What is the Bispecific Antibodies CDMO Market Size?

The global bispecific antibodies CDMO market is witnessing strong growth as CDMOs provide end-to-end services for complex antibody design, development, and production.The growth of the market is driven by rising demand for targeted cancer therapies, increasing biologics development, and growing outsourcing of complex antibody manufacturing.

Bispecific Antibodies CDMO Market Key Takeaways

- By region, North America dominated the global bispecific antibodies CDMO market with about 53% share in 2024.

- By region, Asia Pacific is expected to experience the fastest growth during the forecasted years.

- By antibody format, the IgG-like bispecific antibodies segment led the market while holding a 50% share in 2024.

- By antibody format, the fragment-based bispecific antibodies segment is expected to grow at the fastest CAGR over the forecast period.

- By service type, the upstream processing segment captured around 32% share in 2024.

- By service type, the analytical & characterization services segment is anticipated to expand at the fastest rate over the forecast period.

- By end user, the biopharmaceutical companies segment led the market while holding a 60% share in 2024.

- By end user, the biotechnology startups segment is expected to grow at a considerable rate in the market over the forecast period.

- By therapeutic application, the oncology segment held a 65% share of the market in 2024.

- By therapeutic application, the autoimmune diseases segment is expected to grow at the fastest CAGR in the market over the forecast period.

What is Bispecific Antibodies CDMO?

Bispecific antibodies are designed molecules that can react to two different antigens or epitopes, making them more precisely applicable to the treatment of multifactorial diseases, such as cancer, autoimmune disorders, and infections. CDMOs play a critical role in supporting biotechnology and pharmaceutical companies with their respective services, including cell line development, process optimization, analytical testing, and fill-finish services. The increase in the number of bispecific antibody drug candidates in the preclinical and clinical pipeline underscores the growing market demand for outsourcing production services that can fulfill global regulatory and quality requirements.

Innovations in high-yield expression systems, single-use bioprocessing technologies, and AI-driven process development are improving the scalability and efficiency of production. Additionally, regulatory bodies such as the FDA and EMA have simplified the approval processes of bispecific antibodies, which stimulates quick therapeutic development and commercialization. Pharmaceutical giants and emerging biotech companies are also more likely to collaborate with CDMOs to shorten development times, eliminate production risks, and focus on primary R&D.

Key Technological Shifts in the Bispecific Antibodies CDMO Market Driven by AI

The bispecific antibodies CDMO market is undergoing a transformative shift through the integration of AI, making drug development and manufacturing increasingly efficient, precise, and scalable throughout the entire lifecycle. AI-driven systems enable predictive protein design, optimizing binding specificity, stability, and therapeutic efficacy through enhanced protein engineering. In bioprocessing, AI algorithms identify optimal culture conditions to maximize yield, reduce production variability, and improve process predictability. Additionally, AI facilitates advanced analytics and quality control by enabling real-time monitoring and rapid identification of deviations, ensuring regulatory compliance. Machine learning accelerates process development and shortens scale-up and formulation timelines, which is critical given the structural complexity of bispecific antibodies.

Bispecific Antibodies CDMO Market Outlook

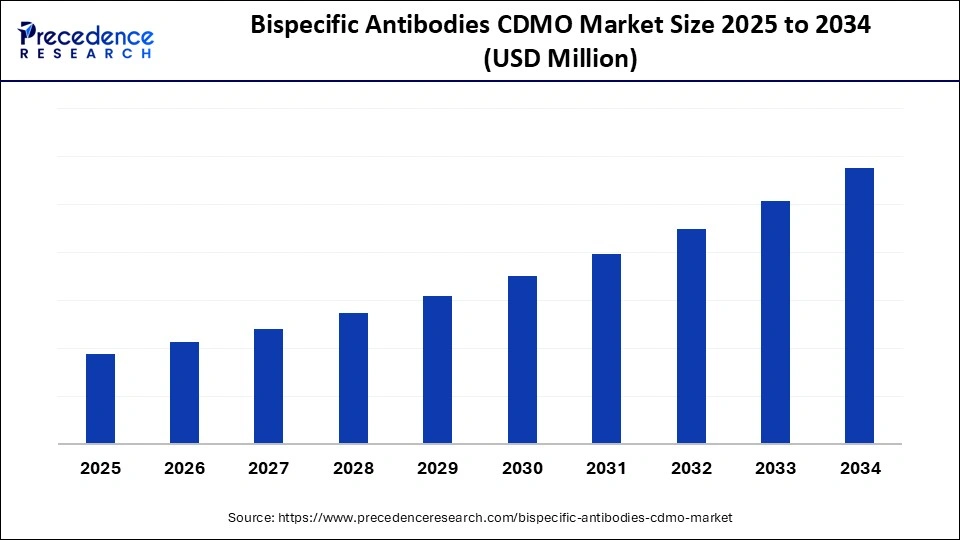

- Market Growth Overview: The market is expected to experience rapid growth between 2025 and 2034 due to the increasing pipeline of bispecific antibody therapeutics for oncology, autoimmune, and infectious diseases. Development and commercialization are shortening the timeframes because increasing outsourcing by biopharmaceutical companies to specialized CDMOs is speeding up the process.

- Global Expansion: CDMOs are exploring diverse geographic regions, increasing biopharmaceutical R&D and production activities. This broadens their client base, fosters strategic partnerships, and drives demand for specialized manufacturing services to support localized development and commercialization of bispecific antibody therapies.

- Major Investors: Major investors include venture capital firms, private equity funds, and government-supported programs targeting biologics innovation, which are significant players in the market. Companies such as WuXi Biologics, Lonza, and Catalent raise substantial funds to increase the manufacturing capacity and facilitate bispecific antibody pipelines.

- Startup Ecosystem: Biotechnology startups are frequently collaborating with CDMOs to address infrastructure and technical issues so that novel bispecific antibodies can be developed within a short period of time. The incubators, grants, and entry into global markets are supported through an ecosystem that enables innovation, scale-up, and entry.

What Factors are Fueling the Growth of the Bispecific Antibodies CDMO Market?

- Increasing Clinical Pipelines: The growing number of bispecific antibody candidates in preclinical and clinical stages is prompting companies to partner with CDMOs that can accelerate development while ensuring consistent quality and regulatory compliance.

- Expanding Outsourcing: Biopharmaceutical firms are increasingly outsourcing the production of complex bispecific antibodies to CDMOs to reduce costs, mitigate manufacturing risks, and focus their internal resources on research, enabling faster commercialization and access to advanced bioprocessing expertise without large in-house facilities.

- Technological Advances: CDMOs are enhancing their capabilities to meet the specialized demands of bispecific antibody therapeutics through innovations such as high-yield expression systems, single-use bioreactors, and automated process optimization, improving production efficiency, scalability, and product quality.

- Increasing Demand from the Oncology Field: The rising incidence of cancers and the growing application of bispecific antibodies in targeting multiple disease pathways are driving market growth, as pharmaceutical companies prioritize the development of these sophisticated therapies for cancer treatment.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Antibody Format, Service Type, Therapeutic Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Targeted Therapeutics

A major factor driving the growth of the bispecific antibodies CDMO market is the increasing demand for targeted and next-generation therapeutics in the fields of oncology, autoimmune, and infectious diseases. The growth in bispecific candidates in preclinical and clinical pipelines has led to a high demand for specialized manufacturing support, driving growth in CDMO services. The focus on outsourcing production to CDMOs is rising because it allows biopharmaceutical companies to take advantage of high-end infrastructure in cell line development, upstream and downstream processing, formulation and analytical testing, ease of cost, and time-to-market. Favorable regulatory conditions and increased investments in biologics research and development worldwide are also accelerating the adoption of this approach, making CDMOs key players in the commercialization of therapeutic bispecific antibodies.

Restraint

Manufacturing Complexity and High Costs

Bispecific antibody production is a complex procedure that involves multiple stages, including purification, formulation, and validation of analysis, which requires specialized skills and facilities. The high cost of development and manufacturing may lead to low accessibility for smaller biotech firms, particularly in emerging markets. The regulatory issues also act as a hindrance, as the processes of ensuring high standards of quality, safety, and efficacy in different regions can delay timelines and result in additional costs for operations.

Moreover, the bispecific antibodies are complex in structure and thus prone to stability problems, reduced yields, and lot-to-lot differences, which also makes large-scale production more complicated. The changing aspects of technology and the fast development of antibody engineering lead to the necessity of constant investment in R&D, infrastructure, and qualified staff, thus limiting the opportunities of smaller and less-capitalized CDMOs to capitalize on market expansion.

Opportunity

Upsurge in Need of Innovative Therapeutics and Technical Complexities

The biopharmaceutical enterprises and biotechnology companies are increasingly relying on CDMOs to save on capital expenditure, obtain specialized expertise, and accelerate time-to-market. The end-to-end services offered by CDMOs that will help commercialize the business opportunities of bispecific antibody therapeutics include cell line development, upstream and downstream processing, formulation, analytical testing, and fill-finish operations. The rapid development of BsAb pipelines, particularly in oncology, autoimmune, and infectious disease treatments, puts a strong demand on scalable solutions with assured quality of production. There are also government schemes in place to promote market growth, including incentive funding packages and streamlined regulatory channels.

Segment Insights

Antibody Format Insights

Why Did the IgG-like Bispecific Antibodies Segment Lead the Market in 2024?

The IgG-like bispecific antibodies segment led the bispecific antibodies CDMO market while holding a 50% share in 2024. This is due to their key advantage of combining both the structural characteristics of standard immunoglobulin G (IgG) molecules, as well as their ability to simultaneously bind two dissimilar antigens, which grants them active, adaptable qualities, as well as an extended half-life. The bispecific antibody of the IgG type is widely used in the fields of oncology and immunotherapy, enabling it to target tumors more effectively, interact with immune cells, and minimize immunotoxicity. The dominance of the segment is also enhanced by the fact that the number of IgG-like bispecific candidates in preclinical and clinical pipelines has been increasing, and investments in research and development, as well as the latest technological advances, which enhance yield, purity, and therapeutic efficacy, are high.

The fragment-based bispecific antibodies segment is expected to grow at the fastest CAGR over the forecast period, owing to its benefits in targeting, tissue penetration, and modular architecture. Fragmented versions, such as single-chain variable fragments (scFvs) and diabodies, are smaller and more conformationally adaptable than full-length IgG-like antibodies, allowing greater tissue penetration and faster systemic clearance. The stability, solubility, and manufacturability of fragment-based bispecifics are being enhanced through protein engineering, linker technology, and fusion technology, and are gaining momentum among biopharmaceutical companies.

Service Type Insights

What Made Upstream Processing the Dominant Segment in the Market 2024?

The upstream processing segment dominated the bispecific antibodies CDMO market with a 32% share in 2024. This is because of the growing pipeline of bispecific antibodies, particularly in oncology, autoimmune, and infectious disease treatments, further drives demand for robust upstream processing solutions. This process involves cell line development, culture optimization, media formulation, and bioreactor operations, all are critical to ensuring the yield, purity, and consistency of bispecific antibody products. Productivity has improved and contamination risks have decreased with the advancement of technologies, including high-density perfusion cultures, single-use bioreactors, and automated monitoring systems.

The analytical & characterization services segment is expected to grow at the fastest rate in the upcoming period due to the structural complexity of bispecific antibodies and stringent regulatory requirements for biologics. These services encompass extensive testing, including physicochemical characterization, functional assays, purity and impurity profiling, stability assessment, and binding specificity. With the increasing sophistication of bispecific antibody formats, including IgG-like and fragment-based structures, the complexity of characterization techniques such as mass spectrometry, chromatography, and bioassays is also rising.

Consequently, end-to-end analytical capabilities are in high demand from biopharmaceutical companies to accelerate product development timelines and mitigate risks associated with product variability. The intensified focus on quality assurance, expedited regulatory approvals, and personalized medicine applications continues to fuel growth in analytical and characterization services globally.

End User Insights

Why Did the Biopharmaceutical Companies Segment Lead the Bispecific Antibodies CDMO Market?

The biopharmaceutical companies segment led the market while holding a 60% share in 2024, as these companies increasingly depend on contract development and manufacturing organizations (CDMOs) to accelerate time-to-market while managing costs and operational complexities. Due to the complexities involved in bispecific antibody therapeutics production and the specialized manufacturing capabilities required, these companies heavily outsource to CDMOs. Large pharmaceutical and biopharma firms are developing bispecific antibodies targeting oncology, autoimmune disorders, and infectious diseases, demanding the highest expertise in cell line development, upstream and downstream processing, formulation, and analytical characterization.

The growing pipeline of bispecific antibody candidates in preclinical and clinical stages further intensifies the need for CDMO services. Additionally, technological advancements such as high-yield expression systems, single-use bioreactors, and process automation enable CDMOs to produce high-quality, consistent products efficiently.

The biotechnology startups segment is expected to grow at the highest CAGR over the forecast period, as emerging companies often lack the in-house infrastructure and expertise needed for complex antibody development and manufacturing. Startups increasingly outsource bispecific antibody production to CDMOs to leverage cutting-edge technologies, allowing them to focus on innovation, pipeline development, and early-stage research while reducing time-to-market. This segment's growth is also supported by rising venture capital investments, government grants, and incubators promoting biologics and advanced therapy innovation. Furthermore, the flexibility and scalability offered by CDMOs enable startups to adapt production volumes as their bispecific antibody candidates advance through preclinical and clinical trials.

Therapeutic Application Insights

Why Did the Oncology Segment Hold the Largest Market Share in 2024?

The oncology segment held a 65% share of the bispecific antibodies CDMO market in 2024. The BsAbs have transformed oncology therapy by simultaneously targeting tumor-associated antigens and immune effector cells, thereby improving tumor cell killing without causing excessive off-target toxicity. The biopharmaceutical firms are farming out their manufacturing to CDMOs to process upstream and downstream, formulate, have their testing services analytically analyzed, and fill-finish, thus being able to develop faster and at a lower cost. The scalability of production, quality, and consistency is also enhanced through the use of technological innovations, including high-yield expression systems, single-use bioreactors, and AI-based process optimization. Furthermore, favorable regulatory environments and the increasing development of investments in the field of oncology biologics contribute to the fast market acceptance.

The autoimmune diseases segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing prevalence of disorders such as rheumatoid arthritis, lupus, multiple sclerosis, and inflammatory bowel disease. The application of bispecific antibodies in autoimmune diseases is a promising therapeutic approach due to their ability to activate and suppress both immune pathways and cytokines, thereby reducing overactive immune responses and minimizing systemic side effects. The growing emphasis on personalized medicine and precision therapies is stimulating biopharmaceutical firms to develop novel BsAbs for autoimmune indications.

Additionally, the expansion of venture capital funding, government support, and collaborative partnerships in the autoimmunity biologics arena is driving an accelerated rate of pipeline expansion. The development of expression technologies, protein engineering, and process automation contributes to increased manufacturability and scalability, enabling the reliable production of high-quality therapeutics.

Region Insights

Why Did North America Lead the Global Bispecific Antibodies CDMO Market in 2024?

North America led the global market with the highest market share of 53% in 2024, riven by its highly developed biopharmaceutical ecosystem and significant investment in research and development. The U.S. plays a pivotal role as the largest contributor, supported by its advanced healthcare system, robust pharmaceutical and biotechnology sectors, and substantial funding for innovative biologics like bispecific antibodies (BsAbs). The region benefits from a skilled workforce, well-established regulatory frameworks, and rapid adoption of cutting-edge manufacturing technologies, including single-use bioreactors, high-yield expression platforms, and AI-driven process optimization.

Infrastructure and Expertise Position U.S. as Bispecific Antibody Market Leader

The U.S. is a major contributor to the market. Major CDMOs in the U.S., such as Lonza, Catalent, Patheon, and Samsung Biologics, offer comprehensive end-to-end services from cell line development to analytical testing and fill-finish. These organizations address the growing pipelines of bispecific antibody therapeutics in oncology, autoimmune, and infectious diseases with specialized expertise often beyond the reach of smaller firms or startups. Additionally, collaborations between academic institutions, biotech startups, and pharmaceutical companies accelerate innovation and clinical translation, facilitating faster commercialization of novel BsAbs. Investments in infrastructure, process optimization, and regulatory compliance ensure consistent product quality and shorter time-to-market.

Why is Asia Pacific Experiencing the Fastest Growth in the Bispecific Antibodies CDMO Market?

Asia Pacific is expected to experience the fastest growth throughout the forecast period, driven by increased healthcare investments, significant advancements in biopharmaceutical infrastructure, and the urgent need for innovative treatments. Countries like China, Japan, South Korea, and India are rapidly expanding their biotechnology and biomanufacturing capabilities by investing in R&D, advanced production facilities, and regulatory frameworks that support the commercialization of biologics. The growing pipeline of bispecific antibodies is being accelerated through strategic investments in biopharmaceutical parks, incubation centers, and public-private partnerships, encouraging both local and global firms to leverage contract development and manufacturing services.

Favorable Policies and Partnerships Propel China's Bispecific Antibody Market

China is at the forefront of Asia Pacific's market growth, supported by strong government backing and rising private sector activity in biotechnology and biopharmaceutical production. The Chinese government has introduced favorable policies, including tax incentives, funding schemes, and streamlined regulatory pathways to foster innovation and domestic manufacturing of complex biologics like bispecific antibodies. The increasing demand to treat oncology, autoimmune, and infectious diseases, alongside an aging population, is driving the adoption of bispecific antibodies in China. Additionally, collaborations between Chinese CDMOs and international pharmaceutical companies are accelerating the commercialization of bispecific antibodies.

In November 2024, BioNTech acquired Biotheus, a Chinese biotech company, securing full global rights to BNT327/PM8002, a late-stage bispecific antibody targeting PD-L1 and VEGF-A. This acquisition enhances BioNTech's oncology strategy by advancing combination therapies, with clinical trials showing promising results, particularly in tumors less responsive to existing checkpoint inhibitors.

Top Companies in the Bispecific Antibodies CDMO Market & Their Offerings

Tier I: Market Leaders

These companies dominate the bispecific antibodies CDMO market by providing comprehensive, end-to-end services, from cell line development to large-scale manufacturing and analytical testing, supported by advanced technologies and strong global presence.

| Company | Key Offerings |

| Lonza Group | Full-scale biologics CDMO services including cell line development, process optimization, and commercial manufacturing of bispecific antibodies. |

| Samsung Biologics | Large-scale manufacturing capacity with rapid development platforms; expertise in complex bispecific antibody production. |

| WuXi Biologics | Integrated drug development and manufacturing with flexible platforms for bispecific antibody therapeutics. |

| Roche (Genentech) | Biologics R&D and manufacturing expertise with a focus on oncology bispecific antibodies. |

| Amgen |

Innovative bispecific antibody production capabilities and robust clinical pipelines, especially in oncology therapeutics. |

Tier II: Established Players

These companies hold a significant market presence with specialized services in bispecific antibody development and manufacturing, focusing on innovation and strategic collaborations.

| Company | Key Offerings |

| AbbVie | Advanced bispecific antibody R&D and manufacturing partnerships with emphasis on immunology. |

| Janssen (Johnson & Johnson) | Expanding bispecific antibody pipeline; offers robust CDMO collaborations for complex antibody formats. |

| Catalent, Inc. | Broad biologics manufacturing services, including bispecific antibody formulation and fill-finish. |

| Charles River Laboratories | Contract services focused on biologics development including bispecific antibody preclinical and clinical manufacturing. |

| Creative Biolabs | Specialized custom bispecific antibody development and manufacturing services with cutting-edge technologies. |

Tier III: Emerging and Niche Players

These companies are emerging players or niche providers contributing innovative technologies, flexible production scales, or regional strengths in the bispecific antibodies CDMO space.

| Company | Key Offerings |

| Sino Biological Inc | Recombinant proteins and bispecific antibody research tools with expanding manufacturing services |

| IQVIA | Data analytics and integrated solutions supporting bispecific antibody clinical development. |

| Samsung Biologics | Emerging niche capabilities in specific bispecific antibody formats and flexible manufacturing. |

| Zymeworks | Innovative bispecific antibody formats with integrated manufacturing partnerships. |

| Sangamo Therapeutics | Focus on gene and bispecific antibody therapies with integrated development and manufacturing expertise. |

Recent Developments

- In March 2025, SanyouBio introduced 73 bispecific antibody reference products, including approved and clinical candidates. These are formats such as CrossMab, BiTE, Duobody, etc., which allow discovery and early development.(Source: https://www.prnewswire.com)

- In January 2025, InnoCare Pharma, KeyMed Biosciences, and their joint venture have signed an exclusive license agreement with Prolium Bioscience to develop and commercialize ICP-B02 (CM355), a CD20xCD3 bispecific antibody. ICP-B02 targets CD20 on tumor cells and CD3 on T cells, activating T-cell Directed Cellular Cytotoxicity (TDCC) to effectively eliminate tumor cells, showing strong potential in oncology and beyond.(Source: https://www.businesswire.com)

Exclusive Expert Analysis on the Bispecific Antibodies CDMO Market

The bispecific antibodies CDMO market is poised for robust expansion, driven by the escalating complexity and therapeutic promise of bispecific modalities within the biologics landscape. With a surging pipeline of bispecific candidates targeting oncology, autoimmune, and infectious diseases, contract development and manufacturing organizations are strategically positioned to capitalize on the increasing outsourcing trend from biopharmaceutical innovators seeking to mitigate operational risks and accelerate time-to-market. Advances in bioprocess technologies, such as single-use bioreactors, high-yield expression systems, and AI-enabled process optimization, are enabling CDMOs to deliver scalable, cost-efficient, and high-quality manufacturing solutions that align with stringent regulatory expectations.

Moreover, the heightened emphasis on personalized medicine and combination therapies underscores significant growth vectors, as biopharma companies increasingly require agile, specialized CDMO partnerships to navigate the intricacies of bispecific antibody production. Collectively, these dynamics substantiate a fertile opportunity landscape for CDMOs to expand capabilities, forge strategic collaborations, and capture value within an evolving and highly competitive market.

Segments Covered in the Report

By Antibody Format

- IgG-like Bispecific Antibodies

- CrossMab

- Knobs-into-Holes (KiH)

- Others

- Fragment-Based Bispecific Antibodies

- BiTEs (Bispecific T-cell Engagers)

- DARTs (Dual-Affinity Re-Targeting)

- TandAbs

- Others

By Service Type

- Cell Line Development

- Stable Cell Line Development

- Transient Expression Systems

- Upstream Processing

- Fed-Batch

- Perfusion

- Downstream Purification

- Protein A/G Affinity Chromatography

- Ion Exchange Chromatography

- Ultrafiltration / Diafiltration

- Formulation Development

- Liquid Formulations

- Lyophilized Formulations

- Analytical & Characterization Services

- Biophysical Characterization

- Bioassays / Potency Testing

- Fill-Finish & Packaging

- Vials

- Prefilled Syringes / Auto-injectors

- Others

By Therapeutic Application

- Oncology

- Hematologic Malignancies

- Solid Tumors

- Autoimmune Diseases

- Rheumatoid Arthritis

- Multiple Sclerosis

- Infectious Diseases

- Viral Infections

- Bacterial Infections

- Others

By End User

- Biopharmaceutical Companies

- Biotechnology Startups

- Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting