What is the Bispecific Antibody Therapeutics Contract Manufacturing Market Size?

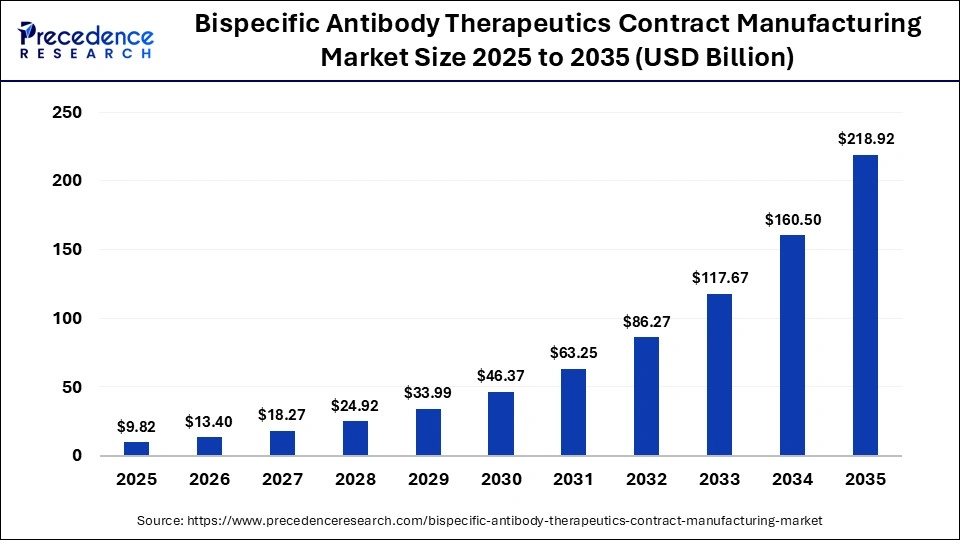

The global bispecific antibody therapeutics contract manufacturing market size was calculated at USD 9.82 billion in 2025 and is predicted to increase from USD 13.4 billion in 2026 to approximately USD 218.92 billion by 2035, expanding at a CAGR of 36.4% from 2026 to 2035. The rapid growth of biopharmaceutical outsourcing and technological advancements in antibody engineering are driving the global bispecific antibody therapeutics contract manufacturing market.

Market Highlights

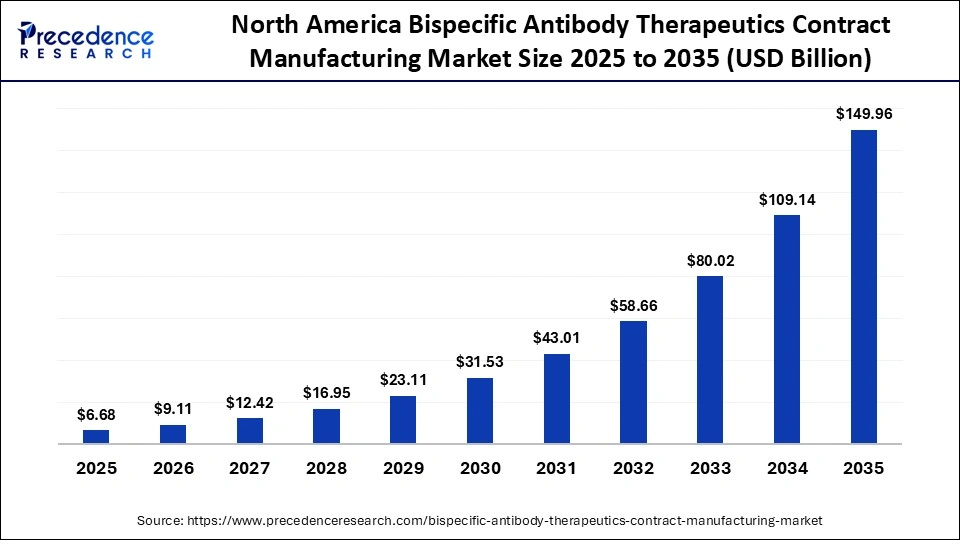

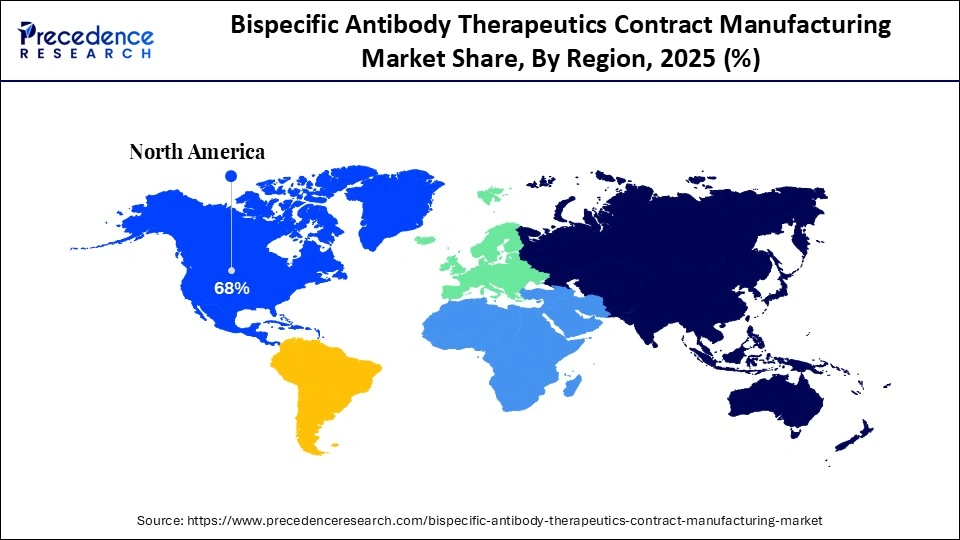

- North America dominated the global market, with the largest share of approximately 68% in 2025.

- Asia Pacific is projected to grow at the fastest CAGR from 2026 to 2035.

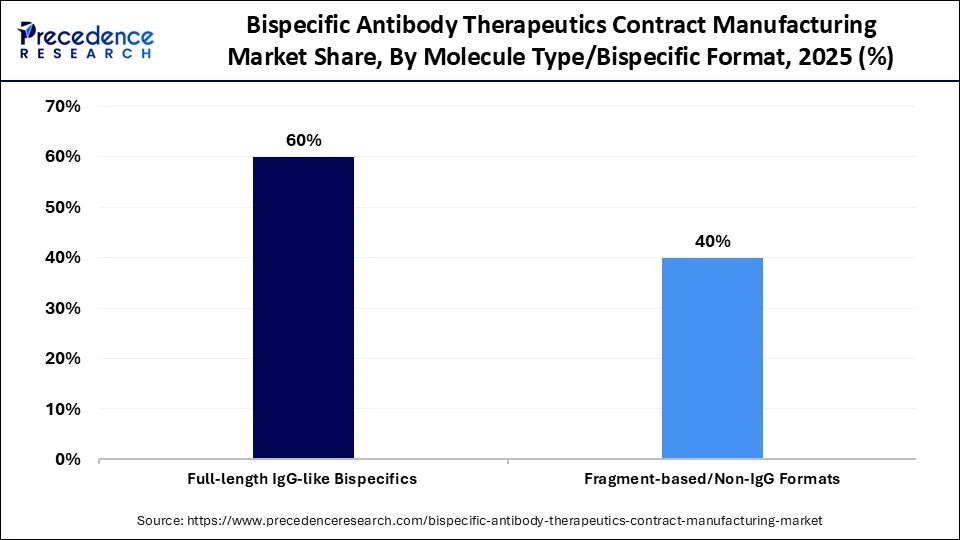

- By molecule type/bispecific format, the full-length IgG-like bispecific segment contributed the largest market share of approximately 60% in 2025.

- By molecule type/bispecific format, the fragment-based/non-IgG formats segment is projected to grow at the fastest CAGR from 2025 to 2034.

- By expression system/host cell line, the mammalian cell systems segment dominated the market in 2025.

- By mammalian cell systems, the CHO (Chinese hamster ovary) cells sub-segment led the bispecific antibody therapeutics contract manufacturing market while holding the largest share of approximately 70% in 2025.

- By mammalian cell systems, the HEK293/human cell lines sub-segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By manufacturing stage/service scope, the clinical manufacturing segment led the market while holding the largest share of approximately 45% in 2025.

- By manufacturing stage/service scope, the commercial manufacturing segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By indication/therapeutic area, the oncology segment led the market while holding the largest share of approximately 55% in 2025.

- By indication/therapeutic area, the autoimmune & inflammatory diseases segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By route of administration, the intravenous (IV) segment led the market while holding the largest share of approximately 65% in 2025.

- By route of administration, the subcutaneous (SC) segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By end-user/contracting model, the biotech companies/emerging players segment led the bispecific antibody therapeutics contract manufacturing market while holding the largest share of approximately 50% in 2025.

- By end-user/contracting model, the pharmaceutical companies (large biopharma outsourcing to CDMOs) segment is expected to grow at the fastest CAGR between 2026 and 2035.

What is the Key Technological Shift in the Industry?

The bispecific antibody therapeutics contract manufacturing market is undergoing A spectacular technological shift due to increased growth and innovations in complex therapeutics like bispecific antibody therapeutics. Manufacturing companies are adapting high-throughput sail line engineering, gene and synthetic biology enhancement.

The market growth is driven by complex production requirements, rising clinical pipeline activity, and pharmaceutical companies' preference for CDMO partnerships to reduce costs and accelerate commercialization timelines. The market is projected to see significant growth in the upcoming period, with an increase in bispecific antibody candidates development, numerous clinical trials, the creation of a massive pipeline, and rising demand for manufacturing services.

What is the Role of AI in the Market?

AI revolutionizes bispecific antibody contract manufacturing by optimizing cell line development, predicting protein stability, and enabling real-time bioprocess control. It reduces development timelines, improves yield, and mitigates chain mispairing, thus enhancing efficiency and lowering manufacturing costs.

What are the Market Trends?

- Rapidly Expanding Pipelines: Increasing clinical trials in oncology and autoimmune diseases are driving high demand for specialized manufacturing of complex bispecific formats (e.g., BiTEs, DARTs).

- Shift to Integrated "One-Stop-Shop" Models: CDMOs are offering end-to-end services from cell line development to commercial fill-finish to reduce technology transfer risks and accelerate timelines.

- Adoption of Advanced Technologies: Widespread use of single-use bioreactors and, increasingly, continuous manufacturing (perfusion) to improve productivity and manage complex purification processes.

- High Growth in Asia-Pacific: Rapid capacity expansion in China and South Korea, driven by cost-competitive manufacturing and growing local biotech hubs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.82Billion |

| Market Size in 2026 | USD 13.4 Billion |

| Market Size by 2035 | USD 218.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 36.4% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Molecule Type/Bispecific Format , Expression System/Host Cell Line , Manufacturing Stage/Service Scope , Indication/Therapeutic Area , Route of Administration , and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insight

Molecule Type/Bispecific Format Insights

Which Molecule Type Led the Market in 2025?

In 2025, the full-length IgG-like bispecific segment led the bispecific antibody therapeutics contract manufacturing market, with a share of approximately 60%, due to strong structural stability and long half-life. The structure of full-length IgG-like by spaces is similar to natural antibodies that help to ensure stability, a longer half-life, and an established manufacturing process. These by-species antibodies offer superior therapeutic efficacy, especially in oncology, infectious diseases, and autoimmune diseases.

The fragment-based/non-IgG formats segment is expected to grow at the fastest CAGR over the forecast period, driven by its well-established platforms, particularly developed by companies like Roche and Genentech. This molecule type offers precise targeting of complex diseases, including oncology, and makes them highly effective. The growing focus on research and development for fragmented best buy-specific antibodies due to increased demand for contract manufacturing services contributes to the segment's growth.

Expression System/Host Cell Line Insights

How Mammalian Cell System Led the Market in 2025?

The mammalian cell systems segment led the bispecific antibody therapeutics contract manufacturing market in 2025, due to its ability to offer correct post-translational modifications (PTMs) and accurate protein folding and assembly. This expression system has superior glycosylation control, which is required for the production of functional antibodies. The ability of mammalian cells to produce high-quality protein with complex structure makes them suitable for producing specific antibodies.

The CHO (Chinese hamster ovary) cells sub-segment dominated the market, with the largest share of approximately 70% in 2024, due to its increased preference for commercial antibody manufacturing. This cell is highly scalable, regulatory acceptable, and has the ability to produce human-compatible antibodies.

The HEK293/human cell lines sub-segment is growing at the fastest CAGR in the bispecific antibody therapeutics contract manufacturing market, due to its role in reducing immunogenicity and enhancing biological functions. This cell can perform human-like post-translational modifications (PTMs) and provides superior speed and efficiency via transient expressions, making it ideal for the early development stage of bispecific antibody therapeutics.

Manufacturing Stage/Service Scope Insights

How Clinical Manufacturing Dominates the Market?

The clinical manufacturing segment dominated the bispecific antibody therapeutics contract manufacturing market, with the largest share of approximately 45% in 2025, due to an increase in commercial production of antibody therapies. The demand for clinical trials for bispecific antibody therapeutics has increased, fueling demand for contract manufacturing services. Ongoing approvals and commercialization of antibody therapies fuel the need for large-scale manufacturing, the ability of clinical manufacturing to provide flexibility and expertise, making it a supportive activity for biopharmaceutical companies.

The commercial manufacturing segment is growing at the fastest CAGR over the forecast period, due to increased demand for approved therapies and rising pipelines of commercial products. The demand for innovative antibody therapies has increased, fueling the requirement for large-scale production like commercial manufacturing. Biopharmaceutical companies are partnering with contract manufacturing organizations for commercial production.

Indication/Therapeutic Area Insights

What Made Oncology Dominate the Market in 2025?

In 2025, the oncology segment dominated the bispecific antibody therapeutics contract manufacturing market share of approximately 55%, due to an increase in cancer prevalence and demand for innovative therapies, like as specific antibodies. The bispecific antibodies are able to provide superior therapeutic efficacy in oncology by simultaneously targeting multiple antigens or pathways. The significant clinical success of specific T cells in cagers and IgG-like formats is redefining cancer immunotherapy. Additionally rising pipeline of bispecific antibody candidates in preclinical and clinical stages for hematological malignancies and solid tumors contributes to this growth.

The autoimmune & inflammatory diseases segment is estimated to grow at the fastest CAGR during the forecast period in the bispecific antibody therapeutics contract manufacturing market, due to an increase in cases of chronic inflammatory diseases and advancements in biological therapies. These therapeutics enable superior efficacy by targeting multiple antigens or pathways. The increased demand for targeted therapies for treating autoimmune and inflammatory diseases is fueling research and development in bispecific antibody therapeutics.

Route of Administration Insights

How Intravenous (IV) Segment Dominated the Market in 2025?

The intravenous (IV) segment dominated the bispecific antibody therapeutics contract manufacturing market, with the largest share of approximately 65% in 2025, due to its rapid benefits in delivering high bioavailability and immediate therapeutic effects. The intravenous administration enables high bioavailability, which makes it preferred for specific antibodies. The ability of the intravenous route of administration to provide immediate therapeutic effect makes it crucial for several diseases, particularly in oncology. The veil established infrastructure and fought the acceptance of intravenous (IV) administration, and its wide use in clinical settings contributes to the segment's growth.

The subcutaneous (SC) segment is growing at the fastest CAGR over the forecast period, due to its convenience and faster onset of therapeutic effect. The subcutaneous SC route of administration enables patient-friendly delivery of drugs and medications. The ongoing focus on biological drugs and self-administration is a few links to demands for subcutaneous formulations of specific antibody therapeutics.

End-User/Contracting Model Insights

Which End-user Dominates the Market in 2025?

In 2025, the biotech companies/emerging players segment dominated the bispecific antibody therapeutics contract manufacturing market, with a share of approximately 50%, due to increased demand for innovative therapies. Biotech companies have increased investments in research and development of bispecific antibody therapeutics. The focus of biotech companies on the development of innovative therapies, such as specific antibodies and antibody drug conjugates, is fueling this growth. These companies are forming strategic partnerships with pharmaceutical companies to enable accelerated development and commercialization.

The pharmaceutical companies (large biopharma outsourcing to CDMOs) segment is growing at the fastest CAGR in the bispecific antibody therapeutics contract manufacturing market between 2026 and 2035, driven by increasing demand for advanced antibody therapies, rising R&D investments, and high prevalence of cancer diseases. The demand for targeted therapies has increased, fueling innovations and antibody therapies, increasing demand for contract manufacturing services. The investments in the research and development sector support pharmaceutical companies in boosting innovations in these therapeutics.

Regional Insights

How Big is the North America Bispecific Antibody Therapeutics Contract Manufacturing Market Size?

The North America bispecific antibody therapeutics contract manufacturing market size is estimated at USD 6.68 billion in 2025 and is projected to reach approximately USD 149.96 billion by 2035, with a 36.5% CAGR from 2026 to 2035.

North America Bispecific Antibody Therapeutics Contract Manufacturing Market

North America dominated the global market, with the largest share of approximately 68% in 2025, due to the region's strong biopharmaceutical industry, the existence of favourable regulations, and advanced infrastructure. North America has a well-established healthcare infrastructure and spectacular investments in the R&D sector, fuelling innovations and development of advanced therapies, including specific antibody therapeutics. Supportive regulatory bodies are promoting biotech innovations, fueling the need for advanced contract manufacturing. The high prevalence of cancer in autoimmunity is fueling demand for advanced therapies in North America.

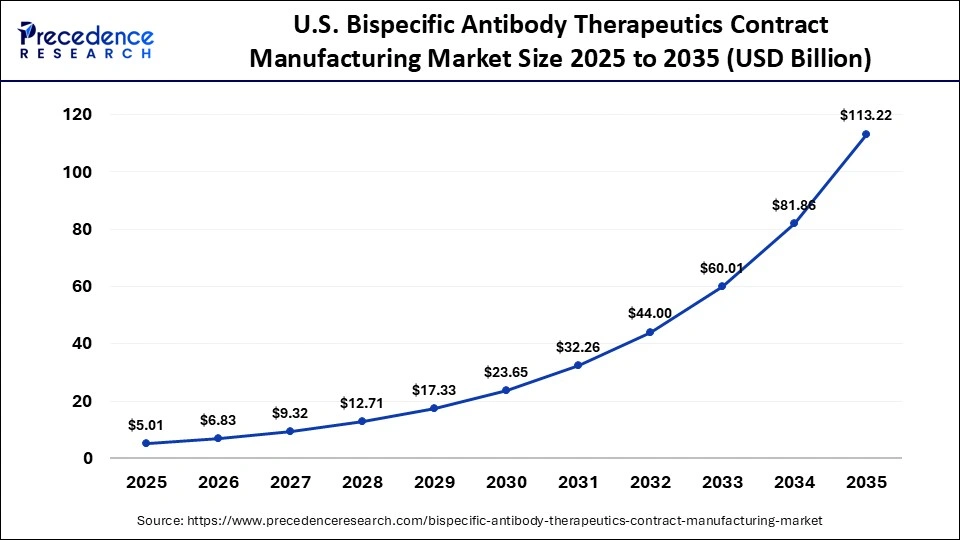

What is the Size of the U.S. Bispecific Antibody Therapeutics Contract Manufacturing Market?

The U.S. bispecific antibody therapeutics contract manufacturing market size is calculated at USD 5.01 billion in 2025 and is expected to reach nearly USD 113.22 billion in 2035, accelerating at a strong CAGR of 36.59% between 2026 and 2035.

Well-established Infrastructure: Key Trend in the U.S. Market

The U.S. is a major player in the regional bispecific antibody therapeutics contract manufacturing market due to its strong biopharmaceutical companies and advanced infrastructure. The existence of leading contract manufacturing companies like Lonza, Samsung Biologics, and WuXi Biologics is supporting the country's biopharmaceutical companies. The U.S. biopharmaceutical companies are focusing on advancements in manufacturing technologies like AI, single-cell technologies, and growth in the shift of supply chains to mitigate risk, like tariffs, which contribute to increased adoption of advanced contract manufacturing for bispecific antibody therapeutics research & development.

Asia Pacific Bispecific Antibody Therapeutics Contract Manufacturing Market

Asia Pacific is estimated to grow at the fastest CAGR in the global market, due to the growing biopharmaceutical industry and focus on cost-effective production. Asia Pacific has experienced rapid growth in the biopharmaceutical industry in countries like China, Japan, and India, fueling the need for contract manufacturing services. The shift toward low-cost production facilities and the availability of a skilled workforce in the Asia Pacific are attracting significant destinations for contract manufacturing services. The demand for monoclonal antibodies in therapeutic applications has increased, further bringing a shift toward innovations and development of by specific antibody therapeutics in Asia.

Strong Government Support and Partnerships: To Fuel China's Innovations

China is a major player in the regional market, due to the country's rapidly growing pharmaceutical industry and strong government support. China has increased its investments in the R&D sector and established a strong focus on global partnerships. Chinese biopharmaceutical companies are partnering with global giants to boost their R&D capabilities, fueling the need for contract manufacturing services. Innovent Biologics' partnership with Roche for an antibody-drug conjugate (ADC) and Duality Biologics' collaboration with Avenzo Therapeutics for a bispecific ADC are the major examples.

Europe Bispecific Antibody Therapeutics Contract Manufacturing Market

Europe is a notable player in the global market, driven by regions' strong investments in single-use bioreactor technology and focus on technological advancements in antibody engineering. The demand for cancer therapies, especially by specific antibodies, has increased in Europe. The strong investments in biopharmaceutical research and development fuel innovation and development of bispecific antibody therapeutics in countries like Germany, the UK, and France. Additionally, a strong presence of key players like group AG, Roche, and WuXi Biologics is providing end-to-end manufacturing solutions.

Robust Biopharmaceutical Industry: Boosts German R&D in Bispecific Antibodies

Germany dominates the regional market due to the country's strong biopharmaceutical industry and presence of advanced contract manufacturing services. The increased global demands for advanced therapeutics and Germany's strong biotech infrastructure are fueling this market. Germany has seen robust expansion in capabilities at contract manufacturing organizations (CMOs) for handling complex bispecific formats and increased outsourcing by pharmaceutical companies.

Bispecific Antibody Therapeutics Contract Manufacturing Market Value Chain Analysis

- R&D: The bispecific antibody therapeutics contract manufacturing requires specialized research and development services, enabling the CDMOs offering to develop and produce these complex bispecific antibody therapeutics.

Key Players: Lonza, WuXi Biologics, Samsung Biologics, AGC Biologics, and Creative Biolabs. - Clinical Trials and Regulatory Approvals: The clinical trials and regulatory approval process for contract manufacturing of bispecific antibody therapeutics is complex and specialized, which involves close coordination between the developing company and the CMO.

Key Players: Lonza, Samsung BioLogics, and WuXi Biologics. - Patient Support and Services: The ancillary services manufacturers provide to patients help the pharmaceutical company ensure patient access, compliance, and safety via the drug's life cycle. These services are beyond the basic manufacturing, which involves support from clinical trials, post-market, and patient education.

Key Players: WuXi Biologics, Catalent, and Lonza.

Who are the Major Players in the Global Bispecific Antibody Therapeutics Contract Manufacturing Market?

The major players in the bispecific antibody therapeutics contract manufacturing market include Lonza Group Ltd., WuXi Biologics, Catalent, Inc., Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim BioXcellence™, Thermo Fisher Scientific (Patheon) , AbbVie Contract Manufacturing, Abzena Plc, KBI Biopharma, AGC Biologics, Rentschler Biopharma SE, Charles River Laboratories Biologics Division, Bio-Techne / ProteinSimple (process analytics support), CMAB Biopharma / WuXi STA (China-based hybrid CDMOs)

Recent Developments

- In April 2025, Lotte Biologics launched its newly completed antibody-drug conjugate (ADC) manufacturing facility in Syracuse, New York. This site has been developed with a $100 million investment, which marks the official launch of Lotte Biologics' ADC contract development and manufacturing organization (CDMO) services.(Source: https://www.pharmamanufacturing.com)

- In December 2024, a leading global life science investor, Novo Holdings A/S, and Catalent, Inc., a leader in enabling the development and supply of better treatments for patients worldwide, announced that Novo Holdings had completed its previously announced acquisition of Catalent in an all-cash transaction with a total enterprise value of around $16.5 billion. This facility is expected to create over 200 new jobs, which can be able to provide development, manufacturing, and analytical services for novel biologics therapies.(Source: https://www.genengnews.com)

Segment Covered in the Report

By Molecule Type/Bispecific Format

- Full-length IgG-like Bispecifics

- Knob-into-Hole (KiH)

- CrossMab

- Dual-Variable Domain (DVD-Ig)

- Duobody

- Fragment-based/Non-IgG Formats

- BiTE (Bispecific T-cell Engager)

- DART (Dual-Affinity Re-Targeting)

- TandAb/Nanobody

- Others (scFv-based, antibody-fragment fusions)

By Expression System/Host Cell Line

- Mammalian Cell Systems

- CHO (Chinese Hamster Ovary) Cells

- HEK293 / Human Cell Lines

- Microbial Systems

- E. coli Expression

- Yeast (Pichia pastoris, Saccharomyces cerevisiae)

- Cell-free & Novel Systems

- Cell-free Protein Synthesis Platforms

- Plant/Insect Expression Systems

By Manufacturing Stage/Service Scope

- Process Development

- Cell Line Development (CLD)

- Upstream & Downstream Process Optimization

- Analytical & Method Development

- Clinical Manufacturing

- Pre-clinical & Phase I/II Production

- GMP Scale-up Manufacturing

- Commercial Manufacturing

- Large-scale Batch Production

- Fill-Finish & Final Formulation

- Stability, QC & Release Testing

By Indication/Therapeutic Area

- Oncology

- Hematologic Malignancies (B-cell/T-cell lymphomas, leukemia)

- Solid Tumors (lung, colorectal, breast, gastric)

- Autoimmune & Inflammatory Diseases

- Rheumatoid Arthritis

- Psoriasis/Inflammatory Bowel Disease

- Infectious Diseases

- Viral Infections (HIV, COVID-19 candidates)

- CNS & Others

- Alzheimer's Disease

- Ophthalmic Disorders

By Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Intratumoral/Localized Delivery (emerging)

- By End-User/Contracting Model

- Pharmaceutical Companies (large biopharma outsourcing to CDMOs)

- Biotech Companies/Emerging Players (pipeline outsourcing)

- CDMOs/CMOs as Primary Service Providers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content