, marking a 3% year-over-year increase. Moreover, renewable energy targets and sustainability requirements are encouraging stakeholders to invest in biomass power projects, thereby driving the market.

Impact of Artificial Intelligence on the Biomass Power Generation Market

Artificial intelligence (AI) is increasingly transforming the biomass power generation industry by improving operational efficiency and optimizing fuel use. Using AI-based analytics, plant operators monitor combustion processes and control equipment operations, enabling stable energy production and reduced costs. Additionally, AI technologies assist with environmental compliance, detect potential emission anomalies, and recommend corrective actions.

Biomass Power Generation MarketGrowth Factors

- Rising Government Incentives for Bioenergy Projects: Policy frameworks and subsidy programs are driving investment in biomass power plants, boosting project development across key regions.

- Growing Demand for Waste-to-Energy Solutions: Increasing municipal and agricultural waste generation is propelling the adoption of biomass technologies for sustainable electricity and heat production.

- Advancements in Combustion and Gasification Technologies: Continuous innovation in biomass conversion methods is enhancing efficiency and reducing emissions, fueling wider industry acceptance.

- Expansion of Decentralized Power Systems: Rising interest in off-grid and distributed energy solutions is boosting small- and medium-scale biomass installations in rural and remote areas.

- Increasing Corporate Sustainability Initiatives: Companies seeking carbon neutrality are driving biomass power adoption as part of renewable energy portfolios, propelling commercial biomass projects.

The Global Biomass Boom: Top Nations, Waste-to-Energy Leaders, and Investment Hotspots

- China was the world's leading producer of biomass power in 2023, generating about 204 TWh of electricity from biomass. This accounted for over a quarter of global biopower output, driven by the extensive use of forestry, agricultural residues, and municipal waste in large-scale projects.

- Brazil ranked second worldwide in biomass power generation in 2023, with a record output of approximately 54 TWh. This achievement was supported by over 600 operational biomass power plants and significant use of sugarcane bagasse for electricity generation.

- Japan was the third-largest biomass power producer in 2023, generating nearly 49 TWh, with the highest year-over-year growth rate among major producers due to expanded capacity and increased feedstock use.

- The U.S. produced substantial biomass electricity in 2023, with EIA estimates showing over 47 TWh of biomass-powered energy, keeping output steady through 2024.

- Vietnam ranks as one of the top biomass feedstock exporters, shipping approximately 2.6 million metric tons of wood pellets in 2024, highlighting rapid growth in pellet production.

- Global investment in bioenergy technologies, including biomass power, was approximately USD 13 billion in 2023, according to the International Energy Agency (IEA), with bioenergy investment forming a notable part of renewable energy funding flows.

- Global investments in bioenergy, including biomass power, were estimated to reach around USD 16 billion in 2025, representing a 13% increase from 2024 and signaling growing financial flows into biomass and related bioenergy technologies worldwide.

Biomass Power Generation Market Outlook

- Industry Growth Overview: The biomass power generation market is expanding rapidly from 2026 to 2035 as governments intensify their focus on renewable energy transitions and waste-to-value strategies. Increasing pressure to decarbonize industrial heating systems, district energy systems, and baseload electricity generation strains modern biomass solutions. Agricultural economies, including Asia-Pacific, Latin America, and Africa, utilize crop residues, forestry waste, and municipal organics to produce clean electricity, reducing reliance on imported fossil fuels and cutting pollution in rural areas.

- Sustainability Trends: Sustainability initiatives drive new project deployments as governments adopt stricter emission standards, forest stewardship requirements, and waste diversion laws. Bioenergy operators invest in cleaner combustion systems, improved flue-gas treatment, and high-efficiency digesters to meet evolving standards across major regions. Innovators in the sector also invest in low-emission transport chains, eco-friendly pellet production, and sustainable land-use frameworks.

- Global Expansion: The market is expanding globally, with Asia-Pacific emerging as the primary hub for biomass power deployment, fueled by its agricultural scale and policy support for waste-to-energy initiatives. Southeast Asian, Eastern European, and Sub-Saharan African utilities collaborate with multinational engineering firms to create integrated projects that promote long-term rural electrification and support decarbonization policies across industries. International partnerships among energy developers, agricultural cooperatives, and municipalities also drive increased technology adoption and capacity growth in the coming years.

- Major Investors: Investment activity increases as private equity firms, development banks, and strategic energy companies target biomass assets for stable, long-term returns. Renewable infrastructure funds invest in waste-to-energy platforms and feedstock processing facilities, which offer diversified revenue streams. The energy, engineering, and industrial manufacturing strategic corporates acquire biomass technology companies to support their sustainability-focused portfolios.

- Startup Ecosystem: The startup ecosystem grows as innovators develop compact digesters, advanced gasification reactors, and next-generation palletization technologies. Smaller modular units are designed by small companies at the early stages of the technology and can be installed on farms, food processing facilities, and in rural areas. Venture capital organizations focused on climate resilience support startups that specialize in enzymatic pretreatment, bioslurry enhancement, and nutrient recovery.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 103.62 Billion |

| Market Size in 2026 | USD 108.19 Billion |

| Market Size by 2035 | USD 159.54 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.41% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Feedstock, Technology, Fuel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Feedstock Insights

What Made Forest Waste the Dominant Segment in the Biomass Power Generation Market?

The forest waste segment dominated the market while holding a considerable share in 2025, owing to its high calorific value and dependable year-round availability. Forest residues have gained traction in 2024-2025 as countries invest in sustainable forestry management and advanced biomass conversion technologies. Logging by-products such as residues, sawdust, and wood chips are increasingly used to supply stable power for industrial operations, while full-scale plants, co-firing systems, and gasification technologies further improve overall plant efficiency. According to IEA and REN21 data, Europe and North America were the largest users of forest biomass in 2024, and expanding government incentives continue to drive the development and modernization of plants in forest-rich regions.

The agriculture waste segment is expected to grow at the fastest rate during the forecast period, driven by the vast availability of residues such as sugarcane bagasse, paddy straw, and corn stalks. This enables a steady, low-cost supply for biomass plants. Furthermore, agricultural waste accounts for over 698 TWh of global electricity generation in 2024, as reported by the World Bioenergy Association. Government incentives and growing sustainability goals also support the shift toward utilizing agricultural residues as a viable, low-cost alternative for clean energy production, supporting segmental growth.

Technology Insights

Why Did the Combustion Segment Dominate the Biomass Power Generation in 2025?

The combustion sector led the market with a significant revenue share in 2025 due to its advanced infrastructure, simplicity, and stability in converting solid biomass into electricity and heat. In countries like China and India, utility-scale plants utilize direct burning of agricultural waste, forest waste, and wood pellets. This enables steady and dispatchable electricity generation to help maintain the grid's stability as renewable energy integration increases. Additionally, the ready availability of low-cost feedstock, especially agricultural and forest residues, presents an opportunity for combustion technology, thereby supporting segment growth.

The gasification segment is expected to grow at a significant CAGR in the coming years, owing to its high efficiency, versatility, and ability to process a wide range of feedstocks, including agricultural residues, forest waste, and municipal solid waste. The plants that use the gasification process are able to convert biomass into syngas to power combined cycle turbines or engines, achieving an electrical efficiency of 35-45% compared to the older combustion system. Additionally, the modular nature of gasification is applied in distributed energy solutions, such as rural electrification and industry, which is expected to drive segmental growth.

Fuel Insights

How Does the Solid Fuel Segment Dominate the Biomass Power Generation Market?

The solid fuel segment dominated the biomass power generation market in 2025 due to its abundant availability, cost-effectiveness, and compatibility with existing combustion infrastructure. Nations such as China, India, and Brazil used the locally available solid biomass to drive utility-scale and community-level facilities. This ensured continuity in electricity supply and reduced dependence on fossil fuels. Additionally, government incentives and renewable energy programs, including feed-in tariffs and capital subsidies, further encouraged solid-fuel-based biomass generation, contributing to the segment's dominance.

The liquid fuel segment is expected to grow at a significant rate in the coming years, as it is energy-dense, transportable, and compatible with existing industrial boilers and gas turbines. Pilot projects in Europe, Japan, and the U.S. have demonstrated that liquid biomass fuels achieve higher conversion efficiencies and lower emission levels than solid fuel plants. Moreover, governments are encouraging the use of bio liquids, which promotes R&D and investment in large-scale production facilities, contributing to segmental growth.

Regional Insights

What is the Asia Pacific Biomass Power Generation Market Size?

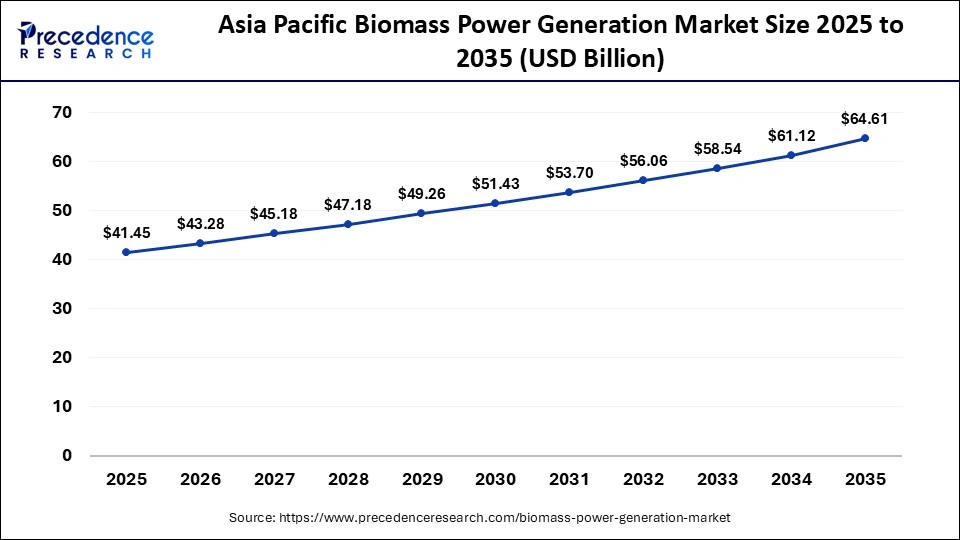

The Asia Pacific biomass power generation market size is expected to be worth USD 64.61 billion by 2035, increasing from USD 41.45 billion by 2025, growing at a CAGR of 4.54% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Biomass Power Generation Market?

Asia Pacific dominated the biomass power generation market, capturing the largest revenue share in 2025, driven by rapid industrialization, abundant agricultural residues, and supportive renewable energy policies across China, India, and Southeast Asian nations. The World Bioenergy Association 2025 report estimates that capacity surpasses 75 GW, with countries like China, India, and Thailand accounting for nearly 50% of the world's biomass electricity production.

There is a notable growth in biomass power plants in both rural and urban areas, driven by policy incentives like feed-in tariffs, tax credits, and rural electrification initiatives. Biomass power has become accepted as a supplement to variable renewables and as a way to boost energy security. Additionally, government and corporate goals of carbon neutrality are likely to sustain the region's market leadership.

China Biomass Power Generation Market Analysis

China is leading the charge in Asia Pacific, owing to the massive availability of agricultural residues, forest waste, and supportive government policies. According to the World Bioenergy Association, in 2024, China is expected to provide nearly 25-30 GW of installed biomass capacity, representing a significant portion of the region's total energy generation. Government policies on renewable energy, feed-in tariffs, and projects to electrify rural areas have driven the construction of biomass plants, especially those that use rice husks, corn stalks, and forestry by-products.

Why is North America Emerging as a Significantly Growing Area for Biomass Power Generation?

North America is expected to grow significantly in the market during the forecast period, driven by corporate decarbonization ambitions, local waste-to-energy initiatives, and state-based renewable energy mandates in the U.S. and Canada. The area features advanced technology implementations such as fluidized bed and gasification processes. This allows for the effective conversion of forest residues, wood chips, and organic waste into electricity and heat. Additionally, federal and state incentives, including the U.S. Renewable Electricity Production Tax Credit and the Clean Energy Fund in Canada, encourage the development of new projects and the retrofitting of coal-fired plants for biomass co-firing.

U.S. Biomass Power Generation Market Analysis

The U.S. is a major player in the market in North America. The market in the U.S. is fueled by extensive forest biomass resources, industrial residues, and supportive federal and state renewable energy policies. Federal programs, such as the Renewable Electricity Production Tax Credit, boosted project expansion and the retrofitting of existing coal-fired plants for biomass co-firing. Furthermore, biomass plants in the U.S. are playing a role in providing renewable electricity, especially in the Pacific Northwest and Northeast.

What Potentiates the Growth of the European Biomass Power Generation Market?

The market in Europe is fueled by strict renewable energy targets, sustainable forestry, and EU regulations like RED II. Countries such as Germany, Finland, France, and Sweden are investing in efficient, modern biomass plants that use forest residues, agricultural byproducts, and waste wood. National integration of biomass plants into energy grids is demonstrated by the production of over 70 TWh of renewable electricity from biomass plants in Europe in 2024, according to REN21. Furthermore, policy enforcement, technological modernization, and attention to carbon-neutral solutions contribute to regional market growth.

Germany Biomass Energy Generation Market Analysis

Germany leads the market in Europe through strict renewable energy goals, sustainable forest management, and modern biomass infrastructure. In 2024, Germany expanded its biomass capacity to meet its targets under the Renewable Energy Sources Act (EEG), which primarily includes forest residues, wood chips, and agricultural by-products. Additionally, both industrial and municipal biomass are supported by policy incentives, sustainability certification requirements, and grid access.

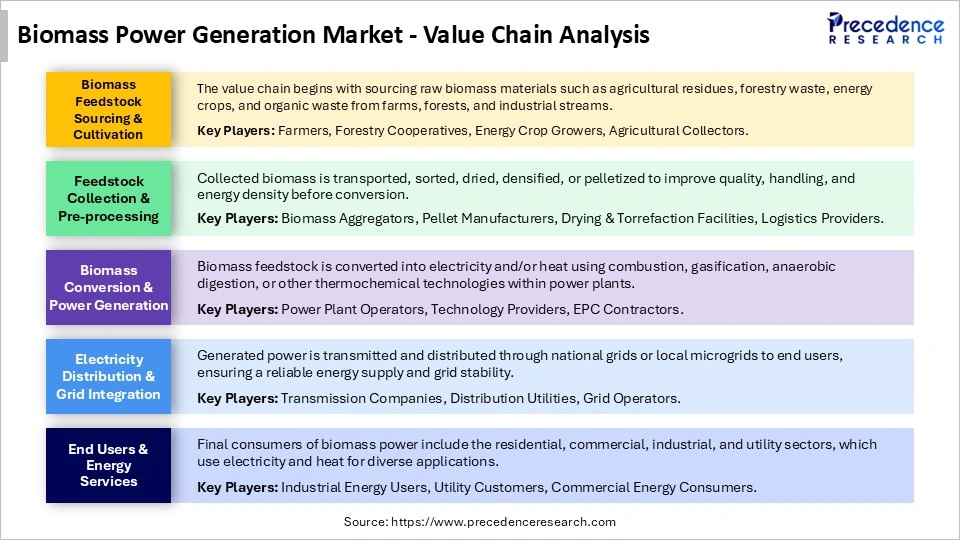

Biomass Power Generation Market Value Chain

Top Companies in the Biomass Power Generation Market

- ENGIE (France): ENGIE is a global energy leader actively involved in biomass power generation, offering large-scale biomass plants, district heating solutions, and integrated renewable energy systems.

- Babcock & Wilcox Enterprises, Inc. (U.S.): Babcock & Wilcox specializes in advanced biomass combustion and boiler technologies for utility-scale and industrial biomass power projects.

- Xcel Energy Inc. (U.S.): Xcel Energy operates a diverse portfolio of renewable energy assets, including biomass power facilities that supply reliable electricity to regional grids.

- Salzburg AG (Austria): Salzburg AG focuses on renewable energy production, managing biomass plants that provide both heat and electricity to local communities.

- rsted A/S (Denmark): rsted develops and operates biomass and waste-to-energy power projects as part of its transition from fossil fuels to sustainable energy solutions.

- EPH (Czechia): EPH is a major energy group delivering biomass power generation solutions alongside district heating and cogeneration facilities across Europe.

- Drax Group (England): Drax Group is a leading biomass power generator in the UK, operating high-efficiency pellet-fired power stations and advanced carbon reduction initiatives.

- ACCIONA (Spain): ACCIONA provides integrated renewable energy solutions, including large-scale biomass power plants and sustainable energy infrastructure.

- EDF (France): EDF operates biomass and combined heat and power (CHP) plants, integrating biomass generation into broader renewable energy portfolios.

- Vattenfall (Sweden): Vattenfall develops and manages biomass-fired power plants and district heating projects, supporting carbon-neutral energy production.

- Belgian Eco Energy (BEE) (Belgium): BEE focuses on biomass and renewable energy generation, offering sustainable electricity and heat solutions for commercial and industrial clients.

Recent Developments

- In September 2025, a New Zealand-based company, Verdus Energy & Associates, launched its Biomass Conversion Technology (BCT). The company seeks to assist dairy and livestock farms in achieving carbon-negative operations while generating a variety of high-value green products. Applying circular economy principles and energy-neutral methods, the company transforms animal manure and agricultural residues into valuable commodities with minimal environmental impact.(Source: https://www.bioenergy-news.com)

- In November 2025, the Indian government announced an INR-1-billion (USD 11.3m/EUR 9.7m) call for proposals for pilot projects aimed at developing new technologies for producing green hydrogen from biomass and waste. The initiative was unveiled by Union Minister of New and Renewable Energy, Shri Pralhad Joshi, at the third International Conference on Green Hydrogen in New Delhi. The scheme, implemented via the Biotechnology Industry Research Assistance Council (BIRAC), invites participation from industries, start-ups, and research institutions.(Source: https://renewablesnow.com)

- In April 2025, Talwandi Sabo Power Limited (TSPL), part of Vedanta Power, commissioned a biomass processing facility with a capacity of 500 tons per day in Mansa, Punjab. The plant is designed to gradually ramp up output to meet TSPL's increasing biomass fuel demand. It will process agricultural residues, primarily stubble, into carbon-neutral bio-pellets to reduce coal consumption at TSPL's thermal power station.(Source: https://www.constructionworld.in)

- In March 2025, international technology provider ANDRITZ delivered a state-of-the-art biomass power plant to Hungrana, Hungary's leading sugar producer. The new facility represents a major step forward in Hungrana's efforts to enhance sustainability and production efficiency.(Source:https://www.andritz.com)

Latest Announcement by Industry Leader

- In October 2025, Honeywell unveiled a breakthrough technology that transforms agricultural and forestry waste into ready-to-use renewable fuels for hard-to-abate sectors, including the maritime industry. The technology produces lower-carbon marine fuel, gasoline, and sustainable aviation fuel (SAF) from abundant, low-cost biomass sources such as wood chips and crop residues. Honeywell continues to lead innovation in the areas that our customers need most, said Ken West, president of Honeywell Energy and Sustainability Solutions. The maritime sector requires renewable fuels that are immediately deployable and economical. Our Biocrude Upgrading processing technology can be provided in modular form, delivering savings from installation to refining and end-use.(Source: https://www.honeywell.com)

Segments Covered in the Report

By Feedstock

- Agriculture Waste

- Animal Waste

- Forest Waste

- Municipal Waste

By Technology

- Anaerobic Digestion

- Combustion

- Gasification

- Pyrolysis

By Fuel

- Gaseous Fuel

- Liquid Fuel

- Solid Fuel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting