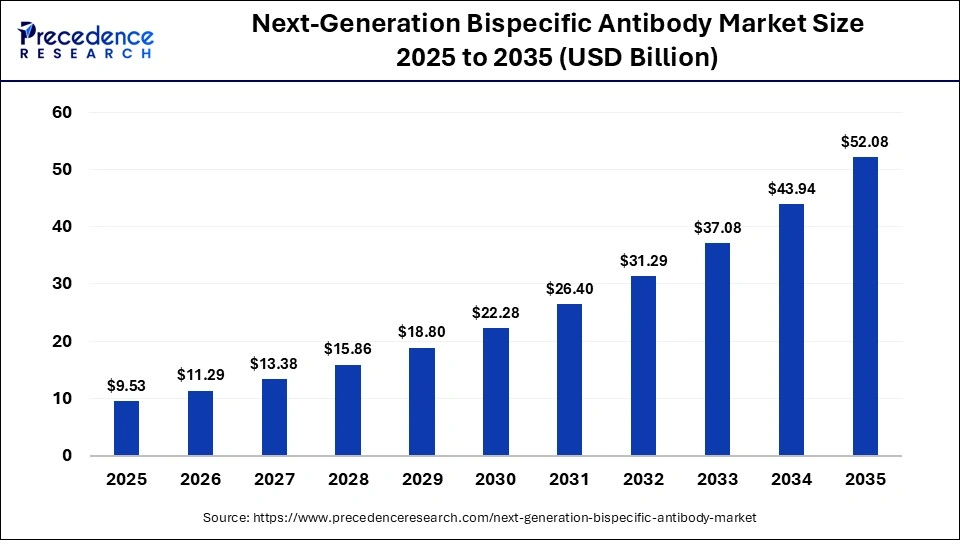

What is the Next-Generation Bispecific Antibody Market Size?

The global next-generation bispecific antibody market size was calculated at USD 9.53 billion in 2025 and is predicted to increase from USD 11.29 billion in 2026 to approximately USD 52.08 billion by 2035, expanding at a CAGR of 18.51% from 2026 to 2035.The next-generation bispecific antibody market is driven by rising demand for targeted cancer therapies, advancements in immuno-oncology, and the adoption of personalized medicine.

Market Highlight

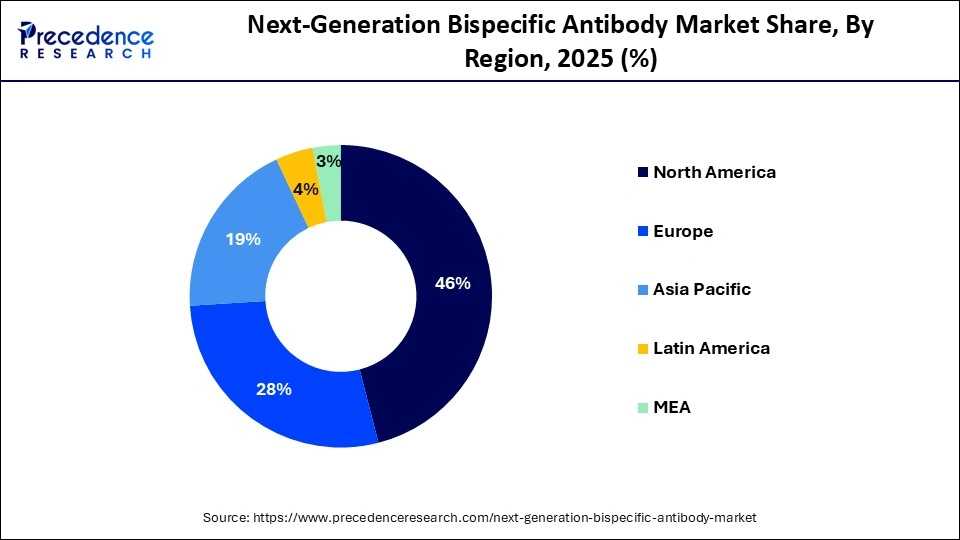

- North America dominated the market, holding the largest market share of 46% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By antibody format, the bispecific antibodies segment contributed more than 52% of the market share in 2025.

- By antibody format, the multispecific/engineered next-gen formats segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By mechanism of action, the T-cell engagers segment generated the biggest market share of 44% in 2025.

- By mechanism of action, the dual immune checkpoint targeting segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By therapeutic application, the oncology segment contributed the highest market share of 78% in 2025.

- By therapeutic application, the autoimmune & inflammatory diseases segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By target type, the tumor antigen × immune cell targets segment held the largest market share of 48% in 2025.

- By target type, the immune checkpoint × immune checkpoint targets are set to grow at a remarkable CAGR between 2026 and 2035.

- Redefining Relief & Diagnosis: How Innovation Is Transforming the Next-Generation Bispecific Antibody Market

Next-generation BsAb will target two distinct antigens or epitopes simultaneously, which can redirect more immune cells and inhibit two pathways simultaneously in addition to targeting tumors. The ability of BsAbs to deliver drugs to targeted areas, block multiple disease pathways, and work together in synergetic combinations in combination therapy is driving it to the pharmaceutical development community and clinical application. The technological growth is further boosting growth because it is possible to design highly efficacious therapies for cancer, autoimmune diseases, and other complex diseases due to the improvements in antibody engineering, molecular design, and optimization of proteins. Next-generation bispecific antibody market growth is also driven by increasing clinical trials and regulatory support, as well as strategic collaborations, and BsAbs have become the foundation of next-generation precision medicine.

Next-Generation Bispecific Antibody Market Trends

- The move towards greater attention on oncology treatments is leading to the creation of improved BsAbs that bind to a variety of tumor antigens.

- The innovation of protein engineering and molecular design is allowing increased stability, half-life, and decreased immunogenicity.

- The clinical use and therapeutic potential of BsAbs are increasing with the rising use of combination therapy.

- Increased research, clinical trials, and commercialization in the world are being spurred by increasing investments and strategic alliances among biopharma companies.

Key AI Integration in the Next-Generation Bispecific Antibody Market

The development and optimization of the next-generation bispecific antibodies (BsAbs) are increasingly using artificial intelligence as a more important element. The application of AI in discovering ideal bispecific targets, streamlining the design of molecular constructs, and accelerating the mechanism of identifying useful antibody constructs through machine learning algorithms and predictive analytics could be applied. The AI also assists in designing new combination treatments with the aid of predicting the synergistic effect and optimizing the dosing regimen, enhancing the effectiveness of treatment. Moreover, AI-based platforms can be integrated to enable automation of protein engineering and high-throughput screening, as well as pharmacokinetics optimization.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.53 Billion |

| Market Size in 2026 | USD 11.29 Billion |

| Market Size by 2035 | USD 52.08 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.51% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Antibody Format,Mechanism of Action,Therapeutic Application,Target Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Antibody Format Insights

Why Did the IgG-Like Bispecific Antibodies Segment Hold a 52% Share in 2025?

The IgG-like bispecific antibody fragment occupied 52% of the next-generation bispecific antibody market in 2025 due to its structural similarity with natural IgG antibodies, which have good pharmacokinetics, a long half-life, and reduced immunogenicity. The format is simpler to produce with the currently available antibody production platforms, allowing for scaling this and translating it to clinical use more rapidly. Its flexibility enables it to be dual-targeted to tumor antigens and immune cells, and it is very useful in cancer therapy with a safety profile. Also, IgG-like BsAbs can be used together with a combination therapy to improve the treatment of complex diseases. The dominance of the segment has been strengthened by high activity of pipelines, the presence of strong clinical trials, and partnerships between companies in the global biopharma sector.

The multispecific/engineered next-gen formats segment is set to grow at the highest CAGR during the forecasted period in the next-generation bispecific antibody market. Such sophisticated constructs can be used to concomitantly modulate multiple disease pathways, which have demonstrated greater effectiveness in oncology and in immune-mediated diseases in which single- or dual-target therapies might not be effective enough. The introduction of trispecific and tetramod forms of engineered proteins has gained momentum due to rapid progress in protein engineering, molecular modeling, and AI-driven design development. Its vibrant development signifies the growing need for the next generation of therapies that can overcome the difficult targets of the diseases as well as enhance the patient outcomes.

Mechanism of Action Insights

Why Did the T-cell Engagers Segment Hold a 44% Share in 2025?

In 2025, the T-cell engagers segment will have a 44% share of the next-generation bispecific antibody market because it can directly target the recruitment of cytotoxic T-cells to tumor cells, which boosts targeted tumor cell-mediated killing. These BsAbs concurrently engage tumor antigens and T-cell receptors without being suppressed by immune response and facilitating specific cytotoxicity. Moreover, T-cell engagers can be used in combination therapy very well, together with checkpoint inhibitors, which enhances patient outcomes. This mode of action is especially appealing to biopharmaceutical companies, as it is a combination of targeted tumor elimination with minimum off-target effects that support its market leadership, and T-cell engagers become the cornerstone of the next-generation cancer therapy.

The dual immune checkpoint targeting segment is expected to expand at the fastest CAGR during the period between 2026 and 2035 in the next-generation bispecific antibody market, as it was able to act simultaneously on multiple immune checkpoints, such as PD-1 and CTLA-4, that enhanced activation of T-cells and antitumor immunity. These BsAbs boost response rates in cancer patients who are resistant to single-agent checkpoint inhibitors by overcoming the immune evasion mechanisms. Moreover, dual checkpoint targeting facilitates the development of combination therapy, which offers synergistic effects when combined with other conventional chemotherapy, targeted therapy, or other BsAbs. The share of the segment was enhanced by the increase in investment in immuno-oncology, regulatory support of combination regimens, and high unmet medical needs in hard-to-treat tumors.

Therapeutic Application Insights

Why Did Oncology Lead the Next-Generation Bispecific Antibody Market in 2025?

The oncology segment dominated the market, occupying 78% in 2025, because most cancers are common, and targeted therapies are required that have better therapeutic efficacy and safety. The oncology leadership was aided by diversity in its clinical pipeline, regulatory clearance, and regimens of combination therapies through the incorporation of BsAbs. The dominance was also through the immuno-oncology research, the numerous industry relationships with big pharma, and the increased use of individualized cancer treatment. Oncology has been the most crucial area of use since the efficacy of BsAbs against solid and hematologic tumors, and in combination regimens, has been established, as well as the synergistic effects of BsAbs with any of these combinations.

The autoimmune & inflammatory diseases segment is set to grow at the highest CAGR during the forecasted period in the next-generation bispecific antibody market owing to the increased prevalence of other autoimmune and inflammatory diseases like rheumatoid arthritis, psoriasis, and multiple sclerosis. Bispecific antibodies against various cytokines or immune pathways are next-generation drugs with better efficacy and fewer side effects than old-fashioned ones. The innovation in protein engineering, guidance medicine, and combination therapy measures is influencing implementation in chronic immune-mediated illnesses. Besides, the increase in patient awareness, clinical trials, and the regulatory support of innovative biologics are driving an increase in market growth. Concurrent multi-target capability of BsAbs and continuous innovation in the molecular design of antibodies make this segment of the business a high-potential segment.

Target Type Insights

Why Did the Tumor Antigen × Immune Cell Targets Segment Hold a 48% Share in the Next-Generation Bispecific Antibody Market During 2025?

The tumor antigen × immune cell targets took up 48% of the market in 2025. This dual-targeting system increases tumor antitumor effects and reduces off-target effects; thus, this type of dual-targeting is highly effective in hematologic malignancies and some solid tumors. The expansion of the segment is based on a healthy clinical pipeline, continued regulatory approvals, and positive therapeutic results in immuno-oncology. This type of target is designated by pharmaceutical companies as a dual-targeting therapy and combination regimen, which expands its application and clinical applicability.

The immune checkpoint x immune checkpoint targets segment is expected to grow the fastest during the forecasted period, and it is expected to grow significantly as it prevents activation of multiple immune checkpoints at once, accelerating T-cell activation and overcoming resistance to cancer therapy. These BsAbs enhance patient response to single-agent checkpoint inhibitors in the unresponsive patients and are increasingly used in combination therapy to enhance the effectiveness. Adoption is being driven by the expansion of the clinical pipeline, advancements in antibody engineering, and growing investment in immuno-oncology research and development.

Regional Insights

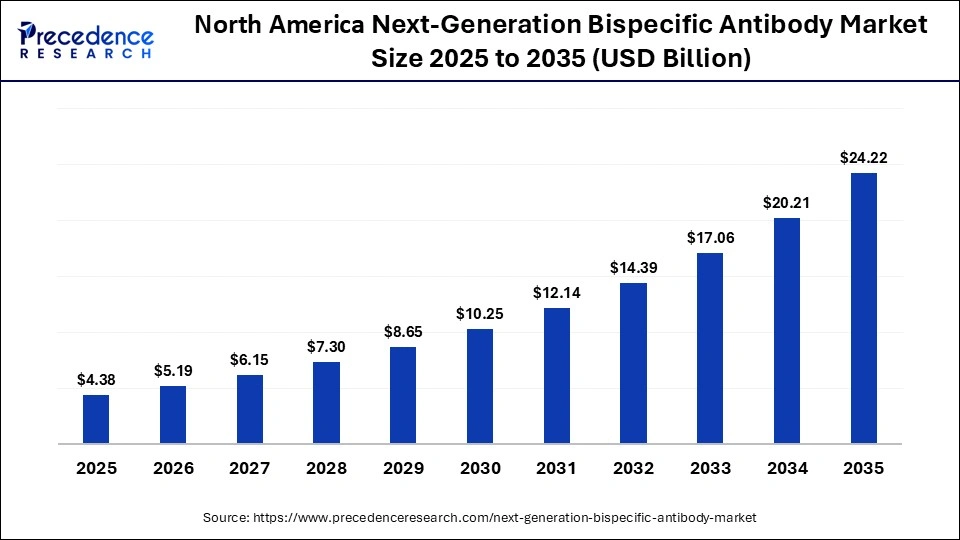

How Big is the North America Next-Generation Bispecific Antibody Market Size?

The North America next-generation bispecific antibody market size is estimated at USD 4.38 billion in 2025 and is projected to reach approximately USD 24.22 billion by 2035, with a 18.65% CAGR from 2026 to 2035.

Why Did North America Lead the Global Next-Generation Bispecific Antibody Market in 2025?

In 2025, North America was the largest market with a 46% share of the next-generation bispecific antibody market because of the high biotechnology and pharmaceutical infrastructure, active clinical research, and high healthcare spending of the region. BsAbs were rapidly developed and commercialized due to the presence of major pharmaceutical firms and significant investment in their research and development, a well-established regulatory framework, and support of innovative biologics. The rising cancer and immune-mediated disease burden and early acceptance of immuno-oncology treatment led to demand. The developed clinical trial system, the access to state-of-the-art technology, and the substantial number of patients confirmed North America as the biggest and most powerful market for next-generation bispecific antibodies.

What is the Asia Pacific Next-Generation Bispecific Antibody Market Size?

The Asia Pacific next-generation bispecific antibody market size is expected to be worth USD 10.16 billion by 2035, increasing from USD 1.81 billion by 2025, growing at a CAGR of 18.83% from 2026 to 2035.

Why is Asia Pacific undergoing the Fastest Growth in the Next-Generation Bispecific Antibody Market?

The Asia Pacific region is experiencing the most rapid growth in the world's next-generation bispecific antibody market due to the rising healthcare spending, growth of pharmaceutical and biotechnology infrastructure, and the increase in the incidence of cancer and autoimmune diseases. Market penetration is increasing rapidly due to rapid market acceptance of new advanced therapies, developing regulatory pathways, and an increase in the level of clinical trials. activity in certain countries such as China, Japan, and India. Also, the partnerships of international biopharma players and regional makers are facilitating technology transfer and local BsAb production. Growth is further stimulated by the increasing patient awareness, growth in healthcare expenditure, and governmental support for innovation in biologics.

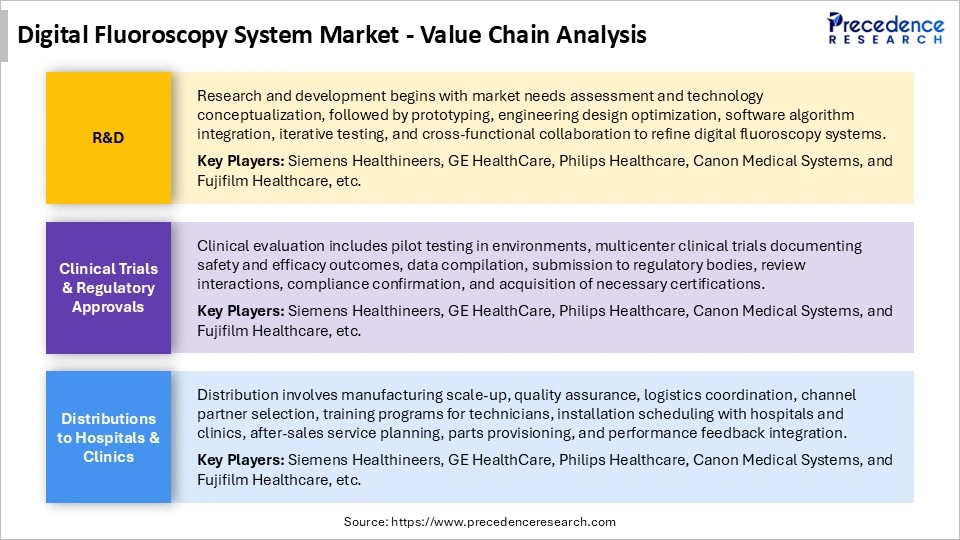

Next-Generation Bispecific Antibody Market Value Chain Analysis

Who are the major players in the global next-generation bispecific antibody market?

The major players in the next-generation bispecific antibody market include Novartis, Amgen, Sanofi, Roche, Pfizer, Celgene Corporation, AstraZeneca, Johnson & Johnson, Regeneron Pharmaceuticals, GSK plcThe major players in the next-generation bispecific antibody market include Novartis, Amgen, Sanofi, Roche, Pfizer, Celgene Corporation, AstraZeneca, Johnson & Johnson, Regeneron Pharmaceuticals, GSK plc

Recent Developments

- In April 2025, SparX Biopharmaceutical Corp. reported some clinical news about SPX-303, an anti-LILRB2/PD-L1 bispecific antibody. This was updated at the 2025 Annual Meeting of the American Association for Cancer Research (AACR) on April 28, showing its potential to be therapeutic. (Source:https://www.prnewswire.com)

- In March 2025, Harbour BioMed created Elance Therapeutics to produce new treatments to deal with the treatment of obesity, such as long-term effectiveness and muscle maintenance. The site employs proprietary technology of Harbour BioMed that uses HCAb-based bispecific antibodies in the development of next-generation therapeutic solutions. (Source:https://www.harbourbiomed.com)

Segments Covered in the Report

By Antibody Format

- IgG-like Bispecific Antibodies

- Non-IgG-like/Fragment-based Bispecifics

- Multispecific/Engineered Next-Gen Formats

By Mechanism of Action

- T-cell Engagers (CD3-based)

- Dual Immune Checkpoint Targeting

- Dual Tumor Antigen Targeting

- Immune Cell Engagers (NK cell, macrophage)

By Therapeutic Application

- Oncology

- Autoimmune & Inflammatory Diseases

- Hematology (Non-oncology)

- Other Emerging Indications

By Target Type

- Tumor Antigen × Immune Cell Targets

- Dual Tumor Antigen Targets

- Immune Checkpoint × Immune Checkpoint Targets

- Cytokine/Growth Factor Targets

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting