What is the Blockchain in Energy Trading Market Size?

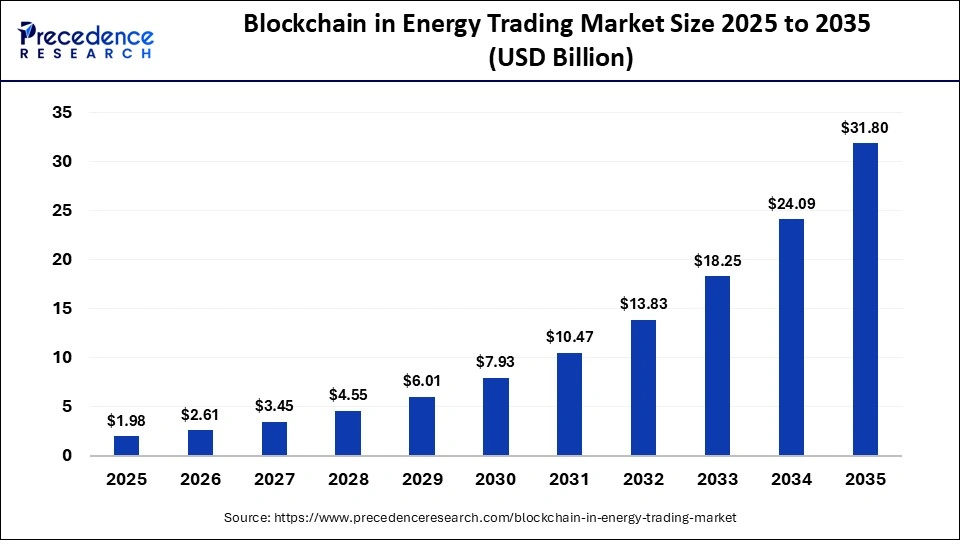

The global blockchain in energy trading market size accounted for USD 1.98 billion in 2025 and is predicted to increase from USD 2.61 billion in 2026 to approximately USD 31.80 billion by 2035, expanding at a CAGR of 32.00% from 2026 to 2035. The market is significantly growing due to the increasing need for transparent, cost-effective, and ethically sourced energy for critical sectors and to the technological development of blockchain and its seamless, rapid integration by the energy sector.

Market Highlights

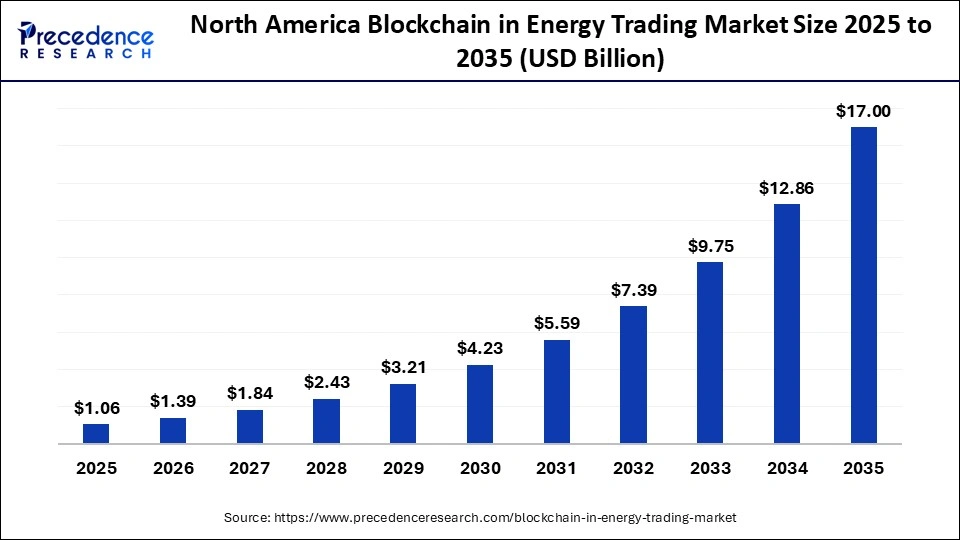

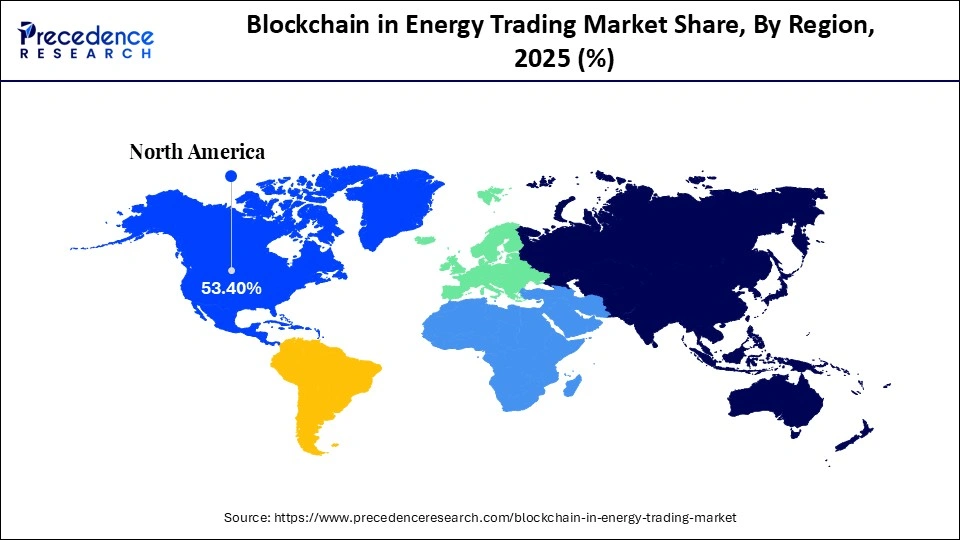

- North America accounted for the largest market share of 53.4% in 2025.

- The Asia Pacific is expected to grow at the fastest from 2026 to 2034.

- By blockchain type, the public blockchain segment held the largest market share of 60.3% in 2025.

- By blockchain type, the private blockchain segment is expected to witness the fastest CAGR of 41.1% from 2026 to 2034.

- By component, the platforms & software segment contributed the major market share of 58.4% in 2025.

- By component, the services & consulting segment is growing at a strong CAGR from 2026 to 2035.

- By application, the energy trading segment recorded more than 40.4% of the market share in 2025.

- By application, the grid management & system operation segment is expected to grow the fastest CAGR from 2026 to 2035.

- By end user/industry, the power sector/utilities segment captured the highest market share of 46.8% in 2025.

- By end user/industry, the renewable energy producers' segment is expected to grow the fastest CAGR of 37.1% from 2026 to 2035.

What the Blockchain in Energy Trading Market Means: Peer-to-Peer Energy Exchange and Digital Commodity Tracking

The blockchain in energy trading market comprises platforms and solutions that use blockchain technology to enable secure, transparent, and decentralized transactions among producers, consumers, utilities, and other stakeholders. These systems facilitate peer-to-peer (P2P) energy trading, automated settlements, smart contracts for energy assets, tokenization of renewable energy certificates, and grid management. Driven by growing renewable energy integration, distributed energy resources (DERs), and demand for real-time settlements, blockchain is transforming energy trading ecosystems worldwide.

Peer-to-peer energy trading enabled by blockchain technology allows households, commercial buildings, and distributed renewable systems to buy and sell excess electricity directly in a decentralized marketplace. Blockchain provides a tamper-resistant ledger that records each energy transaction with transparent time-stamped data, allowing participants to verify the origin, volume, and price of exchanged electricity without relying on a central utility. Smart contracts automate settlement by matching supply and demand in real time, applying predetermined pricing rules, and executing payments through digital tokens or integrated billing systems. Several pilots illustrate the operational model.

The Brooklyn Microgrid project in the United States demonstrated local trading between rooftop solar owners using a blockchain-backed transaction layer. In Europe, Power Ledger trials in Austria (2019-2021) demonstrated how smart contracts could manage real-time allocation of solar surplus within multi-unit housing. These systems support grid efficiency by reducing peak loads, increasing renewable energy utilization, and enabling greater consumer participation in local energy markets. As countries expand distributed-generation infrastructure and adopt policies that support prosumer-based energy systems, blockchain-enabled peer-to-peer trading is emerging as a scalable mechanism for decentralized energy management.

AI Shifts in the Blockchain in Energy Trading Market: Intelligent Forecasting, Automated Bidding and Enhanced Market Integrity

The integration of AI with blockchain in energy trading can revolutionize various factors, including precise energy forecasting, price forecasting and prediction, automated trading with greater efficiency, and effective grid management and optimization. AI supports and manages grids performance by predicting demand and optimizing the energy distribution during power outages.

By offering high-quality, tamper-proof, and verifiable data sources, blockchain reinforces the reliability of AI datasets used for training and decision-making. AI can further enhance blockchain security by detecting potential threats and vulnerabilities in blockchain transactions and mitigating risks to data privacy and cybersecurity.

Blockchain in Energy Trading Market Outlook

- Industry growth overview: The expansion of blockchain in the energy trading market is driven by the growing complexity of power grids, decentralized energy resources such as rooftop solar panels, and the rapid growth of transparent, secure transaction platforms. Its applications include peer-to-peer energy trading and grid management, which offer consumers the chance to buy and sell excess energy directly and enable utilities to handle complex datasets in real time.

- Sustainability Trends: These include continuous tracking of carbon-free energy, energy-efficient protocols, and renewable energy certificates with carbon credits. Blockchain is widely used to track and trade RECs and carbon credits that support green energy claims and their benefits, helping enterprises meet ESG standards.

- Major Investors: The blockchain in the energy trading market is expanding due to substantial investments by leading tech giants, energy corporations, and venture capital firms. Major companies such as IBM, Google, Microsoft, Siemens, and Shell are leading players investing heavily in blockchain energy startups, aiming to integrate the technology into their operations and cloud services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.98 Billion |

| Market Size in 2026 | USD 2.61 Billion |

| Market Size by 2035 | USD 31.80 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 32.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Blockchain Type, Component, Application, End-User/Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blockchain in Energy Trading Market Segmental Insights

Blockchain Type Insights

Public Blockchain: The segment held the largest market share in 2025, at 60.3%, due to the open-access architecture of public blockchain networks, which allow any participant to validate transactions and engage in peer-to-peer energy trading with full transparency. Public chains play a pivotal role in democratization by enabling inclusive, decentralized systems. These systems are perfect for small-scale producers, rooftop solar owners, community solar installations, and commercial prosumers, who can interact with one another without relying on central utilities. The transparency of public blockchains strengthens trust by displaying and analyzing real-time transaction histories, energy flows, and price formation on a distributed ledger that cannot be altered retroactively.

Private Blockchain: The segment is expected to experience the highest CAGR over the foreseeable period, driven by strong alignment with data-privacy requirements, security expectations, and regulatory mandates in the energy sector. Private blockchains restrict validator access to authorized entities, which allows utilities, grid operators, and large industrial energy users to manage sensitive operational data without exposing internal processes to public networks. These platforms also feature faster transaction speeds and higher scalability because consensus mechanisms such as proof of authority can process large transaction volumes with low latency. Private blockchains are increasingly adopted in regulated markets where energy-trading records, grid-balancing data, and metering information must comply with national cybersecurity frameworks.

Consortium/Hybrid Blockchain: This blockchain segment is notably expanding as it combines the controlled-access security of private networks with selected transparency features found in public systems. Consortium blockchains are operated by a group of utilities, technology companies, and regulatory partners who collectively validate transactions, allowing for high data integrity while reducing the risk of single-party control. This structure supports enhanced scalability and performance because participating entities share computational workloads and standardized protocols.

Component Insights

Platforms & Software: The platforms & software segment held the largest market share of 58.4% in 2025, because it provides the foundational infrastructure for scalable, highly secure, and cost-effective energy transactions. It includes tools and frameworks for system development, deployment, and management. Also, the emergence of Blockchain-as-a-service lowers the entry barriers for several companies seeking to integrate blockchain technology at an affordable cost.

Services & Consulting: The segment is expected to experience the highest CAGR over the foreseeable period, as services and consulting expand to meet the organization's need for expert guidance on integrating blockchain technology into its existing systems while safely navigating the intricacies of this process. It manages evolving regulations and develops customized business models.

Hardware & Infrastructure: The segment is rapidly growing in the blockchain in energy trading industry due to improved security enabled by decentralized networks and cryptography, enhanced transparency provided by a shared, immutable ledger, and greater efficiency. The infrastructure further enables data integrity with robust traceability and ownership control.

Application Insights

Energy Trading: The energy trading segment held the largest market share in 2025, at 40.4%, as it offers a solution to the growing need for secure, transparent, and effective peer-to-peer transactions, given the high prevalence of energy sources. The decentralized and immutable nature of blockchain technology is well-suited to the dynamic, critical environments of many industries, especially crucial for balancing supply/demand, managing costs, and hedging price risks for producers, suppliers, and consumers.

Grid Management & System Operation: The grid management & system operation segment is expected to experience the highest CAGR over the foreseeable period, driven by growing demand for efficiency, security, and the ease of integrating distributed renewable energy sources into modern smart grids. Also, combining smart meters and IoT devices with blockchain technology offers a transparent ledger for energy generation and consumption data.

Electric Vehicle (EV) Charging: The segment is notably growing, primarily due to secure, transparent, and automated direct transactions between consumers and energy offerors, largely supported by vehicle-to-grid technology that allows EVs to function as mobile power sources. Also, EVs can participate in P2P energy trading with homes, charging stations, or other EVs, further fuelling the segment's growth.

End User/Industry Insights

Power Sector/Utilities: The power sector/utilities segment held the largest market share of 46.8% in 2025. The segment is dominating because utilities are a major part of the existing energy infrastructure, and blockchain is being used to address their energy-efficiency needs by integrating decentralized renewable energy sources. The energy sector is highly regulated and prone to abuse as well. Thus, blockchain offers highly transparent and cost-effective solutions for energy auditing.

Renewable Energy Producers: The renewable energy producers segment is expected to experience the fastest CAGR over the forecast period 2026-2035. The segment is expanding rapidly due to the unprecedented capabilities of blockchain technology, including peer-to-peer trading, increased revenue with lower transaction costs, grid management, and stability, as well as support for decentralized assets.

Commercial & Industrial Consumers: The segment is notably growing due to the integration of blockchain technology, which enables direct market participation with greater control and eliminates intermediaries in energy trading. Consumers can accurately track and verify the source and origin of their energy by ensuring they use verified renewable energy.

Blockchain in Energy Trading Market Regional Insights

The North America blockchain in energy trading market size is estimated at USD 1.06 billion in 2025 and is projected to reach approximately USD 17.00 billion by 2035, with a 31.98% CAGR from 2026 to 2035.

Which Factors Made North America a Dominant Region in the Blockchain in Energy Trading Market?

North America held the largest market share in 2025, at 53.4%. The region is dominant due to several key factors, including the active presence of major technology companies, highly advanced digital and smart grid infrastructure, a strong policy environment supporting clean energy deployment, and a growing shift toward decentralized and renewable energy sources. North America's digital energy landscape is shaped by extensive smart-meter penetration, automated distribution-management systems, and large-scale integration of distributed solar and storage assets. These conditions create a favorable environment for blockchain applications in energy trading, asset verification, and decentralized market settlement.

Proactive clean energy regulation continues to strengthen the region's leadership. Federal programs such as the U.S. Department of Energy's Grid Modernization Initiative and funding streams introduced under the Infrastructure Investment and Jobs Act of 2021 support digitalization, cybersecurity, and modernization of power infrastructure. Canada's Smart Grid Program, led by Natural Resources Canada, similarly funds demonstration projects that integrate blockchain-backed trading and renewable-energy management into community microgrids. These initiatives accelerate the adoption of digital ledger systems that record, validate, and manage energy transactions with full traceability.

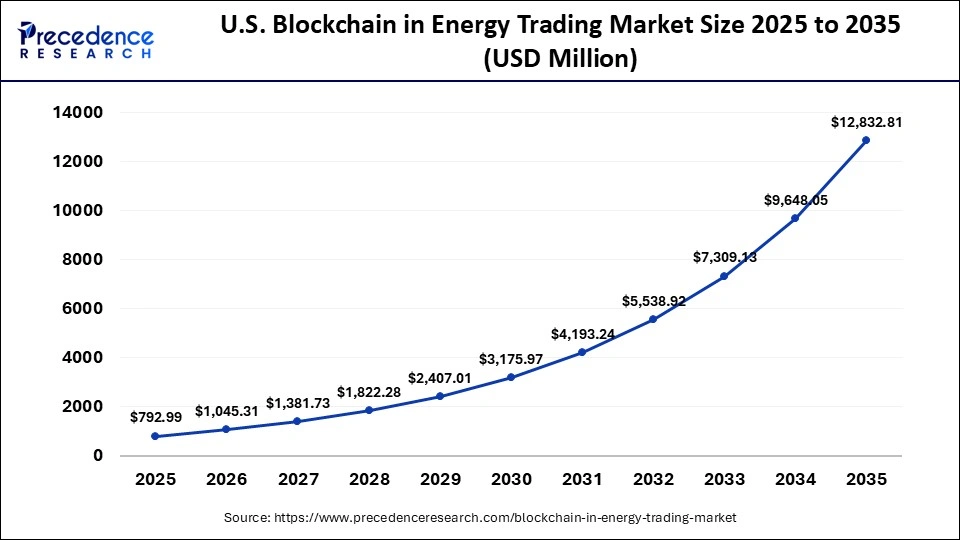

The U.S. blockchain in energy trading market size is calculated at USD 792.99 million in 2025 and is expected to reach nearly USD 12,832.81 million in 2035, accelerating at a strong CAGR of 32.10% between 2026 and 2035.

The U.S. Blockchain in Energy Trading Market

The U.S. boasts a strong foundation of advanced technologies and a mature digital environment that supports rapid blockchain adoption. Leading technology companies such as IBM and Microsoft continue to develop blockchain toolkits and enterprise-grade platforms that support energy settlement, distributed-asset coordination, and renewable-certification tracking. Several states play a pivotal role in shaping market momentum. California, through policies administered by the California Public Utilities Commission, has encouraged pilot programs that explore blockchain for distributed-energy coordination and tracking renewable generation across microgrids. New York, under the Reforming the Energy Vision (REV) initiative and the New York State Energy Research and Development Authority (NYSERDA), has supported projects focused on transactive-energy markets where blockchain is used to validate local energy exchanges and manage grid services in real time.

Asia Pacific is expected to witness the highest CAGR of 45.5% over the forecast period 2026-2035. The region is expanding significantly due to rapid digitalization and countries' growing demand for clean energy for several industries. The region is actively investing in renewable energy sources to meet sustainability goals and reduce carbon emissions by adopting a decentralized approach to energy trading.

Factors such as conducive government regulations for transparent transactions on immutable ledgers, explosive energy demand, and growing trends towards decentralized energy systems like VPPs and microgrids are further expanding the region's growth.

China Blockchain in Energy Trading Market Analysis

The Chinese government has already integrated blockchain technology into its strategic national plan to excel in cutting-edge technologies and their adoption. China has its five-year plan and contributes hugely for its national funding roadmaps. Such a robust government backing encourages development and large-scale implementation of blockchain technology for transparent energy trading in China.

According to IEA reports, China has invested more than USD 625 billion in clean energy projects, and it achieved its solar and wind capacity targets in 2024, which were expected to be completed by 2030. It's 6 years before, highlighting their evolving macroeconomic priorities.

The European blockchain in energy trading market is expected to witness significant growth as regional policymakers and private energy stakeholders intensify efforts to expand clean-energy production and comply with stringent environmental and safety regulations. The European Union's long-term climate objectives, outlined in the European Green Deal (2019) and reinforced by the Fit for 55 Package (2021), require member states to accelerate decarbonization, improve grid efficiency, and adopt systems that support verifiable renewable-energy consumption. Blockchain aligns with these requirements by providing tamper-resistant transaction records, transparent tracking of renewable-energy attributes, and secure verification of Guarantees of Origin across the EU's cross-border energy markets.

These priorities are shaping a wave of infrastructure modernization across the region. The Association of Issuing Bodies (AIB), which manages the European Guarantee of Origin system, is already integrating digital tools to standardize energy-attribute tracking across 30 participating countries. Blockchain pilots such as Electron's flexibility-trading platform in the United Kingdom, Power Ledger's solar-trading demonstrations in Italy and France, and Siemens-backed blockchain microgrids in Germany illustrate how decentralized ledgers can automate settlement, validate renewable generation, and facilitate peer-to-peer trading.

UK Blockchain in Energy Trading Market Analysis

The region is growing due to rising demand for renewable energy, the adoption of smart meters and IoT devices, the expansion of business models, and the potential application of blockchain technology in the energy trading sector. Also, the UK government is highly active in adopting blockchain technology through bodies such as UK Research and Innovation, which support various projects focused on blockchain-based energy trading platforms.

The expansion of blockchain in the Middle East and Africa energy-trading market is highly influenced by the active participation of leading players in the Gulf countries, which continue to drive innovation and technological advancement across the regional energy ecosystem. The Middle East is undergoing rapid digital transformation through national strategies that promote smart-grid development, decentralized energy resources, and transparent energy-market mechanisms.

Across the Gulf, organizations including Masdar, Saudi Aramco's Digital Transformation Program, and Qatar General Electricity and Water Corporation (Kahramaa) are exploring blockchain to enhance transparency in renewable-energy transactions, automate settlement processes, and support digital-twin simulations for grid planning. Africa is also progressing through targeted digitization programs, such as South Africa's Integrated Resource Plan (IRP) 2019 and Kenya's Last Mile Connectivity Project, which encourage distributed solar expansion and the need for secure data-sharing frameworks.

Saudi Arabia's Vision 2030 and the National Renewable Energy Program (NREP) have led to large-scale investment in grid modernization and distributed-energy management, creating opportunities for blockchain to support peer-to-peer trading, carbon-footprint tracking, and renewable-certification management.

UAE Blockchain in Energy Trading Market Analysis

The UAE region is a market frontier in the adoption of blockchain technology to fuel its energy transition project and minimize its dependence on hydrocarbons. The region sets a target of 20% blockchain integration in energy trading by 2025, driving increased traction for crypto and blockchain firms. The United Arab Emirates Energy Strategy 2050 and the Dubai Clean Energy Strategy 2050 both emphasize digital infrastructure for renewable integration, enabling entities such as the Dubai Electricity and Water Authority (DEWA) to pilot blockchain platforms for solar-asset registration and verification.

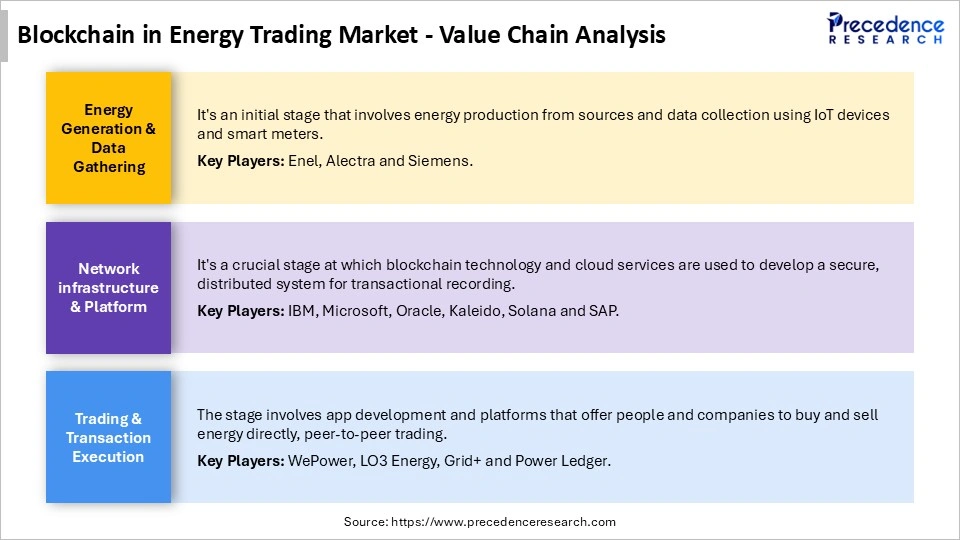

Blockchain in Energy Trading Market Value chain

Top Companies in Blockchain in Energy Trading Market & their Offerings

- IBM Corporation

- Microsoft Corporation

- Accenture plc

- SAP SE

- Oracle Corporation

- Infosys Limited

- Power Ledger Pty Ltd

- LO3 Energy Inc.

- Electron Ltd.

- Energy Web Foundation

- Greeneum GmbH

- SunExchange (Pty) Ltd

- TenneT Holding B.V.

- VAKT Global Ltd.

- Kaleido Insights

Recent Developments

- In March 2025, the Thai government is revising regulations to allow for carbon credits, carbon allowances and renewable energy certificates through the integration of blockchain technology and reinforcing their ambitious plan to become a carbon trading hub.(Source: https://www.reccessary.com)

- In April 2024, an award-winning solar software platform, Enact Systems announced the integration of oracle blockchain technology along with power to issue renewable energy certificates with the help of tokens linked to their solar system value.(Source: https://enact.solar)

Blockchain in Energy Trading MarketSegments Covered in the Report

By Blockchain Type

- Public Blockchain

- Private Blockchain

- Consortium/Hybrid Blockchain

By Component

- Platforms & Software

- Services & Consulting

- Hardware & Infrastructure

By Application

- Energy Trading

- Grid Management & System Operation

- Electric Vehicle (EV) Charging

- Renewable Energy Certificate (REC) & Carbon-Credit Trading

- Supply Chain Transparency

- Other Applications

By End-User/Industry

- Power Sector/Utilities

- Renewable Energy Producers

- Commercial & Industrial Consumers

- Oil & Gas

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting