What is the Biomass Briquette Market Size?

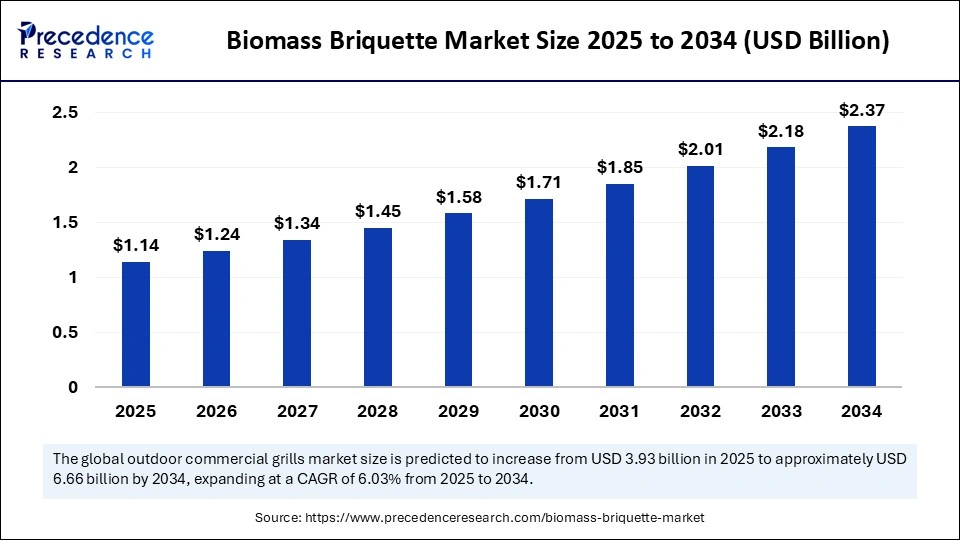

The global biomass briquette market size is calculated at USD 1.14 billion in 2025 and is predicted to increase from USD 1.24 billion in 2026 to approximately USD 2.37 billion by 2034, expanding at a CAGR of 8.45% from 2025 to 2034. The market is driven by the rising adoption of renewable energy, government incentives, and increasing demand for sustainable and cost-effective fuel alternatives.

Market Highlights

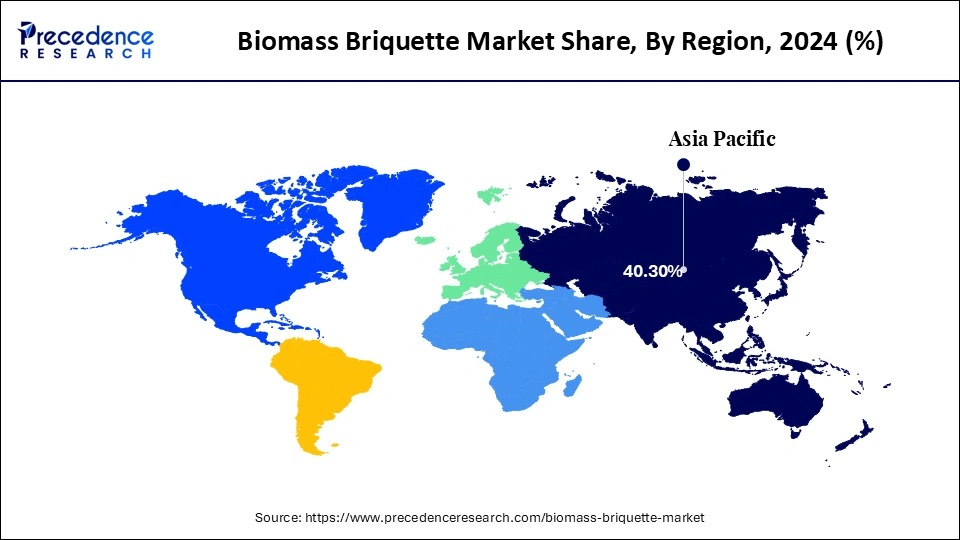

- Asia Pacific led the biomass briquette market with around 40.30% share in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By feedstock type, the agricultural waste segment contributed the major market share of 41.4% in 2024.

- By feedstock type, the forestry residues segment is expected to grow at the fastest CAGR of 7% between 2025 and 2034.

- By type, the wood briquettes segment captured about 39.9% market share in 2024.

- By type, the charcoal briquettes segment is expected to expand at a 7.2% CAGR over the projected period.

- By form, the cylindrical briquettes segment held a 31.4% market share in 2024.

- By form, the hexagonal briquettes segment is expected to expand at a 7.3% CAGR over the projected period.

- By application, the heating segment held approximately 42.2% share of the market in 2024.

- By application, the power generation segment is expected to grow at a 7.3% CAGR between 2025 and 2034.

- By end-user industry, the power plants segment captured approximately 52.2% market share in 2024.

- By end-user industry, the commercial segment is growing at a 7.5% CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 1.14 Billion

- Market Size in 2026: USD 1.24 Billion

- Forecasted Market Size by 2034: USD 2.37 Billion

- CAGR (2025-2034): 8.45%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What Drives the Growth of the Biomass Briquette Market?

The biomass briquette market is primarily driven by the growing demand for renewable, cost-effective fuel alternatives to fossil fuels. Market expansion is further supported by government incentives promoting renewable energy adoption. Biomass briquettes are compressed blocks made from agricultural residues, wood waste, and other organic materials, which serve as eco-friendly biofuels, offering high energy output with minimal carbon emissions, making them suitable for both industrial and residential heating applications.

Rising public awareness around energy security and the need to reduce dependency on coal is also accelerating market growth. Additionally, advancements in briquetting technology are improving fuel quality and production efficiency, enhancing the competitiveness of biomass briquettes in the global energy landscape.

The market involves the production and utilization of compressed biomass materials such as agricultural residues, forestry waste, and industrial biomass to create solid biofuels. These briquettes are used for heat generation, electricity production, and industrial fuel applications. The market is driven by increasing renewable energy adoption, government initiatives for carbon reduction, and rising fossil fuel prices. Biomass briquettes provide a sustainable, cost-effective, and eco-friendly alternative to coal and conventional fuels across industrial, commercial, and residential sectors.

How are Technology Innovations Fueling the Biomass Briquette Market?

The biomass briquette market is experiencing rapid transformation, driven by automation, digitalization, and advanced processing technologies. Modern briquetting systems now feature high-pressure compaction and automated feeding mechanisms, significantly enhancing production efficiency and product uniformity. Innovations in dryer technology, including solar and hybrid systems, are improving moisture control while reducing operational costs. Additionally, binder-free technologies and torrefaction processes are producing briquettes with superior energy density, combustion performance, and environmental sustainability.

The integration of IoT-enabled systems enables real-time monitoring of production parameters, allowing for optimized energy usage, predictive maintenance, and better control over quality and emissions. Collectively, these advancements are improving supply chain efficiency, ensuring consistent output, and contributing to the sector's low-carbon transition.

Biomass Briquette Market Outlook

The biomass briquette market is poised for robust expansion between 2025 and 2034, driven primarily by government incentives promoting renewable energy as a viable alternative to coal. In developing economies, thermal and industrial sectors are increasingly adopting briquettes to lower fuel costs and reduce carbon emissions.

Emerging economies such as India, China, and Brazil are scaling up briquette usage by utilizing agricultural residues and pursuing renewable energy targets. Simultaneously, Western countries are focusing on decarbonizing heating systems, contributing to rising global demand for renewable solid biofuels.

Both public and private sectors are investing in R&D to improve the energy content, combustion efficiency, and storage stability of biomass briquettes. Governments are funding pilot projects in biomass densification and co-firing technologies, aiming to meet efficiency benchmarks and environmental compliance.

National renewable energy programs are attracting investment from utilities, agro-processing companies, and public-private partnerships. These stakeholders are supporting the development of production plants and biomass supply chains, often through aggregation models to ensure consistent feedstock supply and market reliability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.14 Billion |

| Market Size in 2026 | USD 1.24 Billion |

| Market Size by 2034 | USD 2.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.45% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock Type, Type, Form, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Major growth drivers include carbon reduction targets, waste-to-energy initiatives, and clean air policies. Financial incentives such as carbon credits and co-firing mandates are making biomass briquettes an increasingly economically viable energy solution across regions.

Constraints

Despite the positive outlook, several limitations persist. Feedstock availability fluctuates seasonally, especially during off-harvest periods. Other challenges include high transportation costs, inconsistent briquette quality, lack of collection infrastructure in rural areas, and low awareness among small-scale industries, factors that hinders large-scale adoption.

Biomass Briquette MarketSegment Insights

Feedstock Type Insights

The agricultural waste segment dominated the market with the largest share of around 41.4% in 2024. This dominance is attributed to the abundant availability of agricultural residues such as stalks, shells, and husks, which are cost-effective, renewable, and widely accessible. These residues offer consistent combustion with low emissions, making them a highly viable source for large-scale heating and energy production. Additionally, government initiatives promoting the use of agricultural waste for bioenergy further reinforce the segment's leading position.

The forestry residues segment is expected to grow at the fastest CAGR of 7% during the forecast period of 2025-2034. This growth is driven by the rising emphasis on sustainable forest management and the increasing integration of circular biomass practices. Policies aimed at reducing logging waste and utilizing wood by-products for clean energy generation, combined with advances in biomass densification technologies, are creating new opportunities. Further, supportive policy frameworks incentivizing renewable energy from forest-derived feedstocks are expected to sustain the segment's momentum.

Type Insights

The wood briquettes segment led the market in 2024, capturing about 39.9% share. This is mainly due to the increased preference for wood briquettes for their high energy density, consistent combustion properties, and versatility across industrial applications, particularly in heating and co-firing systems. Compared to fossil fuels, they offer advantages such as ease of handling, low ash content, and enhanced sustainability. The rising use of wood-based residues from sawmills and the furniture industry continues to fuel growth in this segment, positioning wood briquettes as a reliable and eco-friendly energy alternative.

The charcoal briquettes segment is expected to expand at a 7.2% CAGR over the projection period. This segment's growth is driven by increasing consumer demand for green alternatives to traditional charcoal, particularly for residential and commercial heating. Additionally, advancements in low-emission carbonization technologies and the growing adoption of charcoal briquettes in co-firing and industrial applications, especially in developing economies, are expected to accelerate this segment's expansion, making it one of the fastest-growing subsegments in the biomass briquette market.

Form Insights

In 2024, the cylindrical briquettes segment accounted for approximately 31.4% share of the market due to their high compressive strength, easy storage convenience, and effective burning characteristics. Additionally, cylindrical briquettes are compatible for use in a variety of biomass boilers and industrial furnaces, which is valuable for larger energy operations. The uniform size and low moisture level of these briquettes contribute to their fuel efficiency, and they continue to be adopted strongly by both industrial and residential sectors.

The hexagonal briquettes segment is expected to grow at a 7.3% CAGR during the forecast period of 2025-2034 due to their better burning efficiency and hollow design, which promotes more air circulation while combusting. Demand for hexagonal briquettes is being fueled by increasing use in barbeques, cooking, and/or heating applications in smaller residential settings. Increasing technology with extrusion machinery and an increasing preference for high-performance low-emission biomass fuels are also helping to accelerate growth in this segment, nationally and globally.

Application Insights

The heating segment dominated the market while holding about 42.2% share in 2024. The segment's dominance is attributed to the rapid adoption of biomass briquettes as a cleaner, cheaper fuel alternative to coals and other fossil fuels in industrial and residential heating applications. The demand for space and processing heating is increasing, especially in cold regions, while tougher emission regulations continue to create a favorable profile for the use of briquettes for sustainable thermal energy generation.

The power generation segment is expected to grow at the fastest CAGR of 7.3% in the upcoming period. This is mainly due to the rising investments in biomass-based power generation and the broader shift toward renewable energy utilization. The use of biomass briquettes in co-firing with coal is gaining traction, as it helps reduce greenhouse gas emissions while enhancing the efficiency of coal-fired power plants. Further accelerating this trend are supportive government policies, renewable energy targets, and the increasing demand for decentralized (stranded) power solutions, particularly in remote or underserved regions. These factors are collectively fostering asynchronous yet rapid adoption of biomass briquettes in power generation across both developed and emerging economies.

End User Industry Insights

The power plants segment led the market in 2024, accounting for approximately 52.2% share. This is primarily due to the extensive usage of biomass briquettes as a renewable fuel alternative in thermal power production. Biomass briquettes have a consistent calorific value, low sulfur emissions, and can be co-fired with coal, making them an ideal fuel source for co-firing. The ambition to decarbonize the energy system and transition away from fossil fuels globally reinforces the prominence of this segment.

The commercial segment is expected to grow at a CAGR of 7.5% during the projection period, driven by the increasing adoption of biomass briquettes by hotels, restaurants, and institutional facilities for clean heating and cooking. As businesses intensify efforts to meet sustainability targets and comply with emissions regulations, biomass briquettes are emerging as a cost-effective, renewable alternative to conventional fuels. Moreover, rising awareness of the economic and environmental benefits of briquettes, along with the availability of customized solutions for smaller-scale commercial applications, is further supporting this segment's growth.

Biomass Briquette MarketRegional Insights

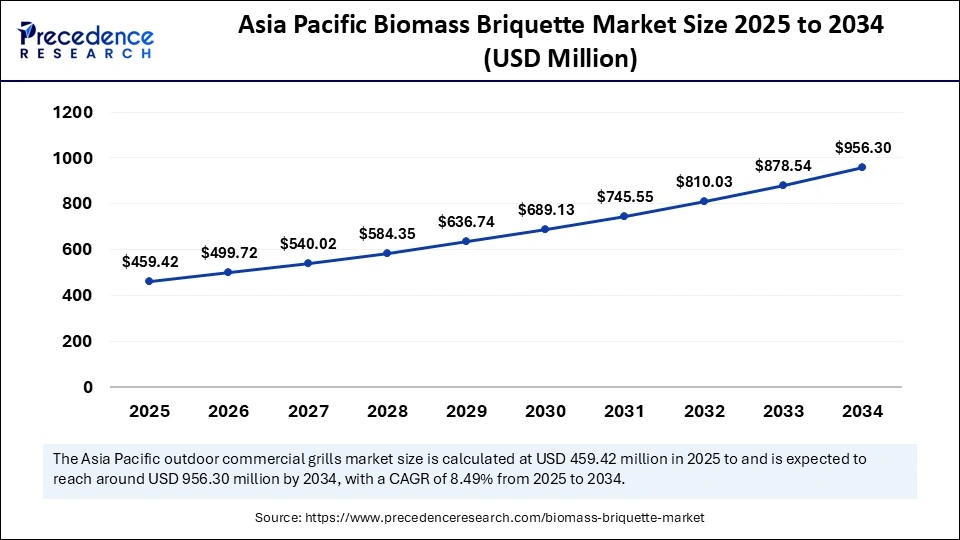

The Asia Pacific biomass briquette market size is evaluated at USD 459.42 million in 2025 and is projected to be worth around USD 956.30 million by 2034, growing at a CAGR of 8.49% from 2025 to 2034.

How Does Asia Pacific Dominate the Biomass Briquette Market?

Asia Pacific dominated the market while holding about 40.3% share in 2024. This dominance is driven by an abundant supply of agricultural residues, rising rural energy demand, and municipal initiatives that support decentralized, waste-to-fuel conversion, making briquette production both economically viable and regionally scalable. Policy frameworks promoting the use of indirect feedstocks and support for on-site waste processing to reduce landfill tipping fees are catalyzing local production models. These approaches offer low-cost thermal fuel solutions for small industries and institutional facilities, particularly in remote or under-served areas.

Government-backed projects, such as horticultural waste briquetting plants and state-led biochar initiatives, illustrate successful integration with local supply chains, reducing logistical complexity and improving operational margins. Compared to long-distance pellet transport, these regional models offer greater supply chain reliability, lower transport costs, and stronger feedstock security, reinforcing Asia Pacific's structural advantage in the global biomass briquette market.

India Biomass Briquette Market Trends

India is well-positioned to take a leadership role in the Asia Pacific biomass briquette market, driven by a synergistic combination of supportive policies, abundant agricultural residue availability, and proactive state-led initiatives. Recent municipal tenders executed through Cooperative Societies exemplify a sophisticated procurement model that facilitates public acquisition of small-scale, decentralized briquetting units. These units leverage local feedstocks and incorporate advanced features such as flash drying and pollution control, enhancing the sustainability and efficiency of urban waste-to-fuel conversions.

Under the government's Biomass Program, briquette and pellet manufacturing plants benefit from a Capital Financial Assistance (CFA) subsidy of ₹9 lakh per Metric Ton Per Hour (MTPH) capacity, capped at ₹45 lakh per plant. This financial incentive fosters investment in decentralized biomass processing infrastructure, supporting cleaner energy solutions for municipal heating and industrial applications across the country.

- In June 2025 Bhopal is set to host Madhya Pradesh first green-waste processing plant, under a PPP model at about ₹8 crore, converting the city's woody and leafy waste into biomass briquettes.

North America is expected to experience the fastest growth during the forecast period. This momentum is driven by public investment programs that promote forest-based biomass innovations, focusing on converting wood residues into a reliable commercial supply. Growing interest in biomass for distributed heating and industrial applications is further accelerating regional demand.

Government grants and innovation initiatives are effectively lowering barriers related to technology adoption and logistics. These efforts enable the densification of woody residues and lower-value roundwood into briquettes for use in local industries, district heating systems, and as exportable bio-products. Significant capital influx through public funding is expediting the modernization of sawmill by-product management and the development of aggregation hubs, which enhance feedstock supply chains and mitigate seasonal shortages. These advancements collectively strengthen North America's position as a key growth region in the global biomass briquette market.

U.S Biomass Briquette Market Trends

The U.S. continues to lead regional growth in the market, supported by robust production capacity and employment in densified biomass fuels. As of May 2025, the country hosts 75 operating producers with a combined production capacity of 13.04 million tons annually, employing approximately 2,417 full-time workers.

In the same period, U.S. producers procured 1.8 million tons of raw biomass, produced 0.90 million tons of densified fuel, and sold 0.85 million tons of these briquettes and pellets. This operational stability underscores the U.S. government's strong commitment to advancing sustainable energy objectives and fostering a circular economy.

- Furthermore, federal initiatives actively promote growth in both domestic production and export markets for renewable heating fuels, signaling sustained support for briquette and pellet manufacturing as vital components of the renewable energy landscape.

Europe's biomass briquette sector is experiencing robust growth, underpinned by strong regulatory frameworks, ambitious decarbonization targets, and increasing demand for locally sourced renewable heating fuels. The European Union's Renewable Energy Directive (RED III) mandates sustainable biomass procurement, which is catalyzing investment in briquette production using regional agricultural and forestry residues. These converging factors are reinforcing Europe's position as a key market for biomass briquettes, reducing dependence on imported fossil fuels, and advancing the continent's 2050 carbon neutrality goals.

UK Biomass Briquette Market Analysis

The UK stands out as a leading market in Europe, driven by evolving clean energy policies and stringent sustainability regulations. The UK's decision to tighten biomass subsidy rules and mandate timber certification has solidified the market for briquette production using domestic feedstock. Additionally, increased investments in carbon-neutral heating infrastructure and active public-private partnerships are fostering innovation in densified biomass technologies. These efforts are cementing the UK's leadership role in advancing Europe's transition toward sustainable biofuels.

Biomass Briquette MarketValue Chain

The process begins with sourcing agricultural residues, sawdust, and forestry waste. Ensuring a reliable and sustainable supply of biomass feedstock is critical to maintaining continuous production and minimizing reliance on fossil fuels.

Collected biomass undergoes processing, shredding, and drying to significantly reduce moisture content. Properly processed and dried biomass enhances briquette quality, combustion efficiency, and addresses key storage and transportation challenges.

Dried biomass is compressed using mechanical or hydraulic briquetting machines. This stage determines briquette density, shape, and energy content—factors that directly influence the final market value and application suitability of the briquettes.

Finished briquettes are distributed through wholesalers, distributors, and retailers to serve both industrial and residential consumers. Efficient logistics and regional supply chains are essential to optimize pricing while minimizing transportation costs.

Biomass briquettes are widely used in power generation, utility boilers, and residential heating. Demand fluctuations across these sectors drive market growth and support the broader transition towards renewable energy adoption.

Biomass Briquette Market Companies

| Tier | Companies | Rationale / Role |

Estimated Cumulative Share |

| Tier I Major Players |

|

These companies are large scale densified biomass fuel producers (briquettes & pellets), with strong production capacity, global supply chains, and significant feedstock access. | 45% |

| Tier II Established Players |

|

These players hold solid regional positions, strong manufacturing presence, and meaningful volumes in the briquette/solid bio fuel segment, though they are generally smaller than Tier I in global scale. | 25% |

| Tier III Emerging Niche Players |

|

These are smaller or regional companies, often focused on niches (e.g., specific feedstocks, local supply), or in earlier phases of scaling. They add to industry diversity but individually hold modest shares. | 18% |

Recent Developments

- In February 2024, ProcMart announced a collaboration with local vendors in the biomass-briquettes and pellets manufacturing sector across four locations, focusing on machinery upgrades and sourcing efficiencies. (Source: https://www.energetica-india.net)

- In April 2025 The Madhya Pradesh government launched its “Scheme for Implementation of Biofuel Projects” under its Renewable Energy Policy 2025, offering incentives to boost bio-CNG, briquettes, pellets and biodiesel production, and create rural jobs.(Source: https://www.energetica-india.net)

Exclusive Analysis

The global biomass briquette market is poised at a critical inflection point, driven by the confluence of mounting decarbonization mandates, increasing feedstock availability and heightened industrial demand for alternative solid fuels. With agricultural and forestry residues representing substantial untapped biomass reserves, briquetting offers an actionable pathway for waste valorization and coal substitution in heavy thermal applications. This dynamic is reinforced by favorable policy regimes, such as co firing mandates, renewable heat incentives and carbon pricing frameworks, which are shifting commercial viability well into positive territory.

Operationally, the value chain is evolving. Technological upgrades in drying, compaction and automation are raising energy density, reducing transport/logistics cost burdens and enhancing fuel uniformity, thus expanding the addressable market beyond small scale heating into industrial utility and power generation segments. The growing adoption of IoT enabled production monitoring further intensifies optimization, delivering cost savings and reinforcing competitive moats for higher end producers. As a result, the market is transitioning from a low volume niche toward a higher volume commodity scale opportunity.

Regionally, growth is diverging powerfully across emerging and mature markets. In Asia Pacific, the convergence of high residue volumes and rural energy demand enables decentralized briquetting business models, presenting a frontier for scale up and structural feed stock cost advantage. In contrast, mature regions such as Europe and North America see regulatory and infrastructure drivers supporting industrial retrofit and utility scale deployment, presenting deployment accelerators and higher margin opportunities. Together, these region specific vectors form a global growth matrix that supports sustained upside.

Strategic opportunity pockets include: (a) feed stock aggregation in agro residue rich zones, where scale and proximity drive margin expansion; (b) industrial boiler and co firing retrofit markets where briquettes can earn premium due to regulatory fuel substitution value; (c) export oriented densified briquettes and torrefied products, which unlock global logistics and higher calorific value plays; and (d) vertically integrated supply chain models that combine collection, densification and logistical optimization to capture value across multiple nodes.

Despite the promising outlook, selective risks remain, primarily feedstock seasonality and quality variability, early stage capex burdens and nascent certification frameworks, however, the magnitude of the opportunity suggests that early mover advantage and technological differentiation will disproportionately reward well positioned players. In sum, the biomass briquette market offers a compelling growth axis for investors and industrial participants willing to align execution with feed stock strategy, regional demand dynamics and technology enhanced product performance.

Biomass Briquette MarketSegments Covered in the Report

By Feedstock Type

- Agricultural Waste

- Forestry Residues

- Industrial Biomass Waste

- Urban Solid Waste

By Type

- Wood Briquettes

- Charcoal Briquettes

- Sawdust Briquette

- Agro Waste Briquettes

By Form

- Cylindrical Briquettes

- Cubical Briquettes

- Hexagonal Briquettes

- Pellet Briquettes

By Application

- Heating

- Power Generation

- Cooking Fuel

- Industrial Fuel

By End-User Industry

- Power Plants

- Residential

- Industrial

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting